Quote of the Week: “Until Trump's policies are clear it will be hard for markets and the Fed to assess the next year.” - Christopher Waller, Federal Reserve Board of Governors

Last week we covered which markets would sink or swim in 2025 , at least, according to analysts' estimates.

This week, we wanted to go a layer deeper and get specific on industries. We give a quick breakdown of how the major sectors are expected to perform this year and why, to help you position your portfolio accordingly.

We’ll wrap up with why secular trends last longer than cyclical trends, and how you can get exposure to some big ones.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

💰 Comcast comes for Big Tech’s moneymaker with a small-biz-focused ad-sales platform ( Sherwood )

- What’s our take?

- As we discussed in November , When a market opportunity is big enough, everyone will want a slice of the pie.

- Comcast is taking inspiration from the bigger tech companies that are simplifying their ad-buying options, and it’s about to offer one of its own for its streaming service, Peacock.

- Comcast’s experience in the TV ad game might make for a smooth launch, and a new, albeit small, revenue stream. However, the small-mid-sized businesses they’re targeting are spoilt for choice in the ad-streaming space given the streaming services have the same offerings, but with much bigger subscriber bases than Peacock.

🤖 Nvidia announces $3k personal AI supercomputer called Digits ( The Verge )

- What’s our take?

- The world’s smallest supercomputer paves the way for Nvidia to increase its network effects and ecosystem.

- The small desktop form factor and reasonable price (relative to its performance) will allow Nvidia to grow the adoption of its hardware and software among more consumers, like data scientists, AI researchers, and others who are outside their usual data center customers.

- If more AI models become open source, then it's in Nvidia's best interest to ensure that the engineers and data scientists contributing to their development are equipped with Nvidia hardware to ensure optimizations are tailored to Nvidia's hardware. That’s how you build up a strong network effect and ecosystem that’s hard or at least unappealing to leave (We’re looking at you, Apple).

- If they can pull this off, their moat in the AI space may grow even further.

🚕 How Uber and Lyft are gearing up for the Robotaxi revolution ( WSJ )

- What’s our take?

- Sometimes it's best to put the swords down and make a deal.

- A few years ago, Uber and Lyft scrapped their own self-driving projects. Now, they’re partnering with the Robotaxi companies themselves, like Waymo and May Mobility.

- These platforms have networks of 10s of millions of customers, meanwhile, the AV car companies have the technology but not the network of riders. So forming partnerships makes sense. They are also exploring allowing individuals to list their own autonomous driving cars on their platforms. It remains to be seen how this revenue opportunity will develop, what its margins will be, and how sustainable it is.

- While progress is being made, Uber executives have said it might take a decade before half of all Uber trips in the US are completed by self-driving cars, so don’t expect this to be a large portion of revenue any time soon.

- Speaking of partnerships, Delta Air Lines has now canceled its 8-year-long partnership with Lyft in favor of Uber.

🤓 Meta says it will end its fact-checking program on social media posts ( NY Times )

- What’s our take?

- A shifting political and social landscape calls for shifting content moderation policies.

- Musks’ X platform (formerly Twitter) has a free speech policy (utilising "community notes" that add context to posts), and it appears Meta’s platforms are going to move in a similar direction.

- The company is moving away from a “censor-first-ask-questions-later” approach that was originally implemented in 2016 and was ramped up over the last few years.

- With the election being a big catalyst for the company’s decision, Zuckerberg said he wants to “ focus on reducing mistakes (like posts taken down accidentally), simplify its policies, and restore free expression on its platforms.”

- From a business point of view, this might help minimize the amount of users who might have left the platform because of its heavy-handed moderation policies.

🏛️ Fed calls out trade and immigration policies as inflation risks ( Axios )

- What’s our take?

- Inflation and interest rates might stay higher for longer than originally anticipated.

- As we’ve discussed multiple times, president-elect Trump’s proposed tariffs and plans for deportations are inherently inflationary, and they are colliding with the Federal Reserve’s plans to get inflation below 2%.

- Policy meeting minutes indicate that because of the elevated upside inflation risk from the uncertain and potential changes to trade and immigration policies, they now see half as many rate cuts in 2025 as they did before (2 from the previous 4).

- Changing interest rate expectations leads to changing investor sentiment and valuations. However, at the moment, there is a lot of uncertainty around these expectations and those on policies, so it’s hard for investors to confidently reflect any of this into the price of assets.

🚜 Deere unveils new autonomous tractors ( Yahoo Finance/Reuters )

- What’s our take?

- Automation is a play on AI, as well as demographic and geopolitical trends.

- Autonomous tractors have been around for a while, but improving technology is making them more capable each year. They now have better hardware (cameras and processors), and software (AI and computer vision models).

- In America, the agriculture industry is expected to be amongst the worst affected by deportations and lower immigration rates. However, labor shortages are becoming a problem in many countries due to aging populations and de-globalization.

- Generative AI gets most of the attention, but automation may have more obvious and pressing use cases. Not that this is a problem for Nvidia , after all, Deere’s new tractors are powered by onboard GPUs.

💻 Technology - The Year That GenAI’s Value Prop Is Shown

Generative AI is still front and center within the technology sector. Macquarie recently published an article, GenAI’s true value will become clearer in 2025 .

They noted that AI's benefits should become more measurable and the real potential will become more apparent in 2025.

The direct way to track AI adoption and demand is by looking at the revenue generated by companies selling models and apps. But we’ll also get an indication from their customers.

Any evidence that companies are managing to increase sales or productivity, or reduce costs, will be good news for application providers.

Quite a few analysts have acknowledged that expectations are high. If investment in AI infrastructure slows meaningfully, a correction in the stock prices of companies like Nvidia and Broadcom is likely.

Are Software And SaaS Companies In Trouble?

A popular topic for opinion pieces recently has been software as a service , aka SaaS, and whether generative AI could disrupt the SaaS business model. Some analysts believe software companies in general are vulnerable.

The premise is that AI agents will be able to create end-to-end workflows, eliminating the need for individual tools. Furthermore, the cost of cloning software apps and replacing legacy systems will continue to fall as agents become more powerful.

It’s probably too soon to declare the whole SaaS model obsolete, but some software companies may well be vulnerable. The adoption of AI agents may also favor the larger companies with expertise across various domains.

🤖 Cybersecurity

Cybercrime remains a growth industry (sadly), with a growing list of tailwinds:

- More connected devices, cloud migration, and hybrid work modes all create more potential entry points for cyberattacks.

- Geo-political polarization means there’s more incentive than ever for state-sponsored cyberattacks.

- Cybercriminals have more sophisticated tools than ever.

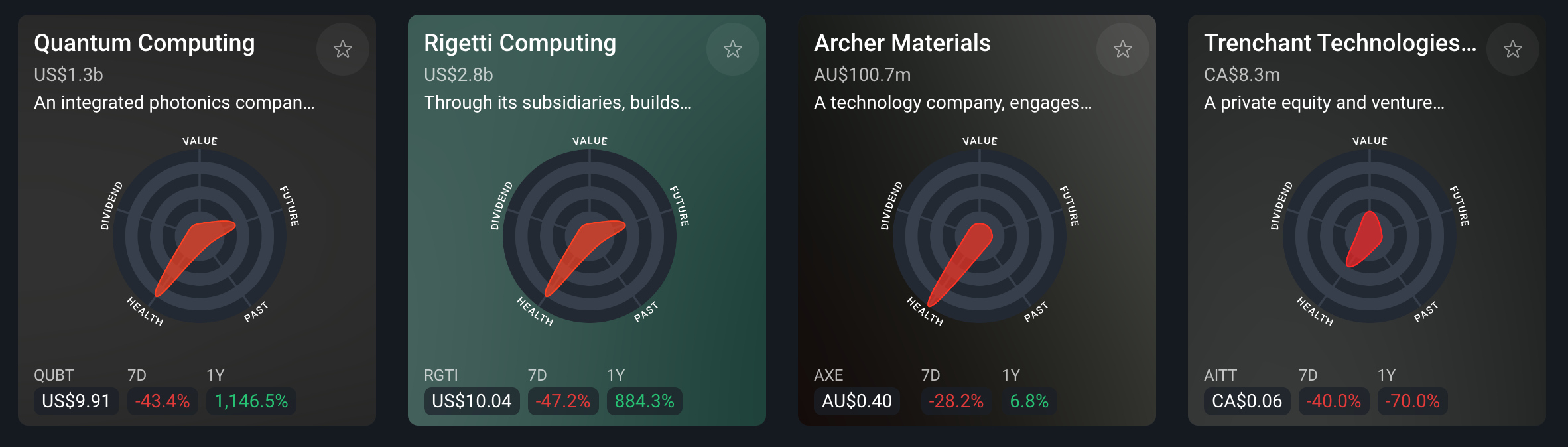

⚛️ Quantum Computing

The latest ‘hot topic’ in technology is quantum computing.

This follows test results from Google’s Willow quantum computing chip . This development is a big step in the evolution of quantum computing. However, it’s also likely to take a while for quantum computing to solve real-world problems.

At the CES event, CEO Jensen Huang said that “ useful quantum computers are 20 years away ” which sent many quantum computing stocks plummeting after their huge rally late last year. Then again, he may have a vested interest in saying that.

Here’s a list of quantum computing stocks (below). It reflects the fact that most of the pure-play companies aren’t expected to be profitable any time soon.

🛒 Consumer Sectors - Consumers Are Resilient But Further Inflation May Change That

The Economist Intelligence Unit estimates global retail sales growth of 2.2% in 2025 , which would be the fastest pace since 2021. They also note a few caveats, including lower savings rates and lower consumer confidence.

The EIU also mentioned the large number of countries closing the loopholes being exploited by low-cost e-commerce low-value imports like Shein and Temu.

That’s one headwind for China’s retail industry, with the other being the economic slowdown. China’s latest stimulus program aims to increase consumption within the country.

We will have to see whether it’s enough to ignite a sustainable recovery rather than a short-term bounce.

As mentioned last week, Mastercard’s Economics Institute pointed out that consumers are shifting spending from goods to experiences. Their data also shows consumers across the globe ‘trading down’ to avoid rising prices .

In particular, they noted that consumers are travelling to cities that offer better value for money than more well-known, but expensive, cities. Consumers are also shifting from high-end luxury apparel to mass-market options, mostly from discount e-tailers.

✨ Whether this trend continues may depend both on inflation and tariffs in the US.

🏥 Healthcare - Budgetary Constraints Will Favour The Frugal

Global healthcare spending continues to rise each year. However, some analysts have warned that government budgets are constrained and spending may not rise as much as in the past.

✨ This will favor healthcare providers that can reduce costs, either by improving efficiency or cutting back on expenses.

Investors are hoping for breakthroughs in cutting-edge fields like genomic medicine - whether that happens in 2025 remains to be seen.

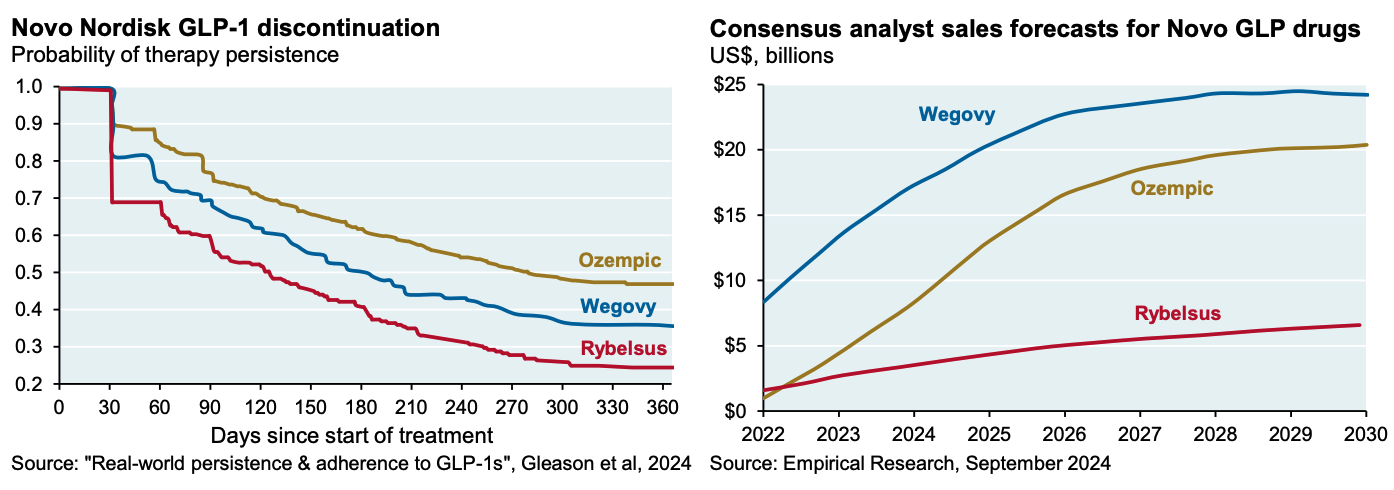

Analysts are somewhat divided over GLP drugmakers like Novo Nordisk. Michael Cembalest at JP Morgan points out that discontinuation rates are likely to affect some GLP producers.

