🚗 Automakers Caught In The Tariff Crossfire

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: "If I had asked people what they wanted, they would have said faster horses." - Henry Ford

Talk about chaotic markets. Donald Trump’s on-again off-again tariffs on imports from Canada and Mexico caused markets to see-saw last week.

Regardless of what happens next, the uncertainty could now weigh on markets until permanent trade deals are negotiated.

The auto industry is right in the crosshairs of these tariffs and is understandably under pressure. The outlook for automakers was already looking shaky with electric vehicle sales losing momentum and consumer spending beginning to slow.

On the other hand, pessimism creates opportunities. So we thought it would be a good time to take a look at the auto industry and check in on the latest developments for EVs, autonomous driving tech, and robotaxis.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

📉 Atlanta Fed estimate for US GDP swings from growth to decline ( Barron’s )

- As the information changes, so will estimates.

- U.S. GDP growth is flashing warning signs, with weak consumer spending, falling manufacturing orders, and the Atlanta Fed GDPNow model briefly forecasting a contraction. It now forecasts an annual GDP decline of 2.8% in Q1 2025, which is down from a 2.3% growth expectation it had back on the 19th of Feb. Talk about a reversal of opinions.

- New tariffs, a shaky bond market, and a possible government shutdown add to investor uncertainty, while inflation risks remain in play.

- For investors, this means a higher likelihood of market volatility and pressure on corporate earnings. A slowdown isn’t guaranteed, but the risk of stagflation, which is weak growth paired with persistent inflation, is growing.

- GDP growth isn’t tanking just yet, but tariffs, inflation, and fiscal chaos could push the economy toward a bumpy landing.

🇩🇪 German bonds worst day since 1990 on €500 billion spending plans ( Bloomberg )

- Is Trump indirectly Making Europe Great Again, like MEGA?

- Germany’s incoming chancellor Friedrich Merz plans to reverse years of conservative borrowing policy, pledging over €500 billion for defense and infrastructure spending. This is partially due to the US pulling back from NATO, and forcing Europe to increase its defense spending. But Europe’s economy has been in need of some form of stimulus for a while.

- Investors now hope the stimulus will reignite growth across the Eurozone. That’s good for equities but means rates may not fall as much as previously expected. Another knock-on effect is that the Euro is surging, which will make imports cheaper for Europe.

- Germany is in the fortunate position of having a manageable debt-to-GDP ratio of around 60%. For other major European economies, debt levels are much higher, so there may be less appetite to increase borrowing.

🛰️ Eutelsat share price rockets 650% on bid to replace Starlink in Ukraine ( Bloomberg )

- The more polarized the world becomes, the more crucial control over communication networks will become.

- As the US scales back support for Ukraine, the EU is looking to Eutelsat, which is based in France, to replace Starlink’s critical battlefield communications. Eutelsat already has thousands of terminals in Ukraine but would still need to scale up significantly to replace Starlink. That could take years, but there’s a bigger picture to consider.

- If the EU and US are going to drift further apart, Europe won’t want to be dependent on a satellite network based in the US - and controlled by Elon Musk. The issue of communications security was also highlighted in December when Finland accused a ship carrying Russian oil of deliberately severing an undersea cable.

- Vodafone and AST SpaceMobile have also announced a satellite-to-mobile network in Europe - though again, AST is based in the US.

- On Thursday, the European Space Agency’s Ariane 6 rocket successfully launched and carried a satellite into orbit. This is the first time Europe has had independent space access.

🇪🇺 Some EU members propose extensions of gas storage targets until 2027 ( WSJ )

- Europe wants full gas tanks without emptying its wallet.

- The EU wants to extend its gas storage targets until 2027, but countries like Germany and the Netherlands argue that rigid requirements drive up prices.

- Many EU nations are pushing for more flexibility, especially in summer months, to ease market pressure while still meeting the 90% storage goal by November.

- For investors, this signals potential volatility in European gas markets. A compromise could soften price spikes, but stricter storage mandates may sustain high energy costs.

- Europe’s gas buyers want breathing room, but the EU isn’t budging, at least not yet. Expect more price swings as negotiations unfold.

⛓️ Metal markets brace for supply chain shift after 'shocking' tariffs ( S&P Global )

- The U.S. and Canada are back at it, and this time metals are in the crossfire.

