Quote of the Week: “Don’t worry about what the markets are going to do, worry about what you are going to do in response to the markets.” - Michael Carr

The US dollar has been on a tear since September, and since Donald Trump became the US President-elect.

The strength of the USD, and the impact of his policies on inflation and interest rates, are likely to be a major factor for global markets in 2025.

It seems Trump also aims to come across as unpredictable to give him the upper hand in trade negotiations - and that spells volatility for currency markets.

We thought this would be a good time to have a look at what a stronger, or weaker, US dollar means for global equities, and how you can prepare yourself for what might eventuate.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened In Markets This Week?

Here’s a quick summary of what’s been going on:

-

⛏️ Copper miners doubt Mexico will seek full open-pit ban, sparing current projects ( S&P Global )

- What’s our take?

- Existing open pit mines seem to be safe from a new administration’s proposed regulations.

- Many copper-mining CEOs across the board have expressed confidence that existing projects, even those in the planning phase, will not be impacted.

- This means any mining operations relying on organic growth from existing mines are still valid, but any narratives relying on new projects can’t be relied upon as strongly.

-

🛰️ SpaceX’s cellular Starlink service is ready to go ( PC Mag )

- What’s our take?

- Calls and texts from anywhere on land or sea are a pretty appealing value proposition.

- After launching 320 direct-to-cell satellites into orbit, with more to come, SpaceX has enough coverage to offer connectivity around the globe, no matter where you are. The FCC has recently just approved SpaceX’s cellular satellite system for commercial operations.

- T-Mobile’s CEO plans to launch a beta service of the service “late this year or early next year”.

- As for the revenue implications for both companies, that’s hard to say. Since pricing hasn’t been announced, it remains to be seen how this service will stack up against existing options for consumers.

-

💰 US banks taking advantage of higher valuations by raising capital ( S&P Global )

- What’s our take?

- Issuing fresh equity after your stock price rallies makes a lot of sense.

- Some banks are raising funds to pursue M&A deals, others are re-shoring their balance sheets, and others are just giving themselves flexibility heading into 2025.

- The $1.42bn raised in Q4 so far isn’t a huge amount, given it’s mostly been from smaller regional banks, but it’s on track to meet the previous quarters' amount of $1.73bn. The past quarter was the highest quarter since Q3 of 2021 when banks raised $5.99bn.

- While the amount of equity raised in Q4 2024 is on track to be the most they’ve raised this year, banks are still primarily using senior debt facilities to raise capital, which significantly outweighs their equity amounts.

-

🛍️ Amazon could have a Black Friday advantage ( Investors Business Daily )

- What’s our take?

- Years of investment into regional fulfillment capacity may pay even more dividends over the next month.

- This holiday season will have 5 fewer trading days between Thanksgiving and Christmas. With a shorter window, quick delivery times will be an even more important factor to shoppers, which Amazon is best positioned to benefit from.

- For this holiday season, online shopping is expected to surpass retail growth at 8.5% year on year, compared to 3.6% for retail.

- Despite consumers remaining relatively price-sensitive, E-commerce trends are still going strong this holiday season.

-

🚗 US and European automakers would be hit by Trump’s tariffs ( Reuters )

- What’s our take?

- Automakers’ profits and consumers' wallets could take a hit from these new tariffs.

- It’s clear what the incoming administration is trying to achieve by imposing these tariffs, but there are likely unintended consequences to US consumers and companies. GM, Ford, Stellantis, and others are some of the companies that will find themselves vulnerable to this. We’ll discuss some of the nuances in this week’s piece below.

- There is still time for countries to try and negotiate more favourable terms on these ideas with the new administration. So while none of these policies are set in stone just yet, the risk is there.

💵 The USD and Equity Markets in 2025

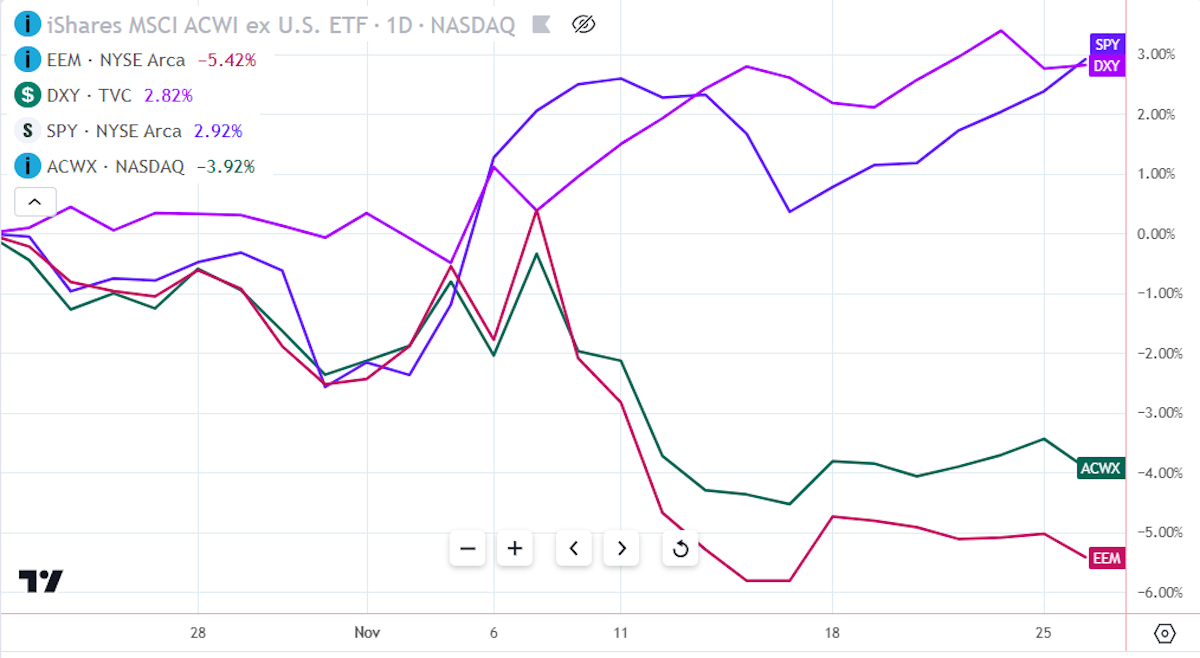

The chart below reflects the USD index (DXY), the S&P 500 (SPY), the MSCI Ex-US (ACXI), and the MSCI Emerging Market (EEM) indexes over the last two months.

✨ The market’s expectations are pretty clear. They believe the US market has better prospects than emerging markets.

Whether those expectations are correct remains to be seen, so investors need to consider two questions:

- Will the US dollar continue to strengthen - or could it reverse course?

- How does USD strength and weakness affect companies in the US and elsewhere?

⚠️ FYI: The Dollar Index reflects the USD against a basket of indexes weighted by trade volumes. The other currencies are the Euro, Swiss Franc, Japanese Yen, the British Pound, Canadian Dollar and Swedish Krona. So it’s not entirely representative of the global currency markets.

The index is currently at 107, up from 100. For context, it reached 160 in the mid-1980s and fell as low as 72 in 2008.

💹 What Determines The ‘Value’ Or Price Of A Currency?

Currency markets are complex, determined by supply and demand rather than valuation - which is difficult to calculate anyway.

The following are the key factors affecting currencies:

- 🤝 Trade flows:

- Importers sell their local currency and buy foreign currencies to pay for the goods they import. Exporters do the exact opposite. If a country imports more than it exports, there will be ongoing pressure on the currency.

- 💸 Investment flows:

- Similarly, investors buy and sell currencies to invest in stocks, bonds, and other assets in other countries. If a market is favored by investors, its currency will be in demand.

- 💱 Interest rate differentials:

- Capital flows from currencies that are cheap to borrow and into currencies that pay higher interest rates (like the Yen carry trade).

- Typically, it's not the current interest rate, but expectations for future rates that affect supply and demand. Those expectations are in turn based on the outlook for economic growth and inflation, and how central banks will respond.

- 💪 Purchasing power:

- If the currency of country A buys more of a given product in country B, then country A’s currency can be viewed as overvalued relative to country B.

- However, the currencies of larger, more developed and stable economies tend to remain at a premium.

- 📉 Changes in credit rating:

- Every currency carries a certain level of risk, which is mostly related to political stability and debt levels. The market is quick to price in changes in perceived risk.

- 🏦 Central bank intervention:

- Central banks can also artificially influence a currency. Sometimes this works (increasing interest rates would make their currency and bonds more appealing to buy), and sometimes it backfires in spectacular fashion (some countries ran at negative interest rates for a while, decreasing their appeal).

Given the above factors, what could lead to further USD strength, or weakness?

USD Strength 📈

- % Higher interest rates: Donald Trump’s intended policies are generally regarded as inflationary and pro-growth.

- ✂️ Deregulation could lead to more corporate activity and IPOs — which along with growth — would attract foreign investment.

- 🏦 If central banks around the world cut rates faster than the US Fed, the USD would remain more attractive.

- ✈️ Flight to safety: The USD usually strengthens when there is a major geopolitical or financial crisis, even if it occurs in the US.

USD Weakness 📉

- 💵 Trump would prefer a weaker USD. He might not get one, but it’s worth mentioning.

- ✂️ A recession in the US would probably result in interest rate cuts. This could occur if tariffs, government spending cuts, or deportations happen faster than the economy can withstand.

- 💹 Stronger economic growth in Europe, Asia, and emerging economies. Equities outside the US trade at a discount to US stocks, so any sign of better-than-expected growth would probably be followed by investment flows.

- 🎰 Bets against its valuation : Consensus amongst investors that the USD is too high/overvalued could lead to bets against the currency.

- 🧑⚖️ A challenge to Fed’s independence. Central banks need to be independent to ensure price stability. Some of Trump’s advisors would prefer the administration to have control over the Fed, which could result in a complete loss of faith in the currency.

✨ Currently, the arguments in favor of a strong dollar are fairly concrete, while the arguments for a weaker dollar all fall under ‘could happen’ 🤷 .

🌏 Global Stocks And The US Dollar

Last week, Donald Trump doubled down on his threat to impose tariffs on imports to the US.

He promised a 25% tariff on goods from Canada and Mexico, and an extra 10% for China. Whether that 10% is on top of, or in place of, the previously promised 60% isn’t clear - honestly it’s hard to keep up.

Most see these threats as negotiating tactics ahead of a new round of trade agreements. Nevertheless, certain countries and industries are likely to face tariffs which need to be considered alongside the strength of the dollar.

💪 Possible Beneficiaries Of Continued USD Strength

Companies that export products to the US benefit from a strong dollar in two ways.

✨ Firstly, their products become more affordable for US consumers and companies. And secondly, the dollars they receive translate into higher revenue in their local currency.

If tariffs are added, the US importer pays more which may affect demand, in which case it affects volumes rather than profit margins.

China, Mexico and Canada are the largest trade partners for the US, and are therefore in the crosshairs of Trump’s rhetoric.

However, a trade war with Mexico and Canada would be counterproductive.

The US economy is dependent on imports from its neighbors, who are also its biggest export markets. So there’s a good chance that any tariffs imposed on those two countries would be offset by continued USD strength.

In that case, a strong US economy and currency would favor exporters in Mexico and Canada.

China probably won’t be that lucky, which would benefit the economies that are already starting to replace China in the manufacturing supply chain. These include India, Indonesia, Vietnam, Malaysia - and Mexico.

India in particular has a lot to gain, and less to lose, as it’s currently outside the top 10 exporters to the US. But a trade deal would probably need to be negotiated, as India already imposes its own tariffs on imports.

India is also less exposed to the dollar than most emerging economies because its economy and most listed companies are more domestically focused.

Commodity producers in Australia and Brazil would benefit from a strong dollar, and from rising demand in the US. Both countries also import more from America than they export, which should really take them off the tariff list.

Europe is a major exporter to America, so additional tariffs could be imposed. But some European industries could benefit from a strong dollar anyway:

- 🪖Companies that supply the US defense industry could be exempt from tariffs.

