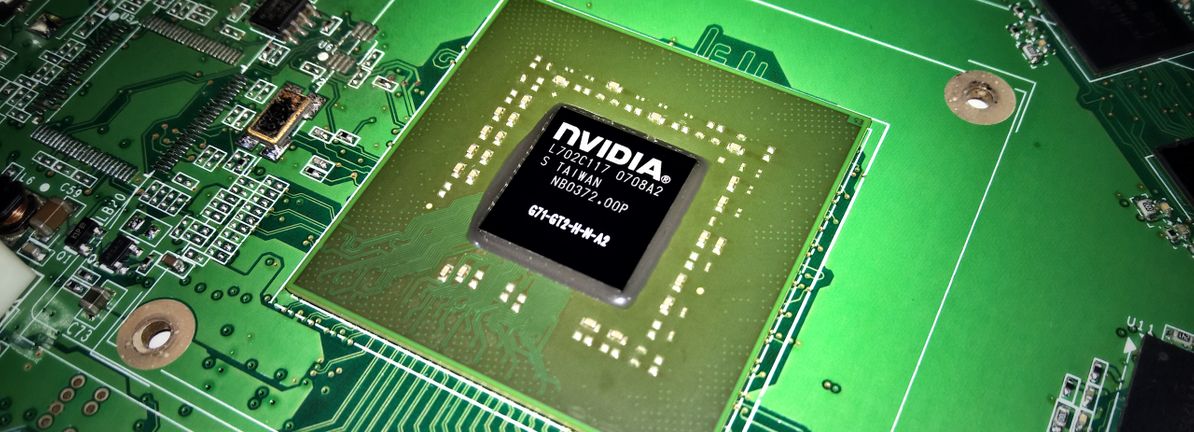

NasdaqGS:NVDASemiconductor

NVIDIA’s Scale-Across AI Networking Launch Could Be a Game Changer for NVDA

NVIDIA recently announced the launch of Spectrum-XGS Ethernet, a scale-across technology aimed at unifying distributed data centers into giga-scale AI super-factories by enabling predictable, ultra-low-latency networking across facilities.

This breakthrough technology highlights the growing demand for advanced AI infrastructure and signals NVIDIA's push to extend its leadership beyond traditional single-building data centers.

We'll look at how NVIDIA’s roll-out of scale-across AI networking...