🤖 The Bull and Bear Thesis on AI’s Decade of Disruption

Reviewed by Bailey Pemberton, Michael Paige

Quote of the week: "You look at today, us using all of our smartphones and other devices, and we effortlessly adapt to these new technologies. And this is gonna be another one of those changes like that." Demis Hassabis, Co-Founder and CEO of Google DeepMind

Over the last two weeks, we’ve taken a closer look at agentic AI and how it could affect companies and entire industries. But this trend doesn’t stop at the corporate level.

Agentic AI will shake up the macro landscape, with some expecting it to bring the biggest wave of creative destruction in history.

This week, we are weighing up the potential productivity gains vs job losses and economic disruption that the global economy could face over the next decade and beyond.

Intimidating? Yes. But it’s a story you need to know about, and at the end we’ll show you how you can position your portfolio for whatever comes.

Let’s dive in.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🇨🇳 China limits supply of critical minerals to Western defense companies ( WSJ )

- China’s chokehold on critical minerals is jacking up costs and delaying deliveries for Western defense firms, spotlighting a serious supply chain weak spot.

- Prices for essential materials have soared, sometimes 5x to 60x higher, hurting margins and squeezing production timelines for everything from drones to fighter jets.

- The U.S. and allies are scrambling to secure alternative sources, but most substitutes won’t ramp up for months or years, meaning volatility and higher costs will stick around.

- Defense giants are now forced to buy materials directly and will have to adjust their sourcing strategies accordingly.

- Investors should expect near-term cost inflation for some U.S. defense plays and keep an eye on emerging suppliers poised to benefit if they can scale (like LYC and ILU ).

🚂 US railroad customers ask regulators to block Union Pacific-Norfolk Southern deal ( Financial Times )

- A UP-NS rail mega-merger could mean higher shipping costs and fewer options for US businesses, with shippers loudly warning of weakened competition and service headaches.

- Industry analysts expect a possible merger between BSNF and CSX could be on the cards with this news, which could create a railroad duopoly and even less choice for cargo owners. That’s potential bad news if you rely on affordable, reliable freight.

- While intermodal shippers may benefit from streamlined coast-to-coast service, bulk and industrial clients fear they’ll get squeezed on both price and service quality.

- Regulatory hurdles are high, and a drawn-out approval process is likely, keeping rail sector volatility and activist investor moves in play.

- If this deal would impact any stocks in your portfolio, it’s worth adding Union Pacific or Norfollk Sourther to your watchlist to be notified of the latest developments.

🇮🇳 Trump imposes extra 25% tariff on Indian goods, ties hit new low ( Reuters )

- Trump’s sudden additional 25% tariff on Indian goods (starting in a few weeks) throws a wrench in $87B worth of exports, slamming sectors like textiles, gems, and footwear just as U.S.-India tension grows.

- Indian exporters face a 30-35% cost disadvantage versus Asian rivals, with GDP and rupee at risk if shipments crater. This would potentially drag India’s annual GDP growth below 6%.

- Oil prices nudged higher on supply fears, and India may eye a shift toward China if relations with Washington keep souring.

- With 21 days before tariffs bite, last-minute trade talks could still save the day, but expect market jitters and tough headlines in the meantime.

- If tariffs stick, volatility in Indian stocks and their U.S. competitors could provide opportunities.

🌎 Trump’s tariffs take effect in fresh test for global economy ( Bloomberg )

- According to Bloomberg Economics, the tariff blitz has catapulted the average US tariff rate to 15.2%. Some estimate even higher at 18%. Regardless, that’s the highest since World War II and it’s fueling inflation worries as companies scramble to rework supply chains.

- Tariff income is hitting records, with the US Treasury recording $27.2bn in customs duties paid by US importers in June alone this year, compared to an average of $7.2bn per month last year.

- Companies have mostly eaten the extra costs so far, but analysts warn that higher prices for consumers and margin pain are lurking as inventories run down.

- Wall Street is flashing yellow, expecting market pullbacks as slower job growth, wobbly consumer spending, and rising costs converge.

- The legal footing for tariffs is shaky, with emergency powers being challenged, so the drama is economic, legal, and political.

🏰 Disney works to utilize and protect itself from AI ( WSJ )

- Disney’s AI forays promise cheaper, faster movie magic, but legal tangles and union worries keep the robots on a tight leash.

- The issue is who owns the rights if AI whips up new Disney content, and what happens if fans or Fortnite gamers remix characters in ways Disney can’t control?

- Disney’s lawsuits against AI startups and its drawn-out internal AI approval process show its main priority: protect its intellectual property first, THEN leverage AI where possible.

- Creative efficiency is possible, but bad PR, fan backlash, or a labor blow-up could easily derail any cost-efficiency savings and spook investors.

- Until Hollywood hammers out contracts and copyright rules for AI, Disney’s balancing act means it’s both a risk and an opportunity for portfolios.

- Outside of the AI content world, Disney is placing plenty of bets on its Parks and Experiences business, and analysts think that part of the business has promise .

🤖 Agentic AI’s Global Economic Impact: Boom or Bust?

What does artificial intelligence mean for the global economy over the next decade?

Opinions couldn’t be more divided:

- 📈 Some believe we’re going to see a productivity supercycle that unleashes historic economic growth.

- ARKInvest, for example, has suggested that a period of 7% annualized GDP growth for the global economy is possible.

- 📉 On the other side of the argument, many fear a "jobs apocalypse" that automates millions of white-collar jobs, triggering a recession.

- Even many of those who are optimistic about the long-term outlook acknowledge it’ll take a period of pain to get there.

Rather than taking sides, we’re going to take a look at both sides of the argument and some of the catalysts that could tip the scales either way.

📈 The Bull Case: A Productivity Supercycle is Coming

The optimistic view is that agentic AI will be the biggest productivity booster in history.

By automating complex cognitive work (not just repetitive tasks), it could unlock massive efficiency gains across every industry.

For example, giving every scientist, engineer, and strategist a team of expert AI assistants working 24/7 could significantly increase their productivity.

And productivity gains aren’t necessarily just about doing old jobs faster; it's about making entirely new discoveries in areas like drug development and materials science.

