- France

- /

- Basic Materials

- /

- ENXTPA:NK

Imerys (ENXTPA:NK): Rethinking Valuation as Investors Notice Subtle Shifts

Reviewed by Simply Wall St

Imerys (ENXTPA:NK) has moved quietly on the radar this week without any headline-grabbing events, but its latest price action is still catching the attention of seasoned investors. Sometimes, when there’s no big announcement or obvious catalyst, these steady shifts can signal something brewing just below the surface. If you follow the stock closely, you know that sometimes the absence of news is itself worth investigating, especially when it prompts you to revisit the fundamental drivers of value.

Looking over the past year, Imerys has struggled to find its footing, with its stock experiencing a steady slide reflective of broader uncertainty around its sector. Even though recent momentum has been flat, it follows declines both in the shorter term and stretching back over several years. That said, revenue did see modest growth this year, and net income bounced back sharply, suggesting the company is navigating some operational challenges with renewed focus.

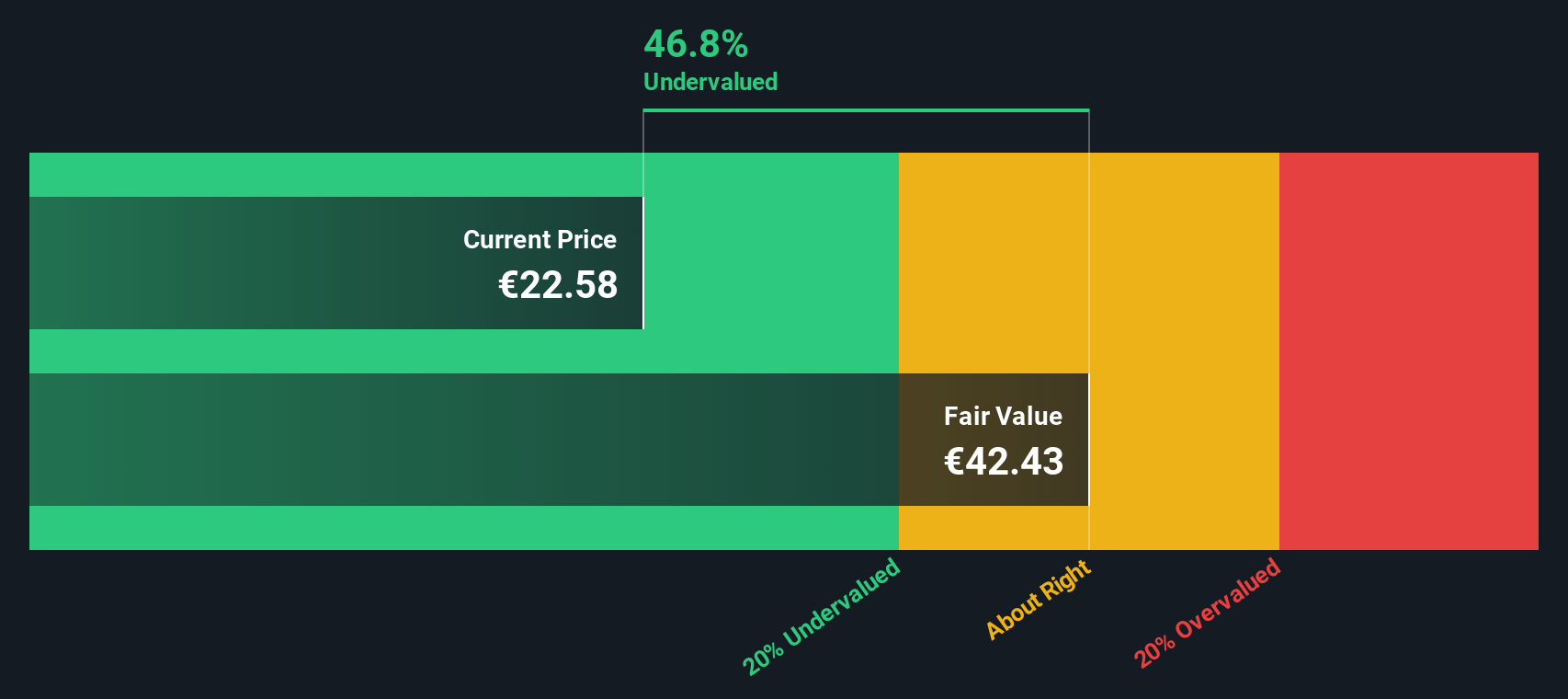

After a year marked by gradual declines and only occasional signs of stabilization, the real question is whether Imerys is trading below its true value or if investors have already priced in any hints of future recovery.

Most Popular Narrative: 21% Undervalued

According to the most widely followed narrative, Imerys shares are trading well below their estimated fair value. Analysts expect material upside over the next several years if the company's ambitious targets materialize.

Imerys is well-positioned to benefit from the rapid expansion of electric vehicles and battery storage. This is demonstrated by robust growth in its Graphite & Carbon business and the strategic EMILI lithium project. These factors should drive revenue and margin improvement as lithium demand and prices recover toward the end of the decade.

This valuation is not just built on vague optimism. There are bold growth assumptions, margin improvements, and a future profit multiple that might not be expected from a materials firm. What critical forecast could be fueling this big value gap? Find out which performance targets and financial milestones analysts are betting on to unlock significant upside for Imerys.

Result: Fair Value of €27.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent low lithium prices or a prolonged downturn in key end-markets could undermine these optimistic projections and challenge the current valuation narrative.

Find out about the key risks to this Imerys narrative.Another View: What Does the DCF Say?

Taking a different angle, the SWS DCF model suggests Imerys is still undervalued based on its underlying cash flows. However, DCF models can be sensitive to future assumptions. Which lens gives the clearest view?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Imerys Narrative

If you see things differently or like to dig into the numbers on your own terms, you can quickly build your own perspective from scratch. Do it your way

A great starting point for your Imerys research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don't let your next big winner slip through your fingers. Unlock game-changing stocks, untapped themes, and the latest financial trends by making a few smart choices listed below.

- Fuel your portfolio’s growth by seizing hidden bargains found with our undervalued stocks based on cash flows.

- Tap into tomorrow’s technologies and take advantage of the AI-powered boom through our handpicked AI penny stocks.

- Collect reliable income streams when you uncover steady earners among dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:NK

Imerys

Engages in the supply of specialty minerals for various industries across Europe, the Middle East, Africa, Asia Pacific, and America.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives