Quote of the week: “Space is an inspirational concept that allows you to dream big. “ Peter Diamandis

The ongoing Trump-Musk feud was a reminder of the stakes involved in the space race. So, we figured, what better time to check in on the industry.

While the most popular name, SpaceX, isn’t listed, there are a growing number of other companies in the industry.

Plus, it's an industry that has a massive runway ahead of it, so it’s worth getting to know it if you are a long-term investor.

After all, if you're here with us, we're hoping that applies to you 😏...

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

📈 Stablecoin firm Circle jumps as IPO pop hits 247% on second day ( Bloomberg )

- Circle Internet Group has had a very successful IPO, climbing from $31 to $117 in just a few days of trading.

- ARK Invest scooped up 4.5M shares, betting big on stablecoins as next-gen financial plumbing.

- This likely isn’t just a crypto hype spike; it’s a signal that stablecoins are being recognized as serious infrastructure plays. Even Meta and Uber are considering using them for cheaper cross-border transfers.

- USDC’s global reach, Treasury-backed reserves, and role in exporting USD via blockchain rails position Circle as a foundational fintech layer, especially in emerging markets.

- Circle’s IPO makes stablecoin infrastructure investable. Investors wanting exposure to firms that are enabling on-chain dollar access, especially in regions traditional finance can’t reach, are watching closely.

🎮 Microsoft and Asus announce two Xbox Ally handhelds with new Xbox full-screen experience ( The Verge )

- Microsoft and Asus have officially entered handheld gaming.

- They unveiled two Xbox Ally handhelds with a console-like Xbox interface layered over Windows.

- The devices aim to simplify handheld PC gaming while offering seamless access to Xbox, Steam, and cloud libraries.

- This signals Microsoft’s deeper push into gaming hardware and platform unification. By removing Windows complexity and optimizing for battery and performance, Xbox Ally could challenge the Steam Deck and PlayStation Portal. If the model gains traction, expect ecosystem effects: higher Game Pass adoption, stronger AMD chip demand, and potential tailwinds for cloud gaming infrastructure.

- Watch for knock-on effects in Microsoft, AMD, and cloud gaming stocks. This holiday launch could spark a new wave in handheld gaming demand.

👓 Snap plans to enter wearables market with AR/VR ‘Specs’ ( Fortune )

- Snap is taking on much larger competitors, Meta, Apple, and Google.

- Google is also having another go at AR glasses, after previous attempts failed to gain traction. Sometimes the technology just isn’t ready for prime time.

- AR/VR glasses and headsets might take a while to bring in the dough for these companies. But they face a potential existential crisis if they don’t enter the race.

- Wearables, and specifically glasses and headsets, are viewed as the next platform for consumers to interact with the digital world, including AI tools and ‘metaverse’ type environments. If consumers move on from PCs and smartphones, social media platforms risk losing their audience.

- Going by Microsoft’s experience with smartphones and Google’s early experiments with glasses, there could be a lot of hit and miss with these products, so be careful with how much you extrapolate growth expectations.

🛢️ EIA expects US oil production to drop in 2026 ( Bloomberg )

- So much for drill, baby, drill!

- If correct, this will be the first year with lower production since 2020.

- There are several reasons for the expected decline, including lower oil prices, weaker-than-expected demand, and global inventory buildup.

- OPEC+ has also begun to unwind production cuts, bringing more supply to the market. However, OPEC production in May actually fell short of its own target.

- The current outlook doesn’t give oil producers much incentive to invest and increase output. But lower production inevitably leads to a supply shortage, and higher prices later.

🤝 Oil steady near 7-week high as investors await details on US-China trade talks ( Reuters )

- Speaking of oil, prices are hovering near a 7-week high as traders digest U.S.-China trade progress and await U.S. inventory data.

- As mentioned, OPEC+ supply is ticking up, but rising domestic demand, especially from Saudi Arabia, may keep prices buoyant.

- The temporary easing of trade tensions reduces downside risk for global demand, while tighter inventories and resilient consumption could provide a soft floor for crude. Still, tepid reaction shows the market wants firmer signs of demand acceleration before pricing in more upside.

- Energy exposure looks stable in the near term. Some analysts are holding or adding to oil-linked assets ahead of summer demand peaks and potential inventory drawdowns.

🇨🇳 China puts six-month limit on its ease of rare-earth export licenses ( WSJ )

- China will resume rare-earth exports to the U.S. but only under six-month licenses, giving Beijing a built-in pressure valve if talks sour again.

- In return, the U.S. agreed to ease controls on jet engines and ethane exports, both vital to China’s industrial base.

- This truce is tactical, not strategic. Rare-earth volatility likely isn’t going away. Expect U.S. manufacturers in EVs, defense, and electronics to accelerate reshoring or diversify supply chains. Meanwhile, companies tied to ethane or aerospace exports could benefit in the near term.

- Stay cautious on firms dependent on Chinese rare earths. This six-month window is more of a warning shot than a white flag.

🚀 The Final Frontier: Your Guide to Investing in the Booming Space Economy

For most of history, space was for superpowers. Today, a new space race is on, and this time, it's driven by commerce.

A growing ecosystem of private companies is building a vibrant economy in orbit and beyond, creating what many believe is one of the biggest investment opportunities this century.

📈 The numbers are staggering. After hitting roughly $630 billion in 2023, the space economy is projected to skyrocket (pun intended) to $1.8 trillion by 2035 .

🌟The Opportunity of Space

The most important thing to know about the space economy is that it’s yet another beneficiary of Wright’s Law.

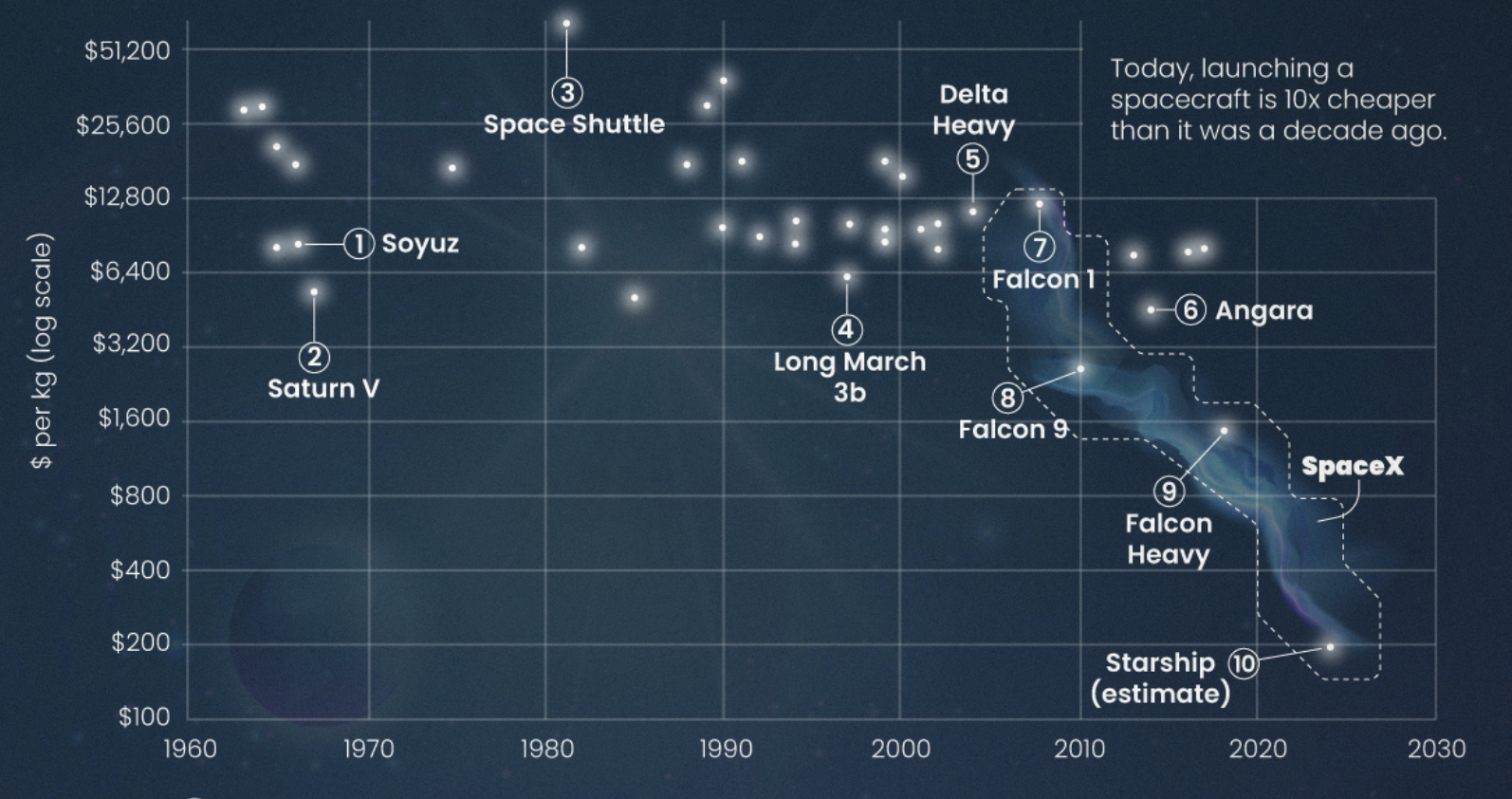

- As more objects are launched into space, investment and innovation lead to greater efficiency and lower costs. As costs fall, the number of viable use cases increases, leading to more revenue and more investment in the industry.

✨ Costs have plummeted in the last 15 years, while the number of satellites launched into space rose from 120 in 2010 to 2,900 in 2024.

Launch Costs Per KG - Visual Capitalist (prices adjusted for inflation)

For investors, another important aspect of the space economy is that it’s not going to reach maturity anytime soon, if ever.

✨ That will give companies decades to compound earnings and no shortage of opportunities to reinvest those earnings.

📈 Current and Near-Term Opportunities

🛰️ The Satellite Economy

As of 2025, there were over 11,700 active satellites in orbit, with around 70% belonging to Starlink. Those satellites serve a growing list of industries ranging from communications, security and defence, to insurance, agriculture, and transport.

The number of use cases is increasing, as more satellites gather more data, and as AI increases the useful insights that can be drawn from that data.

Researchers estimate the carrying capacity of low Earth orbit at around 100,000 (~10x today’s figures) .

But the incremental benefit of adding more satellites may fall before that number is reached.

🌍 Geo-politics and Space Autonomy

The fracturing of global alliances has increased the imperative for countries to have autonomy over their satellite communications and space-based defence systems.

The rift between Europe and the US means that being reliant on Starlink is a risk for Europe.

European nations are also increasing defence spending. These days, a lot of those investments go to surveillance systems and unmanned drones. If you're a fan of Star Wars, our future might start showing some resemblance to that universe.

✨ Emerging Frontiers

🧑🚀 Space Tourism is already a thing, but let’s face it, the economics aren’t great right now.

