🎢 Asia’s 2025 Rollercoaster: From Trade Turmoil to Market Rebounds

Reviewed by Bailey Pemberton, Michael Paige

Quote of the week: “An emerging market is a country where politics matters at least as much as economics to the market." Ian Bremmer

Between tariff threats, growth downgrades, and a surprising equity market rebound, the Asian market is proving to be as unpredictable as ever.

Sure, the IMF trimmed its growth forecasts. But when you zoom out, the big picture doesn’t look half bad, especially considering how messy things got earlier in the year.

And if you’ve glanced at a chart recently, you’ll know Asian stock markets have bounced hard since April’s “Tariff Tuesday.”

So… what’s really going on? Let’s unpack the chaos and the opportunity in this region.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube ! (Released each Monday by 5pm AEST).

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🪖 A ‘terrible spiral of escalation’: World braces for intensifying Iran-Israel conflict ( CNBC )

- The Middle East teeters on the edge as Iran and Israel exchange direct strikes, while the U.S. inches closer to potential military involvement.

- Investors are watching oil markets and defense stocks amid rising geopolitical tensions, with potential knock-on effects for global inflation and energy supply chains.

- Escalation in the Iran-Israel conflict could spike crude prices, test the Fed’s inflation patience, and pressure risk assets globally. Energy-sensitive sectors and emerging markets heavily reliant on oil imports may face volatility. On the flip side, defense stocks and energy producers could see a demand boost. Safe-haven assets like gold and U.S. Treasuries are likely to draw inflows if the conflict broadens.

- If this turns into a full-blown regional war, portfolios not hedged for oil shocks and volatility might be in for a bruising.

-

💵 Senate passes GENIUS stablecoin bill, giving crypto industry first major legislative win ( CNBC )

- This clears the way for fintechs, banks, and even retailers to issue regulated stablecoins, potentially igniting a multi-trillion-dollar market.

- According to Deutsche Bank, stablecoin transaction volume last year was more than $28 trillion, which is larger than Visa and Mastercard’s volumes combined.

- This is a game-changer for the stablecoin space. The bill enshrines U.S. dollar dominance in digital finance and legitimizes stablecoins as serious financial tools. AML rules are baked in, and Treasury takes the regulatory wheel with monthly audits (making sure the stablecoins are backed 1:1 by USD).

- Platforms like Shopify already offer USDC payments through Stripe and Coinbase (which rose 16% on the news), so don’t be surprised if you see a race to integrate or launch compliant stablecoins.

- With stablecoins getting the federal green light, their institutional era is here, and the payment rails are about to get a serious upgrade.

-

📃 Coinbase seeking US SEC approval to offer blockchain-based stocks ( Reuters ).

- If the SEC bites, Coinbase might turn equities into always-on, borderless assets.

- If approved, this could disrupt brokerages like Robinhood and Schwab, slashing costs, accelerating settlements, and enabling 24/7 equity trading.

- This isn’t just a tech play, it’s a structural shake-up for capital markets. Coinbase could unlock a new revenue stream while redefining access to equities, appealing to younger, crypto-native investors.

- Institutional adoption may follow if regulatory clarity lands, but liquidity and global standards still pose hurdles. It’s worth keeping an eye on, because over the longer term, it would be quite disruptive to traditional trading infrastructure.

-

✂️ Microsoft Planning Thousands More Job Cuts Aimed at Salespeople ( Bloomberg )

- Microsoft plans to reallocate that spending toward AI infrastructure and third-party partnerships for SMB software sales.

- This follows May’s 6,000-person layoff round, with AI now clearly reshaping the company’s workforce strategy.

- These cuts signal a large shift: Microsoft is betting heavily on AI while slimming down in areas not seen as essential to that future. Outsourcing SMB sales and trimming sales teams may boost short-term margins but could dampen revenue growth in underpenetrated markets. Investors may welcome the discipline, especially with capital flowing into AI, but should watch for signs of sales channel friction.

- Microsoft’s AI pivot is coming at the cost of human sellers, leaner ops today, but watch for revenue cracks tomorrow.

-

📺 Omnicom partners with Amazon and Meta to build on live content and live shopping ( Digiday )

- These deals aim to close the loop on measurement, helping brands tie live viewership directly to purchases and lifetime customer value.

- This could be a turning point for advertisers aiming to justify spend in live formats. For investors, it's a signal that live commerce and shoppable content are entering a mature, data-rich phase.

- Expect advertising dollars to follow, and possibly boost platform revenue growth for Amazon and Meta. Watch for increased performance-based ad buying tied to creator content.

- Live shopping isn’t just flashy content. It’s becoming a full-funnel sales tool. Long-term investors in ad platforms or Omnicom should bet on this becoming standard practice.

-

🫸 Fed holds key rate steady, still sees two more cuts this year ( CNBC )

- The Fed held rates at 4.25%-4.5% but still sees two cuts in 2025, despite hotter inflation and weaker GDP forecasts.

- Markets got a mixed message: patience from Powell, but a cautious tilt toward eventual easing.

- The Fed is threading the needle between sticky inflation and softening growth. With GDP projections down and inflation estimates up, investors should brace for stagflation-lite conditions.

- Rate-sensitive assets may drift sideways until the Fed acts. High government debt and political pressure from Trump add more complexity, especially with rates staying elevated and debt service costs ballooning.

- So it seems cuts are still coming, but not until inflation blinks first. Resist chasing short-term noise and focus on quality growth and dividend-paying equities that can weather higher-for-longer rates.

🌏 Asia's Rollercoaster Ride in 2025

Asian economies have been in the crosshairs of the Trump Administration’s chaotic tariff policy. For the most part, they have been remarkably resilient, so far.

While the IMF has lowered its growth forecast for Asia to around 3.9% in 2025 and 4% in 2026 , it’s not too bad. Yes, that’s lower than the 4.6% growth rate in 2024, but it’s not a big knock considering the turmoil of the last few months.

Other economists expect an even smaller decline in growth. Of course, this all depends on the direction the trade negotiations take.

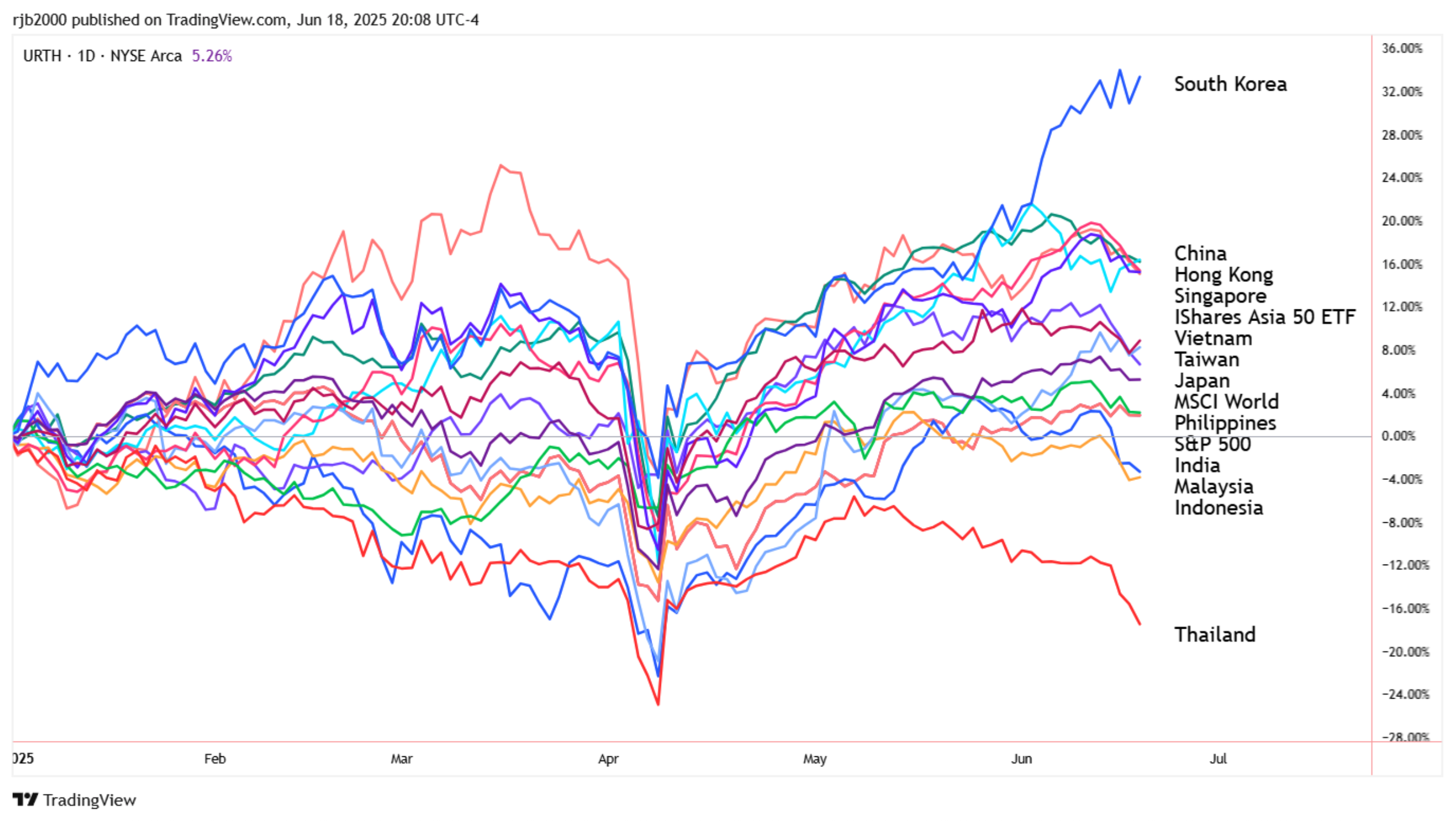

Believe it or not, Asia’s equity markets have bounced back strongly since ‘Tariff Tuesday’ on 8th April.

✨ The 12 largest stock markets in Asia are up between 9% and 38% since the low.

If we use the pre-April peak in early March as the starting point, only two markets (Thailand and Malaysia) are in negative territory.

Asia Stock Markets: Year-to-Date Performance - TradingView

Here are some of the key themes that we’ve observed:

- 🛍️ It’s a mixed bag: There has been little consistency in sector performance across the region over the last 3 months. For example:

- 🧱 The materials sector in Indonesia was up 48%, while the same sector was lower in seven out of the ten remaining markets.

- 🛒 There was similar dispersion in other sectors, including consumer staples, financials, healthcare, and the industrials sector.

- 🔃 Rotation between markets: There appears to be a lot of rotation back and forth between markets; indexes appear to be mean-reverting.

- 🇰🇷 South Korea has been the best-performing market over 3 and 6 months, after lagging in 2024. India’s market lost momentum in the second half of 2024, but began to outperform during the last three months.

- 🇨🇳 China and 🇸🇬 Singapore's markets performed well in the second half of 2024, but have lagged in 2025.

- 📉 Small caps have performed poorly in most Asian markets in 2025.

- 💸 Several reports suggest hedge funds have become very active in Asia.

- This makes sense when we see so much sector rotation (betting that prices will revert to the mean) and the underperformance of small caps (hedge funds focus on the most liquid shares).

✨ The main takeaway from this mixed bag of performance is that there are very few consistent, sector-specific themes to rely on.

So investors should focus on the merits of individual companies. In other words, it's a stock picker's market. The volatility and rotation between sectors and markets could create great opportunities for patient and prepared investors.

Let’s take a look at each market specifically.

🇮🇳 India: A Resilient Haven?

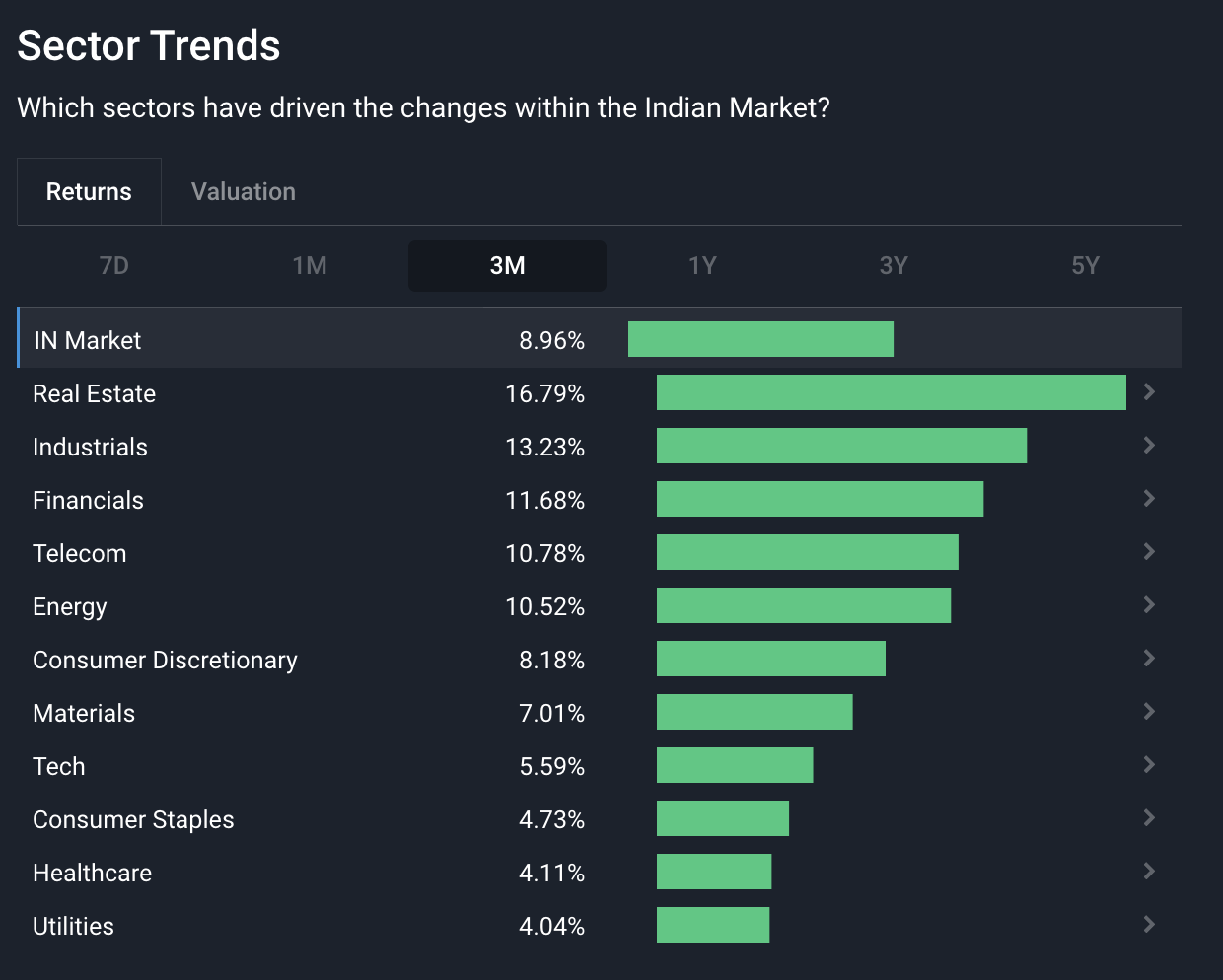

India remains the fastest-growing major economy in the world (up 7.4% YoY growth in Q1), and it’s less exposed to trade wars than others in Asia. The central bank is aiming to keep growth above 7% and has cut the benchmark rate three times since January.

- 🏠 Domestic Strength: It’s considered a "safer bet" by many investors because its growth is primarily driven by strong domestic demand, making it less vulnerable to global trade disruptions.

- 👪 Demographic Tailwinds: The country benefits from significant demographic tailwinds as the economy is being modernized, and living standards and incomes rise.

- As a reminder, India’s per capita GDP is just $2,300 compared to $12,400 in China. That implies a lot more upside potential if these trends continue.

- 💰Trading at a premium: India’s stock market rallied for most of last year but reached a peak just as China enacted massive stimulus measures. That resulted in foreign investors dumping India and chasing returns in China.

The selloff culminated in a mini-crash in February, and the MSCI India index has bounced back since then. Still, the index is down 2.5% over 12 months.

India 3-Month Market Performance by Sector- Simply Wall St

With stock prices up ~ 10% in Q2, it isn’t surprising to see P/E ratios rising. But earnings estimates have fallen too. So while the market isn’t necessarily a bargain, it isn’t the most expensive in Asia either.

📆 India’s 2025 outlook: Investors will need to be patient and focus on the companies that can compound earnings over long periods, rather than chasing momentum as money flows in and out of the market. This market has favourable macro trends, but if you want to outperform, focus on quality.

🇨🇳 China and Hong Kong: AI Hype & Stimulus Hopes

China’s economy still faces several challenges, and the on-again-off-again trade war is only one of them.

The economy actually benefited as foreign importers raced to get orders in ahead of expected tariffs. This was offset by lower imports and soft domestic demand, but GDP growth of 5.4% in Q1 was ahead of estimates.

The IMF is less optimistic about the rest of the year and has revised its full-year forecast down to between 4.0% and 4.6%.

✨ Despite the weak domestic economy and uncertainty over tariffs, there has been renewed interest in the tech sector both in mainland China and Hong Kong.

🤖 Two catalysts are driving a new wave of tech investments.

- 🚀 Several breakthroughs : The tech breakthroughs like DeepSeek’s R1 AI model have reminded investors that innovation is alive and well in China.

- 🫷 Export Controls: The US ban on sales of high-performance chips to China has made developing its own AI chips an imperative. That means government investment is pretty much assured.

China’s equity market has become a mirror image of India’s, with stimulus driving a rally late in 2024. That rally has now lost momentum.

China: 3-Month Market Performance by Sector - Simply Wall St

Looking at returns above for China and Hong Kong, you wouldn’t think Tech stocks were the bright spot, but the one-year numbers look a lot better.

Looking ahead, China’s market appears reasonably valued. But it’s very much a company-specific story. And, with uncertainty over tariffs, weak domestic demand, and potential government stimulus, volatility is the most likely outcome.

🇯🇵 Japan: The Virtuous Cycle

After decades of stagnation, Japan is showing signs of a major turnaround. A new narrative is emerging, built on rising wages, shareholder-friendly reforms, and a historic shift in monetary policy.

- ✨ Pay Raises Are Back: In the spring, Japanese companies delivered an average wage hike of 5.46%—the biggest increase since 1991. This is fueling optimism for a "virtuous cycle" of higher spending and mild inflation.

- 🤝 Shareholder-Friendly Shift: A push for better corporate governance and massive share buybacks In 2024 buybacks amounted to ¥17 trillion (about $100 billion).

The economy is still sluggish though, and GDP growth was flat in Q1. This was mostly due to both export and domestic demand softening. Economists expect slightly higher growth later in the year - but probably still in the 0.5 to 1% range.

Japan 3 - Month Market Performance by Sector - Simply Wall St

Despite the sluggish economy, global investors are optimistic about its stock market. Bloomberg recently reported that global banks are scrambling to hire and retain staff as they expand their offices in Japan.

Japan’s market is amongst the most expensive in Asia, but that’s based on very low expectations. If higher wages do kick off a virtuous cycle of spending and investment, that 15x P/E might be a bargain.

Other Markets

For the remaining markets in Asia, economic and market performance has been country-specific in 2025.

🇰🇷 South Korea’s Comeback: Big Gains After a Brutal Bear

South Korea has been the star performer, up 33% year-to-date and 18% in Q2. But this came after a four year bear market which saw the index fall 45%. The economy also contracted in Q1, which is a reminder that the economy and stock market can be very different things.

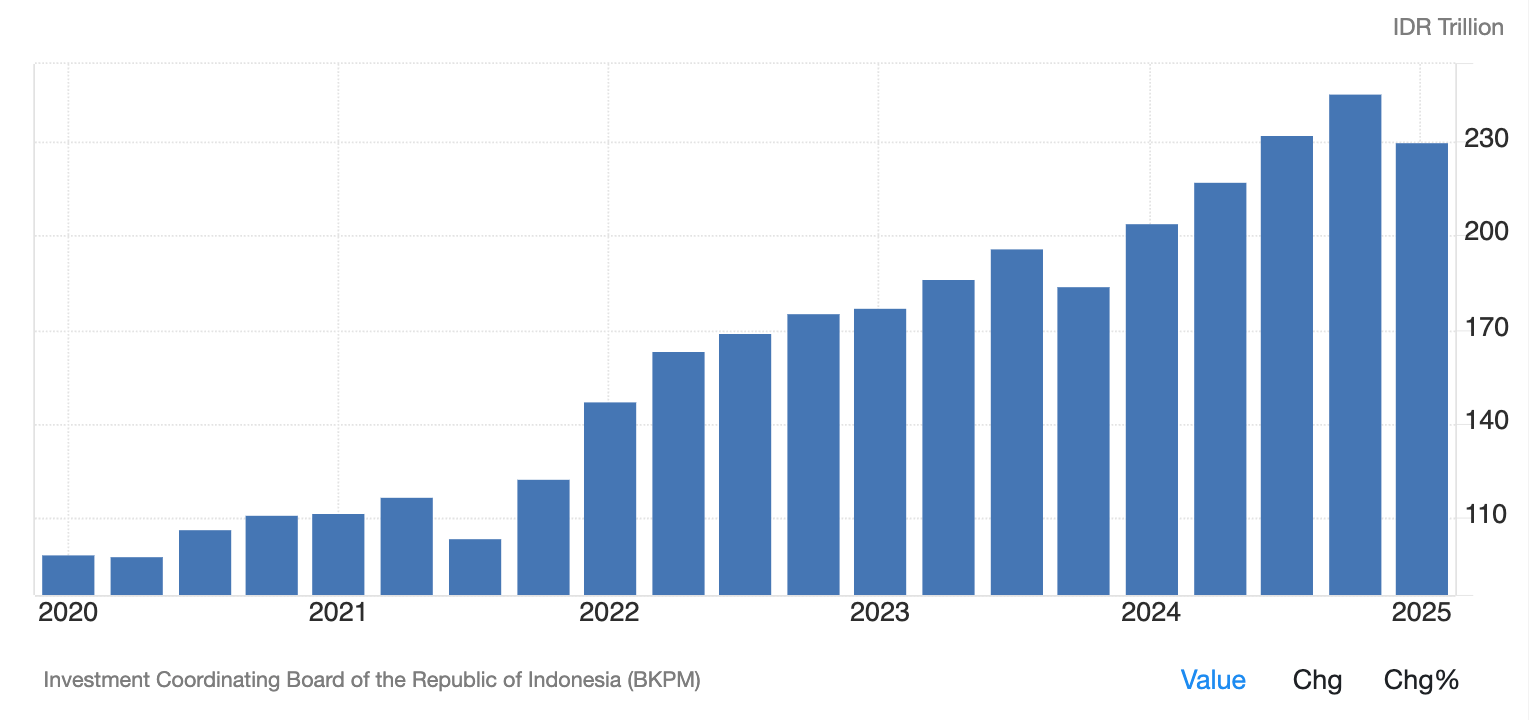

🇮🇩 Indonesia and 🇻🇳 Vietnam: The New Emerging Market Darlings

About 25 years ago, countries like South Korea, China, and Thailand were regarded as “emerging markets”.

