Quote of the Week: “With all this consumer debt, business debt, and government debt, smaller movements in interest rates have a magnified effect. A small movement can tip the boat.” - Bill Gross

Donald Trump's "One Big Beautiful Bill" has been signed into law. It provides stimulus via increased spending, tax cuts and tax incentives that support Trump’s agenda.

Some of the positives could be outweighed by the inflationary effect of the bill itself and the latest round of tariffs. But the bigger issue looming in the background is the $3 to 5 trillion it adds to US government debt over the next decade. This is something any investor with a long-term view needs to pay attention to.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube! (Released each Monday by 5pm AEST).

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

- 🐂 Nvidia’s Run Toward $4 Trillion Fuels Stock Gains ( WSJ )

- Nvidia’s rocket toward a $4 trillion market cap powered the Nasdaq to a new record, shrugging off Trump’s fresh tariff threats and signaling investors are focused on earnings and AI, not trade drama.

- Markets are betting tariffs may not actually stick, especially with the White House’s deadline now pushed to August and ongoing talk of deals, keeping tech and growth stocks in the driver’s seat.

- Volatility fell to multi-month lows, bond yields slipped, and even trade-sensitive stocks joined the party, hinting investors are getting comfortable with tariff headlines. That is, of course, unless real inflation flares up.

- As long as the AI story stays hot and tariffs look more bark than bite, bulls seem to run the show.

- 🤝 CoreWeave to acquire Core Scientific in $9 billion all-stock deal ( CNBC )

- CoreWeave is betting big on AI infrastructure. In this deal, it absorbs $10 billion in lease obligations and gets a huge data center footprint with future expansion power.

- The market’s reaction was rocky, with both stocks sliding post-announcement. The fixed share exchange ratio (1:0.1235) means Core Scientific’s upside is capped by CoreWeave’s volatile (and thinly traded) stock. Arbitrage is nearly impossible for now due to sky-high borrowing costs.

- CoreWeave gains flexibility: it can pivot Core Scientific’s data center infrastructure toward AI workloads, which could make future growth smoother and potentially cheaper than building from scratch.

- For investors, the real play is whether CoreWeave’s value holds up after its IPO lockup ends and as it integrates a business fresh out of bankruptcy (Core Scientific). So the risk is high, but so is the potential reward if AI demand stays hot.

- The deal makes strategic sense for CoreWeave’s growth story, but investors eyeing an easy profit from the merger should buckle up for volatility and watch the float like a hawk.

- ☕️ Starbucks China attracts bids valuing the coffee chain at up to $10 billion, sources say ( CNBC )

- This news highlights just how much global investors still crave exposure to Chinese consumer growth, even as headwinds mount.

- Starbucks isn’t bailing, though. We can expect it to keep at least 30% ownership and push for strategic partners who can help it fight off local rivals like Luckin and adapt faster to shifting consumer habits.

- For investors, the action is on two fronts: private equity firms want in, and Starbucks may unlock capital for buybacks or expansion while retaining upside in China’s lucrative coffee market.

- If bidding heats up further, expect the valuation to creep even higher, but potential buyers need to watch for thinning margins as local competitors and rising costs keep Starbucks on its toes.

- Starbucks China is still a long-term growth story, but whoever buys in better bring deep pockets and local know-how because this won’t be a hands-off cash cow.

- 🇺🇸 Trump announces 50% tariff on copper effective August 1 ( Reuters )

- The move is meant to boost U.S. production but will hit major suppliers like Chile, Canada, and Mexico, and likely push copper prices even higher for U.S. manufacturers.

- Higher input costs could ripple through sectors from autos to semiconductors, adding inflationary pressure and squeezing margins for companies that rely on imported copper.

- Domestic copper miners and developers like Rio Tinto and BHP might see sentiment lift if investors believe tariffs will finally help stalled U.S. projects, but watch for pushback from U.S. trading partners.

- Copper producers could benefit, but U.S. manufacturers and heavy copper users face a cost squeeze. Keep an eye on copper-exposed plays and other inflation hedges.

- While these tariffs make U.S. copper plays more attractive, it comes at the risk of higher costs and renewed global trade friction.

- 🇧🇷 Trump hits Brazil with 50% tariff, orders unfair trade practices probe ( Reuters )

- Trump is turning up the heat on a major U.S. trading partner and raising global trade tensions. He just slapped a 50% tariff on Brazilian imports (starting August 1) and ordered a new probe that could mean even more tariffs.

- He said it’s partly retaliation for unfair prosecution of Jair Bolsonaro , and partly to correct the two countries' “unfair trade relationship”.

- U.S. equity markets didn’t blink, but these rapid-fire tariffs (and talks of more on semiconductors and pharma) have pushed America’s effective tariff rate to a 90-year high, adding uncertainty for exporters and importers alike.

- Brazil, a key supplier of metals, agricultural goods, and minerals, could see U.S. buyers shift to other sources or pay up. So watch for price spikes or supply chain tweaks in copper, ag commodities, and related stocks.

- For investors, tariff escalation spells more headline risk and potential volatility, plus a watchlist of possible winners among U.S. producers and losers in export-heavy emerging markets.

- Tariff fever isn’t cooling. Keep an eye on cost inflation, global supply chains, and any U.S. sector that can benefit if imports get priced out.

🇺🇸 OBBB: Trading Short-Term Gains For Long-Term Pain?

Donald Trump’s "One Big Beautiful Bill" (OBBB) has now been signed into law. This wasn’t a surprise, but many thought it might be watered down a little more before it actually passed.

For investors, the provisions in the bill are a confusing mix of short-term stimulus and long-term risk.

🏗️ Tariffs Take Two

We will start with an update on tariffs, as they could compound - or offset - the impact of OBBB.

The 90-day reprieve on tariffs that was announced in April came to an end last week. So far, just 3 trade deals have been agreed on (well, sort of agreed).

The Trump Administration has now unilaterally imposed new tariff levels on most of its main trading partners, and quite a few others too.

Here’s a rundown on where things stand:

-

📅 The August 1st Deadline: The administration has set a new deadline for pending deals, after which new tariffs will go into effect… unless there’s another extension.

-

🎯 Who is in the Crosshairs? As of July 9th, the following tariff rates had been announced.

- 20%: Philippines

- 25%: Japan, South Korea, Malaysia, Kazakhstan, Brunei, Moldova,

- 30-32%: South Africa, Indonesia, Bosnia, Algeria, Iraq, Libya

- 35-40%: Bangladesh, Serbia, Laos, Myanmar

- 50%: Brazil - for all the reasons mentioned earlier.

- 🇨🇳 The China Situation: China, alongside the UK and Vietnam, has negotiated a separate deal to reduce the pain from this specific round of tariffs. However, tensions with China remain high, with a baseline 10% tariff in place and higher rates (up to 35%) on specific goods linked to issues like intellectual property theft.

- 🇪🇺 Europe: The EU is seeking to conclude a preliminary trade deal this week, which would allow it to lock in a 10% tariff rate beyond 1st August.

-

📈 They’re Cumulative: These tariffs are in addition to any existing duties. It's crucial to understand that these tariffs stack on top of one another, compounding the cost of imported goods.

-

💊 There’s more: Trump has also threatened to impose a 200% tariff on pharmaceutical imports, and 50% on copper. In response, copper futures hit a record high as traders anticipated stockpiling ahead of the increase.

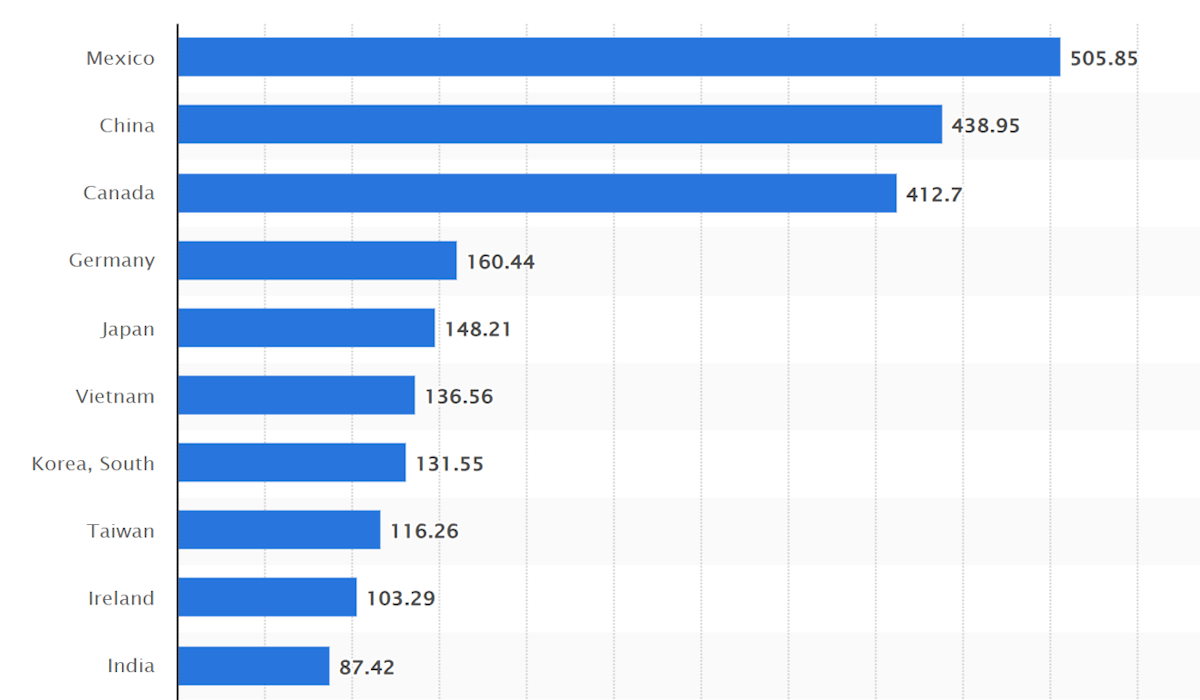

Most countries are facing substantial tariffs, which will affect their exporters. For the US importers, the tariffs imposed on key trading partners are most relevant, i.e., South Korea and Japan.

A few things to note on the tariffs:

- 💹 Although inflationary, the impact might be a one-time occurrence unless systemic ripple effects develop.

- 🤷 It’s generally anticipated that the tariff rates will ultimately be in the 10% to 20% range. However, some analysts have pointed out that markets have become desensitized (and possibly too complacent) to the issue.

💰 Unpacking the “One Big Beautiful Bill”

OBBB is arguably the largest tax and spending package in U.S. history. It’s a bold attempt to stimulate the economy, but it comes with a hefty price tag.

The Short to Medium Term Winners and Losers

The bill will have a direct impact on certain industries, with quite a few winners and a few losers. The key features of the bill aren’t a surprise, but there are some details worth noting.

These are the most important provisions:

-

✂️ Tax Cuts: The bill makes the 2017 tax cuts permanent and prevents the scheduled tax hike, which provides relief to corporations and households. It also eliminates federal taxes on tips and overtime pay, though this is capped.

- 🛍️ Consumer spending should benefit from new tax relief for middle-income groups.

- Corporate profits benefit from the lower tax rate.

-

💸 New tax incentives: The bill is over 1,000 pages and includes numerous tax incentives for businesses and households.

- 🏠 Real estate investors can fully depreciate certain expenditures in the first year. This provision has been reinstated and extended to 2029.

- In addition, Qualified Opportunity Zones offer tax incentives from 2027 to 2033 for investment in rural areas. Low-income developments also offer incentives.

- 💻 Semiconductor manufacturers have been incentivized to build capacity in the US quickly. Companies that break ground on new fabs by 2026 are eligible for up to 35% in tax credits.

- 🏗️ Manufacturing companies in general are being incentivized to reshore and create new jobs.

- Tariffs on imports like steel and copper could dampen the positive effect of these incentives.

-

🏛️ Redirected Federal Spending: The bill allocates massive funds to administration priorities, including $178 billion for immigration enforcement and $153 billion for defense, focusing on shipbuilding and nuclear modernization.

- ✈️ Defense & Aerospace contractors are the obvious beneficiaries of these investments.

- Infrastructure, construction, and materials companies also stand to benefit - if they operate in the right areas.

- The increase in spending could result in elevated inflation.

-

⚡ Energy: The Inflation Reduction Act will be terminated, and renewable energy credits will be phased out.

- ☀️ Renewable energy companies are on the wrong side of this, but this was anticipated.

- 🏗️ Utilities will face higher capex costs without the incentives and longer build times to bring new capacity to the grid.

- 👥 Consumers are likely to face higher electricity prices as capacity growth slows.

- 🛢️ Oil and gas producers benefit from new incentives, and a less competitive renewables industry. The direction of oil and gas prices could overshadow these benefits.

-

⚕️Medicare and Medicaid Cuts are projected to be over $1.5 trillion combined. Many of the cuts and increased work requirements only come into effect in 2026 and 2027, so their effects will be delayed.

- 🏥 Hospitals and insurers will be on the wrong side of these cuts unless consumers are able to make up shortfalls.

-

💵 The Consumer Financial Protection Bureau will see a 50% cut in funding.

- 🏦 Lenders and other financial services companies could benefit from lower regulatory costs.

- This could also lead to heightened systemic risk.

The recent performance of US sectors gives us some ideas of how the market views the passing of the OBBB:

⛰️ The Long Term: A Mountain of Debt

While supporters focus on growth, economists and budget analysts are sounding the alarm on the fiscal impact.

- 💥 Deficit Explosion: The Congressional Budget Office (CBO) projects the bill will add $3.4 to $5 trillion to the national debt over the next decade.

- 💣 The "Debt Bomb": Veteran investor Ray Dalio has warned that this trajectory risks a "debt bomb" scenario, where the sheer volume of debt destabilizes the U.S. dollar and heightens global financial risk. By 2035, estimates indicate the U.S. debt-to-GDP ratio could hit nearly 155%.

The theory behind increased spending is that it will lead to higher economic growth, and therefore higher tax revenues despite the lower tax rates.

Well, that’s the theory at least. Many economists don’t see growth being high enough to pay for the increase in debt. Others argue that the only way out is growth.

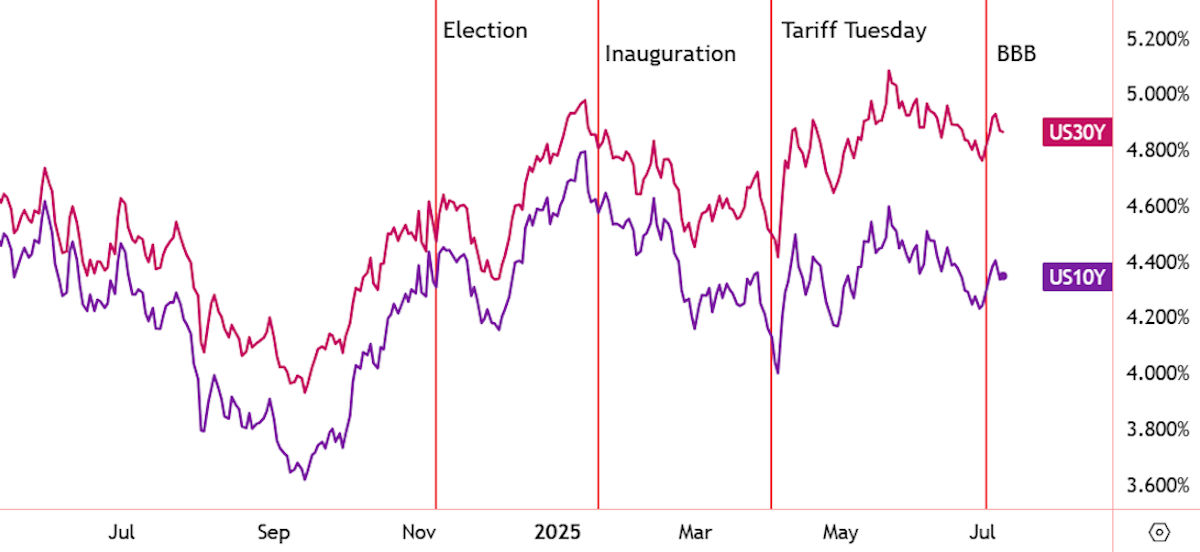

Global bond investors may be beginning to signal when they think US debt will become a real problem. The gap between 30-year and 10-year US treasury yields has gradually widened over the last 12 months, which can be seen below.

It’s a little more complicated than the chart suggests:

- 📊 Bond yields are also affected by the maturities being sold by the US Treasury.

- 🤷 Bond investors don’t (currently) have many alternatives .

✨ If this story unfolds badly, it won’t be a problem isolated to the US, as it could lead to extreme volatility for the USD, interest rates, and inflation around the world.

That might not happen for years, but it’s something to be aware of when making decisions about long-term investments.

🤔 Is The US Exceptionalism Premium Under Threat?

A year ago, we wrote about the 'US exceptionalism premium' , which is one way to explain the outperformance of US stocks and the gap between US and non-US company valuations.

So, given the underperformance of US stocks in 2025, is that premium beginning to erode? Looking back at that article now, most of the catalysts we listed that created the premium are still pretty much intact, particularly in relative terms.

But what about the debt? US government debt currently stands at about 124% of GDP according to the CBO, and it’s set to rise even higher.

The other major economy with more debt relative to its GDP is Japan at 216%, down from a high of 225%. Japan’s debt reached 100% of GDP in 2001 and 200% in 2013. During most of that period, the Nikkei 225 index remained in a bear market.

The prolonged bear market and rising debt were both due to a deflationary environment and very low growth. If that were to happen in the US, it would likely be bad news for a lot of US companies. The important differences are:

- For now, inflation is more likely in the US.

- The companies that dominate US indexes are globally diversified.

💡 The Insight: Find the Companies that Deserve a Resilience Premium

It’s probably a bit early to write off the US exceptionalism premium, but companies that are globally diversified might be more resilient.

If America can grow its way out of the debt, its current debt burden will be manageable. If not, global markets could face unprecedented volatility. If you’re taking a long-term view on your investments, resilience is a key attribute to look for.

