Quote of the Week: “The activist is not the man who says the river is dirty. The activist is the man who cleans up the river.” - Ross Perot

Donald Trump’s return to the White House has shaken up foreign policy, trade, economies, markets and industries. One of the movements on the wrong side of Trump 2.0 is ESG. But let’s face it, a backlash against ESG has been brewing for a while.

Some regard ESG as a necessary part of the investing landscape, while others believe it’s a marketing gimmick or a tool for virtue signalling.

This week, we are taking a look at ESG investing in the Trump 2.0 era, and whether it’s something individual investors need to pay attention to.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

- 💰 Perplexity AI launching $50 million venture fund to back early-stage startups ( CNBC )

- Perplexity AI is leveraging its growing influence in the generative AI space. While the company will anchor the fund, most capital is coming from outside investors, with two experienced venture partners leading the effort.

- With 80,000 developers using its API, Perplexity has a front-row seat to promising AI startups, giving it a potential edge in spotting winners. This move follows its $500 million fundraising push and an ambitious bid to merge with TikTok U.S.

- Now Perplexity isn’t just competing with Google, it’s positioning itself as a kingmaker in AI’s next wave.

- 🤝 UK and India relaunch trade talks in bid to boost investment opportunities ( FT )

- The UK and India are restarting trade talks, aiming to secure a long-delayed deal that could boost investment in key sectors like clean energy and financial services. Negotiations stalled last year due to elections, but sticking points remain—India wants better visa access and social security benefits, while the UK is eyeing easier market entry.

- With India on track to become the world’s third-largest economy by 2028, British businesses see a major growth opportunity. However, past Brexit-era promises of a quick deal have proven elusive.

- A UK-India trade deal seems like a no-brainer, but the fine print could drag talks on yet again.

- 🍎 Apple’s Vision Pro has a problem a year into its existence: Not enough apps ( CNBC )

- Apple’s Vision Pro is struggling with a lack of must-have apps, a year after its launch. Developer interest is fading, and big players like Google, Meta, and Netflix have yet to release key apps.

- The high price and slow adoption have kept the app ecosystem from taking off, unlike the iPhone’s early boom. Indie developers are still experimenting, but sales remain small. Meanwhile, Meta’s Quest platform has surged, offering cheaper hardware and a larger app marketplace.

- So without more compelling apps, or a cheaper, lighter model, the Vision Pro risks becoming a niche product rather than Apple’s next big thing.

- 🛢️ BP's "reset" shows the challenge of transition ( Axios )

- BP is doubling down on oil and gas, walking back earlier promises to cut production and slashing its low-carbon investment plans. This shift reflects both investor pressure and the reality of persistent fossil fuel demand, which we covered last week.

- For investors, the move signals BP’s prioritization of cash flow and returns over aggressive transition bets. Higher upstream spending and cost-cutting efforts could boost profitability, but scaling back renewables may hurt long-term competitiveness. Elliott Investment Management’s growing influence suggests more shake-ups could be ahead.

- BP’s “reset” is a bet that oil demand, and investor patience, will outlast the energy transition hype.

- 📈 Nvidia sales grow 78% on AI demand, company gives strong guidance ( CNBC )

- Yet again, Nvidia crushed earnings expectations, with AI-driven revenue surging 78% in Q4. The company issued bullish guidance which signals confidence that it can continue to dominate, even as growth slows from last year’s breakneck pace.

- Investors are eyeing Blackwell, Nvidia’s next-gen AI chip, which CEO Jensen Huang calls its “fastest product ramp” ever. The data center business now makes up 91% of total sales, overshadowing gaming and networking. Share buybacks hit $33.7 billion, rewarding investors handsomely.

- While Nvidia remains the AI king, its future growth hinges on maintaining its hardware advantage against custom chips from Big Tech.

- 🏰 Netflix is building an “anti-Disneyland" ( Sherwood )

- Netflix is betting on live experiences but avoiding Disney-style theme parks. Instead, it’s opting for mall-based entertainment hubs, VR partnerships, and pop-up events.

- Their strategy aims to create repeat visitors rather than one-time, high-cost tourists, leveraging flexible attractions and digital integration.

- In our eyes, this move signals a long-term play to monetize IP beyond streaming, but its financial impact remains uncertain. Unlike Disney’s $34B theme park empire, Netflix's venture is lower-risk yet unproven. With commercial landlords eager for tenants and shifting consumer habits, the timing could work in Netflix’s favor.

- If executed well, Netflix’s “anti-Disneyland” could drive brand engagement and diversify revenue, but it’s a gamble on whether fans will come back for more.

📅 ESG Investing In 2025 And Beyond

ESG investing is one of many investing themes that seems to have come and gone in the last five years.

However, unlike some of the other recent fads, there’s a lot more money involved in this theme.

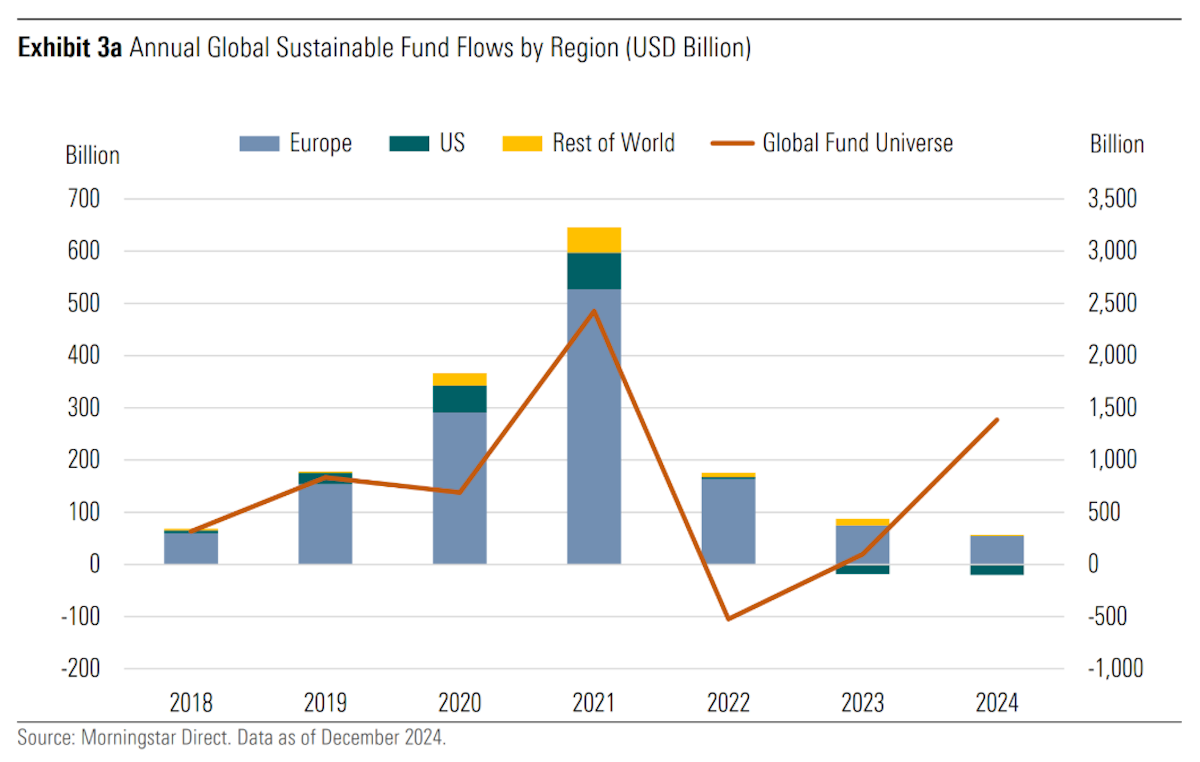

Line displays net flows for funds globally (not just ESG), and uses the right axis.

