- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB): Assessing Valuation Following Analyst Upgrades and Strong AI Product Momentum

Reviewed by Simply Wall St

Astera Labs (ALAB) has been catching eyes after a series of upbeat analyst updates, all pointing to the company’s strong execution across its Scorpio, Aries, and Taurus product portfolios. The spark for this new attention is more than analyst optimism; it is the actual traction Astera Labs is reporting with key AI and cloud service customers. The Scorpio X platform now serves over ten AI and cloud providers, and Scorpio P switches have officially hit volume production, already generating over 10% of total revenue. That sort of product momentum, paired with a better-than-expected second quarter, is tough for investors to ignore.

Zooming out, Astera Labs’ stock has delivered a 316% gain over the past year, outpacing most peers and suggesting that market sentiment has shifted decisively in its favor. Momentum accelerated in the past month with a 47% gain, driven in large part by these stronger performance signals and new revenue streams from high-demand hardware. Recent participation in tech-focused investor conferences adds to the sense that Astera Labs is actively telling its growth story to the market, fueling further interest as it builds on meaningful financial results.

With these recent upward moves, investors are left with a dilemma: Is Astera Labs merely keeping pace with lofty expectations, or is there still untapped value if growth continues to surprise? Is the market already pricing in the next phase, or could there be more room to run?

Most Popular Narrative: 7.6% Overvalued

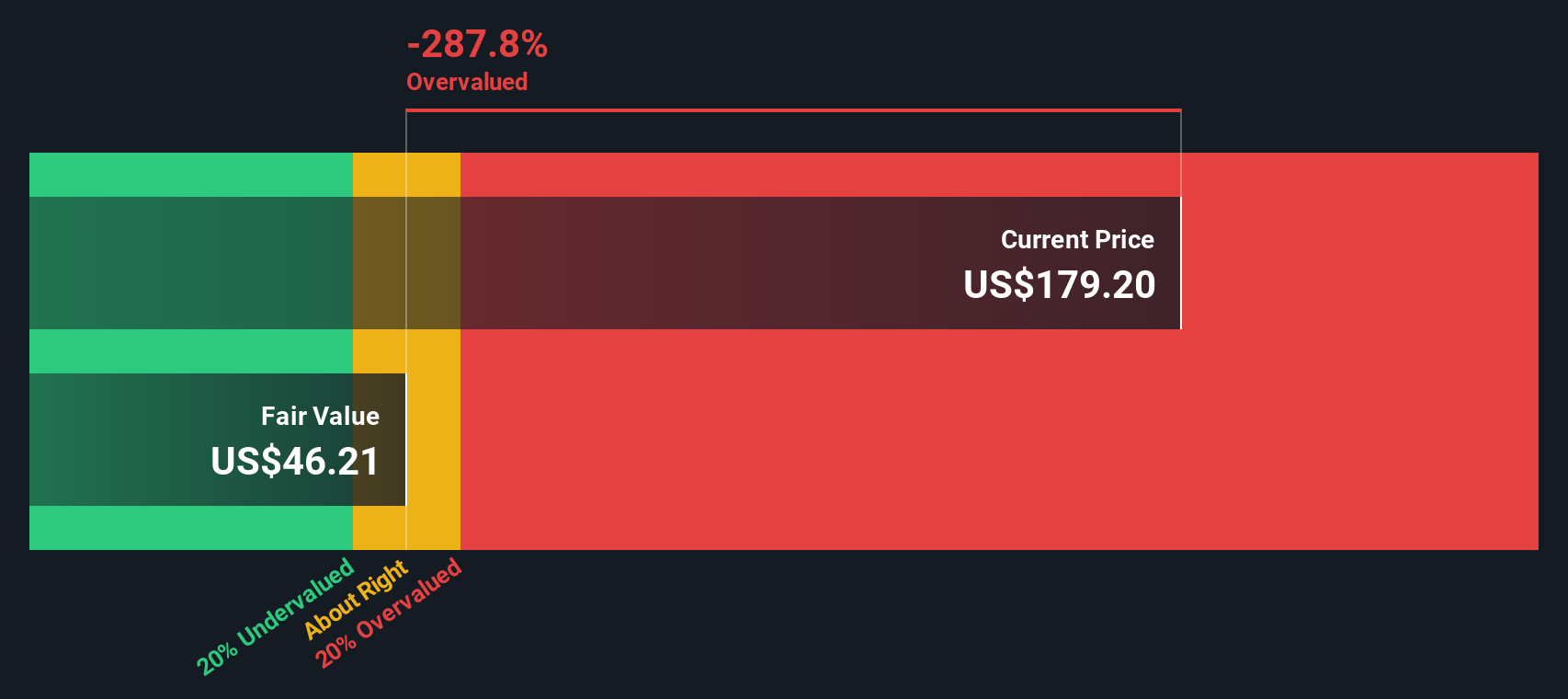

According to the community narrative, Astera Labs is currently seen as overvalued, with a consensus fair value estimate falling below its latest share price.

Strong early engagement with hyperscalers and AI platform providers on open, interoperable standards like UALink (which are still in the early adoption phase, with projected ramp in 2027 and beyond) enables Astera Labs to capture the industry's shift toward open, multi-vendor AI Infrastructure 2.0. This ensures exposure to significant long-term market expansion and incrementally larger addressable markets. These factors have the potential to positively impact revenue growth rates and future margin potential as adoption accelerates.

Is Astera Labs’ valuation really justified by these AI and cloud tailwinds? The narrative hints at breakthrough revenue growth, expanding margins, and ambitious profit projections over the next few years. Want a peek at the bold financial expectations and the numbers insiders believe will drive the company’s fair value? The answers may surprise you.

Result: Fair Value of $166.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected AI investment or cloud customers consolidating purchases could quickly challenge the growth targets that are now built into Astera Labs’ valuation.

Find out about the key risks to this Astera Labs narrative.Another View: Discounted Cash Flow Tells a Different Story

Looking at Astera Labs through the lens of our DCF model, the company appears even more stretched compared to traditional benchmarks. This approach suggests a different outlook on the business’s underlying worth. Could the market be overlooking key risks, or is optimism still running too high?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Astera Labs Narrative

If you see things differently, or want to dig into the numbers on your own, nothing is stopping you from building your own view in just a few minutes. So why not do it your way?

A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stop with just one stock? Get ahead of the market and broaden your portfolio with unique ideas from the Simply Wall Street Screener. You could miss out on game-changing opportunities if you don’t look further.

- Zero in on steady passive income streams by checking out companies offering dividend stocks with yields > 3% and consistent performance. These can be useful for building long-term wealth.

- Tap into the booming healthcare tech sector by investigating healthcare AI stocks. These options are changing the way medicine is delivered and data is leveraged for better outcomes.

- Seize the momentum with AI penny stocks and consider positioning yourself in the race toward the next big leap in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives