Why 8 million investors choose Simply Wall St over Investing.com Pro

TL:DR What are the key differences between Simply Wall St and Investing Pro?

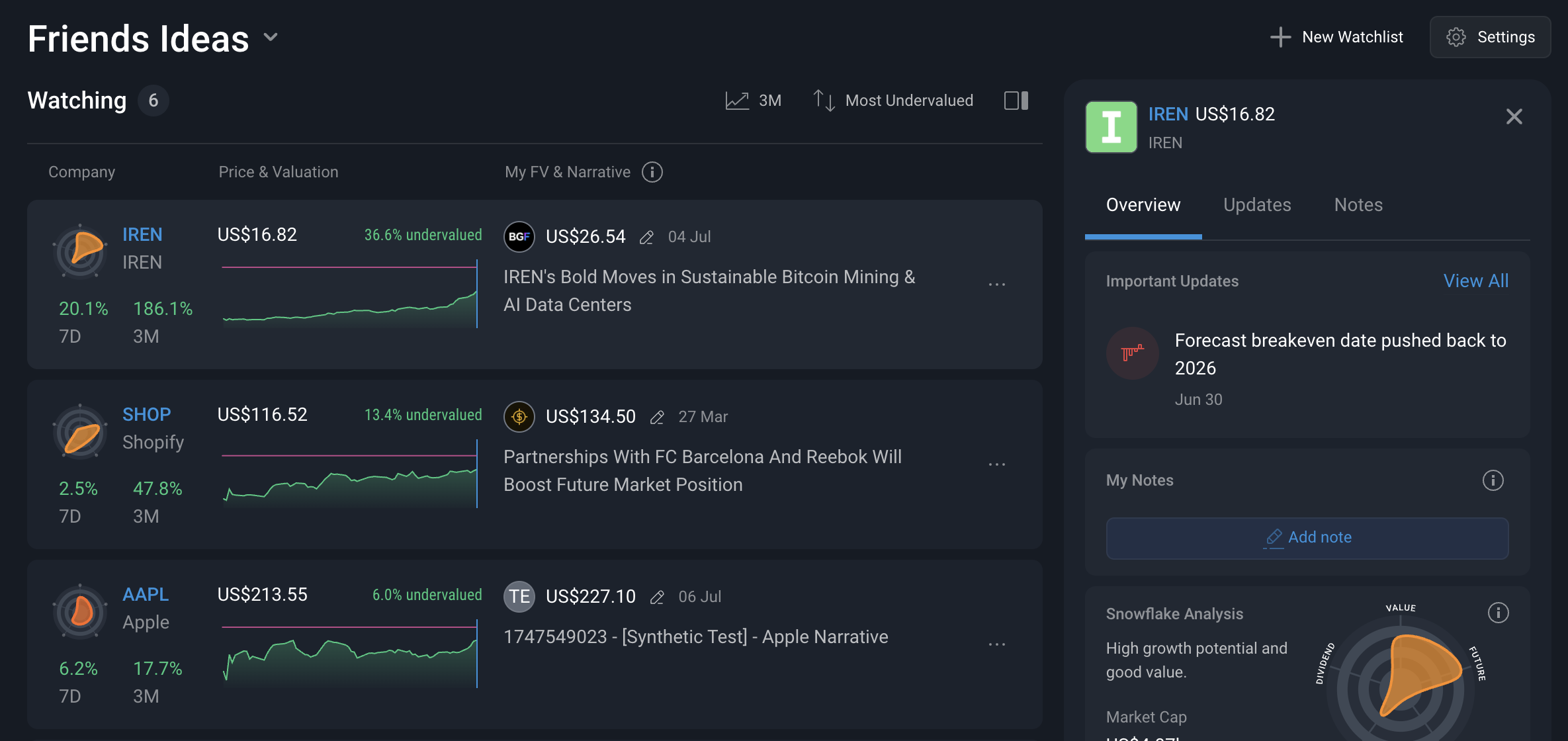

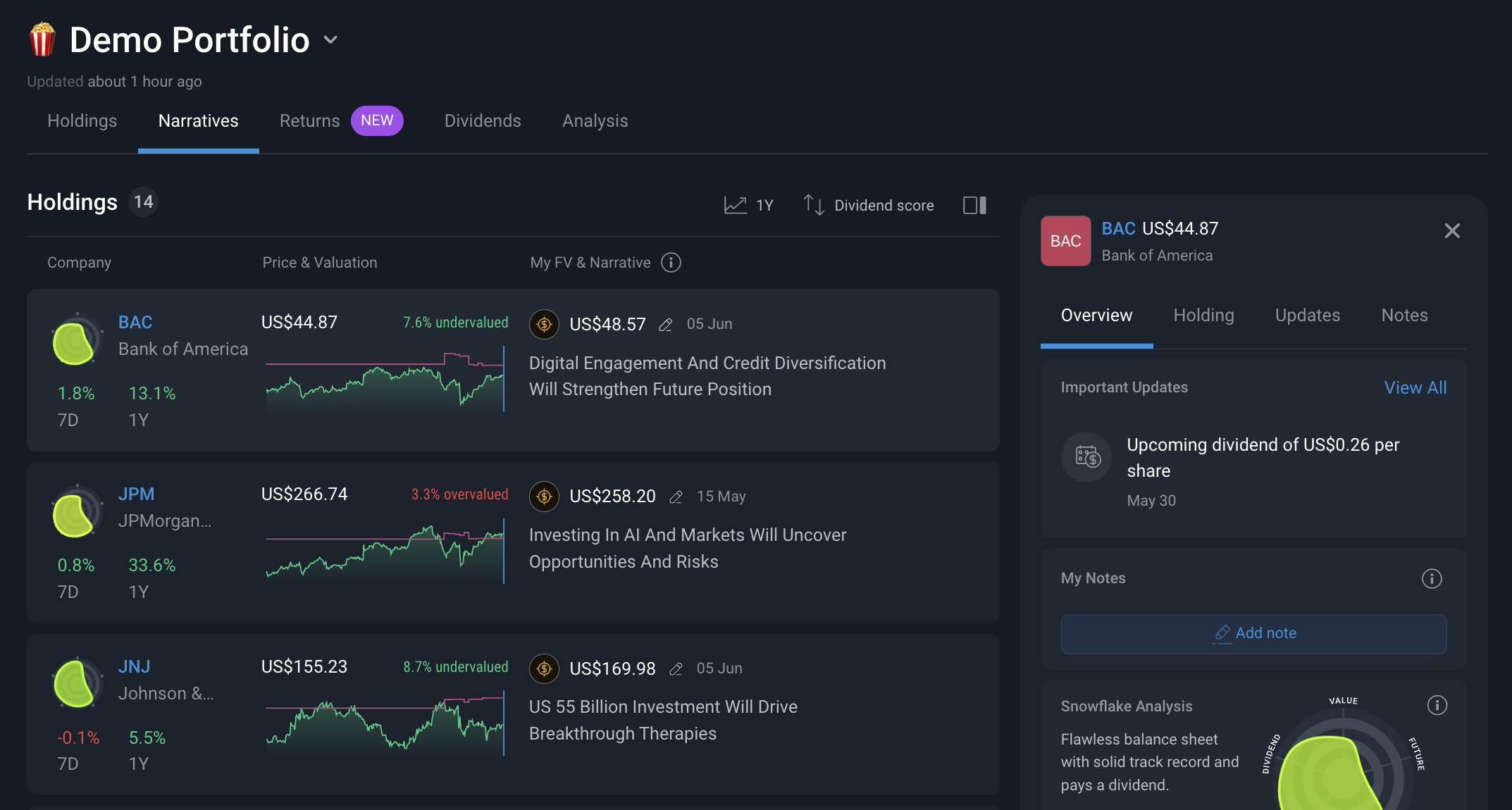

- Simply Wall St lets you build and maintain a Portfolio using narratives - this is not possible on Investing Pro

- Investing.com or Investing Pro does not have a Portfolio Management or Tracking Feature

- Investing Pro features a Data Explorer and Charting which are not available on Simply Wall St

- Investing Pro does not feature a community sharing ideas

- Investing Pro offers access to Warren AI and ProPicks - one is similar to ChatGPT and the latter is a stock picking service now with AI added in the name 🤔

Intro

Choosing the right investment research platform can make a huge difference for a retail investor. Both Simply Wall St and Investing Pro are popular among savvy stock pickers but they are fundamentally different, lets explore why.

Foundational Principles

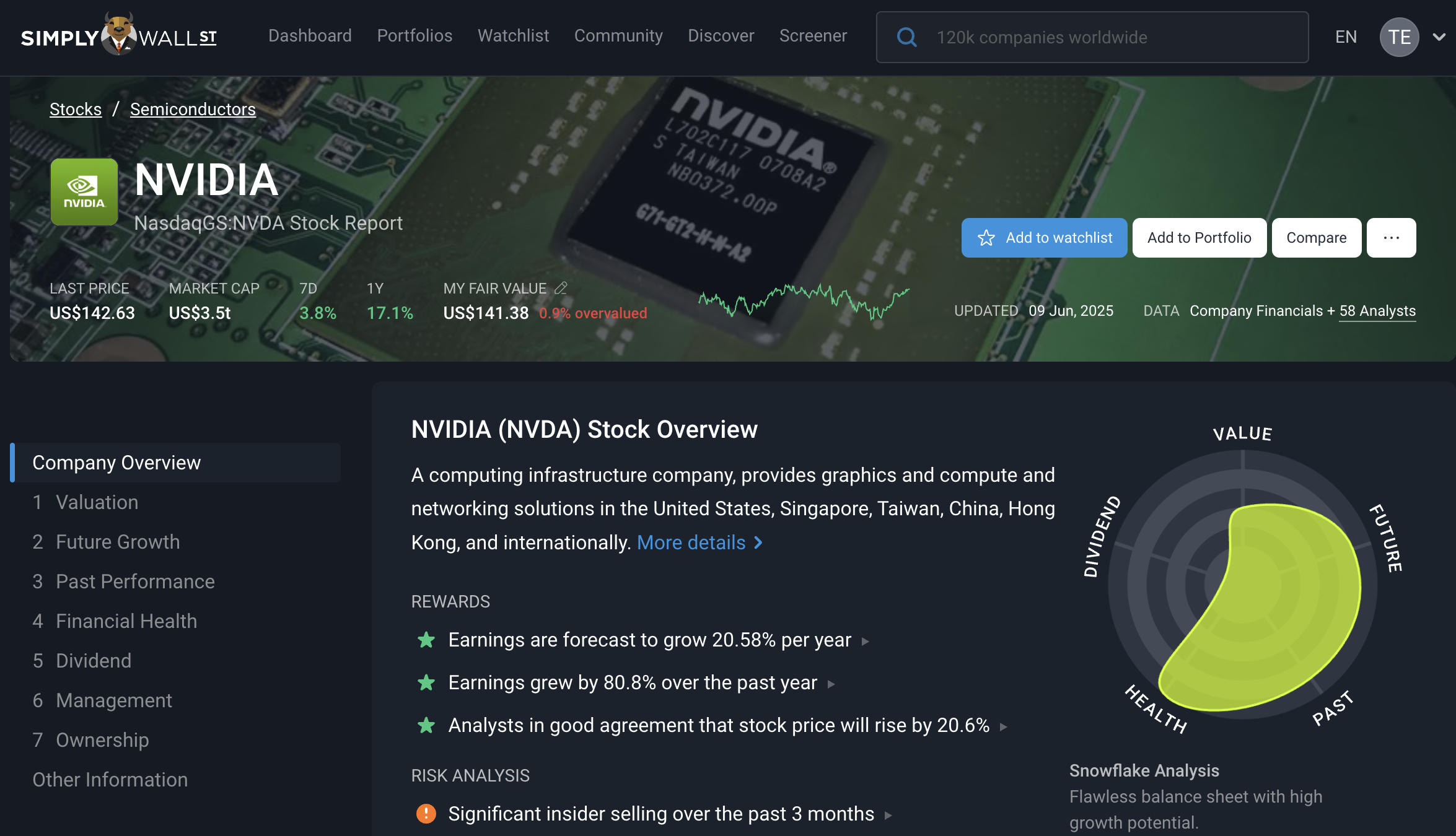

Simply Wall St is explicitly designed for individual investors, whereas Investing.com products have traditionally catered to traders. Simply Wall St emphasizes an accessible and visual approach to stock research – its platform presents key financial data in easy-to-read charts and infographics. The service is popular among retail investors (over 8 million users worldwide as of 2025), and its design reflects this focus: complex financial metrics are distilled into intuitive visuals (like the Snowflake diagram) that help users quickly grasp a company’s fundamentals.

Investing.com was founded in 2007 initially focused on forex markets, it quickly grew to cover a wide range of assets, including stocks, commodities, cryptocurrencies, and indices, catering to both novice and experienced traders.

Stock Research Reports

For any stock worldwide, Simply Wall St gives you an instant visual summary (the “snowflake” graphic) that distills the company’s fundamentals into five dimensions (value, future growth, past performance, financial health, and dividends). Key metrics and fair value estimates are right there on the page, with color-coded graphics and sliders indicating how the company stacks up. This approach lets you quickly grasp a stock’s strengths and weaknesses without reading lengthy reports. It’s a fundamentally unbiased, by-the-numbers analysis – every stock is evaluated with the same rigorous criteria and data from S&P Global. The method used by Simply Wall St is also well documented on their Github account.

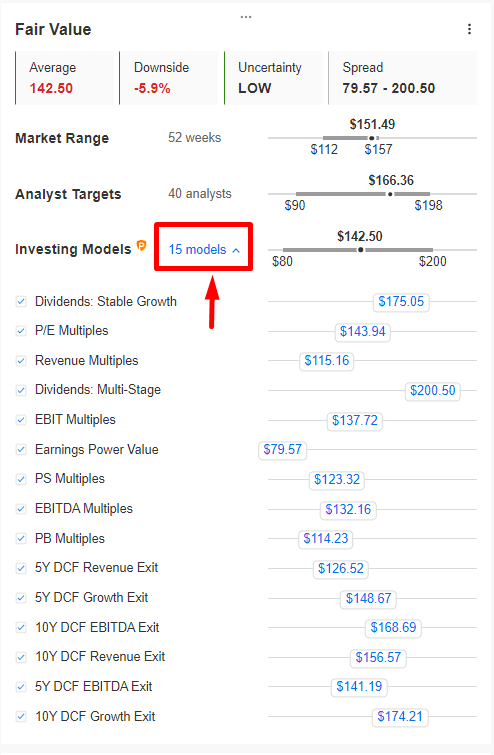

Investing Pro provides a Financial Health Rating and a Fair Value. Their method for Fair Value uses the average of 15 models - on the surface this might seem like a good thing, but in reality most of these models are not applicable for all companies. A simple example would be using a Dividend model to value a growth company or a PB multiple to value any company which is not a bank, neither make any sense.

Likewise their Financial Health Rate is based on:

InvestingPro’s Financial Health uses a scale of 1-5 based to rate a stock by taking into account its five parameters, our Health Checks: Relative Value, Price Momentum, Cash Flow Health, Profitability Health, and Growth Health. Financial Health is calculated as a weighted average of the Health checks.

This is strange as many of these parameters or checks are nothing to do with Financial Health, in fact all of these metrics are simply based on comparing ratios to their percentiles. For example "Growth Health" is simply based on PEG ratio.

This is substantially different to the Snowflake analysis where each check is specifically designed to correctly analyse an aspect of the company.

Relevant links

- Simply Wall St Company Report on Nvidia

- Simply Wall St Equity Research Methodology

- Investing Pro Fair Value Methodology

- Investing Pro Financial Health Methodology

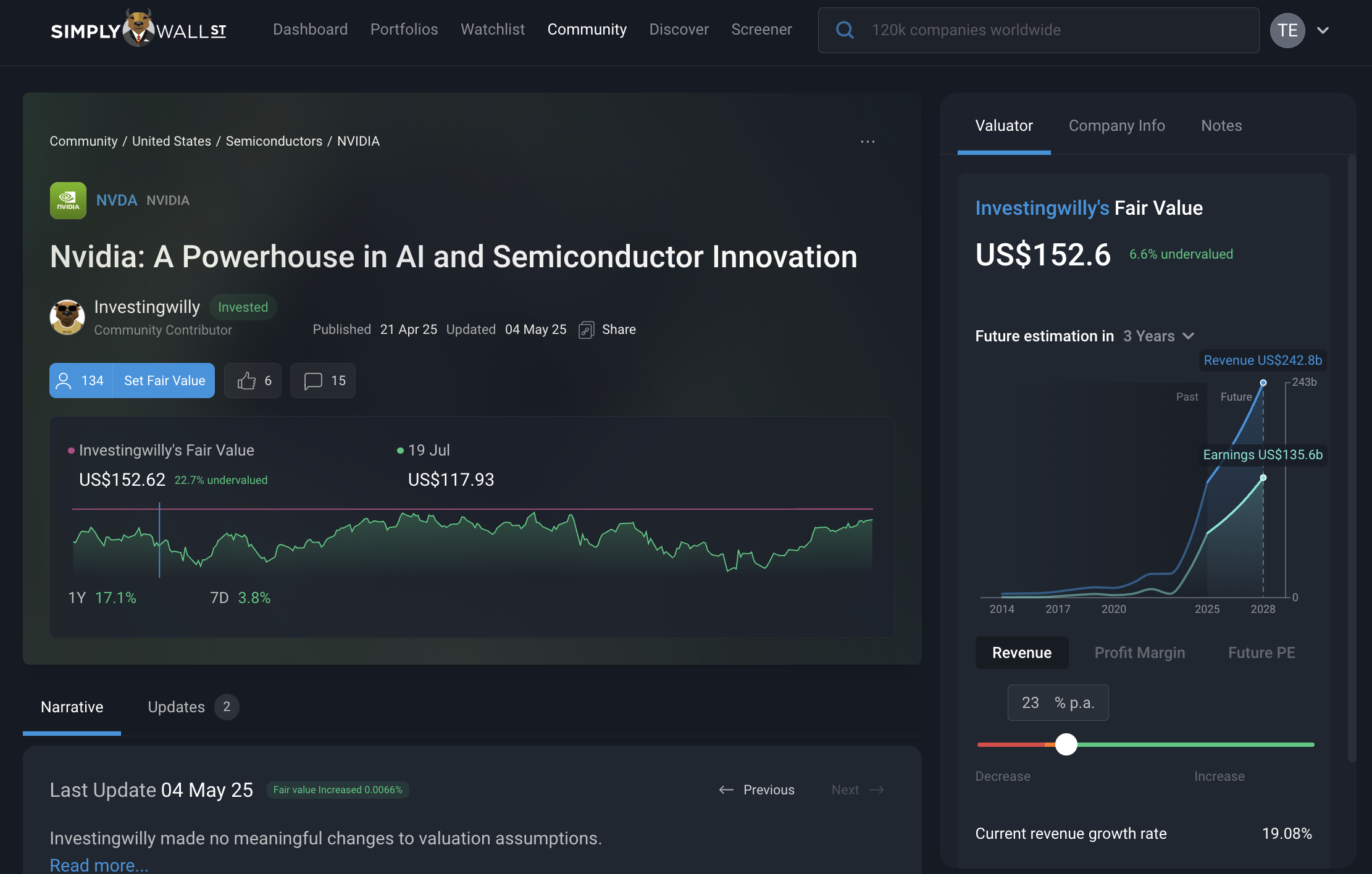

Community Ideas

Investing Pro does not feature a community unlike Simply Wall St, this means investors can't share and discuss ideas or build a portfolio using narratives.

Relevant links

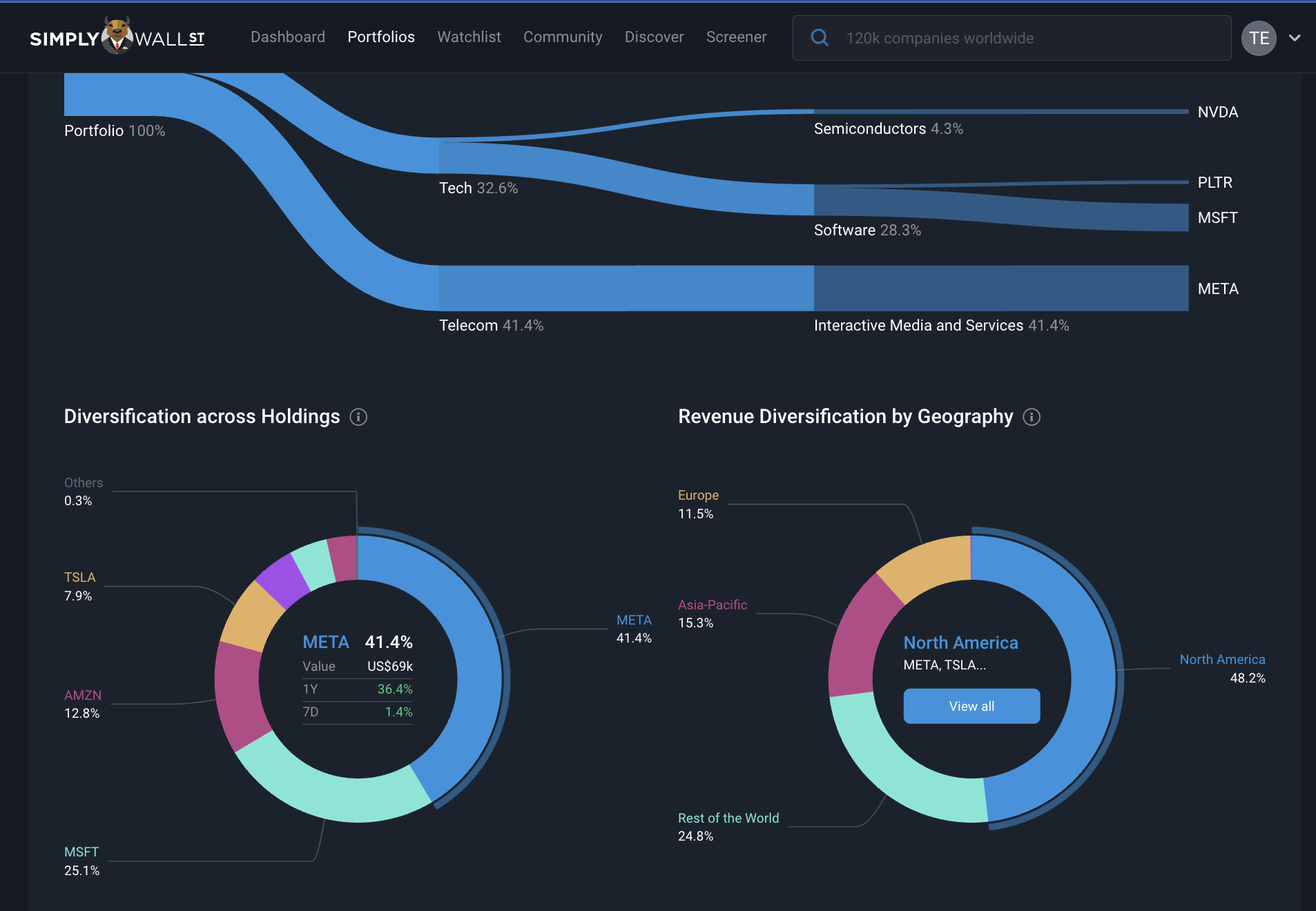

Portfolio Management

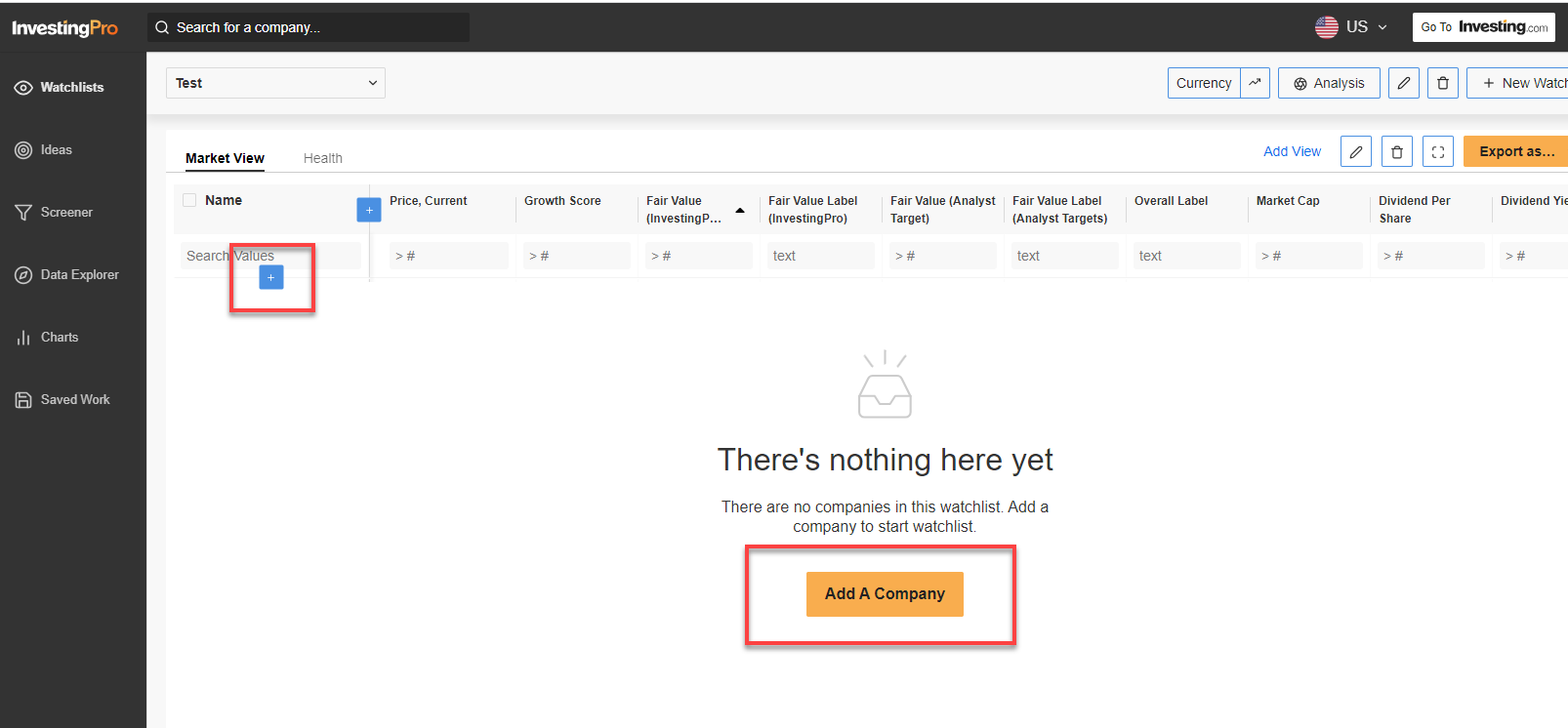

Investing.com Pro does not offer Portfolio Management in the same way as Simply Wall St, and instead only offers a watchlist (also offered by Simply Wall St). This is a major difference between the two products. All these products focus around the concept of setting a fair value and tracking it, although with Simply Wall St this can be done by selecting community fair values alongside analyst price targest our our discounted cash flow value.

Relevant Links

Cost (Plans and Pricing)

Simply Wall St Pricing: Simply Wall St has a freemium model with three tiers: Free, Premium, and Unlimited.

Investing.com Pro Pricing: Seeking Alpha’s basic plan gives one article for free but afterwards is paid.

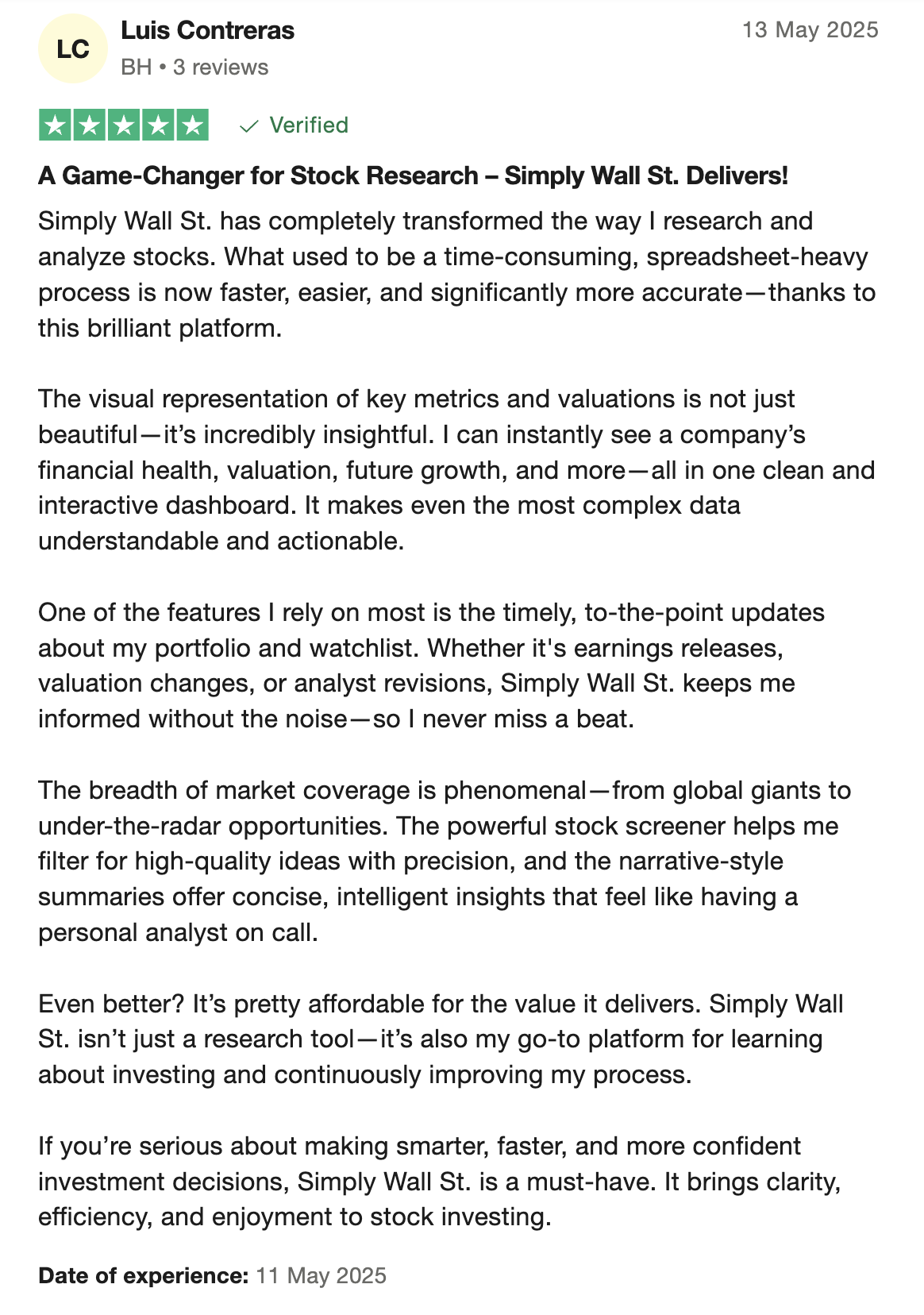

Reviews and Ratings

Lets compare ratings of the two products side by side.

Simply Wall St Trustpilot: 4.4 ★★★★☆

Investing Pro Trustpilot: 3.8 ★★★☆☆

.svg)