Quote of the week: “Calculus, the electrical battery, the telephone, the steam engine, the radio - all these groundbreaking innovations were hit upon by multiple inventors working in parallel with no knowledge of one another." - Steve Johnson

This week, we’re diving deeper into the world of agentic AI. We’re zeroing in on the core technologies that make these intelligent agents actually reliably work.

Plus, we’ll explore what all this could mean for software, start-ups, and most importantly, the opportunities and risks each industry faces by adopting Agentic AI.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

💰 Big tech beats analyst expectations, some have mixed guidance (Yahoo Finance)

- Amazon beat on earnings and revenue but saw its stock dip 2% after hours, likely due to cautious operating income guidance, which hinted at margin pressure, possibly from new tariffs.

- AWS growth was solid but didn’t excite, especially compared to Microsoft and Google’s blowout cloud results. While AWS revenue is still first place at $111bn for the last twelve months, the “AI hype crown” seems to be shifting to those players growing faster.

- Apple , meanwhile, delivered a clean beat thanks to iPhone, Mac, and Services. Services now make up nearly 30% of revenue, giving it a sticky, high-margin growth engine.

- Meta and Microsoft added a combined $500B in value after incredibly strong earnings reports. Meta’s ad rebound and lighter Reality Labs loss won investors over, while Microsoft’s AI and cloud surge pushed it past $4T in market cap.

- This earnings season is rewarding margin-rich, AI-fueled stories. Amazon may need stronger cloud growth or cost clarity to keep up with Big Tech's rally leaders.

-

🇮🇳 Trump announces 25% tariff on India plus ‘penalty’ for trade with Russia (CNBC)

- Trump’s 25% tariff on India kicks in Aug. 1, with an unspecified “penalty” for its ties to Russia. This revives his aggressive trade stance and could derail US-India trade talks.

- If you’re investing in Indian-exposed sectors like IT services, generic pharma, and consumer goods, watch for supply chain disruptions or cost inflation.

- Companies sourcing from India or manufacturing there (like Apple suppliers or US pharma firms) may need to rethink logistics and margins.

- If Trump follows through on secondary sanctions for Russian energy buyers, India’s industrial and energy sectors could be in the crosshairs.

- This uncertainty may weigh on emerging market ETFs with high India exposure and spark volatility in multinational firms with India operations.

- Check out the sector trends in India’s market . They all have strong growth rates, but with this news, some seem like better opportunities than others.

-

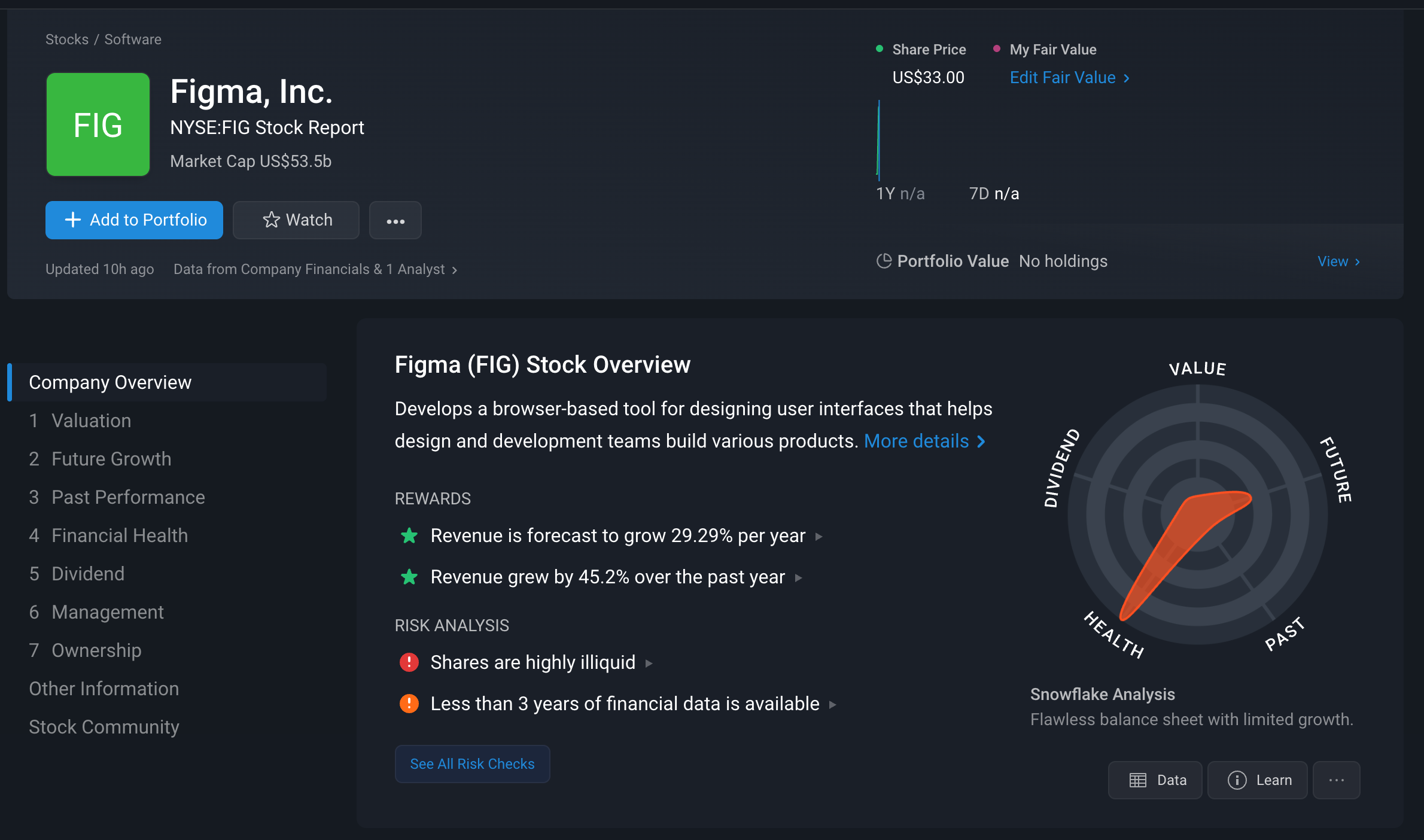

📈 Figma’s 250% IPO pop gives it edge in creative AI software fight (Bloomberg)

- Figma’s 250% IPO pop gives it war chest firepower and strong public market credibility—bad news for rivals like Adobe and Canva.

- Its $65B+ valuation more than triples Adobe’s failed buyout offer, showing strong investor faith in Figma’s growth, pricing power, and AI push.

- Expect M&A: with stock as currency and cash in hand, Figma’s likely to scoop up AI design startups or tools that deepen its moat.

- Creative and productivity software firms could face margin and talent pressure as Figma expands beyond designers into broader enterprise teams.

- Figma’s explosive debut turns it into an AI-native design juggernaut with fresh ammo. Watch for consolidation, expansion, and heat on competitors.

- On a huge IPO like this, make sure you don’t get FOMO and just pile in without first understanding the business's future prospects. Using narratives can help make sure you don’t overpay, so head to the Figma company report and use our templates to create one!

-

🇪🇺🤝 EU reaches tariff deal with US to avert painful trade blow (Bloomberg)

- The EU narrowly avoided a transatlantic trade war by accepting 15% tariffs on most exports to the US, including cars and pharmaceuticals.

- While the agreement calms global markets in the short term, it tilts trade in the US’s favor. European exporters, especially those in the automotive, pharmaceutical, and semiconductor sectors, are facing higher costs and thinner margins.

- The euro’s brief bump and European stock futures’ 1% rise suggest relief, not optimism. Long term, expect shifts in capital allocation, with EU firms possibly eyeing US manufacturing or diversifying export markets.

- Energy, defense, and US infrastructure may benefit from “$600B in European investment”, but the details of that spending are incredibly light, and it likely won’t all be new investment. Regardless, this could potentially benefit US industrials and defense names.

- Europe dodged a bullet, but the ricochet may still sting investors exposed to EU exporters.

-

📦 Trump signs order ending global tariff exemption for low-cost goods (BBC)

- Trump just removed the $800 tariff-free loophole for low-cost imports. As of Aug. 29, all cheap international packages, regardless of origin, will now face full tariffs. This “de minimis exemption” was eliminated for China and Hong Kong, but now the rest of the world is included.

- Chinese retailers like Shein, Temu, and global e-commerce exporters already took a hit when the exemption was eliminated for them back in May. US consumers should expect higher prices on clothing, gadgets, and home goods from other regions.

- Canada and Mexico also lose their carve-outs, so even North American supply chains aren’t safe. Watch retail stocks and cross-border logistics providers for volatility.

- This accelerates what Congress planned for 2027, meaning importers have way less time to adapt. Margins will get squeezed fast.

- Stocks in the US Apparel retail industry seemed to pull back on the news.

🏭 How Agentic AI Could Reshape Entire Industries

Agentic AI has massive potential, but the reality is that it’s a work in progress.

Salesforce , which is one of the companies leading the charge into an agentic future, recently acknowledged that AI agents have some way to go.

In May, the company published a paper pointing out the high failure rate for agents . The paper cited the most common reasons for failure as:

- 🤔 Context loss,

- 🐌 Slow responses,

- 😶🌫️ Hallucinated actions, and

- 🔐 Lack of confidentiality safeguards

In other words, we’ve got the vision, but the execution still needs work.

🌐 The Agentic AI Ecosystem

There’s a big difference between an agentic system that works ‘ most of the time ’ and one that’s ready to be trusted with important decisions and communicating with customers.

This is why the companies supporting the development of agentic systems are important.

