- United States

- /

- Banks

- /

- NasdaqGS:CASH

Discovering Undiscovered Gems in the United States December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.8%, contributing to a remarkable 24% climb over the past year, with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks that are not yet widely recognized but have strong potential for growth can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services across the United States with a market capitalization of approximately $1.81 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer and Commercial segments, contributing $426.17 million and $251.14 million, respectively. The company's market capitalization is approximately $1.81 billion.

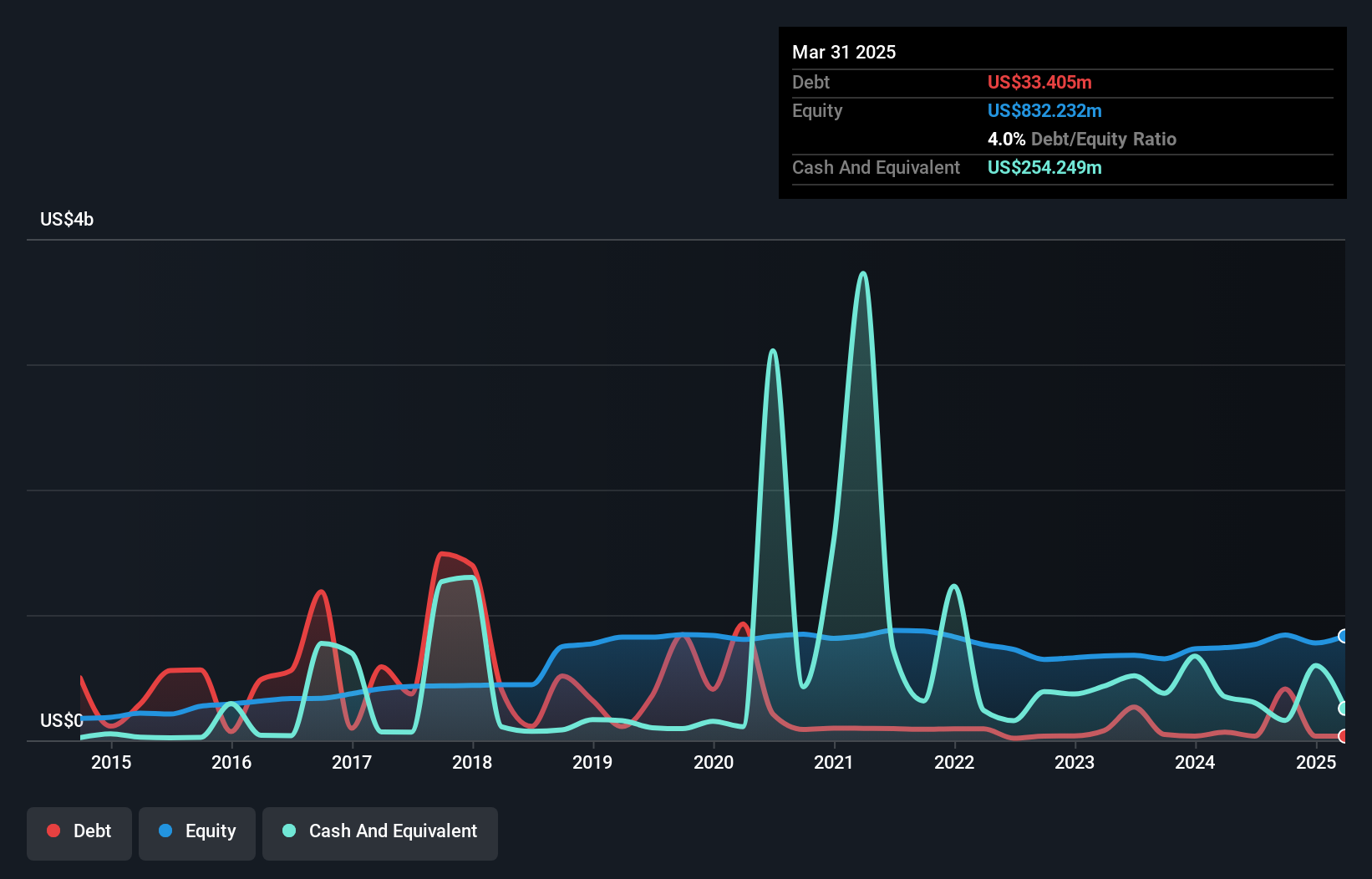

Pathward Financial, with assets totaling US$7.5 billion and equity of US$839.6 million, stands out in the financial sector with its strategic focus on high-yield finance loans and asset optimization. The company has a robust allowance for bad loans at 109% and maintains a low-risk funding profile with 88% of liabilities sourced from customer deposits. Recent actions include repurchasing 236,308 shares for US$14.99 million between July and September 2024, reflecting confidence in its value proposition as it trades significantly below fair value estimates by about 70%. Despite challenges like economic uncertainties, Pathward's earnings growth of 3.5% last year surpasses the industry average decline of -11.8%, indicating resilience amidst market pressures.

Gatos Silver (NYSE:GATO)

Simply Wall St Value Rating: ★★★★★★

Overview: Gatos Silver, Inc. focuses on the exploration, development, and production of precious metals and has a market cap of $980.72 million.

Operations: Gatos Silver generates revenue primarily from the sale of precious metals. The company's financial performance is influenced by production costs and market prices for these metals.

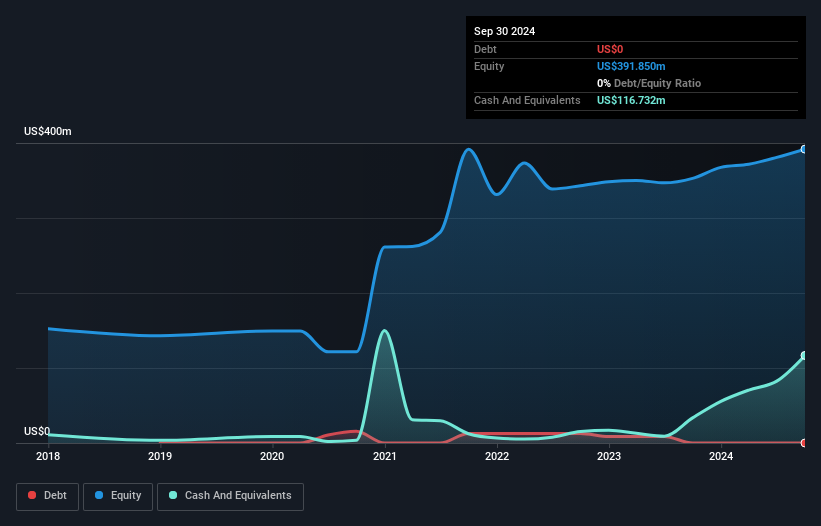

Gatos Silver has been making waves with its impressive 542.8% earnings growth over the past year, outpacing the Metals and Mining industry's -29.4%. Despite a notable one-off loss of US$11.6 million impacting recent financial results, the company remains debt-free and cash flow positive, highlighting its robust financial health. The recent strategic alliances with Dowa Metals & Mining enhance Gatos Silver's management rights within their joint venture, allowing for full consolidation of financial statements starting January 2025. These developments position Gatos Silver for potential growth as it continues to explore and expand its Los Gatos district operations in Mexico.

- Navigate through the intricacies of Gatos Silver with our comprehensive health report here.

Understand Gatos Silver's track record by examining our Past report.

Stewart Information Services (NYSE:STC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Stewart Information Services Corporation operates through its subsidiaries to offer title insurance and real estate transaction-related services both in the United States and internationally, with a market capitalization of approximately $1.95 billion.

Operations: Stewart Information Services generates revenue primarily from its Title (including Mortgage Services) segment, contributing approximately $2.05 billion, and Real Estate Solutions segment, adding around $333.08 million.

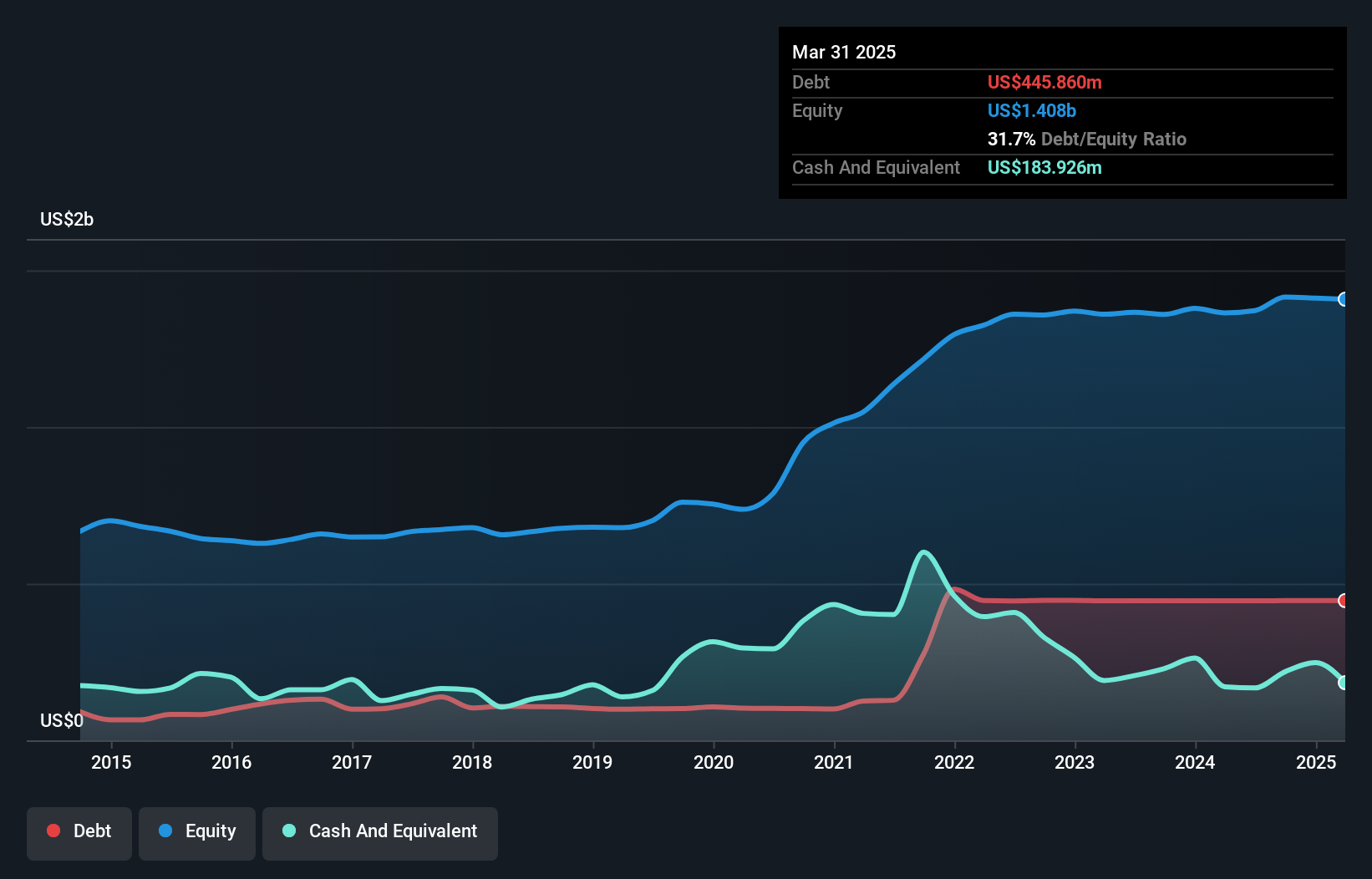

Stewart Information Services, a nimble player in the title insurance industry, has shown promising growth with earnings surging 70% over the past year, outpacing the broader insurance sector's 36.6%. The company's debt to equity ratio rose from 13.3% to 31.5% over five years but remains manageable with a satisfactory net debt to equity ratio at 16%. Recent financials reveal robust performance; Q3 revenue hit US$667 million up from US$602 million last year, while net income doubled to US$30 million. Despite significant insider selling recently, Stewart trades at a value below fair estimates and maintains high-quality earnings.

Make It Happen

- Click here to access our complete index of 243 US Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASH

Pathward Financial

Operates as the bank holding company for Pathward, National Association that provides various banking products and services in the United States.

Flawless balance sheet and undervalued.