Quote of the Week: “If you are not completely confused by quantum mechanics, you do not understand it.” - John Wheeler

Last week's news was dominated by the numerous executive orders signed by Donald Trump. We will cover these in more detail once we have had a chance to assess their implications.

In the meantime, we’re having a look at two computing-related topics:

- The underwhelming recovery in PC shipments in 2024, and the potential for improvement in 2025.

- The quantum computing frenzy that started late last year, and whether it's the real deal or another over-hyped pipe dream.

Let’s dive in!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🇨🇳 Beijing tells insurers to buy more Chinese stocks ( FT )

- What’s our take?

- Wasn’t it government interference that started the rout?

- Chinese authorities are now setting targets for the amount state insurers and mutual fund companies must invest in local shares. The FT believes that could result in $68 billion flowing into China’s local equity market.

- That may well lead to upside in the short term - but what will it do to investor confidence in the longer term? Markets do need to be regulated to a degree, but when regulation extends to asset allocation targets, at some point it stops being a market.

💹 Currency manipulation warning sparks debate on Trump’s plans ( Bloomberg )

- What’s our take?

- The US’s trading partners are suffering from a stronger USD, but Trump wants to prevent them from taking action.

- The USD traded at near 2-year highs recently due to higher relative interest rates, and strong growth. While this is good for US importers, it’s bad for those who buy goods from the US, and US exporters.

- Several key federal agencies have been tasked with addressing foreign exchange manipulation from other countries. Bloomberg noted that the “ US Treasury Department already has China, Japan, Germany, and Singapore on their monitoring list”, and strategists are wondering who will be added.

- Basically, if a country is seen to be actively trying to strengthen its currency relative to the USD, expect the US to react accordingly.

📈 Oracle shares rally on involvement in Stargate AI infrastructure initiative ( CNBC )

- What’s our take?

- This could be even better news for data center hardware suppliers.

- Oracle certainly stands to benefit from its involvement in the project. The company is also forming a closer partnership with OpenAI, which can’t be a bad thing.

- But it's also great news for companies like Nvidia and Broadcom . At some point, the other hyperscalers investing in AI infrastructure might slow those investments. This project aims to invest another $500 billion over five years - assuming the money materializes.

🪖 CEOs launch war rooms, hotlines to cope with Trump’s order blitz ( WSJ )

- What’s our take?

- In times of emergency, get all hands on deck.

- The executive orders around trade, immigration, tax, and energy policies are shaking up corporate boardrooms, or at least some of them. Consulting firms have mentioned that “ few companies grasp the potential impact of these changes ”. Given the importance of the policy changes, law firm Akin Gump, even launched a Trump Executive Order Tracker to help their clients.

- The incoming administration plans to “shake things up” in its first 100 days, and it hasn’t wasted any time. Some more clarity around the implementation of these orders will come soon.

🏢 Hedge funds bet big on Trump’s second term ( Fast Company )

- What’s our take?

- Overleveraging can’t possibly go wrong… right?

- Hedge funds are leveraging to the gills, reaching their highest borrowing levels since 2010, as they anticipate the tailwinds from Trump's era of deregulation and tax policies. The Rydex Leveraged bull to bear ratio reached 100:1 recently ( page 4 ), indicating that for every $1 in a leveraged bear fund, there was $100 in a leveraged bull fund. That level is even higher than the level reached in the peak of 2021 at around 80:1.

- Many managers have reduced their exposure to emerging markets, as they expect rising tariffs and continued strength in the dollar to hurt EM equities and companies with dollar-denominated debt.

- Trump, who took office on January 20th, kicked off his second term in the White House with several protectionist policies that’ll position American economic interests over trade partners.

🤑 New potential TikTok buyers emerge ( NBC News )

- What’s our take?

- Don’t they know they can get it for free on the app store!?

- As ByteDance faces increasing pressure from US regulators to divest TikTok, several big names have been thrown around as potential buyers. Oracle’s Larry Ellison, YouTuber MrBeast and the ever-present Elon Musk are all names that have popped up to throw their hat into the ring.

- China’s softened stance on a potential sale is quite a shift from the ‘ban or bust’ standoff, but questions still remain whether TikTok’s prized algorithm will remain untouched, preserving user experience.

- With a 75-day extension on divestment granted, TikTok will need some big-money buyers stepping up to the plate soon if they want to ink a deal on the company, whose US operations are valued at around $50 Billion.

💻 Will the PC Market Recovery Accelerate in 2025?

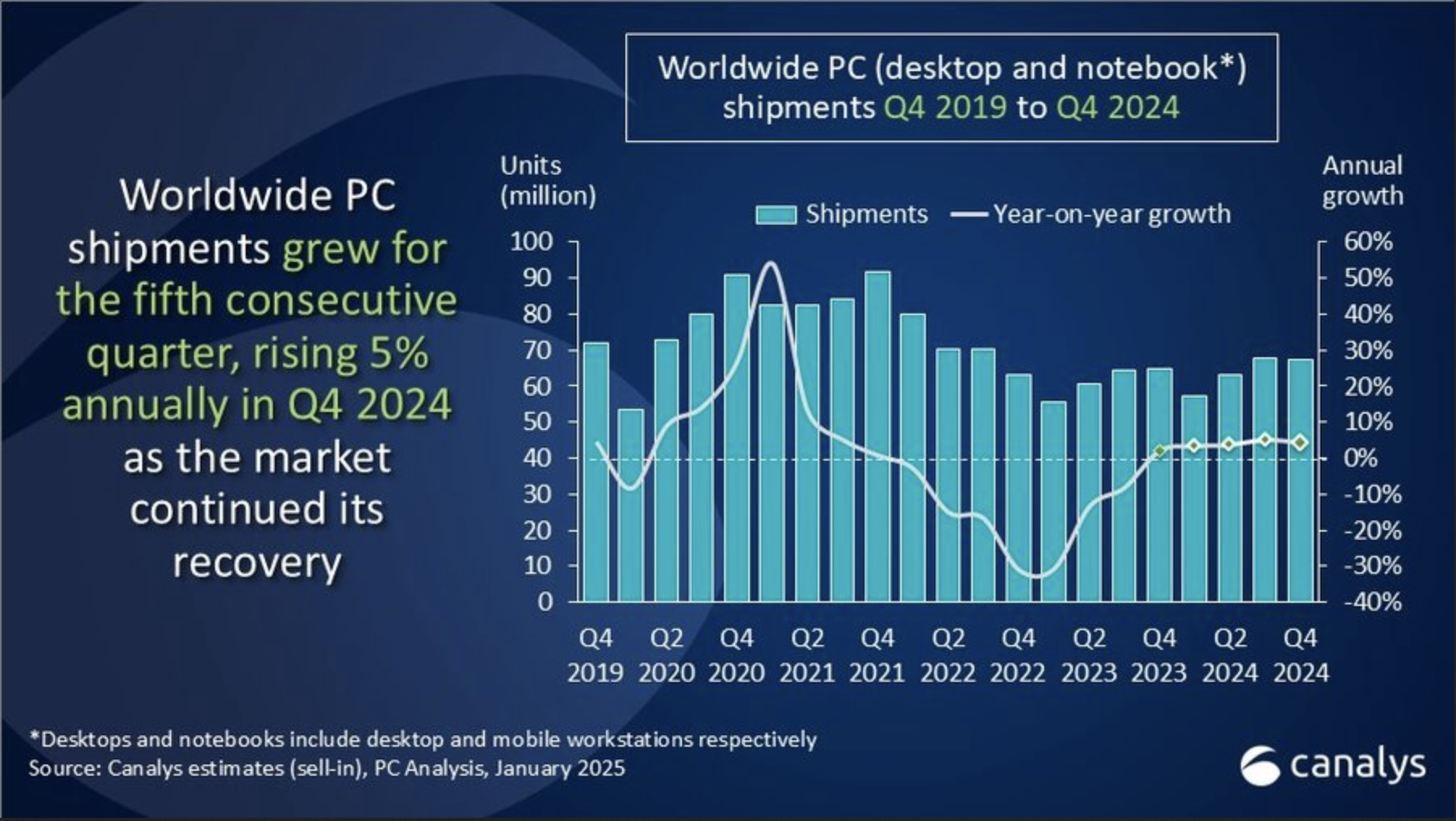

Global PC shipments increased for the 5th consecutive quarter in Q4 2024 , reaching 255 million units for the year.

