📊 Leveraged Upside and Downside With Bitcoin Treasury Companies

Reviewed by Richard Bowman, Bailey Pemberton

Quote of the week: “It's easy to fall into the trap of assuming that a new technology is very similar to its predecessors. A new technology is often perceived as the linear extension of the previous one, and this leads us to believe the new technology will fill the same roles - just a little faster or a little smaller or a little lighter.” Michael J. Saylor

Last week, we covered the successes and risks of the Bitcoin ETFs , but now we’re covering bitcoin treasury companies, which are much more involved and have had quite a ride over the last 18 months as well.

Market sentiment on these stocks is moving, and with volatility rising, disagreements over their future prospects are as heated as ever.

We’re going to dive into what bitcoin treasury companies are, the premium debate, their financial engineering mechanisms, and the risks involved, so you know what to watch out for.

At the end, we’ll show you the many ways to get bitcoin exposure and a step-by-step method for achieving bitcoin proxy exposure via stocks.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🎤 Powell's Jackson Hole speech turns Fed's focus toward 'curious' labor market (Yahoo Finance)

- Powell hinted at rate cuts starting in September but flagged the labor market as the bigger wild card now.

- With job growth softening and revisions painting a weaker picture, the Fed’s focus is shifting from inflation to employment risks, especially given structural uncertainties like tariffs, immigration, and tax policy.

- Markets are pricing in cuts, but Powell’s cautious tone suggests the Fed won’t rush if employment cracks don’t deepen. Expect more data dependence and volatility around labor releases.

- Rate cuts may be coming, but the labor market, not inflation, is now steering the Fed’s wheel.

📉 European defense stocks slide on renewed hopes of a Ukraine Ceasefire ( CNBC )

- The outlook for peace in Ukraine changed dramatically over the course of three days. Predictably, the price of leading EU defense stocks fell as much as 10%.

- Reactions like this show how reactive markets can be - but buying and selling stocks based on one news cycle rarely pans out. If anything, these reactions create buying opportunities with a longer time horizon.

- defense budgets don’t change on a day-to-day basis. The changes in outlook over the last year have as much to do with the relationship between the EU and the US as the war in Ukraine.

- If you missed it, we covered European defense stocks in March . Better yet, have a look at our US Aerospace & Defense Screener or European Aerospace & Defense Screener to see which companies are involved.

🫸 Meta freezes AI hiring after blockbuster spending spree ( WSJ )

- Meta has hit the brakes on AI hiring after a whirlwind spree that poached 50+ researchers from rivals like OpenAI and Google. Investors weren’t thrilled with the nine-figure pay packages, and it’s starting to show in tech stock sentiment.

- The reorg into four AI units under “Superintelligence Labs” signals a pivot from aggressive scale to structured execution. Internal shakeups, including the dissolution of the underperforming Llama team, show Meta is trimming fat fast.

- With stock-based compensation swelling and buyback potential weakening, shareholders are starting to question whether this AI arms race is worth the burn rate.

- If Meta’s AI bet doesn’t pay off fast, expect more investor pushback and a rethink of "growth at any cost”.

💸 Walmart hikes annual forecast as low price focus draws shoppers ( Reuters )

- Walmart lifted its full-year sales and earnings outlook as budget-conscious shoppers across income levels continue to flock to its aisles and app.

- A 25% jump in global e-commerce and 40% growth in marketplace categories like electronics and toys show Walmart is gaining digital ground.

- While Target and others sweat tariff costs, Walmart’s heavier domestic sourcing gives it more pricing power and insulation from trade drama.

- Q3 guidance came in lighter than anticipated, which could pressure the stock short term, but stronger-than-expected comps and margin discipline show long-term resilience.

- Low prices are still king, and Walmart’s throne just got sturdier. Check out the narrative based on analysts' opinions .

✂️ Tariffs are beginning to affect corporate margins and guidance ( Business Insider )

- Tariffs have become a popular topic during earnings calls, particularly for US retailers and consumer goods businesses .

- Estée Lauder warned that tariffs will cost the company about $100m. That’s only a fraction of the company’s $1.3bn loss over the last 12 months, but it adds to the pressure.

- As mentioned, Walmart is managing better, but it did say it expects costs to rise as inventory is replaced at post-tariff price levels. The company has said it’s keeping prices as low as possible, for as long as possible.

- Sony has increased the price of the PlayStation 5 in the US by $50, citing ‘tariff uncertainties’.

- Sometimes companies use things like tariffs as an excuse to raise prices or to justify weak performance. If they raise prices, the reason doesn't really matter - it’s still inflationary and might affect volumes. If it’s an excuse for weak performance, there may be more to the story.

🇮🇳 India’s Tax Overhaul Could Boost Consumption ( CNBC )

- A plan to simplify India’s Goods and Services Tax has moved closer to being approved. GST is currently levied at four different rates: 5%, 12%, 18%, and 28%. Only the 5% and 18% rates will remain, and most products in the eliminated categories will move to a lower rate.

- So a large number of consumer goods and services could soon be 7-10 percentage points cheaper. One analyst believes the boost to consumption could be as much as $10 billion, but also said it wouldn’t offset the effect of the 50% tariff now being levied on India’s exports to the US.

- Besides the positive impact on consumer spending, simplifying the tax code makes it cheaper and easier to do business. India’s economy is notorious for red tape, and any way it can be reduced is a positive development.

- Ideally, India needs to negotiate a manageable tariff with the US. Regardless, this is still good news for India’s Consumer sector , and probably for Financials too.

💳 Bitcoin Treasury Companies: The Arbitrage Trade.

Some investors see Bitcoin treasury companies as a passing fad. Others believe they’re pioneering a new era of corporate treasury management.

Which side you’re on depends largely on your view of Bitcoin’s long-term trajectory.

At their core, these companies operate on 3 pillars:

- Acquire Bitcoin — an asset they believe will appreciate faster than their cost of capital.

- Raise capital aggressively — equity, debt, or hybrid structures to fuel further BTC purchases.

- Engineer their balance sheets — using different securities tailored to investor demand and capital structure considerations.

Put simply: they’re exploiting an arbitrage opportunity .

They see it as the chance to capture the spread between interest rates (their cost of capital) and what they believe bitcoin’s CAGR will be going forward (the return) for as many years as that spread exists.

Large pools of capital (like pensions, fixed income funds, retirement accounts) often can’t directly own Bitcoin or even ETFs.

So these treasury companies are providing the vehicles for converting investor funds into proxy Bitcoin exposure securities that offer different degrees of risk and volatility.

🚀 Who’s Leading the Charge

The obvious leader is Strategy , which has transformed itself from an analytics company into a full-scale Bitcoin proxy. In August 2025, it held ~628k BTC worth ~$71bn , up from 289k BTC ($29bn) late last year.

That makes it the world’s largest corporate holder of Bitcoin by far.

But it’s not alone:

- 🏨 Metaplanet has become Japan’s “Strategy,” issuing securities inspired by its U.S. counterpart.

- 🔬 Semler Scientific , a former medical diagnostics company, shocked markets when it pivoted into Bitcoin.

- 🌐 Smarter Web , once a small-cap software company, followed suit.

- 🏢 Cantor Equity Partners (soon to be Twenty One after ther merger) is the new kid on the pure-play bitcoin equity block.

- 🇨🇦 Even a Canadian vape company recently joined the ranks.

You’ll notice these pure bitcoin plays often have weaker or stagnant core operations, and are using bitcoin to reinvent themselves and attract investor interest.

And the movement is spreading. New entrants are arriving through SPAC listings , while smaller companies are exploring creative ways to differentiate themselves. Some will no doubt use methods less sustainable than others.

Over time, if their bitcoin holdings grow large enough (through accumulation and price appreciation), some may try to acquire or build new operating businesses on top of their BTC base.

For now, though, their stock and debt issuances have become their products. But for equity investors, that raises the stakes.

🗜️ The Premium Problem

For now, investors have been happy to pay more than what the company’s bitcoin holdings are actually worth for these securities because the supply of such opportunities is scarce (people often refer to mNAV: Multiple of bitcoin Net Asset Value).

But like any arbitrage trade, the more players that enter the trade, the thinner the opportunity and the less reason to pay up.

Grayscale’s Bitcoin Trust offers a cautionary tale of premium compression.

- It traded at hefty premiums for years, since it was one of the only ways to gain proxy exposure.

- From 2021 to 2024, it flipped into a deep discount as ETFs launched and more proxy exposure became available, eroding its advantage.

- Only after converting to an ETF did the discount finally vanish.

Strategy itself has actually followed a similar arc.

- In late 2024, its shares traded at ~4x mNAV .

- By mid-2025, that premium compressed to ~1.5x , even as BTC holdings doubled.

- Its share price is down ~30% from its peak, despite accumulating ~339k more BTC (and additional stock issuances would have contributed).

This is the equivalent of a stock’s P/E ratio compressing. Earnings (or BTC holdings) rise, but the multiple falls, and so does the share price.

Investors have already begun debating how sustainable these premiums are. Short seller Jim Chanos and bitcoin advocate Pierre Rochard recently debated this exact topic . It’s great to hear both sides of the trade.

And i nvestors in the community are discussing exactly this, too. Check out this narrative on Strategy that discusses the company, its mNAV, and what could be in store going forward.

🌅 The Industry is Evolving Quickly

Changes in legislation are also making ETFs and direct Bitcoin investment available to more investors, including via retirement funds:

- In the US, 401(K) accounts may soon be able to hold cryptocurrencies or crypto ETFs .

- Beginning in October, r etail investors in the UK will be able to invest in crypto ETNs (exchange-traded notes), but not ETFs.

As the list of alternatives increases, the justification for the premium falls. This means companies need to find different ways to fund BTC purchases - including debt.

So, if or when premiums are wide enough, the strategy is to arbitrage the mNAV premium. If debt is used, it becomes an arbitrage between the annual BTC price appreciation (CAGR) and the funding rate.

💰 Financial Engineering at Work

Companies are becoming increasingly creative with the way they fund their bitcoin purchases. The funding mechanisms they use have implications for:

- Ongoing financing costs

- Whether debt needs to be refinanced at a later stage

- If and how much holders of common stock will be diluted.

The mechanisms include:

Common Shares

Issuing new equity when premiums are high is the simplest play. New investors effectively buy bitcoin at a markup, while existing shareholders see BTC-per-share rise.

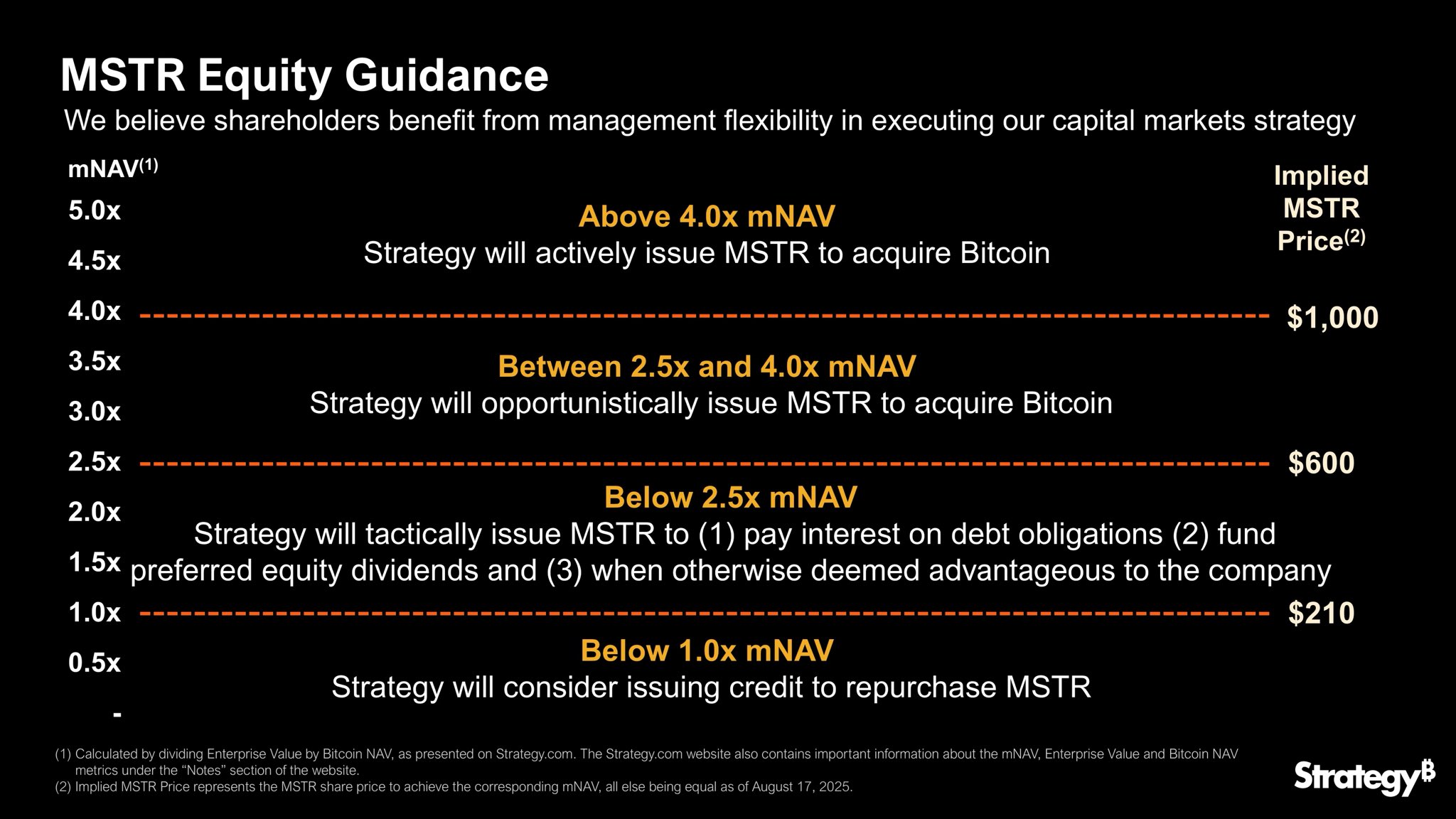

Strategy recently updated its guidance on how it’d issue At-The-Market (ATM equity.

Strategy updated ATM Equity Guidance - X

You can see in the comments on that X thread, not all are convinced it is a great move.

Convertible Notes

Strategy has issued five tranches of convertible notes maturing between 2028–2032. Most yield between 0% and 1%, which is extraordinarily cheap capital. Investors accept low yields because they gain the option to convert into equity if the stock rallies.

- If shares rise, debt vanishes as notes convert to equity.

- If shares stagnate, MSTR must refinance or repay at maturity.

Preference Shares

The most creative structures are in preferred shares — hybrids of debt and equity. In the past year, Strategy launched four tranches:

- STRK : 8% yield, convertible.

- STRF : 10% yield, cumulative.

- STRD : 10% yield, non-cumulative.

- STRC : variable (starting 9%), cumulative, callable.

These are perpetual preference shares, which mean the principal doesn’t need to be repaid, but the company does need to keep paying dividends.

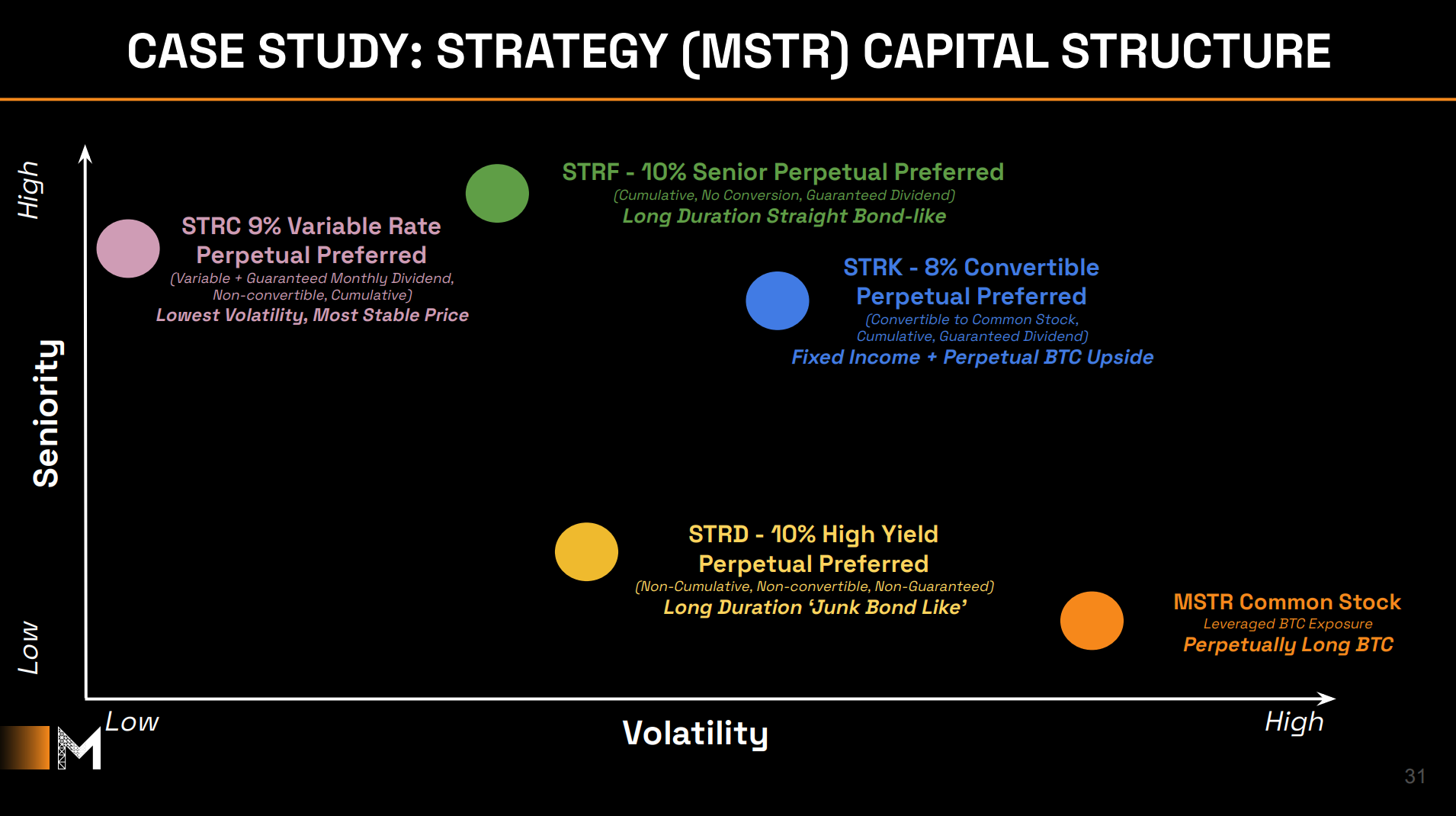

✨ An important aspect of these funding mechanisms is seniority.

When it comes to dividends (and in the case of liquidation, claims on the company’s assets), bonds and notes come first, then preferred shares, and then common shares.

Metaplanet plans to issue similar pref shares in Japan. The company used Strategy’s preferred shares as an example to highlight the different risk profiles that can be achieved.

Strategy Preferred Shares - MetaPlanet Presentation

✨ This slide reflects an important aspect of BTC treasury companies. They need to have a very good understanding of capital markets, and there needs to be demand for various types of financial instruments.

This brings us to the downside risks…

⚠️ Scenarios and Risks

Like a flywheel, the leveraged bitcoin treasury model spins fast in both directions.

In a bull market: Raise capital → buy BTC → BTC rises → stock rises → raise more capital → repeat.

In a downturn: BTC falls → mNAV compresses → stock falls → financing dries up → dilution or forced sales follow.

To understand the upside potential and downside risks, let’s consider a few scenarios that could apply to any given company:

Scenario 1: BTC continues to appreciate, and mNAV remains above ~2x

- No worries here - the company can continue to increase the BTC per share for existing shareholders without adding to debt obligations or interest payments.

- Dividend and interest payments would also come from share sales (which wouldn’t be as dilutive with a high mNAV).

Scenario 2: BTC appreciates, but the mNAV narrows

- This means the company will need to use other forms of financing, like convertibles or pref shares - assuming there is demand. This financing would fund new purchases and dividend/interest payments.

- This will increase the annual interest cost and potential dilution for shareholders (because mNAV is lower).

Scenario 3: BTC consolidates or drifts lower

-

If the price of BTC goes sideways or a little lower, the mNAV would probably narrow.

-

In this scenario, the company could probably still issue convertibles or pref shares.

-

If this scenario persists, a growing chunk of new issuance would go to dividend payments with increasing potential for dilution of common stock.

Scenario 4: BTC bear market

- A bear market would really test the strategy. The outcome would depend on how deep the decline and how long it lasted.

- Issuing shares would put pressure on the common stock. Issuing pref shares or convertibles would increase both debt and interest payments.

Scenario 5: Worst-case scenario

- In a bear market, the company can always sell BTC to fund interest payments. However, this can also add selling pressure to BTC itself.

- If the value of a company’s BTC approaches the value of outstanding debt, the common stock will have little value.

- This is why perpetual, preferred shares are becoming popular. But demand for these shares would also evaporate in this scenario.

- Equity holders could get wiped out as seniority kicks in.

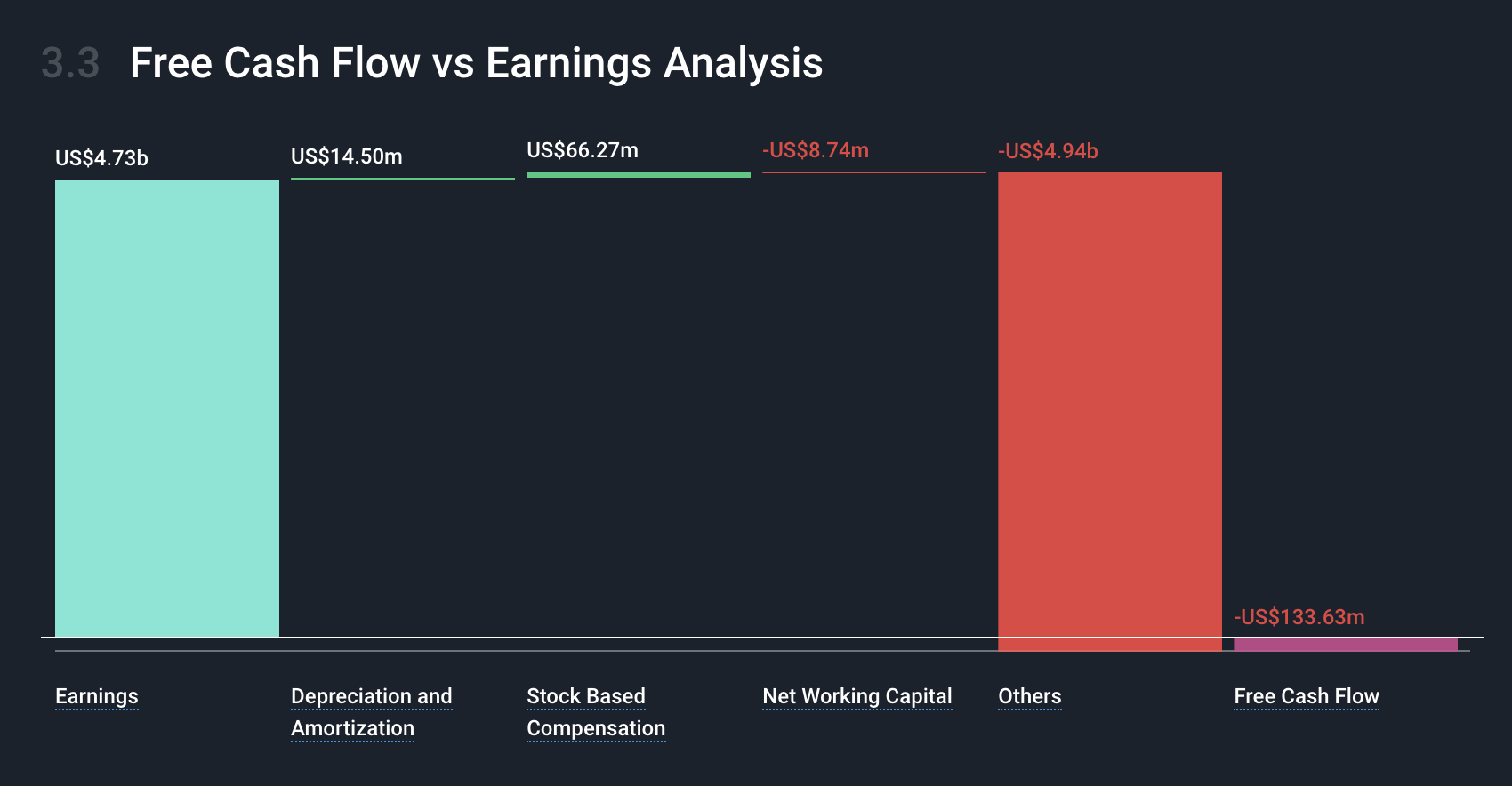

Remember, BTC is now treated as a mark-to-market security for US companies.

That means quarterly gains and losses are treated as earnings on the income statement. These are non-cash earnings, and not cash flow. Strategy reported $4.7bn in earnings for the year to June, but -$133m in free cash flow.

Strategy Earnings vs Free Cash Flow - Simply Wall St

‼️ More Complexity Requires More Due Diligence

Clearly you need to be quite bullish about bitcoin to invest in a BTC Treasury Co., and it’s not just a case of taking a view on the price of bitcoin. You’re taking a view on price, volatility, premiums, and demand for other financing instruments.

As we always say, invest within your circle of competence. If bitcoin and financial engineering are in there, you then need to build a comprehensive narrative. So here are a few things to consider:

- 👨💼 The Team : Can they raise capital through cycles, manage multiple tranches of debt, convertibles, and prefs?

- Look at their history and experience. Go through the ownership and management sections of the company report to find out more.

- 📊 Model Scenarios : Work out the maximum premium you can pay and still outperform bitcoin itself (because that’s why you’re buying these securities in the first place).

- Identify failure points and try to estimate the probability of different scenarios.

- ⚠️ Systemic Risks : As more players enter the space, yields demanded by investors rise.

- Try to determine at what point preferred yields would hit unsustainable levels.

💡 The Insight: There Are Many Ways To Get Bitcoin Exposure

Of course, bitcoin treasury companies are just one way to invest in bitcoin and the broader ecosystem. Besides buying bitcoin itself, there are bitcoin ETFs , bitcoin miners (like MARA , RIOT , etc), and even exchanges to consider, like COIN , BLS , or the soon-to-be-listed Gemini .

Here is a simple process when you’re considering these listed equities as bitcoin proxies:

- 🔎 Discover BTC stocks

- Check out our Global Bitcoin Stocks screener to start your search.

- 📝Build your narrative

- Each stock will have a slightly different narrative, future prospects, and risk profile.

- For example, this IREN narrative is a very different narrative from this AI analyst narrative on RIOT platforms .

- You can either follow other investors’ narratives or build your own!

- ⏰ Wait for the right time

- As mentioned with the mNAV risks, the current price may not always be right. Estimate a fair value to make sure you watch and pay a good price for the value you’re getting.

- 📊 Portfolio sizing matters

- If you do decide to add BTC-linked equities or ETFs to your Portfolio , make sure your position sizing makes sense for your financial goals and objectives.

Bitcoin treasury companies thrive on premiums related to scarcity and management’s ability to execute sound financial engineering.

They can deliver powerful leveraged upside when b itcoin rallies, but when markets turn, premium compression, debt covenants, forced liquidations, or inability to access liquidity in capital markets mean the risks are just as large.

Key Events Next Week

Tuesday

🇦🇺 RBA Meeting Minutes

- ➡️ Why it matters: With markets split on the next move, any hint of a shift in tone could sway rate expectations and the Aussie dollar.

🇺🇸 Durable Goods Orders

- 📉 Forecast: -2.5% (Previous -9.3%)

- ➡️ Why it matters: A smaller decline after last month’s plunge may ease concerns about a collapse in business investment.

Thursday

🇺🇸 US GDP Growth Rate QoQ 2nd Est

- 📉 Forecast: 3% (Previous -0.5%)

- ➡️ Why it matters: A sharp upward revision would confirm a much stronger Q2, supporting the Fed’s higher-for-longer stance.

Friday

🇺🇸 US Core PCE Price Index (MoM)

- 📉 Forecast: 0.3% (Previous 2.2%)

- ➡️ Why it matters: A tame monthly reading keeps the Fed on track for a pause—this is their go-to inflation gauge.

🇺🇸 US Personal Spending (MoM)

- 📉 Forecast: 0.3% (Previous 0.3%)

- ➡️ Why it matters: Flat growth suggests consumers are treading carefully, potentially cooling overall demand.

🇨🇦 Canada 2nd Qtr GDP (YoY)

- 📉 Forecast: 0.2% (Previous 2.2%)

- ➡️ Why it matters: A major slowdown points to fading economic momentum and could bring BoC rate cuts closer.

All eyes will be on Nvidia’s earnings on Wednesday, after the market closes. There are also lots of cloud software companies expected to report this week.

Disclaimer

Simply Wall St analyst Michael Paige has a position in MSTR. BlackGoat is an employee of Simply Wall St, but has written a narrative in their capacity as an individual investor. Simply Wall St has no position in the company(s) mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Any narratives mentioned are general in nature and explore scenarios and estimates created by the authors. These narratives do not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company’s future performance and are exploratory in the ideas they cover. The fair value estimates are for informational purposes only and do not constitute a recommendation to buy or sell any stock. They do not take into account your objectives or financial situation. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.