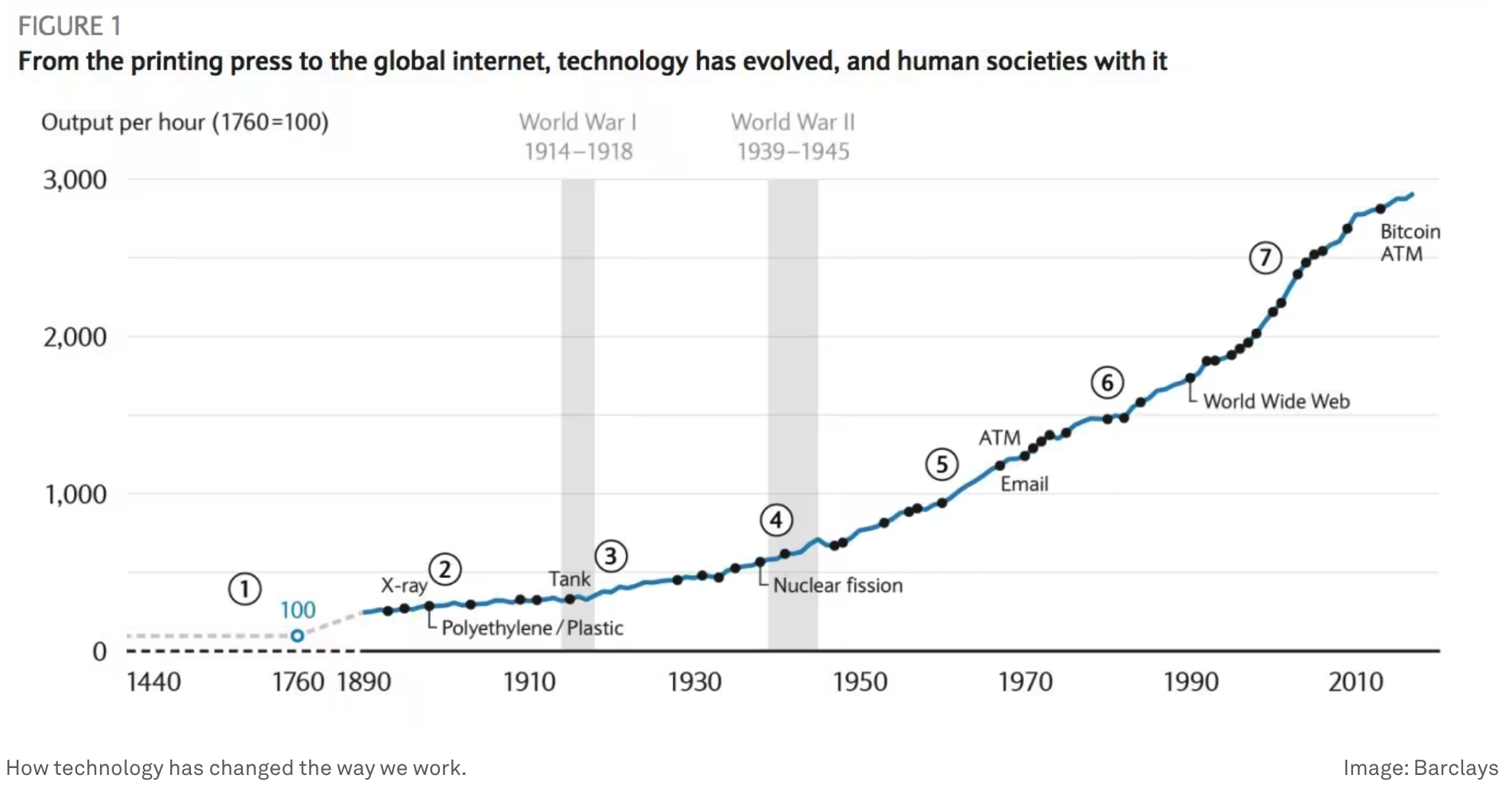

✨ Human history is the journey of us innovating technological advancements into existence to increase our productivity and improve our living standards.

Bulls argue that artificial intelligence is the next leg on this journey.

Innovation vs Hourly Output - WeForum

The Industrial Revolution, electricity, and the internet all sparked fears of mass unemployment. Yet each time, "creative destruction" kicked in :

- 🏭 Old industries were replaced by new, more innovative ones.

- 👷♂️ More jobs were created than were lost.

- 📈 Living standards rose dramatically for many.

The current wave of innovation isn’t only about AI, but the convergence of AI and other technologies, including automation, genomic health, and IoT (internet of things).

So here’s what the bullish scenario looks like:

- ⚡ Faster and cheaper development: Products can be prototyped in hours instead of weeks or months. The cost of developing software and creating content is dramatically reduced.

- Put simply, companies and entrepreneurs can do more with less. This brings more companies and products to market, and more jobs can be created. There will always be problems to solve.

- 🤖 Workflow automation: Both basic and complex tasks can be automated, and human capital can be deployed efficiently.

- More people are freed up from doing basic and monotonous tasks, and instead devote their time to more creative and productive work. This leads to increased productivity, lower costs, or better yet, both!

- 🧩 The hard problems get solved: With the help of AI, we can solve the hard problems in medicine, materials science, and energy.

- This leads to better healthcare outcomes, with lower costs, and to more abundant energy.

That all sounds well and good. But not everyone thinks that way.

📉 The Bear Case: "This Time It's Different"

The pessimistic argument is that this revolution is unlike previous waves of automation.

✨ Previous technologies replaced muscle power. AI is replacing brain power.

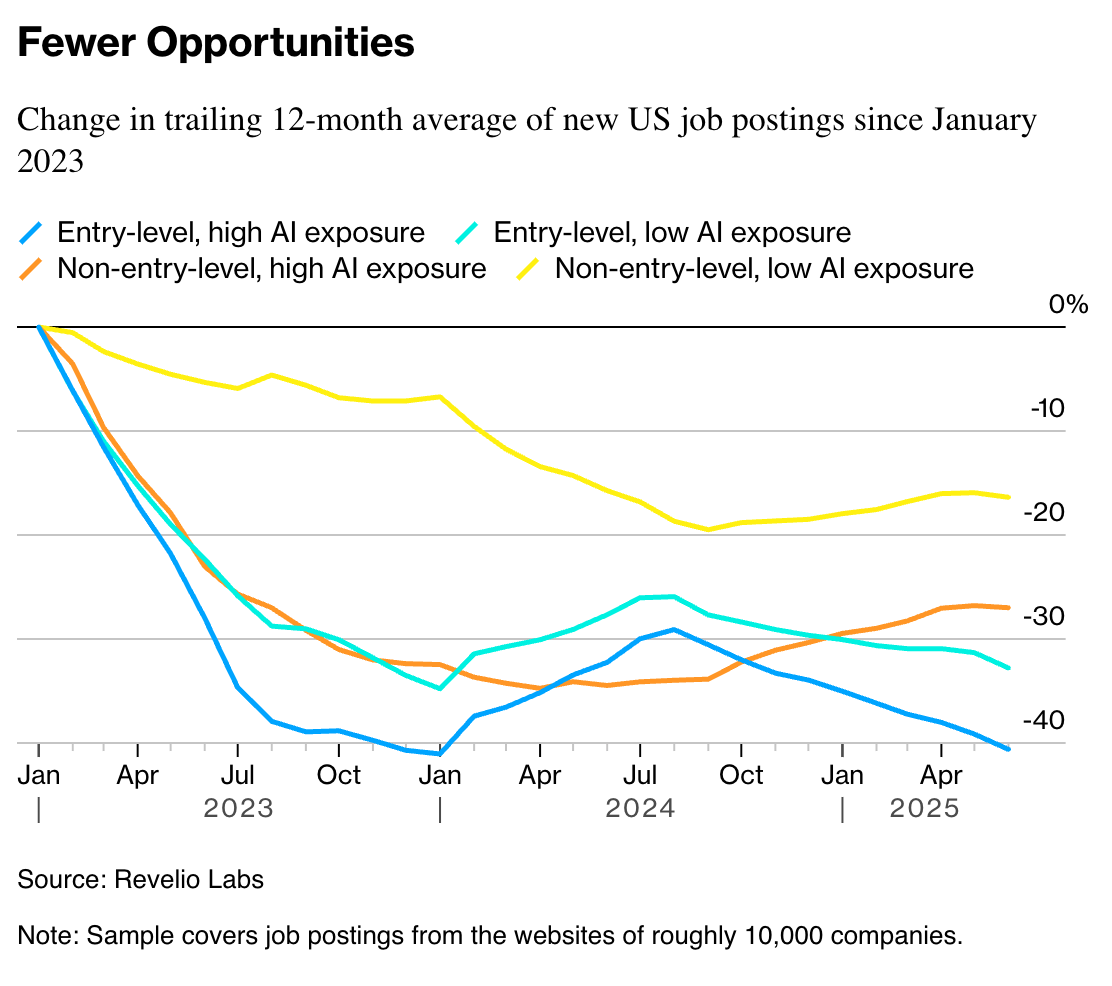

In particular, AI is already beginning to replace entry-level office and customer service jobs. It’s also learning to do jobs that require more analysis, creativity, and problem-solving - ie. higher paying white collar jobs.

Entry-Level Job Displacement - Bloomberg

What does this mean?

💥Collapsing Demand : At the macro level, losing high-paying jobs would mean consumer spending dives. Consumer spending is the biggest component of GDP in developed economies, so it’s a big deal.

📉 Deflationary Spiral: Falling demand leads to falling prices, which further dampens economic activity.

💸 Wealth Chasm: The gains from AI could flow to a tiny group of tech owners, creating extreme inequality and social instability.

Estimating the number of jobs that could be lost is really a guessing game, but for what it’s worth, here are a few estimates from different players:

- 🌍 Goldman Sachs estimated AI could replace 300 million jobs .

- That’s about 10% of the global workforce.

- 💼 Wall Street expects to replace 200,000 roles with AI by 2030.

- 🗃️ The World Economic Forum said that more than 7.5 million data entry jobs will be lost by 2027 .

- 📉 And 41% of employers worldwide intend to reduce their workforce due to AI.

✨ As you can see, their estimates mostly agree, but they looking at different metrics. And, more importantly, these stats don’t include jobs that could be created.

The WEF’s 2025 Future of Jobs report estimates a net gain of 78 million jobs by 2030, despite 92 million roles being displaced.

⛵️ How The Transition Could Actually Be Smooth

The adoption of agentic AI isn’t happening in a vacuum, and there’s a lot that can moderate both scenarios.

📉 We mentioned last week that AI agents are still a work in progress , and so far haven't lived up to the hype. Developers are also finding that the underlying LLMs often deteriorate over time as they are exposed to evolving real-world data.

That leaves us with two important insights for now:

- 🕰️ A slower path to reliable agents could give the economy and workforce more time to adapt.

- 🧑💻 Agents that aren’t reliable enough to act autonomously can still be very useful co-pilots.

- This could be a win-win outcome where AI makes workers more productive rather than replacing them outright.

Since it’s not developing in a vacuum, there are 3 other catalysts to think about when considering how adoption might unfold.

👷 New Industries, New Jobs: The AI economy will inevitably create new jobs.

Think AI auditors, ethicists (yep), integration specialists, and other roles we can't even imagine yet. To compete, companies will need both AI and people to fill in the gaps and make sure the agents are doing what they’re supposed to.

With lower barriers to entry, more new companies will pick up the slack in the job market.

🔌 Physical Limits: Even if the most optimistic scenarios play out, the world will struggle to generate enough energy to power all of the data centers. Demand for commodities will continue to increase, and mines can’t be built overnight.

We’re seeing increased demand for nuclear power to meet these needs , but again, they’re hugely complex, multi-year projects. Fossil fuels are currently their next best bet for reliable energy.

Automating heavy industry and resource extraction will take longer and cost more. These physical constraints could act as a natural brake on how fast agentic AI adoption can grow.

🏛️ Government Action: History shows us that policymakers typically respond to a financial crisis with fiscal stimulus to keep liquidity in check and the economic engine spinning (for better or worse).

In the foreseeable future, governments will be faced with a tough choice: protect jobs with financial support to certain industries or race for AI supremacy.

We’ve seen that rising inequality tends to have political implications, so it will be an incredibly tricky balancing act for them to manage.

❓ There Are Unknown Unknowns

Beyond what we can analyze, there's a universe of uncertainty.

- ✨ New Frontiers: 40 years ago, just the concept of ride-sharing, streaming, and smartphone apps was virtually non-existent. Going even further back, 60% of people today work in occupations that did not exist in 1940.

- So that begs the question, what new industries and business models will exist in 10 years' time?

- 🎓Could AI solve the AI skills gap? The risk to jobs is really a structural problem. While roles that can be automated will likely get replaced by agents, demand for people with AI-related skills is increasing.

- It’s already easier than ever to learn new skills, and AI agents could make it even easier.

