🤖 AI Companies Hit The Bond Market

Reviewed by Stella Ong, Bailey Pemberton

Quote of the week: “If you think Treasuries have no risk and high yield bonds have risk, the yield spread is there to compensate for the bearing of that incremental risk. The question is whether it is adequate.” - Howard Marks

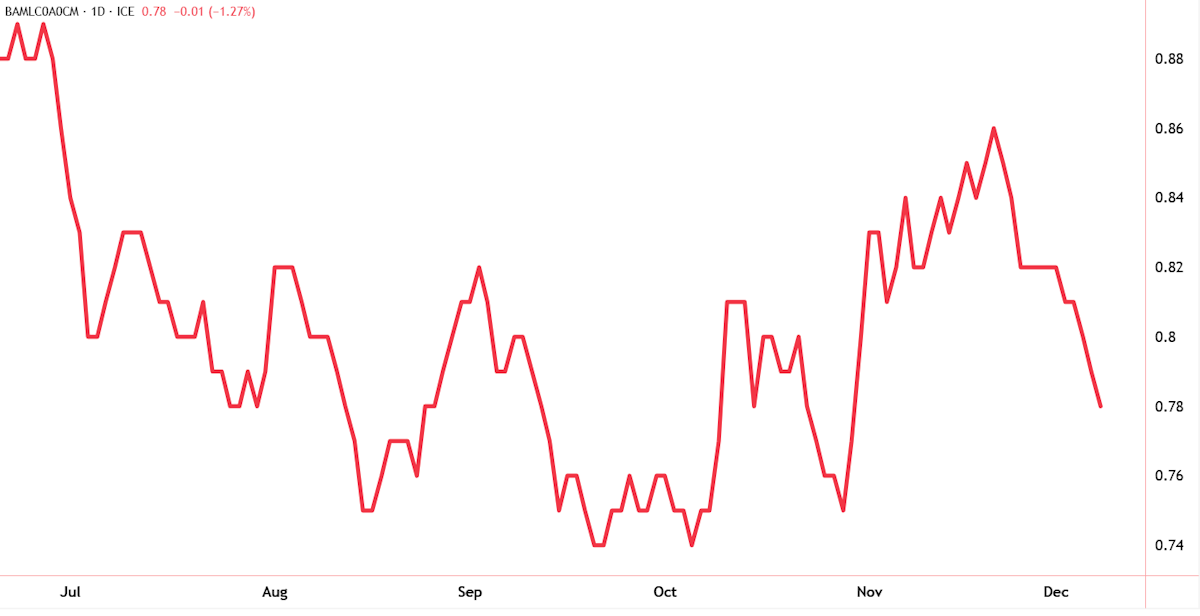

The recent dip in stock prices came on the back of stretched valuations and fears of an AI fueled bubble. This time the nervousness also spilled into the corporate bond market as AI companies flooded the market with new debt issues.

This led to a mini freakout in late November, with corporate credit spreads spiking. Since then the dust has settled, stock prices have recovered and those credit spreads have narrowed.

But the story isn’t over. AI companies may well continue to tap the bond market to fund their growth. This has implications for the sector, and possibly for the entire financial system.

This week we are breaking down what this means for investors, and how you can use the corporate bond market to assist you in analyzing companies.

🌍 What Happened In Markets This Week

Here’s a quick summary of what’s been going on:

🇨🇳 China Pledges to Double Down on Stimulus in 2026 ( Reuters )

- China’s massive stimulus packages over the last 18 months are beginning to pay off, and policymakers don’t plan to hold back next year. Chinese leaders have committed to a "proactive" fiscal policy for 2026, targeting ~5% growth through boosted consumption and investment.

- Economists have pointed to a contradiction in this strategy. The dual focus on supply and demand may fail to shift the economy away from its production-driven model. The reliance on investment to drive growth threatens to perpetuate debt issues and trade imbalances.

- The deficit target remains high (4% of GDP), forcing the economy deeper into debt to finance investment. Without a decisive shift to a consumption-led model, China risks long-term stagnation.

- Still, this could be good news for global commodity stocks and Asian industrial stocks.

💸 Oracle plunges as $50B capex hike spooks investors ( Yahoo Finance )

- Oracle fell sharply after announcing a massive hike in capital expenditures (aiming for $50B by 2026) without immediate matching revenue growth.