- 💰 US companies that source high-value products, or those that are difficult to substitute, from Europe would import them regardless of tariffs. This includes semiconductors, industrial products, and pharmaceuticals.

- ✈️ A strong dollar makes overseas travel more affordable for US citizens. The top three destinations are Mexico, Canada and Europe, but tourism and hospitality companies globally would stand to benefit.

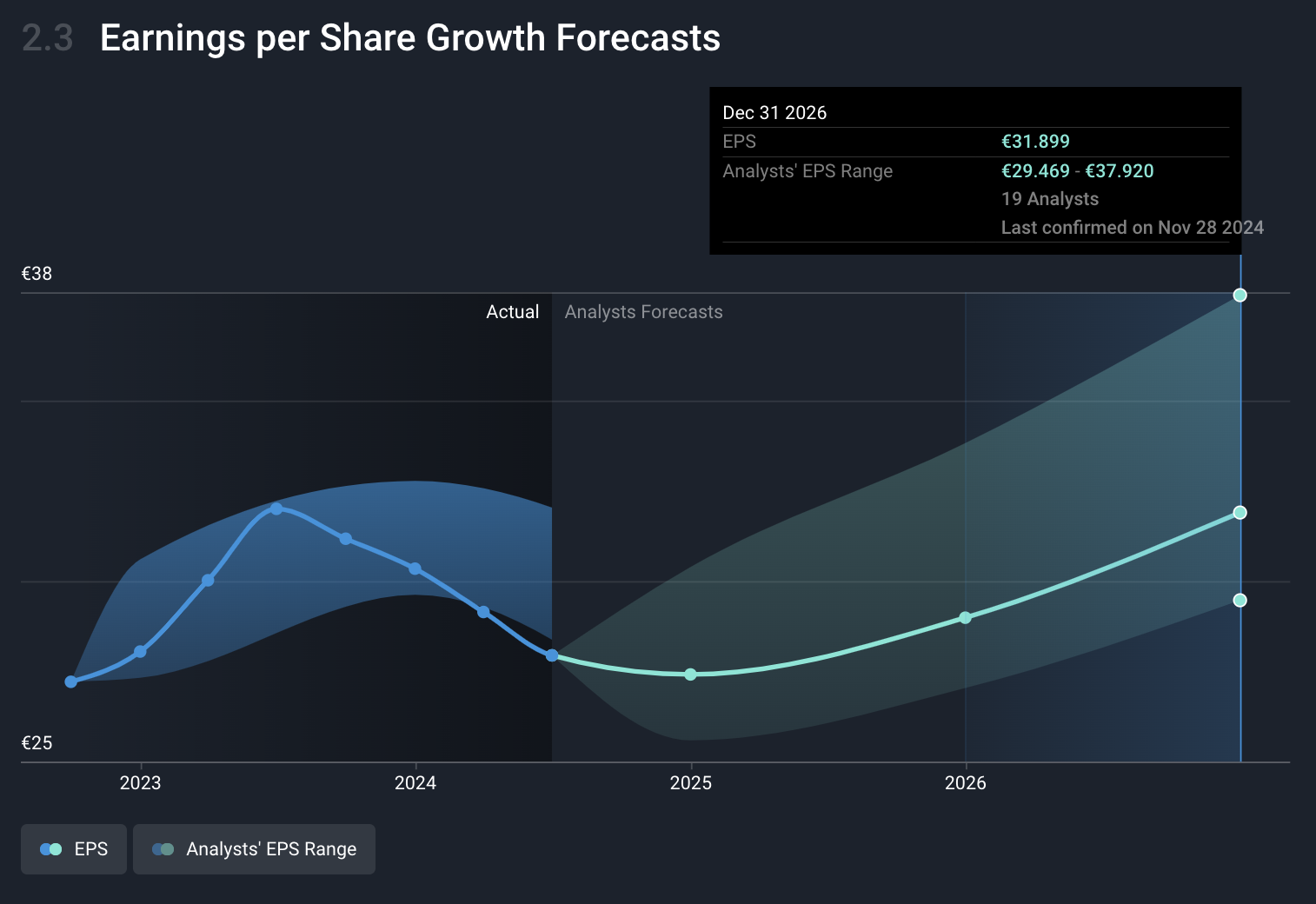

- 👜 European luxury goods companies have recently been hit by lower demand from China. These companies could see that demand replaced by US consumers, particularly those benefiting from extended, or new tax cuts. If that happens, LVMH’s EPS (below) could be at the upper edge of the consensus range.

The United Kingdom is also in a unique position and could actually see some upside from its split with the EU. Not only does the UK fall outside of US/EU trade deals, but it imports more from the US than it exports.

✨ A strong dollar makes imports of products from America more expensive, but it doesn’t affect trade between other countries, or domestic activity.

Companies with a domestic focus, including banks, food producers, and general retailers may not benefit from a strong dollar, but they would be more defensive than the companies that depend on imports.

📉 Who Would Benefit From A Reversal?

A reversal to a weaker USD doesn’t seem likely now. But it’s not priced in, which means the effect would be larger.

✨ A weaker dollar would benefit companies that import from the US. It would also help emerging economies cut rates faster, which would promote growth.

🇺🇸 US Stocks And The US Dollar

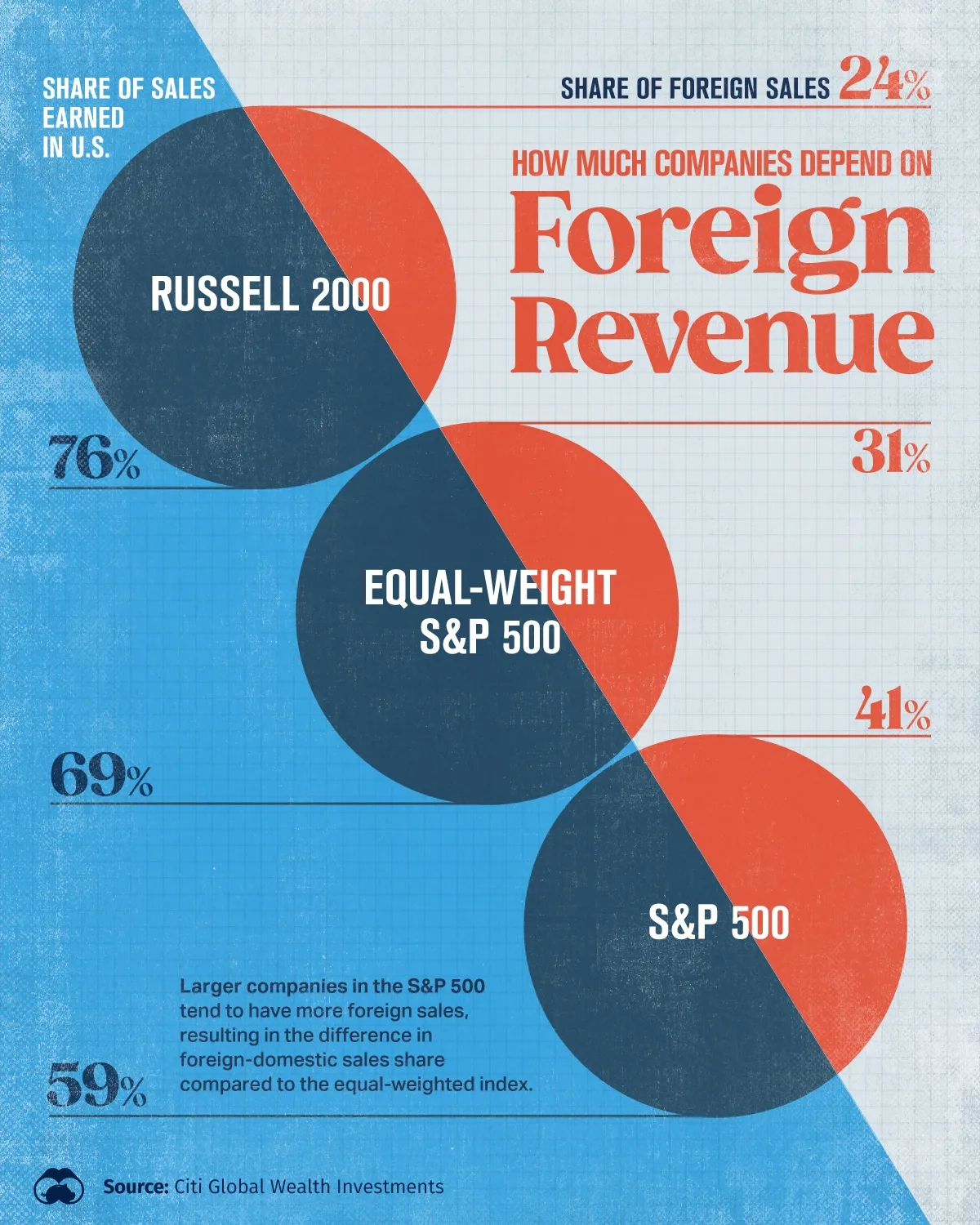

Most of the largest companies in the US earn revenue around the world. When the dollar is strong, those revenues translate into fewer dollars on the income statement.