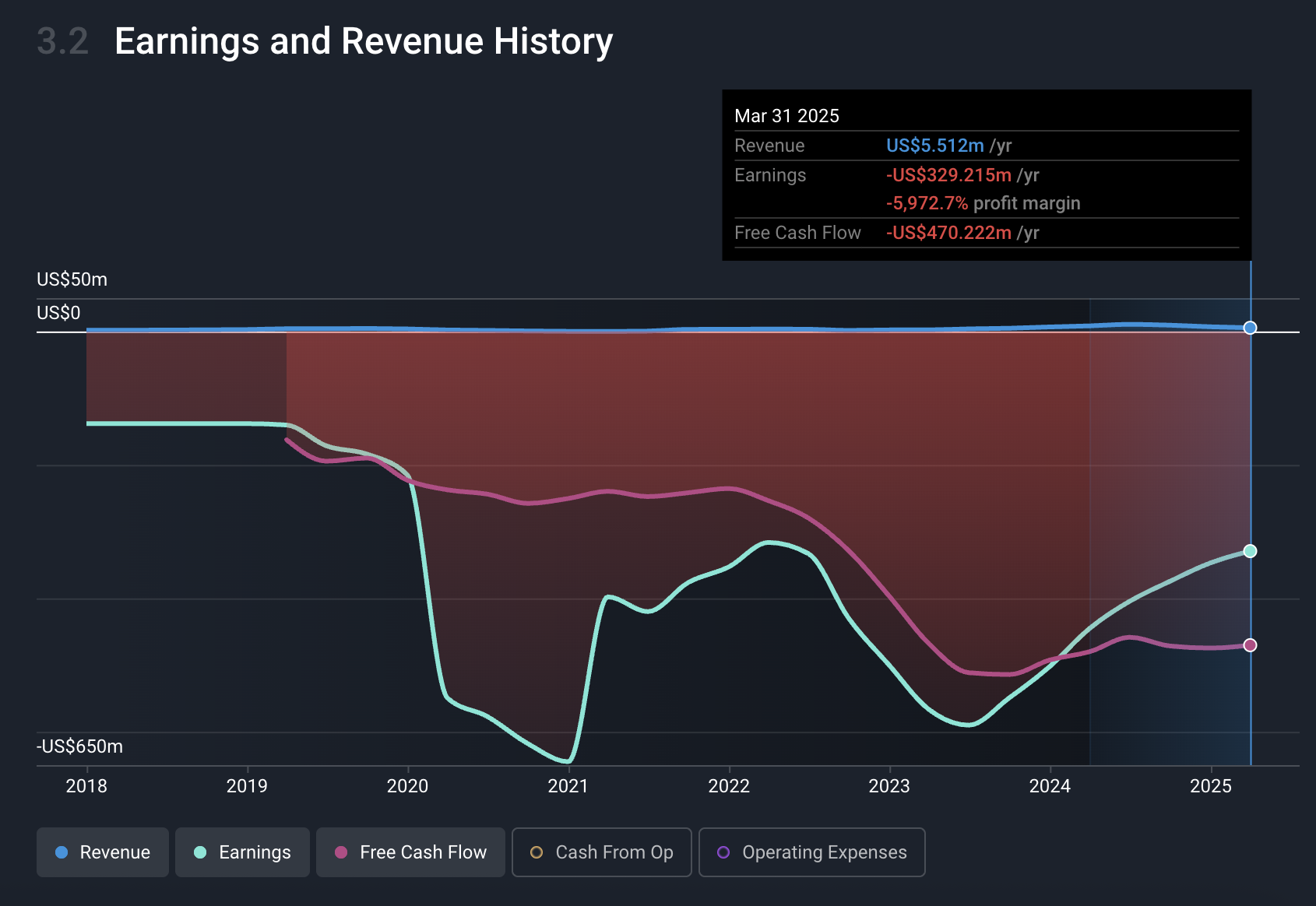

Virgin Galactic’s share price is down more than 99.5% since the 2021 peak. The company has been burning $500 million a year - at $600k for a 15-minute flight, how many tickets can they sell?

Virgin Galactic - Simply Wall St

Colonizing Mars or the Moon are obvious ambitions, but they are likely decades away. There are a few other ambitious plans on the table:

- ⚒️ In-Space Servicing: With a growing economy in space, there will be a need to service, repair, refuel, and even build structures in space.

- ⛏️ Resource Extraction: The ultimate goal of mining the Moon or asteroids for valuable minerals could reduce the pressure on the Earth’s resources. Theoretically, this could all be fueled by extracting water, oxygen, and hydrogen from lunar ice.

- 🏗️ In-Space Manufacturing: It’s also hoped that the unique microgravity environment could lead to breakthroughs in materials science, pharmaceuticals, and other fields. Ultimately, the equipment and infrastructure used in space could be manufactured there too.

⛓️ The Value Chain of the Space Economy

The universe of space companies is expanding fast and includes a wide variety of players, each with a different risk profile. The ecosystem is commonly divided into upstream and downstream segments.

" Upstream " players are involved in creating and deploying space infrastructure. Basically the design, manufacturing and launching of space assets.

Meanwhile, " downstream " players use the data and infrastructure created by the upstream players. They leverage space assets for services and applications on Earth.

Let's start with the foundation, the hardware and systems that make space activities possible.

🏗️ Upstream: Building and Sending into Space

🚀 Launch Services

Building and operating the rockets that carry everything to orbit has been the big hurdle until recently. The sheer cost of launching anything into space meant it was only government agencies that could make it happen.

