🎢 From Panic to Peak: Q2’s Wild Ride and What’s Next

Reviewed by Bailey Pemberton, Michael Paige

Quote of the week: "The single greatest edge an investor can have is a long-term orientation." — Seth Klarman, CEO, Baupost Group.

The second quarter was a wild one, starting with a global selloff and ending with record highs. It was also a quarter with some important lessons for investors.

In this week’s newsletter, we are taking a look at what’s been happening while everyone’s been focused on Donald Trump’s tariff turnaround and yet more geopolitical drama.

In particular, we are taking a look at Q1 earnings season, which has had very little airtime, and some of the other factors behind the market rally.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube ! (Released each Monday by 5pm AEST).

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

👨⚖️ House narrowly passes Trump’s megabill in major victory for Republicans ( CNBC )

- Trump’s sweeping “One Big Beautiful Bill” passed the House by a razor-thin margin, delivering major tax cuts and new immigration spending, offset by deep Medicaid and social program cuts.

- Markets are likely to price in higher deficits, with Treasury yields potentially rising as the Congressional Budget Office warns of a $3.4 trillion debt bump over 10 years.

- Defensive sectors like healthcare could see pressure from Medicaid cuts, while tax-cut beneficiaries in oil and gas stocks may rally on lower production costs and expanded access to federal lands. Renewables face headwinds as subsidies dry up post-2027, so clean energy manufacturers may scale back U.S. investment plans.

- Tax cuts could fuel growth, but rising debt and trade risks may spook bonds and global equities.

🔨 Immigration crackdown hits economy ( Axios )

- Net immigration to the U.S. has plunged to an annualized rate of 600,000, down a third from late 2024, as Trump’s immigration crackdown bites. Deportations are up, unauthorized crossings are down, and key industries are already feeling the labor pinch.

- Sectors like agriculture, hospitality, and construction face acute shortages, while smaller cities that leaned on immigration for economic revitalization are seeing spending dry up.

- Economists warn GDP could dip 0.25% long term, and inflation may edge higher due to constrained labor supply and disrupted supply chains.

- Fewer newcomers mean tighter labor markets and higher wages in some pockets, but also slower growth and margin pressure for businesses reliant on immigrant workers.

🛑 Web giant Cloudflare to block AI bots from scraping content by default ( CNBC )

- Cloudflare will now block AI bots from scraping websites by default, shifting the power balance back to publishers and potentially cutting off key training data for AI developers like OpenAI and Google.

- The move affects about 16% of global internet traffic and introduces a “pay per crawl” model, which could raise costs for AI firms and slow model development.

- For investors, this could mean higher barriers to entry for smaller AI players, margin pressure for big ones, and a potential boon for content-rich publishers able to monetize their data.

- Cloudflare’s clampdown could reshape the AI ecosystem, favoring data owners and squeezing AI firms reliant on free web content.

🗄️ Figma just filed for IPO, revealing its financials for the first time publicly ( Sherwood )

- Figma’s IPO filing reveals a rare beast: a fast-growing SaaS firm that’s already profitable, with revenue up 46% YoY and 17% operating margins. Big customers (like 95% of the Fortune 500) now drive most of its $228M quarterly haul.

- The company shrugged off a failed Adobe buyout and a $894M one-off expense in 2024 to re-emerge with strong cash flow, $618M in cash, and a loyal enterprise base.

- Holding $70M+ in bitcoin on its balance sheet (with $30m in stablecoin for future bitcoin purchases) drew attention, both positive and negative.

- Figma’s IPO could set the tone for a SaaS comeback, but its premium pricing will test investor appetite for growth with profits.

🤖 Meta deepens AI push with 'Superintelligence' lab ( Reuters )

- Meta has consolidated its AI efforts into “Superintelligence Labs,” led by Scale AI’s Alexandr Wang and ex-GitHub CEO Nat Friedman, as Zuckerberg doubles down on artificial general intelligence (AGI).

- The move follows a talent raid on OpenAI, Anthropic, and DeepMind, with $100M signing bonuses rumored to lure researchers. Yet Meta faces skepticism after Llama 4’s lukewarm reception and Reality Labs’ $60B burn with little payoff.

- The AI spending spree from Alphabet, Amazon, Meta, and Microsoft is set to hit $320B in 2025 , but the timeline for AGI breakthroughs remains uncertain.

- Meta’s AI hiring spree cements its position as a serious OpenAI-Google challenger. Keep an eye on margin impacts from huge AI capex that may occur before the revenue flywheel spins up.

🚘 Tesla reports 14% decline in vehicle deliveries, marking second straight year-over-year drop ( CNBC )

- Tesla deliveries dropped 14% year-over-year in Q2 to 384,122 vehicles, but still came in slightly above Wall Street expectations. The stock jumped 5% as investors had braced for worse.

- Production outpaced deliveries again, adding to inventory concerns, while Chinese EV makers continue to eat into Tesla’s global share.

- Political noise around Musk and U.S. policy shifts could also impact subsidies and EV demand in key markets.

- Some analysts believe Tesla’s Q2 dip may mark a bottom, but growing competition and geopolitical headwinds mean investors shouldn’t count on a quicker rebound.

💥 From Fear to Euphoria: Q2's Epic Market Rebound

The second quarter of 2025 was a wild ride. It started with a gut-wrenching plunge and ended with an all-out sprint to record highs.

So, what happened?

In short, the market gave us a masterclass in one of the most important lessons in investing: how to separate the signal from the noise.

For investors who didn't panic, it was a hugely rewarding quarter. Let's break down how it all unfolded.

Once again, global markets started the quarter with a meltdown and ended with record highs. The same occurred less than a year ago in Q3 2024.

The big event, Tariff Tuesday in the first week of April, appeared to be the final nail in the coffin for markets, and added another ~8% to Q1’s losses. But Donald Trump ultimately relented and delayed his ‘reciprocal tariffs’ by 90 days.

Since then, it’s been one-way traffic for most indexes, with several ending the quarter at or close to record highs.

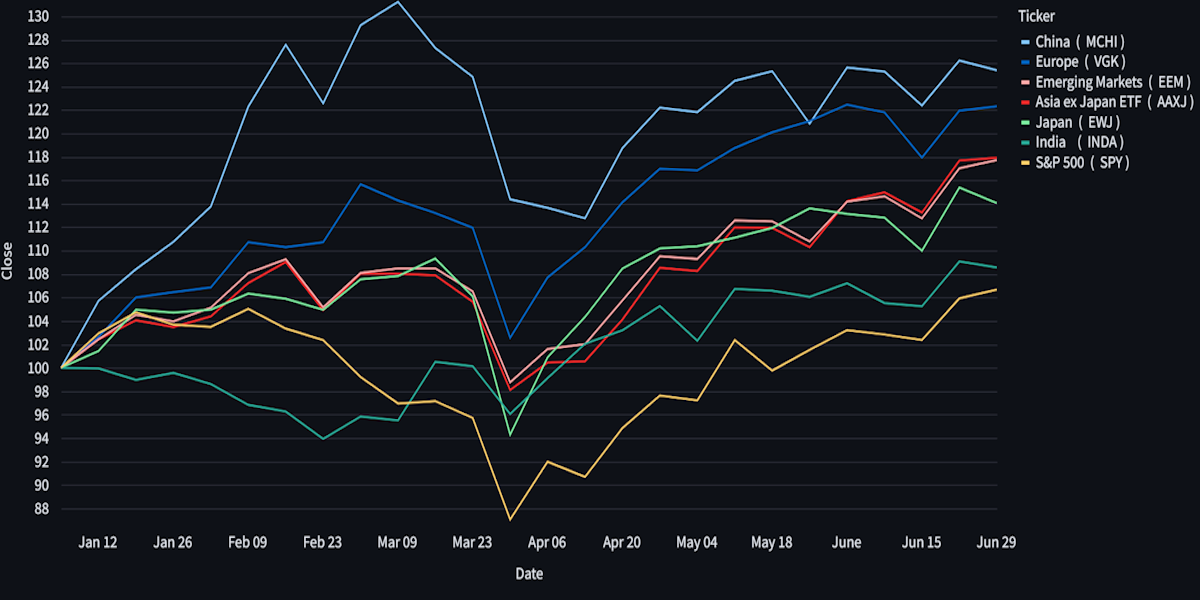

Market Performance: 1st Jan to 29th June 2025

🐔 Beyond the TACO Trade

The market’s turnaround wasn’t just a relief rally.

Money needs to go somewhere, and the tariff fiasco has forced investors to look beyond the usual assets. This has resulted in a broader rally, although the Magnificent 7 came to the party too.

A few other notable catalysts have played their part:

- 📅 Earnings season was remarkably resilient, despite slowing economic growth. More on that below…

- 💻 US tech stocks have maintained their earnings momentum.

- A lingering concern has been all the optimism baked into the AI trade and how long it can continue. Big tech has managed to keep earnings growth ahead of expectations, and its investments in AI infrastructure keep rising. This suggests they are still seeing demand.

- 💵 US dollar weakness has acted as a tailwind for the companies that were previously on the wrong side of the strong dollar. For US multinationals, foreign earnings now offset any local slowdown.

- 📈 The IPO market is back.

- The number of US companies going public in 2025 is already higher than in recent years. After a low start, the success of high-profile IPOs like Coreweave and Circle has boosted investor interest, and several high-profile listings are planned for H2. Elsewhere, IPOs are also breaking records. In Hong Kong, 43 companies have been listed this year, and another 220 plan to follow them . In India, 140 companies plan to IPO too.

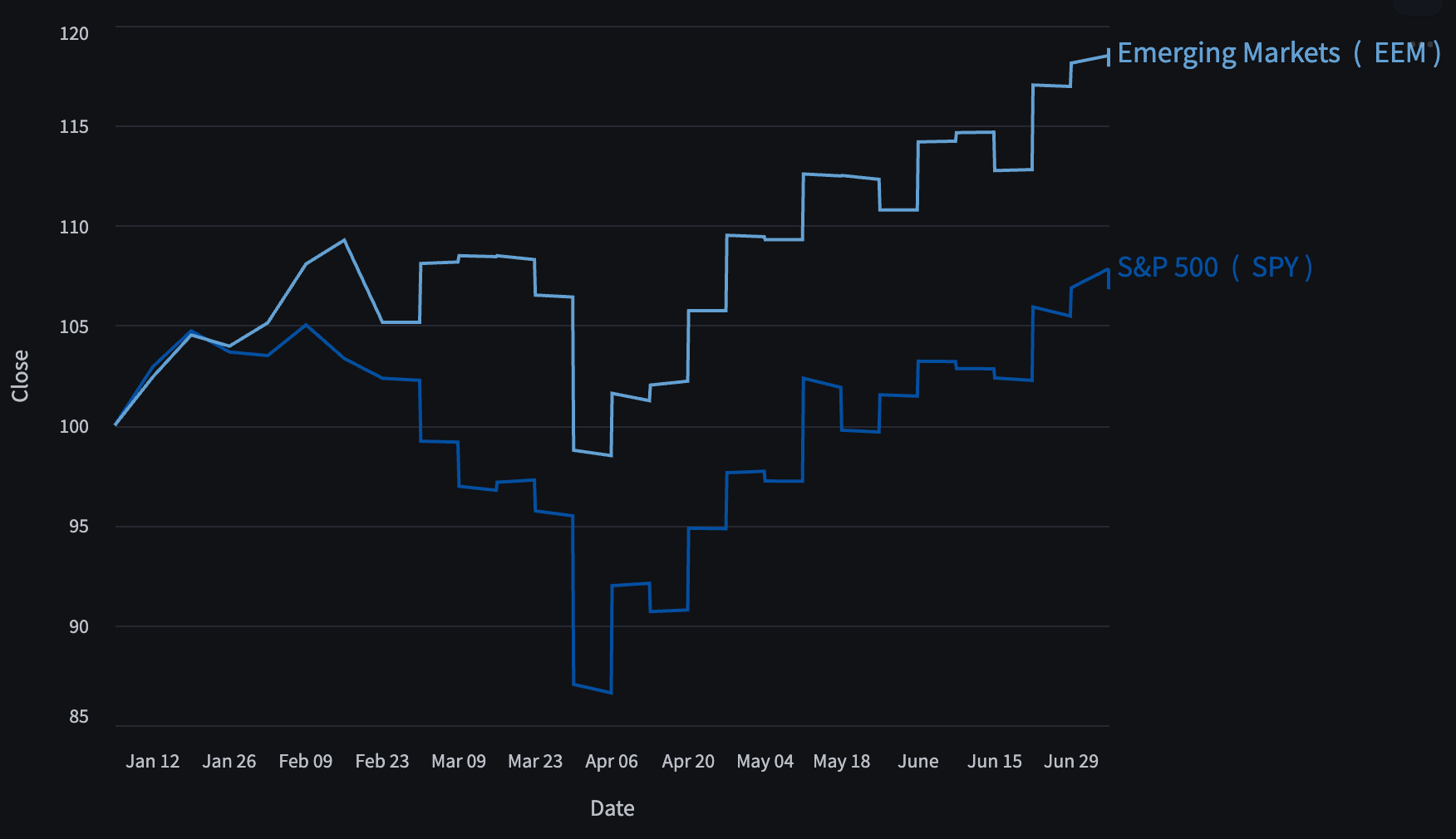

- 🌏 Emerging markets are also back.

- After nearly two decades of underperformance, a handful of emerging economies are attracting investor interest. This is partly the result of fund managers looking at new opportunities, and strong fundamentals in countries like India , Indonesia, and Vietnam .

Emerging Markets (teal) vs S&P 500 (blue): Jan 1st to June 30th 2025

Emerging market outperformance and increased IPO activity are common signs of increased risk appetite, despite the slowing global economy and ongoing geopolitical tension.

📆 Q1 Earnings Season

🇺🇸 US Earnings: Magnificent for Some, Meh for Others

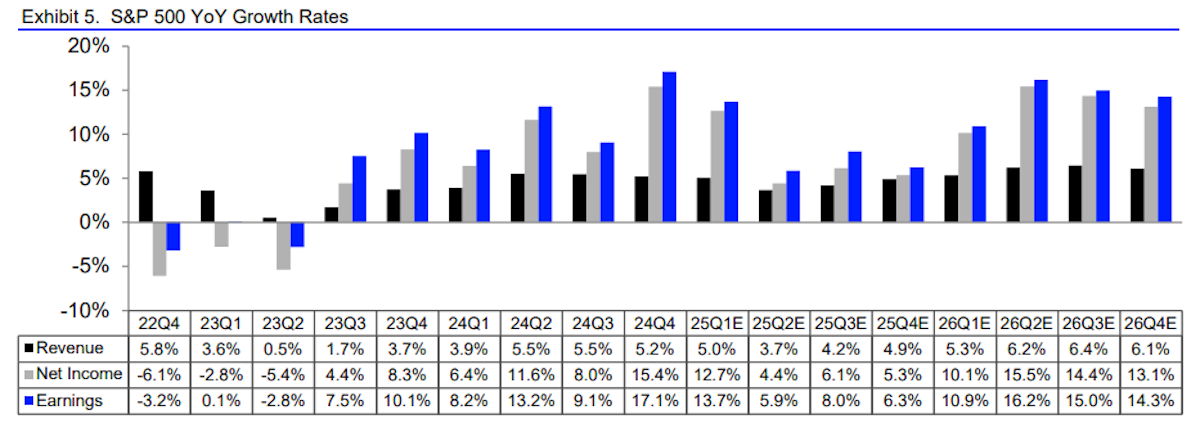

S&P 500 companies reported EPS growth of 13.7% on revenues that were up 5% over the last 12 months. This was down from the 17.1% and 5.2% growth reported for Q4 2024, but still fairly robust, and better than expected.

S&P 500 Revenue, Net Income and EPS: Actual and Expected - LSEG I/B/E/S

Notably, the Magnificent 7 reported EPS growth of 27.7%, compared to the 16% expected at the end of March.

The US Healthcare sector reported the highest EPS growth rate (46.4% vs 38% expected), followed by Communication Services (31% vs 6.2%).

Healthcare earnings growth had lagged the rest of the market prior to this quarter. While this recovery has been anticipated for some time, its growth is now expected to slow substantially.

Energy stocks reported EPS down 16.5% over the last 12 months, which wasn’t a surprise, and real estate (-7%) and consumer staples ( -5.4%) were the only other sectors reporting a decline in earnings.

For smaller companies, the strong recovery of the previous three quarters came to a sudden end. Russell 2000 companies reported EPS growth of 9.9% compared to 46% in December. This was despite revenue growth being slightly higher than Q4.

Smaller US companies are facing more margin pressure, and have less exposure to offshore earnings, which benefit from the weaker US dollar.

✨ Looking ahead, analysts have grown cautious about earnings over the remainder of the year. This reflects the increased uncertainty around tariffs, inflation, US debt, and the USD.

This is somewhat at odds with the outlook from companies. Companies issuing positive guidance is slightly higher than average , and most have maintained their guidance for the full year.

🇪🇺 Europe: A Mixed Bag of Hits and Misses

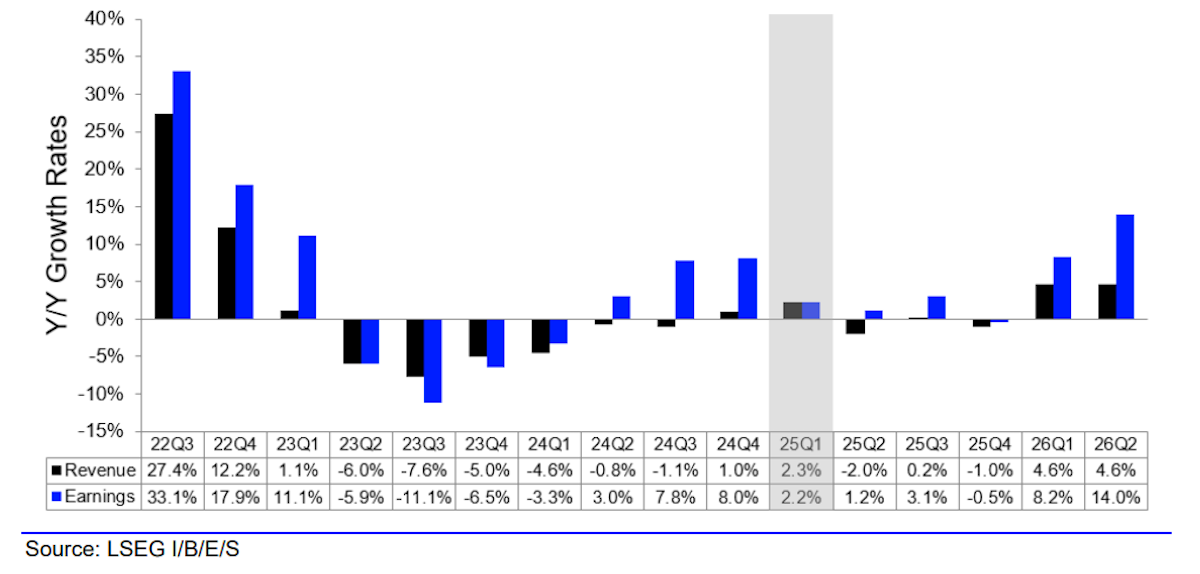

In Europe, the earnings recovery of 2024 has also ended abruptly.

Amongst the Stoxx 600 companies that have reported so far, earnings were up just 2.1% over the 12 months to March , with revenues increasing 2.3%. However, those numbers are for the entire index, and the story has been very different for the various sectors.

✨ LSEG pointed out that without the energy sector, earnings were 7.8% higher, and revenue was 4.3% higher.

The energy sector reported a 27.8% decline in earnings, while consumer cyclical companies saw earnings fall 21% over 12 months.

Those results were countered by strong growth from the real estate (+23%), technology (+20%), and industrials (+16%) sectors.

✨ Financial performance has also been country-specific. Companies based in Poland, Belgium, and Denmark reported growth of 19%+, while earnings fell 12% in Portugal and 19% in Finland.

This probably says more about a handful of companies based in the respective countries than the local business environments.

Stoxx 600, Net Income and EPS: Actual and Expected - LSEG I/B/E/S

Looking ahead, analysts see more of the same over the next three quarters, with an improvement in the first half of 2026. There are two things to note about these projections:

- 📈 Earnings accelerated in H2 2024 for the first time in three years, but this raised the bar for the remainder of this year.

- 📊 The outlook for individual companies varies widely compared to the average.

🌏 Asia: Korea Leads, China Lags, Japan Reforms

We published a more detailed update on Asian markets two weeks ago, but here’s a brief look at earnings season in the region:

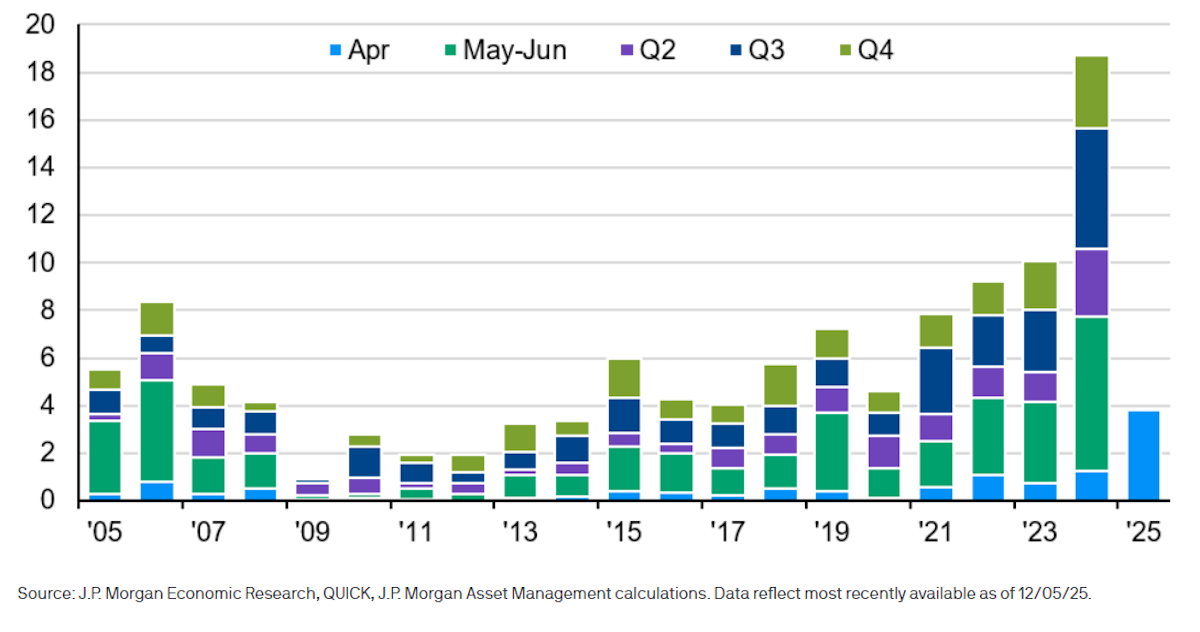

🇯🇵 Japan

Japanese companies reported earnings growth of 2.5%, with exporters seeing a slowdown in demand. Companies are also very cautious about the remainder of the year and the impact of tariffs.

Investors are, however, more focused on corporate reforms, particularly the value that can be realized from share buybacks. Share repurchases announced in 2024 were nearly 4x the average prior to 2020.

Share Buybacks Announced by Japanese Companies - JP Morgan Asset Management ( Japan fiscal year is April-March)

🇰🇷 South Korea

The star performer in Asia was South Korea, reporting earnings growth of 23%. This was attributed to a jump in demand ahead of expected tariffs and restocking of inventory.

🇮🇳 India

Companies in India reported earnings growth of 10.6%, with financials standing out. The steady performance of India’s financial sector is further evidence of the way banks benefit from economic development in emerging economies.

🇨🇳 China

China’s challenges are still weighing on most companies, with the exception of a handful of tech companies, which are seeing a resurgence of investment.

💡 The Insight: Narratives and Valuations Will Help You Filter Out the Noise 🎯

The last three months have been yet another reminder that investors need to focus on the signal and filter out the noise.

That can be easier said than done, but having a framework to assess investments makes it a lot easier.

Remember:

- 🗣️ The Noise largely consists of short-term price movements, the media, and political rhetoric.

- 📈 The Signal comes from understanding a company's strengths and weaknesses, competitive position, and what it’s realistically worth.

Companies are considering a much longer time horizon than the media and politicians. There will always be demand for the products sold by companies with strong management, intellectual property, and a competitive edge.

