Quote of the week: “Investors should bear three things in mind: The enormous likelihood that AI and related developments will change the world… the possibility that it is different for some companies… but also the fact that in most new, new things, investors tend to treat far too many companies (and often the wrong ones) as likely to succeed.” Howard Marks

Stocks keep climbing to fresh highs, and naturally, the whispers about stretched valuations and another looming bubble are back.

Here’s the catch, though: for the past decade, “buy the dip” has been a winning move, while selling an “ expensive ” market has mostly just meant sitting on the sidelines and missing out.

That leaves investors stuck in a classic dilemma: ride the wave or bail out before things look too frothy?

Howard Marks, the co-founder and co-chairman of Oaktree Capital Management, digs into this exact puzzle in his latest memo. So this week, we’re breaking down his key takeaways and explaining how you can navigate this market with the right mindset and tools. We've made a screener at the end which will help.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

👨⚖️ Alphabet soars on court ruling that doesn’t force the search giant to sell Chrome ( Sherwood )

- Alphabet dodged a bullet as the court ruled it broke antitrust laws but stopped short of forcing a Chrome or Android divestiture. Shares jumped, and analysts quickly raised price targets .

- Exclusive search deals, like the $20B/year Apple agreement, can no longer be exclusive, but they are allowed to continue - Google can still pay partners to preload its products. That keeps Apple’s services revenue engine humming.

- Apple also got a lift, since it can still cash Google’s checks without exclusivity clauses. No forced search shakeup means less disruption for both firms.

- The biggest win: Google avoids major structural changes while competitors get limited data-sharing crumbs. Regulators may push harder in the upcoming ad tech case. Add Alphabet to your watchlist to receive all the latest news, narrative updates, and insights from us.

- Google keeps its core intact and its $26B search deal machine running. Investors betting on a breakup can stand down, for now.

📈 Gold price hits record high as investors seek safe haven ( The Guardian )

- Gold breaking above $3,500 signals a deepening loss of confidence in traditional safe havens like US Treasuries. Central banks are cutting exposure to US debt and ramping up gold reserves instead.

- Soaring long-term yields in the UK, France, and Germany are making borrowing more expensive just as political pressure mounts. Investors are starting to price in fiscal instability, not just inflation.

- The pound’s sharp drop and the FTSE’s decline show that markets are uneasy ahead of the UK’s autumn budget. Europe followed suit, and Wall Street joined the slide after the Labor Day break.

- With the dollar soft and the Fed expected to cut rates this month, pressure is building on central banks to diversify further. Gold is now the second-largest reserve asset after the dollar—and still climbing.

- Silver is also heating up, hitting its highest level since 2011. With the gold-silver ratio still elevated, some analysts believe silver may offer more upside in the near term.

- Since central banks are making moves into gold, that’s a signal to investors that owning some may no longer be optional.

⚖️ The market winners and losers if tariff ruling holds ( Axios )

- A federal appeals court ruled Trump’s global tariffs were illegal, but sectoral tariffs are still on the table, and the decision won’t take effect until October.

- Retail giants like Walmart , Home Depot , and Nike could rally if broad tariffs are lifted. Lower import costs = fatter margins.

- Southeast Asia stands to gain the most, especially in transshipping, with potential margin jumps above 60%.

- Auto makers like Ford and GM won’t catch a break—Section 232 tariffs are untouched, leaving them stuck with billion-dollar tariff bills.

- Other sectors like semiconductors, furniture, and critical minerals may still get hit with targeted levies, keeping pressure on input costs.

- If tariff revenue drops, Trump may double down on sectoral tariffs to shore up fiscal optics. That’s bad news for bond markets banking on that income.

- If the ruling sticks, retailers and Southeast Asia win big. But don’t count on tariff relief across the board, because Trump still has tools, and markets know it.

💸 Alibaba shares jump 19% on cloud unit acceleration, report of new AI chip ( CNBC )

- Alibaba’s 19% rally in Hong Kong was powered by its cloud division, which grew 26% year-on-year, outpacing previous quarters and putting it firmly in the AI spotlight.

- A new in-house AI chip is also helping boost sentiment, signaling Alibaba’s intent to compete with US tech giants in monetizing AI through cloud services.

- While revenue missed expectations, net income beat forecasts with a 78% surge, showing solid margin discipline even amid heavy investment in instant commerce.

- The company is leaning hard into one-hour delivery via Taobao, a costly but potentially sticky play in China’s brutally competitive e-commerce arena.

- Alibaba’s cloud and AI momentum is pulling investor focus away from top-line misses. Analysts still see modest upside ahead. If execution holds, this could be the beginning of a re-rating.

📉 Warren Buffett says he is ‘disappointed’ in Kraft Heinz split; shares fall 7% ( CNBC )

- Kraft Heinz is breaking back into two companies, but Buffett isn’t cheering. With Berkshire holding 27.5%, his public disappointment drove shares down 7%.

- The merger with 3G Capital never delivered—packaged food demand fell, cost-cutting starved brands, and the stock lost nearly 70% of its value since 2015. We’ve summarised some of the points from the pessimistic analysts in more detail in this narrative.

- Splitting Kraft Heinz may not fix structural issues like shifting consumer tastes and lagging brand investment. Buffett flatly said dismantling won’t solve the core problems.

- For Berkshire, Kraft Heinz remains a painful, illiquid bet—it can’t exit easily without flooding the market or taking a reputational hit.

- The Kraft Heinz breakup doesn’t reset the table. It highlights how little room the brand has left on investors’ plates.

🚘 Google’s Waymo now has 2,000 autonomous cars in service, while Tesla has about 30 ( Sherwood )

- Waymo has scaled up to more than 2,000 autonomous cars across five markets, dwarfing Tesla’s ~30 in Austin. The gap in fleet size makes Musk’s “millions of Teslas” forecast look increasingly ambitious.

- Tesla covers more ground in Austin (173 square miles vs. Waymo’s 90), but Waymo deploys three times as many cars there, meaning more rides, more data, and faster iteration.

- Surveys indicate that consumers overwhelmingly want lidar in the mix, which aligns with Waymo’s model, while Tesla’s camera-only bet is at odds with public sentiment and potentially regulators.

- Tesla’s Austin rollout remains invite-only with safety monitors, while Waymo is already operating at scale in San Francisco, Phoenix, LA, and Atlanta.

- Tesla’s robotaxi experiment is still a small pilot, while Waymo is running a real business. Investors banking on Tesla’s autonomy story will need patience and faith.

🧮 The Calculus of Value

Howard Marks of Oaktree Capital has a knack for dropping market wisdom in his memos. We previously highlighted two gems: Sea Change and Easy Money .

His latest memo, The Calculus of Value , dropped in August and digs into valuations—specifically, how to navigate today’s market when prices look… a little stretched.

It’s worth reading (or listening to the podcast ), but here’s a quick breakdown of the big takeaways.

⚖️ Value vs Price

“Value is what you get when you make an investment and price is what you pay for it.” Howard Marks

- Intrinsic value = the cash an asset can generate today and in the future.

- Price = the market’s consensus guess of what that’s worth right now.

As Ben Graham put it, “In the short run, the market is a voting machine. In the long run, it’s a weighing machine.”

Marks says investors only create real alpha if they’ve got an edge in one of three areas:

- Spotting mispriced assets

- Seeing where the market’s gotten it wrong.

- Forecasting better than others

- Predicting future earnings with more accuracy.

- Catching popularity shifts

- Recognizing when the market is about to re-rate an asset.

If you don’t have an edge in at least one of these , you’re just riding the wave.

And that’s the heart of the question right now:

✨ Have today’s “votes” (aka prices) already run so far ahead that the eventual “weighing” (aka intrinsic value) won’t be able to back them up?

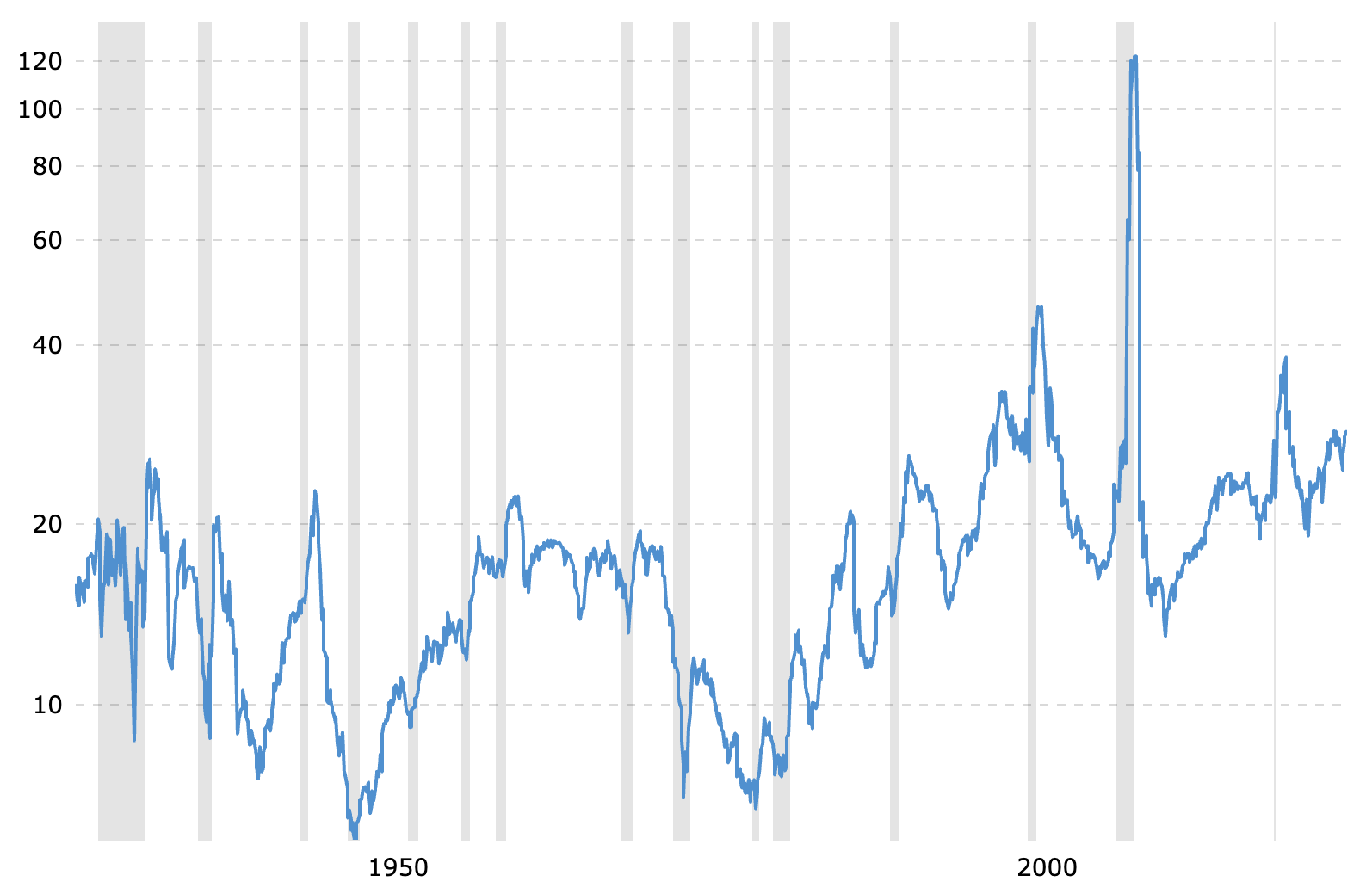

S&P 500 P/E Ratio 1928 to 2025 MacroTrends

📅 The Current State of Valuations

By almost every metric, US stocks look pricey. Here’s why:

- S&P 500 forward P/E : ~23x

- Historically (between 1987 and 2014), paying 23x forward earnings has led to 10-year annual returns of just -2 to +2% .

- It’s not just the “Magnificent 7” propping up the index. Marks notes that the other 493 stocks are also trading at ~22x.

Other warning lights flashing:

- 📈 Buffett Indicator (market cap / GDP) is at all-time highs.

- 💰 Stocks at 3.3x sales —a record.

- 🧨 Credit spreads razor-thin → investors are shrugging off risk.

- 📉 Dividend yield vs 10-year Treasuries looks unattractive.

- 🐒 Meme stocks & SPACs making a comeback.

It all screams “ risk appetite is alive and well .”

Could it be different this time?

Maybe. Today’s dominant companies are different:

- 💻 Less capital-intensive (however, data centers are challenging that).

- 🌎 More global.

- 🏰 Stronger competitive moats.

- An economy led by software and services arguably deserves higher multiples than one built on smokestacks and steel.

We mentioned a few other reasons when we took a look at the US Market’s ‘Exceptionalism’ Premium .

Marks quotes John Templeton’s famous line: “It’s different this time,” turns out true about 20% of the time. He thinks that percentage might be higher today, but warns against assuming every company deserves that pass.

What about the rest of the world?

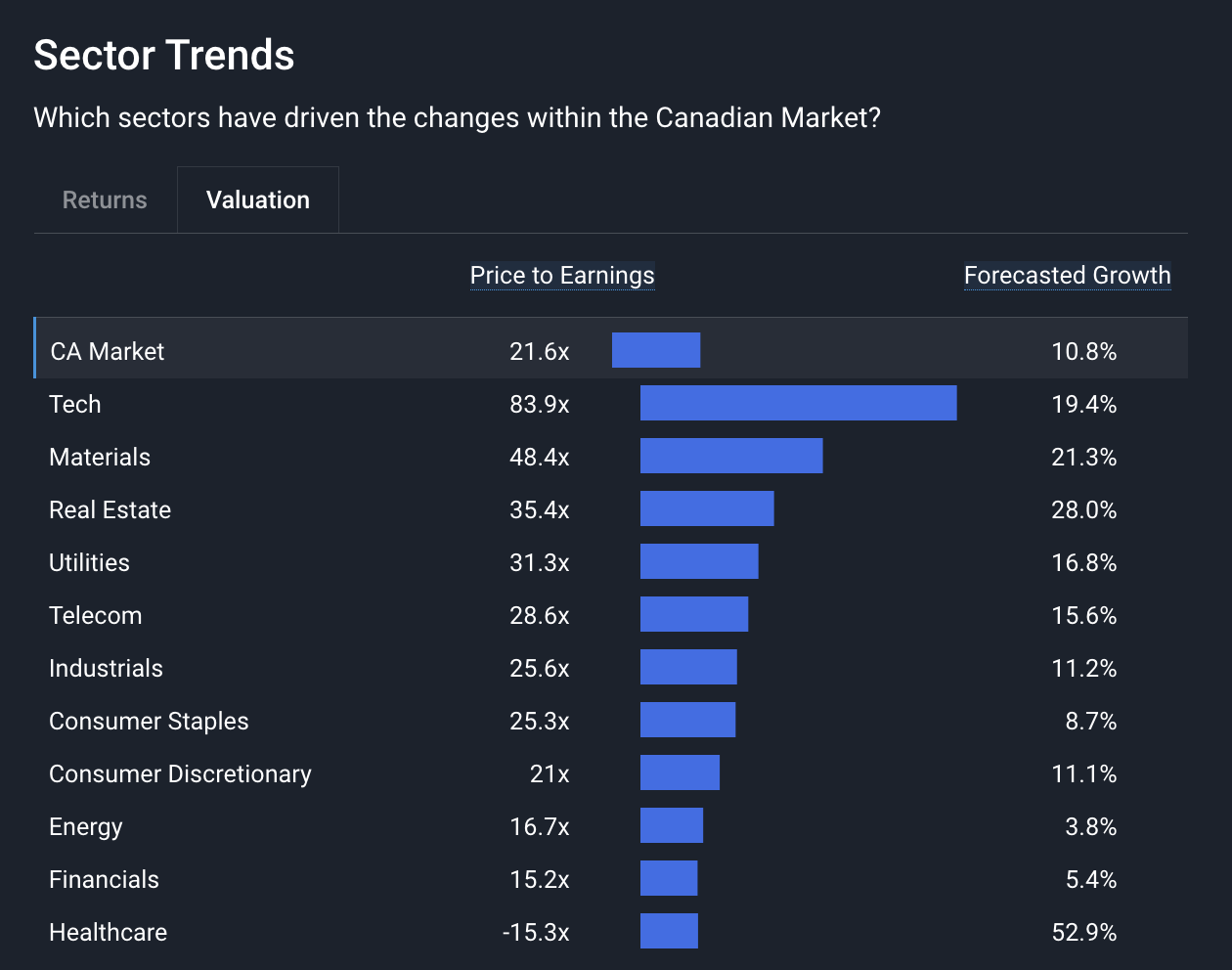

The valuation gap between the US and other markets has narrowed in 2025. In fact, quite a few markets are now trading on valuations that are historically high.

-

The P/E ratios for China and Germany’s stock markets are at the top end of their 10-year range.

-

Meanwhile, the UK , Canada (below), and India are closer to mid-range, but still not screaming bargains.

PEG ratio (P/E ÷ growth), most global markets hover around 2x. Whether that’s fair or expensive depends entirely on whether that growth actually shows up .

Canada: Market P/E vs Forecast Earnings Growth Simply Wall St

🗺️ Navigating High Valuations

“What should you do about it? I consider tactical actions in terms of the spectrum that runs from aggressiveness to defensiveness.” Howard Marks

Whether the market is or isn’t overvalued is subjective. But even if we can objectively prove that it is, it doesn’t mean a downturn is imminent.

✨ Marks’ treats valuation as a tool for risk management, not a market-timing signal.

He draws a parallel with the defense readiness conditions that range from Defcon 5 to Defcon 1 as the risk of a nuclear attack rises, though he adds one more level.

Marks’ version goes like this:

- InvestCon 6: Stop buying ( we assume he means aggressive holdings )

- InvestCon 5: Reduce aggressive holdings, increase defensive holdings

- InvestCon 4: Sell off the remaining aggressive holdings

- InvestCon 3: Trim defensive holdings

- InvestCon 2: Sell everything

- InvestCon 1: Go short

However, he stresses that it’s just about impossible to ever be certain enough to implement the last 3 levels.

So, instead of making binary " all-in " or " all-out " moves, valuations can be used to move along a “spectrum of readiness”. This means calibrating your portfolio, not liquidating it.

✨ In that vein, Marks said in this memo: “…But I have no problem thinking it’s time for InvestCon 5…”.

It’s also easier if you focus on value as a function of long-term earnings power - rather than on price and near-term forecasts, which is exactly what our narratives allow you to do. With our narratives, you’re forecasting earnings power out 3, 5, or 10 years from today, which helps you to do what many investors don’t do: think long term.

🧠 Incorporating Intangibles in a Valuation

“A company's earning power almost always exceeds the sum of the earning power of each of its individual assets taken in isolation. Combining individual assets to maximize a company's overall earning power is the top job of management. When successful, the result is synergy, the benefit gained from skillfully combining things.” Howard Marks

Marks emphasizes one thing above all: long-term earnings power .

That’s often driven by intangibles , which are much harder to measure:

Some intangibles, like patents , trademarks , and brand , can be bought and sold - and to an extent valued.

Others are even more difficult to define, or value - but they play a huge role in a company’s long-term earnings power. These include:

- 👩💻 Culture and the ability to attract talent

- 🔬 Trade secrets, research capability, and know-how

- 👨💼 Management skills and reputation

These assets build competitive moats, boost margins, and fuel growth.

Durability and breadth are two factors that can help companies grow earnings at above-average rates over the long term.

- 🌎 Breadth : the ability to apply skills, resources, and distribution across multiple arenas (think Amazon, Alphabet, Microsoft).

- 💸 Durability : the ability to reinvest cash flows at above-average returns.

✨ Companies with both often deserve premium valuations.

So, how do you identify companies with these attributes?

💡 The Insight: The Numbers Can Reflect The Intangibles

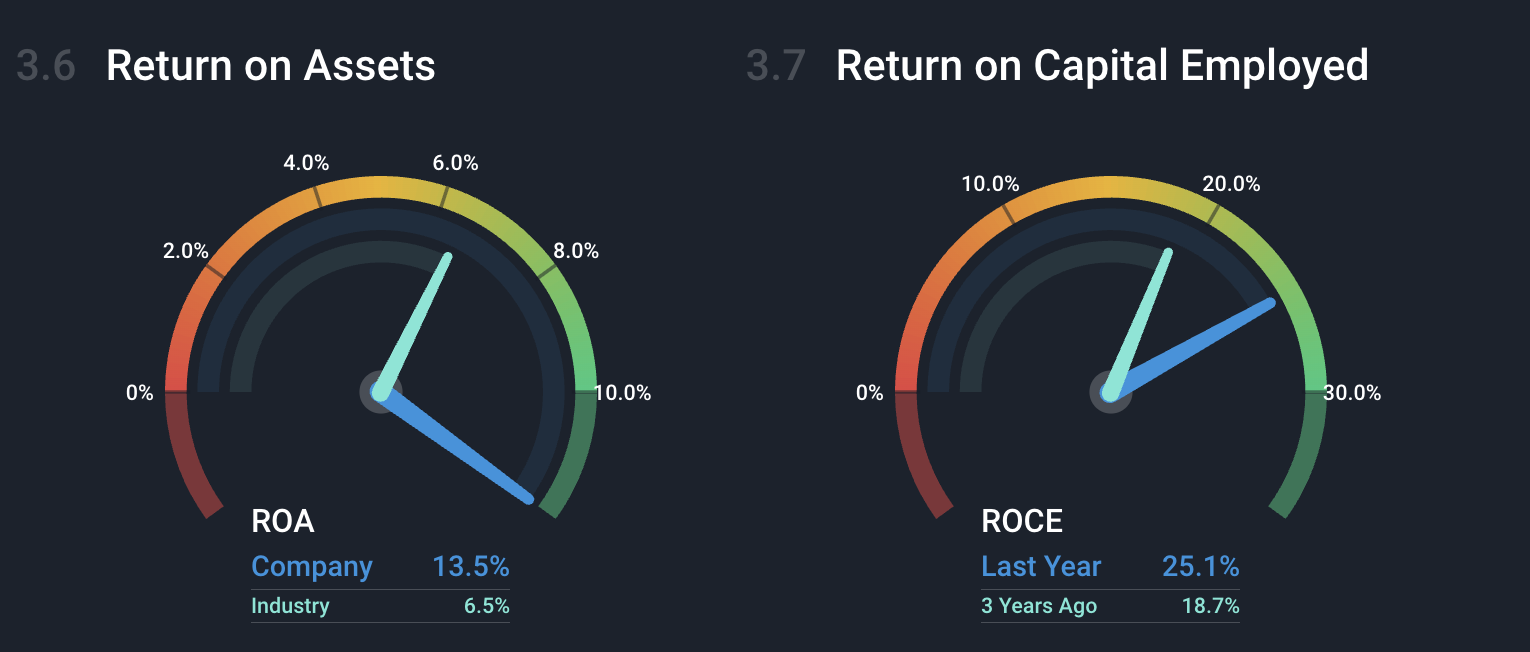

Metrics like ROE (return on equity), ROA (return on assets), and ROCE (return on capital employed) are a great place to start.

These reflect a company’s ability to generate returns on its assets and the capital they are reinvesting in the business.

You can think of these metrics in three ways:

- Is this return better than low-risk alternatives (like bonds)

- How does it stack up against peers?

- Has it been improving—and is it likely to keep improving?

The Simply Wall St company reports compare ROA to the industry average, and ROCE to the level three years ago. You can also see an estimate for ROE in three years time.

PDD Holdings ROA and ROCE - Simply Wall St

The chart above shows us that PDD Holdings' ROA is high relative to its industry, and ROCE has improved in the last three years.

But the big question is—are these trends the result of durable, intangible advantages? Or just temporary tailwinds?

That’s the real calculus of value: figuring out which companies are built to compound earnings for the long haul.

You can use our powerful stock screener to filter companies by ROE, ROCE, and ROA, and then look at the qualitative attributes.

To start your search for companies that Marks would approve of, check out this screener , which filters companies with ROCE above 15% and high value and past performance scores. Save it, then add any additional metrics you’d like to refine your search even further.

Key Events During the Next Week

Wednesday

- 🇺🇸 US PPI MoM

- 📉 Forecast 0.6%, Previous 0.9%

- ➡️ Why it matters: A drop suggests tariffs may be having less impact on inflation than feared.

- 🇪🇺 ECB Interest Rate Decision

- ⏸️ Forecast 2.15%, Previous 2.15%

- ➡️ Why it matters: A surprise cut would signal growing concern over the Eurozone economy.

Thursday

- 🇺🇸 US Inflation Rate YoY

- 📈 Forecast 2.8%, Previous 2.7%

- ➡️ Why it matters: A hotter print could reignite tariff-driven inflation fears and delay Fed cuts.

Friday

- 🇬🇧 UK GDP MoM

- 📉 Forecast 0.1%, Previous 0.4%

- ➡️ Why it matters: A slowdown adds to recession worries and boosts the case for BoE easing.

- 🇺🇸 US University of Michigan Consumer Sentiment Index

- 📉 Forecast 57.0, Previous 58.2

- ➡️ Why it matters: Weakening sentiment points to cautious consumers and slower spending ahead.

Earning season is winding down, but there are still a few prominent tech companies and retailers due to report:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.