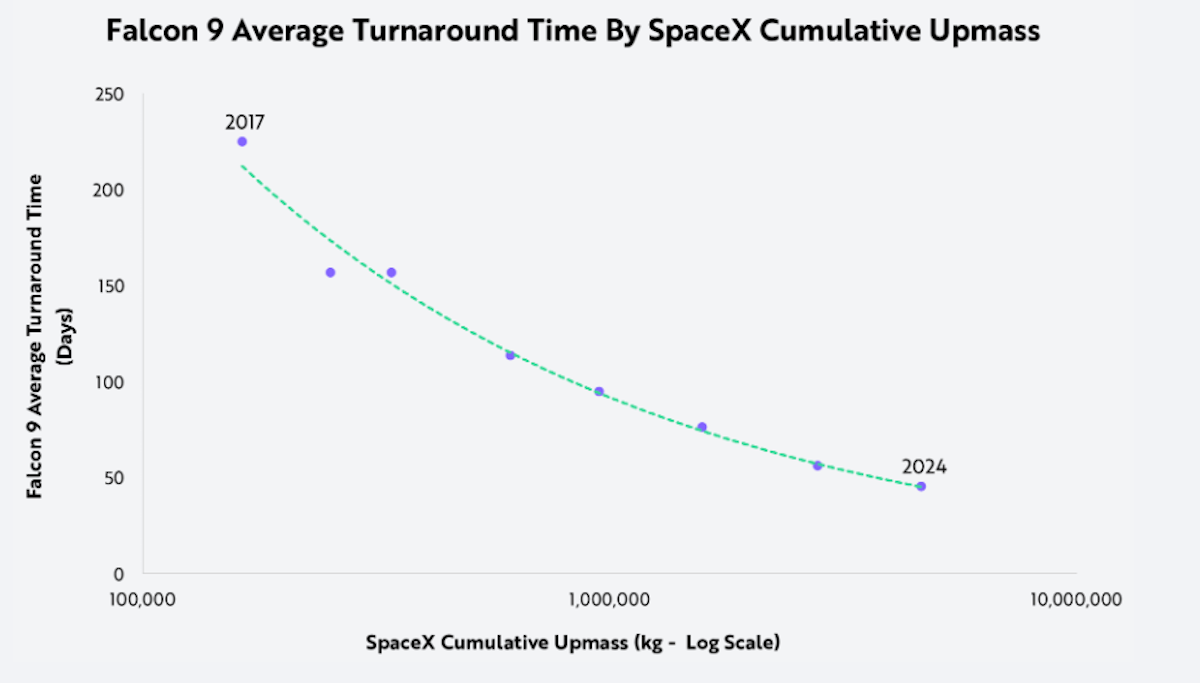

SpaceX has changed that with its reusable rockets. It's also building bigger rockets, capable of carrying bigger payloads. Besides reusing rockets, SpaceX has reduced the turnaround time between launches by ~70%. These advances have changed the economics for the industry completely.

Falcon 9 Turnaround Time vs Cumulative Payload - ARK Invest

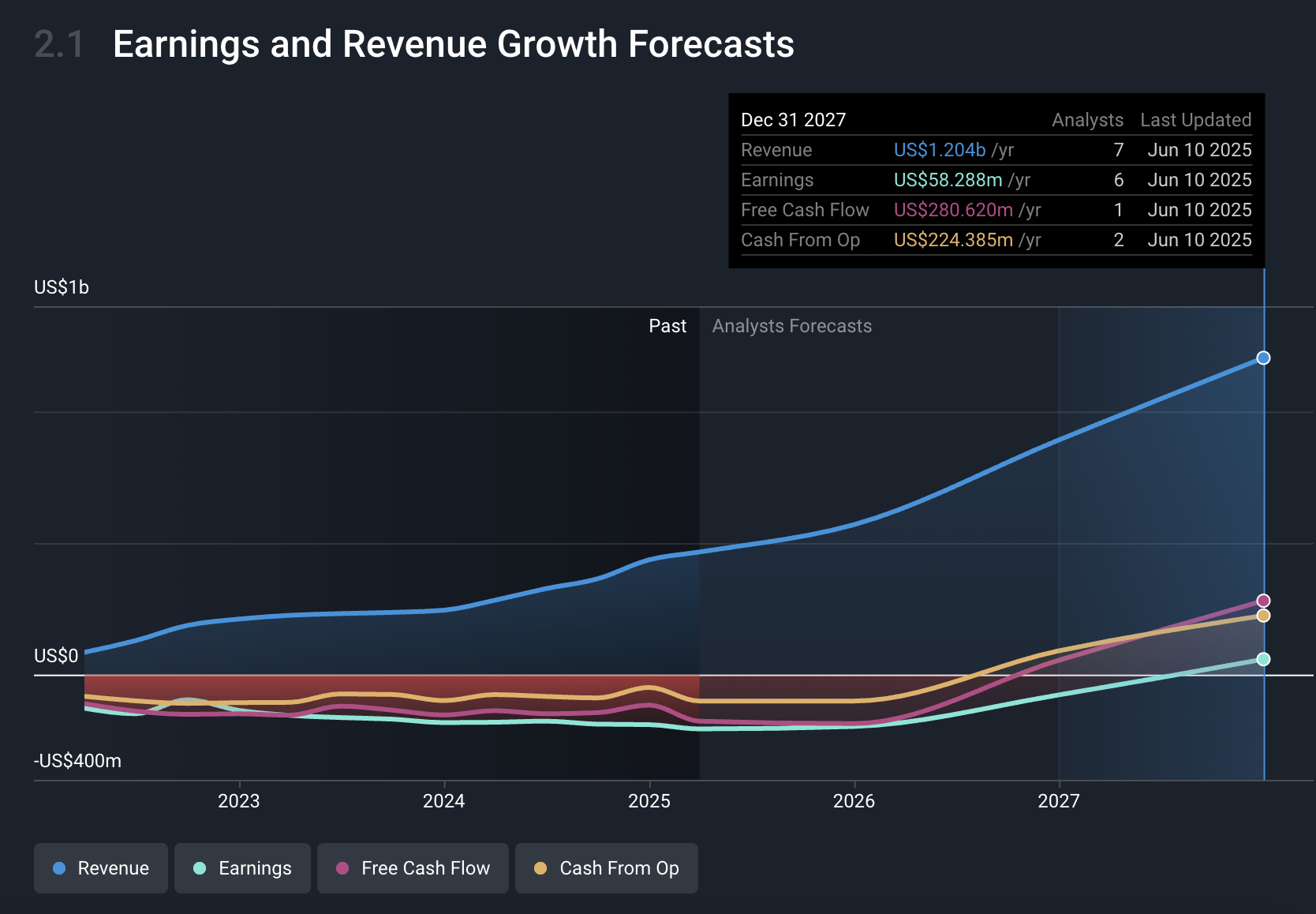

SpaceX is the undisputed leader when it comes to commercial launch platforms. Rocket Lab , the only other real contender, has now racked up 63 orbital rocket launches (vs SpaceX’s 502).

The company’s financial trajectory is also looking impressive, and expectations are high.

Rocket Lab - Simply Wall St

Apart from SpaceX and Rocket Lab, there are quite a few companies and government agencies around the world conducting launches. However, apart from China, the number of launches are dwarfed by SpaceX.

You may have heard of United Launch Alliance , a joint venture between Boeing and Lockheed Martin, but ULA has conducted fewer than 10 launches a year since 2015.

🚀 Satellites, Spacecraft, and Vehicles

There’s a larger group of companies that develop and build satellites and equipment used in space. Some notable examples include:

- AeroVironment : Unmanned vehicles, including the NASA helicopter used by the 2020 Mars Mission.

- Intuitive Machines : Vehicles and craft used for lunar missions and payload delivery.

- AST SpaceMobile : BlueBird satellite constellations providing broadband directly to smartphones.

- Planet Labs : Geospatial data satellite constellations.

- Redwire : Sensors and other equipment used on spacecraft and satellites.

✈️ Legacy Aerospace & Defense

The established giants like Lockheed Martin , Boeing , and GE Aerospace have deep manufacturing expertise, strong balance sheets. Most importantly, they have massive government defence contracts to keep the cash flow going.

As mentioned, Lockheed and Boeing’s launch service has fallen behind, but the companies provide a lot of other technology to the industry.

L3Harris Technologies is a slightly smaller provider of hardware and software solutions used by defence, aviation, and space industries. The company has a strong pipeline of government contracts.

📡 Ground Systems

An important network of antennas, data centers and software are required to keep assets in space, and receive data from them.

Companies in this segment include some of those mentioned above. Another notable example is Kratos Defense & Security Solutions which provides a wide array of equipment used on the ground, in the air and in space. This is another key defence contractor.

🖥️ Downstream: Applications & Data

This is where space gets monetized. It’s all about using satellites to provide services back on Earth, and it’s where most of the revenue is today.

Satellite Communications: Beaming down broadband internet, IoT connectivity, and secure communications:

- Iridium Communications provides communication services used by ships and in remote areas.

- EchoStar provides a range of TV and broadband services via satellite and 5G, as well as equipment used by other satellite TV providers.

🌍 Earth Observation (EO): Using satellite imagery to provide data for agriculture, climate science, insurance, and defense:

- MDA Space : Geo-intelligence solutions, communications, and sensors used in space.

- BlackSky Technology : Satellite image processing and analytic,s and real time site monitoring.

🧭 Positioning, Navigation, and Timing (PNT): The tech behind GPS that powers global logistics, ride-hailing apps, and countless other services.

- Trimble : geo-location technologies and GPS correction data.

- Spire Global satellite-based aircraft and marine tracking data and predictive weather analytics.

Follow the Money 💰

The space economy has a long runway ahead.

It’s very likely that there will be booms and busts along the way, and some of the companies operating at the leading edge will struggle to find funding when the chips are down. A lot of start-ups have already failed in this space (again, pun intended).

Space mining and colonizing Mars are probably a while away (and the feasibility is arguable). In the meantime, it makes sense to focus on companies in segments where money is actually being spent:

- 📱 Communications and satellite data companies

- 🏛️ Defence contractors and companies helping governments achieve space autonomy.

- 🤝 Companies selling equipment to the companies making big investments in technology.

There are lots of space-focused ETFs, but these need to be assessed carefully.

Space stocks don’t necessarily lend themselves to market-cap-weighted indexes. Actively managed ETFs make more sense, but you need to be comfortable that the manager knows what they are doing.

One of the glaring anomalies amongst space companies is the fact that the biggest player, SpaceX, is still unlisted.

There are some indirect avenues to investing in SpaceX, like the Destiny Tech100 fund. We’ve covered this fund before , but if you missed it, here’s what you need to know:

✨ This is a closed-end fund, which means the price is determined by supply and demand, not the NAV. It’s currently trading at around 6x its NAV!

ARK Invest has a similar fund that’s priced closer to NAV, but it’s only open to accredited investors. It also has a much smaller allocation to SpaceX.

💡 The Insight: A Balanced Approach to Space Exposure

A high-risk, high-reward sector like space lends itself to a "barbell strategy”. This means balancing stability with a few calculated, high-growth bets.

This strategy involves holding two distinct types of assets at opposite ends of the risk spectrum, while avoiding the muddled middle.

⚖️ The Stable Foundation.

This side of your barbell consists of established, profitable companies that are essential suppliers to the space industry—your "picks and shovels."

- These could be legacy aerospace giants or specialized tech companies with strong cash flows and diverse customers.

- Their growth may be slower, but they provide stability and a foothold in the sector without the extreme volatility of a pure-play startup.

Typically, these companies will have a large snowflake showing a healthy balance sheet and track record:

L3Harris Technologies- Simply Wall St

🚀 The "Moonshots"

This side of the barbell is a small, carefully selected basket of high-growth "New Space" companies.

- These are your potential 10x returners—the companies aiming to create or dominate new markets. These companies might not look very strong on the company report, and you’ll need to anticipate what the company could become, rather than what it is now.

- The key here is diversification. By holding a few different companies across launch, satellites, and data, you spread your risk. You’re betting on the growth of the whole ecosystem, not just one company.

Key Events During the Next Week

Tuesday

- 🇯🇵 Bank of Japan Interest Rate Decision

- 📊 Forecast: 0.5% | Previous: 0.5%

- ➡️ Why it matters: With rates steady, markets will dissect BoJ language for signs of policy shifts or yield curve tweaks.

Wednesday

- 🇯🇵 Japan Balance of Trade

- 📊 Forecast: -170.0B(¥) | Previous: -115.8B(¥)

- ➡️ Why it matters: A widening deficit signals weaker exports or rising import costs, potentially weighing on the yen.

- 🇬🇧 UK Inflation Rate (YoY)

- 📊 Forecast: 3.6% | Previous: 3.5%

- ➡️ Why it matters: A hotter print could delay BoE rate cuts and push up gilt yields and the pound.

Thursday

- 🇬🇧 UK Official Bank Rate

- 📊 Forecast: 4.25% | Previous: 4.25%

- ➡️ Why it matters: With no change expected, investor focus shifts to guidance on the BoE’s inflation battle.

- 🇺🇸 US Federal Funds Rate

- 📊 Forecast: 4.5% | Previous: 4.5%

- ➡️ Why it matters: The decision may stay put, but the Fed’s tone at the press conference could make or break market expectations on cuts.

Analysts will be getting a break this week as very few large companies are reporting:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.