- United States

- /

- Insurance

- /

- NYSE:RYAN

3 High Growth US Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility, with futures pointing to a lower open amid fluctuating indices and cryptocurrency slumps, investors are keenly observing sectors that can weather such uncertain conditions. In this environment, growth companies with significant insider ownership often attract attention due to their potential for strong alignment between management and shareholder interests, making them worthy considerations for those seeking resilient investment opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Myomo (NYSEAM:MYO) | 13.7% | 69.1% |

Let's take a closer look at a couple of our picks from the screened companies.

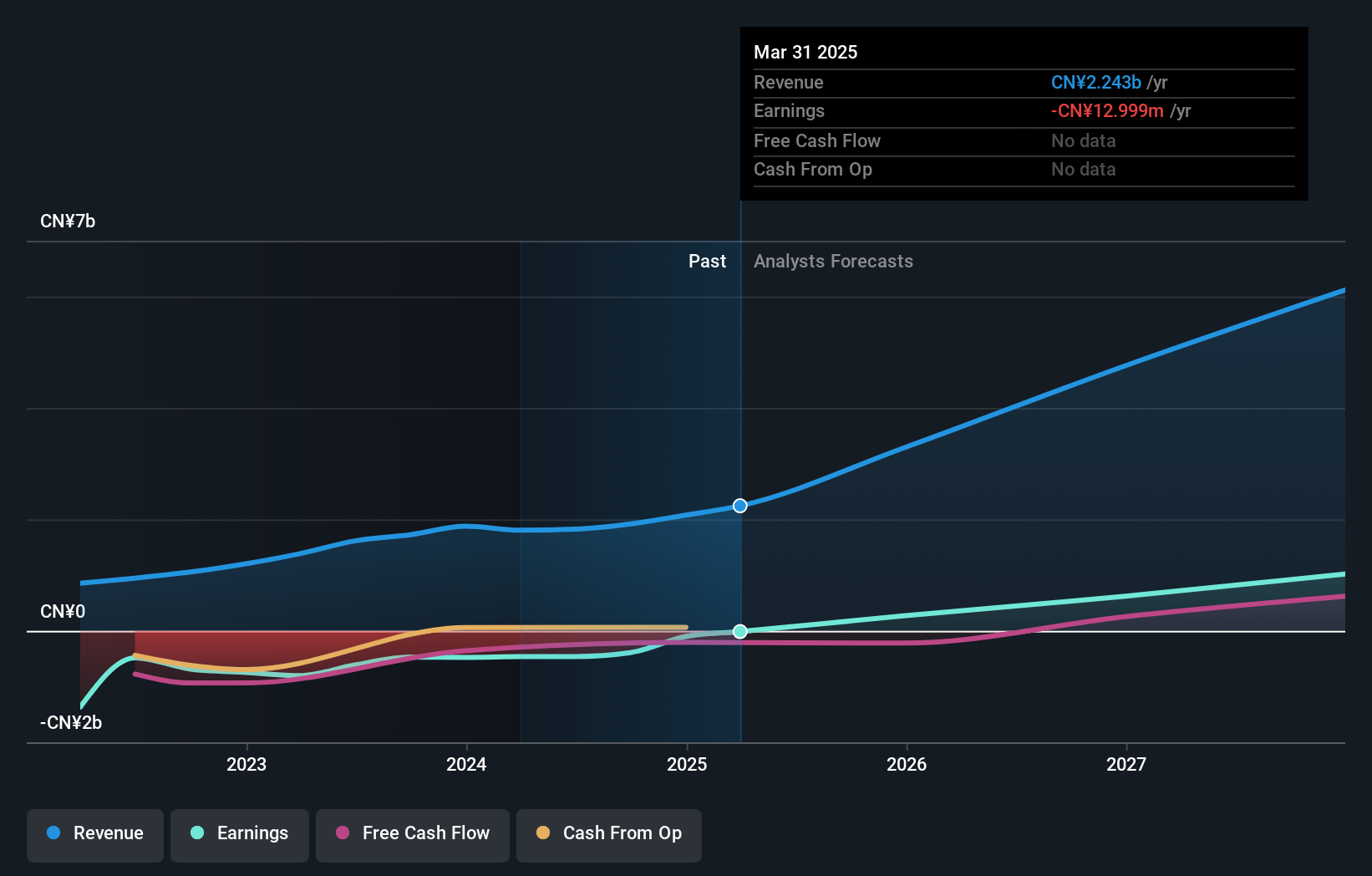

Hesai Group (NasdaqGS:HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally with a market cap of approximately $1.64 billion.

Operations: Hesai Group generates revenue through the development, manufacturing, and sales of three-dimensional LiDAR solutions across various international markets including Mainland China, Europe, and North America.

Insider Ownership: 24.4%

Hesai Group is positioned for significant growth, driven by strategic partnerships with Changan Automobile and Leapmotor, enhancing its role in the intelligent driving sector. Recent earnings show improved financial performance, with a reduced net loss and projected profitability within three years. Revenue is expected to grow at 30.1% annually, surpassing market averages. However, the stock remains volatile despite trading below estimated fair value and lacking substantial insider trading activity recently.

- Take a closer look at Hesai Group's potential here in our earnings growth report.

- The analysis detailed in our Hesai Group valuation report hints at an inflated share price compared to its estimated value.

Ibotta (NYSE:IBTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ibotta, Inc. is a technology company that provides the Ibotta Performance Network (IPN), enabling consumer packaged goods brands to offer digital promotions to consumers, with a market cap of approximately $1.99 billion.

Operations: The company's revenue is primarily generated from its Internet Software segment, which accounts for $368.55 million.

Insider Ownership: 17.8%

Ibotta, Inc. demonstrates potential for growth with forecasted earnings expansion of 64.9% annually, surpassing market averages. Recent executive changes aim to bolster revenue generation and partnerships. Despite a decline in profit margins and insider selling activity, the company has secured a US$100 million credit agreement to support operations. Revenue grew by 26% last year, and upcoming quarterly guidance suggests further increases, although insider buying remains limited in recent months.

- Click here to discover the nuances of Ibotta with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Ibotta's current price could be inflated.

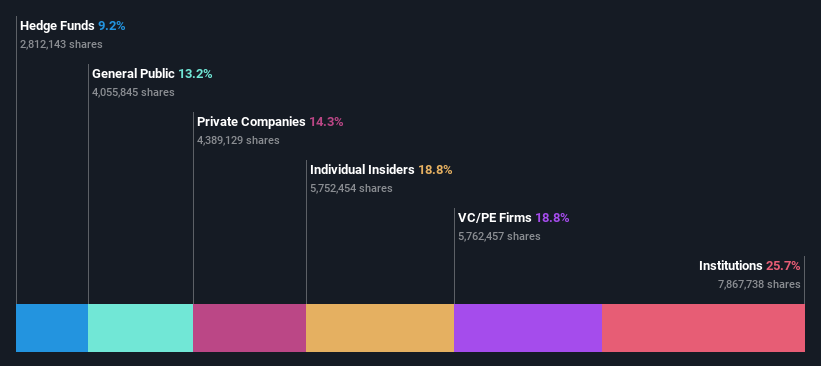

Ryan Specialty Holdings (NYSE:RYAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. is a service provider offering specialty products and solutions to insurance brokers, agents, and carriers across the United States, Canada, the United Kingdom, Europe, and Singapore with a market cap of approximately $16.89 billion.

Operations: The company's revenue primarily comes from its insurance brokers segment, totaling $2.32 billion.

Insider Ownership: 16.8%

Ryan Specialty Holdings is poised for growth with earnings projected to rise significantly at 36.6% annually, outpacing the broader US market. Recent earnings reports show strong revenue and net income increases, reflecting robust financial performance. However, insider activity reveals significant selling in recent months despite substantial buying earlier. The pending acquisition of Innovisk Capital Partners could enhance product innovation and diversification efforts within its underwriting segment, aligning with the company's strategic growth initiatives.

- Unlock comprehensive insights into our analysis of Ryan Specialty Holdings stock in this growth report.

- Our expertly prepared valuation report Ryan Specialty Holdings implies its share price may be too high.

Next Steps

- Dive into all 199 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYAN

Ryan Specialty Holdings

Operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, Europe, and Singapore.

High growth potential with proven track record.