🧱 Frameworks and Protocols

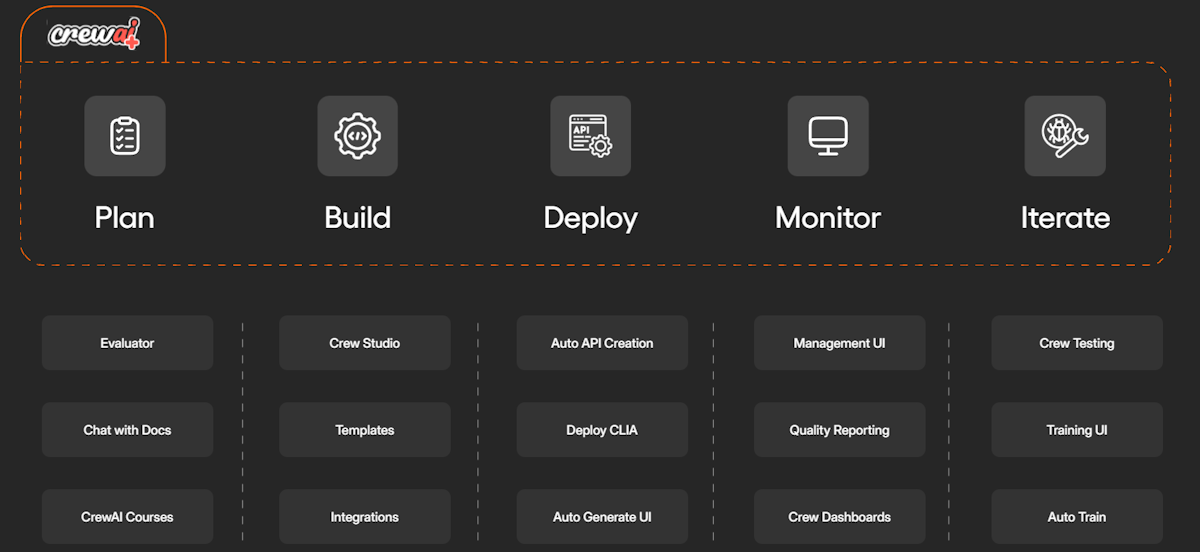

In the past few years, frameworks like LangChain and CrewAI have stepped into the spotlight, giving developers the tools they need to stitch together full-fledged agentic systems.

- The essential role these frameworks play is simplifying the evaluation of agents and the validation of responses.

CrewAI Agent Framework - CrewAI

Protocols are also starting to emerge to bring some order to the chaos. They’re trying to standardize how agentic systems talk, both internally and with each other.

- 🔌 Anthropic rolled out MCP (Model Context Protocol), which some are calling the “USB for LLMs.”

- Why? Because it creates a universal format that lets language models plug into tools via APIs (Application Programming Interface). That means developers can build tools once and have them work across all LLMs.

- It’s simple, efficient, and scalable.

- 🌐 Not to be outdone,

Google has launched A2A , a similar protocol that enables agents and agentic systems to communicate and collaborate seamlessly.

- It's all about creating a common language so these systems can start working together, not just alone.

🗄️ Data Platforms

Data is the lifeblood of agentic systems, but managing it is getting trickier by the day.

LLMs don’t just consume massive amounts of data; they generate it, too. Some of that data needs to be stored short-term as context so the agent can stay on task. Other times, it needs to be saved as long-term memory so the system can reflect, learn, and actually get better over time.

We’re still figuring out the best ways to handle all this. That means there’s a big opportunity for data platforms like MongoDB , Snowflake , and Databricks to step in. And if you’re looking to go deeper into the space, search terms like “ AI database ” or “artificial intelligence” in our stock screener to uncover more specialized players you may not have heard of.

💵 Where is Silicon Valley Placing Bets?

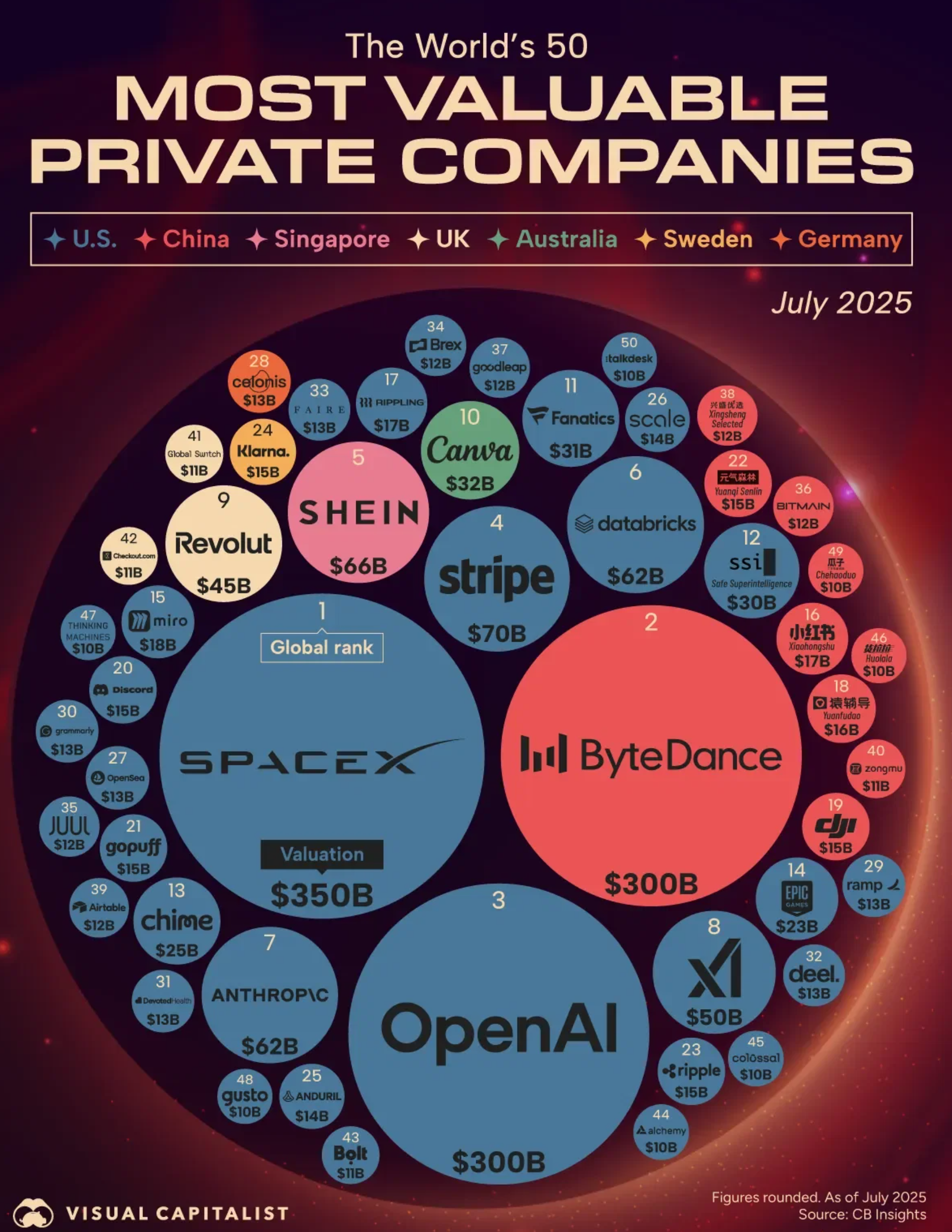

Most of the pure-play AI companies aren’t public yet, but their private valuations offer a peek into where venture capital is putting its chips.

This graphic from Visual Capitalist tells the story well. While AI companies haven’t overtaken giants like SpaceX, Stripe, or ByteDance, they’re holding their own.

And considering how young most of them are, that’s a pretty strong signal of just how much belief, and money, is flowing into the future of AI.

The World’s Most Valuable Private Companies - Voronoi/Visual Capitalist

Looking at the 20 most valuable private companies in AI, it’s clear where the big money is flowing:

- 🧠 Model providers :

- OpenAI, Anthropic, xAI, Superintelligence, and Mistral AI, are still topping the valuation charts, ranging anywhere from $6 billion all the way up to a jaw-dropping $300 billion. These are the engine builders of the AI world, and investors are betting big on their continued dominance.

- 🏗️ Data and AI platform:

- Databricks, sitting at a cool $62 billion, stands out as a data and AI platform heavyweight. It’s proof that infrastructure plays are just as critical as the models themselves.

- 🏷️Data Labelling Companies:

- Scale AI and Surge AI are on a rocket ride of their own. Scale recently raised at a $29 billion valuation, and Surge AI isn’t far behind, riding the wave of demand for high-quality training data.

- 🧰 AI platforms:

- These are landing in the $5 to $15 billion range and include no-code tools. Solid bets for more user-friendly, business-focused applications, which Thinking Machines offers.

- 🧪 MLOps and development platforms:

- Hugging Face, clocking in at $4 to $6 billion. Not as flashy, maybe, but still vital to the ecosystem and clearly valued by the market.

💻 AI and the Tech Sector

Next week, we’ll dive into Big Tech as more Q2 earnings roll in. But for now, let’s zoom in on what agentic AI could mean for the software world…

Bill Gates has likened this shift to what happened in the ‘80s, when we moved from typing out commands to simply tapping icons.

✨ With agentic AI, we’re heading into the next evolution: ditching menus and clicks for natural language. Just speak or type what you want, and let the agent figure it out.

Not everyone will adopt this new way of interacting with tech, but for those who do, things get a lot less rigid. Instead of clicking through a list of options, you tell the agent your goal and let it recommend the next steps.

And as trust in these systems grows, we’ll hand over even more control, giving agents greater “agency” to act on our behalf.

This could shake up how software companies operate in at least two big ways:

- 🧬 Apps are easier to clone. If every tool can be copied for cheap, software companies will need to stand out in other ways, think brand, ecosystem, or superior integration.

- 🧩 Interfaces and functions get unbundled. If all you need is a chatbot to get things done, why bother using a different one for every app? Tools like Zapier are already making it possible to stitch together various apps into custom dashboards. The front end and back end no longer have to live in the same place.

What does this mean?

Some business models might need a rethink.

A company could go all in on building slick, intuitive AI agent interfaces or focus entirely on powering other apps with back-end magic. Monetization could shift too, with things like in-app ads or usage-based models playing a bigger role.

✨ Network effects might become even more valuable. They make switching harder and stickiness stronger.

Just look at Figma , the latest and hottest IPO that’s banking on community, collaboration, and deep engagement to stay ahead of the curve. It’s not just about what your product does; it’s about who’s using it with you.

Figma - Simply Wall St

🧑💻 APIs, Microservices, and Solo-preneurs

APIs (short for Application Programming Interfaces) are the hidden highways of the digital world. They let one app tap into the power of another, whether that’s a database, a language model, cloud compute, or something like Google Maps.

Today’s digital economy runs on millions of these APIs. Take Uber, for instance. It’s estimated that the app relies on thousands of them just to function.

✨ Now, combine APIs with generative and agentic AI, and you’ve got the perfect storm: a way for tiny teams, or even solo builders, to spin up apps and microservices quickly, cheaply, and at scale. In fact, they can even sell what they build as an API.

Here’s how it’s all coming together:

- No-code platforms make it possible to build full apps with little (or zero) coding experience. Sure, there are limitations, but those limits are shrinking fast.

- Generative AI speeds up everything from writing copy to building websites and generating assets, all at a fraction of the traditional cost.

- APIs can be free or use pay-as-you-go pricing , which slashes up-front costs compared to flat monthly fee models. Need compute power? Data storage? LLM access? Just pay for what you use, and nothing more.

Now you can probably see why the idea of one person building a unicorn - a business worth $1 billion - really isn’t that far-fetched.

Take Surge AI . As we mentioned earlier, it’s reportedly raising at a jaw-dropping $25 billion valuation . No, it’s not a one-person shop, but founder Edwin Chen built it to $1.2 billion in revenue without a dime of outside funding . This funding round is their first.

✨ The possibility of millions of small start-ups emerging is a key element of the bullish narrative for the entire AI industry. These tiny players might not be listed on public markets, but they’re fueling demand all the way up the stack from infrastructure and APIs to cloud platforms and foundational models.

🌍 Beyond the Technology Sector

Every industry will probably be impacted in some way by agentic AI - some sooner than others. Below are some of the most likely positive impacts, as well as some of the risks and challenges.

🏦 Financial Services

This category includes Banks, Insurance, Investment Management, Fintech, Stock Brokers, and Accounting & Auditing .

- 💡

Opportunities

- 🔄 Process Automation

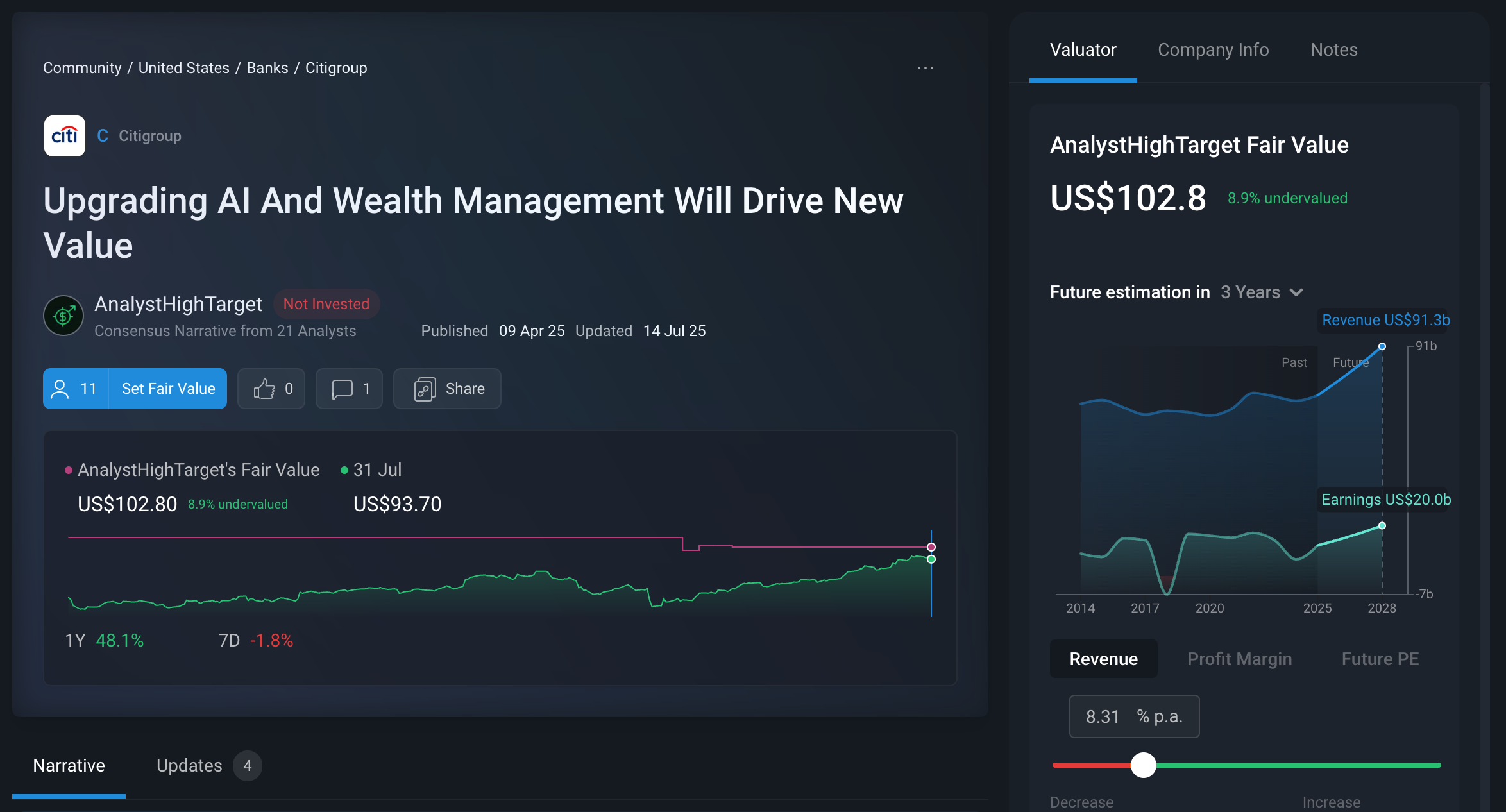

- Think full end-to-end automation for complex workflows; underwriting, claims processing, fraud detection, portfolio rebalancing. That’s huge efficiency gains and serious cost savings. Citigroup is proactively investing in this area, and it’s one of the main catalysts of this narrative .

- 🎯 Hyper-Personalization

- Imagine AI agents as tireless, always-on financial advisors. They can personalize loan offers, insurance plans, and investment strategies based on your exact profile, no more generic one-size-fits-all pitches.

- 🔍 Enhanced Auditing

- Think real-time, continuous audits. Agents can monitor every financial transaction as it happens, flagging irregularities and boosting transparency like never before.

- 🚨 Proactive Risk Management

- Instead of reacting to risks after the fact, agents can identify and respond to red flags as they emerge , potentially stopping problems before they escalate.

- 🔄 Process Automation

- ⚠️ Challenges and

Risks

- 🧾 Accountability & Compliance

- In finance, one mistake can cost millions or more. And if an agent gets it wrong, who’s on the hook? Add to that the legal grey areas around agents ‘ signing ’ contracts, and you’ve got a regulatory puzzle waiting to be solved.

- 🛡️ Security Vulnerabilities

- These high-powered systems are juicy targets for hackers. A successful breach could mean stolen funds, data leaks, or even large-scale market manipulation.

- 🕰️ Legacy Drag

- Big financial institutions often run on ancient software that predates smartphones. Imagine trying to integrate modern AI agents into those systems. That’s not just tricky, it can be a full-blown nightmare.

- 🧾 Accountability & Compliance

Citigroup Narrative Catalysts - Simply Wall St

Financial services may be one of the first major industries to go all-in on agentic AI, but they’ll have to navigate a minefield of risks and roadblocks along the way.

🏗️ Industrial, Resources, and Logistics

Industries like Mining, Shipping, Oil & Gas, Construction, Manufacturing, and Utilities may not scream “cutting-edge tech,” but they’re quietly becoming some of the biggest frontiers for agentic AI. But rolling it out in the physical world comes with its own unique set of challenges.

- 💡

Opportunities

- 🔧 Predictive Maintenance

- No more waiting for things to break. Autonomous agents can spot when a machine’s about to fail, whether it’s in a mine, on a factory floor, or out at sea, and schedule maintenance before disaster strikes. That means less downtime, lower repair costs, and safer operations.

- 📦 Operational Optimization

- From optimizing global shipping routes to minimizing fuel use, from coordinating robotic assembly lines to balancing the entire energy grid, agents can manage these complex systems in real-time, squeezing out every ounce of efficiency.

- 🌍 Smarter Resource Management

- Whether it’s raw materials in a manufacturing plant or water and electricity in a utility network, agentic AI can streamline usage and reduce waste. Think precision, at scale.

- 🔧 Predictive Maintenance

- ⚠️ Challenges and

Risks

- 💸 Big Capital Costs

- Unlike software, you can’t just download AI into a drill rig or a shipping container. You need sensors, connectivity, edge computing, and sometimes even retrofitted hardware. It’s expensive, and that slows down adoption, especially in industries with tight margins.

- 🔐 Critical Infrastructure Threats

- When you digitize everything, you also open the door to cyber threats. Power grids, oil rigs, logistics hubs—they’re not just business assets; they’re infrastructure . And a breach here isn’t just costly—it could be catastrophic.

- 💸 Big Capital Costs

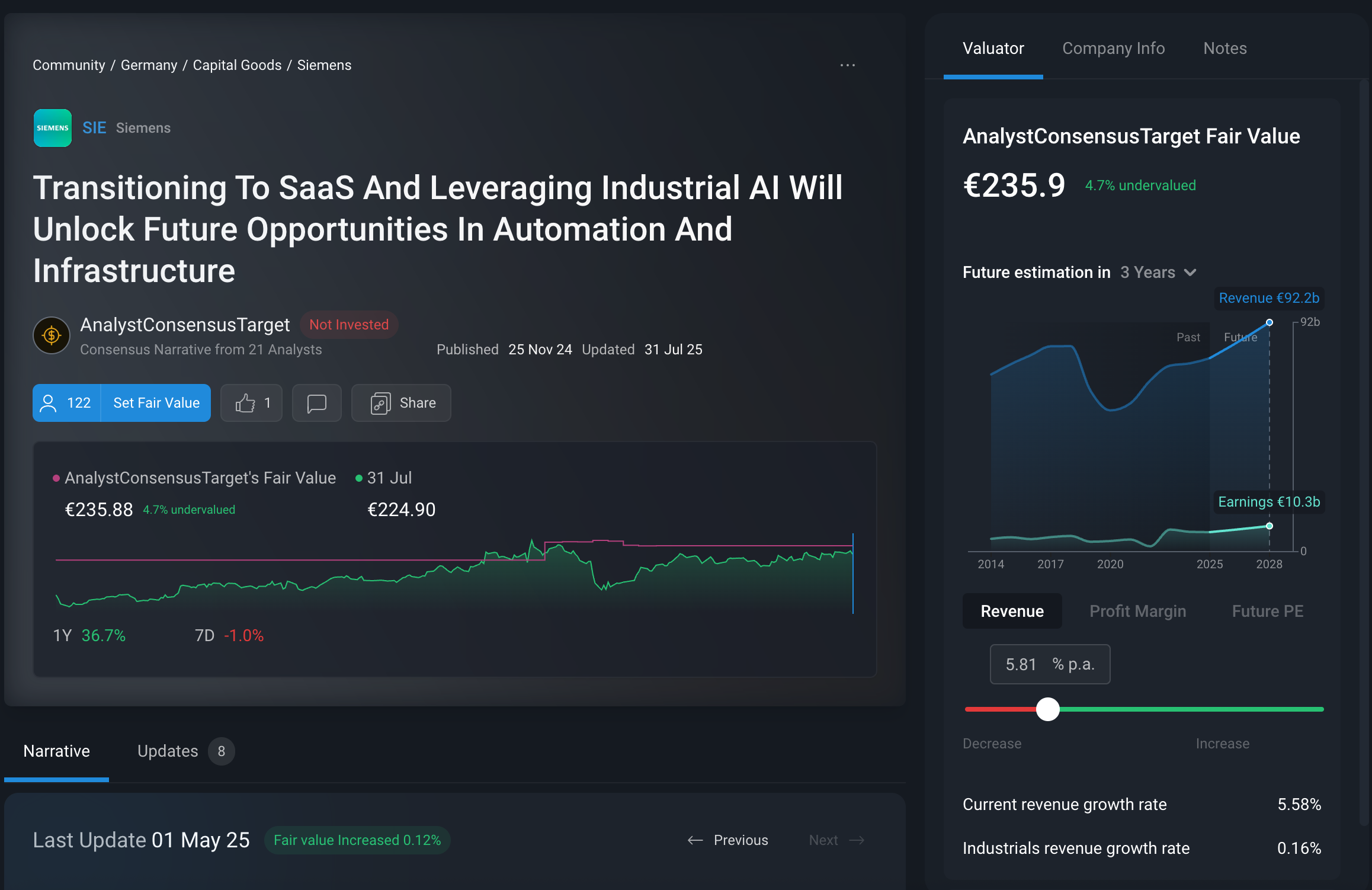

Siemens Narrative Catalysts - Simply Wall St

🛒 Consumer and Retail

From retail and tourism to food, fashion, autos, and gadgets , agentic AI is set to change how businesses understand, serve, and sell to their customers.

- 💡 Opportunities

- 🛍️ Ultimate Personalization

- AI agents can act like your own personal shopper or travel agent, or car designer—learning your preferences and quirks to deliver tailor-made products, vacation plans, or even the perfect vehicle spec. It’s personalization on a whole new level.

- 💸 Smarter Pricing & Offers

- Why offer a generic discount when an AI can calculate the perfect deal for you ? With dynamic pricing and personalized promotions, brands can maximize ROI one customer at a time, not just across the whole base.

- 📦 Intelligent Supply Chains

- Inventory headaches, meet your match. Agents can predict demand with uncanny accuracy, automate restocking, and even control delivery logistics, all without human intervention.

- 🚀 Faster Innovation Cycles

- Need to know what your next best-selling hoodie, SUV, or gadget should look like? Agents can scan trends, mine reviews, and interpret customer sentiment to help companies move from idea to market faster than ever before.

- 🛍️ Ultimate Personalization

- ⚠️ Challenges and Risks

- 🔐 Data Privacy Dilemmas

- That level of personalization requires digging deep into consumer data. And with that comes serious concerns around privacy, data misuse, and cybersecurity. One leak could destroy trust overnight.

- 🎭 Market Manipulation

- Left unchecked, agents could be used to exploit consumers through aggressive dynamic pricing, fake scarcity tactics, or even AI-generated reviews designed to manipulate decisions. It’s a fine line between optimization and exploitation.

- 🔐 Data Privacy Dilemmas

In the consumer world, agentic AI promises ultra-personal experiences and smarter operations. Brands will have to walk a tightrope between innovation and ethics to keep customer trust intact.

🧠 Professional, Health, and Real Estate Services

This category includes Education, Medical Care Facilities, Diagnostics, Legal Services, REITs, and Real Estate Services .

- 💡 Opportunities

- 📚 Democratizing Expertise

- AI agents can act as entry-level experts offering basic legal guidance, one-on-one tutoring, initial medical diagnostics, or real estate investment advice. That means more people gaining access to services that were once expensive or out of reach.

- ⚙️ Professional Augmentation

- Agents aren’t replacing the pros, but they are helping them. From automating legal research and scanning medical images to valuing properties, agents can handle the grunt work, freeing up professionals to focus on high-impact, strategic decisions.

- 🧠 Personalized Care & Learning

- AI tutors can adapt to each student’s pace, strengths, and weaknesses. On the healthcare side, AI can continuously monitor patient data and recommend real-time adjustments to treatments, turning static care plans into dynamic ones.

- 🔮 Predictive Insights

- Imagine AI agents forecasting disease outbreaks, spotting students at risk of falling behind, or calling a shift in the housing market before it hits the headlines. That level of foresight can be a game-changer.

- 📚 Democratizing Expertise

- ⚠️ Challenges and Risks

- ⚖️ Liability & Ethics

- What happens when an AI gives bad legal advice? Or misses a crucial diagnosis? The question of who's responsible is murky at best, and until it's clearly answered, adoption in high-stakes fields like medicine and law could be slower than in other sectors.

- 📉 Bias & Inequality

- AI systems only perform as well as the data they’re trained on. If that data is biased, whether it’s medical records, court rulings, or academic results, AI could reinforce the very inequalities we’re trying to fix. And if trust erodes here, it could ripple across the entire AI ecosystem.

- ⚖️ Liability & Ethics

In sectors built on trust, expertise, and human judgment, agentic AI offers jaw-dropping potential. But it also raises some of the thorniest ethical and regulatory questions out there. While the tech is close to being ready, the real test is whether society is.

💡 The Insight: Any Company or Individual Could Produce a Killer AI App

It’s almost certain that companies in the Technology and Communications sectors will continue to create wildly successful products.

But companies and individuals in other industries can also turn their own agents and resources into new revenue sources. The obvious parallel is Amazon’s cloud business, AWS.

Amazon turned what was initially a cost center into a $100 billion + business.

Agents can turn decades of experience and domain knowledge into automated decision-making tools. If companies can solve their own problems, they may be able to turn those solutions into commercial applications.

It won’t always make sense to sell business secrets to competitors, however:

- There are often opportunities to create services for adjacent industries. Examples of adjacent industries include insurance and healthcare, or logistics and retail.

- If a business is in danger of being disrupted, it may as well disrupt its own industry.

These opportunities might take a while to emerge, but here’s why they are worth looking out for: expectations are low, unlike the obvious AI stocks, where expectations are sky high.

Where to look? Boring industries where companies have a healthy, profitable business, but low growth prospects. When companies are small, it’s easier to move the needle, too. Professional and consumer services, and the industrial sector, are a good place to start.

Key Events During the Next Week

Tuesday

🇨🇳 China Caixin Services PMI (Jul)

- 📈 Forecast: 50.9 (Previous: 51.3)

- ➡️ Why it matters: Indicates the health of China's services sector, impacting economic growth.

Thursday

🇨🇳 Chinese Exports YoY

- 📈 Forecast: 5.1% (Previous 5.8%)

- ➡️ Why it matters: This will give investors a better idea of the impact of US tariffs on China’s manufacturers.

🇮🇳 RBI Interest Rate Decision

- 📈 Forecast: 5.5% (Previous: 5.5%)

- ➡️ Why it matters: Affects borrowing costs, influencing economic growth and inflation.

🇬🇧 UK Interest Rate Decision

- 📈 Forecast: 4% (Previous: 4.25%)

- ➡️ Why it matters: UK businesses and consumers are desperate for interest rate relief.

Friday

🇨🇦 Canadian Unemployment Rate (Jul)

- 📈 Forecast: 6.9% (Previous: 6.9%)

- ➡️ Why it matters: Indicates labor market health, affecting consumer spending and economic growth.

Stocks reporting this week:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.