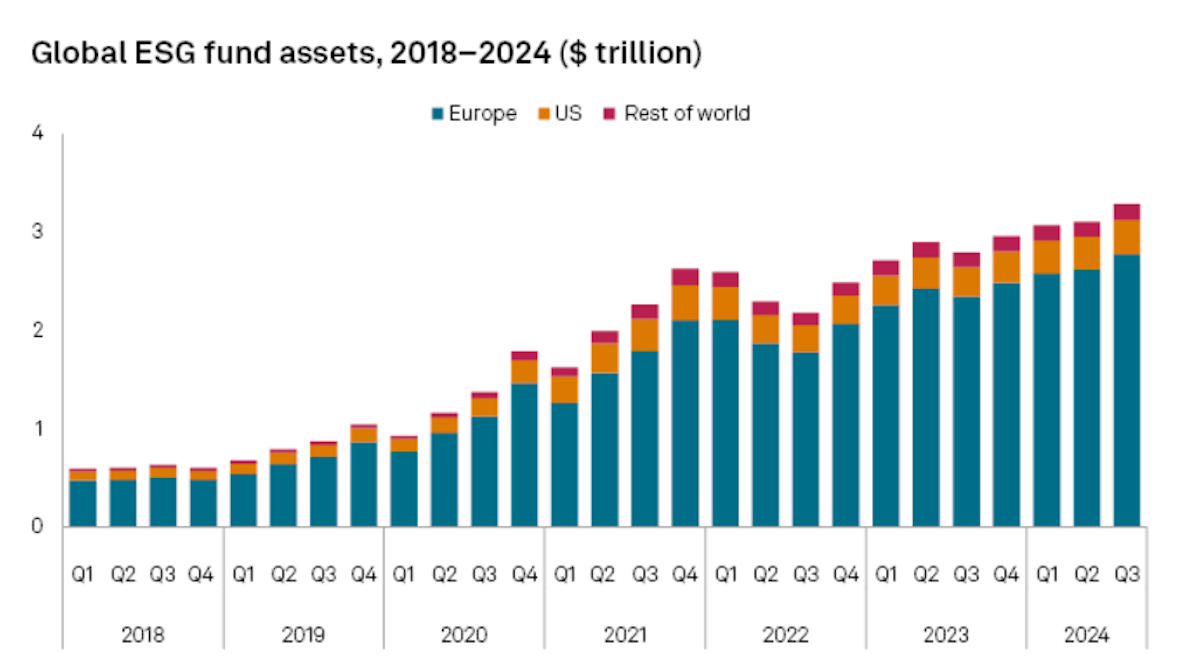

The charts from Morningstar and S&P Global tell us two things:

- 🌊 ESG funds received a flood of new money between 2019 and 2021.

- Since then the flow has dropped off dramatically, though total assets continued to rise through 2024, reaching over $3 trillion.

- 🇪🇺 It’s a much bigger thing in Europe than anywhere else.

- Over 84% of assets in ESG funds are in Europe. Just 11% are in the US and 5% elsewhere.

🤔 What Exactly Is ESG?

Companies have an impact on the world that goes beyond selling products, paying workers, and generating returns for shareholders.

ESG investing principles attempt to measure these impacts, in terms of:

- 🌲 Environmental impacts include pollution and emissions, use of scarce resources, waste management and the effect on biodiversity.

- 👫 Social impacts can affect employees, customers, local communities, and extend throughout the supply chain. This includes DEI (diversity, equity, and inclusion), human rights, safety, and labor relations.

- 🪧 Governance includes shareholder rights protection, transparency, risk management, and executive compensation.

The term ESG is often used interchangeably with other investing terms that suggest profit should not be the sole goal of investing. These include:

- 🌳 Sustainable investing, which focuses on the impact a company has on the environment and society.

- 🌎 SRI, or socially responsible investing, with a broader focus on the impact of investments on the world. SRI often boils down to excluding companies in certain industries (e.g. weapons or oil) from a portfolio.

- 🛠️ Impact investing, in which investors attempt to direct their investments to make a positive impact on the world. This typically means investing in companies attempting to solve problems in the world.

ESG overlaps with these concepts, but it attempts to create a framework to evaluate a company’s impact on the world. Various frameworks have been developed to standardize the impact and risks. ESG metrics and scores can be used like traditional financial metrics to evaluate and compare investments.

✨ ESG factors have as much to do with shareholder value and risk, as they do with making the world a better place.

When companies mismanage their ESG-related impact, it’s usually shareholders that take the hit… A few prominent and expensive examples include:

- 🛢️ BP’s Deep Horizon oil spill cost the company some $65 billion in fines and cleanup costs.

- 🏦 Wells Fargo paid some $6.5 billion in fines and restitution for overcharging customers and other abuses.

- 📉 Credit Suisse had a long history of scandals and risk management failures. These ultimately led to the bank’s collapse and acquisition by UBS for a fraction of its peak value.

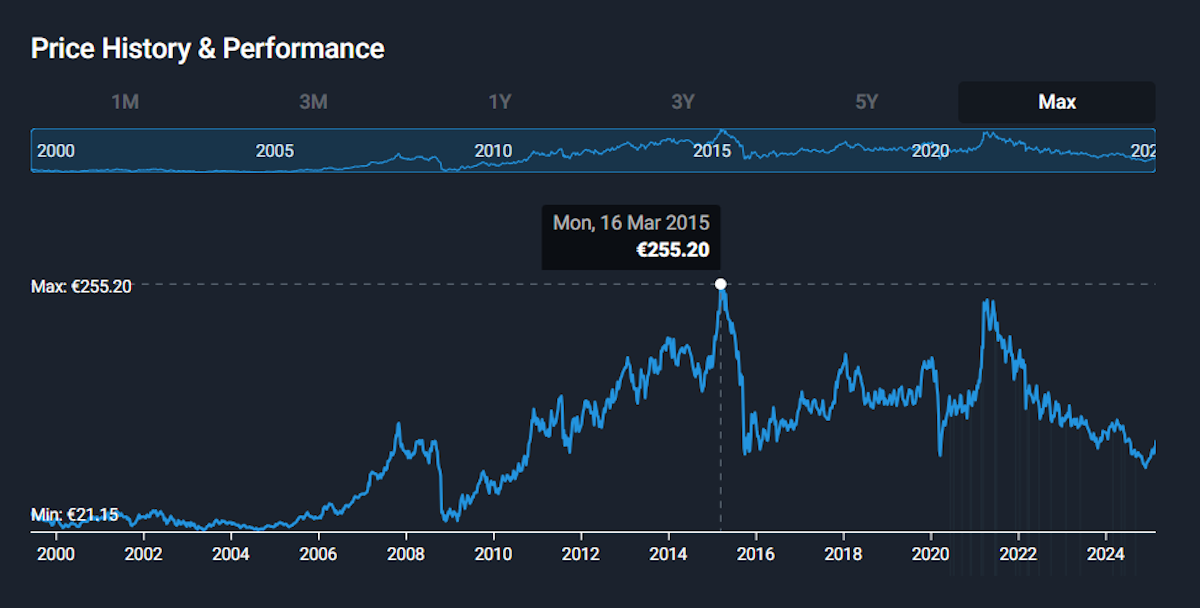

- 🚗 VW’s emission scandal cost shareholders over $33 billion in fines and related costs. The share price (below) fell 62% after the scandal and has yet to reach the previous level.

🌏 ESG In The Real World

The reality of ESG investing has been challenging, which has created some skepticism.

🤔 It’s Open to Interpretation

ESG means different things to different people.

While some view it as a risk management tool, others use ESG as a proxy for sustainable investing. This has led to the concept becoming a marketing too l for funds and created confusion for some investors.

There are also philosophical differences in the way it is interpreted.

For example, if you support the transition to renewable energy, do you avoid oil and gas producers entirely, or do you support those that commit to reducing their carbon footprint?

✨ This dilemma became apparent when Tesla was dropped from the S&P 500 ESG index, while ExxonMobil remained in the index. Tesla was dropped due to labor and safety issues, while Exxon was included because it scored better than other oil and gas companies.

There is some logic behind ranking companies within each industry - as it provides an incentive to improve. At the same time, it doesn’t make sense to punish an EV maker while rewarding an oil producer.

💵 It’s Expensive

For companies, ESG reporting and compliance is very expensive.

You may have noticed that company annual reports devote more and more space to ESG and sustainability reporting. Gathering and auditing all that data - which extends to the supply chain too - is costly.

This has created another dynamic: more profitable companies can afford to score well. Companies like Microsoft and Alphabet can afford to invest in renewable energy, and they can afford to pay their employees very well. They can also afford all the consulting and compliance costs required to improve their ESG scores.

On the other side of all those expenses is a massive ESG rating and consulting industry. This includes S&P Global, MSCI , Sustainalytics (part of Morningstar ) and McKinsey.

✊ Activism and Greenwashing

Critics of ESG point out that the term ESG has been misused, and even weaponized.

The growing popularity of exchange-traded funds has given companies like BlackRock and State Street outsized influence as shareholders. Some investors have accused these fund managers of using ESG factors to impose their agendas on companies.

Asset managers have also been accused of mislabelling funds to capitalize on investor appetite for sustainable and ESG investments.

The UK’s Financial Conduct Authority has already responded to this with new sustainability disclosure requirements (SDR).

📊 Performance And Impact

Several studies have shown that companies with good ESG scores have outperformed their peers.

✨ But, this is where the high cost of compliance is probably a factor. Highly profitable companies can afford to improve their scores and also tend to outperform.

Timeframes also play a role. Between 2018 and 2021, renewables outperformed, while oil and gas stocks have outperformed since 2021.

More recently, vice stocks (gambling, tobacco, and alcohol) which many would give low ESG scores, have underperformed. However, defense stocks which might also have low ESG scores have outperformed. These trends have little to do with ESG.

McKinsey does believe that companies with strong growth, profitability, and ESG scores will trade at a premium.

🏛️ Trump 2.0 and ESG 2.0

It’s no secret that Donald Trump is no fan of renewable energy or DEI, both of which are pillars of ESG. He’s already rolling back Joe Biden’s initiatives that supported renewable energy investments. This will make it more expensive for companies to improve or maintain ESG scores.

The SEC’s climate-related disclosure rules, which were on hold already, are also set to be rolled back.

In addition, corporate leaders in America have very publicly abandoned previous commitments to net-zero alliances, and even to DEI.

✨ The new US administration and the recent backlash against ESG investing are almost certain to slow the flow of capital into these funds, particularly in the US.

At this point, it would be easy to write off the entire ESG movement. But there are a few reasons to believe it’s not over, although it probably needs a reset:

- 🇪🇺 The EU is rolling out legislation that will make certain ESG reporting compulsory starting in 2028.

- This will mean international companies operating in Europe will need to comply.

- 🇺🇸 Even within the US, California is implementing similar legislation.

- 🏢 Many of the largest asset managers still view ESG as an important risk management framework .

- Even if they talk about it less, they might still follow the principles.

- 📅 Companies must plan more than four years ahead.

- They are likely to hedge their bets by paying some attention to ESG scores.

- 🧒 Younger generations are still committed to sustainability and other ESG issues.

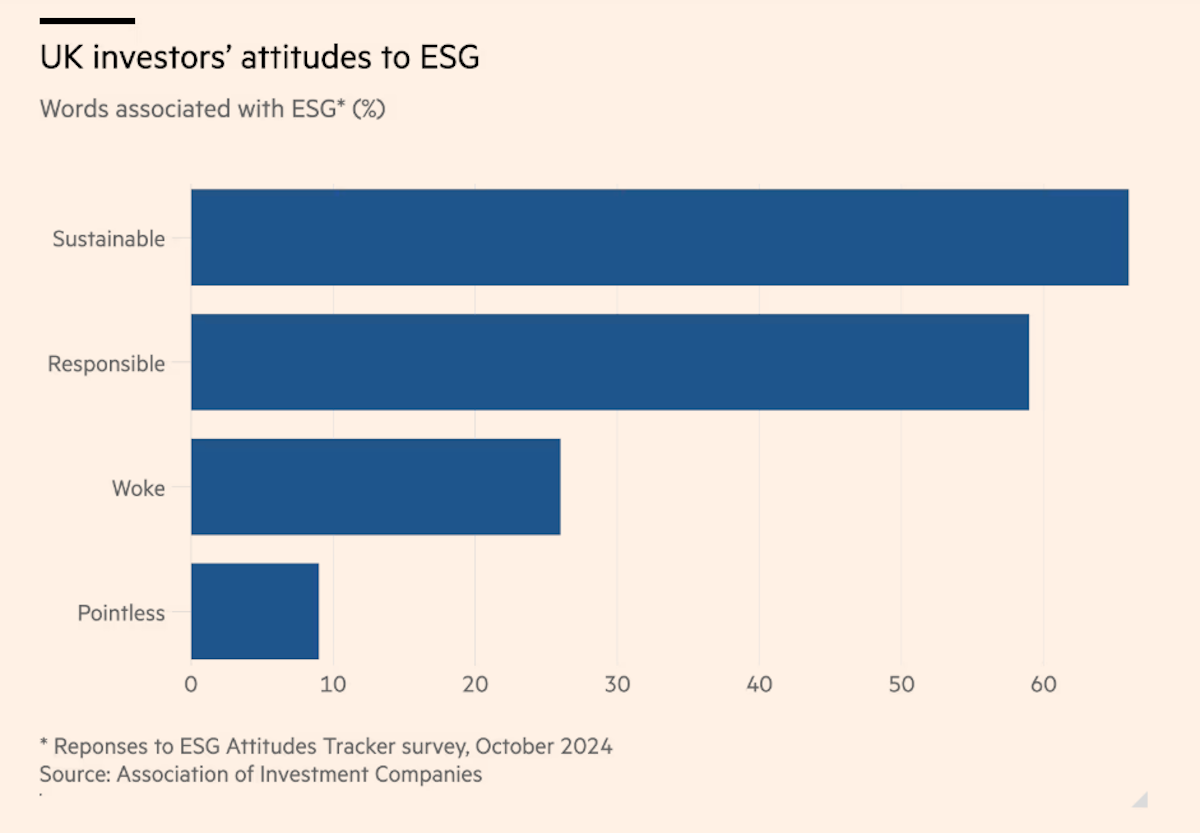

- 🌍 In Europe and the UK, ESG principles still had reasonable support as of late 2024.

✨ The ESG movement might not disappear, but it will probably look a little different, with more emphasis on risk management, and less on politically charged terms like DEI or ‘being woke’.

💡 The Insight: For Individual Investors, ESG Has Value as A Risk Management Tool

Institutional investors and fund managers need to pay a lot of attention to things like ESG because they are trying to keep various stakeholders happy.

For individual investors, things are simpler.

You might make a decision to invest in certain industries, and to avoid other industries. That decision will dictate the universe of companies you’re going to consider investing in. Assessing and deciding which companies you actually invest in should be a separate decision.

The risks posed by ESG factors are the ones that don’t show up in a company’s financials, so it’s important to do some research to see what those risks might be.

There’s a lot of uncertainty surrounding certain industries at the moment, particularly renewable energy. One way to reduce the risk is by identifying companies with more than one tailwind or catalyst.

This recently published narrative for EMCOR is a good example.

EMCOR provides mechanical and electrical construction services, so it offers exposure to electrification and renewable energy. The author also identifies data center expansion, reshoring, and infrastructure spending as catalysts. In other words, EMCOR isn’t entirely reliant on renewable energy.

Key Events During the Next Week

Monday

- 🇪🇺 Eurozone inflation data will be published. Economists expect annual inflation to remain at 2.5%, with the monthly increase in prices at 0.6%.

Wednesday

- 🇦🇺 Australia GDP growth rate for Q4 is expected to show the economy growing 1.3% year-on-year, compared to 0.8% in Q3.

- 🇺🇸 The US ADP National Employment report is due and expected to show 200K new jobs, up from 183k last month.

Thursday

- 🇪🇺 The ECB will announce its interest rate decision. The benchmark rate is expected to be cut 0.25% to 2.65%. The deposit facility rate is also expected to be reduced by 0.25% to 2.5%.

- 🇺🇸 US Initial jobless claims are forecast to rise from 242k to 250k.

Friday

- 🇨🇳 Trade data is due in China. Exports are forecast to be up 15% YoY, while imports are forecast to be up 3%. The trade surplus is expected to widen from $105 billion to $120 billion.

- 🇨🇦 Canada’s unemployment rate is expected to be steady at 6.6%

- 🇺🇸 US employment data will be published. The unemployment rate is expected to be steady at 4%, while nonfarm payrolls are expected to rise to 180k.

As we head into the last few weeks of earnings season we have a few chipmakers, SaaS companies, retailers and dual listed companies reporting:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.