- The U.S. slapped 25% tariffs on most Canadian and Mexican imports, disrupting cross-border trade and rattling industries reliant on steel, aluminum, and other metals.

- Canada hit back with retaliatory tariffs, and officials are now considering blocking exports of key metals like nickel and uranium.

- For investors, this means higher costs in U.S. manufacturing and potential supply chain headaches, but also rising prices for metals, especially gold and silver, as geopolitical uncertainty fuels demand. Battery metal producers seem unfazed, with China and Korea remaining their primary buyers.

- Tariffs are shaking up North American trade, but metals, especially precious ones, may shine amid the chaos.

📉 The market fears a recession ( Axios )

- Trump’s new trade war is rattling markets, and this time, there’s no “Trump put” to bail them out.

- Treasury Secretary Scott Bessent signaled the administration isn’t prioritizing Wall Street, focusing instead on small businesses and consumers.

- Bond markets are betting on multiple Fed rate cuts, a sign investors expect weaker growth or even a recession. Polymarket had the odds of a US recession in 2025 at 38% earlier this week, but it’s now sitting at 31%.

- Higher tariffs are fueling inflation concerns while also weakening the dollar, an unusual move that suggests markets see real economic damage ahead.

- Markets are flashing warning signs, this trade war could hit growth hard, and the Fed may be forced to step in.

🇺🇸 Worries mount that Trump agenda is testing economy’s resilience ( WSJ )

- The economy is throwing mixed signals, so markets are on edge.

- Consumer spending fell 0.2% in January, the biggest drop in four years, while consumer confidence posted its sharpest decline since 2021. Meanwhile, inflation expectations are rising, which adds pressure on the Fed.

- Markets are a bit concerned about all this. The S&P 500 is down 3.1% from its February high, and the 10-year Treasury yield has fallen below short-term rates, which typically is a classic recession signal.

- Trump's aggressive tariff hikes, immigration crackdowns, and federal spending cuts are hitting growth before potential stimulus like tax cuts, and deregulation can kick in.

- Economists are increasingly raising their recession odds, with some slashing Q1 GDP forecasts from growth to contraction, like the Atlanta Fed did recently.

- Markets and consumers seem to be starting to lose confidence, and soft data may soon hit hard reality.

🚘 The Outlook For Automakers In 2025

The auto industry has always been challenging.

It’s estimated that nearly 2,000 automakers have existed in the US since 1895. That means a lot of companies have come and gone while trying to get their slice of the auto pie. A similar story has occurred in the US electric vehicle market in recent years, with plenty exiting the intensely competitive market.

That’s why Warren Buffett famously said the right trade in 1900 was to short horses rather than invest in automakers. While it was easy to see who the losers would be, choosing the winners was much harder.

Vehicle manufacturers have a unique set of challenges:

- 🏗️ Automakers need to continually make massive Capex and R&D investments to remain competitive.

- 💸 Vehicle sales are cyclical and correlated to economic cycles and consumer spending.

- 👑 In addition, consumers are fickle when it comes to vehicles.

- They tend to gravitate to particular brands and models. At any given time, one or two automakers will be on top - but they seldom stay there for extended periods.

- 🔧 Modern vehicles last longer, and are replaced less often.

- 🔌 Automakers are now faced with the additional challenge of deciding how aggressively to invest in electric vehicles.

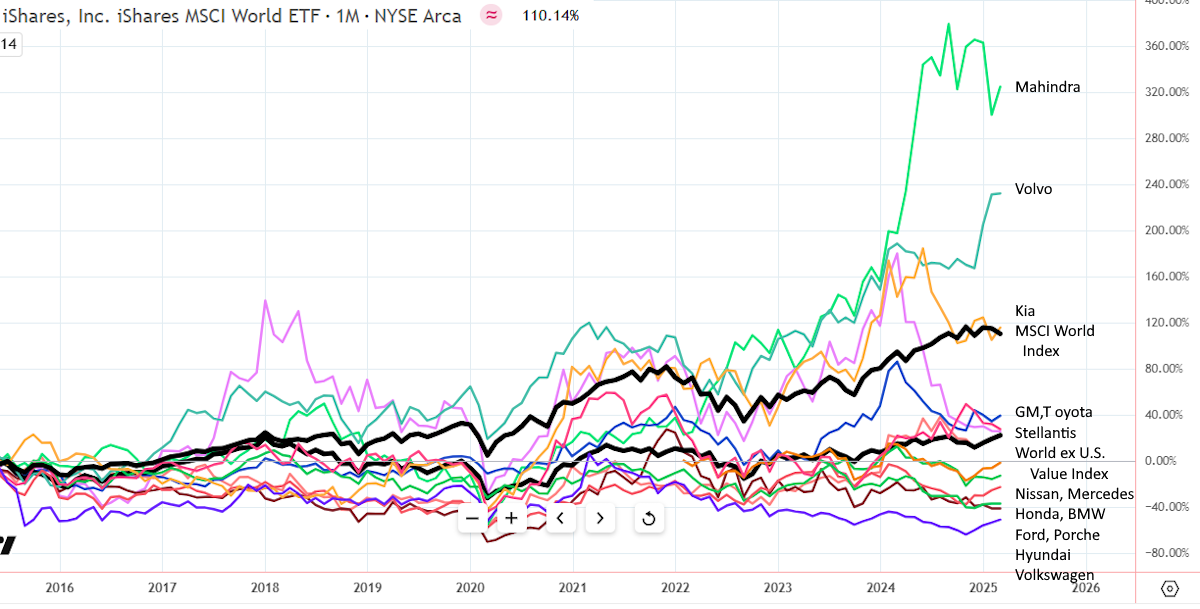

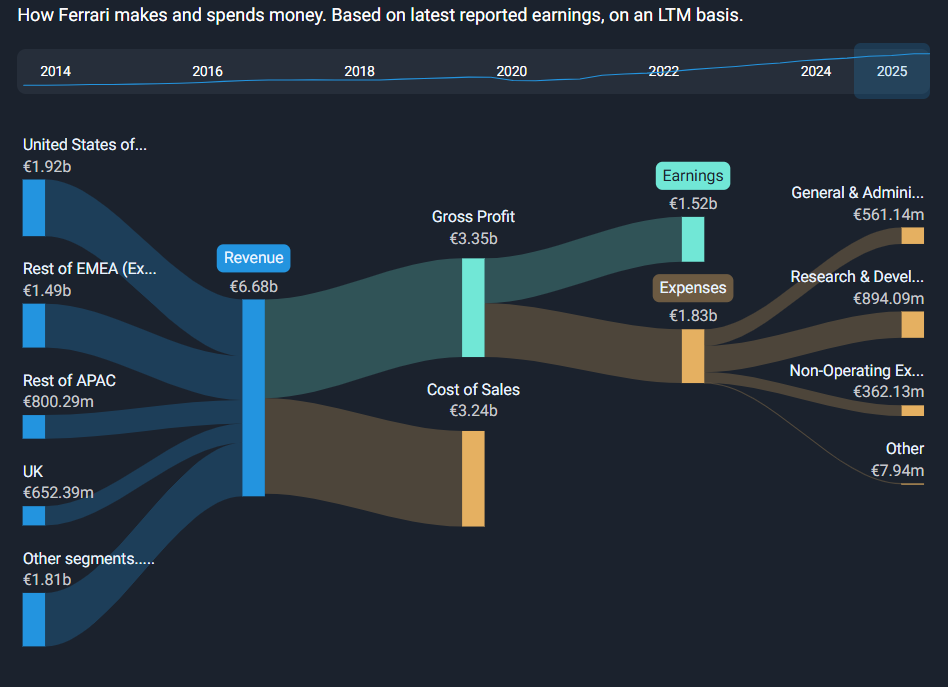

Over the last 10 years, very few automakers have delivered outstanding returns. Tesla’s share price is up 1,800% (down from 2,800% just two months ago), while BYD has gained 1,180%. In third place is Ferrari with a 792% return.

Amongst the legacy automakers, only three have beaten the MSCI World index over the last 10 years: Mahindra & Mahindra (name so nice you say it twice) and Volvo, and Kia.

If we use a Global value ex-US index as a benchmark, we can add Toyota, GM and Stellantis to the list of outperformers. But those three stocks only returned about 3.5% a year, excluding dividends.

Just about all the other legacy automakers are in negative territory over 10 years. Again, these returns don’t include dividends, but dividends for auto stocks aren’t as reliable as they are for other industries.

The bottom line is that amongst automakers, a handful of companies tend to stand out at any given time, while the majority can underperform. In particular, the once mighty German automakers are struggling to grow revenues profitably.

💲🌎 What Do Tariffs Mean For Automakers?

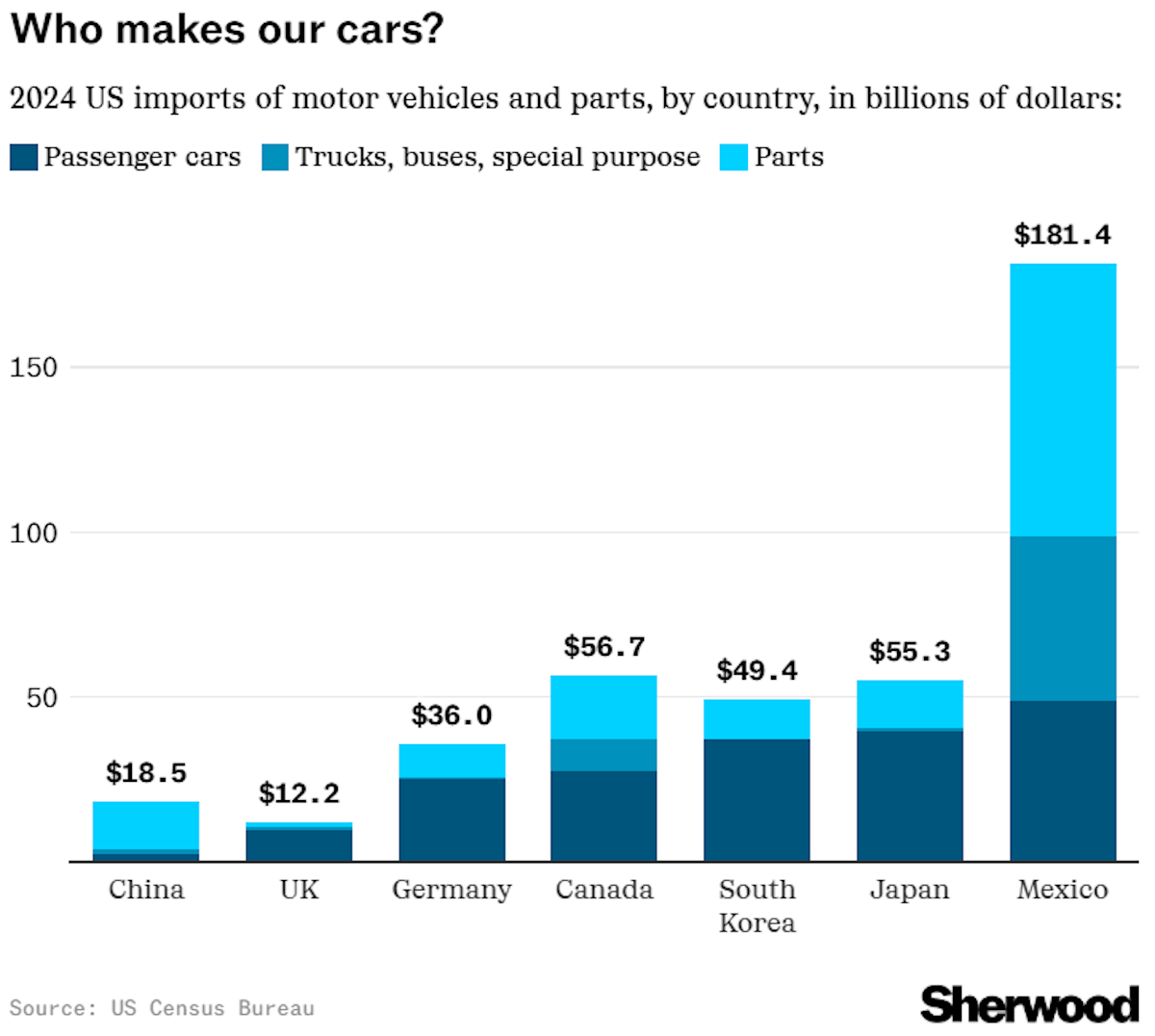

Like many global industries today, the vehicle manufacturing industry is incredibly complex.

The major brands are based in a handful of countries, but the manufacturing and assembly of vehicles often occur in different countries. Mexico, Spain, Brazil, and Thailand are just some of the countries that have large manufacturing and assembly industries even though they may not have their own auto companies.

Ironically, these industries are often set up when trade deals are signed.

This is why many vehicles sold in the US are manufactured in Mexico and Canada. Moreover, the components that go into vehicles assembled in the US are often manufactured in those two countries.

Trump, apparently, wants to impose 25% tariffs on imports from Mexico and Canada to incentivize companies to move that manufacturing to the US.

However, as Bank of America analysts point out, there are two problems with that:

- 📅 Setting up new factories could take years, and

- 💵 Paying the 25% tariff could end up being cheaper than manufacturing locally - but that cost will still be passed on to the consumer.

Many analysts also agree that tariffs will ultimately lead to higher vehicle prices, and that will cause lower sales numbers.

✨ The tariffs have once again been postponed by a month - but that doesn’t really help management teams who need to plan for the future. So it’s very likely that the uncertainty will weigh on the market until a permanent deal is made.

With the focus on Mexico and Canada, it’s also the US companies that are most affected. It’s still unclear if European and Japanese companies will face similar tariffs.

While most companies could manufacture vehicles in the US, one company that probably won’t is Ferrari. It has the widest margins in the industry - but famously manufactures all its vehicles in one factory, in Maranello, Italy.

The US is its biggest market, so it’s no surprise to see the share price down sharply despite strong earnings a few weeks ago.

📰 The Latest on EVs

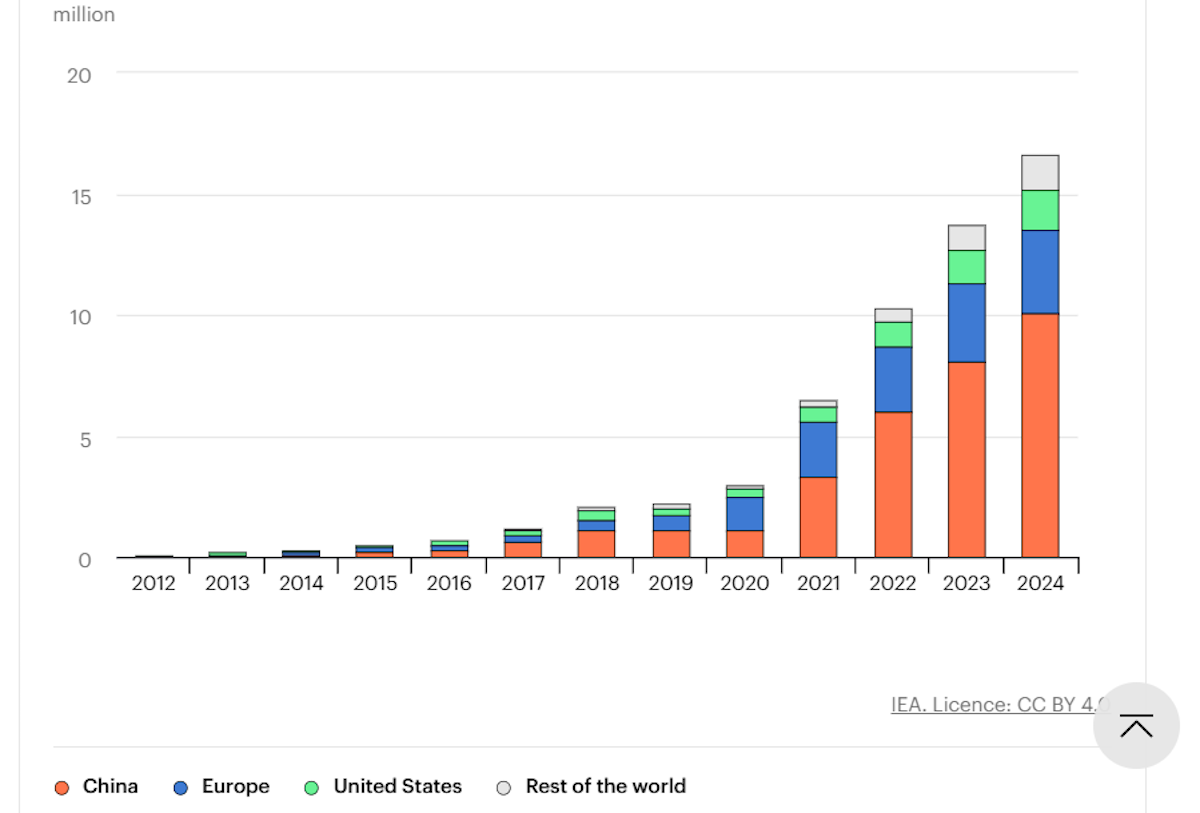

We previously covered electric vehicles in detail, just as the slowdown in sales was starting. Since then, global EV sales growth has slowed, but by less than anticipated. Most of the growth came from China, and notably BYD’s 33% increase in sales.

The surge in sales of PHEVs (plug-in hybrids) was a surprise last year, with their share of global EV sales rising from 30% to 38%.

Hybrid vehicles help address two challenges for consumers; the lack of charging infrastructure in some areas, and range anxiety. This extends the market to those consumers who were reluctant to fully commit to battery-only vehicles.

The other driver of sales has been subsidies in China (and elsewhere), which have helped companies bring prices down substantially. China recently extended the subsidies and incentives - and Europe responded by extending their subsidies.

The EV subsidy issue is something to keep an eye on. One way or another, these are paid by governments, and they might not be affordable forever.

If governments are forced to reduce their deficits, those subsidies might be cut, which will hit demand. France has already cut its EV subsidies, and they are very likely to be cut in the US.

So that begs a question…

😬 Are Legacy Automakers Still Committed To EVs?

Most of the largest automakers in the US and Europe have scaled back their EV plans.

This has been partly in response to slowing sales - but it’s also a question of budgets. Many have seen overall vehicle sales slowing, while costs have increased. Some also had a very large range of EV models in development, while their EV units were still unprofitable.

There has also been a shift toward hybrid models following BYD’s success.

The entire auto industry is facing uncertainty, and staying solvent is a priority. Right now, their most important assets are a strong balance sheet and sustainable cash flows.

💡 The Insight: You Might Find Better Value In The Supply Chain

The automotive sector is likely to remain under pressure until there is more clarity on tariffs.

Even without this uncertainty, the broader outlook for most automakers is tepid at best. A quick scan of automakers on the platform reveals few auto companies with strong fundamentals, which just reinforces the industry's overall weakness.

However, if you want to get off this automaker seesaw we’re on, you might be more enticed by the brighter outlook of auto component manufacturers.

Unlike automakers, these companies are less exposed to shifting consumer preferences and the high-stakes competition that often results in "winner takes all" scenarios.

Their business models tend to be more resilient, making them a more attractive option in the current environment for those who want stability.

While automakers face headwinds from potential tariffs and structural challenges, auto component companies could offer more stable opportunities.

Try to focus on businesses with consistent demand and lower exposure to unpredictable market dynamics. You’ll be able to assess that by looking at their past performance and future prospects on the platform, which we’ve added to the filters above.

The best part is that you can save this screener example we’ve made above, and then make your own changes to filter down to any finer details that you’re looking for, like dividend yield, low leverage, and plenty more.

Key Events During the Next Week

Investors will be watching inflation and employment data closely this week in light of recent developments.

Monday

- 🇩🇪 Germany’s balance of trade due for January. The trade surplus is expected to widen with €25.1B forecast, up from €20.7B from December.

Tuesday

- 🇦🇺 Westpac’s Consumer Confidence data is due. Consumer confidence is expected to remain largely unchanged month-on-month, with a -0.3% change expected.

- 🇺🇸 US JOLTs job openings are being reported, with openings expected to come in at 7.5M, down slightly from 7.6M in the prior month.

Wednesday

- 🇺🇸 US annual inflation rate for the year to February is being reported on Wednesday. The headline rate is set to fall slightly to 2.9%, down from 3%.

- 🇺🇸 US year-on-year core consumer price inflation rate is also due, with expectations of a slight cooling in the rate, down to 3.1% from 3.3%.

- 🇨🇦 The Bank of Canada’s interest rate decision is due. A 25 basis point cut is forecast, which would see the rate fall to 2.75%, down from 3%.

Friday

- 🇬🇧 UK’s month on month GDP figures for January are due. Expansion is set to slow to only 0.1%, just shy of the 0.4%.

- 🇺🇸 The preliminary Michigan Consumer Sentiment figures are due. February’s figure of 64.7 was already the worst since November 2023, and things still look to remain grim, with 63.2 forecast for March.

The last of the US large cap stocks will be reporting over the next two weeks. The biggest names due this week include:

- Oracle

- Adobe

- PDD Holdings

- Lennar Corp

- BioNTech

- Dick's Sporting Goods

- DocuSign

- Ulta Beauty

- Dollar General

- Rubrik

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.