- United States

- /

- Professional Services

- /

- NYSE:CBZ

Will CBIZ’s (CBZ) Investment Strategy Shift Under New CIO Shape Its Competitive Edge?

Reviewed by Simply Wall St

- CBIZ, Inc. recently appointed Jennifer Hutchins as Chief Investment Officer of CBIZ Investment Advisory Services, LLC, effective August 18, 2025, leveraging her over 20 years of experience in financial planning and investment strategy to oversee key investment functions.

- This leadership change comes as broader market optimism is supported by Federal Reserve signals of potential interest rate cuts, which can influence demand for business services by affecting borrowing costs and client spending confidence.

- We'll consider how the combination of new investment leadership and shifting interest rate expectations might shape CBIZ's outlook going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

CBIZ Investment Narrative Recap

Being a shareholder in CBIZ often means believing in the firm's ability to ride structural trends in business outsourcing while managing market cycles and integrating acquisitions. The recent appointment of Jennifer Hutchins as CIO is unlikely to materially impact the most immediate short-term catalyst, realizing integration synergies from the Marcum deal, but may support longer-term improvements in investment strategy. However, risks from pricing pressure and revenue concentration remain front of mind in the near term.

Among recent company updates, CBIZ's July earnings release stands out, showing a significant year-over-year jump in sales and net income. This performance aligns closely with one of the main catalysts for the stock: the expectation that scaling up through acquisitions such as Marcum will enhance recurring revenue streams and drive sustainable growth, though success depends on effective integration and margin management.

By contrast, investors should remain aware of the impact that persistent pricing pressure could have on the company’s ability to...

Read the full narrative on CBIZ (it's free!)

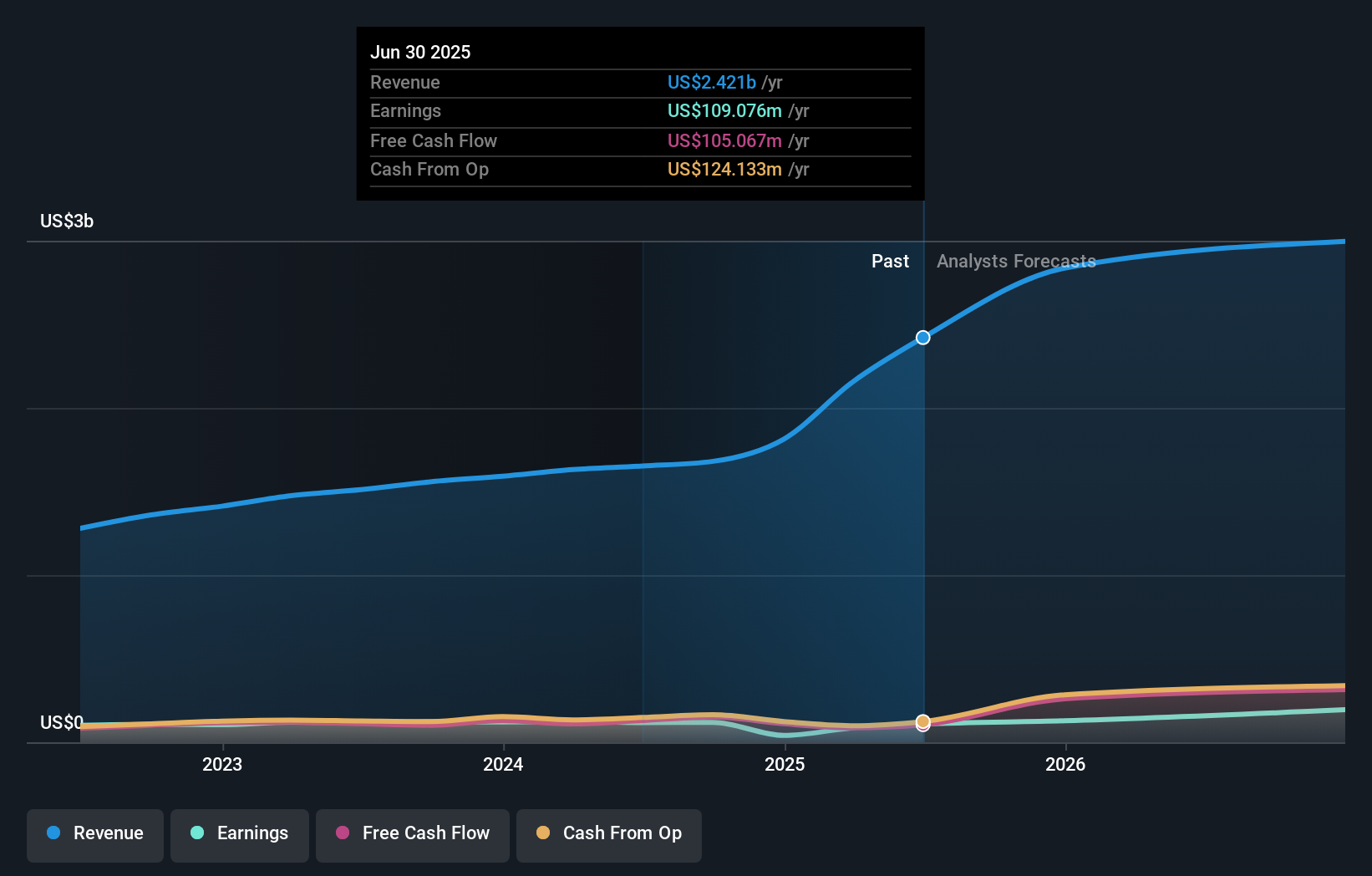

CBIZ's narrative projects $3.7 billion revenue and $317.4 million earnings by 2028. This requires 15.3% yearly revenue growth and a $208.3 million increase in earnings from the current $109.1 million.

Uncover how CBIZ's forecasts yield a $95.00 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely, from US$95 to US$237.60, based on 2 distinct forecasts. While confidence in integration benefits remains a key theme, your perspective on CBIZ may hinge on how you assess the risks of margin compression over time.

Explore 2 other fair value estimates on CBIZ - why the stock might be worth just $95.00!

Build Your Own CBIZ Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBIZ research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CBIZ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBIZ's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBZ

CBIZ

Provides financial, insurance, and advisory services in the United States and Canada.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives