The data which powers Simply Wall St is provided by our partners S&P Global Market Intelligence LLC. Unlike competitors our coverage is fully global with no difference in our coverage by market. S&P not only collect the data from a range of sources but also review and normalize it, normalizing the data allows us to do apples-to-apples comparisons between companies. Unless specified we generally use Trailing Twelve Month (TTM) or Last Twelve Month (LTM) Data, this helps us avoid seasonality in company results, makes data more consistent and comparable, is the same data used in valuation metrics whilst still being up to date.

We currently use end of day market prices and not real time or delayed. Our reports are design to be used by long term investors who are not attempting to ‘time’ the market.

Normalizing the financial data and updating our models means our reports can take anywhere from a few hours to a day represent any new results, we aim to have the latest analysis available as soon as possible.

Below are examples of the data used:

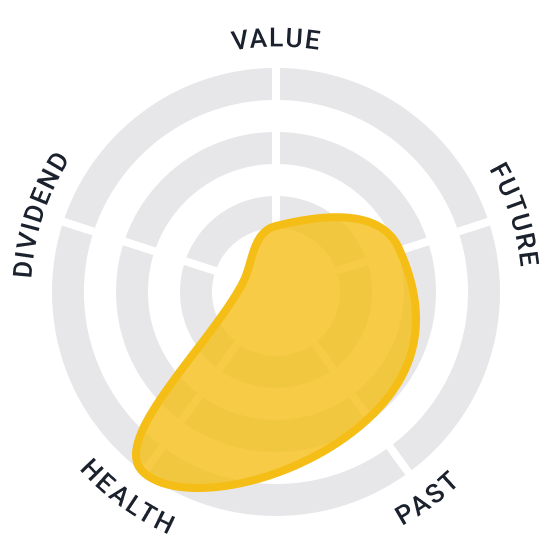

Analysis Model and Snowflake

Details of the analysis model used to generate our research reports is available on our Github page, we also have guides on how to use our reports and tutorials on Youtube.

Learn about the world class team who designed and built the Simply Wall St analysis model.

Our model is frequently being updated and improved, any changes will be mentioned in our changelog.

Feedback on our data

Please visit our Help Center for more information or submit your feedback.

.svg)