Quote of the week "Anything that won't sell, I don't want to invent. Its sale is proof of utility, and utility is success" – Thomas A. Edison.

Utilities used to be the sleepiest corner of the stock market: Predictable dividends, steady cash flows, and not much excitement.

But the AI and data center boom is turning that assumption on its head. Electricity demand is surging, governments are pushing through massive grid upgrades, and utilities are finding themselves at the center of both energy security and the tech revolution.

In this week’s breakdown, we’ll unpack why utilities are getting a second look, the risks that could short-circuit the story, and how to spot the winners across regions.

By the end, you’ll know whether utilities belong in your portfolio as a safe income play or as an unexpected growth engine.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

✒️ Trump signs executive order to transfer TikTok to US owners ( The Guardian )

- Trump’s executive order clears the way for TikTok’s US arm to be majority-owned by American investors, with Oracle leading the consortium and taking control of US user data and a licensed copy of the app’s algorithm.

- The deal neutralizes bipartisan data-security concerns while giving US firms a direct foothold in one of the fastest-growing ad platforms, which could shake up digital advertising dynamics currently dominated by Meta and Google .

- Oracle’s cloud business stands to benefit meaningfully from TikTok’s infrastructure needs, while private equity and media players like Silver Lake and the Murdochs gain exposure to a sticky consumer platform.

- With 180m US users, TikTok’s advertising firepower could now be monetized more aggressively under US oversight, creating both a challenge and an opportunity for listed social media stocks.

- Investors should watch Oracle’s earnings and adtech-linked names ( The Trade Desk , Magnite ) for early signals of revenue shifts as TikTok starts behaving more like a US-owned ad giant.

🤝 Nvidia’s investment in OpenAI will be in cash, and most will be used to lease Nvidia chips ( Reuters )

- Nvidia’s $100B “investment” in OpenAI is mostly a clever way to lock in future GPU leasing revenue. Cash goes in, chips come back out, on Nvidia’s terms.

- By leasing rather than selling chips upfront, Nvidia spreads its earnings over time, while reducing capex barriers for OpenAI, making the deal more palatable to banks and private investors.

- This structure limits downside for Nvidia and boosts visibility into long-term demand, even if OpenAI’s near-term cash flow is shaky.

- The financing model reinforces Nvidia’s status as the backbone of AI compute, but also raises questions about the sustainability of circular funding flows in the AI boom.

- Investors should treat this less like equity investment risk and more like pre-sold infrastructure. Consider Nvidia’s lease-driven revenue as a defensive moat amid potential AI spending pullbacks. The consensus from analysts is that there is still more upside from here.

📈 Alibaba stock soars 8% on expected AI spend, Nvidia pact ( Yahoo Finance )

- Alibaba just threw its hat into the $4 trillion AI ring, pledging to go beyond its original $53B AI spend, and investors loved it, sending shares up 8%.

- A fresh pact with Nvidia gives Alibaba access to top-tier AI training tools, even as China tries to reduce reliance on US chips. It’s a diplomatic and strategic tightrope.

- The company’s cloud business is surging, and new international data centers in Brazil, France, and the Netherlands point to serious global AI ambitions.

- This positions Alibaba as China’s closest contender to US cloud-AI titans like Amazon and Microsoft , while also hinting at a coming price war in AI infrastructure.

- With Ark Invest’s CEO, Cathie Wood, jumping back in and over 110% YTD gains, investors appear to be shifting their perspective on Alibaba.

- If it can sustain cloud growth and avoid geopolitical blowback, the stock could re-rate as a global AI leader. Investors looking for non-US AI exposure with upside should watch Alibaba's cloud execution and overseas expansion.

🪖 Defense Stocks Rally as Trump Shifts Rhetoric on Ukraine War ( CNBC )

- A more hawkish Trump tone on Ukraine is fueling a rally in global defense stocks, with European names like Hensoldt , Leonardo , and Saab leading the charge.

- The shift signals growing U.S. political alignment with NATO’s defense posture, which could open the door to more arms deals, training programs, and air defense deployments.

- Defense names in Asia also jumped, hinting at a broader regional read-through as allies prepare for a potential uptick in military spending.

- European defense firms may now benefit from both U.S. support and rearmament trends across the bloc. Smaller-cap suppliers and dual-use tech players with NATO exposure could benefit here.

- Watch for any contract wins or order backlogs from European mid-caps like Hensoldt and Renk , which stand to benefit first from accelerated NATO spending. These could offer higher upside potential than U.S. primes like Lockheed or RTX .

🏁 AI Arms Race Escalates as Stargate Project Expands with 5 New Data Centers ( Sherwood )

- The Stargate project just announced five new data center sites, pushing its confirmed agreements to 7GW and over $400B in investment already.

- This means the project is on track to meet its target of getting $500B of committed investment and 10GW of data center capacity by the end of 2025.

- Oracle is tapping debt markets for $15B, including a rare 40-year bond, signaling long-term confidence (and commitment) to AI infrastructure dominance.

- With Nvidia racks already arriving in Abilene and more capacity coming online, this is translating hype into actual hardware deployment, which is a key signal for investors tracking AI execution, not just announcements.

- SoftBank’s involvement adds another layer of capital and optionality, possibly boosting its AI-linked holdings as infrastructure plays become a more viable equity theme.

- Investors should watch names of possible beneficiaries like Eaton (power systems), Vertiv (thermal management), Arista Networks (data center networking), and Fluor (engineering & construction) as buildout continues.

- With Stargate moving fast, it can help to build a watchlist of infrastructure enablers tied to hyperscale AI, because that's where the capital is actually landing.

🧬 The Evolution of Utility Stocks

Utility stocks have long been the bedrock of defensive portfolios. They’re right up there with consumer staples and healthcare. After all, we are talking about the companies delivering services you simply can’t live without:

Which makes them a go-to for stability, predictable cash flows, and steady dividends .

Well, that’s the theory: In reality, they can vary widely depending on the country they operate in and the type of service they provide.

And lately, some are starting to look like growth stocks too.

To cover the sector, we’ll:

- 💥 Break down the main reasons utilities may deserve a place in your portfolio

- ⚠️ Flag the key risks and complicating factors you’ll want to know about

- 🌍 Explore country-specific nuances that shape the sector

But before we dive into all that, let’s start with a quick overview of the different types of utilities .

Utilities come in many shapes and sizes, each with unique risks and returns.

Here’s the breakdown:

⚡ Electric Utilities (largest, most complex segment)

- Vertically Integrated Utilities

- These players r un the full chain, from generation to transmission and distribution. Think of the likes of Duke Energy in the U.S.

- Transmission & Distribution (T&D) Utilities

- These companies focus only on the “poles and wires”. They’re regulated monopolies with highly predictable c ash flows. Stocks like National Grid in the U.K. meet this criteria.

- Merchant Generators / Independent Power Producers (IPPs)

- These names o wn power plants and sell into wholesale markets.

- They’re exposed to fuel and power price swings, so they’re riskier, but have higher upside potential. A priva te company, Calpine, fits this mold, but it was acquired by Constellation Energy for $16B this year.

🔄 Multi-Utility & Integrated Utilities

- They provide a mix of electricity, natural gas, and water, and this diversification helps smooth out their revenues. A good example here is Eversource Energy .

🌱 Renewable IPPs & Grid-Scale Storage

- They’re focused on clean energy assets, like wind, solar, and hydro, and as you can imagine, they’re increasingly key to decarbonization strategies. However, grid-scale battery storage is key to balancing out renewable energy’s intermitt ency. NextEra Energy and Orsted (in Denmark) are popular names here.