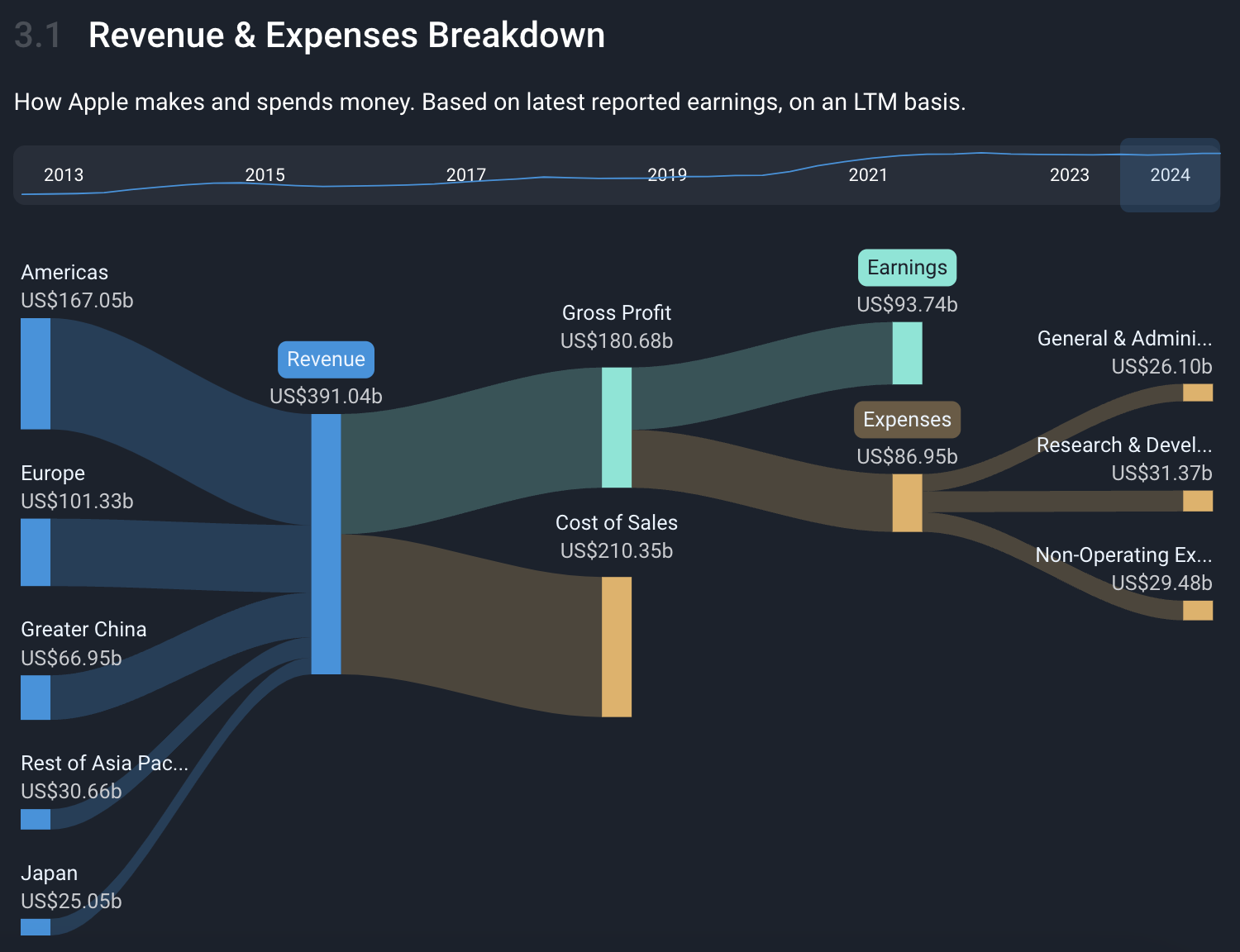

Apple (below) earns about 57% of its revenue from international markets. The picture is similar for Microsoft, Alphabet, Netflix, and many others.

✨ When revenue growth is strong, the currency effect hardly affects the bottom line. But when growth stalls, the effect does matter. Slow-growing companies like Coca-Cola are now facing this reality.

In general smaller companies earn less revenue overseas, and sectors like financial, healthcare, and real estate tend to have a more domestic focus.

On the other side of the dollar are companies that import products from around the world - including the likes of Walmart.

For companies importing from China, USD strength would be completely outweighed by a 60% tariff - if that’s what they are charged.

Some companies are now building up inventory ahead of Trump’s inauguration, so margins could actually improve in the short term. That, and the rhetoric over tariffs, could make for an interesting year for those companies.

Tariff regimes usually come with loopholes for certain industries. So the companies in those industries - probably defense, maybe healthcare - would benefit from cheaper imports without the extra cost of tariffs.

So, how would these companies fare if we were to see weakness in the US Dollar?

✨ A weaker dollar would really just result in a reversal of the above, with exporters earning more dollars from their offshore revenue.

In addition, if a weaker USD was accompanied by lower rates, growth stocks trading on high multiples would benefit from the lower discount rate.

💡 The Insight: The More The Dollar Rises, The Greater The Opportunity It Creates

It makes sense to have a portfolio that isn’t too dependent on either scenario but with a slight bias toward a strong dollar in the medium term given the probabilities.

The stronger the dollar gets, the more it will affect multinationals, and the more it could potentially reverse at some point in the future. That could set up a great buying opportunity for large-cap stocks.

So, it’s a good idea to have a list of stocks you’d like to own if there’s a change in policy - and the higher the dollar rises, the more valuable that list will be. Some of the companies mentioned in this article are a great place to start!

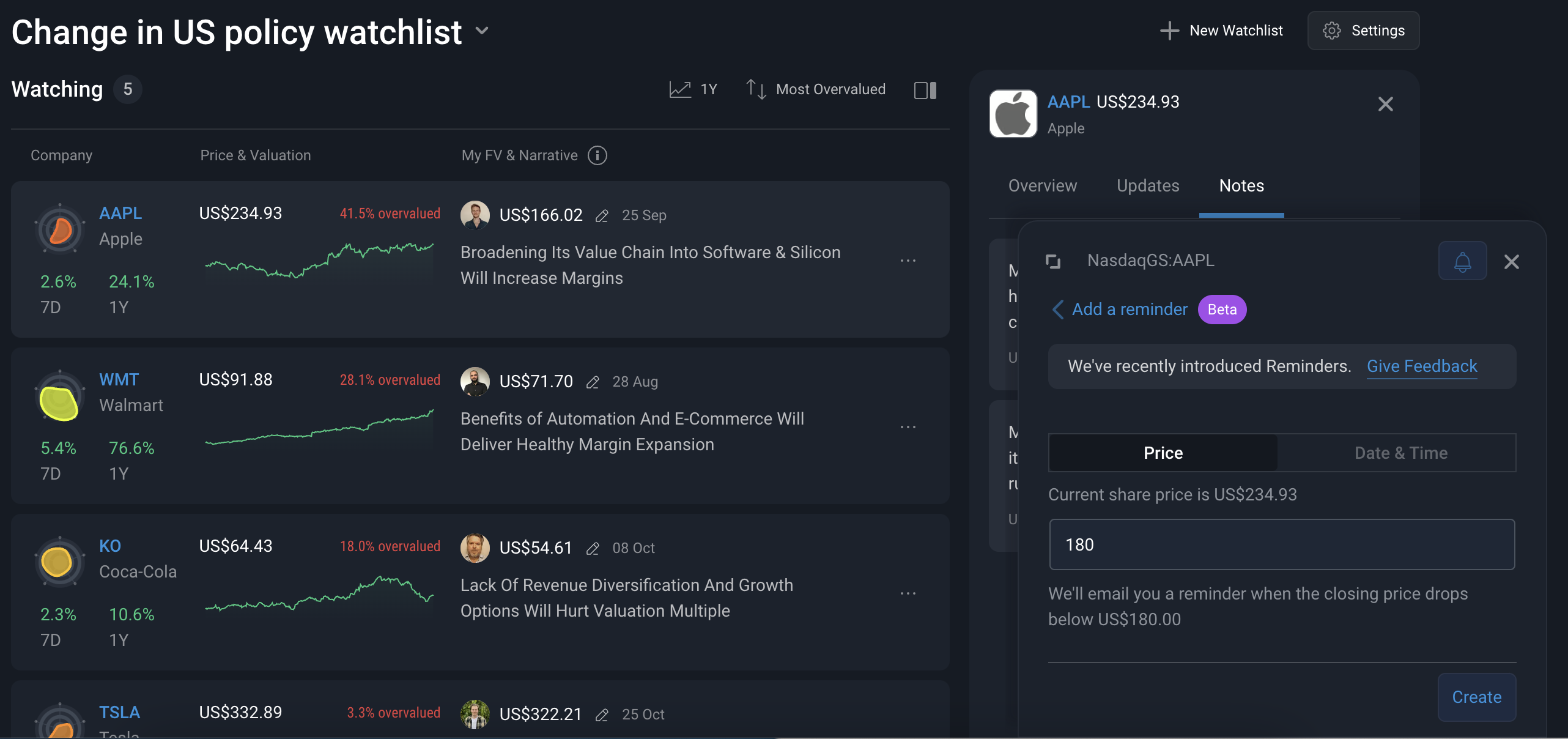

Here’s an example Watchlist on the platform, with estimates of Fair Values set based on what analysis we’ve seen from others in the Simply Wall St community.

To stay up to date, you can set alerts by writing a note on each stock, clicking the bell 🔔 icon up the top right of the note, and setting a price reminder where you’ll be notified when it passes that price.

Even better, soon you’ll be able to set up notifications on your account for when the share price passes your Fair Value estimate!

To know when this new feature arrives, and to keep up to date on the rest of our latest platform improvements, check out our regularly posted What’s New updates.

Key Events During the Next Week

There isn’t a lot of economic data due this week, but a few important employment reports will be published.

Tuesday

- 🇺🇸 The US JOLTs report will be published. Job openings are forecast to fall to 7.38 million, which would be the lowest level since January 2021.

Wednesday

- 🇦🇺 Australia’s GDP report will be released. Economists expect the report to show Q3 growth at 0.5%, up from 0.2% in Q2.

- 🇺🇸 The US ADP employment report is expected to show private sector job growth of 240K vs. 233K in October.

Friday

- 🇨🇦 Canada’s unemployment rate is forecast to remain at 6.5%.

- 🇺🇸 US employment data will be released. Consensus estimates are for 194k new jobs vs. 183K in October and an unemployment rate unchanged at 4.1%.

After this week, there are just a few prominent companies due to report. This week it’s mostly software companies and retailers are reporting:

- Salesforce

- Synopsys

- Marvell Technology

- Veeva Systems

- Zscaler

- DocuSign

- Okta, Inc

- Kroger Company

- Lululemon

- Dollar General

- Dollar Tree

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.