However, 2024’s 3.8% increase over 12 months was much lower than expected.

The chart below shows how the recovery that began in 2023 really lost momentum in 2024. Sales are well below the 2020 to 2021 peak, and in fact below the pre-pandemic levels too.

Sales of notebook and desktop PCs shot up in 2020 as companies equipped employees to work from home, and consumers upgraded their own gaming PCs.

After that boom in sales, the decline in 2022 wasn’t surprising. But PCs are typically replaced every 3 to 5 years, so sales were expected to pick up again between 2023 and 2025. So far, annual sales are barely 5% above 2022 levels.

Guidance from Dell and HP in November suggested both companies don’t see things improving in the near term either.

The slow recovery is happening across the industry, as changes in market share - measured as units sold - were marginal. Gartner estimates that Lenovo gained the most share (+ 0.8%) followed by Apple and Acer (both + 0.3%). Most of those gains came at the expense of Dell (-0.5%) and smaller manufacturers, while HP and Asus were flat.

PC shipment cycles also affect the companies that supply the components that go into notebooks and desktops. First and foremost are Intel and AMD which supply most of the CPUs in PCs - but most of the large semiconductor manufacturers including TSMC , Samsung and Micron are part of this supply chain.

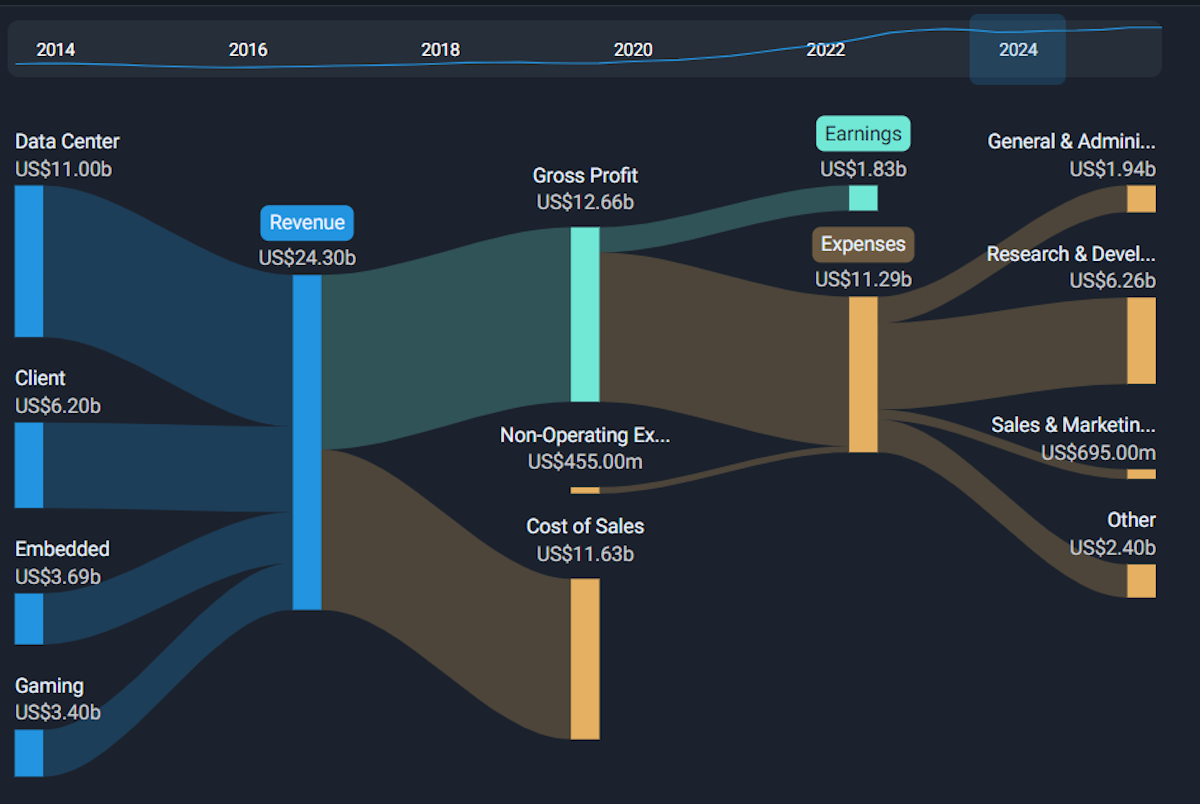

In 2021 AMD’s Client segment (which supplies PC manufacturers) earned $6.9 billion and accounted for 42% of revenue. In 2024 the segment earned $6.2 billion, and slipped to 25% of revenue - and that’s despite gaining market share from Intel.

🐌 Possible Reasons for a Slower Recovery

There are a few factors, both structural and cyclical, that explain the slow recovery:

- 🔁 Modern PCs simply don’t need to be replaced as often as they used to.

- PCs manufactured in the last 10 years are robust and fast, and the compute power required by most users hasn’t increased very much during that period. Increased use of cloud applications also pushes more processing to data centers.

- 💰 Inflation and high interest rates have squeezed budgets for businesses and consumers.

- That’s probably caused many potential buyers to delay the next upgrade until necessary.

- 📊 Distributors and retailers have struggled to sell excess inventory from the last cycle.

✨ Two catalysts that were expected to drive demand in 2024 actually acted as headwinds - but that could change in 2025 or later.

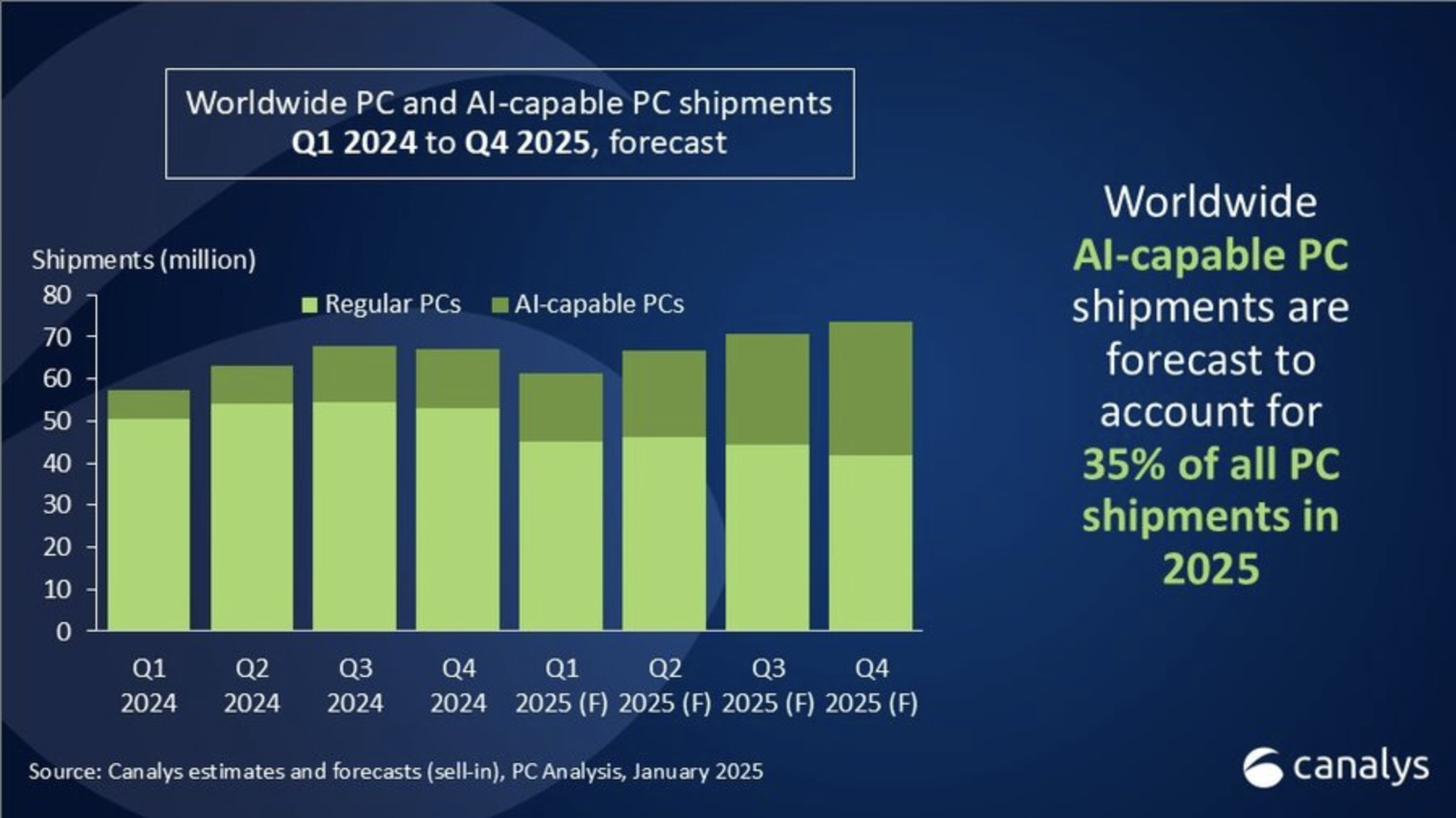

The first was lower-than-expected sales of AI PCs (see below), and the second was the delayed Windows 10/11 upgrade cycle.

Windows 10 can’t be upgraded on many older PCs. Microsoft delayed the termination of support for Windows 10 to November this year, which means there wasn’t as much urgency - but that’s likely to change later in 2025.

✨ While consumers may decide to put up with the older OS, businesses usually like to stay up-to-date .

🤖 AI PCs: The Catalyst Everyone's Waiting For?

PCs capable of running AI applications locally are a brand-new category within the market.

As mentioned, even mid-spec PCs older than 5 years are perfectly adequate for most tasks. That could all change if more people want to run AI applications locally. Some analysts thought that would happen last year, but the uptake was slow.

In Q1, 7% of PCs shipped were reported as AI-capable, and that percentage is estimated to have reached 15% in Q4. However, that number is skewed by the fact that all Apple notebooks and desktops are AI-capable.

There may be a lot of potential PC buyers taking a wait-and-see attitude .

AI tools are advancing rapidly, but many PC users are still experimenting rather than relying on them for daily tasks. If that’s the case, it's hard to justify the extra cost of an AI-capable machine.

On the other hand, there’s the risk of buying a new machine now and then having to upgrade again in a year or two to use tools that become essential.

✨ Things could change quickly if, or when, AI applications become essential. Add to that the Windows 11 upgrade, and the fact that companies will eventually replace all the PCs they bought in 2020 - and there could be a sudden change in the trend.

