Quote of the Week: “In any diversified portfolio, there will be both winners and losers, and the consideration that should determine which you should sell, if any, is certainly not the price at which you bought it originally.” ― Daniel Kahneman

The market’s latest pullback is getting pinned on the escalating trade war. Tariffs are dominating the headlines, right alongside sinking GDP forecasts.

But beneath the surface, there’s a growing unease about valuations and earnings.

So this week, we’re diving into that side of the story, how valuations and earnings fit into the bigger picture of tariffs, growth, inflation, and interest rates.

Sure, we’re mostly talking about the U.S. market here, but trust us, this matters everywhere.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🚀 Surge in war spending sends European defense stocks soaring ( Forbes )

- With U.S. military aid to Ukraine on hold, Europe is going all in on defense, fueling a surge in arms stocks.

- Germany is leading the charge, while the EU unveiled an $840 billion plan to modernize its military capabilities.

- European defense stocks are soaring, Leonardo , Thales , and Rheinmetall have seen massive gains as investors bet on long-term demand.

- The global defense landscape is shifting fast, and investors are piling into military stocks. Depending on how the situation unfolds in Europe, this may not just be a short-term play, it could be a structural realignment.

-

📉 Kohl’s tumbles after dividend cut and weak sales warning ( Sherwood )

- Kohl’s shares took a beating as it slashed its dividend and warned of weaker sales, with shares diving up to 20%.

- Lower-income shoppers are pulling back on spending which is pressuring sales despite an earnings beat.

- The retailer’s guidance for 2025 is a gut punch because projected earnings are well below even the most bearish forecasts.

- Overall, the consumer squeeze is real, and Kohl’s isn’t alone. It seems like retailers reliant on discretionary spending are facing a rough road ahead.

-

🇪🇺 Europe retaliates against Trump’s 25% tariffs on steel and aluminum imports ( CNBC )

- The EU is firing back at Trump’s 25% steel and aluminum tariffs with counter-tariffs on $28 billion worth of U.S. goods.

- The trade war is heating up, spooking markets as investors worry about supply chain disruptions and rising costs.

- Trump’s push for “reciprocal tariffs” could mean more economic turbulence ahead, especially for industries reliant on transatlantic trade.

- We as in vestors should be ready for further volatility because this trade spat isn’t just about metals, and it could have many flow-on consequences in multiple different industries and markets.

-

🥱 Adobe shares fall as dull forecast raises AI monetization doubts ( Reuters )

- Adobe’s revenue outlook matched expectations, which was great, but investors weren’t thrilled about its forecasts, so the stock dropped 4% in extended trading.

- Investors were concerned about how fast Adobe could monetize its AI offerings because so far, its AI-driven revenue remains modest, despite heavy investment.

- The company mentioned it’s expecting to double its AI-related annual recurring revenue by year-end, but the market wants results sooner.

- So far, AI investment isn’t translating into immediate dollars for Adobe, which makes sense for any long-term capital expense. However Wall Street is getting impatient. This seems healthy because it could be a case of overly high expectations coming back down to earth and the valuations changing accodingly.

-

💻 Intel appoints Lip-Bu Tan as CEO to orchestrate turnaround ( CNBC )

- Intel, the struggling chipmaker, tapped former Cadence CEO Lip-Bu Tan to lead its turnaround which sent shares up 12%.

- Investors are hoping Tan can revive Intel’s struggling chip business and help it compete in AI, where Nvidia dominates.

- With Intel’s foundry expansion facing skepticism and past leadership shakeups rattling confidence, Tan has a tough job ahead.

- Wall Street loves a fresh start, and Tan has been saying all the right things, but Intel’s turnaround will take more than just a new CEO. It needs results, and fast.

-

✈️ Reduced “corporate confidence” hits Delta Airlines and others hard ( Sherwood )

- Delta slashed its profit forecast, blaming “consumer and corporate confidence” issues, sending its stock, and the airline sector, further down.

- It’s a sign that business travel is slowing, which tells us companies are tightening their budgets beyond just airfare.

- A downturn in corporate travel ripples across hotels, car rentals, restaurants, and even job security as companies look for more places to cut.

- When businesses stop spending, typically layoffs aren’t far behind. This means Delta’s warning may be a canary in the coal mine for broader economic conditions to come over the foreseeable future.

🎢 Trump Tariff Turbulence and Tech Valuations

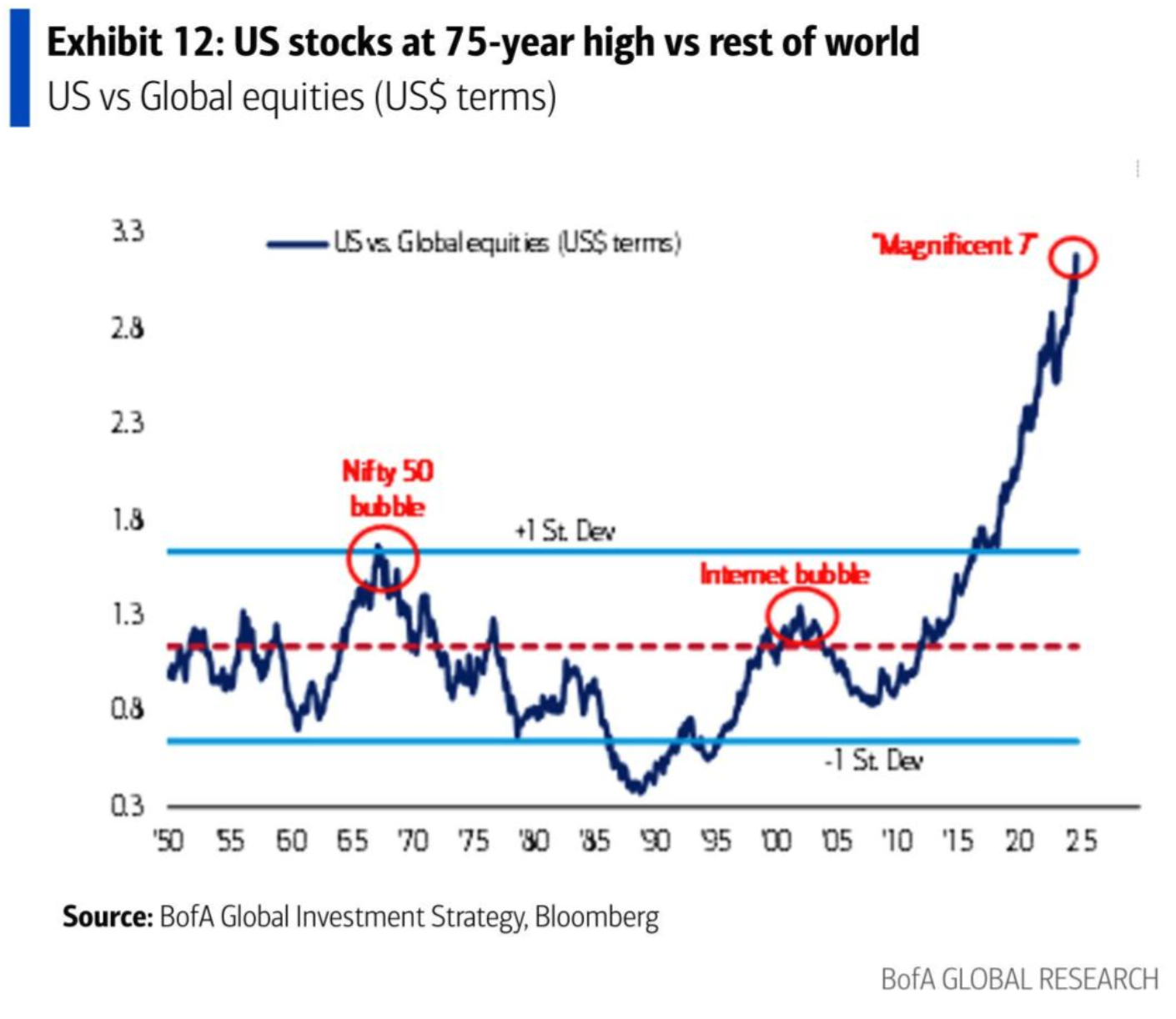

In early February strategists at Bank of America warned that US growth stocks were well into bubble territory.

One of the numbers they pointed to was the ratio of US companies vs non-companies’ market caps - which was then 3.3 standard deviations above its long-run average.

Source: Business Insider

As you can see, for context, at the height of the 1960s and 1990s bubbles, the ratio was less than 1.3 standard deviations above its mean.

✨ The report suggested that growth stocks could drag the S&P 500 index 40% lower if the bubble deflated. To be clear, BofA wasn’t calling for an imminent crash - they were merely warning of the risk posed by valuations.

What’s happened since hasn’t appeared to be related to valuations, or tech stocks, or growth stocks. But the uncertainty created by the prospect of tariffs, and weaker guidance from some consumer-facing businesses has caused risk appetite to evaporate (which we mentioned in the news stories).

When risk appetite disappears, the first stocks to be hit are the ones that have been chased by the ‘hot money’. The chart below shows that last year’s outperformers quickly became underperformers.

On the other hand, some of last year’s underperforming markets have benefited from rotation and USD weakness. The chart shows USD-denominated ETFs - iShares MSCI indexes unless otherwise stated.

Year-to-Date Market Performance to March 12th- TradingView

BofA’s analysis also pointed to the influence of passive investing (i.e. ETFs) on the current structure of major indexes.

Passive investing was in its infancy in the 1990s, and was just beginning to take off in 2008 - so it hasn’t previously been a factor during major shake-ups in the market.

Before the advent of passive investing, most money in the market was actively managed. New money flowed into the stocks that fund managers picked, on the basis of valuation and growth prospects.

When they thought a share was overvalued, they sold it and bought one they thought offered better value. They may have struggled to beat the indexes, but that’s how things worked and that’s how stock prices were generally determined.

Passive investing directs new money into the largest companies in an index. Active decisions being made by individual investors, active managers and hedge funds do affect prices - but a huge chunk of global savings go into passive funds.

✨ Passive funds tend to reinforce the status quo, helping outperforming companies to continue to outperform. It’s worked out very well so far, but maybe that won’t always be the case.

The good news is you don’t have to invest in ETFs - you can choose individual companies on their own merits.

Right, now back to valuations…..

US 10yr Market Valuation and Performance Chart - Simply Wall St

Above we can see that the current market-weighted average P/E for US companies is virtually spot on with the 10-year average of 28.4x.

The US tech sector (below) is now at 41.8x earnings, which is a lot higher than the 10-year average of 33.3x.

There are two things to note about those ratios:

- 🦠The averages were dragged higher during the Covid pandemic when earnings collapsed for a few quarters. Without that period the averages would have been lower.

- For most of the past 10 years, US stocks have been considered expensive . The 10-year average is quite a bit higher than it’s been over any prior period .

US Tech Sector 10yr Market Valuation and Performance Chart - Simply Wall St

Based on historical data, there’s no doubt that the US market is very optimistically valued.

But there is another side to the argument:

- 💪 The index heavyweights like Microsoft , Alphabet , etc are very different from the market leaders of the past. They are more profitable, faster growing, and they have very little debt. They are also less capital intensive - well they were until they started spending 100s of billions on GPUs.

- 🇺🇸 There’s still a strong argument for the US Market’s ‘Exceptionalism’ premium that we covered back in September last year.

- 🤖 If generative AI delivers on its promise, earnings growth could accelerate for an extended period.

✨ On balance, it's probably fair to say there’s a lot riding on the AI trade.

📅 Earnings Season

Earnings season got off to an okay start, but guidance from retailers and airlines (that were reported later) pointed to weakening consumer demand (which we mentioned in the news stories).

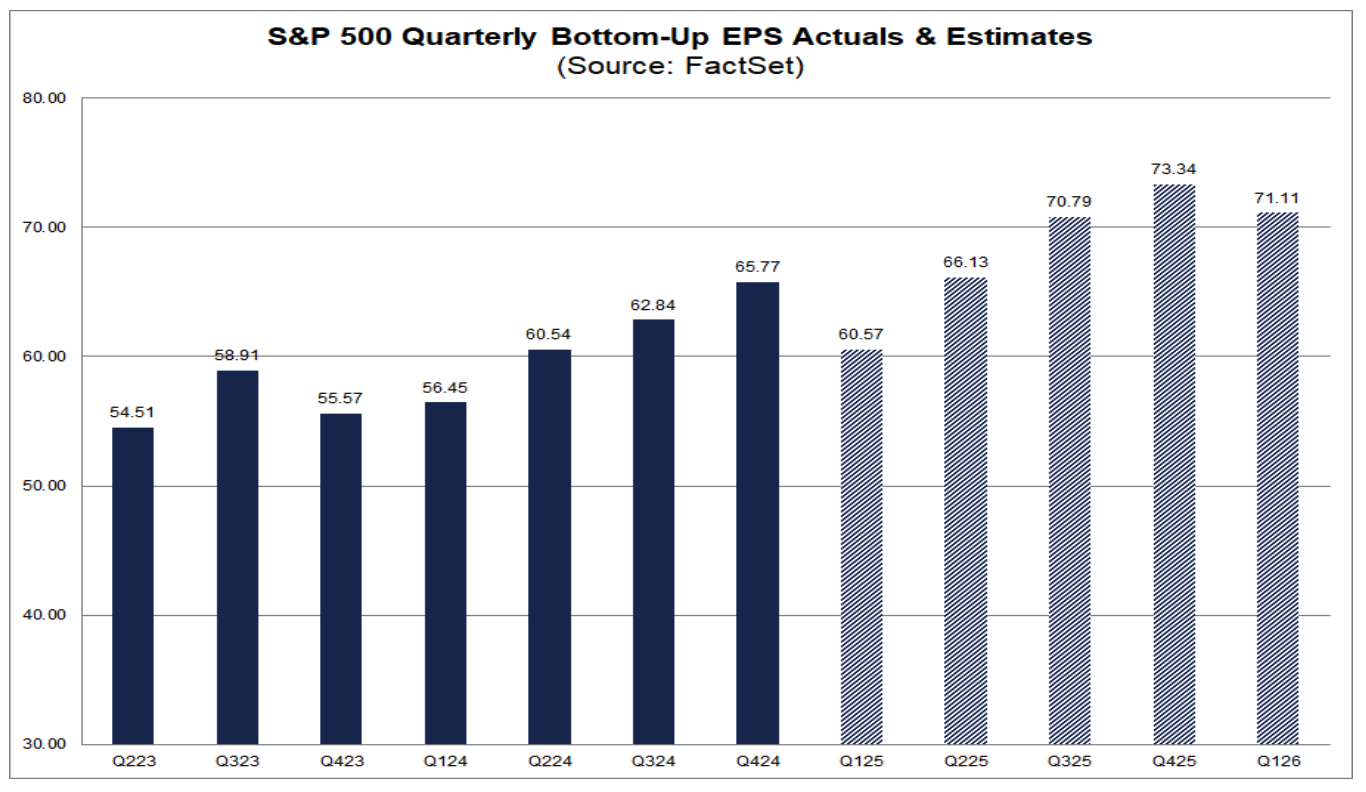

During earnings season, it’s normal for analyst estimates for the current quarter to drift lower. This time around they were cut by 3.5% during January and February according to Factset. That’s more than usual, and they could be cut more by the end of March.

EPS estimates for Q1 now point to the first quarterly decline in 5 quarters. Estimates for the full year were pretty rosy at the start of the year, so there’s now a lot riding on the second half.

S&P 500 Index Quarterly EPS: Actual and Estimated - FactSet (Y-axis is S&P 500 EPS figures)

On the AI front, investors want to see traction amongst end users. The hyperscalers have been building the infrastructure for two years - now it’s time for the applications to start driving revenue growth.

Two of the companies best placed to do that, Adobe and Salesforce , disappointed investors with their Q4 revenue and outlook. That doesn’t mean they won’t deliver in the future, but for now, the jury is still out.

🏛️ What is Donald Trump Actually Trying to Do?

Coming back to tariffs, Donald Trump's antagonistic and haphazard approach to trade policy has a lot of people wondering what he’s up to.

Most economists agree that the widespread use of tariffs is counterproductive and inflationary.

Many now believe that Trump’s actions are deliberate. Lots of theories have been floated, including:

- 🫷Pushing trade partners into a corner to force them to cut their own tariffs on imports from the US.

- 🔄 Forcing a hard reset on the economy to shift the investments from speculation to the ‘real economy’.

- 📉 Orchestrating a recession to bring interest rates down.

✨ We can only speculate on Trump’s intentions, but it is worth mentioning the potential impact of the third theory. A sustained bear market, recession, or financial crisis would allow the Fed to cut rates.

Lower rates would:

- 💰 Allow the US to refinance debt at lower rates. That would bring interest payments down, which would also support the case for tax cuts.

- 💵 Lead to a weaker USD, making US exports more competitive. Imports would be more expensive, as they will be with tariffs.

- 🏘️ Reset the real estate and housing market and make owning a home affordable to more people.

- 📈 Ultimately be positive for growth industries - but probably after a period of pain.

💸 The Fed Put and the Trump Put

When Trump was elected, some analysts suggested there was now a ‘Trump Put’, in addition to the ‘Fed Put’. The first implies that Trump will reverse course if the stock market falls, the second implies that the Fed will cut rates if there's a financial crisis or recession.

With the S&P 500 down ~10% Trump hasn’t blinked . Maybe 20% is the magic number - maybe not. In the meantime, it’s going to be a guessing game.

💡 The Insight: There’s More Than One Way to Diversify

Investors are once again facing a period of significant uncertainty, particularly when it comes to US stocks in general and technology and growth stocks in particular.

But it might be time for some underperforming sectors and markets to shine.

Diversification is often considered a fundamental principle of risk management. Yet, quite a few well-known and successful investors reject the concept and advise investors to stick to a handful of investments. There is some wisdom to their approach.

- It keeps you focused,

- It’s easier to keep track of a handful of companies, and

- It forces you to invest only in high-conviction ideas.

There are a few arguments against that approach, particularly when it comes to individual investors:

- 📈Firstly, investors like Warren Buffett don’t typically invest in growth companies that need to grow at 20%+ for years to justify their valuation. That means the downside is limited because expectations typically aren’t high.

- 🏭🛬 Some highly respected investors specialize in industries they know well. Others travel the world visiting management teams. Either way, they know their investments incredibly well since they have the means to do so as it’s their full-time job.

- Finally, and especially when investors manage their own money, they are often risking capital they don’t need immediately. If you can handle a temporary 80% drawdown, typically being more aggressive on your best ideas makes sense.

So where does this leave us mere mortals? Well here are a few ideas that bridge the gap:

First, two diversification traps to avoid:

- ❗ Owning a ‘diversified’ portfolio of companies that are actually all exposed to the same risks.

- 🤔 Using diversification as a justification to invest in marginal ideas (like your 100th best idea).

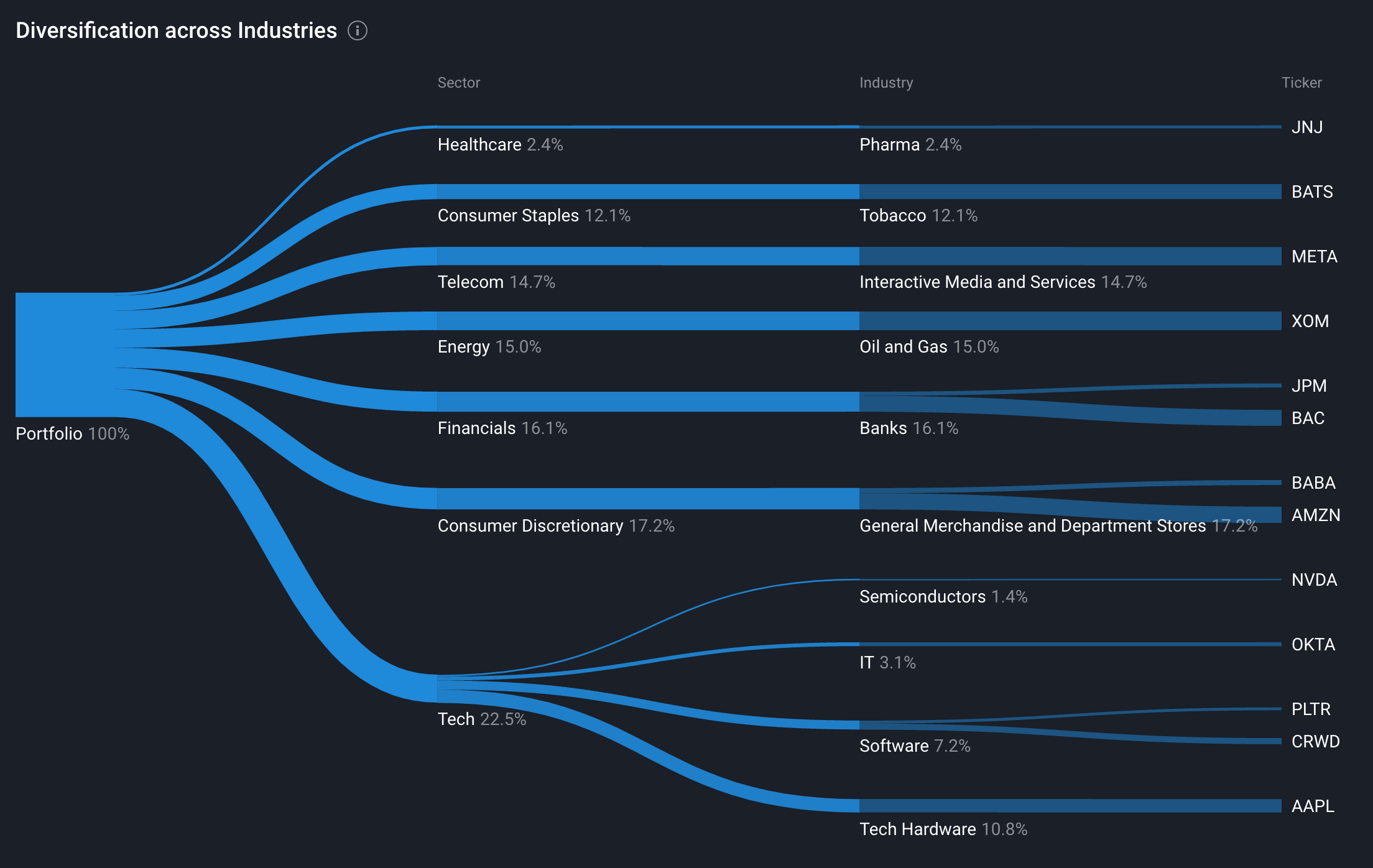

Once you've avoided those traps, you then need to consider how your portfolio is spread across key economic factors:

- 🌍 Regions & Countries – Don’t let all your investments hinge on one market.

- 🏭 Sectors & Industries – AI and cybersecurity might be hot, but what else is in your mix?

- 💱 Currencies – The strength of the USD vs. other currencies can impact your returns.

- 📈 Inflation & Interest Rates – Some investments thrive in high-inflation environments; others crumble.

- ⚡ Energy Prices – A key player in market cycles that shouldn’t be ignored.

Lastly, you need to consider valuations and expectations. A stock can be:

-

📊 Undervalued with low expectations.

-

☀️ “Expensive” but with strong future prospects.

-

⚖️ Fairly valued, offering steady, sustainable growth.

✨ Investments in all three categories can deliver returns over time, but their performance will vary in different market environments.

That’s why it’s so important to have a narrative and fair value estimate behind every single stock you own or want to own. It’ll make your decision-making process for buying, holding, or selling that much easier.

At Simply Wall St we’ve added heaps of these features to our portfolio tool and narratives over the last year that will help you as an investor manage your portfolio that much easier.

To check it all out, simply go to Portfolio on your SWS account, and then either link to your broker, import your transactions, or view the demo portfolio above to see what all the fuss is about.

Key Events During the Next Week

It’s Fed Funds week! Jerome Powell faces the challenge of explaining the committee’s rate strategy in this economic climate.

Monday:

- 🇺🇸 US Retail Sales (Feb) expected to rise 0.5% after a 0.9% dip in Jan.

Tuesday:

- 🇨🇦 Canada Inflation Data – Headline inflation forecast at 2.5% (up from 1.9% in Jan), core inflation at 2.2%.

- 🇺🇸 US Housing Data – Building permits forecast at 1.47M (slight drop from Jan), housing starts at 1.34M (vs. 1.37M in Jan).

Wednesday:

- 🇯🇵 Bank of Japan expected to hold rates steady at 0.5%.

- 🇺🇸 US Fed Decision – No rate change expected (currently 4.5%), but economic projections will be key.

Thursday:

- 🇬🇧 UK Unemployment forecast to remain at 4.4%.

- 🇬🇧 Bank of England likely to keep rates at 4.5%.

- 🇺🇸 US Housing Data – Existing home sales forecast to dip to 4.05M.

- 🇺🇸 Initial Jobless Claims expected to rise from 220K to 225K.

Friday:

- 🇯🇵 Japan Inflation Data – Headline inflation forecast to increase from 4% to 4.2%.

Earnings to Watch:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.