The other side of that argument is the fact that GLP-1 drugs are proving to be effective in treating a growing list of other conditions.

✨ Ultimately, the winners are likely to be the companies that can produce GLP-1 treatments with fewer side effects.

🏘️ Real Estate - Strength In Specialty, Weakness In Others

Real estate industries in many countries have faced major challenges over the last few years. In the residential space, housing shortages are making homes unaffordable for most consumers, while commercial real estate is suffering from a lack of demand.

Nareit believes that four megatrends will continue to shape the global REIT market , namely:

- 🔬 Specialization - Honing in on one property sector will enable REITs to become better operators.

- 📈 Scale - The larger the operating platform, the greater the economies of scale.

- 🧑🔬 Innovation - Developing new types of properties will help catch the eye of forward-thinking investors.

- 🌳 Sustainability - Offering an energy efficient asset will attract sustainability-minded investors.

There is plenty of demand in certain key industries like data centers and healthcare, and other specialty industries.

Other industries, like office and retail, are for the most part on the wrong side of secular trends - though there are some pockets of demand in those industries.

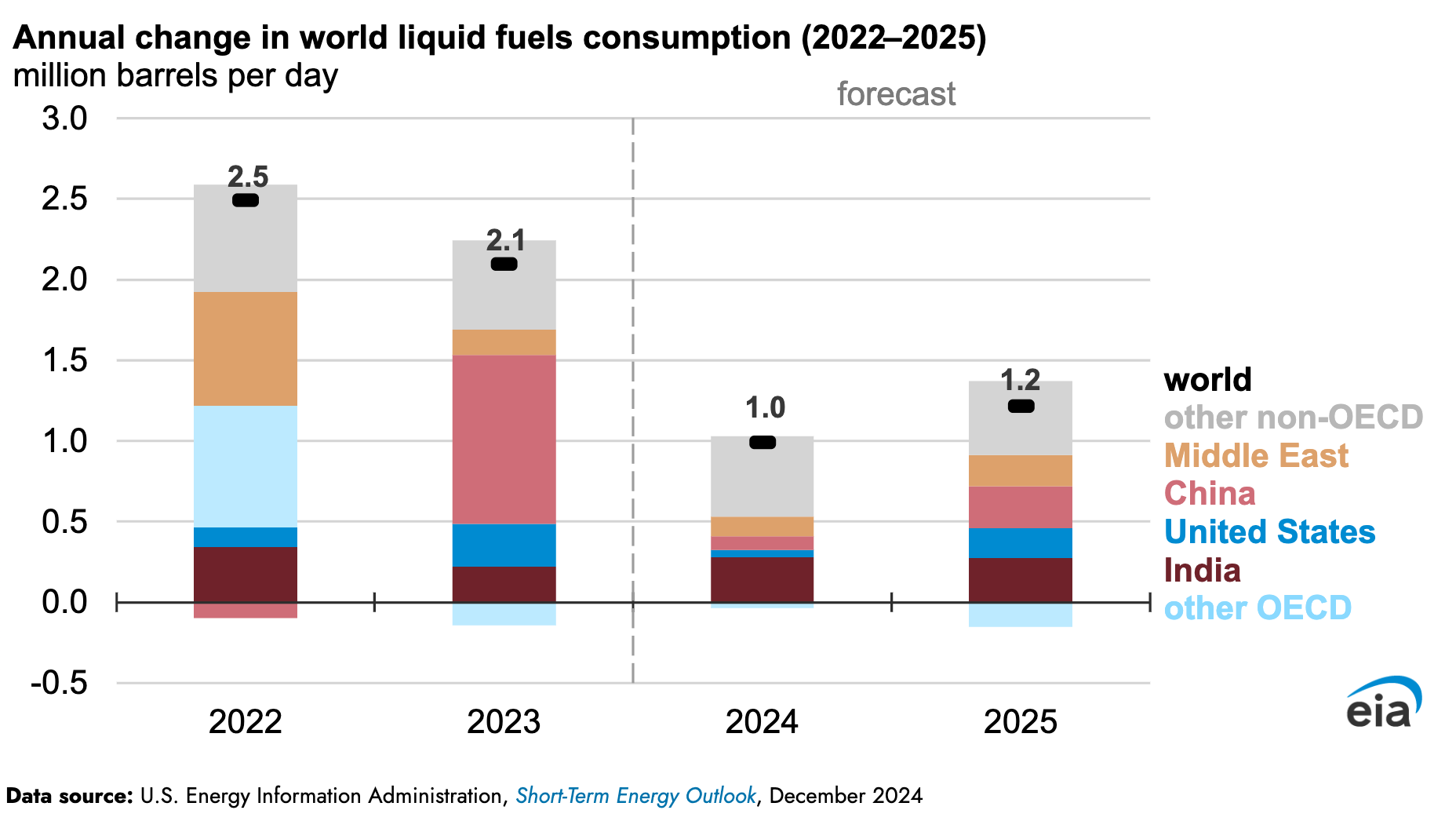

🛢️ Energy: Oil and Gas - Consensus On Weaker Outlook

The outlook for the oil price and oil producers appears very subdued:

- Historically, China has been the biggest driver of oil demand growth. In 2025 India is expected to take that crown. Sinopec believes that China’s consumption of oil will peak by 2027, and possibly as early as 2025.

- OPEC+ have cut their demand forecasts for five consecutive cuts. Nevertheless, OPEX+ members plan to gradually end their production cuts.

- Non-OPEC producers led by the US are increasing production.

- Donald Trump is in favor of increasing production even more.

India now accounts for more consumption growth than China, but growth is likely to be subdued unless economic activity surprises on the upside in either country.

Despite the weak outlook, oil stocks can act as a hedge against inflation and geopolitical events.

Also, while many analysts aren’t optimistic, some are still bullish. For one of the more bullish theses, have a look at Fidelity’s energy outlook.

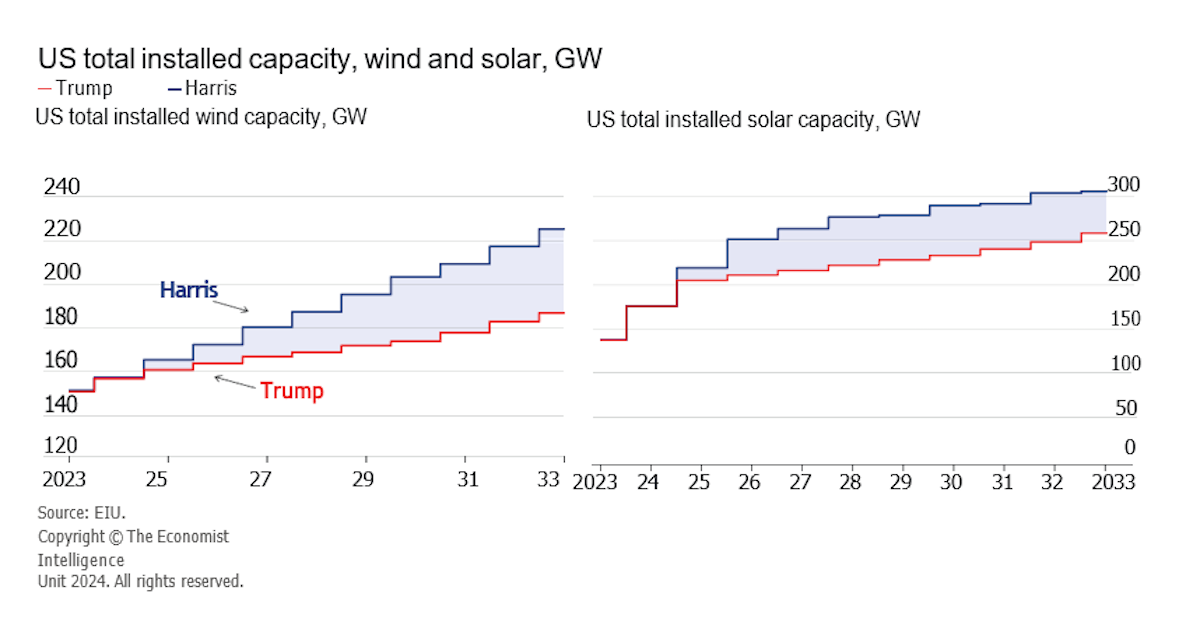

☀️ Energy: Renewables - Headwinds In The US, But Not Elsewhere

It’s no secret that Donald Trump isn’t a fan of wind or solar power.

His election win will certainly result in lower growth than a Harris victory would have. But most analysts still see the installed capacity in the US increasing - just at a slower pace.

Outside the US, policymakers are as committed to renewable energy as ever. Furthermore, lower interest rates will result in more projects being viable and therefore approved.

🪨 Commodities - Broadening Demand Increases

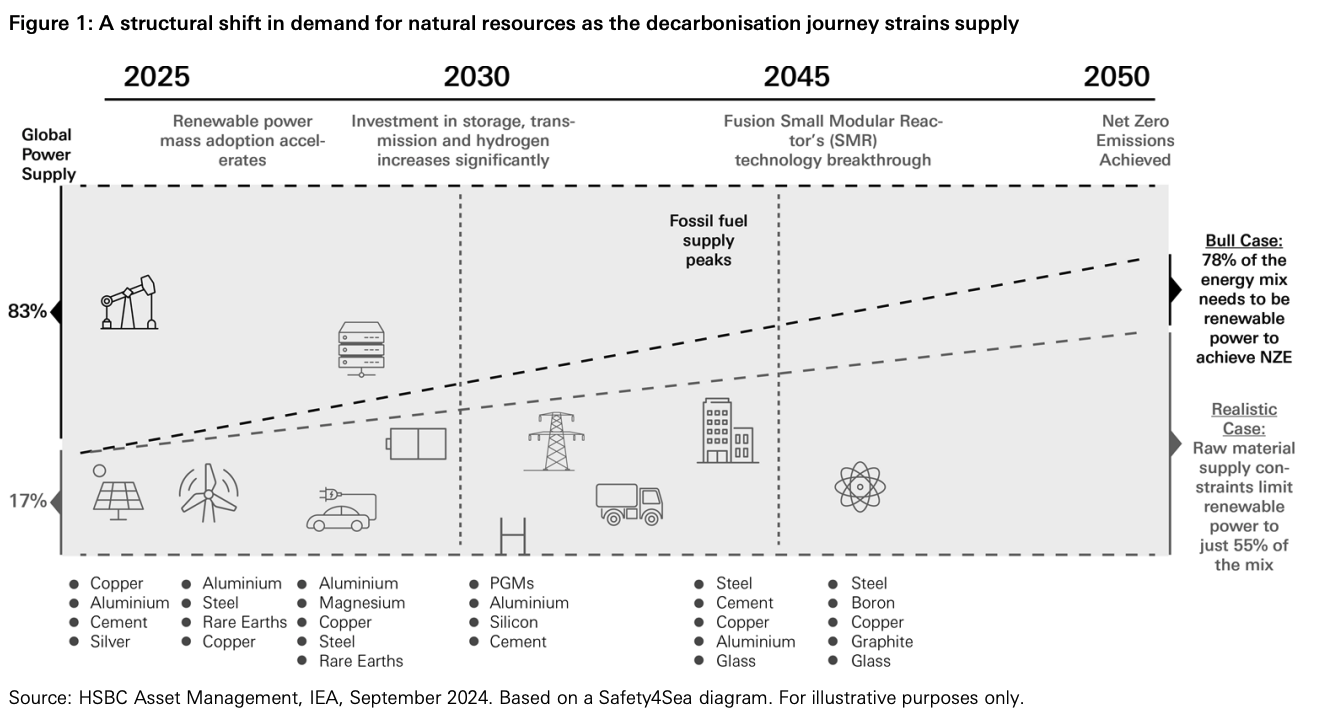

HSBC believes there is a major shift in the demand for resources happening due to the decarbonization and electrification of the global energy mix. In the short term, this favors copper and aluminum. Over time they believe demand will broaden to include other materials.

HSBC actually sees the supply of these materials potentially constraining the transition to clean energy.

So if policymakers are committed to renewables they may need to step in to ensure there’s enough supply of these materials.

⛏️ Gold - Bullish As A Hedge Against Macro Events

Quite a few research teams are bullish on gold in 2025. Goldman Sachs sees the U.S. dollar as structurally overvalued and that gold is an effective means of diversifying currency exposure.

Standard Chartered mentioned gold is also an effective hedge against inflation and extreme geopolitical tail risks.

Despite the rise in the gold price, flows to gold ETFs have actually been quite weak, suggesting gold isn’t over-owned either.

🧑🏭 Industrials - Possible Higher Capex, Lower Opex

The most common theme in the industrial sector was automation.

Labor shortages and reshoring mean the incentive to automate manufacturing processes is as high as ever. At the same time compute power and advances in computer vision and AI mean machines are more capable each year.

Electrification is another theme with strong tailwinds. If economies are to become more ‘electrified’, they need larger and more efficient power grids. We covered this theme in more detail in a previous newsletter.

For more ideas on companies in the space, check out GlobalX’s newly launched ‘ZAP’ ETF.

🏦 Financials - Lower Rates And Deregulation Could Spice Things Up

There are several catalysts that could be very positive for certain companies in the financial sector:

- Mergers, acquisitions and IPOs are expected to pick up globally. In the US, deregulation is the big catalyst for M&A. Elsewhere, relatively low valuations could lead to acquisitions by US companies (which may be blocked by local regulators), or by private equity funds. Either way, banks stand to earn higher fees advising on deals.

- Infrastructure investment is a theme that came up in most outlooks. This asset class is less accessible to retail investors - but again, banks earn fees when they arrange funding for infrastructure projects.

- Citi mentioned that while short-term rates are falling, long-term rates are rising. This means banks can borrow cheaply, and lend at higher, long term rates.

- If market performance is strong, asset and wealth managers will benefit from rising fees and inflows.

- Most US fund managers hold portfolios that are less concentrated than the S&P 500 index. So, they would really benefit from a broadening of the bull market.

Apart from the very large fintech incumbents, the fintech industry has been slow to recover after 2022’s sell-off. The industry stands to benefit from deregulation, and from a pro-crypto administration in the US. Simply Wall St’s Fintech collection includes 37 prominent companies in the space.

💡 The Insight: Secular Trends Last Much Longer Than Cyclical Trends

Analysts are generally optimistic about cyclical stocks for 2025. They also favor small caps, and companies in the UK and Europe which are trading on lower valuations.

It’s quite possible that shares of these companies will outperform in 2025.

However, if you are a long term investor, you shouldn't overlook the long term secular trends that can act as tailwinds for companies for much longer periods.

We covered these in our ‘Big Trends’ series. GlobalX recently published a great presentation on the subject too.

Cyclicals can perform well in the medium term - but secular growth stocks can compound returns for decades.

If there’s more rotation into cyclical stocks, it could create some great opportunities for those growth stocks that may temporarily be out of favor.

For ideas on stocks within each of those 12 Big Trends we covered, check out the entire series, starting with Healthcare .

Then, you might want to assess how your portfolio's industry diversification stacks up relative to what secular trends you want to be exposed to based on those we covered in the Big Trends series.

Key Events During the Next Week

Tuesday

- 🇺🇸 US producer inflation data will be published. PPI is forecast to be slightly higher at 3.2% while core PPI is forecast to remain at 3.4%.

Wednesday

- 🇬🇧 UK inflation is forecast to be unchanged at 2.6%.

- 🇺🇸 US consumer price data is expected to show prices rising 2.9% over the last 12 months, compared to 2.7% in the year to November. The core inflation rate is forecast to be steady at 3.3%.

Thursday

- 🇦🇺 Australia’s unemployment rate is forecast to rise from 3.9% to 4.3%.

- 🇬🇧 UK GDP data is expected to show the economy growing 0.2% over the last three months, up from 0.1%. Annual GDP growth is also expected to be 1.5%, up from 1.3%.

- 🇺🇸 US initial jobless claims are forecast to be 209K, compared to 201K.

Friday

- 🇨🇳 China’s GDP growth is expected to be 5%, up from 4.6% in the year to September.

4th quarter earnings season kicks off with the big banks, along with a handful of insurers and asset managers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.