- The company spent $12B this quarter alone on data centers, raising fears of a "debt-fueled" build-out taking too long to pay off.

- Bookings have increased significantly, but most of this comes from a single customer, OpenAI.

- Oracle was late to the cloud computing race and appears to be taking the opposite approach with AI. If this bet pays off it could become one of the leading suppliers of AI infrastructure. Ultimately, the key question is whether AI demand grows fast enough to deliver a return on these investments.

🎥 Disney drops $1bn on OpenAI and unlocks its characters for Sora ( Reuters )

- Disney is investing $1 billion into OpenAI and letting Sora generate videos using Star Wars, Marvel and Pixar characters – a massive shift in how Hollywood uses AI.

- The deal gives Disney new tools to cut production costs and pump out short-form content for Disney+, while rolling ChatGPT out to employees across the company.

- Hollywood unions are alarmed: writers, animators and actors say the partnership risks letting AI eat into their work and compensation.

- Disney is adding guardrails to block inappropriate use of characters, while also securing warrants for future OpenAI equity.

🚗 Carvana roars back from near-bankruptcy to outvalue Ford and GM ( Reuters )

- Carvana’s market value has rocketed to ~$97B – now higher than Ford and GM – after the stock surged more than 8,000% from its 2022 lows.

- The turnaround caps a stunning three-year shift from default fears to S&P 500 inclusion, with shares hitting record highs and extending a 10-day win streak.

- Stronger fundamentals, tighter cost controls and a rebound in used-car demand helped Carvana swing back to profitability, inflicting an estimated $1B in losses on short-sellers.

- The company sold a record 155,941 retail units last quarter, with revenue up 55% and analysts say it could overtake CarMax in sales by late 2026.

- Valuation is now sky-high at 57x forward earnings, far above Detroit peers, signalling that investors are betting on a long-term market share grab.

🤖 AI Has Started To Dominate The Bond Market

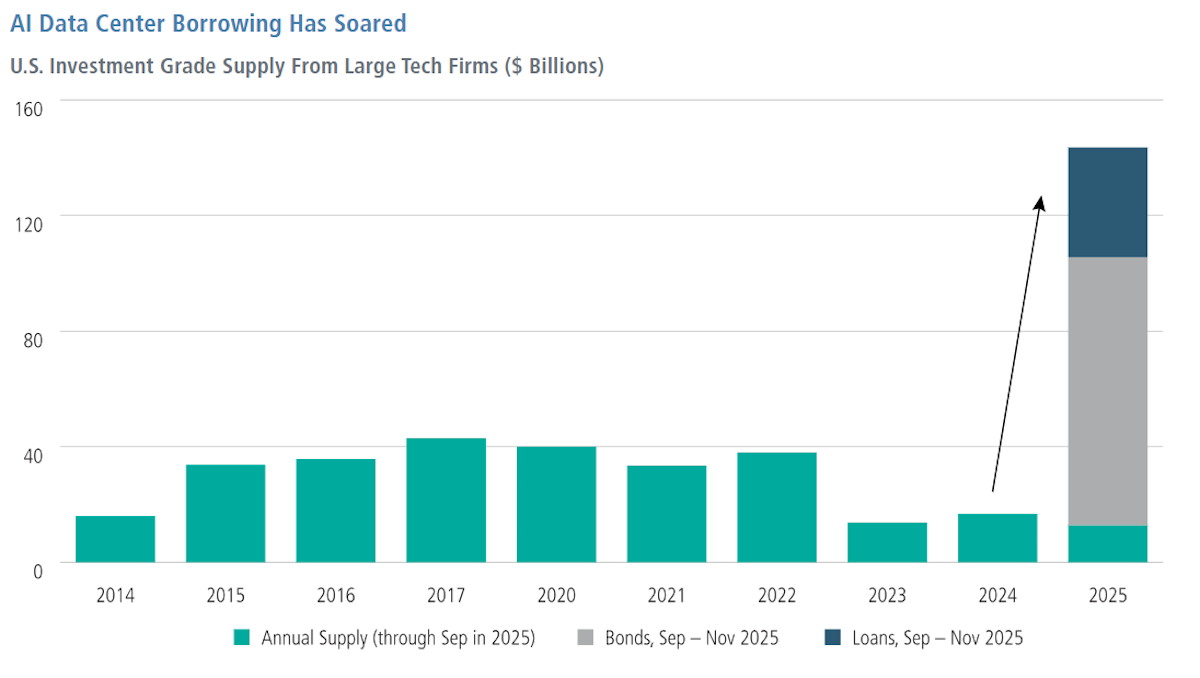

🤕The bond world experienced a mild panic attack in November as bond issues from AI companies gathered pace. Companies are turning to the debt market to fund their growth rather than relying on cash flows or new share sales. The wave of new bonds kicked off in September and continued through October and November.

The credit spread between US corporate bonds and US Treasuries spiked to 0.86% in November, but they’ve since narrowed again.

✨ What’s a credit spread? It’s the difference between a bond’s yield, and the yield on US Treasuries.

It represents the premium investors require to compensate them for the additional risk of owning debt that isn’t backed by the government. Wider spreads reflect higher perceived risk.

In the greater scheme of things, this spike was tiny, and anything below 1% is the low end of the range. For context, in 2001 spreads hit 2.45% and in 2009 they touched 6.4%.

😎If anything, the current spread may suggest bond investors are a little too complacent:

- Spreads trading at historically low levels imply very little perceived risk - which is at odds with all the talk of a bubble.

- On the other hand, bond investors are keen to diversify away from US Treasuries, and there aren’t many alternatives.

🤔 What does this mean for AI companies and the Tech Sector?

Big tech companies have been swimming in cash for the last 10 years, so they have little reason to borrow. But their CapEx has also soared since the AI boom began. After three years of spending their own cash they’ve decided to add debt to the mix:

To give this more context, consider this:

-

💻 The tech and communications sectors typically account for around 10% of US corporate bond issuance - way below their 45% combined weight in the S&P 500 index.

-

🏦 Conversely, the financial sector usually accounts for around 40% of bond issuance, but makes up just 13% of the index.

-

🛢️ The energy sector is the second biggest bond issuer (15%) but takes up just 2.8% of the index.

So it is unusual to see tech companies using debt like this. However, when we look at how much these companies are expected to spend, the $200 billion projected to be sourced from bond sales is just a fraction of the total. In fact other forms of debt are much larger.

So, why bother with bonds? There are a few reasons:

- 📊 They are diversifying their capital structure.

- 💸 This gives them more liquidity (i.e. cash) for share buybacks and acquisitions.

- 🤑 If the higher for longer rate scenario plays out, ~5% may end up being a bargain.

💰It’s also worth noting that a lot of companies took advantage of near zero rates during the pandemic, and that needs to be refinanced in the next year or two. So companies that want to borrow may want to get ahead of a potential squeeze on liquidity.

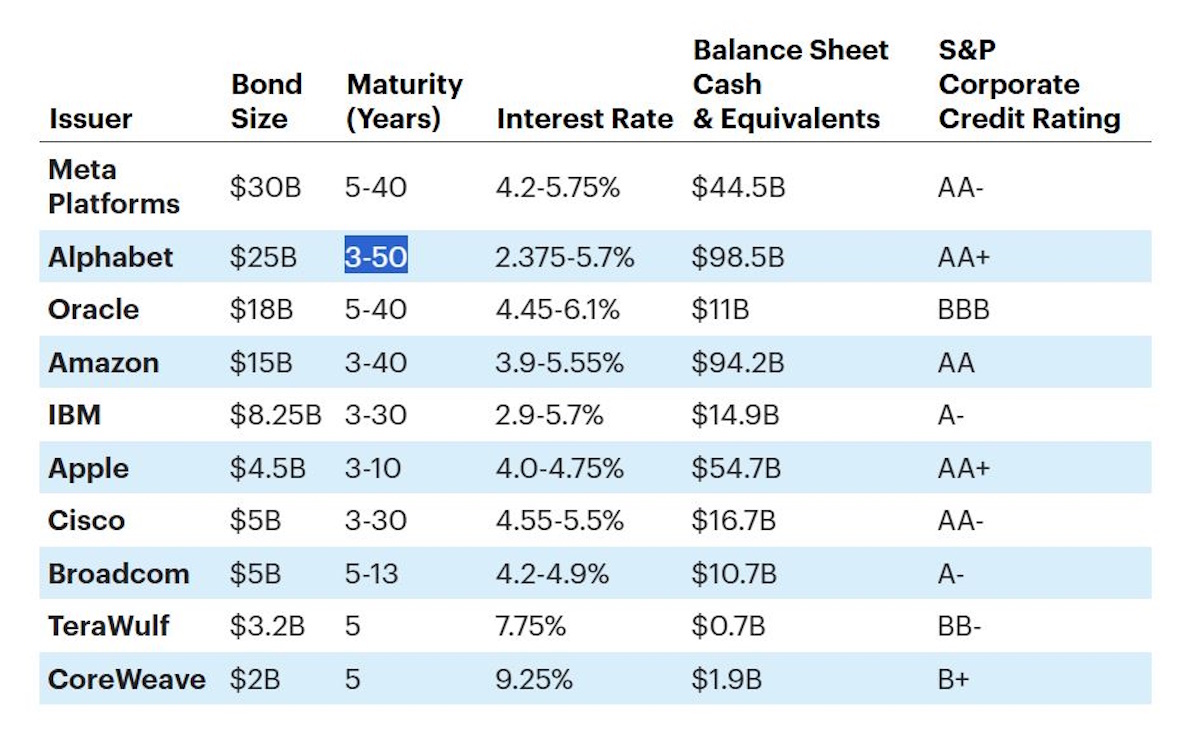

⚖️ The Difference Between Bonds From Larger vs. Smaller AI Companies

There’s also a very big difference between bonds issued by cash flush hyperscalers (i.e. Alphabet, Apple, etc.) and smaller players. The former are borrowing at around 5% for up to 50 years.

The smaller datacenter operators like TeraWulf and CoreWeave are paying up to 9%, and have to refinance in five years time.

✨ NB: The market might get nervous when supply increases, but the real test typically occurs when it comes to refinancing or repaying debt.

📝 A Note for Equity Investors

Using debt prudently can be great for investors because it allows companies to raise capital without diluting shareholders. But - that’s not the case with convertible bonds, which are once again gaining popularity.

Convertible bonds - which can be converted to equity - lower the interest expense for issuers, but dilute shareholders if they are converted. Investors need to consider the fully diluted share count when projecting EPS.

⚠️ The Risks: When One Sector Dominates Both Debt and Equity Markets

This brings us to the systemic risk angle. When a single sector dominates both stock index performance and corporate bond issuance, it could, potentially, impact the financial system and other sectors.

Here are some reasons why.

🏟️ Crowding Out

Like any market, the bond market is driven by supply and demand. AI companies are now adding new supply to the market, and competing with all the other companies trying to issue debt.

The $200 billion in debt issued by tech companies in 2025 is already about 10% of the US corporate bond market. If it grows, borrowing costs for banks, energy companies and other companies that rely on debt will rise.

In addition, these bond issues add supply to the entire global bond market which includes government, municipal and mortgage bonds.

🚧 Systemic Risk

The financial and banking system is increasingly exposed to AI. Private credit funds, bond funds and banks are lending against the future cash flows of AI companies. If the "AI Bubble" were to burst—the credit market could freeze.

Financial crises are typically triggered by events that drain liquidity from the market. There are lots of parallels to be drawn with the dot-com era, which we covered here.

💾 The "GPU-Backed" Security

GPUs are a hot commodity right now, so it isn’t all that surprising to see them being used as collateral for loans and debt securities. Companies are issuing debt collateralized by clusters of H100 GPUs, which isn’t necessarily a bad idea - provided those GPUs aren't rendered obsolete faster than expected. Of course this also adds a new level of complexity to assessing risk.

Creative structures are also being devised to keep debt off balance sheets. We previously covered these structures, as well as the circular financing deals here. Once again the parallels with previous crises are easy to see.

🏁 The Bottom Line

Whether these risks become real, probably comes down to how far things go. The $200 billion in AI corporate bonds issued this year might be manageable. The ‘danger scenario’ is the one where a whole lot of new, speculative companies jump on the bandwagon, using complex structures to raise money for dubious business models.

- Ironically, this could end up playing into the hands of well financed ‘big tech’ companies that get to pick up the pieces.

💡 The Insight: Why This Matters For Equity Investors

If you are an individual investor you probably don’t invest in corporate bonds - and if you do, it’s more likely to be via an ETF. But you can still use them to inform your decisions about investing in a company’s shares.

Corporate bonds are typically held by institutional funds and hedge funds. The analysts who scrutinize these bonds are extremely thorough.

Where equity analysts are concerned with potential gains, bond analysts are more concerned with potential losses. This makes sense, as bonds offer limited upside, and that upside needs to justify the risk that the company can’t repay the loan.

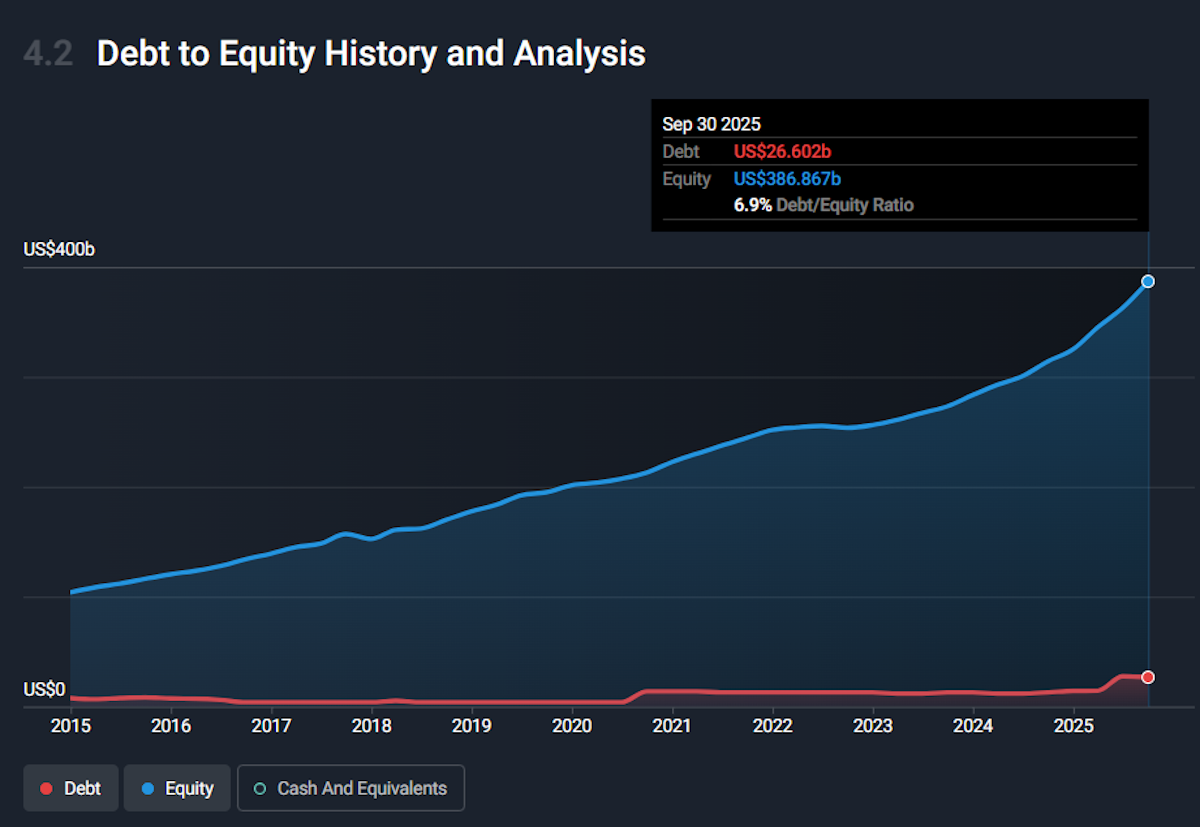

One of the first things to check with any company is the debt to equity ratio.

If it looks like Alphabet’s, the debt is pretty much insignificant:

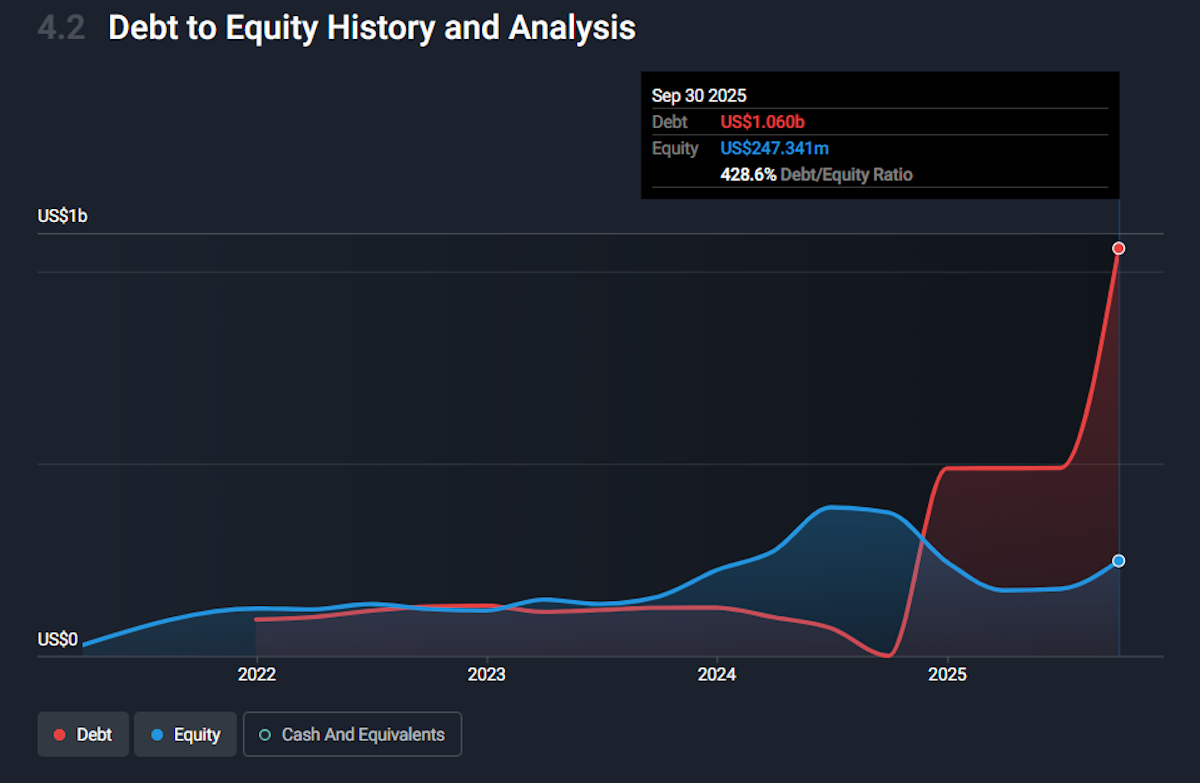

But if it looks like TeraWulf’s, you know debt is a big part of the equation:

If that’s the case, you need to know:

- ⌛ When does the debt need to be refinanced;

- 📉 What is the rate on that debt;

- 🤔 What form the debt takes.

If the debt takes the form of bonds, it’s important to know how bond investors are pricing that debt vs. similar companies and risk free securities (US Treasuries)

Finra (Financial Industry Regulatory Authority) is a wealth of information on corporate bonds. You can find out the coupon and current yield for corporate bonds as well as the Moody’s and Standard & Poor's credit ratings. You can also see how the yield is trending - and compare it to similar yields.

✨ NB: If a company’s stock price is rising, but its bond spreads are widening (yields are going up relative to Treasuries), the bond market is screaming caution. It suggests that while equity traders are hyped on growth, credit analysts are worried about cash flow.

You can also use corporate bond yields to guide your discount rate when valuing a stock.

🗓️ Key Events Next Week

It’s a big week for interest rates as three major central banks will meet to decide on monetary policy:

Monday

🇨🇳 Industrial Production YoY NOV

- 📈 Forecast: 5.40% , Previous: 4.90%

- ➡️ Why it matters: Accelerating production signals a strengthening recovery in China’s manufacturing sector and global demand.

Thursday

🇬🇧 BoE Interest Rate Decision

- 📉 Forecast: 3.75% , Previous: 4%

- ➡️ Why it matters: A rate cut is expected as inflation stabilizes and economic growth softens.

🇪🇺 ECB Interest Rate Decision

- ▶️ Forecast: 2.15% , Previous: 2.15%

- ➡️ Why it matters: The ECB is expected to maintain its ‘wait and see’ stance.

Friday

🇯🇵 BoJ Interest Rate Decision

- 📈 Forecast: 0.75% , Previous: 0.50%

- ➡️ Why it matters: Wage price growth has markets leaning toward a 0.25% rate hike which would take the benchmark to its highest level since 2008.

Q3 earnings season is just about over, but a few large caps are still due to report:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.