- 🚨 Systemic Risk: What happens if a critical AI system managing global finance or logistics fails? It’s going to be harder than ever to keep tabs on systemic risks lurking in the shadows.

- 🎭 Bad Actors: Sophisticated AI could be used for economic sabotage, hyper-realistic disinformation campaigns, or worse.

💡 The Insight: Hedge Your Bets and Keep an Open Mind.

With so many dynamics at play, it’s a good idea to be prepared for a range of outcomes. There are a few ways to do that.

Play offence and defence.

- ⚔️ To play offence, invest in the companies doing the disrupting.

- That’s the AI leaders ranging from semiconductor companies to the hyperscalers, and the software companies building an edge around AI.

- 🛡️ To play defence, diversify and invest in the companies that are less likely to be disrupted or impacted by AI.

- These include utilities, energy, and resource companies. These also have the advantage of exposure to real assets.

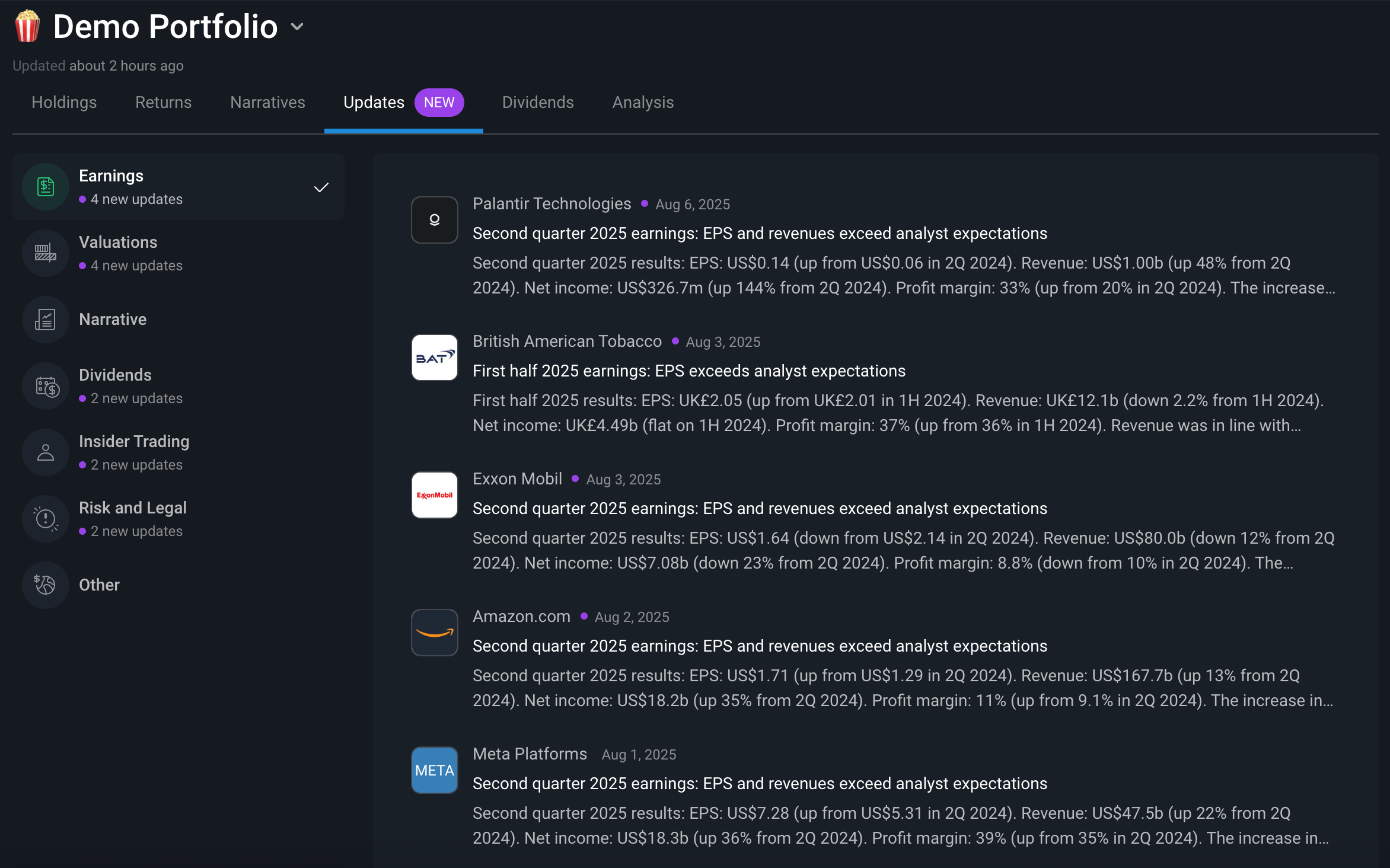

The Simply Wall St Portfolio Tool can help you here. Use it to check how your investments are diversified across offense and defense plays, and then stay informed on all the latest developments for those stocks with “Updates”.

Portfolio Analysis: Updates - Simply Wall St

Keep second-order AI risks in mind

If the worst-case scenario plays out, our consumer-facing companies will struggle - some more than others. It’s important to know who a company’s customers are and what AI might mean for their spending power.

✨ This doesn’t mean you need to dump your consumer stocks, but it’s good to know what to keep an eye on.

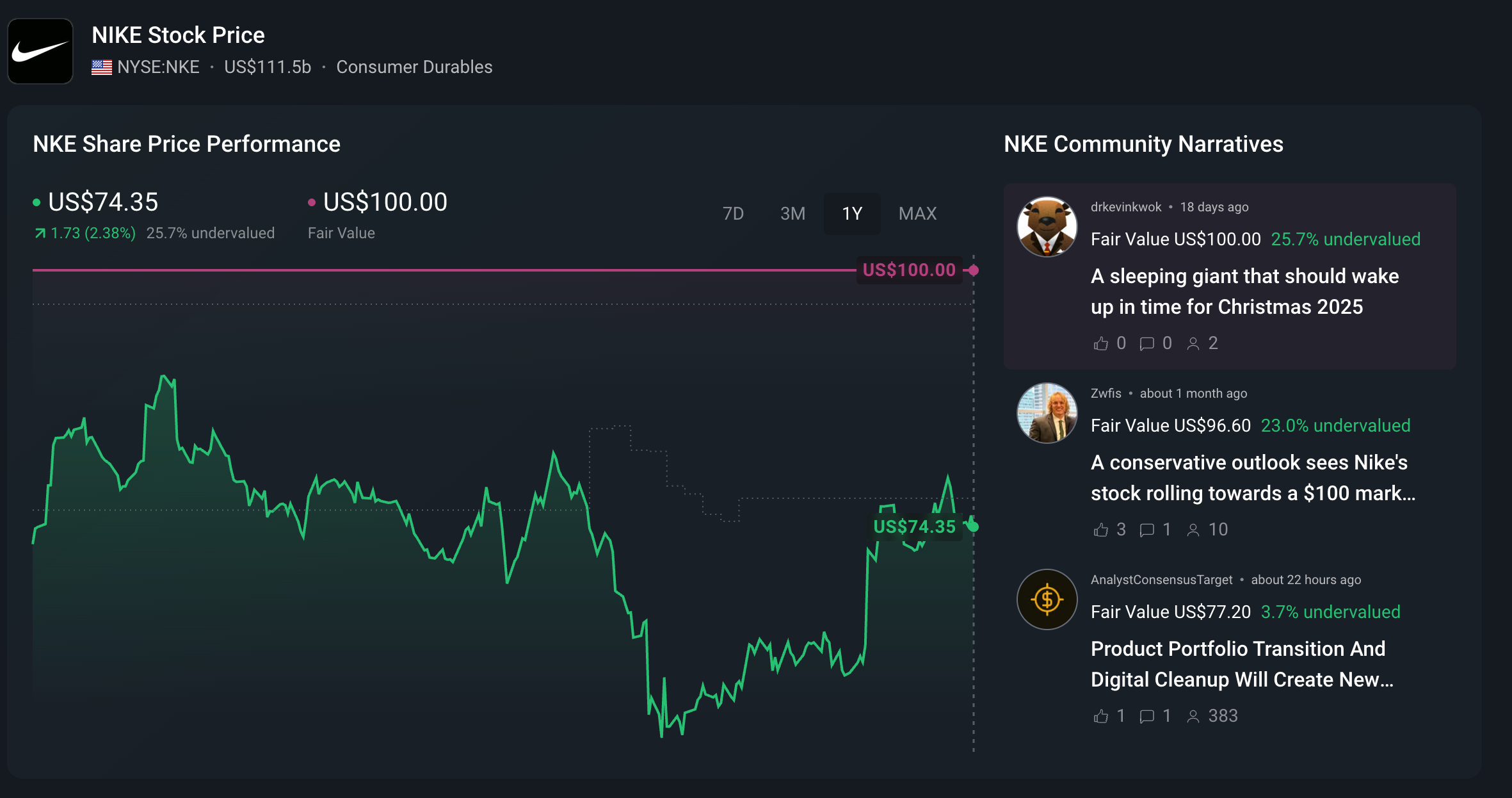

Like many companies, Nike is leveraging AI across its business, from personalized recommendations to product design. But it could also be exposed to an AI-induced slowdown in consumer spending at some point.

Nike Community Narratives - Simply Wall St

Given the range of possible outcomes, it’s crucial, now more than ever, to keep your finger on the pulse of the stocks you own and what moves they’re making to not get left behind over the next 10 years.

Key Events During the Next Week

Tuesday

🇦🇺Reserve Bank of Australia Interest Rate Decision

- 📉 Forecast : 3.6% (Previous: 3.85%)

- ➡️ Why it matters : A potential rate cut would mark a shift toward easing, aiming to support growth as economic momentum fades.

🇬🇧 UK Unemployment Rate

- 📉 Forecast : 4.6% (Previous: 4.7%)

- ➡️ Why it matters: A slight drop suggests the labor market remains tight, possibly keeping the BoE cautious on cuts.

🇺🇸 US Core Inflation (YoY)

- 📈 Forecast : 3% (Previous: 2.9%)

- ➡️ Why it matters : A rise in sticky core prices could delay Fed easing and weigh on rate-sensitive assets.

