- United States

- /

- Electrical

- /

- NYSE:VRT

3 US Stocks Estimated To Be Up To 39.5% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with a stumbling Santa Claus rally and a downturn in major indices, investors are keenly observing opportunities amidst this volatility. In such an environment, identifying undervalued stocks can be pivotal, as these equities may offer potential value when their market price is significantly below their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.29 | $53.16 | 48.7% |

| Argan (NYSE:AGX) | $143.57 | $279.10 | 48.6% |

| Western Alliance Bancorporation (NYSE:WAL) | $84.75 | $165.15 | 48.7% |

| Lamb Weston Holdings (NYSE:LW) | $63.69 | $125.18 | 49.1% |

| HealthEquity (NasdaqGS:HQY) | $95.68 | $189.22 | 49.4% |

| LifeMD (NasdaqGM:LFMD) | $4.91 | $9.75 | 49.7% |

| Progress Software (NasdaqGS:PRGS) | $66.26 | $129.49 | 48.8% |

| Freshpet (NasdaqGM:FRPT) | $145.17 | $283.12 | 48.7% |

| WEX (NYSE:WEX) | $171.67 | $333.02 | 48.5% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.45 | $29.97 | 48.4% |

Let's take a closer look at a couple of our picks from the screened companies.

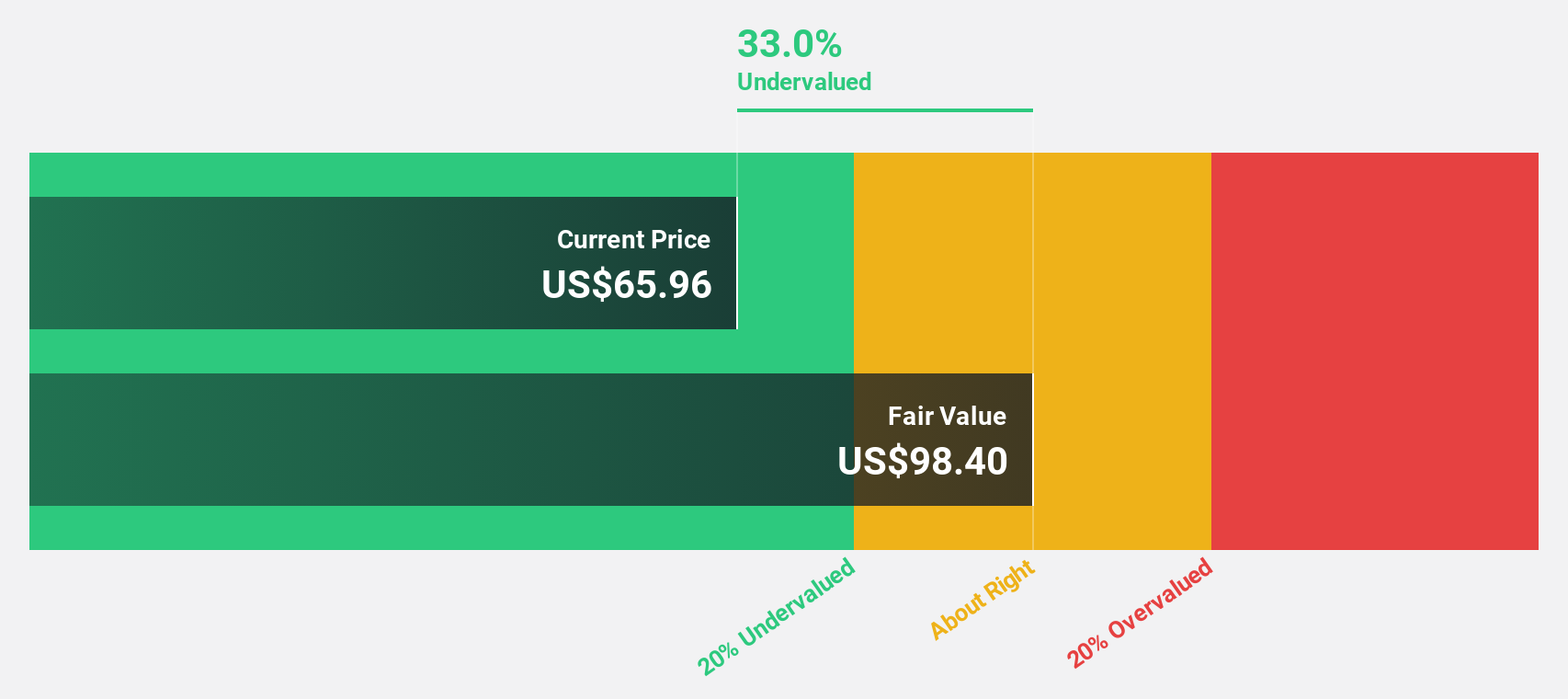

Zillow Group (NasdaqGS:ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States, with a market cap of approximately $17.83 billion.

Operations: Zillow Group generates revenue through its diverse real estate services offered via mobile apps and websites across the United States.

Estimated Discount To Fair Value: 39.5%

Zillow Group is trading at a significant discount to its estimated fair value, with shares priced at US$73.8 against a fair value estimate of US$121.93, suggesting potential undervaluation based on cash flows. Despite reporting a net loss for Q3 2024, revenue increased to US$581 million from the previous year, and earnings are projected to grow significantly in the coming years as Zillow aims for profitability within three years.

- Our earnings growth report unveils the potential for significant increases in Zillow Group's future results.

- Get an in-depth perspective on Zillow Group's balance sheet by reading our health report here.

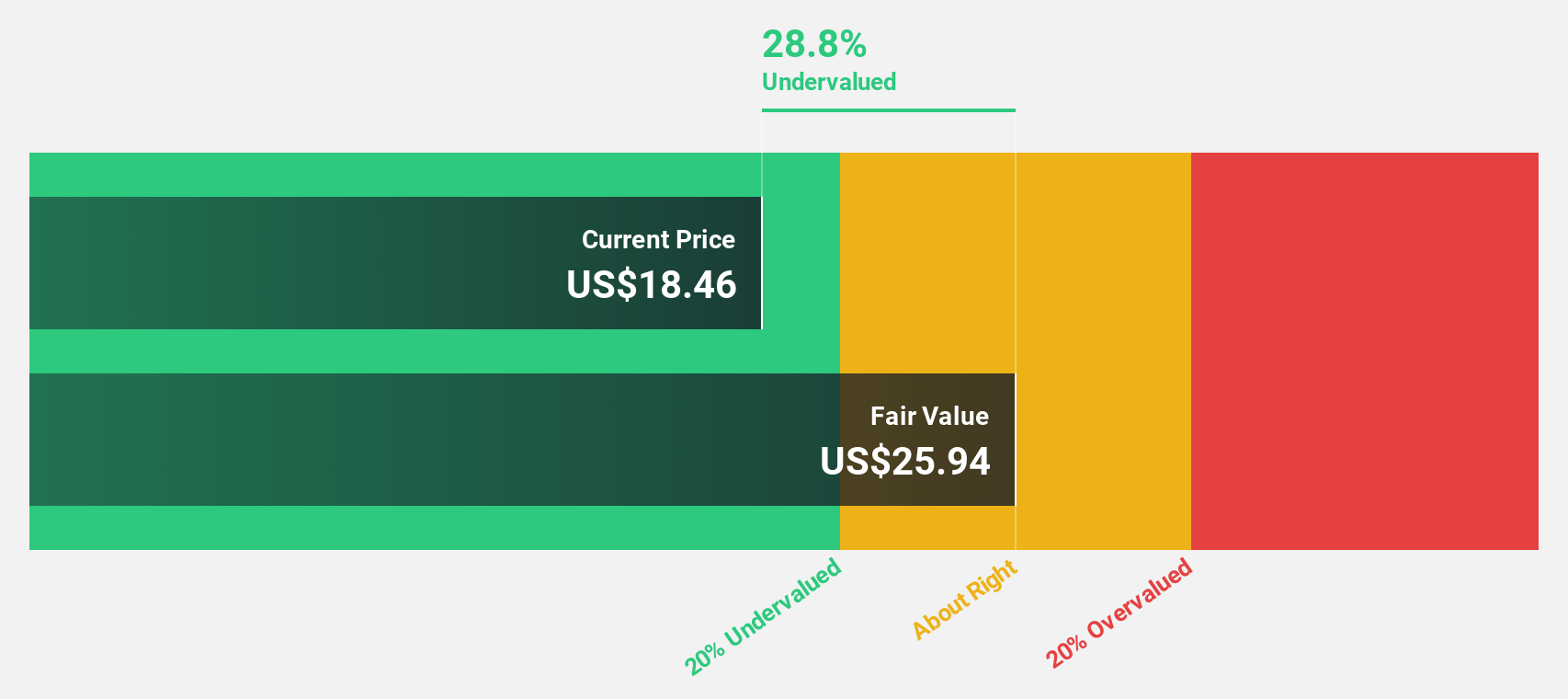

KeyCorp (NYSE:KEY)

Overview: KeyCorp, with a market cap of approximately $17.22 billion, operates as the holding company for KeyBank National Association, offering a range of retail and commercial banking products and services in the United States.

Operations: KeyBank National Association generates revenue primarily through its Consumer Bank segment, which accounts for $3.09 billion, and its Commercial Bank segment, contributing $2.85 billion.

Estimated Discount To Fair Value: 34.5%

KeyCorp is currently trading at US$17.37, significantly below its estimated fair value of US$26.53, highlighting potential undervaluation based on cash flows. Despite a recent net loss of US$410 million for Q3 2024 and a decline in profit margins from the previous year, earnings are forecast to grow substantially by 71.9% annually, outpacing the broader U.S. market growth rate of 15.3%.