Now that those economies are maturing, the mantle has been passed to other countries, most notably Indonesia and Vietnam. These are the countries that China now outsources to, AKA the ‘China + 1 strategy’.

Emerging markets have had a bad run since 2008.

But fund managers around the world are now looking to EMs as they run out of ideas elsewhere. In Asia, India, Vietnam, and Indonesia are the favorites. Elsewhere, Brazil and Uzbekistan are in the spotlight.

Stock markets can be fickle, but another way to get an idea of investor commitment to an economy is to look at FDI - foreign direct investment.

This refers to money invested directly. Unlike stocks, these investments can’t be dumped as soon as things look shaky. The trend for FDI into Indonesia is hard to miss:

Indonesia: Foreign Direct Investment - TradingEconomics

🌧️ Dragged by Giants: Thailand, Malaysia & Singapore Struggle for Momentum

Thailand’s economy and market have been under pressure for a while. Thailand is very exposed to China’s economy, and it’s also a key manufacturing base for Japan’s auto industry.

Malaysia and Singapore have fared slightly better, but exposure to both Thailand and China has weighed on sentiment and economic activity.

✨ The Insight: The USD and Bond Market Could Have a Moderating Effect on Asian Equity Markets

For the last four decades, Asian economies have profited by exporting goods to the US, and then recycled those dollars into US Treasuries.

That arrangement helped Asian countries build their economies, and it helped the US fund massive deficits. But it’s been on an unsustainable path, and now it seems to be coming to an end - or at least slowing down.

This will put pressure on the US dollar and US bonds - which makes them even less attractive.

But trade isn’t going to stop, and the dollars earned from exports to the US need to go somewhere. They could go into local stock markets, local government bonds, private investments, real estate, or gold. Most of those options are good for local economies.

What this means is that the bleaker the outlook for the USD and treasuries, the more incentive there is to invest locally.

So while a weaker USD and higher interest rates in the US would hurt Asian exporters, they could also result in more domestic investment.

Key Events During the Next Week

Monday, June 23, 2025

🇩🇪 Germany IFO Business Climate (Jun)

- 📊 Forecast: 89.7, Previous: 89.3

- ➡️ Why it matters: A key survey of German business morale. A rising number suggests optimism, boosting the Euro and European stocks.

Tuesday, June 24, 2025

🇨🇦 Canada CPI Inflation (YoY) (May)

- 📉 Forecast: 2.6%, Previous: 2.7%

- ➡️ Why it matters: The Bank of Canada's primary inflation gauge. A lower reading could pave the way for further interest rate cuts.

Wednesday, June 25, 2025

🇦🇺 Australia CPI Inflation (YoY) (May)

- 📈 Forecast: 3.8%, Previous: 3.6%

- ➡️ Why it matters: A key inflation read. A higher figure could push the Reserve Bank of Australia to delay potential rate cuts.

🇺🇸 US GDP Growth Rate (QoQ) (Q1 Final)

- 📊 Forecast: 1.3%, Previous: 1.3%

- ➡️ Why it matters: The broadest measure of economic output. Revisions can shift views on the economy's strength and Fed policy path.

Thursday, June 26, 2025

🇺🇸 US Durable Goods Orders (May)

- 📉 Forecast: -0.1%, Previous: 0.7%

- ➡️ Why it matters: A key gauge of business investment. A decline suggests companies are pulling back on spending, a negative for growth.

Friday, June 27, 2025

🇨🇦 Canada GDP (MoM) (Apr)

- 📈 Forecast: 0.2%, Previous: 0.0%

- ➡️ Why it matters: Tracks monthly economic growth. A rebound would ease concerns about a slowdown and support the Canadian dollar.

Stocks reporting this week:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.