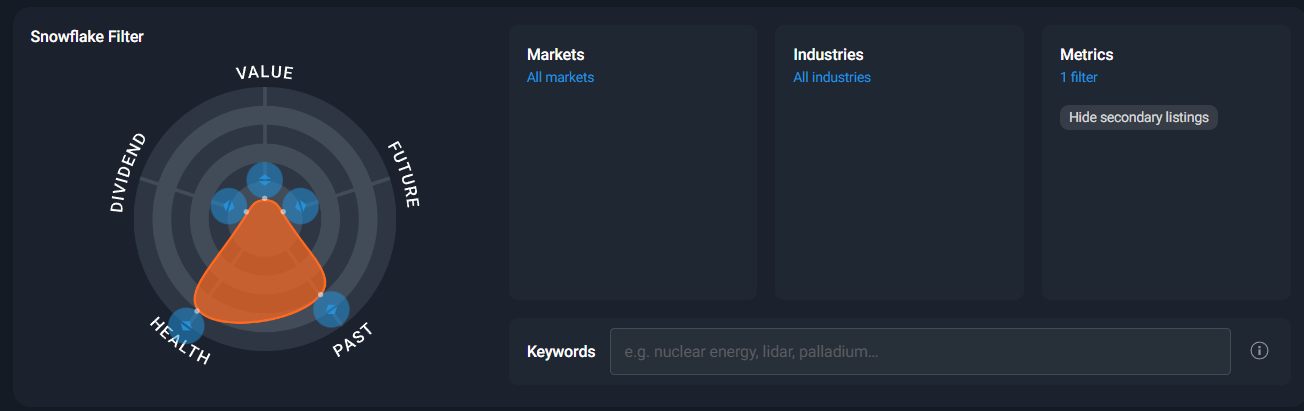

The Simply Wall St Stock Screener gives you a few ways to narrow down the list. A good starting point is to set a high bar for ‘Health’, and a fairly high bar for ‘Past Performance’. From there, you can narrow the list down by country, sector, and industry.

To be even more precise, you can specify the following metrics:

- 🏢 Company

- Risk Score - number of identified risks

- 📅 Past Performance

- ROE, ROA, ROCE - profit as a function of equity, assets and capital employed

- 💪 Financial Health

- Debt to Equity

- Net Debt to Equity - debt less cash to equity

- Current Ratio - current assets to current liabilities.

These metrics will help you find companies that (a) aren’t overly indebted, and (b) are actually generating returns on the investments they are making.

Key Events During the Next Week

Tuesday

- 🇨🇳 C hinese GDP Growth Rate YoY

- 📉 Forecast : 4.1% year-over-year (Previous 5.4%)

- ➡️ Why it matters: A significant dip is expected, so anything higher would be seen as positive.

- 🇨🇦 Canada Inflation Rate

- 📉 Forecast: 1.5% year-over-year (Previous 1.7%)

- ➡️ Why it matters: Continued declines in prices will be good news for consumers.

- 🇺🇸 US Inflation Rate

- 📈 Forecast: 2.5% year-over-year (Previous 2.4%)

- ➡️ Why it matters: Inflation has been tracking lower than expected over the last two months and will be closely watched.

Wednesday

- 🇬🇧 UK Inflation Rate

- 📈 Forecast: 3.7% year-over-year (Previous 3.4%)

- ➡️ Why it matters: Inflation will influence the Bank of England's monetary policy decisions.

- 🇺🇸 US PPI

- 📈 Forecast: 2.8% year-over-year (Previous 2.6%)

- ➡️ Why it matters: Producer prices can act as a leading indicator for consumer price inflation.

Thursday

- 🇦🇺 Australia Unemployment Rate

- 📉 Forecast: 4.1% (Previous: 4.1%)

- ➡️ Why it matters: Indicates labor market health, influencing Reserve Bank of Australia's policy.

- 🇬🇧UK Unemployment Rate

- 📉 Forecast: 4.6% (Previous: 4.6%)

- ➡️ Why it matters: Unemployment, along with inflation, are key drivers of interest rate policy.

- 🇺🇸 US Retail Sales

- 📈 Forecast: 0.2% month on month (Previous: -0.9%)

- ➡️ Why it matters: Indicates consumer spending trends, a key driver of U.S. economic growth.

Friday

- 🇯🇵 Japan Inflation Rate

- 📈 Forecast: 3.7% year-over-year (Previous: 3.5%)

- ➡️ Why it matters: Japan is one country where inflation is seen as a positive sign for the economy.

Q2 earnings season kicks off with all the big banks, as well as a few other large caps:

- JP Morgan

- Wells Fargo

- BlackRock

- Citigroup

- Bank of America

- Morgan Stanley

- Goldman Sachs

- American Express

- Johnson & Johnson

- ASML Holding

- TSMC

- GE Aerospace

- Abbott Laboratories

- Netflix

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.