- The growth report we've compiled suggests that KeyCorp's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of KeyCorp stock in this financial health report.

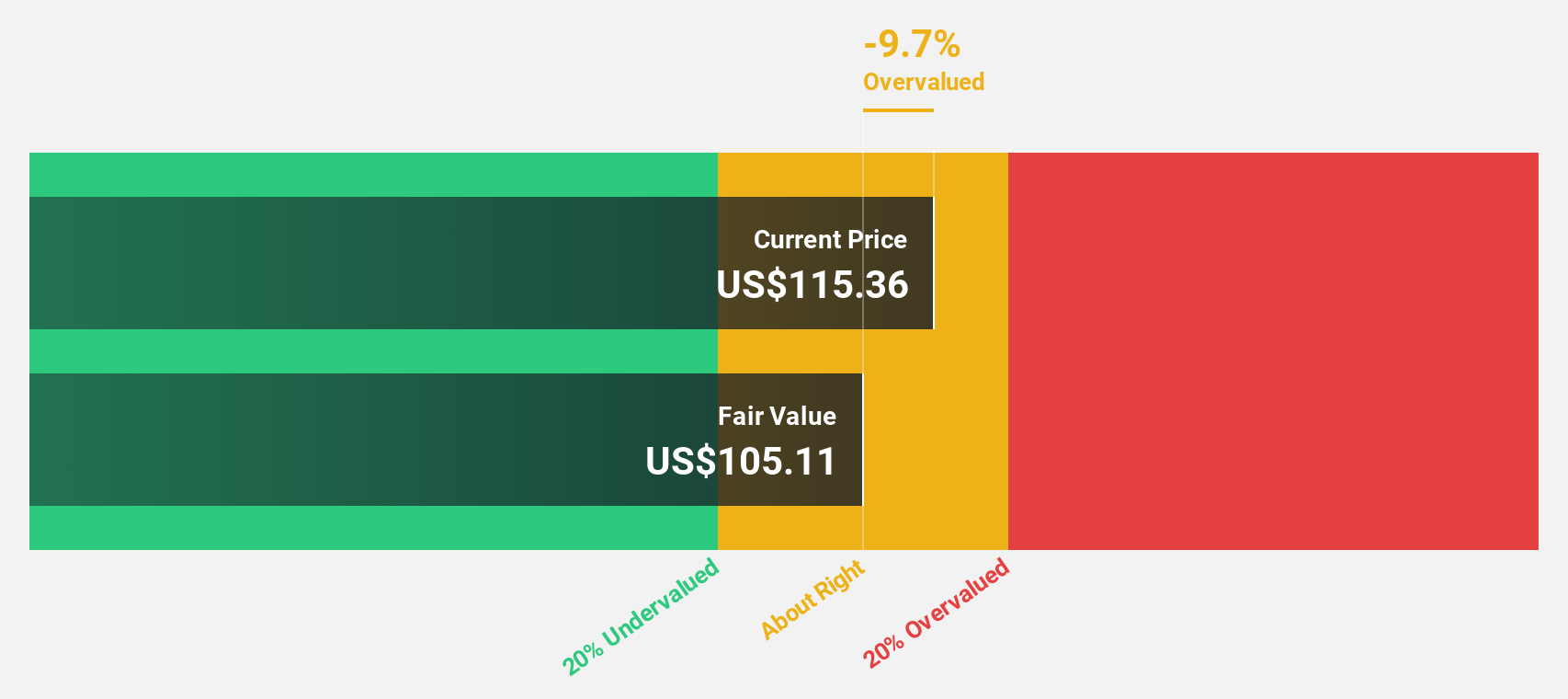

Vertiv Holdings Co (NYSE:VRT)

Overview: Vertiv Holdings Co designs, manufactures, and services critical digital infrastructure technologies for data centers and communication networks globally, with a market cap of approximately $44.57 billion.

Operations: The company's revenue segments are comprised of $4.30 billion from the Americas, $1.74 billion from the Asia Pacific, and $2.13 billion from Europe, the Middle East, and Africa.

Estimated Discount To Fair Value: 13.9%

Vertiv Holdings Co is trading at US$118.74, below its estimated fair value of US$137.86, suggesting potential undervaluation based on cash flows. Despite high debt levels and recent significant insider selling, earnings are forecast to grow 30.6% annually, surpassing the U.S. market's growth rate. Recent initiatives include repricing a $2.1 billion term loan for interest savings and launching energy-efficient products like the Vertiv PowerUPS 9000 to enhance operational efficiency in data centers globally.

- According our earnings growth report, there's an indication that Vertiv Holdings Co might be ready to expand.

- Dive into the specifics of Vertiv Holdings Co here with our thorough financial health report.

Where To Now?

- Unlock our comprehensive list of 174 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with solid track record.