- United States

- /

- Luxury

- /

- NYSE:DECK

Deckers Outdoor (DECK): Evaluating Valuation Following Strong Brand Momentum and New Teva Launches

Reviewed by Simply Wall St

If you have been watching Deckers Outdoor (DECK) lately, you are not alone. The stock is getting attention after the company rolled out Teva’s Autumn-Winter 2025 collection and announced a talked-about collaboration with designer Sean Wotherspoon. These product launches are more than just seasonal; they tap into key trends and underline Deckers’ commitment to performance, style, and international expansion at a time when the company is already riding high on the momentum of its HOKA and UGG brands.

This wave of innovation comes after a consistent streak of earnings beats, fueling ongoing investor interest. Deckers has shown nearly flat performance over the past three months but is still up almost 100% over the past three years and more than 200% across five years. This indicates long-term momentum. While the stock has cooled a bit this year, recent activity suggests growth drivers remain firmly in place.

After this stretch of headline-grabbing launches and a multi-year climb, the question remains: is Deckers Outdoor a bargain, or are investors already paying up for future growth?

Most Popular Narrative: 15.6% Undervalued

According to community narrative, Deckers Outdoor is seen as undervalued, with analysts projecting a notable upside based on future earnings and growth strategies.

The continued investment in direct-to-consumer (DTC) operations and expansion into new markets with selective retail partnerships is expected to enhance margins. This would reduce reliance on wholesale channels and increase full-price sales with higher-margin direct sales strategies.

Curious why analysts see so much value left in Deckers? Discover the assumptions that hint at ambitious growth targets and rising profit potential. Ready to see which pivotal numbers could push Deckers higher? There is more to this fair value call than meets the eye. Dig in to unpack the full narrative.

Result: Fair Value of $129.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, uncertain currency swings and ongoing supply chain hurdles could challenge Deckers' growth story and put pressure on its profitability outlook going forward.

Find out about the key risks to this Deckers Outdoor narrative.Another View: What Does Our DCF Model Say?

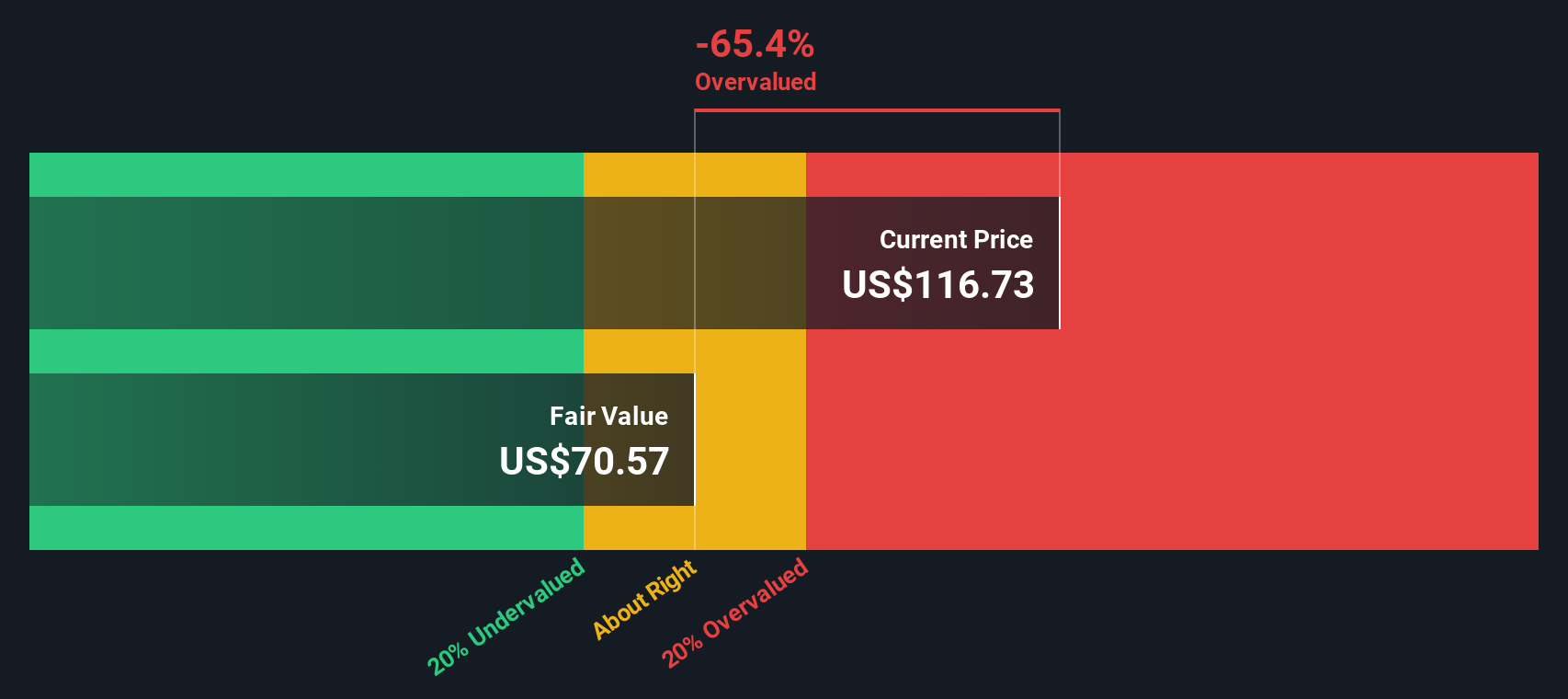

While analysts see Deckers Outdoor as undervalued based on future growth, our DCF model takes a more cautious approach. It suggests the stock may be overvalued if you focus on fundamentals and projected cash flows. Could this signal some optimism is already baked in, or is it missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Deckers Outdoor Narrative

If you have a different perspective or want to dig into the details yourself, you can quickly build your own customized take in just a few minutes. So why not do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Deckers Outdoor.

Looking for More Smart Investment Opportunities?

Why stop at just one great idea? The market is full of exceptional stocks that match your financial goals, if you know where to look. Give yourself an edge with targeted, up-to-date investment ideas that have been shown to perform. Take your portfolio to the next level by seizing opportunities others might overlook.

- Capture steady income streams by checking out dividend payers offering yields above 3% with dividend stocks with yields > 3%.

- Fuel your growth ambitions with leading healthcare AI innovators highlighted by healthcare AI stocks.

- Unlock potential bargains quickly by targeting undervalued shares based on future cash flow using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives