💸 Finding Quality Dividend Yields in a Rate-Cutting Environment

Reviewed by Bailey Pemberton, Michael Paige

Quote of the week: “While we can learn from the long run about how bonds and stocks respond to changing environments and to each other, the long run can tell us perilously little about what kinds of environments lie ahead.” Peter Bernstein

The bond market’s been on a wild ride over the past 12 months with lots of noise, lots of movement… and now we’re basically right back where we started.

The market has already priced in a 25bps rate cut from the Fed next week like it’s a done deal.

So this week, we’re zooming in on what’s really been going on in the bond market, and what it all means for dividend investors who want to maintain yield.

The outlook is still murky. But don’t worry, we’ll walk you through a few smart ways to steer clear of the most likely yield traps out there with screeners to find high-quality dividend stocks.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

✂️ Dismal Jobs Report Fuels Expectations of Faster Rate Cuts ( WSJ )

- August’s weak jobs report locked in a September Fed cut and shifted market bets toward consecutive quarter-point cuts through December. Odds of three straight moves are now around 75%, with 2-year yields dropping to a three-year low.

- Inflation is the sticking point, still running above target, keeping some officials cautious about cutting too aggressively.

- Traders see policy easing accelerating, but the Fed must balance softer hiring with sticky prices. More cuts could support equities and credit, though inflation surprises risk forcing a slower pace.

- Jobs are weakening, markets are leaning dovish, and the Fed is preparing to move, but inflation will decide the throttle.

💬 Robinhood Aims New Social Platform at Reddit’s WallStreetBets ( Bloomberg )

- Robinhood is building its own version of WallStreetBets, launching a social platform where users can post trades, track each other’s performance, and even follow high-profile investors like Nancy Pelosi.

- All posts must be tied to real-time trades, giving Robinhood a credibility edge over Reddit’s screenshot method and more control over the investing conversation.

- This is less about community and more about retention. By locking users into its ecosystem with social features, Robinhood could boost engagement and time-on-platform, which are key metrics for monetization.

- Traders can also soon short stocks and trade index options overnight, signaling a push toward more sophisticated retail activity.

- Robinhood’s turning into a one-stop investing-entertainment machine. If it works, expect stickier users and possibly even more volatility from social-fueled trades.

🏛️ Lutnick Says U.S. Should Take a Chunk of Universities' Patent Revenue ( Axios )

- The U.S. government is eyeing university patents as its next revenue stream, following its surprise stake grabs in companies like Intel and Nvidia.

- If Lutnick’s plan takes off, federally funded research could come with strings attached: give the taxpayer half the commercial upside.

- This marks a big shift from the 40-year Bayh-Dole norm, where schools kept the rights to inventions made with federal cash. If enforced, it could reshape how universities negotiate licensing deals and dampen venture funding for academic spinouts. Investors with biotech or university-affiliated IP exposure should watch closely.

- The government wants in on university patents. If it succeeds, expect tighter margins on IP-based plays.

☁️ Oracle’s Insane Cloud Infrastructure Forecast is Giving Shades of Nvidia’s Data Center Business ( Sherwood )

- Oracle says its cloud business will hit $144 billion by 2030, which is a 14x jump from last year’s $10 billion haul.

- The fuel is a $300 billion cloud deal with OpenAI, which helped drive Oracle’s backlog up 359% to $455 billion.

- That scale puts Oracle on a path that mirrors Nvidia’s rise in AI infrastructure. Shares reacted fast, climbing over 40% and Larry Ellison briefly edged within reach of the world’s richest title. Still, investors are concerned about reliance on one mega-customer like OpenAI since it introduces real concentration risk.

- Oracle just muscled into the AI cloud race. That raises the ceiling, and the stakes, for everyone in the game.

📈 Klarna’s Stock Jumps 15% in NYSE Debut After Pricing IPO Above Range ( CNBC )

- Klarna jumped 15% in its NYSE debut after pricing shares above range at $40, raising $1.37b and landing a $17.3b valuation.

- The IPO adds momentum to a busy stretch of tech listings, following strong debuts from Circle and Figma , with Gemini next in line.

- Klarna is leaning harder into U.S. banking, with 700,000 debit card users and 5 million on the waitlist. That shift could strengthen recurring revenue, but UK regulation on BNPL remains a headwind. Sequoia cashed in $2.65 billion, while SoftBank is still sitting on steep paper losses.

- Klarna is back in the spotlight, and the market's betting on its banking pivot to drive the next leg of growth. To navigate IPOs successfully, just remember what we mentioned recently .

🇲🇽 Mexico to Raise Tariffs on Cars From China to 50% in Major Overhaul ( Reuters )

- Mexico plans to hike tariffs on Chinese autos from 20% to 50%, part of a broader levy overhaul hitting $52b in imports across cars, steel, toys, and textiles.

- The move shields 325,000 local jobs but also aligns Mexico more closely with U.S. pressure to limit China’s regional footprint.

- For automakers, the tariffs raise the cost of Chinese EV and car imports, boosting domestic producers and U.S. auto exports into Mexico. Nearshoring trends get another tailwind as Mexico reinforces its role in U.S.-linked supply chains.

- Mexico is tightening the trade door on China, giving Detroit and Mexican plants more room to run.

📈 Bonds, Yields & The Hunt for Income

The past year has been nothing short of a rollercoaster for bond watchers.

Sure, the biggest fireworks were back in 2022–2023 when inflation was roaring, but even as central banks started shifting gears, the ride didn’t exactly calm down.

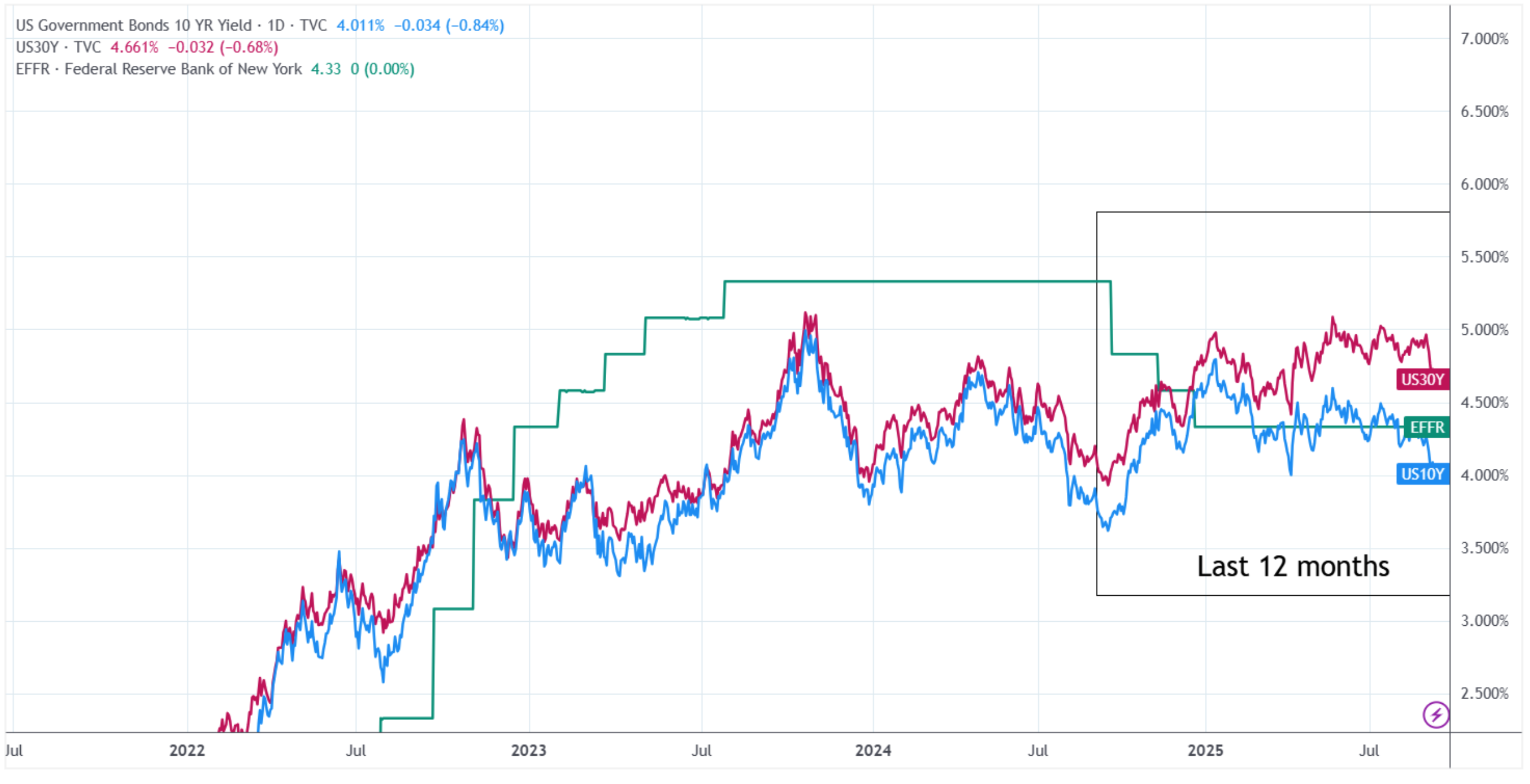

Take the U.S. for example: just as the Fed began cutting rates last year, bond yields did the opposite.

US 10 and 30-Year Bond Yields vs Fed Funds Rate - TradingView

Since late 2024, the Fed has been on pause, but as we mentioned in the news stories above, markets are betting that the cutting cycle resumes next week.

As a quick reminder, bond yield movements are basically a tug-of-war between three forces:

- ⚖️ Supply & Demand: More government borrowing = more bonds on the market.

- Total demand depends on who’s buying: either short-term “flight to safety” investors or big institutions holding for the long haul.

- 🏦 Central Bank Policy: When inflation heats up, rates typically rise to curb spending, which increases bond yields. When recession fears or crises occur, rates are typically lowered to encourage spending, and bond yields decrease.

- ⚠️ Perceived Risk: If debt looks unsustainable, investors demand higher yields as compensation for the risk they’re taking. Currency risk plays a role, too.

✨ Over the past 12 months, we’ve seen all of these dynamics at work.

U.S. 10-year Treasury yields have been caught in a tug-of-war of competing storylines lately.

- 🇺🇸 First, Donald Trump’s improving poll numbers and subsequent election win had markets bracing for higher inflation.

- 🤷 Then came the doubt, maybe he wouldn’t actually follow through.

- 💰 Cue “Liberation Day” ( tariffs ) and the “ Big Beautiful Bill ” ( deficit spending ), and suddenly inflation fears were back on center stage.

But since May, the script has flipped again:

- 🗣️ Trump and his Treasury Secretary, Scott Bessent, may have managed to “jawbone” yields lower (verbally).

- 🚨 Data is flashing signs that the U.S. labor market is softening.

- 👨⚖️ And now the Supreme Court has agreed to rule on whether Trump’s tariffs are even legal.

As a result of all that, yields on 10-year Treasuries have slid back to pre-“Liberation Day” levels. But the 30-year yield is still elevated , showing just how divided the market really is.

- In the medium term, inflation fears are giving way to expectations of monetary easing.

- However, longer term, the elephant in the room is a mountain of US debt that just keeps growing.

✨ Those buying longer-term US government bonds want more compensation for the perceived risk.

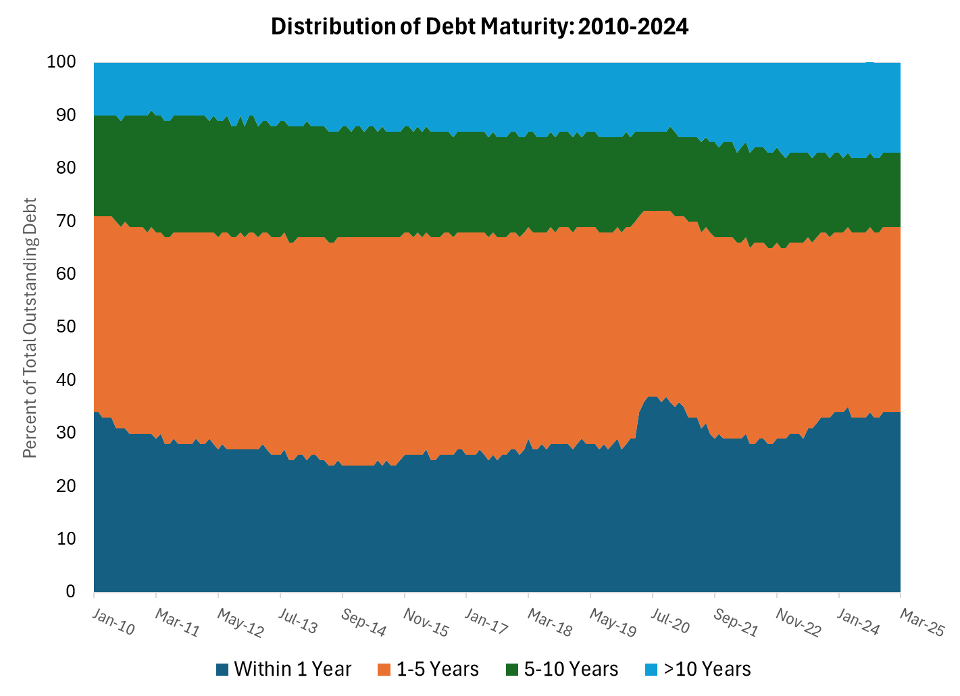

Despite record borrowing, the US Treasury has limited issuance of longer-dated bonds. That means less supply (and less upward pressure on yields), but also less liquidity.

⚠️ And ultimately, the near-dated bonds will need to be refinanced. As of the most recent data from Q3 of FY2025, approximately 31% of U.S. publicly held marketable debt will be maturing within 12 months .

While this chart below shows that the percentage (⅓ of total debt) maturing in less than 12 months is pretty typical, the issue nowadays is the amount . At today’s debt load, ⅓ of the debt is around $10 trillion .

Source: The Quarterly Ledger: A Review of the Nation’s Balance Sheet: Q2 FY2025 - The Unseen and The Unsaid

Debt servicing costs now make up 22% of annual federal tax revenue , compared to around 11% in 2022 . The government’s efforts to reduce interest rates are no doubt related to its intent to refinance this debt as cheaply as possible.

🌍 Regional Nuances of Bond Yields

Wherever you live, invest, lend, or borrow, US Treasury yields matter.

That’s because they are the benchmark risk-free asset (at least for now), and everything else is priced against them.

Nevertheless, there have been some local factors at play too:

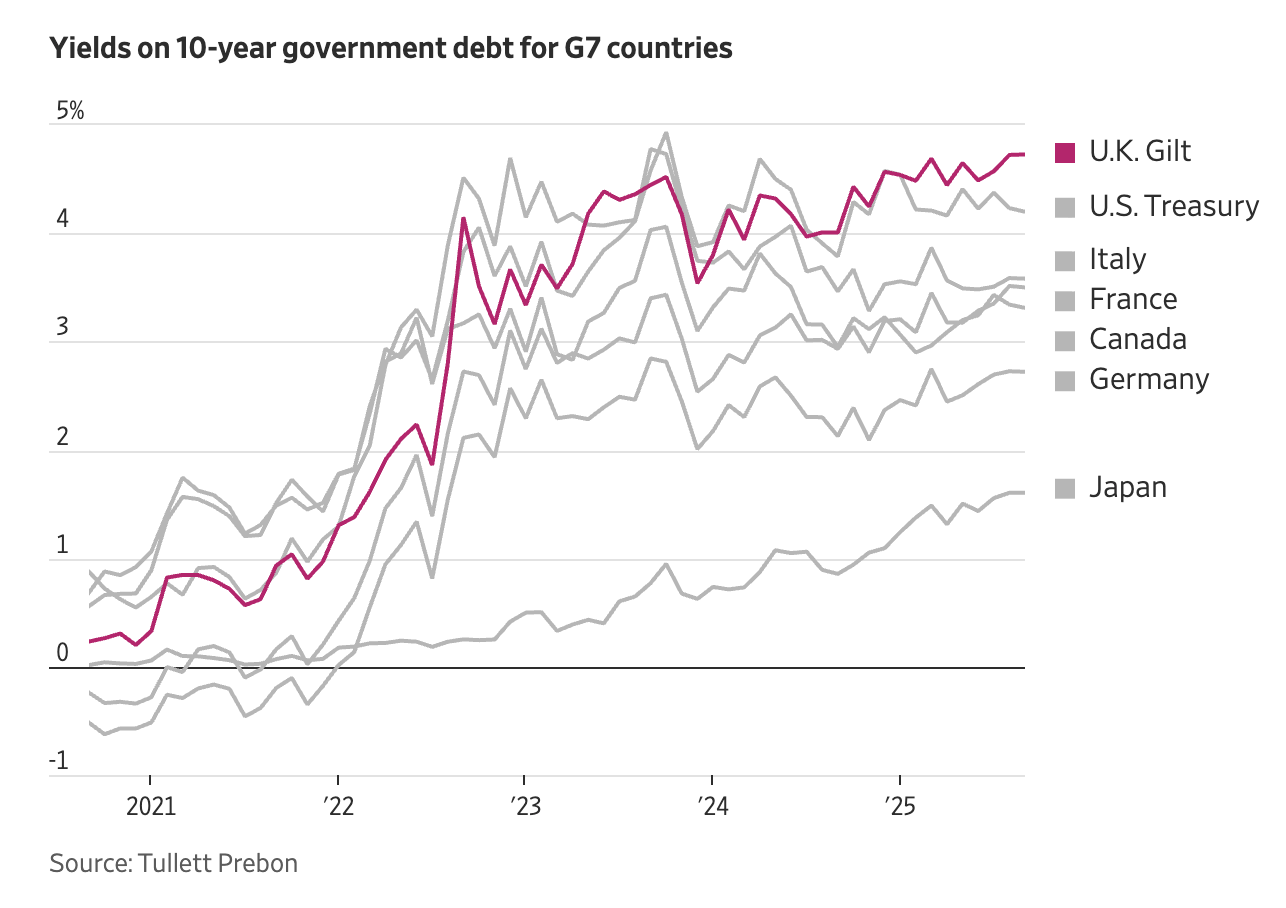

🇪🇺 Europe – Stability with Cracks

Yields rose, but modestly in most cases.

- 🇩🇪 Germany’s new stimulus pushed yields higher.

- 🇬🇧 UK’s Gilt Yields are at 15-year highs as the Bank of England struggles to get a grip on inflation.

- 🇮🇹 Italy’s yields have remained elevated, even after a surprise ratings upgrade from S&P .

🇯🇵 Japan – The Slow Unwind.

The Bank of Japan’s easing of Yield Curve Control (where a central bank buys and sells government bonds to achieve a desired yield) finally injected volatility into Japanese Government Bonds (JGBs). Yields crept up, but they remain low compared to the world.

Source: Wall St Journal

🌎 Emerging Markets – The Split Story

Here it’s all about selectivity. Fiscal concerns, commodity prices, and US tariffs have hit economies like Brazil .

But in Asia, things have been different:

- Fiscal easing in China and Thailand (due to slowing growth) led to lower yields.

- Other markets, like India , saw record issuance, as local investors began to ‘de-dollarize’ as they invest locally.

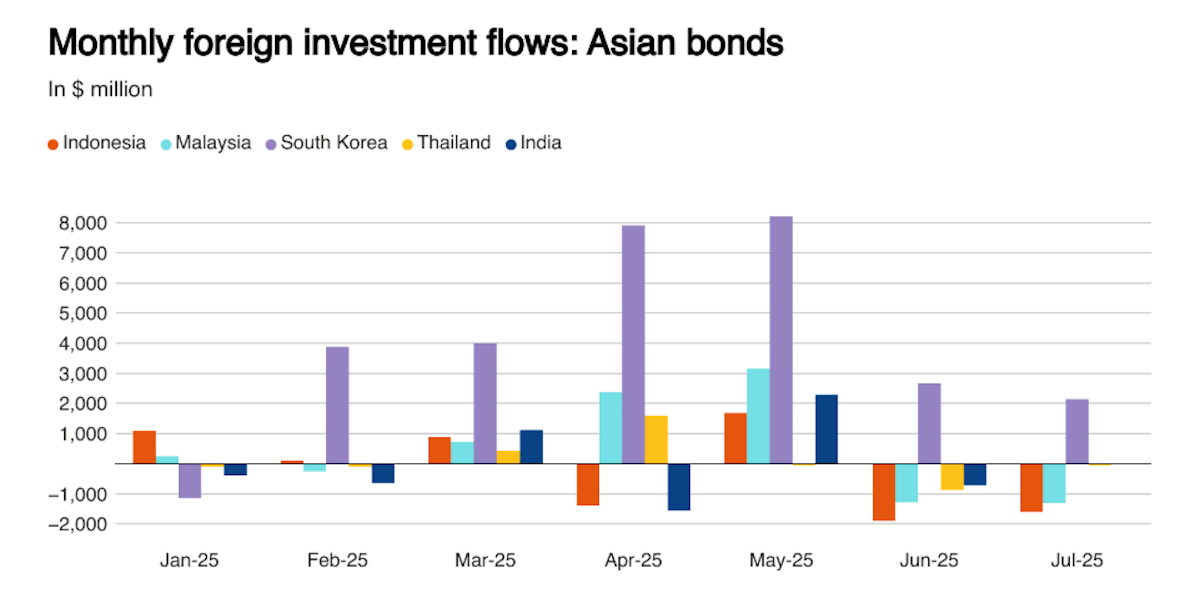

✨ As you can see below, foreign investors also piled into Asian bonds earlier in the year from March to May, though that buying has slowed since then.

Foreign Buying of Asian Bonds - Reuters

📊 The Dividend Investment Dilemma

These interest rate swings have kept income-focused investors on edge for the past few years.

When “risk-free” government bonds yield 4–5%, dividend stocks yielding the same can lose their sparkle.

However, there have been some bright spots:

- ⚡ Utilities have rallied as electricity demand heats up.

- 🌍 Bluechips have benefited from a weaker USD.

- 🚀 A handful of riskier , high-yield stocks in hyped-up sectors.

But the usual go-to sectors for income, like Energy, Real Estate, Healthcare, and Consumer Staples, have struggled to deliver.

And the outlook going forward is pretty divided.

A lot hinges on the next employment reports and the US Supreme Court’s tariff ruling . But, even if rates fall, how low can they realistically go, and what will they look like over the next decade?

This is a timely reminder: clarity of your objectives is everything.

- 💸 Are you chasing short-term yield ?

- 🏦 Or building a long-term income portfolio ?

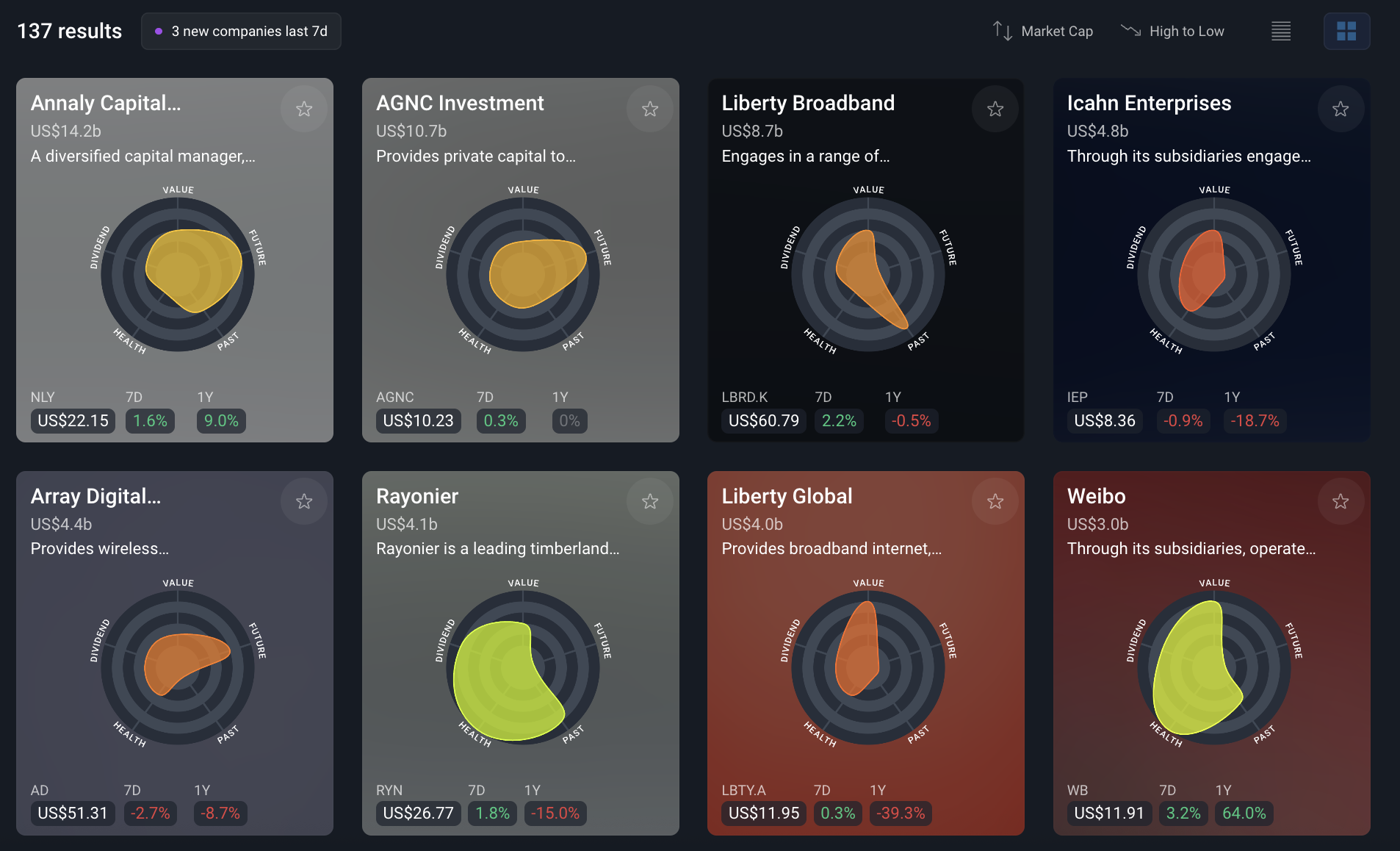

This US High Yield Stocks screener we’ve made shows that in the US, there are currently 137 companies offering dividend yields above 10% (and 1,021 stocks if you look globally).

⚠️ But remember: whether those yields are sustainable is an entirely different question. So you need to add more criteria.

US Stocks with dividend yields over 10% Simply Wall St

Those big, juicy dividend yields often look irresistible… but to avoid getting burned, you need to look under the hood.

In many cases, companies hand out chunky dividends not because they’re rolling in cash, but because they have to . Once they’ve built up a track record of paying dividends, their investor base builds the expectation of dividends, which they need to meet if they want to keep them around.

And if the music stops, if they can’t actually pay what they promised, the share price tanks as those investors lose faith, wiping out years of those “reliable” payouts in one go.

👉 The bottom line is: chasing high yields only works if you really know the business inside out.

Now, building a dividend portfolio for the long haul is a different story. It’s less about today’s headline yield and more about a company’s ability to generate and sustainably pay out cash over the next 5, 10, even 20 years.

In other words, spotting tomorrow’s cash cows.

🔍 Finding and Analyzing Dividend Stocks for the Long Run

Firstly, there are a few different types of dividend-yielding stocks to consider:

- 💰 The Cash Cows

- These are mature companies pumping out more cash than they can reinvest. They may not be growing as fast anymore, but they can still throw off serious income for years, sometimes decades. Think Coca-Cola .

- 📈 Dividend Growth Plays

- Businesses with room to expand earnings and increase their payout ratio. Today’s modest yield could turn into tomorrow’s fat income stream. Think Mastercard and Visa , in the early 2000s.

- 🤑 Capital + Dividends Combo

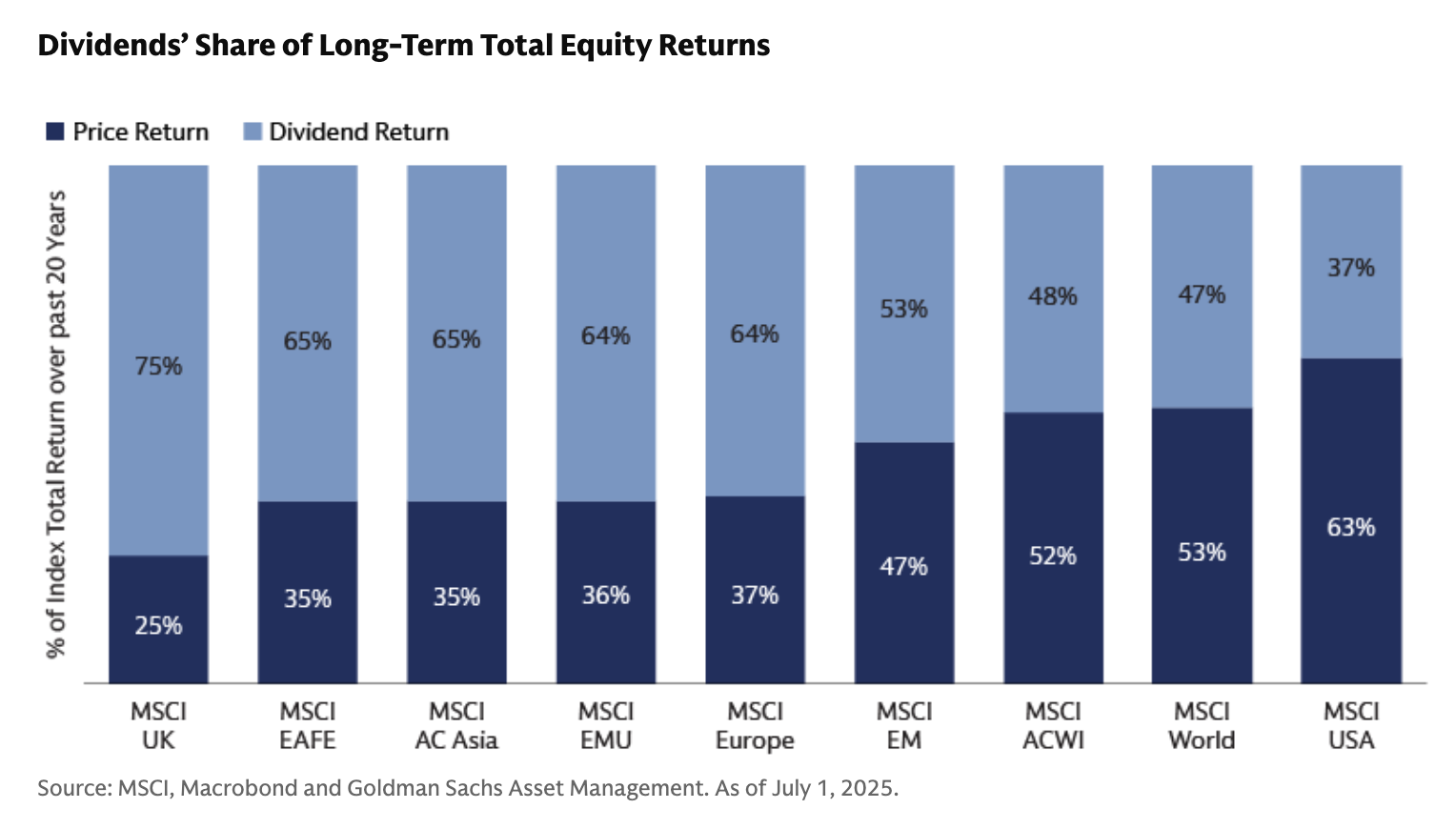

- Some of the best long-term returns come from a mix of rising share prices and dividends. Think of Apple in 2016 when the yield was 2.4% . If you bought back then and held to now, you’re receiving a 4.4% yield on that initial purchase price , AND the share price has increased by 8.5x . It’s hard to get that kind of performance from a bond. In certain markets, dividends have historically been a huge slice of total returns:

Dividends’ Share of Long-Term Total Returns - Goldman Sachs Asset Management

Picking dividend stocks for the long run requires both quantitative and qualitative screening.

It’s usually easier (and quicker) to start with a quantitative screen to come up with a shortlist, and then move on to the qualitative aspects.

This is where the Simply Wall St Stock Screener and the company reports come in.

🔍 Stock Screener:

-

Profitability ratios:

- Metrics like ROE , ROA , and ROCE (which we mentioned last week ), as well as profit margins , are a great place to start.

- Is this a cash-generating business?

-

Growth: If a company has stopped growing, it should be profitable and those profits need to be defendable (aka: a moat).

-

🏰 Balance Sheet:

- How much debt?

- Can they handle it long term?

- It’s a big red flag if dividends rely on borrowing.

-

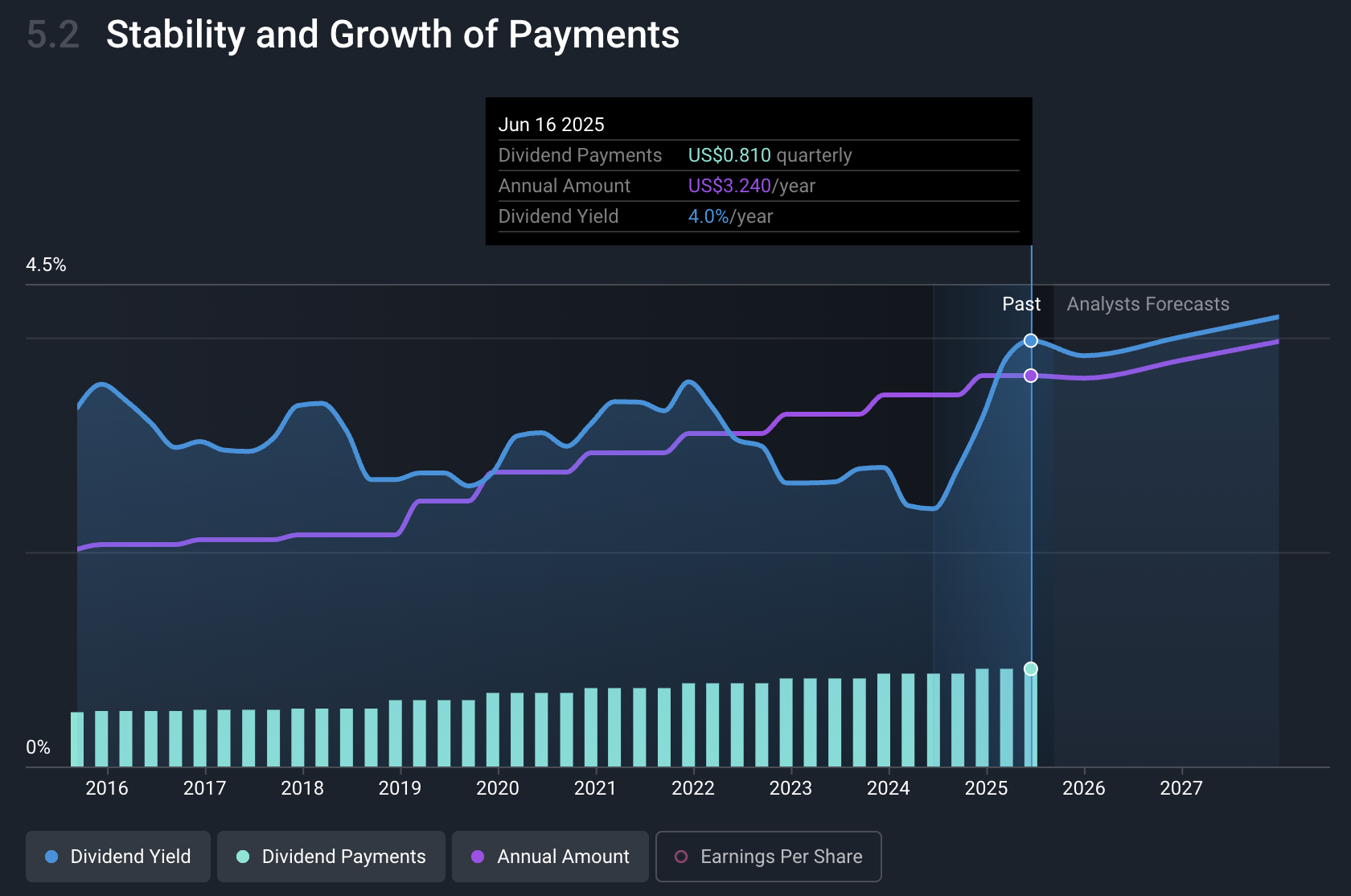

💸 Dividend Metrics:

- Focus on the forecast yield , not the current yield .

- Check the payout ratio (ideally under 40%, though higher for certain sectors like REITs).

- Look at dividend growth history. Have payouts been rising consistently over 3, 5, or 10 years?

We’ve built a screener to find these exact companies. While it sets the bar pretty high, that explains why there are currently only 4 US stocks that meet these criteria.

From there, you can check out further analysis on the company report to see:

- 📊 Dividend Yield vs. the Market

- How high is the current yield?

- What’s the forecast looking like?

- Are they beating the market average or trailing behind?

- 📈 Payout Consistency

- Have dividends been steady and on the rise? That’s a good sign.

- 🚨 But if payouts have been all over the place, consider it a red flag. Past volatility could spell future surprises (and not the good kind).

- 💸 Share Buybacks

- Don’t forget to check for buybacks. They might fly under the radar, but they’re a key part of the total shareholder return story.

Merck Dividend History Simply Wall St

Dig Deeper (Qualitative Check)

Next comes a qualitative analysis - again, some of the points we touched on last week come in here . The numbers matter when looking at the past and present, but the intangibles and market position matter when you’re looking into the future.

🎯 Quality stocks are generally those with a sustainable competitive advantage.

💡 The Insight: More Uncertainty = More Reason to Diversify

As mentioned, there’s a lot riding on upcoming economic data and on the Supreme Court decision on tariffs:

- That could mean tariffs are seriously curtailed - but as the WSJ points out, if the court sides with Trump, it could give him even more ‘fiscal power’ .

With so much uncertainty, having all your eggs in one basket (i.e. sector) is a bit like playing roulette.

Different backdrops favor different winners. A few areas to keep on the radar:

- 🏦 Banks : Steeper yield curves = juicier margins.

- ⛽ Oil & Gas : Today’s oversupply could set up tomorrow’s tighter production. Plus, oil doubles as a hedge against global tensions.

- ⚡ Utilities : Electricity demand isn’t disappearing anytime soon.

- 📦 Govt-backed plays : Any sector with policy support is worth a look.

Final Note: Don’t FOMO the Dividend Chase

You don’t need to chase every yield. If you want to wait for better entry points, the Vanguard Short-Term Treasury ETF currently yields over 4%. That’s better than earning nothing while waiting for better opportunities and entry points.

Key Events During the Next Week

Tuesday

-

🇬🇧 UK Unemployment Rate

- ▶️ Forecast 4.7%, Previous 4.7%

- ➡️ Why it matters: Any uptick in unemployment would strengthen the case for more aggressive rate cuts.

-

🇨🇦 Canada Inflation Rate YoY (Aug)

- 📈 Forecast 1.8%, Previous 1.7%

- ➡️ Why it matters: With inflation below 2%, it would take a much bigger spike to warrant action from the central bank.

-

🇺🇸 US Retail Sales YoY

- 📉 Forecast 3.2%, Previous 3.9%

- ➡️ Why it matters: Falling retail sales will be further confirmation of a slowing economy.

Wednesday

- 🇺🇸 US FOMC Interest Rate Decision

- 📉 Forecast 4.25%, Previous 4.5%

- ➡️ Why it matters: Fed fund futures imply a 92% chance of a 0.25% rate cut. The real impact will come from any hints about possible rate cuts in October and December.

Thursday

- 🇬🇧 UK BOE Rate Decision

- ▶️ Forecast 4%, Previous 4%

- ➡️ Why it matters: UK inflation has risen steadily over the last year, and the BOE is expected to keep rates at 4% for now.

Friday

- 🇬🇧 UK Retail Sales YoY (Aug)

- 📈 Forecast 1.5%, Previous 1.1%

- ➡️ Why it matters: This would be the third consecutive uptick in retail sales - good for the economy, but contributes to rising inflation.

Just a few notable companies reporting this week, but plenty of small caps:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.