Quote of the week: “Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value.” - Eric Schmidt, former CEO and executive chairman of Google.

Back in December of last year, we mentioned how institutional adoption of Bitcoin could change the narrative.

It seems that the narrative is playing out.

Since we wrote that piece, we now have endowments, corporations, and the U.S. government openly allocating capital to bitcoin (or at least planning to).

So this week, we’re going to look at the regulatory changes, how adoption has been trending, and one of the risks with the ETFs.

If you want some exposure to Bitcoin, at the end, we’ll show you some different ways you can position your portfolio accordingly.

Next week, we’re going to discuss bitcoin treasury companies in depth!

What Happened In The Markets This Week?

- 💰 Trump Administration Said to Discuss Taking Stake in Intel ( Bloomberg )

- Intel may be getting a financial lifeline from an unlikely investor: the US government.

- With delays in its Ohio chip hub and rising financial strain, a government stake could both stabilize Intel and keep Trump’s domestic chipmaking dreams alive.

- For investors, this could mean renewed upside in Intel if the deal materializes. It also signals deeper state involvement in strategic sectors, boosting companies seen as national security assets. Watch for similar moves in defense-critical industries.

- 💸 Wholesale prices rose 0.9% in July, much more than expected ( CNBC )

- Wholesale inflation surged 0.9% in July, blowing past expectations and marking the biggest monthly jump since mid-2022. Core PPI also spiked, with services leading the charge.

- This puts pressure on the Fed, complicating the case for near-term rate cuts. Traders are now less confident about three cuts in 2025.

- Rising pipeline inflation suggests businesses may soon pass costs onto consumers, especially if tariffs continue biting. That could reignite broader inflation and hurt rate-sensitive sectors.

- The inflation beast isn't dead, it just slipped into the supply chain. Watch for ripple effects in consumer prices and Fed tone.

- 👨💼 Berkshire invests in UnitedHealth, trims Apple stake ( CNBC )

- It seems Buffett, or his lieutenants, still love a good bargain.

- Berkshire just took a $1.6b swing at UnitedHealth , a stock down 50% YTD and mired in scandal.

- With the stock trading near decade-low valuations, the bet hints at confidence in a turnaround despite DOJ scrutiny, a CEO exit, and earnings uncertainty.

- Investors may want to reconsider beaten-down healthcare names if Buffett sees long-term value. Also worth noting: Berkshire is leaning into industrials and homebuilders, while trimming Big Tech like Apple.

- Berkshire is not waiting for perfect headlines; it’s buying fear. If UnitedHealth rebounds, this could be one of those classic Buffett steals.

- 🇯🇵 Japan’s economy expands more than expected in second quarter despite U.S. tariff headwinds ( CNBC )

- Japan’s Q2 GDP beat expectations at 0.3%, since it was spared from “Liberation Day” tariffs. It has now agreed to 15% tariffs on all exports, including its crucial auto exports, which made up 28% of all exports to the U.S. in 2024.

- Exports have proven resilient, but trade friction could weigh more heavily in the second half as the latest tariff deals kicks in.

- The BOJ’s modest upgrade to its growth outlook signals cautious optimism, but weak export data and global policy uncertainty are headwinds. Investors in Japanese automakers and exporters should brace for margin pressure.

- Japan may have dodged a recession, for now, but the real stress test is coming as tariff pain builds.

- 🛢️ Oil Markets Heading for Record Oversupply in 2026 ( Bloomberg )

- Energy analysts are warning of a record supply glut over the next 18 months. Supply forecasts have been rising all year, and OPEC+ has added fuel to the fire by announcing plans to increase output faster than previously stated.

- The International Energy Agency now expects global oil supply to increase by 2.5 million barrels per day (bpd) in 2025, compared to its previous forecast of a 2.1m bpd increase. The agency only expects demand to rise by 680,000 bpd this year and 700,000 bpd in 2026 - though that estimate is lower than most.

- The US Energy Information Administration has also cut its price forecast for Brent Crude to $58 in Q4 and $50 in early 2026.

- Lower oil prices are good news for consumers, but bad news for the oil industry, particularly upstream producers and oil service companies . The US rig count has fallen to a multi-year low, suggesting activity is slowing down.

- Diversified oil and gas producers are less exposed, while refiners can benefit from lower input costs.

📈 Bitcoin Adoption Grows

Considering it’s an asset that is only 16 years old, Bitcoin is still viewed by many as speculative.

However, it’s sitting at a $2.4 trillion market cap as of this writing, making it the 8th largest currency in the world, just behind the Hong Kong dollar and just ahead of the Taiwan dollar.

In the US, the more favorable regulatory climate and increasing federal budget deficits have probably encouraged investors to review its potential in their portfolio as a store of value and inflation hedge.

Owning a form of money that has a pre-determined supply cap and is decentralized in nature does have its benefits.

Let’s start with what’s changed in the U.S. regulatory landscape.

🇺🇸 U.S. Wants To Be Crypto Capital Of The World

The regulatory shift in the U.S. this year has been swift and material. Here’s what has happened so far:

- 🏦 Banks can now custody digital assets

- The SEC rescinded SAB 121 (Staff Accounting Bulletin), which was a major deterrent for banks to custody BTC for clients. Now though, they’re allowed to custody digital assets for clients without having to classify them as liabilities on their balance sheet (i.e. no need for 1:1 cash reserves).

- 🌬️ Policy tailwinds

- Two Executive Orders, the Anti-CBDC (Central Bank Digital Currency) ban and the Strategic Reserve Act, signal an explicitly pro-Bitcoin posture and institutionalize government BTC holdings (at least their seized coins).

- Treasury Secretary Scott Bessent recently tweeted about how they plan to accumulate more bitcoin.

- 📜 Legislative momentum

- Crypto Week was big, with House passage of the CLARITY, GENIUS, and Anti-CBDC acts being the most comprehensive congressional movement to date. The GENIUS act is now law, with agency rulemaking next.

- ⏳ What’s pending

- The BITCOIN Act (The strategic reserve) and the Anti-CBDC Act still need Senate action; watch committees & markups .

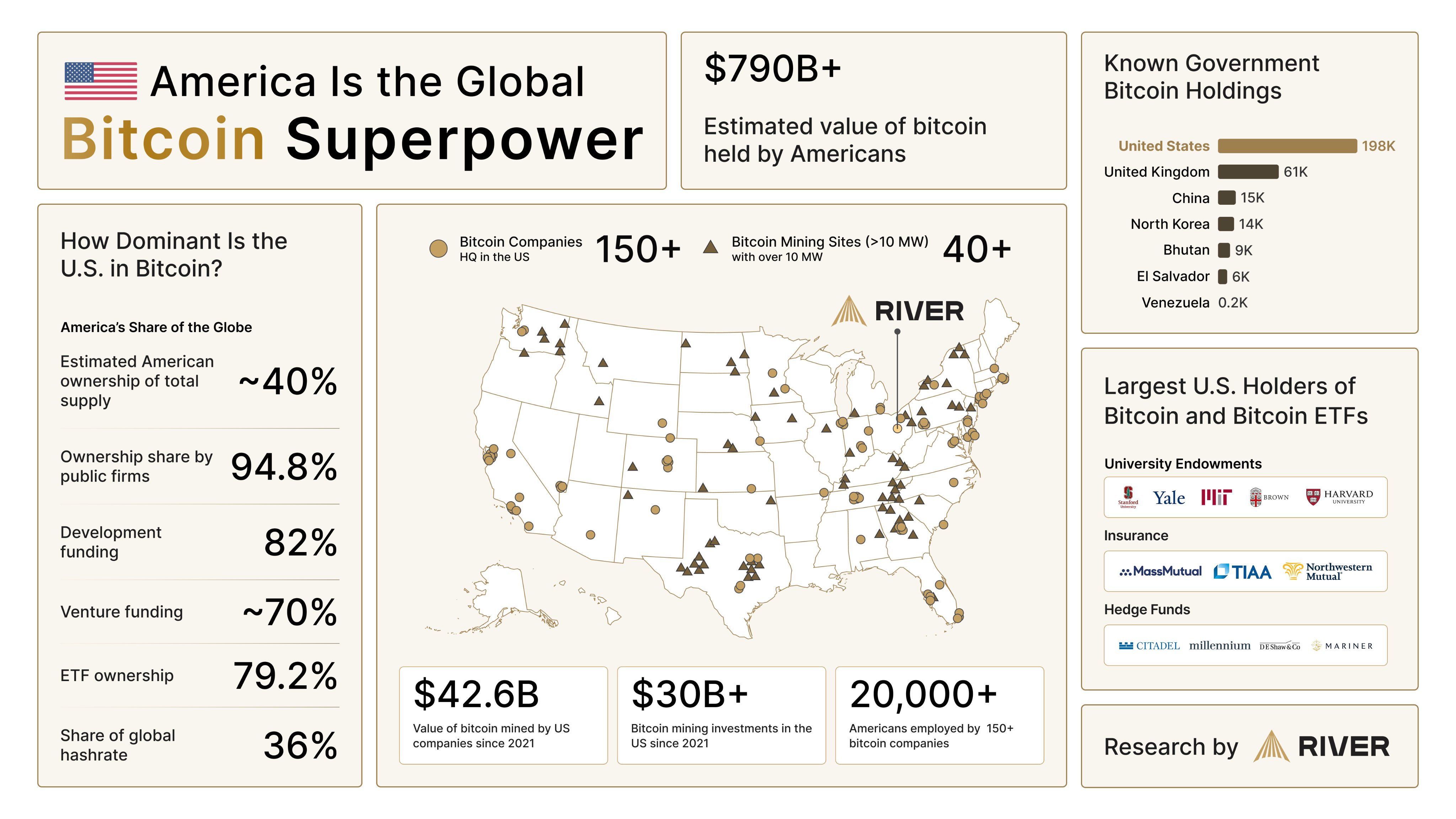

Research by River

The thing to note here is that t he se developments are removing major compliance barriers, giving institutional allocators less cause for concern in adding small Bitcoin positions to their portfolios.

One year ago, the regulatory tone around Bitcoin was “proceed with caution” . Today, with all the above changes, it’s “come on in, the water’s fine.”

And investors are taking that invite. This probably helps explain why the bitcoin ETFs have been the best-performing ETF launches in history.

📈 ETFs Surpass Every Historic Benchmark

Some analysts believe that the bitcoin ETFs are going from niche product to portfolio staple .

The performance of the ETFs in just 18 months would indicate as much. The publicly listed players who have issued these ETFs, like BlackRock , Fidelity , Wisdom Tree , Franklin Templeton , and Invesco , will all be happy, some more than others.

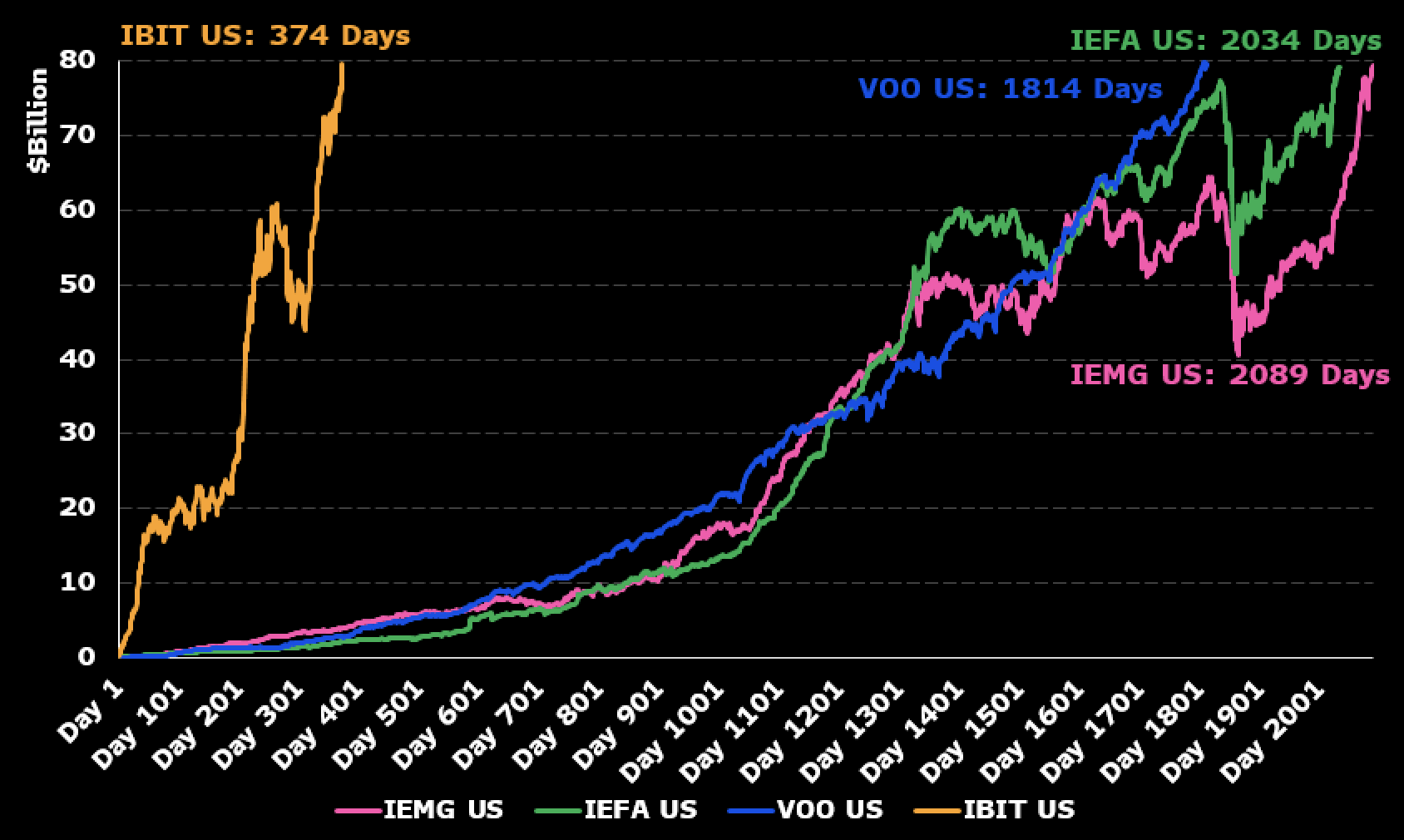

According to Bloomberg’s ETF analyst Eric Balchunas, BlackRock’s IBIT reached $80 billion AUM in just 374 days (by July 11th), which is 5x faster than the next fastest ETFs to hit that threshold.

IBIT AUM compared to other successful US ETFs - Eric Balchunas

A month later, by the 15th of August, it hit $91b in AUM.

He was also a guest on Onramp’s podcast recently, and he listed a few statistics just to emphasise how well IBIT and the other ETFs have performed:

- 👶 IBIT is the youngest among the biggest ETFs.

- While IBIT is the 20th largest ETF in the US by AUM, the next youngest ETF in that top 20 list is 12.5 years old (both IEFA and IEMG launched on Oct 18th, 2012). He said it’s like a toddler hanging out with teenagers.

- 💸 IBIT is BlackRock’s most profitable ETF

- Reports show that at $52b in AUM, charging a 0.25% management fee, it was more profitable than its flagship S&P 500 ETF (IVV), bringing in around $187m in revenue. Eric made the comment that at $90b (which it just reached), it’s BlackRock’s most profitable ETF of all 1,100 that it has globally.

- 🥈 Bitcoin ETFs are nearly as big as Gold ETFs

- Across the 11 US-listed bitcoin ETFs, their assets under management are currently sitting at $154b , which is just shy of the $179b sitting across the US-listed gold ETFs , yet gold ETFs have been around for about 20 years.

- Given the similar trade rhetoric of store of value and inflation hedge, gold seems to have some competition hot on its heels.

- 🏢 >1,600 different institutions already own these ETFs.

- Eric mentioned that across all the Bitcoin ETFs, there are about 1,600 institutional holders (those who manage funds >$100m have to file a 13F). Comparatively, he said other ETFs launched in January 2024 have roughly 10-20 institutional filers each.

All of this is to say two things.

Firstly, these Bitcoin ETFs have transformed Bitcoin’s accessibility to investors. They provide operational simplicity, deep liquidity, and audit-backed legitimacy without the friction, complexity, or risks of self-custody.

Secondly, institutional investors are clearly interested. Eric mentioned that big institutions typically move more slowly because they need big volume and legitimacy before they initiate positions. The fact that there are already 1,600 institutional holders after 18 months is impressive.

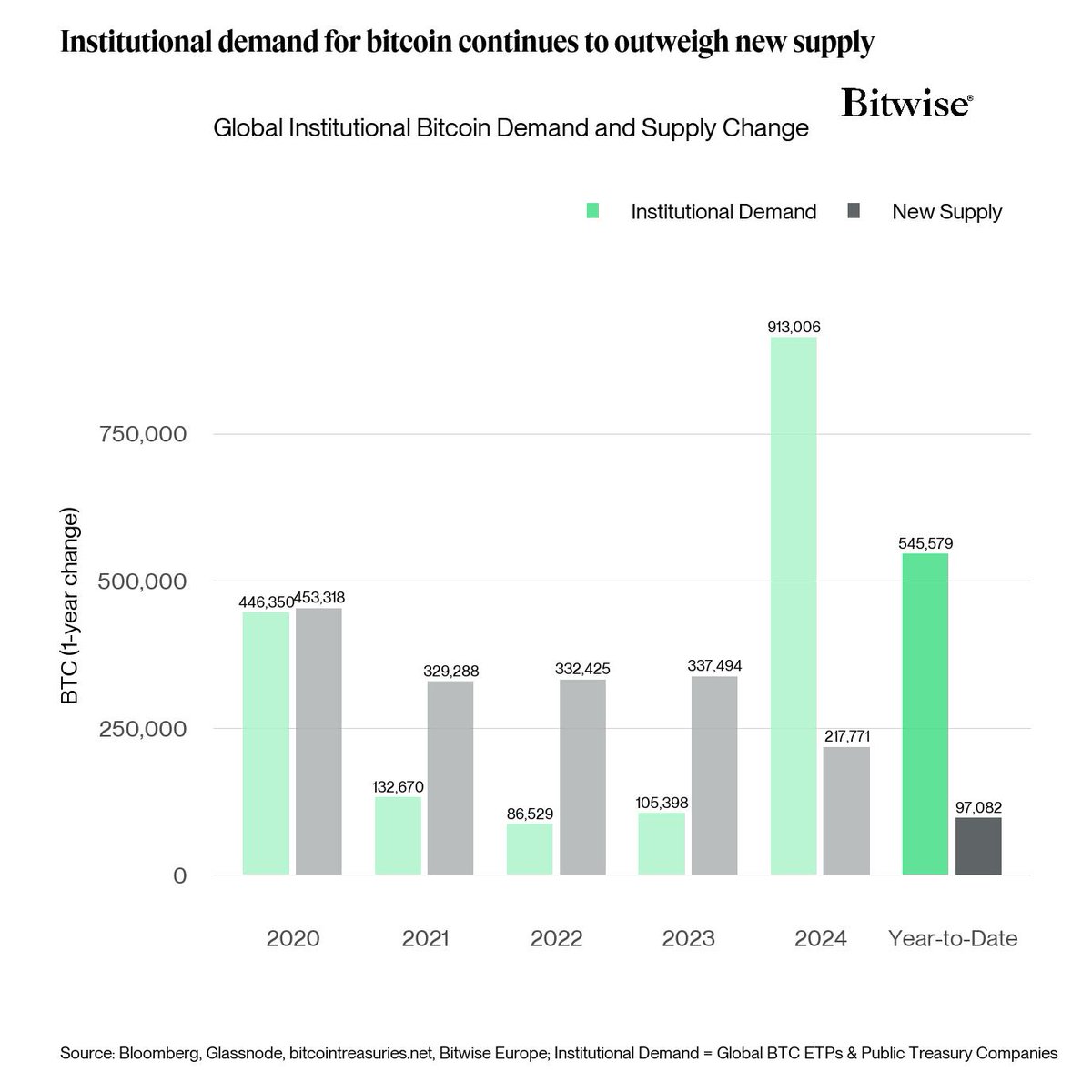

Source: Bitwise

While some institutions are completely happy owning a security that gives them exposure to the underlying, others want to own the real thing themselves for the many upsides of self-custody. We will talk more about that next week!

Now, while the momentum is bullish for now, we need to point out a pretty large risk present with this trend.

⚠️ The Custody Concentration Risk Is Real

Most U.S. spot Bitcoin ETFs trust only a handful of “qualified custodians” to guard their bitcoin.

Coinbase Custody is the main player here , holding roughly 81% of ETF bitcoin assets and working with 8 of the 11 U.S. spot Bitcoin ETFs, including heavyweight IBIT .

The rest go their own way:

- Fidelity ( FBTC ) uses Fidelity Digital Assets

- VanEck ( HODL ) custodies with Gemini

- ARK 21 Shares ( ARKB ) uses BitGo

✨ The problem here is that when one custodian holds that much of the market’s bitcoin, you’ve got a massive single point of failure .

If Coinbase were hit by a cyberattack, a technical outage, or a legal freeze, multiple ETFs could face delays in rebalancing, redemptions, or coin transfers.

Plus, bitcoin custody isn’t FDIC insured. It relies on private insurance and comes with its own operational quirks.

If something did happen, moving tens of billions to new custodians is no quick swap. It would involve KYC checks, fresh audits, and wallet whitelisting.

Basically, it wouldn’t be an overnight project, and it would put serious doubt in investors' minds about the suitability of these products, or even the bitcoin itself.

Thankfully, it isn’t these custodians' first rodeo, and they’ve taken many measures to minimise them, including:

- 🔒 Segregated trust accounts:

- Where a ssets are bankruptcy-remote from their main businesses.

- 🏦 Cold storage & audits:

- Custodians emphasize offline storage, mul ti‑party approval workflows, SOC‑audited controls, and even NYDFS oversight.

So while custodian concentration is a non-zero tail risk , strong legal structures, controls, insurance, and an expanding roster of custodians do help to reduce the probability or severity of losses from custodian-related failures.

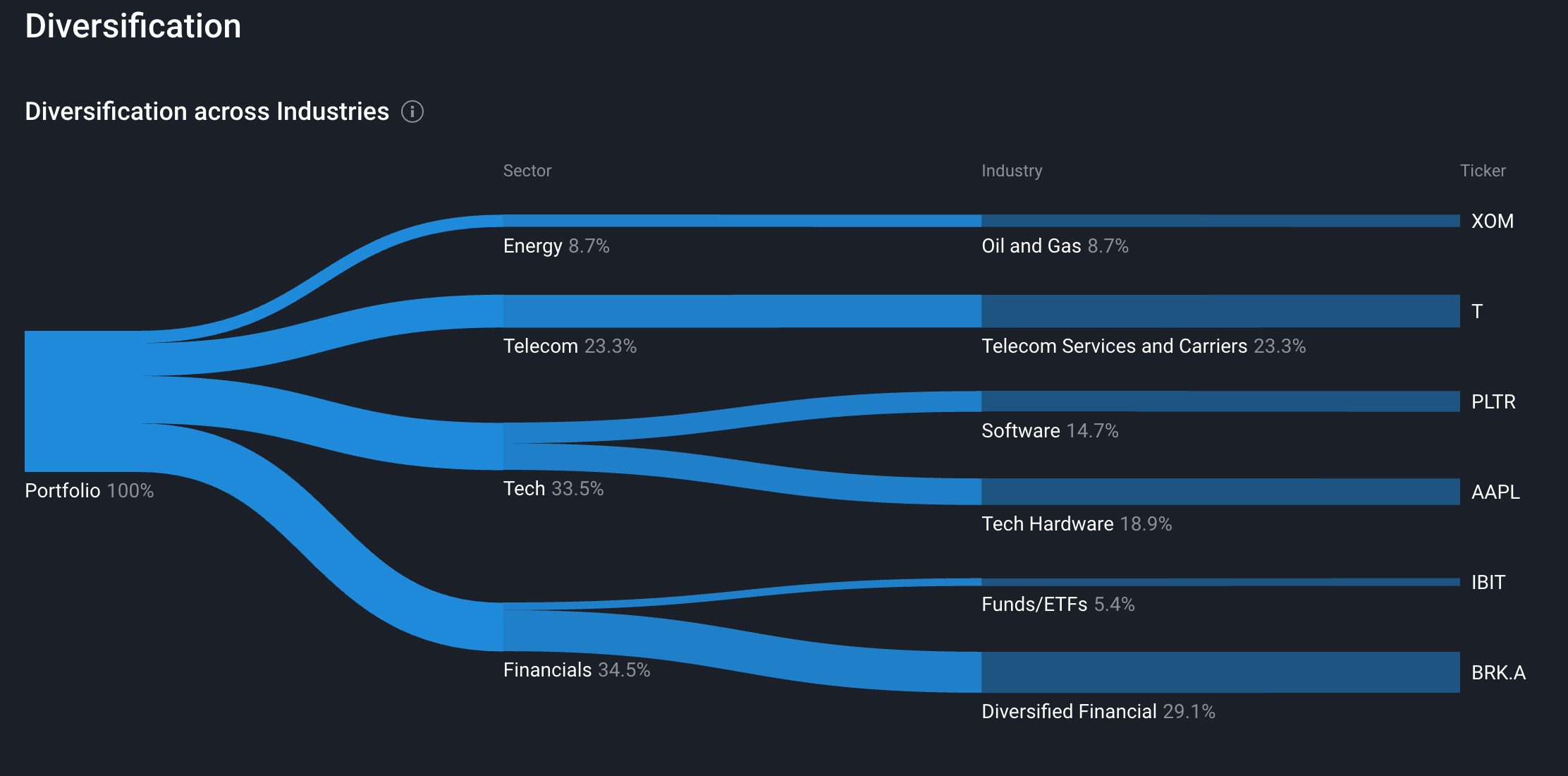

💡 The Insight: Many Are Treating Bitcoin Like Gold In Their Portfolio

With relaxed U.S. regulations, unprecedented ETF adoption, and institutional buy-in, Bitcoin has grown in legitimacy.

Many are treating it similarly to gold in their portfolios. For example, the Harvard endowment is buying both Gold and Bitcoin .

It recently disclosed a position in IBIT, but it also initiated a position in SPDR Gold Trust. The bitcoin position is a 0.2% exposure of their fund, which means it’s “market neutral” (Bitcoin’s market value is 0.2% of global assets).

So if you’re also concerned about inflation or currency weakness, Bitcoin’s value proposition and history make it a compelling exposure.

But remember: Portfolio sizing matters.

If you do decide to add any of the ETFs to your Portfolio , make sure your position sizing makes sense for your financial goals, objectives and risk profile.

For those concerned about the custody risk we mentioned, you can spread your exposure across ETFs like IBIT , FBTC , and HODL because they’re held at different custodians.

If the bulls are right, a small position could help protect against further currency debasement, similar to gold exposure.

If they’re wrong, though, the cost of holding a very small 1–3% position is not catastrophic.

Next week, we’ll dive into bitcoin treasury companies, what their angle is, and how to assess them.

Key Events Next Week

Tuesday

-

🇨🇦 Canada’s Inflation Rate YoY

- 📉 Forecast: 3.6% (Previous: 3.85%)

- ➡️ Why it matters : A cooling inflation print boosts expectations for BoC rate cuts in the months ahead.

-

🇺🇸 US Housing Starts

- 📉 Forecast : 1.29 m (Previous: 1.32 m)

- ➡️ Why it matters: A slowdown in new builds may signal softening demand and stress in the real estate market.

Wednesday

- 🇬🇧 UK Inflation Rate YoY

- 📉 Forecast 4% (Previous 3.6%)

- ➡️ Why it matters: A reacceleration in inflation complicates the BoE’s path—raising doubts about near-term rate cuts.

- 🇺🇸 US FOMC Minutes

- ➡️ Why it matters: Even before the latest inflation data, the Fed’s tone here could shed light on how seriously it views lingering price pressures.

Thursday

- 🇺🇸 US Initial Jobless Claims

- 📉 Previous: 224.k

- ➡️ Why it matters : Any drop would challenge the recent trend of softening labor data and delay the Fed’s pivot to easing.

Friday

- 🇬🇧 UK Retail Sales YoY

- 📉 Forecast: 1.8% (Previous 1.7%)

- ➡️ Why it matters: A slight uptick suggests consumers are still spending despite elevated rates and price pressures.

Most of the largest retailers will be reporting over the next few weeks, along with some prominent tech companies. This week, the big names include:

- Walmart

- Home Depot

- Alibaba

- Intuit

- Lowe’s

- Estee Lauder

- Target

- TJX

- Medtronic

- Analog Devices

- Palo Alto Networks

- Workday

Simply Wall St analyst Michael Paige has a position in bitcoin. Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.