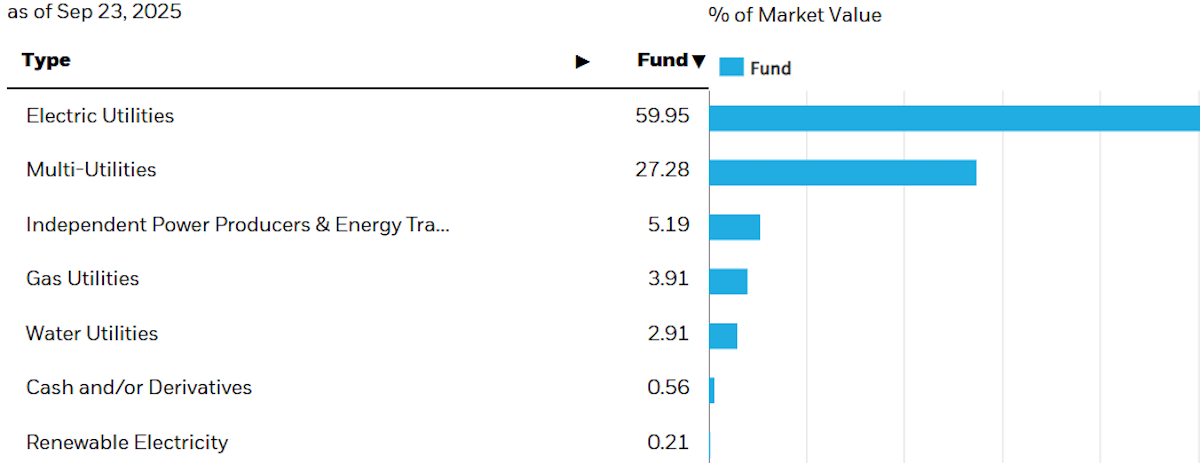

There are also utilities that solely provide gas or water, but the utilities sector is largely about electricity, with some gas, and a tiny sliver of water. Here’s what the largest global utilities ETF looks like:

iShares Global Utilities ETF Industry Exposure - iShares

It’s also worth mentioning that a few industries are closely related, though not classified as utilities:

- 🏗️ The companies that build power infrastructure

- 🛢️ Oil and gas infrastructure, like pipelines and storage, and

- ☎️ Telco networks

✨ New innovations start out as growth industries, but eventually become more like utilities. It happened with electricity, then landlines, broadband, and eventually it’ll probably be the same for datacenters and AI.

🌬️ Why Utilities Have the Wind at Their Back

Utilities typically enjoy multiple secular tailwinds, and they benefit from being regulated monopolies. Electricity, natural gas, and water are scarce resources - and becoming even more scarce.

Here are 3 big tailwinds that utilities benefit from.

1. 📈 Rising GDP Per Capita

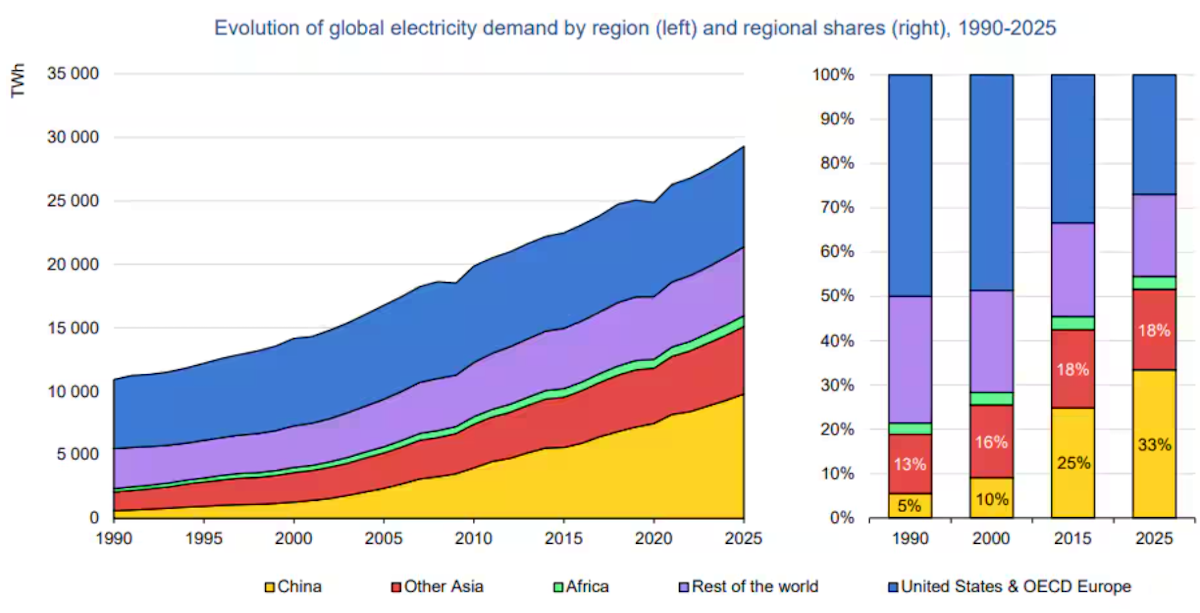

Electricity demand rises in lockstep with GDP per capita. So, before we even consider datacenters, EVs and electrification, we know global demand is rising at a steady clip.

The standout feature of the chart below is China. China’s GDP per Capita is now around $13k, while India’s is less than $3k, and Africa’s is less than $2K. So there’s lots of potential demand growth to come in Asia and Africa.

Global Electricity Demand 1990 to 2025 - WEF

2. ⚡ The Energy Transition and Widespread Electrification

The transition toward renewables means more of the economy is going electric. This includes:

- 🚘 Transportation, like EVs, is well underway.

- 🏙️ Buildings (heating and cooling) are also underway, and

- 🧑🏭 Industry, but this has a long way to go.

With more storage and grid capacity needed, this transition can continue for decades.

Utilities in some regions now project 6–8% annual retail sales growth , which is a big jump from the flat demand seen over the past decade.

3. 🤖 The AI & Data Center Boom

- As we all know, data centers are electricity guzzlers, and AI is only accelerating the trend. The big story this week which we mentioned above was Nvidia investing in OpenAI to help it build 10 GW of data center capacity. - Most of the focus is on the dollar amount and GPUs, but 10GW is the equivalent of a large city when it comes to electricity demand.

- U.S. data center demand could climb from 6–8% of total power use today to 11–15% by 2030 . Similar increases are on the cards in China.

- Big Tech also happens to be a customer with deep pockets, and is happy to pay for a reliable power supply.

🔒 The Golden Handcuffs of Regulation

With industries as important as these ones, it should be no surprise that the government is heavily involved with a lot of them. Most utilities have a special deal with their local governments.

- ⚖️ The Trade-Offs

- They get to be a monopoly (the only game in town), but in return, a regulator gets to cap their profits.

- ✈️ Predictability on Autopilot:

- Regulators allow them to earn a fair and steady profit on all their investments (the poles, wires, power plants, etc). So they aren’t a get-rich-quick scheme, but they’re just about the closest thing to a guaranteed paycheck in the corporate world.

- ⛔ Too important to fail .

- If things do go wrong, the government can’t let them fail. That doesn’t guarantee common stockholders won’t get wiped out, but bailouts can and do happen in this space.

Besides this cozy arrangement, utilities tend to be:

- 🛡️ Recession-Proof

- When the economy gets rocky, you might cancel a streaming service, but you're going to make sure you keep the lights on.

- 👑 Dividend Kings

- Utilities have big upfront capex, but then they become cash cows over the longer run with plenty of excess cash to return to shareholders.