Thursday

🇬🇧 UK GDP Growth Rate QoQ Prel

- 📉 Forecast : 0.3% (Previous: 0.7%)

- ➡️ Why it matters : A sharp slowdown raises recession risks and strengthens the case for BoE rate cuts.

🇺🇸 US PPI (YoY)

- 📈 Forecast : 2.5% (Previous: 2.3%)

- ➡️ Why it matters : Upward pressure on producer prices may bleed into CPI and keep inflation sticky.

Friday

🇯🇵 Japan GDP Growth Rate QoQ Prel

- 📈 Forecast : 0.3% (Previous: 0%)

- ➡️ Why it matters : A modest rebound may ease pressure on the BoJ, but won’t erase concerns about fragile growth.

🇬🇧 UK Manufacturing Production YoY

- 📈 Forecast : 1.5% (Previous: 0.3%)

- ➡️ Why it matters : Contrary to UK GDP estimates above, a big jump points to a rebound in UK industry, potentially softening the case for rate cuts.

Earnings season continues with some prominent tech companies, including some leading Chinese names.

- Alibaba

- Cisco

- Applied Materials

- Deere and Co

- Sea Ltd

- NetEase

- CoreWeave

- JD.com

- Barrick Mining

- Circle Internet Group

- Tencent Holdings

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.