⚛️ Is Quantum Computing the Real Deal?

The latest technology revolution to grab the attention of investors is quantum computing. The big catalyst was Google’s announcement that its quantum chip, Willow, could perform a calculation in five minutes that would take a supercomputer 10 25 years. Yep, 10 septillion years, a number that is bigger than the history of the universe.

This resulted in the handful of ‘pure play’ quantum computing stocks taking off, some jumping over 500%. A couple of weeks later, Jensen Huang said “quantum computing is likely to be 15–30 years away from being truly useful ,” and the same stock prices promptly halved.

However, there is a strange paradox regarding the field of quantum computing.

Several prominent tech industry leaders have said that ‘really useful' quantum computers are decades away. Yet, IBM, Google, Amazon AWS and other companies currently offer cloud access to quantum computers, and they have for a while.

So what exactly are they offering?

🤔 Quantum What?

First, what is quantum computing? We’re not even going to try to explain it fully, but here’s the 50-word or less version:

Quantum computers use properties of subatomic particles to store and process data. Qubits (quantum bits) can represent multiple values at the same time, unlike the binary bits (0s and 1s) used by today’s computers. Rather than performing calculations step by step, a quantum computer uses simulation and probability to arrive at a solution in a single step.

If you are after a more detailed explanation, IBM was one of the first companies to invest heavily in the field. There is a great, detailed explanation on their website. Alternatively, this YouTube video explains the field in an easy-to-understand way.

Quantum computers are being developed to solve very complex problems. This includes AI, but is particularly relevant to materials science, and pharma and biotech research.

The challenge is that as qubits are added, the complexity increases exponentially, which can lead to errors increasing exponentially too.

Google has a six-step roadmap to develop its quantum computers and says its latest chip puts it at stage three, so currently halfway. The company’s blog post stated, "Our new chip demonstrates error correction and performance that paves the way to a useful, large-scale quantum computer. "

So large-scale, useful quantum computers are likely to be decades away. In the meantime, there’s a limited market for the early iterations of quantum computers. These existing solutions are being used for materials and life science research.