⚠️ Drawbacks, Risks & Complications

The ‘ defensive ’ label can sometimes be a bit misleading. As an example, here’s how you might imagine performance to look for the utilities sector:

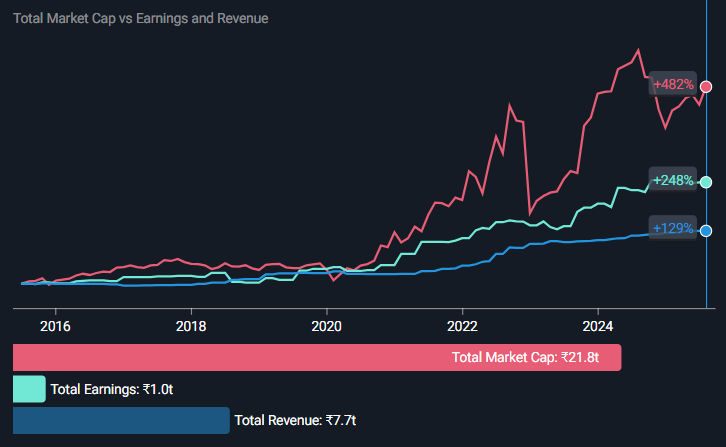

India Utilities: Revenue, Earnings, Market Cap - Simply Wall St

That’s India’s Utilities sector . In the US, it looks very similar, with revenue and earnings rising steadily. Shareholders in both regions are happy.

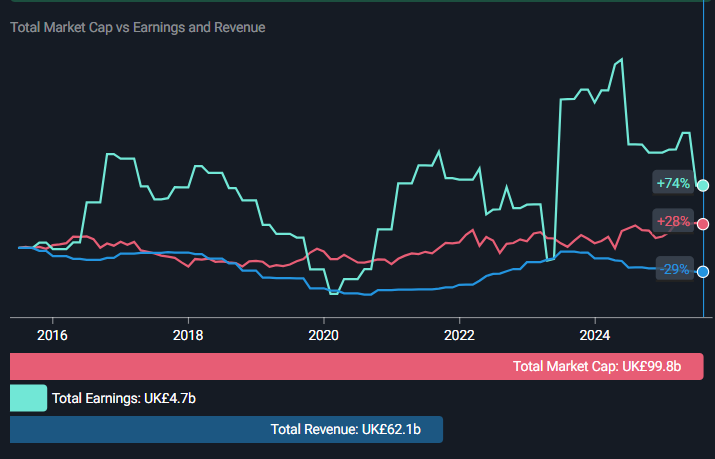

However, in the UK’s Utilities sector for the same period, we see something quite different:

UK Utilities: Revenue, Earnings, Market Cap - Simply Wall St

The UK example isn’t actually unique. In fact, it’s more typical than the previous example, particularly for the last 10 years.

The reality is that there are a lot of moving parts to a utility’s income statement. In Europe (and elsewhere), all those moving parts have been moving a lot over the last 5 to 10 years due to 5 main factors:

📉 Interest Rate Sensitivity

- Utilities are capital-intensive and carry heavy debt loads. That means higher borrowing costs when rates rise.

- High interest rates have upended the business model for wind and solar utilities in North America and Europe.

- As dividend-heavy stocks , they also compete with bonds, which have had higher yields recently.

🛢️ Input costs

- Russia's invasion of Ukraine made life difficult for utilities in the UK and Europe.

- Access to energy commodities is a major factor for utilities.

- These are plentiful in countries like the US and Canada .

- That’s not the case for most of Europe.

- Throw in currency volatility, and it becomes even trickier, just ask Turkey!

📜 Regulatory Risk

- This is the #1 risk for regulated utilities.

- Regulators need to approve rate increases.

- When inflation is rising, they tend to resist even if they know they’ll have to relent eventually.

- In times of inflation or stress, regulators face pressure to keep consumer bills low, so their decisions are often popularity-driven.

- These decisions directly hit profitability and stock prices.

🏗️ Capital Intensity & Execution Risk

- Energy transition projects are massive capex programs (wind farms, solar parks, new transmission lines).

- Risks include cost overruns, delays, and supply chain issues.

- Also, “Stranded asset” risk is when an asset suddenly loses its economic value before the end of its useful life. Fossil fuel plants (e.g., coal) have often been forced into early retirement, which involves massive asset write-downs.

🧑🚒 Natural disasters and weather events

- Extreme weather events can put immense pressure on grid networks.

- The state of Texas suffered a major power crisis in February 2021 due to extremely cold weather, and PG&E filed for bankruptcy in 2019 due to liability related to California fires caused by their equipment.

With all these dynamics at play, don’t expect utilities stocks to be a smooth journey year after year.

Remember, volatility creates opportunities, and ultimately, the world needs electricity.

🌍 The Country-Specific Nuances

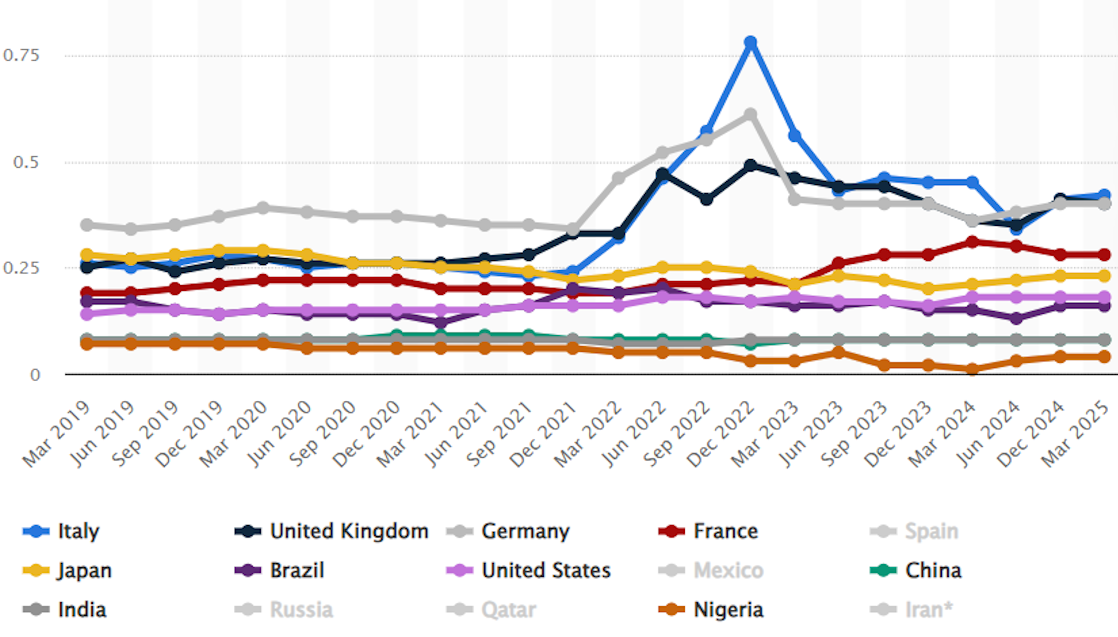

Utility investing looks very different depending on where you are. You can see below just how much electricity prices and volatility can vary around the world:

Electricity Prices by Country 2019 to 2025 - Statista

Structures, regulations, and growth drivers vary widely, so here are a few key takeaways on a regional basis:

- 🇺🇸 United States

- Highly fragmented regulatory system, with oversight mainly at the state level .

- Key themes:

- Grid modernization

- Renewables on hold

- Surging AI & data center demand

- Notable companies: NextEra Energy , Southern Company , Duke Energy

- 🇪🇺 Europe

- The region is driven by aggressive decarbonization goals, like the EU Green Deal.

- Many countries “unbundled” utilities, which essentially separated generation from networks.

- Diverse opportunities:

- Regulated networks: 🇬🇧 National Grid

- Global renewable leaders: 🇮🇹 Enel , 🇪🇸 Iberdrola

- 🇨🇳 China

- Dominated by state-affiliated enterprises .

- Policy-driven sector, focused on renewables and grid expansion.

- Largest build-out of clean energy infrastructure in the world.

- Notable: China Yangtze Power is the world’s biggest listed hydropower company.

- 🇦🇺 Australia

- The Eastern seaboard runs a competitive wholesale market ( National Electricity Market, NEM ), which leads to higher price volatility.

- Transmission & distribution networks remain regulated monopolies, so they earn steadier returns.

- Key players: AGL Energy , Origin Energy (generation), APA Group , AusNet (networks), which is now private .

- 🇨🇦 Canada

- A mix of provincially owned giants (Hydro-Québec, BC Hydro) and listed players.

- Public companies often focus on regulated T&D plus renewables, both domestically and abroad.

- Notable names: Fortis , Emera , Brookfield Renewable Partners .

- 🇮🇳India

- High-growth market with rising demand + renewable energy auctions.

- Issues with state-owned distributors (DISCOMs).

- Key players: NTPC , Power Grid Corp , Tata Power , Adani Green .

- 🇰🇷 South Korea :

- While state-controlled KEPCO drives national energy policy, Korea Electric Power is the largest utility provider in the region.

- 🌎 Other Emerging Markets & Latin America

- Higher growth potential (population, industrialization), but also higher political, regulatory, and currency risks .

- Privatizations and reforms open opportunities, but policy can shift fast.

- Key names: 🇧🇷 Enel Américas , Eletrobras .

💡 The Insight: You Can Hedge Your Utility Bills Too

Investors often look to oil or gold stocks as hedges against inflation, volatility, and tail risks. But utility stocks can play that role too, and in a unique way, they can even help hedge your own power bills .

If you’re going to be competing with AI datacenters for electricity, you might as well benefit from it.

Here’s how utilities can act as a cushion:

- ⚡ Hedge Against AI & Cloud Volatility

- If data centers face soaring electricity costs, utilities are positioned to benefit. Or, if there is too much supply at times, data centers gain from cheaper power.

- 🌍 Currency Diversification

- By owning foreign utility stocks (in the likes of Europe, Canada, etc.), it can add income streams in different currencies if you’re concerned about a weaker USD.

- Doing this helps diversify risk in an income portfolio, while tapping into regional growth trends.

Having some portfolio allocation to utilities makes sense if you’re looking for stability, predictable cash flows, and steady dividends . With today’s macro environment, there’s even some possibility of more elevated upside given the huge demand and importance of what they provide.

However, don’t be surprised if regulators step in to limit how much that is.

Plenty of investors are watching this Duke Energy narrative that cites grid modernisation, strong regional economic activity, and supportive legislation as key drivers to its future growth.

Key Events During the Next Week

Monday

- 🇺🇸 US Pending Home Sales MoM

- 📈 Forecast: 1.70%, Previous: -0.40%

- ➡️ Why it matters: A strong rebound suggests the housing market is stabilizing, a positive signal for broader economic health.

Tuesday

-

🇦🇺 AU RBA Interest Rate Decision

- ▶️ Forecast: 3.6%, Previous: 3.6%

- ➡️ Why it matters: Holding rates steady suggests the RBA is in a wait-and-see mode, balancing inflation and growth concerns.

-

🇺🇸 US JOLTs Job Openings

-

📉 Forecast: 7.1M, Previous: 7.18M

- ➡️ Why it matters: A continued cooling in job openings would support the Fed’s intention to cut rates twice more this year.

Wednesday

- 🇬🇧 UK Nationwide Housing Prices YoY

- 📈 Forecast: 4.10%, Previous: 2.10%

- ➡️ Why it matters: House prices add to the inflationary pressure, despite stagnant economic growth.

Friday

- 🇺🇸 US Non-Farm Payrolls

- 📈 Forecast: 70K, Previous: 22K

- ➡️ Why it matters: A rebound would suggest the labor market is cooling rather than collapsing.

Q3 earnings season kicks off from 6th October, but a few large caps are still due to report Q2 earnings:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.