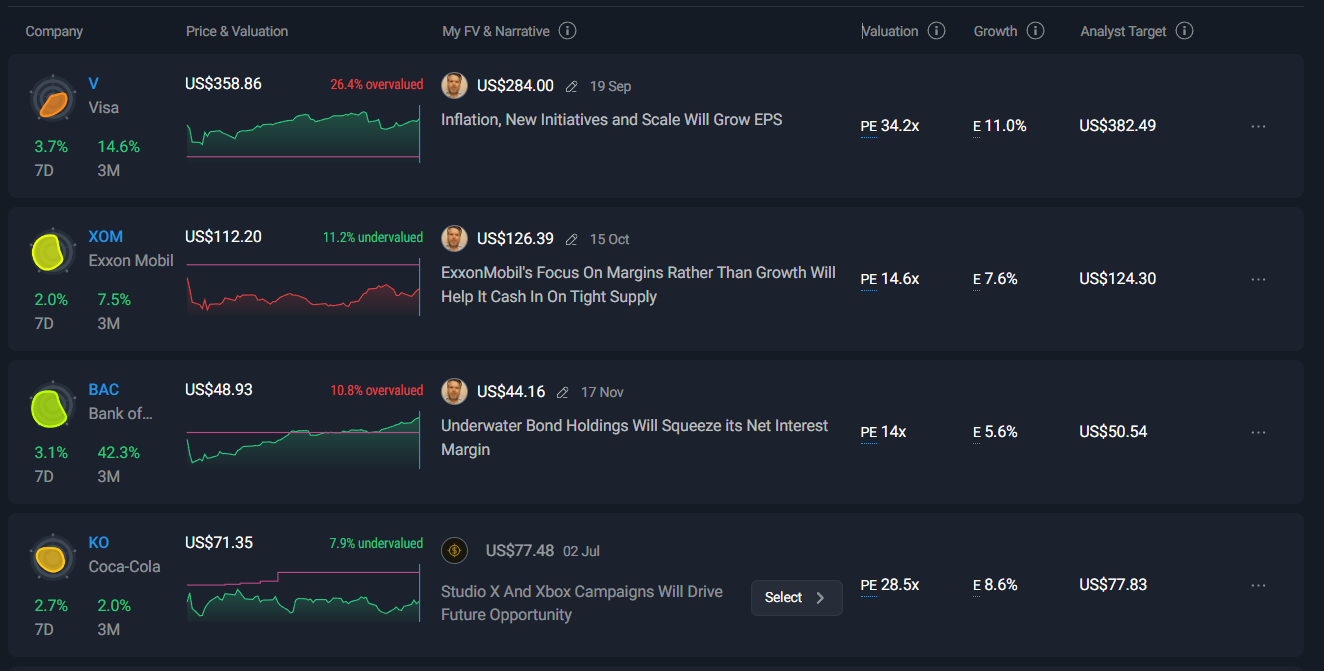

If you do the work to create an investment narrative and calculate what you believe a company is worth, you’ll have an anchor independent of the day-to-day price swings for a company’s share price.

This reframes volatility from a threat into a potential opportunity.

For companies you own, you can set fair values in the Simply Wall St Portfolio Tool .

And for those you’d like to own at the right price, you can set your fair value on a watchlist . This is your signal amidst the noise.

Watchlist With Fair Values - Simply Wall St

Key Events During the Next Week

Monday

- 🇩🇪 Germany Industrial Production (May)

- 📉 Forecast: -0.6% MoM, Previous: -1.4% MoM

➡️ Why it matters: Tracks the pulse of Germany's manufacturing sector, a bellwether for broader eurozone growth.

- 📉 Forecast: -0.6% MoM, Previous: -1.4% MoM

Tuesday

- 🇦🇺 NAB Business Confidence

- 📉 Forecast: -5, Previous: 2

➡️ Why it matters: Gauges confidence among businesses, often an early signal of broader economic trends.

- 📉 Forecast: -5, Previous: 2

- 🇦🇺 RBA Interest Rate Decision

- 📉 Forecast: 3.6%, Previous: 3.85%

➡️ Why it matters: Lower borrowing costs reduce costs for businesses and give consumers more spending power.

- 📉 Forecast: 3.6%, Previous: 3.85%

Wednesday

- 🇺🇸 FOMC minutes

- ➡️ Why it matters: The minutes from their last meeting give investors more insight into the Fed’s deliberations over monetary policy.

Thursday

- 🇺🇸 Initial Jobless Claims

- 📈 Forecast: 245k Previous: 233k

➡️ Why it matters: Jobless claims provide insight into the health of the labor market.

- 📈 Forecast: 245k Previous: 233k

Friday

- 🇬🇧 UK GDP Estimate (May)

- 📉 Previous: -0.3% MoM

➡️ Why it matters: A weak print would fuel recession fears and strengthen the case for BoE rate cuts.

- 📉 Previous: -0.3% MoM

- 🇨🇦 Unemployment rate

- 📉 Forecast: 7% (unchanged)

- ➡️ Why it matters: Changes in the unemployment rate affect consumer spending and the BOC’s monetary policy stance.

Stocks reporting this week

The second quarter earnings season kicks off on the 14th of July. Until then, there are just a few companies due to report.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.