Currently, the market is estimated at around $2 billion, and is expected to grow to $70 billion by 2030. That’s probably a moving target and dependent on how useful quantum technology becomes in the next five years.

🏢 Who Are The Companies In This Space?

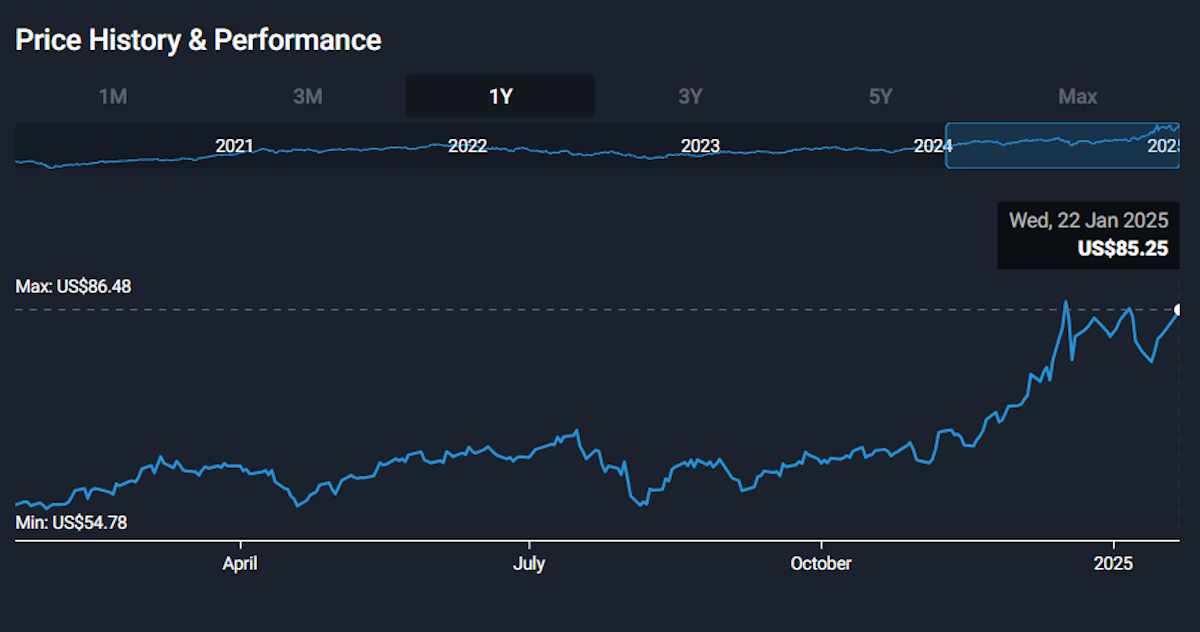

There are a handful of companies that focus on quantum computing, with most earning very little revenue, although some are forecast to grow those revenues at 50%+. These include D-Wave Quantum , Quantum Computing, Rigetti Computing, and IonQ .

The broader ecosystem includes semiconductor materials companies like Applied Materials and those that provide equipment to the semiconductor industry.

The Defiance Quantum ETF has been a lot less volatile than the quantum stocks, but that’s probably because it has about 90% of its assets in the broader semiconductor sector and just 10% in the pure play stocks. You can see all the holdings here .

💡 The Insight: Make Sure You Understand The End Game When Investing In Innovative, Loss-making Companies

If quantum computing goes the way of many of the other technology innovations, it will probably be companies like Alphabet and Microsoft that capture the most value. But the profits will be gradual, and it takes a lot to move the needle for multi-trillion dollar companies.

At the other end of the spectrum, the small, pure-play, quantum computing stocks could offer a lot of upside.

And that’s why their stock prices will probably move a lot on any positive industry news - even if it has little to do with them.

Last week, an analyst more than doubled his price target on Rigetti Computing, from $4 to $8.50. As we mentioned last week, there’s a difference between a 12-month price target and a valuation . For speculative companies, it’s often more about the hype cycle than real valuations.

One of the things to keep in mind is the likely end game for small technology companies.

Before you even consider the potential upside, there are a few things to check, which you can find in section 3 and 4 of every Simply Wall S company report:

Section 3: Past Performance

- 3.1 - Revenue & Expenses Breakdown

The first number to look at is expenses over the last year. This number is unlikely to fall, and if the company is going to grow, expenses are likely to grow substantially.

Section 4: Financial Health

- 4.3 - Balance Sheet

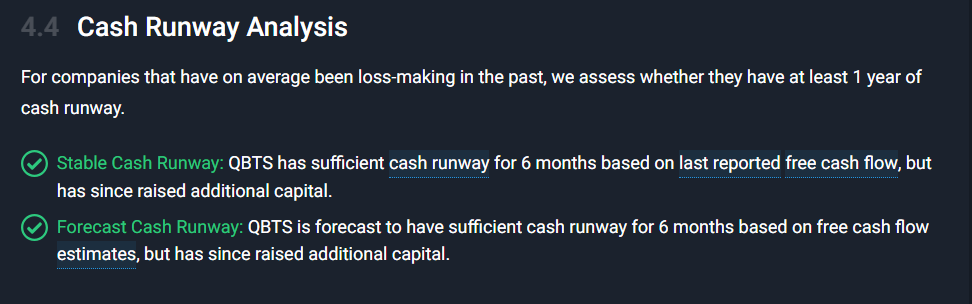

- 4.4 - Cash Runway Analysis

The second number to check is the company’s cash balance. Debt isn’t usually a big factor for tech companies, but it’s worth checking that too.

Below that, you will also see an analysis of the cash runway, which is based on cash flow. This tells you how long the company can continue to operate with its current cash balance.

It’s common for small, growing companies to have a short cash runway. When the outlook for the company and industry is bright, raising more cash shouldn’t be a problem. But that does mean your shareholding is likely to be diluted.

✨ If profitability is likely to be years away and expenses are likely to increase considerably, shareholders are going to be diluted considerably too. This needs to be factored into whatever you think the company could be worth in the future.

Industries also fall out of favour at times, which makes raising cash more difficult. Many high-flying companies in 2021 saw their stock prices fall 75%. That means new shares need to be sold at much lower prices, and dilution increases. In some cases, like the EV industry, small companies just can’t raise cash at any price.

Finally, in many cases the most likely end game for small, innovative companies is an acquisition by a much larger company. That may seem like a good result for investors, but sometimes the apparent gain doesn’t actually justify the risk, or the amount you get diluted along the way.

This doesn’t mean speculative companies are never investible - but these aspects of an investment are often overlooked. So again, make sure you understand the end game when investing in these kinds of stocks.

Key Events During the Next Week

It’s a big week for interest rates, data, and earnings - and quite possibly for executive orders too.

Tuesday

- 🇺🇸 US Durable Goods Orders are forecast to swing from -1.1% to 0.5%.

Wednesday

- 🇦🇺 Australia’s inflation rate will be released, and is expected to fall to 2.2% from 2.8%.

- 🇨🇦 Canada's central bank is expected to cut the benchmark rate 0.5% to 3%.

- 🇺🇸 The Fed’s FOMC will hold its first meeting of the year, but is expected to keep the Fed Funds Rate at 4.5%.

Thursday

- 🇪🇺 Eurozone unemployment is forecast to rise slightly, from 6.3% to 6.4%

- 🇪🇺 The ECB will announce its interest rate decision. Economists expect all three key rates to be cut by 0.25%. This will leave the ECB at 2.9%.

- 🇺🇸 The advance estimate of US GDP growth for Q4 will be published, with 3% expected vs. 3.1% in Q3.

- 🇺🇸 US Initial Jobless Claims are forecast to rise slightly to 228k.

Friday

- 🇺🇸 US PCE price data and personal income and consumption data will be published. The core price index is forecast to be flat at 2.8%.

This week is the big one for 4th quarter earnings season, as four of the Magnificent Seven are scheduled to report, along with large-cap companies in most sectors. The largest are listed below - and the Nasdaq website has a more comprehensive list:

- Microsoft

- Meta Platforms

- Apple

- Tesla

- ASML

- ServiceNow

- IBM

- Visa

- Mastercard

- SoFi Technologies

- Boeing

- Starbucks Corporation

- Exxon Mobil

- Chevron

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.