Quote of the Week: "The individual investor should act consistently as an investor and not as a speculator." -Ben Graham

With markets looking frothy and a handful of mega-caps doing most of the heavy lifting, it’s no surprise investors are eyeing “defensive” sectors as a potential safe house.

The catch is that in 2025, many of those supposed safe havens are trading at anything but bargain prices, and some are behaving more like growth stories than shock absorbers.

In this piece, we’ll cover the key defensive sectors across the US, Canada, the UK, Europe, and Australia, compare their valuations to the broader market, and highlight where “safety” might actually be expensive risk in disguise.

By the end, you’ll have a clearer sense of which defensives still make sense, where caution is warranted, and what to consider instead if you want resilience without overpaying.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🤖 Google makes a splash in the AI race ( Axios )

- Nvidia’s AI throne just got a bit shakier. Google’s Gemini 3 is reportedly outperforming ChatGPT and runs on its own TPUs, not Nvidia’s chips. Meta is even eyeing Google’s silicon for its data centers.

- This dents the narrative of Nvidia’s unchallenged dominance. With both companies now trading near $4T market caps (Alphabet $3.9T, Nvidia $4.3T), investors may begin to price in real competition.

- Nvidia’s dip and Alphabet’s rally show how fast sentiment can shift in AI. The bigger risk is that a fragmented chip ecosystem could challenge Nvidia’s pricing power and future margins.

- If Google starts licensing TPUs more widely, that could open a new AI arms race and alter chip allocation across the tech stack.

- Nvidia’s moat is still wide, but not unbreachable. Investors betting on eternal AI supremacy from this stock may want to revise some of their forecasts to be more conservative.

- Check out the latest Nvidia narratives from our community.

📈 Australia’s consumer inflation accelerates to 3.8% in October, overshooting estimates ( CNBC )

- Inflation in Australia is picking up speed again, with October CPI rising 3.8%, the fastest in 7 months and above forecasts. Housing and electricity were the big culprits, with power costs alone jumping over 37%.

- With the RBA already cautious about rate cuts, this fresh inflation surge could delay any easing moves deep into 2026. Traders hoping for relief in 2025 may need to recalibrate.

- The Aussie economy is holding up better than expected, but persistently high inflation narrows the central bank’s wiggle room.

- Bond yields ticked higher, and the AUD slipped, suggesting markets are bracing for tighter-for-longer monetary policy.

- Since rate cuts are likely on pause, rate-sensitive sectors could experience pressure and keep AUD volatility alive.

🚕 Uber rolls out driverless robotaxis in Abu Dhabi ( CNBC )

- Uber’s robotaxis have landed in Abu Dhabi, its first fully driverless rollout outside the U.S., and a bold step into the Middle East. The move, in partnership with WeRide, signals Uber’s growing push to automate rides at scale.

- This adds a new layer of global exposure for investors in AV firms like WeRide and could hint at revenue diversification for Uber beyond U.S. shores.

- While Uber hasn’t shared the revenue split, scaling robotaxi operations to 15 cities could compress costs and improve margins in the long term.

- It also puts pressure on competitors like Lyft to accelerate their AV timelines, especially as Uber targets high-traffic urban centers abroad.

- Uber’s AV ambitions are no longer U.S.-centric. Global robotaxis could become a real growth lever if costs stay grounded and adoption keeps pace.

📉 China industrial profits drop 5.5% in October, worst performance in five months ( CNBC )

- China’s industrial profits dropped sharply in what was a clear reversal from September’s surge. The culprit is slumping manufacturing, shaky global demand, and lingering trade tensions with the U.S.

- The PMI drop to 49.0 signals ongoing contraction, and with core inflation inflated by gold prices, underlying domestic demand looks weak.

- Beijing’s crackdown on overcapacity and geopolitical spats (like the seafood ban on Japan) aren’t helping manufacturers either.

- For investors, the signal is clear: hopes of a China industrial rebound are premature, and export-facing firms could remain under pressure for the foreseeable future.

🕶 Alibaba launches $500 AI smart glasses to take on Meta ( CNBC )

- Alibaba just dropped its Quark AI Glasses in China, undercutting Meta’s $799 Ray-Bans and adding voice-controlled features like translation, shopping, and real-time product info.

- The move doubles down on its ChatGPT rival Qwen, aiming to embed it into everyday devices and grow its consumer AI footprint.

- If adoption takes off, Alibaba could tap into a fast-growing market where AI wearables are expected to double in shipments to reach 10 million units during 2026.

- Keep an eye out for signs that these glasses are becoming more than a flashy gadget, especially as they link to Alibaba’s core platforms like Taobao.

🛡️ Fortifying your Portfolio with Defensive Stocks

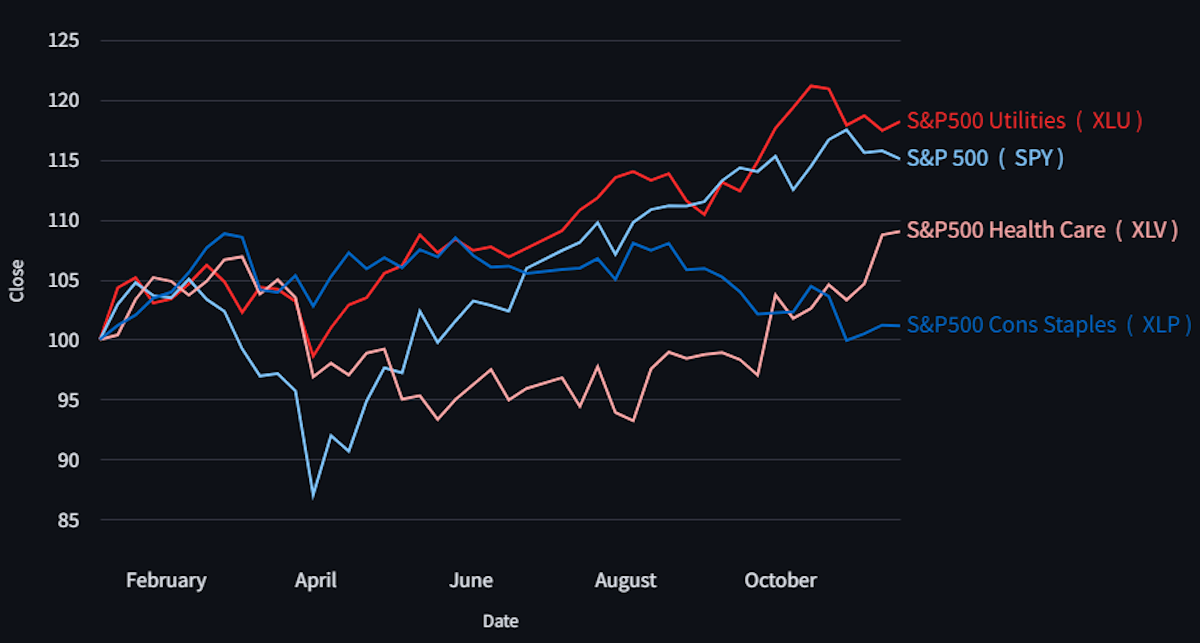

Defensive stocks as a group have drawn attention recently, but over the course of the year, their performance has been varied.

In the US market, Utilities have outperformed year-to-date, while Healthcare stocks lagged initially and outperformed more recently. Consumer Staples are barely in the green for the year, and way behind the S&P 500.

US Defensive Sectors vs S&P 500 - Simply Wall St

Before we take a closer look, let’s have a quick look at what counts as a defensive stock, industry, or company .

These are the ‘ boring ’ companies that keep chugging along regardless of the state of the economy. They offer steady cash flows and usually feature a low or event negative "beta" (finance speak for "they don't have a panic attack every time the S&P 500 sneezes").

But in 2025, even the boring stuff is getting complicated.

🗃️The Core Defensive Sectors

If you are looking for safety, these are the sectors universally recognized as the safe harbors of the equity world:

- 🧼 Consumer Staples:

- These guys sell the stuff you buy on autopilot. Toothpaste, soap, snacks. Whether the economy is in a boom or a bust, people still need to eat and shower (we hope).

- 💊 Healthcare:

- Think Big Pharma and insurance. Thanks to aging demographics and the fact that illness doesn't check the GDP before striking, these revenue streams remain pretty consistent.

- 💡 Utilities:

- The providers of electricity, gas, and water. These are regulated monopolies with incredibly predictable income. Nobody cancels their power bill to save money for a vacation.

And a few other industries…

A few other industries can also be defensive:

- 📡 Telecoms:

- Thirty years ago, these were high-growth tech darlings. Today, they are basically utilities with better marketing. We’re all addicted to data, making their revenue streams nice and predictable.

- 🏢 REITs (Real Estate Investment Trusts):

- These can be defensive, with a few important caveats:

- Interest-rate sensitive (very).

- Some sectors are cyclical (retail), others face secular shifts (office, parts of healthcare).

- Residential and industrial REITs tend to be more stable.

- These can be defensive, with a few important caveats:

- 🛡️ Defense Stocks:

- While it’s literally in the name, defense contractors have the ultimate customer: the government. Generally, national security budgets don't care about economic cycles.

⚠️ The Defensive Trap

Here is the theory: Own growth stocks when the sun is shining. Own defensive stocks when storm clouds gather.

Simple, right?

In reality, trying to execute this switch is a lot easier said than done. Here is the painfully common scenario:

- You sense a downturn coming.

- You and everyone else bid up the price of defensive stocks. You end up overpaying for safety.

- The downturn… never happens. Or it’s mild.

- You eventually sell your boring staples at a loss and buy back into growth stocks, which are now at record highs.

Or ….. You hold your growth stocks through a major correction, and then switch to defensives just before the recovery. Then you watch the high beta stocks rally while the defensives underperform in the recovery environment.

There are lots of ways for market timing to go wrong.

⚾ The 2025 Curveballs

Just to make things trickier, the landscape in 2025 is a bit weird.

- Consumer staples have been impacted by tariffs, currency movements, and other factors. The impact has been positive in some cases and negative in others.

- Utilities are… aggressive?: Thanks to the insatiable energy hunger of AI data centers, power utilities are suddenly a growth story , which we talked about 2 months ago.

- Defense is booming: Geopolitical tension in Europe and beyond has governments opening their wallets.

German Aerospace & Defense Industry - Simply Wall St

When a boring industry suddenly becomes a "growth" story (like Utilities has), speculation ramps up. And once speculation enters the chat, that stock isn’t really a defensive play.

🌎 Global Defensives Round-Up

We can compare valuations on a like-for-like basis by dividing the current P/E ratio by the expected growth rate (ie, the PEG or PE to Growth ratio).

✨ Below, you’ll notice a recurring theme in every major market: Defensive sectors are looking pricey compared to the rest of the market. This implies that investors are paying a premium for perceived stability or safety.

The premiums are substantial, too - though there may be some justification:

- 📈 Lower growth rates can be sustained for longer periods.

- 💰 In many cases, investors are paying up for real profitability, rather than profits that still need to be proven.

🇺🇸 US

Most US large caps are trading on historically high multiples, and that includes the defensive sectors.

There are individual companies within each sector with less demanding valuations, but investors will need to be cautious before assuming any company is really defensive.

- Consumer staples have been out of favor, so some may be offering better value.

- Telcom networks and certain REITs might also be worth a look, but ‘ value stocks ’ might actually be the more defensive play.

🇨🇦 Canada

Canada’s utilities sector hasn’t been swept up in the AI trade to the extent that US power utilities have, but trading at 33x earnings is still quite high for the sector.

The other defensive sectors also appear to be ‘optimistically’ valued, as do telcos (which have negative growth forecasts).

🇬🇧 UK

The UK’s defensive sectors are trading on higher valuations than the overall UK market, but their valuations are quite a bit lower than other markets.

That makes sense with a sluggish economy, but the multinationals are less exposed to the domestic economy.

🇪🇺 Europe

In Europe, defensive sectors are also trading on higher multiples than the broader market, particularly in Switzerland and France .

The premium is narrower in Germany , where defensives have lagged the broader market. In other words, defensive stocks may have a better chance of actually being defensive.

🇦🇺 Australia

Australia’s defensive sectors are trading on similar multiples to the US, though interestingly, they are actually slightly lower than the historical average. Real estate and telecom networks are similarly priced.

Investors will probably need to be very selective across all of the industries.

You can dive deeper into this kind of data for any market on the Discover Page , under the Markets Tab.

💡 The Insight: Avoid the Knee-Jerk Switch to Defensives

As you can see, there’s a real risk of overpaying for safety and stability.

Does that mean you shouldn’t even consider these sectors? Of course not!

Defensive stocks have a valuable role to play in your portfolio. They can add stability and income, and they can actually compound over long periods of time.

The risk is in overpaying for them, and in trying to flip back and forth between cyclical, growth, and defensive stocks. We mentioned this during our review of Howard Mark’s “The Calculus of Value” Memo back in early September.

If you buy a defensive stock at the right price, it can compound over a very long period.

As an example, Berkshire Hathaway’s Coca-Cola stake has compounded at roughly 9% for over 30 years, and that’s excluding the dividends.

And, while you hold a stock like that, it can provide stability to your portfolio.

To reduce the risk of overpaying, make sure you know how the sector’s current valuation measures up against the historical average - and then do the same for the stock itself (section 1.4 of the Company Report)

Tesco PLC Historical P/E Ratio - Simply Wall St

If you do want to dampen volatility in the short term without buying overpriced soap companies, there are other alternatives:

- 🛢️ Contrarian value plays (like Energy ),

- ⛏️ Commodity producers, or Gold.

- 💰 Cash - which you can use to pick up bargains after a correction.

✨ The bottom line: Boring can be beautiful, but only if the price is right.

Key Events During the Next Week

Tuesday

- 🇺🇸 US JOLTs Job Openings

- 📉 Forecast: 7.2M, Previous: 7.23M

- ➡️ Why it matters: A cooling labor market supports the case for Fed rate cuts.

- 🇪🇺 EU Inflation Rate YoY Flash

- ▶️ Forecast: 2.1%, Previous: 2.1%

- ➡️ Why it matters: Steady inflation near target levels reinforces expectations for the ECB to maintain current interest rates.

Wednesday

- 🇦🇺 AU GDP Growth Rate YoY

- 📈 Forecast: 2.2%, Previous: 1.8%

- ➡️ Why it matters: Accelerating growth reduces recession fears but could prompt the RBA to keep rates tighter for longer.

- 🇺🇸 US ADP National Employment Report

- 📉 Forecast: -15.0k, Previous: 42.0k

- ➡️ Why it matters: A contraction in private payrolls signals significant economic weakness, likely fueling expectations for Fed rate cuts.

Thursday

- 🇺🇸 US Balance of Trade

- 📈 Forecast: -57.0B, Previous: -59.6B

- ➡️ Why it matters: A narrowing trade deficit positively impacts GDP growth calculations and may reflect stronger export performance.

It’s a big week for cloud software, and for discount retailers:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.