- United States

- /

- Banks

- /

- NasdaqGS:COLB

3 Stocks Trading At Estimated Discounts Up To 49.3% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, the U.S. stock market has experienced volatility, with technology stocks under pressure due to concerns about an AI bubble, even as the Dow Jones Industrial Average reached new highs before pulling back. Amidst these fluctuations, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer potential value in a turbulent market environment. Understanding intrinsic value and recognizing discounts in stock prices can help investors make informed decisions during such times of economic uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $119.88 | $232.81 | 48.5% |

| Sportradar Group (SRAD) | $23.14 | $46.18 | 49.9% |

| Sotera Health (SHC) | $16.90 | $33.63 | 49.7% |

| Schrödinger (SDGR) | $18.13 | $35.35 | 48.7% |

| QXO (QXO) | $22.12 | $43.12 | 48.7% |

| Perfect (PERF) | $1.77 | $3.41 | 48.1% |

| Pattern Group (PTRN) | $12.75 | $25.43 | 49.9% |

| Newsmax (NMAX) | $10.03 | $19.73 | 49.2% |

| FirstSun Capital Bancorp (FSUN) | $37.83 | $73.32 | 48.4% |

| Columbia Banking System (COLB) | $29.26 | $57.69 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

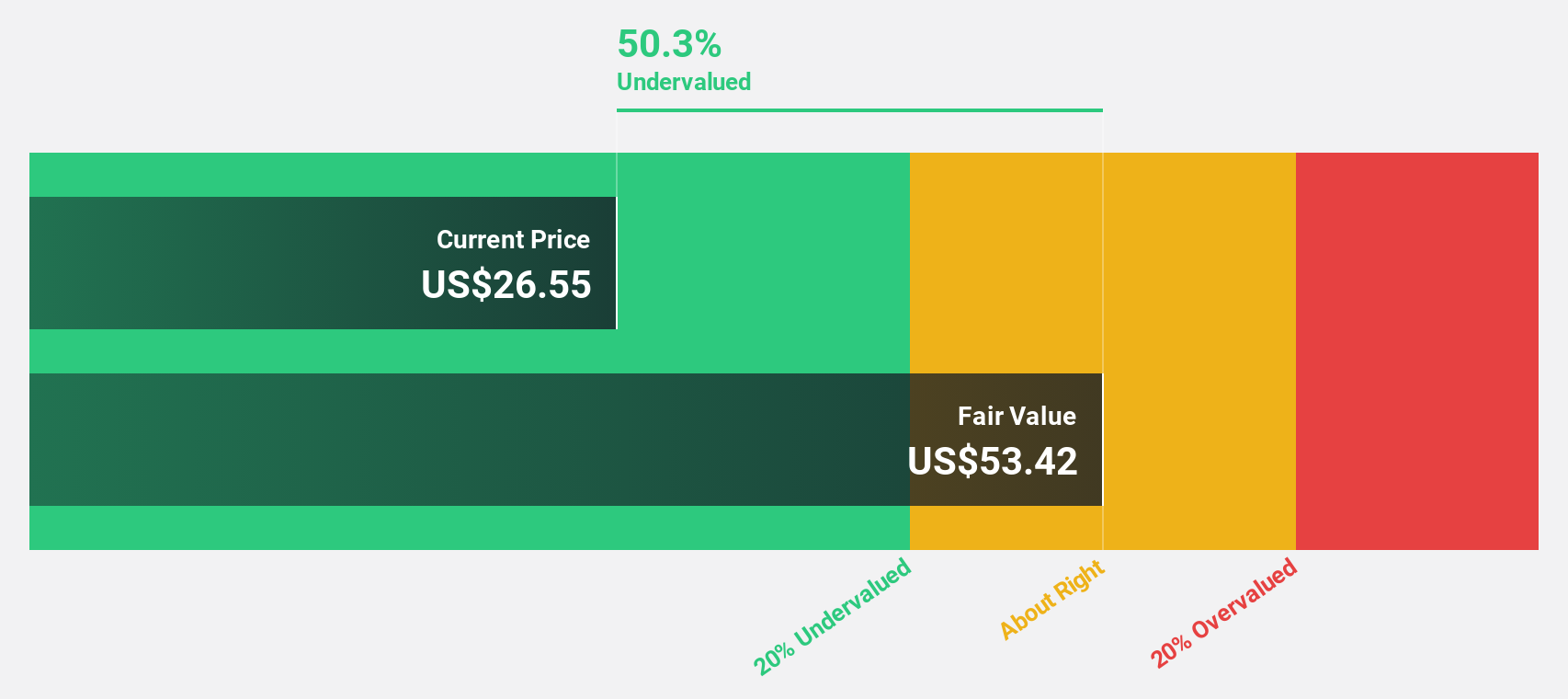

Columbia Banking System (COLB)

Overview: Columbia Banking System, Inc. is a bank holding company for Columbia Bank, offering banking, private banking, mortgage, and other financial services in the United States with a market cap of $8.69 billion.

Operations: The company generates revenue primarily from its banking segment, which accounts for $1.92 billion.

Estimated Discount To Fair Value: 49.3%

Columbia Banking System is trading at US$29.26, significantly below its estimated fair value of US$57.69, highlighting its potential as an undervalued stock based on cash flows. Despite recent executive changes and a share repurchase program worth US$700 million, the company faces challenges like past shareholder dilution and large one-off items impacting earnings. Nevertheless, forecasted earnings growth of 29.7% annually outpaces the broader market, suggesting robust future cash flow potential amidst ongoing strategic adjustments.

- The analysis detailed in our Columbia Banking System growth report hints at robust future financial performance.

- Get an in-depth perspective on Columbia Banking System's balance sheet by reading our health report here.

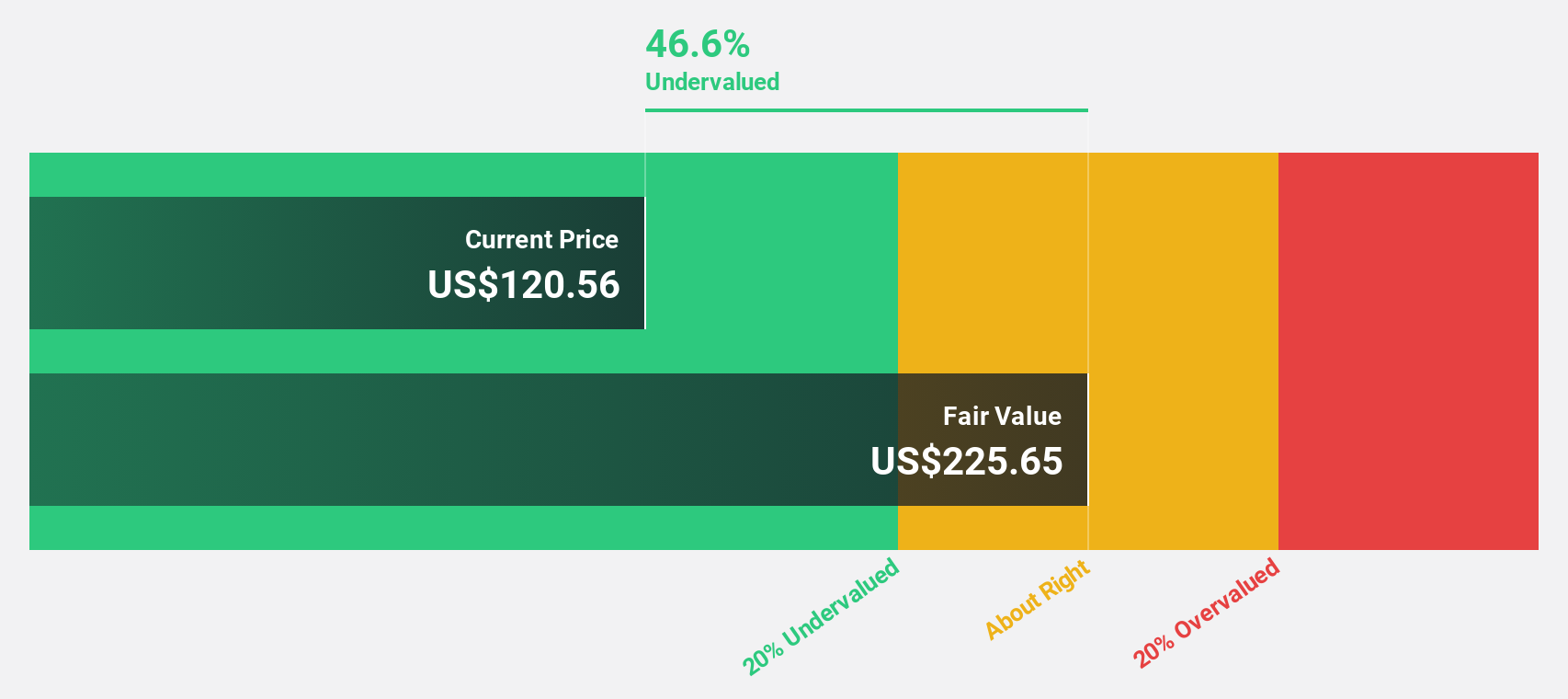

UMB Financial (UMBF)

Overview: UMB Financial Corporation is a bank holding company offering banking services and asset servicing both in the United States and internationally, with a market cap of $8.99 billion.

Operations: The company's revenue is primarily derived from three segments: Personal Banking ($386.78 million), Commercial Banking ($1.15 billion), and Institutional Banking, including Healthcare Services ($680.53 million).

Estimated Discount To Fair Value: 48.5%

UMB Financial is trading at US$119.88, significantly below its estimated fair value of US$232.81, suggesting it may be undervalued based on cash flows. Despite substantial insider selling and increased net charge-offs to US$18.38 million in Q3 2025, the company shows robust earnings growth potential with forecasts of 22.6% annually over the next three years, surpassing market averages. Recent dividend increases further underscore its commitment to returning value to shareholders amidst these challenges.

- Our expertly prepared growth report on UMB Financial implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of UMB Financial with our detailed financial health report.

MGM Resorts International (MGM)

Overview: MGM Resorts International operates as a gaming and entertainment company through its subsidiaries in the United States, China, and internationally, with a market cap of approximately $10.17 billion.

Operations: MGM Resorts International generates revenue from several segments, including MGM China ($4.24 billion), MGM Digital ($605.80 million), Regional Operations ($3.75 billion), and Las Vegas Strip Resorts ($8.50 billion).

Estimated Discount To Fair Value: 44.9%

MGM Resorts International, trading at US$37.44, is significantly undervalued compared to its estimated fair value of US$67.98. Despite a high debt level and recent net losses, its earnings are forecast to grow substantially at 49.3% annually over the next three years, outpacing market averages. However, insider selling and a drop from the FTSE All-World Index raise cautionary flags amid these positive growth prospects based on cash flows.

- Upon reviewing our latest growth report, MGM Resorts International's projected financial performance appears quite optimistic.

- Navigate through the intricacies of MGM Resorts International with our comprehensive financial health report here.

Make It Happen

- Delve into our full catalog of 206 Undervalued US Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)