We recently highlighted the reasons alternative investments are getting a lot of attention. We’ve decided to follow up with a more detailed look at the outlook for alternative sectors in 2026 and beyond. We went through a bunch of annual outlook reports from the pros on Wall Street to find the key insights.

Some alt market asset classes are more accessible to individual investors than others, but the list of alt products available to the retail market is growing. Regardless, the growth and developments in these markets will have implications for public markets (ie. listed stocks) and the broader economy.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🏦 Federal Reserve signals rate hikes remain possible in 2026 (CNBC)

- What happened: Minutes from the Federal Reserve’s January 27-28 meeting showed most officials favor pausing rate cuts, while several discussed possible rate hikes if inflation stays elevated. Rates remain at 3.5% to 3.75%, with markets now pricing at most two cuts in 2026 and the first no earlier than June.

- How it impacts investors: The prospect of higher-for-longer rates challenges assumptions around aggressive easing next year. Rate-sensitive sectors could remain under pressure if inflation does not cool toward the 2% target.

- Next steps: Review our US Market overview to assess sector-level performance and rebalance exposure accordingly

👑 Amazon overtakes Walmart in annual revenue (Bloomberg)

- What happened: Amazon reported US$717 billion in 2025 revenue, surpassing Walmart’s US$713.2 billion and ending more than a decade of Walmart’s lead as the world’s largest company by sales. Growth has been driven by its cloud computing division, AWS, alongside its e-commerce operations.

- How it impacts investors: The milestone highlights the increasing weight of high-margin cloud services within Amazon’s revenue mix. It also underscores the structural divergence between tech-enabled platforms and traditional retail models.

- Next steps: Compare Amazon and Walmart to assess revenue growth, margin trends, and long-term return potential.

🖥️ Nvidia secures multi-year AI chip deal with Meta Platforms (Reuters)

- What happened: Nvidia signed a multi-year agreement to supply Meta with millions of AI chips, including Blackwell and next-generation Rubin GPUs, as well as standalone Grace and Vera CPUs. The deal is estimated to be worth tens of billions of dollars and marks the first large-scale standalone deployment of Nvidia’s Grace CPUs.

- How it impacts investors: The agreement reinforces Nvidia’s role at the center of hyperscaler AI spending and expands its footprint into data center CPUs. It also signals that Meta’s US$135 billion AI capital expenditure plan for 2026 has clear hardware commitments.

- Next steps : Analyze Nvidia and its semiconductor peers using our Large Cap Semiconductors screener to compare growth, margins, and valuation.

⚛️ Microsoft targets commercial quantum rollout by 2029 (CNBC)

- What happened: Microsoft’s quantum vice president said commercially valuable quantum computers could be deployed in data centers by 2029, a timeline he described as more certain than a year ago. The company’s Majorana 1 chip uses topological qubits designed to consume significantly less power than traditional data center hardware.

- How it impacts investors: A defined 2029 timeline shifts quantum computing from long-term theory to medium-term capital allocation planning. It also highlights potential energy efficiency gains that could reshape AI infrastructure economics.

- Next steps : Use our High Growth Tech & AI screener to monitor companies building next-generation compute infrastructure.

🎵 Spotify slips after Alphabet unveils AI music model (Yahoo Finance)

-

What happened: Spotify shares hit a speed bump after Alphabet unveiled Lyria 3, a Gemini-powered AI music generation model. Spotify closed the session up about 2%, as investors weighed the competitive implications.

-

How it impacts investors: Advances in AI-generated music introduce new competitive dynamics for streaming platforms and music rights holders. The development may pressure valuations if content creation becomes more commoditized. This applies to platforms like Netflix too.

- Next steps: Add Spotify and other streaming media platforms to your Watchlist to track analyst revisions and competitive positioning shifts.

🏦 Blue Owl Capital halts fund redemptions as liquidity strain hits private credit (Yahoo Finance)

-

What happened: Blue Owl Capital l permanently halted quarterly redemptions for its retail-focused private credit fund OBDC II after withdrawals rose 20% year over year, with US$150 million pulled in the first nine months of 2025. The firm sold US$1.4 billion in direct lending assets at 99.7% of par to fund payouts, and its shares fell around 10% to a two-and-a-half year low.

-

How it impacts investors: This puts a spotlight on liquidity risk across the US$1.8 trillion private credit market, especially in non-traded BDCs and interval funds. If redemption pressure spreads, investors could see tighter liquidity terms and increased volatility across alternative asset managers.

-

Next steps: Explore our Alternative Managers screener to compare asset managers and stress-test balance sheet strength before adding exposure.

Where are alternative investments headed in 2026? Part two!

Analysts are broadly in agreement on the outlook for alt sectors. The short version: conditions are arguably more favourable for alternatives right now than at any point since the 2008 financial crisis. But as always, the details matter.

As a report from Julius Baer put it, “while the outlook for alternatives is constructive, success will depend on selecting top-tier managers, maintaining diversification across strategies, and aligning commitments with long-term objectives.”

Here is a summary of the themes driving activity in the major alt sectors…

🏦 Private Equity: The "deal dam" is breaking

After two-plus years of frozen dealmaking, private equity is thawing fast. With capital flooding into the private credit market, funding for deals is more readily available and borrowing costs are lower.

Meanwhile, some institutional investors have found themselves underallocated to private assets due to their gains in listed equity. JP Morgan pointed out that the sweet spot is the small and mid-market (companies valued below $1.5 billion) where valuations are lower and there is more room for operational improvement.

JPM is also optimistic about PE in Europe, India and Japan. In Europe they point out that the fragmented market and large number of mid-sized companies creates opportunities. India’s PE market is being driven by the country’s economic growth and global supply chain shifts. Japan’s corporate governance reforms are leading to more deal activity and corporate spin-offs.

Global M&A deal value 1996 to 2025 with trendline extrapolation to 2028 - Morgan Stanley

In the US, venture capital and PE fund are benefitting from two factors:

- The secondary market is becoming more liquid. Investors in private companies are able to sell to other investors rather than waiting for a buyout or IPO.

- The IPO market is also picking up, which is giving funds another opportunity to exit.

If this continues, more capital will be available to be recycled into new deals and start-ups.

👉 You can find most of the listed companies with significant exposure to private equity in this screener.

🏗️ Real Estate: Recovery, but be selective

Commercial real estate had a brutal repricing cycle. Values fell more than 20% in many markets over the past couple of years. But analysts expect a global recovery from here, as we highlighted in December.

For the first time in recorded history, property income has stayed positive even as values fell. That means investors buying today are getting better income yields and potential capital upside as valuations recover.

Apollo points out that high valuations in public equity markets make real estate attractive on a relative basis, particularly private real estate.

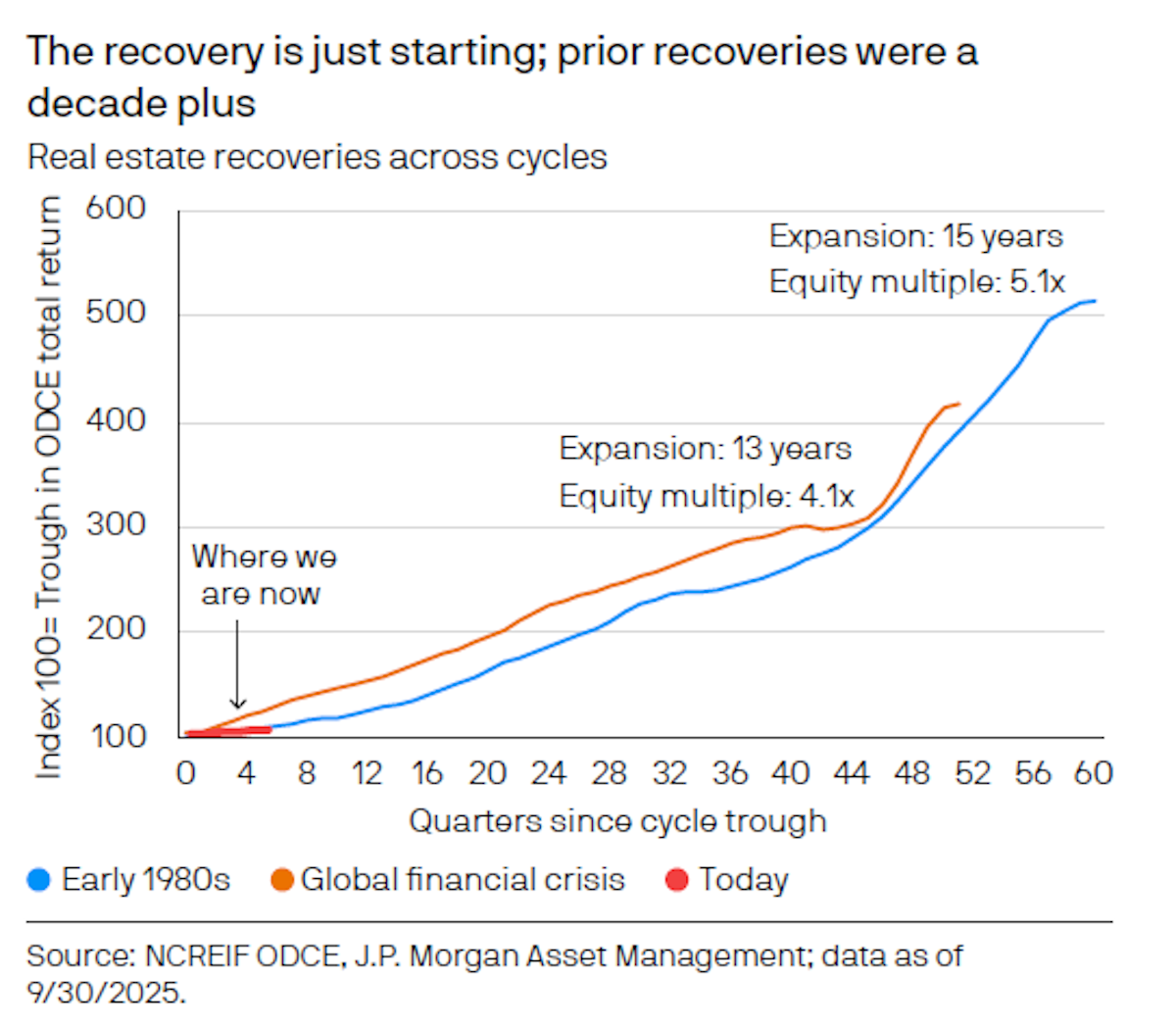

JP Morgan reckon this is very early in what could be a decades long recovery.

Not all sectors are equal, though. Industrial and logistics space is benefiting from onshoring and AI-driven infrastructure demand — particularly assets with high-power electrical capacity. US retail, oddly enough, has been the best performing sector for the past two years, with vacancies near all-time lows (the death of retail was apparently greatly exaggerated). Office remains the tricky one: premium, well-located space is recovering, but commodity office stock continues to struggle.

For residential, the supply-demand picture is stark. The US alone has a deficit of roughly 4.7 million homes, and the median age of a first-time buyer has risen from 30 before the GFC to 40 today.

The shortage of residential properties is very much a global phenomenon, apart from a few countries like China. There are however unique factors affecting specific sub-sectors in each country.

👉 You can use the Simply Wall St stock screener to narrow the REIT universe down to very specific industries, including data centers, industrial, retail and ~15 others. Then, you can filter by country and key metrics to arrive at a short list to analyze in more detail.

💳 Private Credit: Growth pains and quality questions

Private credit has been one of the great success stories of the post-GFC era — growing roughly 10x from $250 billion in 2007 to $2.5 trillion today, and projected to reach $3.5 trillion by 2029. That growth has attracted a lot of competition, which is now squeezing spreads and loosening lending standards.

One of the knock-on effects of the recovery in commercial real estate is the opportunity being created in private lending markets: Nearly $2T in CRE debt maturities are expected through the end of 2026.

As banks continue to deleverage (lend less), and investors look to diversify away from the traditional 60/40 portfolio, private credit is expected to continue to grow.

However, there are some warning signs worth watching. The share of loans with PIK (payment-in-kind) features, where borrowers pay interest with more debt rather than cash, has risen from 6.6% at the end of 2021 to 11.4% today, with half of those added after the loan was originated.

Any sharp increase in default rates (still relatively low) could cause sentiment to deteriorate quickly.

⚡ Infrastructure & Transportation: Where the real action is

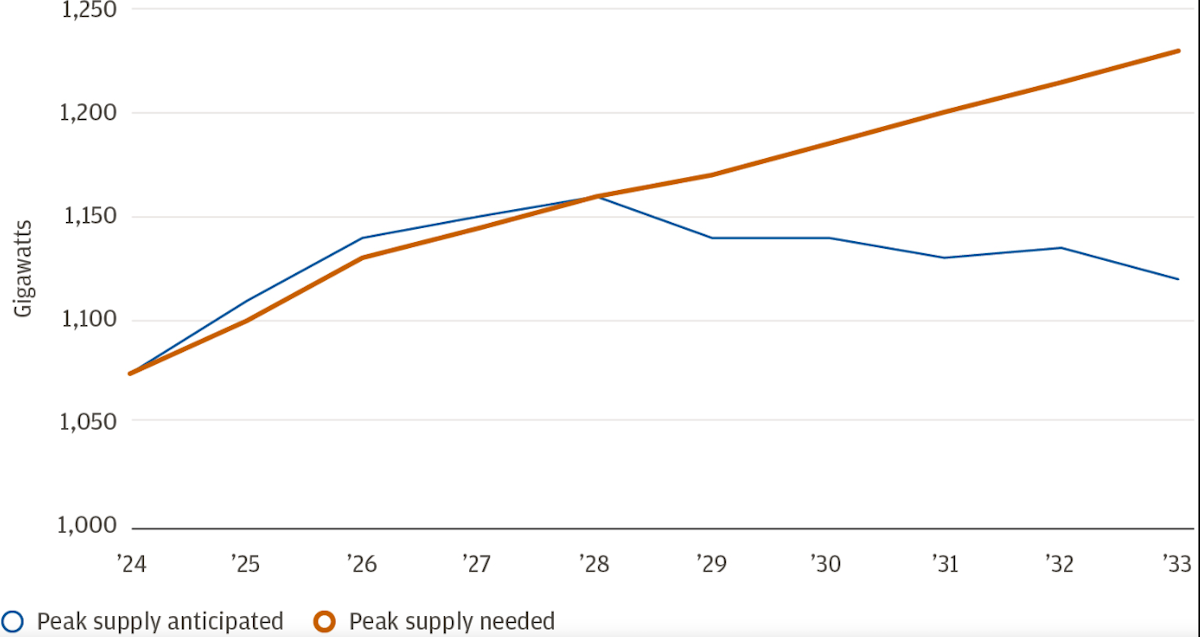

If there's one theme that cuts across the entire alternatives landscape right now, it's energy and infrastructure. The numbers are almost hard to believe: US power demand is expected to grow at 1.7-3.2% per year through the 2040s, compared to just 0.4% historically. The drivers are well known: AI data centers, electric vehicles, industrial onshoring, or as Brookfield puts it: “Digitalization, Decarbonization, and Deglobalization”

The capital implications are enormous. J.P. Morgan describes this as a "capex super-cycle" where capital expenditure will outpace asset depreciation for the first time this century. The bottleneck isn't money — it's time. Power plants, transmission lines, and data centers take years to plan, permit, and build. That supply constraint is what creates the return opportunity for investors already in the space.

Beyond AI and EVs, energy security is a priority everywhere. This means investment in infrastructure isn’t confined to specific regions or countries.

Transportation is experiencing a parallel dynamic. The global fleet encompassing ships, aircraft and rail have an average age of nearly 14 years, representing roughly 56% of its useful life. New environmental regulations are rendering older vessels economically unviable, while manufacturing capacity for replacements is booked out more than a decade in advance. The result is a structural shortage of modern transport assets, which supports pricing power for owners.

Tariffs and trade disruptions are adding another layer. Rather than reducing overall trade volumes, tariffs are mostly rerouting goods via longer routes, which actually increases demand for vessels and freight capacity.

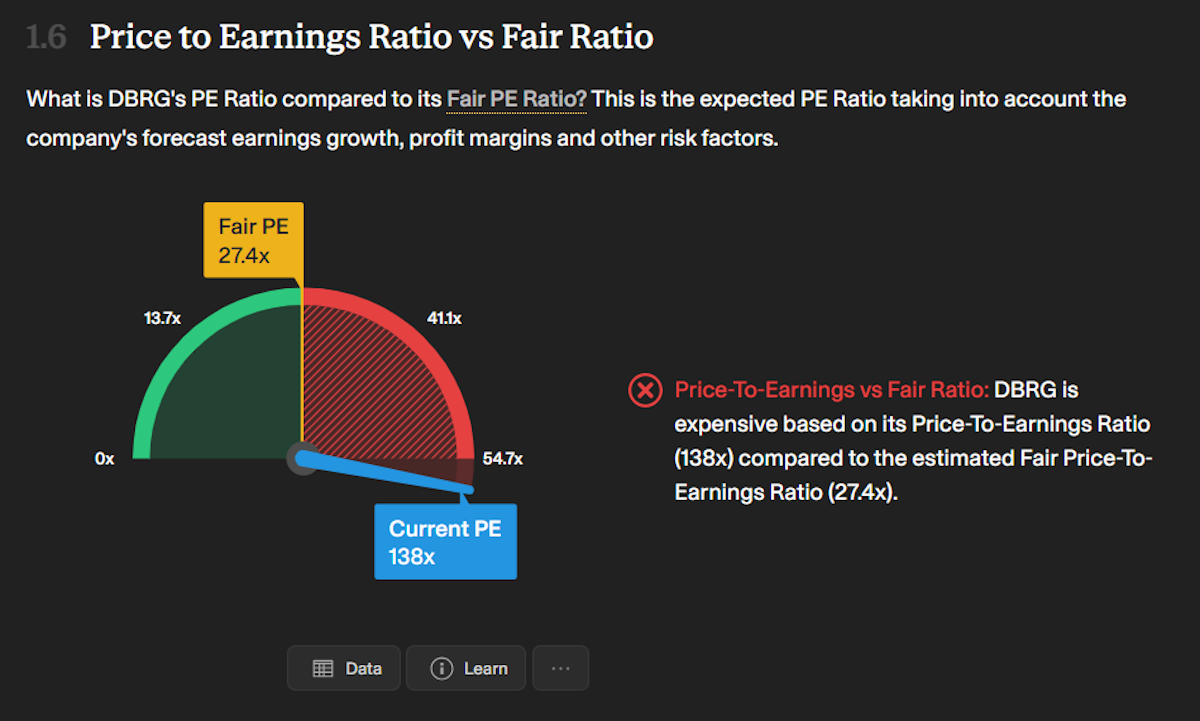

Infrastructure as an asset class has some big long term tailwinds, but that’s often reflected in valuations. The P/E to Fair P/E for chart for DigitalBridge is a good example:

👉 Check out the Electricity and Transport Infrastructure screener to find the major players in the space.

🎲 Hedge Funds: The alpha winter is over

From roughly 2011 to 2019, conditions for hedge funds were unusually poor. Low rates, low volatility, and high correlations between assets meant there was very little for skilled managers to exploit. That environment has fundamentally changed.

Higher interest rates, greater dispersion between individual stocks, and divergent central bank policies globally have created what J.P. Morgan calls a "richer alpha environment."

Relative value strategies, global macro, and equity long/short are all benefiting. One standout opportunity: Japan, where corporate governance reforms have dramatically increased M&A activity and shareholder returns, creating a multi-year window for activism-driven returns.

This Hedge Fund Managers screener includes some of the big players in the industry.

💡 The Insight: The Second Order Effects

Many of the alt sectors mentioned here aren’t very accessible to individual investors just yet. But that doesn’t mean they aren’t worth paying attention to.

The downstream effects of what happens in these markets will be relevant to quite a few listed equity sectors. Here are a few examples:

- Infrastructure: Infrastructure investments typically take the form of bonds or direct investments by institutional investors. But that money eventually flows to companies that actually build the infrastructure and supply the raw materials, including:

- Commodity producers (ie the materials sector)

- All of the companies that build electrical infrastructure, covered in more detail here.

- Nuclear energy companies could see sustained and growing demand too.

- Private equity and private credit: Most of the deals in these sectors flow through the banking sector. The banks that arrange these deals are already earning lucrative fees.

- Listed fund managers also benefit from flows and performance in private equity, credit and hedge funds.

- Real estate: As we mentioned in December REITs appear well positioned in 2026, and particularly those in the right parts of the market.

- If you invest in real estate anywhere in the world, the JP Morgan report we referenced in this article has some excellent insights on the dynamics shaping the industry around the world.

Key Events Next Week

The main event this week will no doubt be Nvidia’s 4th quarter earnings.

Tuesday

- 🇺🇸 US CB Consumer Confidence (February)

- 📈 Forecast 83, Previous 84.5

- ➡️ Why it matters: Still near 12-year lows; any further deterioration deepens fears of a spending slowdown.

Wednesday

- 🇦🇺 Australia CPI YoY (January)

- 📉 Forecast 3.6%, Previous 3.8%

- ➡️ Why it matters: A pullback from December's holiday-distorted spike would ease pressure on the RBA and support rate cut bets.

Thursday

- 🇺🇸 US Initial Jobless Claims (Week ending Feb 21)

- 📈 Forecast 229K, Previous 227K

- ➡️ Why it matters: Claims near cycle lows give the Fed some breathing room. Any sustained rise would shift the rate outlook quickly.

Friday

- 🇯🇵 Japan CPI YoY (February)

- 📈 Forecast 2.0%, Previous 1.5%

- ➡️ Why it matters: A rebound toward 2% after January's energy-subsidy dip would reinforce BoJ's case for continued rate hikes.

- 🇺🇸 US PPI MoM (January)

- 📉 Forecast 0.3%, Previous 0.5%

- ➡️ Why it matters: A softer print after December's spike would support the view that producer inflation has peaked.

Apart from Nvidia, a few prominent technology and energy companies are due to report:

- NVIDIA

- Salesforce

- Dell Technologies

- Alibaba

- Home Depot

- Intuit Inc

- Monster Beverage

- Constellation Energy

- MercadoLibre

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.