- United States

- /

- Healthtech

- /

- NYSE:EVH

Why Evolent Health (EVH) Is Up 6.4% After Convertible Note Restructuring and Stock Repurchase

Reviewed by Simply Wall St

- Earlier this week, Evolent Health, Inc. completed a US$166.75 million convertible note offering, using proceeds to repurchase existing notes and Class A common stock and amending its balance sheet structure.

- This move boosts Evolent's financial flexibility during a period of heightened market uncertainty tied to macroeconomic events including new Federal Reserve guidance.

- We'll examine how Evolent’s convertible note issuance, aimed at financial restructuring, influences its future investment outlook.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Evolent Health Investment Narrative Recap

Evolent Health’s investment case revolves around confidence in its ability to accelerate value-based care adoption, scale its specialty platforms, and convert a sizable pipeline of new contracts to realize revenue growth. The recent US$166.75 million convertible note issuance does not materially alter the immediate catalyst, the execution of pending client deals, which remains the most important short-term driver, as well as execution risks tied to contracting delays and client concentration.

Among recent announcements, the Q2 earnings report stands out, showing year-over-year declines in both revenue and profitability. This context heightens attention on whether Evolent’s enhanced financial flexibility from the note offering will help deliver on future growth targets, particularly as margins remain sensitive to contracting outcomes and broader utilization volatility.

But if heightened financial flexibility does not offset timing risk from pipeline delays, investors should be mindful that...

Read the full narrative on Evolent Health (it's free!)

Evolent Health's narrative projects $3.0 billion in revenue and $1.7 million in earnings by 2028. This requires 10.6% yearly revenue growth and an earnings increase of $186.9 million from the current earnings of -$185.2 million.

Uncover how Evolent Health's forecasts yield a $15.31 fair value, a 59% upside to its current price.

Exploring Other Perspectives

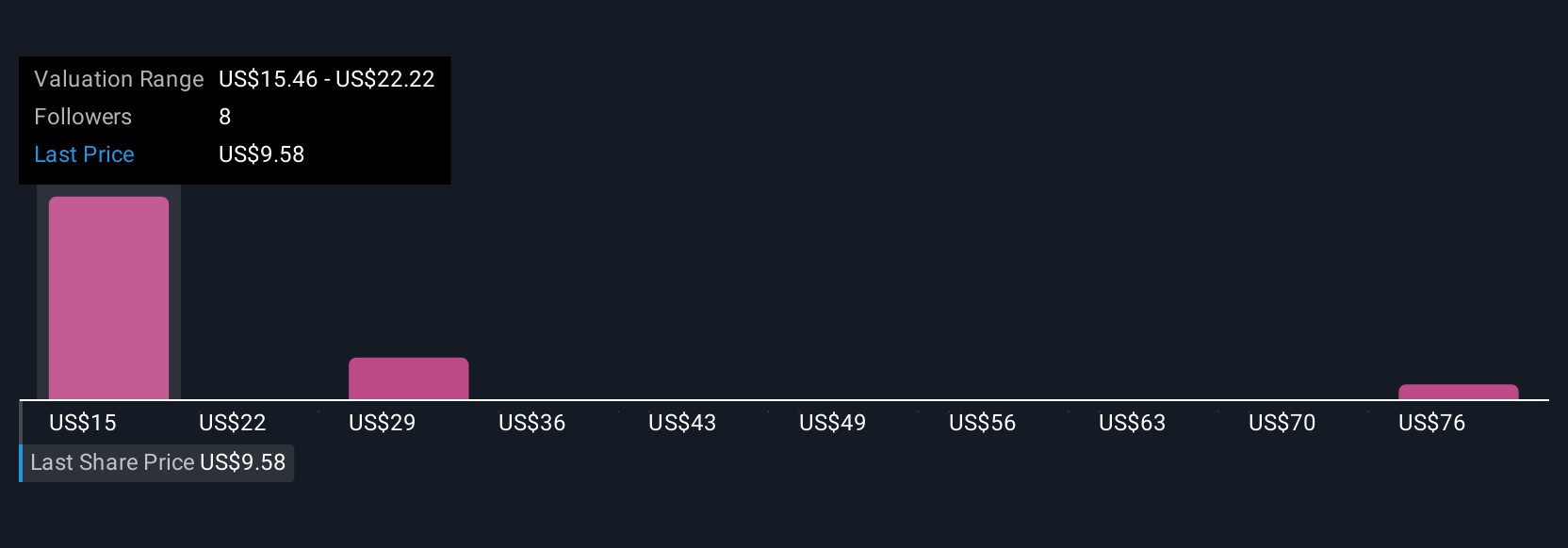

Three fair value estimates from the Simply Wall St Community span US$15.31 to US$83.08 per share, reflecting very different growth assumptions. Keep in mind that for Evolent, future deal conversions and the execution of its pipeline remain key to how these valuations line up with actual results.

Explore 3 other fair value estimates on Evolent Health - why the stock might be worth just $15.31!

Build Your Own Evolent Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolent Health research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Evolent Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolent Health's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolent Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVH

Evolent Health

Through its subsidiary, provides specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives