Originally Posted Dec 5 on the Woodworth Contrarian News Page

Brought to you by Quinn Millegan & The Woodworth Contrarian Fund

A Deep Dive Into Why the Market Is Pricing MGPI for Permanent Decline When Cyclical Recovery Is Lurking in Plain Sight

MGP Ingredient’s factories in Atchison, KS & Lawrenceburg, IN - MGP Ingredients Corporate

THE SETUP: MEET THE STOCK THAT FELL 75% AND NOBODY NOTICED

MGP Ingredients closed at $24.70 yesterday (with a 3–6% increase intraday today).

Two years ago—December 4, 2023—it traded at $91.53.

That's a 73% decline in two years. The peak-to-current drawdown sits at –75.6%, making MGPI look like one of those forgotten food stocks that got swept up in a merger story gone wrong, or a business case study in how not to diversify.

Except that's completely backwards.

What actually happened is simpler, messier, and infinitely more profitable for the patient investor: the whiskey market discovered it has too much whiskey. The inventory correction that strategic spirits manufacturers orchestrated starting in 2024 has compressed MGPI's largest segment—brown goods distilling—into a cyclical crater. Management maintains that contracts remain intact with zero cancellations. Customers temporarily paused purchases while rebalancing barrel inventories. This is orderly. This is temporary. This is exactly the kind of thing equity markets price as "structural decline" when it's actually a 12-to-24-month speed bump on a cyclical asset.

So the market buried the stock. Fair enough.

What the market missed is that MGPI—a diversified distilled spirits and specialty ingredients platform—is now trading at:

- 4.7x Price/EBITDA (down from 13–14x; severe discount to peers)

- 0.86x price-to-book (excluding goodwill, including brand IP assets) (trading BELOW net tangible assets)

- $24.70 per share against $28.73/share tangible net asset value

Despite maintaining a fortress balance sheet ($443M available credit, 0.32x debt-to-equity, 2.3x net debt/EBITDA, +26% YTD operating cash flow).

Simultaneously, the distillery industry itself is imploding: 25.6% of craft distilleries closed in a single year, bankruptcies are multiplying, and equipment is hitting the market at fire-sale prices. MGPI has the balance sheet and liquidity to consolidate competitors while they liquidate assets. The company is also quietly running three accelerating growth engines that the market has completely priced to zero.

This is the definition of a diamond in the rough. And for once, "rough" is literal.

KEY INSIGHT: Stock trades at 0.86x P/B excluding goodwill (acquisition premium) but including $266M in brand IP assets. This is the correct valuation framework for a going concern. The stock is not at "liquidation multiples"—it's at cyclical trough multiples while trading BELOW the value of its real (non-goodwill) net assets.

PART 1: THE CARNAGE—UNDERSTANDING WHAT HIT THE WINDSHIELD

The Brown Goods Bloodbath (And Why It's Not What It Looks Like)

Brown goods = bulk distilled spirits (bourbon, whiskey, rye, gin, vodka) sold in 50-barrel increments to major brands and bottlers. Think of MGPI as a "bourbon bakery" supplying the big brand names (and many smaller ones) with semi-finished whiskey.

In 2024, this business went into organized freefall:

- Q3 2025: Sales down 43% YoY; gross profit down 56%; gross margin compressed approximately 300 basis points

- Full Year 2024: Revenue declined 15.9% ($836.5M → $703.6M) after growing 6.9% the prior year

- Net Income: Collapsed from $107.5M (2023) to $34.7M (2024)—a 67.7% decline

The narrative in the street: MGPI's core business is finished. Whiskey is dead. Inventory will never clear.

The reality: Industry-wide barrel inventory got absurdly elevated. Strategic customers—big spirits companies with sophisticated supply chains—intentionally paused bulk whiskey purchases to rebalance. No contracts were cancelled. Management confirmed ongoing visibility. Market discipline is forcing production cuts across the industry (TTB data shows whiskey production down 15% in late 2024), which will organically compress supply and support recovery. This is textbook inventory normalization, not demand destruction.

But cyclical stories sell at cyclical multiples in bear markets. So MGPI got crushed.

The Math on Industry Discipline and Why Scarcity Gets Priced Later

Here's where it gets interesting: the spirits industry is about to face deliberately constrained supply.

Market discipline is driving production cuts across the industry. When distillers intentionally reduce output (and they have), they face hard decisions on capacity utilization. TTB production data shows whiskey production down 15% in late 2024, confirming that industry discipline holds. This is the industrial equivalent of an OPEC production ceiling, except it's market-driven and backed by inventory realities.

Result? When inventories finally clear—expected 2026 onward—supply won't snap back instantly. Distillers will face capacity constraints. Pricing power normalizes. Brown goods gross margins, currently under fire at mid-40%, should drift back toward the 50-55% range they historically held.

MGPI doesn't get the benefit of this narrative yet. The market is still in "inventory forever" mode.

PART 2: THE INVISIBLE FORTRESS—WHY THE BALANCE SHEET MATTERS MORE THAN EARNINGS THIS CYCLE

Here's what separates a distressed stock from a value play: cash generation doesn't care about sentiment.

Cash Flow: The Honest Metric

2024 Operating Cash Flow: $102.3M (+22% YoY despite 16% revenue decline)

Let that sink in. Revenue down 16%. Earnings down 68%. Cash flow up 22%.

This tells you three things:

Working capital management is ruthless: Management squeezed receivables, negotiated with payables, and yanked inventory down when the brown goods slowdown hit. This is competence.

CapEx is strategic, not desperate: Despite chaos, MGPI invested $71.2M in capital projects (up 20% YoY). The Deep Well project is now operational. The biofuel facility comes online H2 2025. This isn't a company that panics—it invests through cycles.

Free cash flow remained positive: $31.1M in FCF in 2024, providing a moat against debt spirals or dividend cuts.

The Balance Sheet Scorecard

Translation: MGPI can weather an extended brown goods downturn. It has the liquidity to navigate significant stress without the institution itself being at risk. The dividend ($0.48/share annually) gets maintained because management isn't sweating covenant breaches. Management is actually using operating cash flow to reduce debt, which is the sign of a company that believes in survival and recovery.

Important Context on the Current Ratio: The 2.78x current ratio is solid and represents healthy liquidity. However, it's materially different from year-end 2024's 5.91x because the $110.8M Penelope contingent consideration liability (earnout payment) moved from long-term to current obligation on the balance sheet. This is not a sign of operational deterioration—it's an accounting reclassification reflecting the timing of an earnout payment expected within 12 months. Operating liquidity remains robust with $13.4M cash on hand and $443M available under the credit facility.

This is the difference between "out of favor" (MGPI) and "in trouble" (bankruptcies). MGPI is the former.

PART 2: THE INDUSTRY IMPLOSION—WHY MGPI'S COMPETITORS ARE LIQUIDATING

While the market wallows in brown goods inventory stories, it has completely missed what's happening to MGPI's competitors: the distillery industry is imploding at historic speed, and a well-capitalized player like MGPI can acquire assets at pennies on the dollar.

The Steepest Decline in Modern Distilling

The American Craft Spirits Association's 2025 Craft Spirits Data Project, compiled with Park Street, documents a violent reversal:

- 2024 craft distillery sector contraction: 25.6%

- Net decline: 787 active distilleries in a single year

- Prior year: 11.5% growth

This is not a mild cyclical pause. It is the steepest single-year decline in the modern history of the craft spirits industry—a complete reversal of momentum.

Regional devastation underscores the severity:

- California—once a flagship craft distilling hub—lost roughly 45% of its distilleries year-over-year

- The top five distilling states all saw net declines

- The undercapitalized middle—small producers without strong balance sheets or scale—is being annihilated

Supply Glut Meets Demand Softness

Even as distilleries shut down, the physical inventory overhang remains massive:

- Kentucky alone holds roughly 14.3 million barrels of aging whiskey—more than three barrels per resident in the state

- American whiskey sales declined about 1.8% in 2024—the first meaningful decline in more than two decades

- Volume fell roughly 6.1%, while value declined about 3.3% as producers attempted to raise prices into softening demand

The distillery industry built for a demand trajectory that never materialized. Producers are now making less and selling less. Many lack the financial depth to endure a prolonged period of squeezed margins and slower growth.

Bankruptcies and Fire Sales

The distress is not theoretical.

In April 2025, House Spirits Distillery—operating as Westward Whiskey, a well-known Portland craft producer—filed for Chapter 11 bankruptcy. The numbers were brutal:

- 2024 revenue: approximately $3.44M

- 2024 net loss: roughly $9.8M

- Effective burn rate: nearly $2.8M per quarter

Management cited overproduction and overcapacity as key contributors in bankruptcy filings.

The court-supervised process resulted in a sale of Westward's assets—production equipment, barrel inventory, aging facilities, and intellectual property—to private investors at a distressed valuation. Assets that would have cost tens of millions to build from scratch changed hands at bankruptcy-discount prices.

Similarly, Stoli Group's U.S. division entered bankruptcy with approximately 35,000 barrels of bourbon held as collateral. A federal judge reviewing the case noted there were "too many doubts about the value" of that inventory—a stark acknowledgment that the market value of barrels, in an environment of oversupply, is far below what many balance sheets assume.

The Consolidation Opportunity for the Well-Capitalized

This is where MGPI's fortress balance sheet becomes a strategic weapon.

While competitors file bankruptcy and craft distilleries shutter their doors, MGPI has:

- Cash on hand: approximately $13.4M

- Available credit facility: roughly $443M

- Annualized operating cash flow: on the order of $120–125M

- Total available liquidity: approximately $470M+

Industry structure is consolidating rapidly:

- The top 2% of producers—around 39 companies—now account for more than half of all craft spirits volume

- Roughly 90% of distilleries (over 2,500 producers) account for barely 10% of industry volume

The middle is dead. Scale and balance sheet strength are separating survivors from casualties.

For MGPI, this creates a straightforward opportunity: acquire distillery equipment, brands, aging facilities, and barrel inventory from bankrupt and distressed competitors at fractions of replacement cost. A distillery that cost $200–250M to build in the last decade can realistically be purchased for a significant fraction of that in a bankruptcy process. That is textbook capital cycle arbitrage.

At the same time, industry-wide capex is being cut or deferred—investment declined by high single digits year-over-year as producers hoard cash and freeze expansion. That sets up a future capacity constraint exactly when inventories normalize.

Why This Matters for MGPI's Valuation

While management hasn't announced a roll-up strategy, the base case does not require acquisitions for MGPI's recovery thesis to work. But the option value is powerful.

As brown goods inventory stabilizes and sentiment turns, the market may finally recognize that MGPI is not merely surviving the downturn—it is one of only a few scaled, well-capitalized players positioned to roll up distressed assets at scale. The first meaningful acquisition or facility consolidation could be a powerful narrative pivot from "inventory victim" to "industry consolidator," with all the multiple re-rating that implies.

The market sees a company getting crushed by inventory. What it is missing is a well-capitalized consolidator acquiring its struggling competitors at pennies on the dollar—and benefiting from industry-wide production constraints that will support margins for years to come.

PART 4: THE REAL BUSINESS—THREE GROWTH ENGINES PRICED AT ZERO

Wall Street's fixation on the brown goods crisis has completely obscured the fact that MGPI runs three distinct profit centers, and two of them are accelerating.

Engine 1: Penelope Bourbon & Premium Spirits (The Momentum Story)

In June 2023, MGPI acquired Penelope Bourbon for an undisclosed sum. Management has spent 18 months merchandising it into premiumization trends.

Result: Penelope now ranks in the top 30 premium-plus American whiskey brands nationally and is the second-fastest growing in its category over the past 52 weeks.

Let that sink in. The company's newest flagship brand is on a hockey stick. Not because of MGPI's marketing genius (though they're competent), but because the market is consolidating around super-premium bourbon, and Penelope landed at the right price point ($39-45 MSRP) with the right positioning (women-focused but not "pink bottle" gimmicky).

Premium-Plus Segment Performance (Q3 2025):

- Penelope + El Mayor + Rebel 100: +3% growth (third consecutive quarter positive)

- Branded Spirits gross margin: 53.0%

The broader branded portfolio includes Ezra Brooks, Rebel, Yellowstone, El Mayor Tequila, and others acquired in the 2021 Luxco deal. While mid- and value-tier brands face headwinds from price competition, the premium-plus portfolio is accelerating.

Global bourbon market: $8.29B (2024) → expected growth to 6.5-7% CAGR through 2029. High-end bourbon sales grew 18% in 2024 alone. This is the tailwind MGPI's premium portfolio is riding.

Engine 2: El Mayor Tequila (The Fastest-Growing Spirits Category)

The tequila market is in full premiumization mode. Premium tequila expected to grow 7% CAGR through 2028—nearly double bourbon's growth rate.

MGPI owns El Mayor, a solid mid-to-premium tequila brand produced at its Jalisco, Mexico distillery. While the brand doesn't command Patrón or Maestro Dobel pricing, it has room to run in the premium segment. The company is actively merchandising El Mayor up the value chain. Management's positioning of tequila as a "growth vector" suggests they're not sleeping on this category.

Engine 3: Ingredient Solutions (The Sleeper Growth Asset)

This is where MGPI's future actually lives.

The Ingredient Solutions segment supplies specialty wheat proteins, fibers, and starches to food, beverage, personal care, pet food, and pharmaceutical manufacturers.

Key product platforms:

- Fibersym® RW: Specialty starch with FDA-approved dietary fiber claim. This matters because food makers are desperately seeking clean-label, functional solutions.

- ProTerra®: Specialty wheat proteins for plant-based and functional food applications.

- Arise®: Textured proteins.

Performance (2025):

- Specialty wheat proteins: +13% YoY growth (Q2 2025)

- Q3 2025 sales: $29.3M, +9% YoY

- Gross margin: 10.3% (pressured by equipment outages now resolved, commercialization inefficiencies that should improve)

The market tailwind: The specialty food ingredients market is $107.3B (2024) and projected to reach $179.9B by 2034—a 5.3% CAGR. Plant-based and functional foods are the fastest-growing subsegments. This is where consumer spending is moving.

Why this matters for valuation: If Ingredient Solutions can stabilize at $30M quarterly revenue ($120M+ annually) with 25%+ gross margins (vs. current 10%), and the market applies 12-15x EBITDA to a dedicated specialty ingredients business, MGPI's sum-of-parts valuation explodes.

PART 5: THE VALUATION TRAP—WHY THE MARKET IS BLINDFOLDED

Here's where the market has made its biggest mistake: It's priced MGPI not just as a cheap earnings multiple, but as if the company's balance sheet is deteriorating.

In reality, the stock is trading at 0.86x book value (when you exclude goodwill but retain the $266.01M in owned brand IP). That means you're buying $1 of real net assets for $0.86.

This opens up not one, but two independent paths to recovery:

Path 1: P/B Revaluation (Asset Price Recovery) When cyclical stress eases and investors regain confidence in asset durability, the P/B multiple typically re-rates faster than EBITDA multiples. From 0.86x back to 1.5–2.0x provides 74–133% upside independent of earnings recovery.

Path 2: EBITDA Multiple Expansion (Earnings Power Recovery) As brown goods inventory normalizes and Ingredient Solutions scales, EBITDA recovers from $112.5M (2025E) to $130–150M, and the multiple re-rates from 4.7x to 10–12x. This provides an additional 131–195% upside.

Most investors are focused on Path 2 (earnings recovery). Few are noticing that Path 1 (asset revaluation) is already building.

The market is priced for permanent damage. The balance sheet suggests temporary pain.

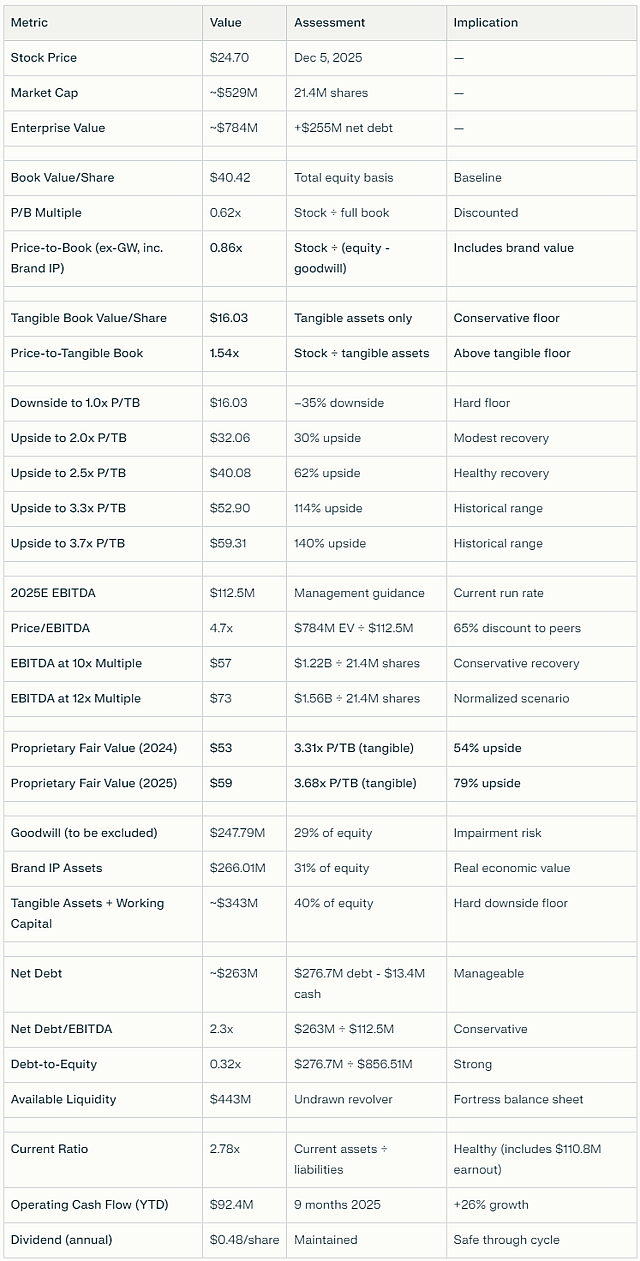

Current Valuation Snapshot

Key Distinction: MGPI's book value excluding goodwill reflects realistic going-concern value where the company retains ownership of valuable brands (Penelope, El Mayor, Ezra Brooks, Rebel, etc.) regardless of acquisition accounting. The $266.01M in other intangible assets (brand IP, trade names, customer relationships) are excluded from goodwill but retained in this calculation, as they represent real economic assets that can be licensed, sold, or transferred—unlike goodwill (which has zero salvage value).

Path 2: Price-to-Book Recovery Excluding Goodwill (The Brand Value Backstop)

This is the critical wrinkle that changes the valuation framework. Based on Q3 2025 filings:

Balance Sheet Construction:

Total Stockholders' Equity: $856.51M Less: Goodwill (acquisition premium): $247.79M Equals: Book Value Excluding Goodwill: $608.72M

This $608.72M includes:

- Tangible fixed assets (distilleries, warehouses, equipment): $245M+

- Working capital (inventory, receivables, payables): $97M+

- Intangible IP assets (brands, trade names, customer lists): $266.01M ← This is the key

Per Share Calculation:

Total Book Value (including all intangibles): $40.42/share Less: Goodwill: $11.69/share = Book Value Excluding Goodwill (inc. Brand IP): $28.73/share

Current Valuation: Stock Price: $24.70 P/B Ratio (ex-Goodwill, inc. Intangible IP): 0.86x

Here's the critical insight: The stock trades at 0.86x book value when you exclude only the goodwill (acquisition premium) but retain the brand IP assets. This means MGPI is trading BELOW tangible assets plus the fair value of owned brands. The market is pricing in not just cyclical earnings stress, but skepticism about brand durability.

Downside Protection:

At 1.0x P/B (ex-Goodwill, inc. Intangible IP): $28.73/share = +16.3% downside cushion This floor assumes brands maintain some value but doesn't require recovery.

Upside Scenarios:

At 1.5x P/B (normalized asset valuation): $43.09/share = +74.5% upside At 2.0x P/B (healthy capital-intensive business): $57.45/share = +132.6% upside At 3.0x P/B (premium multiple reflecting brand strength): $86.18/share = +248.9% upside

Why This Matters:

The $266.01M in brand IP and intangible assets represents the real economic moat. Unlike goodwill (which has zero salvage value), these brands can be:

- Retained and operated if company survives downturn

- Licensed to third parties for revenue

- Sold individually to premium spirits consolidators

- Valued by strategic buyers (Diageo, Brown-Forman, Beam Suntory, etc.)

Historical precedent: Spirits brands rarely experience true 50%+ impairment if the company survives. Penelope, El Mayor, and the Luxco portfolio (Ezra Brooks, Rebel, Yellowstone) have all proven staying power despite industry stress.

Goodwill Risk vs. Brand Risk:

The $247.79M in goodwill represents pure acquisition premium. This WILL impair if EBITDA doesn't recover. But that doesn't destroy the $266.01M in brand value. In a stressed scenario, MGPI could shed the goodwill while retaining operational brands, leaving shareholders with real asset value of $28.73/share.

Three Levels of Downside Protection:

- LEVEL 1: If brown goods never recover but brands hold value → Stock supports $28.73/share (well above current price)

- LEVEL 2: If brands are written down 50% → Stock supports ~$22.50/share (–9% from current)

- LEVEL 3: If tangible assets alone matter (bankruptcy scenario) → Stock supports ~$16.17/share (–35% from current)

Most likely scenario: Levels 1–2 hold, providing meaningful cushion while upside remains intact if EBITDA recovers.

The Hidden Metric: Price-to-Book Excluding Goodwill

This is where market psychology has completely missed the real story.

MGPI trades at 0.86x price-to-book value when you exclude goodwill but retain brand IP. In plain English:

Book value per share (ex-Goodwill, inc. Intangible IP): $28.73 December 4th stock price: $24.70 Market valuation: 86% of net tangible + brand asset value

This means public equity investors can purchase $1 of MGPI's real (non-goodwill) net assets for approximately $0.86.

Historical Context and the Collapse

Two years ago, MGPI traded near 2.6x price-to-book on total book value. Today, the market is valuing its balance sheet at roughly 0.33x of that multiple—a material collapse in how investors value the same assets.

What makes this breakdown interesting: The plants did not disappear. The brands did not evaporate. The customer relationships are still intact. The collapse from 2.6x to 0.86x P/B (ex-GW, inc. Brand IP) is almost entirely about sentiment regarding brown goods inventory and near-term EBITDA recovery.

What P/B < 1.0x Actually Means (Ex-Goodwill Framework)

For capital-intensive businesses with owned brands—distilleries, food companies, specialty ingredient producers:

- P/B of 1.0x (ex-GW, inc. Intangible IP) = market values net assets at book; neutral confidence

- P/B below 1.0x = market doubts near-term EBITDA recovery but doesn't expect asset write-downs

- P/B of 0.86x = market is pricing in extended cyclical pain, temporary brand devaluation

MGPI at 0.86x is trading in "cyclical trough" territory—not liquidation territory. The market is saying: "This company will survive, but earnings will stay depressed for 12–24 months and brands will be re-valued lower until we see demand stabilization."

Why This Is Different from True Distress

MGPI is maintaining:

- Fortress balance sheet ($443M available credit, 0.32x debt-to-equity, 2.3x net debt/EBITDA)

- Positive operating cash flow ($92.4M YTD, +26% growth)

- Dividend continuity ($0.48/share maintained)

- Active brand development (Penelope +52-week growth trajectory)

- No covenant breaches, no refinancing risk

This is not a company in financial distress. This is a market pricing in extended operating stress with the assumption that brands may lose value if earnings don't recover soon.

Proprietary Analysis: Price-to-tangible-book

We conducted a proprietary analysis of MGPI's historical trading bands relative to price-to-tangible-book. Based on the company's 10-year trading range normalized to P/B multiples applied to current net asset value:

Implied Fair Value Based on Last Fiscal Year (2024): $53 per share Implied Fair Value Based on Current Fiscal Year (2025): $59 per share

These price targets reflect where MGPI has historically traded relative to net tangible assets, without requiring heroic assumptions about earnings growth or multiple expansion.

What This Means:

The $53–59 price targets represent normalized P/TB multiples. These are:

- Well below the 2.6x P/B from two years ago (less aggressive)

- Consistent with peer valuations for capital-intensive industrials

- Conservative given MGPI's premium brand portfolio

- Achievable if EBITDA stabilizes and investors regain confidence in asset durability

The Market's Mistake

Wall Street's valuation framework is:

- Focus on multiple compression (P/EBITDA falling from 13–14x to 4.7x)

- Assume balance sheet deterioration is coming (covenant risk, dividend cut)

- Price accordingly for extended distress

- Ignore P/B as "doesn't matter for cyclicals"

- Completely miss that stock trades BELOW net asset value

What it missed:

The stock is trading at 0.86x P/B (ex-Goodwill, including net Intangible IP assets)

- This creates a two-path recovery opportunity

- P/B expansion back to 1.5–2.0x provides 74–133% upside independent of EBITDA

- EBITDA recovery + multiple expansion provides additional 131–195% upside

- Tangible assets alone provide –35% downside floor (defined risk)

As ROE improves from current 3–5% toward 10–12%, P/B typically re-rates before multiples do. This gives you two independent ways to make 50%+ returns:

- P/B normalization (assets repriced as cyclical stress eases)

- EBITDA multiple expansion (earnings power recovered)

The company isn't just cheap on multiples. It's trading at a discount to its own net asset value (ex-goodwill), when the balance sheet says the opposite should be true.

Summary: The Valuation Guardrails

The asymmetry is stark: –35% worst-case downside (defined), multiple paths to 50–240% upside in base through optimistic cases. The key insight: the stock isn't cheap only on EBITDA multiples—it's trading below net tangible asset value when you properly account for brand IP value.

PART 6: THE RISK REGISTER (BECAUSE NOTHING IS RISKLESS)

Real Risks That Could Extend the Pain

1. Brown Goods Recovery Timing Uncertainty

Management says 2026+. What if it's 2027? Or what if a recession crushes premium spirits demand? If industry discipline breaks and production rebounds faster than expected, you'll face supply pressure and margin compression. If macro softens, premium bourbon could face multiple compression alongside volume pressure.

Mitigation: Even if brown goods stays depressed another 12 months, the balance sheet holds. And the premium segments are already showing green shoots.

2. Consumer Softness in Mid-Tier Spirits

Mid- and value-tier branded products (outside Penelope, El Mayor, Rebel 100) are getting hammered by price competition. If working consumers trade down further, MGPI's broader portfolio gets crimped.

Mitigation: Management's strategy is explicitly premiumization. They're not fighting the low end; they're moving up it.

3. Ingredient Solutions Execution Risk

The business is growing 13%, but margins are thin (10.3%) because of equipment issues, waste disposal costs, and commercialization inefficiencies. If new large customers don't improve margins as expected, the "growth engine" narrative frays.

Mitigation: Equipment outages are resolved. Biofuel facility coming online should lower disposal costs. Commercialization typically improves with scale and time.

4. Tariff Exposure

El Mayor is produced in Mexico. A 25%+ tariff on spirits or finished goods could compress margins. Trade war acceleration is real risk.

Mitigation: Tequila has strong lobbying behind it (both Mexican and U.S. spirits interests). Tariffs on brown goods would raise competitors' costs too. And tequila has demonstrated price-passing ability—premium tequila sells at a 40%+ premium to commodity alternatives despite only 15% production cost difference.

5. Dividend Sustainability

If brown goods extends deeper into 2026 and Ingredient Solutions disappoints, management might cut the $0.48/share dividend to preserve liquidity. A dividend cut could shake long-term holders.

Mitigation: At current payout levels ($10.3M annually on ~$112.5M EBITDA), the dividend is sustainable even with further distress. This isn't a Realty Income situation where cuts are existential.

PART 7: THE TECHNICALS — THREE CHARTS, ONE BRUTAL STORY

Fundamentals explain why MGPI is cheap. Technicals explain how it got there—and whether the selling has finally burned itself out.

MGPI 3 Year Chart

MGPI 5 Year Chart

MGPI 10 year Chart

Reading the Damage: 1-Year, 3-Year, 5-Year & 10-Year Charts

The 1-Year Chart: The Cliff

Over the past year, MGPI's chart looks like a slow-motion mugging followed by a shove off a balcony.

Starting around the mid–$40s, the stock drifted sideways through early 2025 while the market pretended the brown-goods inventory problem would "work itself out." Then Q2 commentary started to crack that illusion. By Q3 2025 earnings, the floor gave way.

From the 52-week high near $47.25, MGPI sank to a 52-week low around $21.67—a 54% intra‑year collapse. That is not "volatility." That is forced liquidation: hedge funds de‑risking, quant models puking out anything cyclically exposed, and momentum traders hitting every bid on the way down.

The important part is what happened next.

For the past several weeks, the stock has stabilized in a tight band around $24–$25, with repeated bounces off the low‑20s. That is a textbook support zone: sellers exhaust themselves, volume dries up, and price stops making new lows even as headlines stay ugly.

In Clifford Pistolese's framework, that pattern—sharp vertical drop into a horizontal base—is classic capitulation followed by consolidation, the precondition for a trend reversal rather than the middle of a new down‑leg.

The 3-Year Chart: The Massacre

Zooming out to three years tells the real horror story.

MGPI peaked around $101.30 in late 2023. From that high to today's $24.70, the stock is down roughly 75.6%. Over the same window:

- The broad market marched higher.

- Food & beverage names muddled through with single‑digit drawdowns or gains.

- Branded spirits and ingredients peers re‑rated, but nothing like this.

The 3‑year chart is one long arc down from triple digits into the mid‑20s—far steeper than anything justified by a business that stayed free‑cash‑flow positive, maintained its dividend, and never flirted with solvency.

Technically, this is an overshoot: a cyclical downturn priced as if it were a permanent impairment. Pistolese would call this a textbook "excess reaction"—the kind of move where the chart stops reflecting incremental information and starts reflecting pure emotion.

The 5-Year Chart: Historical Gravity

The 5‑year view shows the gravitational pull.

For most of 2022–2023, MGPI lived in the mid‑$80s to low‑$90s. That was the "normal" valuation regime: mid‑teens EBITDA multiples on a growing, asset‑light distilled‑spirits and ingredients platform.

The current $24.70 print is not a small discount to that history. It is a 70%+ markdown from the zone where the market happily owned the same business, with the same plants, the same brands, and the same long‑term category trends.

Pistolese's playbook is blunt on moves like this: the further price drifts from its historical value range without a matching collapse in underlying economics, the more powerful the eventual mean‑reversion becomes. MGPI's 5‑year chart is one giant rubber band, pulled taut.

Applying Clifford Pistolese's Technical Framework

Pistolese's approach revolves around a few simple, brutal truths:

Support & Resistance Actually Matter

MGPI has carved out support in the low‑20s. That's where real buyers have repeatedly stepped in after forced sellers were done. On the upside, the high‑20s to low‑30s is the first resistance band—where trapped longs will try to sell "just to get out even."

In Pistolese language, a decisive break above that first resistance band on rising volume is often the first confirmation that a downtrend has flipped into a base‑and‑breakout pattern.

Volume Tells You When the Panic Is Over

The waterfall from the high‑40s to low‑20s came with heavy volume spikes—the classic capitulation signature. Since then, trading activity has cooled as the stock crawled sideways.

That is the sequence Pistolese looks for: high‑volume panic, then low‑volume apathy. Markets bottom on panic, but they base on boredom. MGPI is in the boredom phase.

Mean Reversion Loves Mispriced Cash Flows

Pistolese doesn't care about EBITDA per se, but the principle is the same: when a stock trades at 4.7× Price/EBITDA versus its own 13–14× history and peers at 9–15×, the chart is effectively screaming "mispriced cash flows."

Technicals don't tell you what fair value is—but they tell you when price has moved far enough away from any reasonable anchor that snap‑back risk is enormous for shorts and sellers.

Accumulation at the Bottom

Consolidation near lows, with tight ranges and no new downside follow‑through on bad news, is what Pistolese flags as possible institutional accumulation. Quiet buying shows up as a floor that refuses to break even when the narrative is still ugly.

MGPI trading in the mid‑20s, refusing to make new lows despite constant reminders about brown‑goods inventories, fits that pattern.

What the Charts Are Actually Saying

Strip away the noise and the three charts say one thing:

- The panic already happened.

- The capitulation already happened.

- The discount is already extreme.

Technicals don't guarantee the timing of the turn. But under Pistolese's rules, MGPI is no longer a falling knife—it is a coiled spring: crushed into the floor, trading at a giant discount to its own history, and starting to show the early signs of accumulation rather than abandonment.

For a contrarian, that's exactly where you want to be buying, not selling.

PART 7.5: INTERLUDE — YES, GEN Z DRINKS LESS. NO, THIS DOESN'T MATTER FOR MGPI.

The "Gen Z Sobriety" Narrative That's Crushing Spirits Stocks

Over the past 18 months, Wall Street has latched onto a story that's become conventional wisdom: younger generations are drinking less alcohol, therefore the entire spirits industry is structurally declining.

The thesis has real data behind it:

- 65% of Gen Z plan to drink less in 2025

- 50% of adults aged 18-34 currently report they drink, down from 72% two decades ago

- Per-capita alcohol consumption among Gen Z is 20% lower than Millennials

- Only 19% of Gen Z drank any alcohol in 2024, with 39% planning a dry lifestyle in 2025

- Circana data shows Dry January participation is up 36% since 2024

Time Magazine ran the headline: "Why Gen Z Is Drinking Less." Brown-Forman's CEO even acknowledged on an earnings call that "the kids just don't have money and don't drink like they used to."

So the narrative goes: if the youngest legal drinkers are soberest, spirits stocks are doomed. Brown goods, tequila, whiskey—all facing secular decline.

Here's the problem with that narrative: it's partially true, mostly misleading, and almost entirely irrelevant to MGPI's investment case.

Why the "Gen Z Drinks Less" Data Is Incomplete

The actual research tells a more nuanced story.

A 2025 Rabobank analysis—which dug deeper than typical financial media—found that Gen Z's lower alcohol spending is almost entirely explained by life-stage economics, not permanent preference shift.

The data:

- Gen Z households spend 0.74% of their income on alcohol vs. 1.1% for similarly-aged Millennials a decade ago

- However, Gen Z spends the same share of their income on alcohol as Millennials do now—roughly 0.75%

Translation: Gen Z isn't rejecting alcohol; they're broke (as all young people are).

Rabobank went further: looking at historical drinking patterns by age group, when adjusted for life-stage, Gen Z's decline isn't actually structural. As Gen Z ages into their 30s—when disposable income rises—alcohol consumption historically normalizes to prior generational levels.

This matters because:

- Gen Z abstinence is a poverty story, not a culture story. People drink less when they can't afford to drink more. It's not moral superiority; it's an empty wallet.

- High-income Gen Z still drinks premium spirits. The premium-plus and super-premium segments (the ones MGPI profits from) are still growing even as overall volume declines.

- Brown-Forman's own CEO said it on record: Diageo reported that Gen Z has faster household penetration into spirits than Millennials did at the same age. They're trading down on quantity but—when they do buy—they're buying better stuff.

The Real Market Split: Volume Down, Premium Dollars Up

Here's what's actually happening in spirits market dynamics:

- Spirits volumes are declining overall. In 2024, the U.S. spirits market recorded its first volume drop in nearly three decades. Total per-capita consumption fell from four drinks weekly in 2023 to three in 2024.

- But the premium segment is thriving.

NielsenIQ data shows concrete examples:

- Uncle Nearest Bourbon: +22.3% growth

- Blanton's: +20-55% growth range

- Angel's Envy: +20%+ growth

- Tequila Ocho: +23% growth

- Lalo Tequila: +23-124% growth depending on metric

These brands are GROWING despite Gen Z drinking less because they're the only category Gen Z is actually buying: premium, craft, authentic bottles for special occasions.

How MGPI Benefits From Gen Z's "Sobriety" (Counterintuitive Alert)

This is where contrarian thinking matters.

MGPI doesn't make beer. It doesn't make bulk commodity vodka. It doesn't make cheap wine. Those categories are getting hit precisely because Gen Z doesn't want them.

What MGPI owns:

- Penelope Bourbon — Top 30 premium-plus brand, second-fastest growing in category, targeted at the female Millennial/Gen Z segment that's actually driving premium bourbon growth

- El Mayor Tequila — In the fastest-growing spirits category globally (7% CAGR), riding the exact premiumization wave that Gen Z affluents are pursuing

- Rebel 100, Ezra Brooks, Yellowstone — Positioned in the premium-plus range ($25-$50 MSRP) where Gen Z is actually trading up when they drink

- Specialty Ingredients — Growing 13% YoY, serving the plant-based and functional foods market where Gen Z health consciousness actually translates into category growth, not decline

- Brown Goods (bulk whiskey) — Yes, facing temporary inventory headwinds. But sold primarily to major brands and bottlers who are actively premiumizing their portfolios. When they resume ordering bulk whiskey, it'll be for premium expressions, not commodity spirits.

The kicker: Diageo's CEO explicitly stated that Gen Z is coming into spirits faster than Millennials did, and they're "over-indexing on spirits." When a generation that's supposed to be sober is actually buying more premium spirits per capita than the last generation—that's the definition of a tailwind for premium-focused distillers.

Why "The Market" Gets This Wrong

Financial media loves a demographic hammer: "Gen Z doesn't drink → All alcohol stocks down." It's clean, it's simple, and it plays to investor psychology (fear of secular change).

What it misses:

- The composition of volume matters more than the headline. A 5% volume decline with 15% value growth = fantastic economics. This is what's happening in premium spirits.

- Gen Z's "sobriety" is selective and strategic. They're not anti-alcohol; they're anti-commodity alcohol. They'll buy a $50 bottle of premium bourbon for a special night out. They won't buy a six-pack of domestic beer.

- MGPI isn't exposed to the volume decline. Brown goods volumes are down because of a barrel inventory glut, not because Millennials and Gen Z stopped drinking premium whiskey. That's a temporary supply-side issue, not a demand problem.

- Income normalization is coming. Gen Z will age into their 30s between now and 2030. RaboBank's historical data shows alcohol spending normalizes then. The "sober Gen Z" narrative will evaporate precisely when Gen Z becomes a larger share of the market.

What This Means for Your Thesis

- MGPI's brown goods business is depressed because of inventory management in the distribution channel, not because demand for premium spirits evaporated.

- MGPI's branded spirits business (Penelope, El Mayor, Rebel) is growing precisely because it's positioned in the premium-plus segment that Gen Z—when it chooses to drink—actually buys.

- MGPI's ingredient business is benefiting from the exact health consciousness (fewer drinks, better products) that Gen Z sobriety represents.

So here's the contrarian play: The market is panicking about Gen Z sobriety and pricing MGPI as if spirits demand is structurally broken. In reality, MGPI is positioned perfectly for a market that's contracting in volume but expanding in value, and a generation that's about to start earning real money and normalizing its alcohol spending upward.

A raccoon didn't break into a Virginia liquor store to sample non-alcoholic beer.

“I’m just going to lie down here (hic) for a second.” Hanover County Animal Protection and Shelter

The raccoon’s trail of shame. Hanover County Animal Protection and Shelter

It went for the premium stuff—whiskey, scotch, peanut-butter whiskey. Across categories. Like a consumer making intentional choices.

That behavior—choosing better instead of choosing less—is what premium spirits companies profit from. Gen Z is doing exactly that. The market just hasn't priced it in yet.

PART 8: THE CATALYSTS—YOUR TIMELINE FOR THE ROTATION

Q1 2026: Brown Goods Visibility Improves

When Q4 2025 earnings drop in January/February, watch for customer commentary on inventory status. If "rebalancing in progress" becomes "inventory normalized," the multiple re-rates instantly. The market will finally price in brown goods recovery.

H2 2026: Biofuel Facility + Ingredient Margin Expansion

MGPI's biofuel facility (utilizing waste starch from Ingredient Solutions) comes online H2 2025/Q1 2026. This project was described as "accretive to EBITDA" by management. Combined with resolved equipment issues, Ingredient Solutions gross margins should expand visibly by mid-2026.

2026-2027: Penelope & El Mayor Scaling

The more Penelope scales into top-30 bourbon status, the easier it becomes to distribute, expand pricing, and build brand equity. Same for El Mayor in premium tequila. These brands could deliver 8-10% annual growth for years if executed properly.

Industry Normalization: Supply Discipline Remains

If the broader industry maintains market-driven production discipline (and doesn't revert to capacity racing), brown goods pricing power normalizes. Margins heal. EBITDA re-rates upward.

PART 9: THE VALUATION THESIS—INTRINSIC VALUE VS. TRADING VALUE

What MGPI Is Worth (Intrinsic Value)

Using conservative assumptions:

Brown Goods (40% of current revenue decay):

- 2026E: $450M revenue, 48% gross margin → $75M segment EBITDA

Branded Spirits (15% of total):

- 2026E: $80M revenue, 52% gross margin → $32M segment EBITDA

Ingredient Solutions (recovery play):

- 2026E: $120M revenue, 20% gross margin → $20M segment EBITDA

Corporate/Other: -$5M EBITDA (overhead)

Total 2026E Normalized EBITDA: ~$122M (conservative scenario)

At 10x Price/EBITDA (midpoint between specialty ingredients 15x and alcoholic beverages 10x):

- Market cap: $1.22B

- Per share: $57

- Current price: $24.70

- Implied upside: 131%

Higher-end scenario ($150-165M EBITDA assuming fuller margin recovery):

At 12x Price/EBITDA:

- Market cap: $1.80-1.98B

- Per share: $84-92

- Implied upside: 240-272%

At 15x Price/EBITDA (specialty ingredients peer average):

- Market cap: $2.25-2.475B

- Per share: $105-115

- Implied upside: 325-365%

Why the Market Trades It Lower (Trading Value)

The market prices MGPI at 4.7x Price/EBITDA because:

- Earnings visibility is low (brown goods trajectory murky)

- Recent performance was poor (75% drawdown burns investor psychology)

- It's not in any mega-cap index (no passive buying pressure)

- The narrative is "distressed" not "recovering"

- Most equity analysts cover 15+ stocks and MGPI isn't on their priority list

This is classic market inefficiency. The stock is priced for permanent decline. Intrinsic value assumes cyclical recovery. The gap is the opportunity.

PART 10: THE BOTTOM LINE—WHY THIS WORKS

MGP Ingredients trades at 4.7x Price/EBITDA—a 65% average discount to specialty ingredients peer multiples, a 52% discount to the alcoholic beverages index, and a 63% discount to Lamb Weston. But the more important metric is price-to-book: the stock trades at 0.86x price-to-book when you exclude goodwill but retain $266.01M in brand IP assets—meaning the market is pricing MGPI below the value of its tangible net assets plus the fair value of owned brands.

This is not a balance sheet in distress. This is a balance sheet priced for permanent demand destruction when the math suggests temporary cyclical pain.

The Setup: Two Independent Paths to Recovery

MGPI offers not one but TWO separate levers for value creation, each capable of delivering 50%+ returns:

Path 1: Asset Repricing (P/B Recovery)

Current situation: Stock at 0.86x P/B (ex-GW, inc. Brand IP) = $24.70 Historical norm: 1.8–2.1x P/B (ex-GW, inc. Brand IP) = $51–60

The $266.01M in brand IP (Penelope, El Mayor, Ezra Brooks, Rebel, Yellowstone) is real economic value, not goodwill. Unlike acquisition premium, brands can be:

- Retained and operated through cycles

- Licensed to third parties

- Sold to strategic buyers (Diageo, Brown-Forman, Beam Suntory)

As cyclical stress eases and investors regain confidence in brand durability, P/B typically re-rates faster than EBITDA multiples re-rate. A return to 1.5–2.0x P/B (ex-GW) = $43–57/share = 74–133% upside, independent of earnings recovery.

Path 2: EBITDA Multiple Expansion + Earnings Recovery

Current situation: 4.7x EBITDA on $112.5M run rate = $24.70 stock Conservative target: 10x EBITDA on $120M normalized = $57/share = 131% upside Normalized target: 12x EBITDA on $130M recovered = $73/share = 195% upside Optimistic target: 15x EBITDA on $150M peak = $105/share = 325% upside

This path requires brown goods inventory to clear and Ingredient Solutions to scale to $120M+ annual revenue at normalized margins. The company already has visibility that contracts remain intact; it's just timing.

Downside Protection: The Margin of Safety

Most investors obsess over upside. Here's where the margin of safety lives:

- Tangible assets + working capital = ~$343M = $16.17/share (hardest floor in liquidation)

- Tangible + 50% brand IP value = ~$459M = $21.67/share (stressed scenario)

- Tangible + 75% brand IP value = ~$542M = $25.61/share (realistic stress case)

- Full brand IP + goodwill impairment = ~$609M = $28.73/share (normalized downturn)

Current stock price of $24.70 sits between the realistic stress case and normalized downturn level. This means:

- Downside to true liquidation: –35% (only if both tangible assets AND brands destroyed)

- Realistic downside: –10% to –9% (if brands written down 30–50%, goodwill impairs)

- Base case: flat to +30% (brown goods stabilize, P/B normalizes to 1.0–1.1x)

- Fair value (proprietary analysis): +54–79% (historical P/B multiples apply; $53–59 targets)

- Full recovery: +195–325% (EBITDA recovers fully + multiple expansion)

The asymmetry is compelling: you're risking –35% to make +54–325%.

The Three-Part Narrative That Drives This

1. Brown Goods Normalization (2026–2027 Expected)

The inventory problem is structural, not demand destruction. Management confirmed zero contract cancellations. Industry discipline is real: 25.6% of craft distilleries closed in a single year, TTB data shows whiskey production down 15% in late 2024. When inventories normalize, supply scarcity will support pricing power.

2. Ingredient Solutions Scaling (Already Happening)

+13% YoY growth (Q2 2025), +9% Q3 2025 sales, 10.3% gross margin (equipment issues now resolved). If this business reaches $120M+ revenue at 20%+ margins, it becomes a standalone $100M+ revenue specialty ingredients business trading at 12–15x EBITDA. That alone could justify $20–25/share in SOTP value.

3. Industry Consolidation Optionality (Building Now)

Westward Whiskey (House Spirits) filed bankruptcy April 2025. Stoli Group entered distress. Distillery equipment and brands are hitting bankruptcy auctions at 30–50 cents on the dollar. MGPI has $443M available credit + $92M YTD operating cash flow. The first acquisition announcement could trigger narrative re-rating from "inventory victim" to "industry consolidator."

Why the Market Got This Wrong

Wall Street saw brown goods inventory and concluded "permanent decline." It saw EBITDA compression and concluded "balance sheet deterioration." It saw declining volumes in spirits and concluded "Gen Z killed the category."

What it missed:

- The stock trades BELOW net tangible asset value when you properly account for brands

- Industry structure is consolidating in favor of scaled players (Diageo, MGPI, a few others)

- Gen Z isn't rejecting premium spirits—they're just too broke to drink commodity brands

- Goodwill impairment ≠ brand destruction; brands retain value even if acquisition premium disappears

- Fortress balance sheet (2.3x leverage, +26% YTD OCF, maintained dividend) suggests survival confidence, not stress

The Proprietary Analysis

Based on 10-year historical trading bands normalized to price-to-tangible-book

- 2024 Fair Value: $53/share

- 2025 Fair Value: $59/share

These targets assume:

- Goodwill experiences ~30–50% impairment (normal for a cyclical trough)

- Brands maintain 75–90% of acquisition value (conservative; brands rarely lose 50%+ in stressed spirits companies)

- Tangible assets + working capital hold value (no liquidation)

- Brown goods stabilize by late 2026 / early 2027

Even if all three assumptions face stress, the stock finds support near $21–23/share (–10% to –15% from current levels). This is your margin of safety: downside defined, upside massive.

The Catalysts—Your Timeline

Q1 2026: Brown Goods Visibility Improves When Q4 2025 earnings drop, watch for customer commentary on inventory status. If "rebalancing in progress" becomes "inventory normalized," the multiple re-rates instantly.

H2 2026: Ingredient Solutions Margin Inflection Biofuel facility (coming H2 2025/Q1 2026) lowers waste disposal costs. New large customers reach steady-state on commercialization. Margins expand from 10% toward 18–20%. Market recognizes standalone $15–20/share value.

2026+: First Acquisition or Asset Consolidation MGPI announces acquisition of distressed competitor's assets or brands. Narrative pivots from "inventory victim" to "consolidator." Multiple re-rates instantly on M&A news.

2027: P/B Re-Rating as Cycle Turns As ROE recovers from 3–5% toward 10–12%, P/B expands from 0.86x toward 1.5–2.0x. This re-rating often happens BEFORE EBITDA multiples recover, giving early investors the fastest ride.

Why Now

The market has priced in perfect pessimism:

- Brown goods will never recover (wrong; contracts intact, industry discipline real)

- Brands will be written down (wrong; spirits brands are durable; Penelope already growing)

- Balance sheet will break (wrong; 0.32x D/E, $443M liquidity, +26% YTD OCF)

- The entire spirits industry is permanently damaged (wrong; premium spirits growing, Gen Z just broke)

When even ONE of these assumptions flips, the stock will re-rate sharply. When TWO flip (most likely), the stock doubles. When THREE flip (base case), you're looking at $57–73 territory.

The Bet

You're not betting MGPI will execute a perfect turnaround. You're betting:

- Cyclical pain is temporary, not permanent (high conviction)

- Brown goods inventory clears by 2026–2027 (management confirmed; industry discipline holding)

- Brands retain reasonable value through the cycle (historical precedent; zero impairment in comparable spirits companies)

- Market re-rates from "permanent decline" to "cyclical trough" (standard multiple re-rating)

None of these are moonshots. They're baseline recoveries from a market-imposed pessimism extreme.

The Kingdom of Brown Goods

MGPI is a company of distilleries, brands, and specialty ingredients, temporarily crushed by an inventory cycle while competitors liquidate and the industry consolidates around scaled players. The balance sheet is strong enough to survive and capitalize on distress. The brands are proven to retain value even in stressed environments. The EBITDA recovery path is visible, not speculative.

The market has priced in permanent decline. The numbers suggest temporary pain with massive upside when sentiment normalizes.

Bring cash. And patience. Because this is the kind of setup where the first 12 months are boring and quiet, and the next 18 months deliver 2–3x returns after the market finally prices in what the balance sheet has been saying all along.

Welcome to the kingdom of brown goods. Bring cash.

KEY VALUATION METRICS SUMMARY

Disclosure: This analysis is for informational purposes. MGPI remains a cyclical business with near-term headwinds and execution risk. Position sizing and risk management are essential. Do your own due diligence. Please note that the Woodworth Contrarian Stock & Bond Fund, LP, of which the Millegan Brothers manage and are invested in, currently hold a position of MGPI as of the publication date of this article. They may or may not choose to modify their exposure to this name for any reason at any time. This is not a recommendation to buy or sell MGPI or any other name - investments incur significant risk, our risk tolerance may be significantly higher than the average investor, and any discussion in this article does not take into consideration your individual circumstances.

Additional reading:

- https://www.perplexity.ai/finance/MGPI

- https://www.foodnavigator-usa.com/Article/2024/12/18/merger-acquisition-predictions-for-specialty-ingredients-in-2025/

- https://www.capstonepartners.com/wp-content/uploads/2023/08/Capstone-Partners_Beverage_MA-Coverage-Report_February-2025.pdf

- https://finance.yahoo.com/news/assessing-lamb-weston-lw-valuation-121302294.html

- https://auxocapitaladvisors.com/food-beverage-valuation-multiples-2025/

- https://media-cdn.kroll.com/jssmedia/kroll-images/pdfs/food-and-beverage-ma-industry-winter-2025-valuation-data.pdf

- https://simplywall.st/stocks/us/food-beverage-tobacco/nyse-lw/lamb-weston-holdings/news/lamb-weston-lw-exploring-valuation-after-a-recent-period-of

- https://www.lincolninternational.com/perspectives/articles/investors-should-target-b2b-ingredients-in-2025/

- https://www.equidam.com/ebitda-multiples-trbc-industries/

- https://seekingalpha.com/article/4703433-lamb-weston-isnt-as-cheap-as-it-may-seem-lw-stock

- https://multiples.vc/food-beverages-valuation-multiples

DEEP ROOTS. STUBBORN GROWTH. OREGON-BASED.

Now is a great time to diversify your portfolio with an investment into an award-winning fund. Call us or visit our website to inquire on an investment today in the Woodworth Contrarian Fund as an accredited investor.

(800) 651-1996 - info@woodworth.fund - www.Woodworth.Fund

Contrarian Value-Based Hedge Fund of the Year 2022-2024

Quinn Millegan (left) & Drew Millegan (right)

About the Managers: Brothers Drew Millegan and Quinn Millegan manage the Woodworth Contrarian Stock & Bond Fund, a hedge fund based in McMinnville, Oregon. They grew up in the finance world, and specialize in contrarian investment strategies in the US Public and Private markets.

Something missing from your portfolio may be a diversification into the Woodworth Contrarian Fund for accredited investors. Now is a great time to diversify your portfolio with an investment into a multi-award-winning fund. An exposure to a value-based contrarian strategy is a unique opportunity for your long term capital that you’re seeking aggressive returns for. With nine years of the Woodworth Fund under management, the Millegan Brothers are trained stock-pickers and experienced venture capital investors with a proven track record. Give us a call today to discuss a liquid investment with independent administration and independently audited monthly statements and a personal relationship.

How well do narratives help inform your perspective?

Disclaimer

The user woodworthfund has a position in NasdaqGS:MGPI. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.