- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

The Bull Case For ePlus (PLUS) Could Change Following Fed Rate Cut Signals and Rising Market Optimism

Reviewed by Simply Wall St

- Shares of IT solutions provider ePlus rose after the Federal Reserve signaled in recent days that interest rate cuts may be imminent, fueling market optimism across rate-sensitive sectors.

- The potential for lower borrowing costs is especially relevant for business services firms like ePlus, since it could encourage increased corporate technology and IT project spending.

- We'll examine how the expectation of lower interest rates could shape ePlus's earnings outlook within its current business and sector trends.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ePlus Investment Narrative Recap

To be a shareholder of ePlus, you need to believe in the company’s ability to convert technology spending trends, from digital transformation to security demand, into sustained profit growth despite its project-driven revenue base. The recent optimism from potential Federal Reserve rate cuts may attract more IT investment and support short-term earnings growth, but it does not fundamentally resolve the biggest risk: future revenue volatility tied to non-recurring, large enterprise projects.

Of ePlus’s recent announcements, the August increase in earnings guidance stands out as most relevant to today’s rate-driven rally. Higher projected sales and profits for fiscal 2026 show management’s confidence in ongoing demand and ability to capitalize on stronger corporate IT spending, which aligns directly with broader market enthusiasm linked to easier borrowing conditions and anticipated capex upticks. However, it’s important to recognize that...

Read the full narrative on ePlus (it's free!)

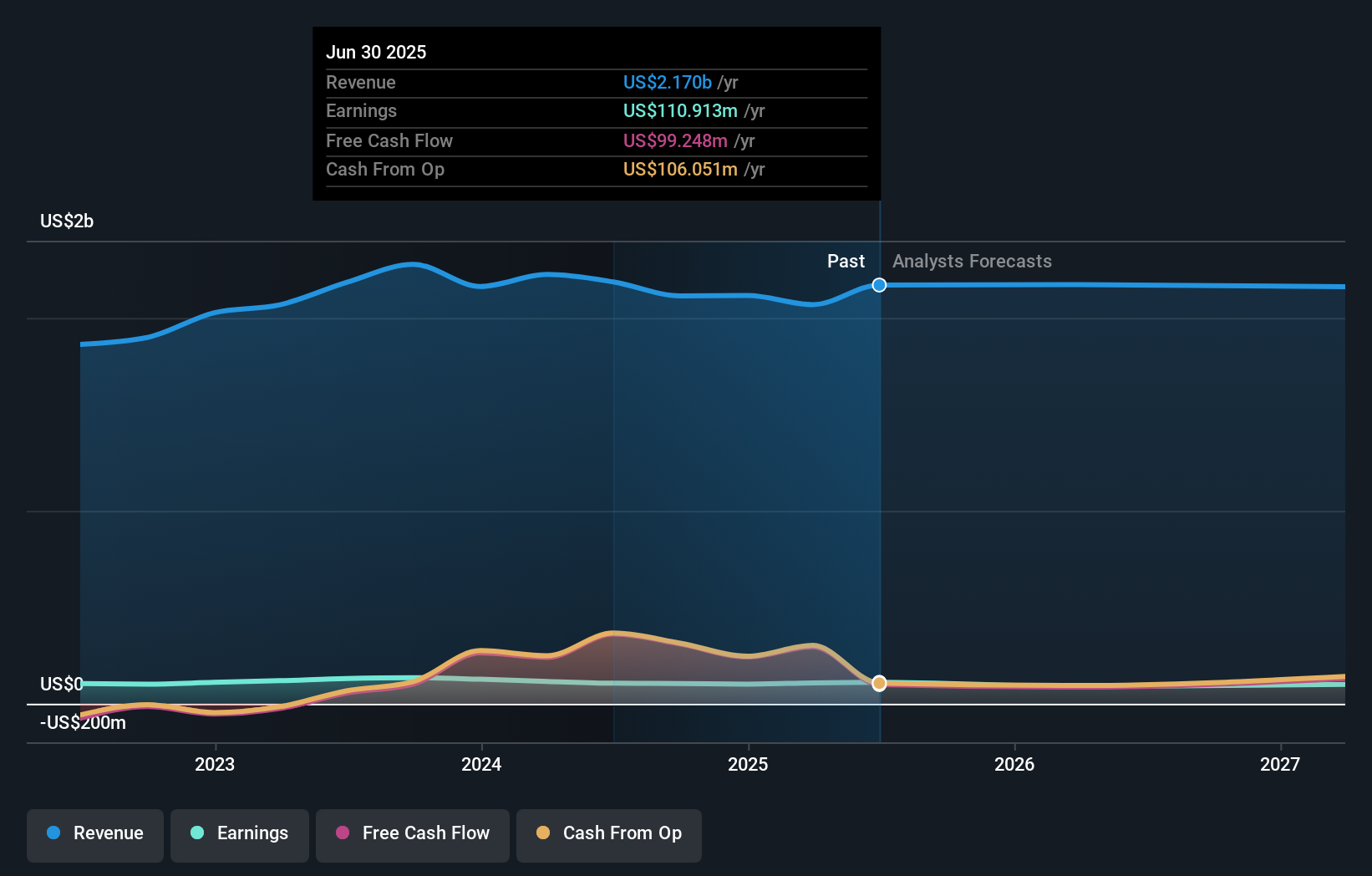

ePlus' narrative projects $2.2 billion revenue and $78.4 million earnings by 2028. This requires a 0.2% annual revenue decline and a $32.5 million decrease in earnings from $110.9 million.

Uncover how ePlus' forecasts yield a $92.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two very different fair value estimates between US$35.86 and US$92.00 for ePlus. Many are still weighing the risk that revenue growth may be less predictable if large enterprise deals prove difficult to repeat over time.

Explore 2 other fair value estimates on ePlus - why the stock might be worth less than half the current price!

Build Your Own ePlus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives