🇪🇺 🇬🇧 Momentum Is Returning to European and UK Markets

Reviewed by Bailey Pemberton, Michael Paige

Quote of the week: “Invest for the long haul. Don’t get too greedy and don’t get too scared.” Shelby M.C. Davis

European and UK equities have trailed their US counterparts for years, and the valuation gap has only grown wider. Normally, without a big catalyst, these discounts just… linger.

But 2025 has ignited a few unexpected sparks that could finally light a fire under these markets.

The big question now is: will that fire keep burning, or will it fizzle out just as quickly?

In this week’s newsletter, we’re unpacking the key catalysts driving the rally, the risks that could derail it, and, most importantly, why index tracking might not cut it this time.

Stick with us to the end for insights that could change how you approach Europe and the UK.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🤖 Google, OpenAI, Anthropic, and xAI awarded DoD contracts with $200M ceiling ( Reuters )

- The US Department of Defense just locked in up to $200 million deals each with Google, OpenAI, Anthropic, and Musk’s xAI to boost advanced AI adoption across national security. The government wants AI agents handling real-world defense tasks, and is moving fast on deployment, helped by a push to reduce regulation.

- Tech stocks with federal AI exposure could see momentum, but these contracts also entrench the biggest players in sensitive government work, raising barriers for smaller AI startups.

- Musk’s xAI is now aggressively pitching “ Grok for Government,” which could further deepen its moat with federal and security clients.

- The arms race in military AI is heating up, and the winners seem to be big tech.

-

🇩🇪 EU clears Germany's multi-year fiscal plan ( Politico )

- Germany just secured EU approval to turbocharge spending on infrastructure, defense, and security, front-loading investment until 2029 with a promise to tighten the purse strings later.

- Investors should expect a near-term boost for construction, defense, and industrial stocks, but keep in mind the plan’s eventual shift to fiscal restraint may limit long-term stimulus effects.

- The new budget flexibility could help Germany shake off recent economic stagnation, but tighter controls after 2026 could cap momentum, especially for sectors reliant on government contracts.

- Germany is hitting the gas on growth, just don’t expect the fiscal party to last forever.

-

📈 Bitcoin surpasses $120,000 ahead of 'Crypto Week' ( CNBC )

- Bitcoin surged past $120,000 on expectations that US lawmakers will finally deliver crypto-friendly regulation, attracting waves of institutional money and record ETF inflows.

- Policy clarity is sparking a stampede from corporate and fund buyers, while retail investors are still mostly watching from the sidelines, meaning the rally has room to run if Main Street joins in.

- Watch for volatility tied to global trade tensions and possible Fed rate hikes, but long-term holders and “Crypto Week” legislative momentum are keeping the bulls firmly in charge.

- The regulatory tide is turning. Institutions are piling in, and new laws could turn this record run into a full-blown bull cycle.

-

🇪🇺 EU looks to impose retaliatory tariffs on US aircraft, cars, bourbon ( FT )

- The EU is preparing to slap tariffs on US aircraft, cars, and bourbon if Trump follows through on his latest threat of 30% levies, raising the stakes for automakers, aerospace, and spirits producers on both sides of the Atlantic.

- Investors in US exporters, especially Boeing and Detroit automakers, should brace for potential downside if trade talks collapse, while European firms exposed to US tariffs will also face margin pressure.

- These tit-for-tat tariffs risk triggering another round of transatlantic trade turbulence, with volatility likely for stocks in targeted sectors and global supply chains.

- The tariff chess match is heating up. Be ready for market swings in autos, aerospace, and spirits if the clock runs out on US-EU trade talks.

-

🏛️ Trump Escalates Campaign Against Fed Chair Powell ( Bloomberg )

- Trump’s public threats against Fed Chair Powell rattled markets, causing a brief dollar slide and a jump in Treasury yields as investors worried about Fed independence.

- Even without an actual firing, the political spectacle could spook global investors, raise uncertainty about US monetary policy, and complicate the Fed’s next moves on rates, potentially delaying cuts markets are hungry for.

- Bond and currency traders are bracing for more volatility as Trump weighs his options and the search for Powell’s replacement becomes a new market subplot.

- Even trial balloons can shake markets. Expect more noise and possible rate volatility as the president pushes for a more dovish Fed chief.

-

🏡 US Retirement Plans May Get The Green Light For Private Equity Investments ( Barrons )

- This could be a double-edged sword more than people realize.

- The WSJ reported that Donald Trump plans to sign an executive order to make private equity investments more easily accessible to 401(K) retirement plans.

- This would likely result in a flood of new offerings and products coming to the market. Most investors would love the opportunity to invest in unlisted companies like Space-X, OpenAI, and Stripe.

- But private investments don’t offer the same transparency and liquidity that public markets do. This could also become a dumping ground for all the investments private equity funds don’t want.

- With more access pre-IPO, the IPO itself might not offer the upside investors are hoping for anyway.

- If this happens, the losers are likely to be closed-end funds that currently offer exposure to the private companies mentioned above, but with a steep premium. The Destiny Tech 100 fund ( DXYZ ) initially fell 20% on the news before recovering some ground.

🌅 Things Are Looking Up For Europe And The UK

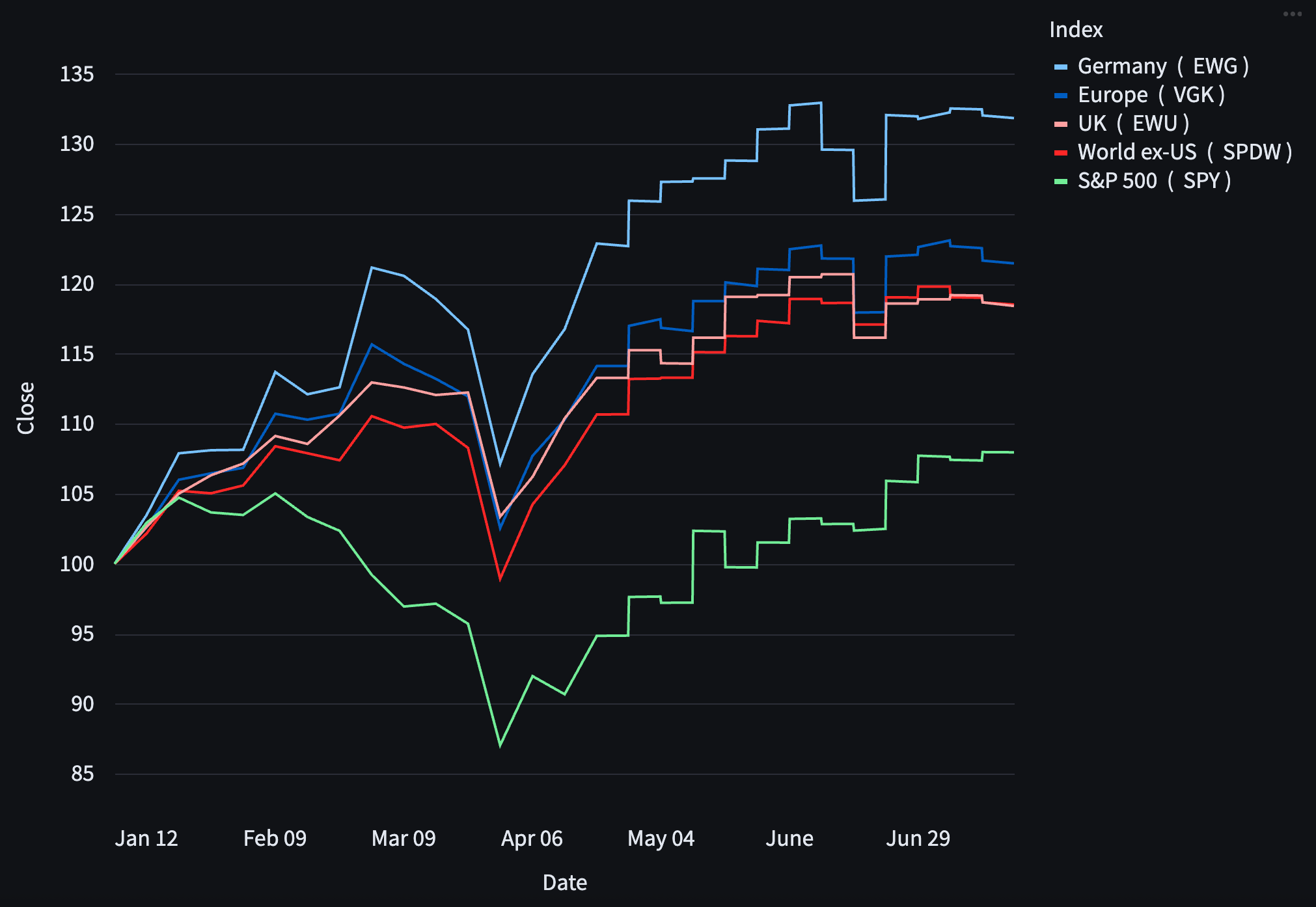

European markets are having a moment in 2025, pulling off a rare streak of outperformance.

Since January, UK, European, and Global ex-US large caps have all managed to outpace the S&P 500.

YTD Performance: Europe and UK vs US and World Ex-US Large Caps

😌 Confidence Is Returning To The EU Economy

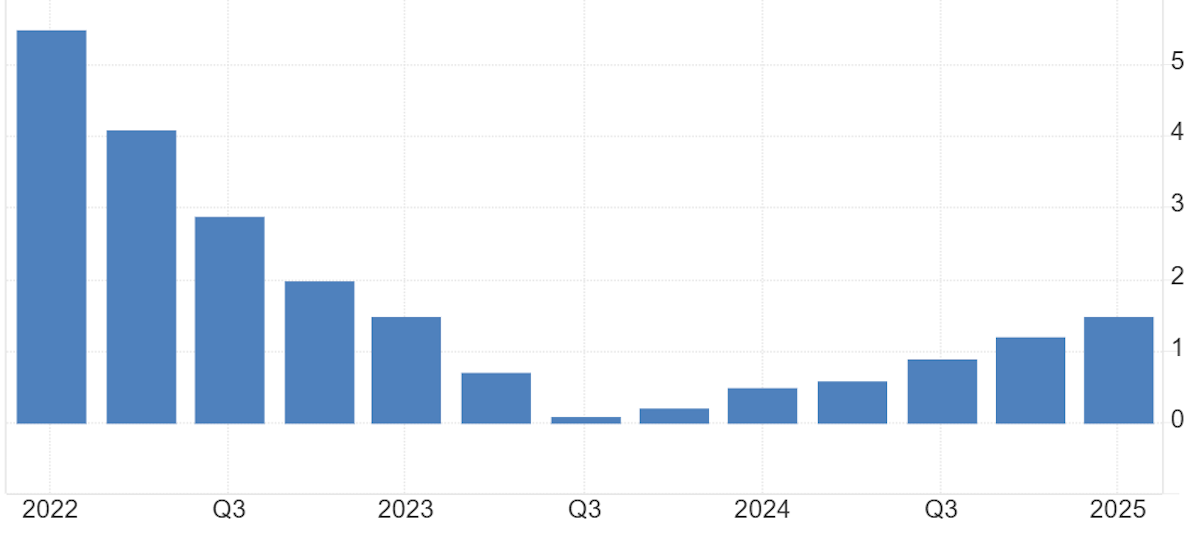

Euro Area GDP grew 1.5% in Q1.

Okay, it’s not exactly world-beating, but it does mark six straight quarters of improvement. That steady momentum, paired with falling interest rates and softer energy prices, has given both businesses and consumers a much-needed confidence boost.

Euro Area GDP (YoY) by Quarter - Trading Economics

Inflation across the Euro Area is sitting comfortably around 2%. Core inflation (excluding food and energy) has eased to 2.3%, while headline inflation has been treading water, largely thanks to low energy prices.

🇩🇪 Germany’s Big Fiscal Pivot

In March, Germany flipped the script on its famously cautious fiscal stance, unveiling a €500 billion infrastructure investment plan, funded by borrowing. On top of that, Berlin is set to pump more cash into its defence budget.

Their hope is to kickstart Germany’s economy and send positive ripples across Europe. But there’s a catch: the spending spree won’t actually kick in until 2026.

The timing, though, couldn’t be better.

With uncertainty swirling in the US, investors are sniffing out opportunities beyond American shores and Europe’s borrowing costs are looking relatively cheap.

🇺🇸 US Tariffs and a Potential Trade Deal

All eyes are on trade talks ahead of August 1st, when a hefty 30% tariff is slated to hit EU imports.

Such a move would be a gut punch for European exporters. Still, there’s optimism that negotiators can hammer out a better deal, even if Europe has to give a little ground to get there.

🇬🇧 The UK Is A Little More Complicated

The UK’s FTSE 100 just smashed through the 9,000 mark for the first time on Tuesday.

It’s a milestone that feels a little at odds with how the broader economy has been performing over the past year:

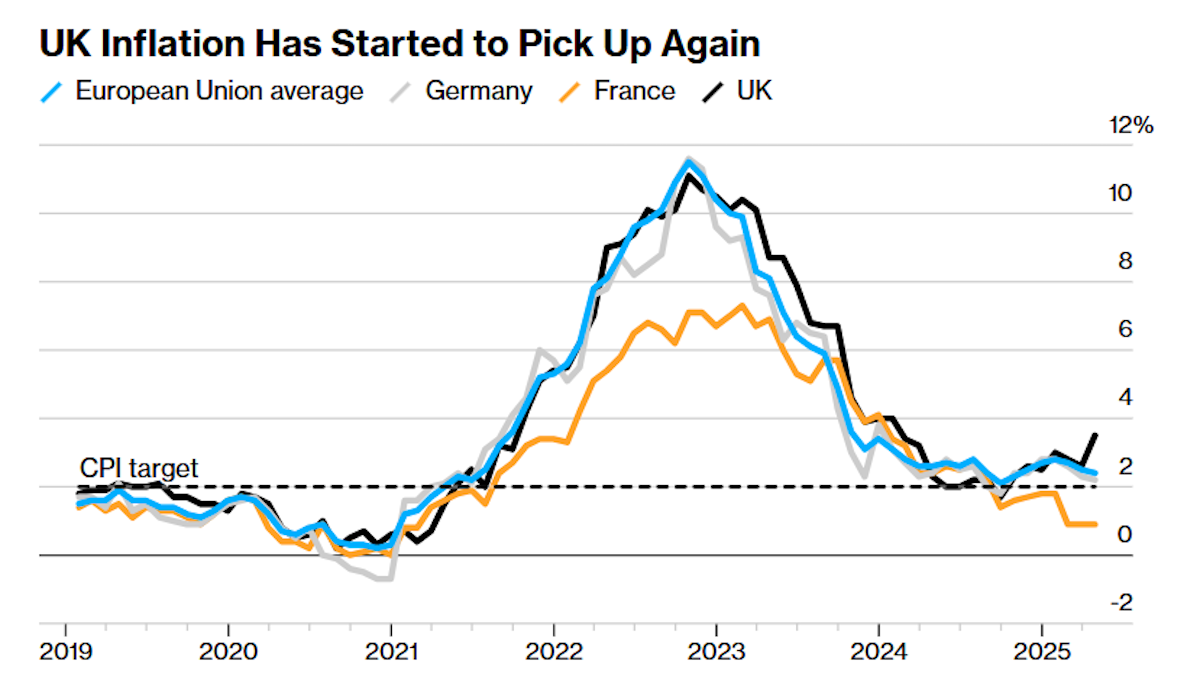

- 📈 Inflation jumped from 1.7% (Sept 2024) to 3.4% (May 2025), while EU prices stayed stable.

- ✂️ The BOE cut rates to 4.25% (from 5.25%), but the ECB is already down at 2.15%.

- 📊 Unemployment rose from 3.6% to 4.6% over three years—modest, but notable among major economies.

- 📉 After 18 months of growth, the economy contracted in April and May.

EU Inflation - Bloomberg

So why did inflation rebound? A few factors are in play:

- ⚡️ Energy costs surged, with the UK more reliant on imported gas.

- 🔌 Utility bills jumped as providers invested heavily in infrastructure upgrades.

- 💰 New business taxes and a higher minimum wage have pushed up costs for companies.

- 💸 And wages have risen more broadly, adding to price pressures.

On the plus side, many of these drivers, like utility hikes, are one-off effects. And stronger wage growth could translate into more disposable income for consumers.

🇺🇸🇬🇧 US/UK Trade Deal

The UK and US have struck a trade agreement that will see most UK exports hit with a 10% tariff, though some goods will be exempt.

This is still a net positive for two reasons:

- 🚚 It gives UK exporters a relative advantage over competitors,

- 🤷♂️ And it takes the uncertainty off the table, something many other countries are still wrestling with.

💹 Equity Market Expectations and Valuations

Back in May last year, a Reuters survey had analysts predicting the Stoxx 600 would drift lower through the rest of 2024 before staging a rally in 2025.

So far, they’ve been spot on, even though no one saw Germany’s fiscal pivot or the sharp April correction coming.

Fast forward to today, and analysts remain upbeat about UK and European equities, pointing to several key factors:

- ⚖️ On forward P/E multiples, European stocks are still trading at a ~35% discount to US stocks, with UK equities at an even steeper 42% discount.

- 💰 Dividend yields from European shares are nearly three times higher than those in the US.

- 🇪🇺 The ECB’s policy stance remains supportive, and the Bank of England is expected to deliver two 25bps rate cuts before year-end.

- 🌍 While US stocks have clawed back losses since April, European funds are still pulling in strong inflows, suggesting global investors are quietly tilting exposure toward Europe and trimming back on the US.

Commentary from European banks in Q2 has also been encouraging:

- 🏦 Banks are benefiting from stronger economic activity, increased borrowing, and healthy fund flows.

- 📆 Few have lowered their full-year guidance, even with the looming threat of 30% tariffs on “liberation day.”

- 🛑 That said, some clients are pressing pause on projects until tariff uncertainties clear.

Beyond Germany’s big infrastructure package, Europe’s push into renewables is also expected to drive fresh investment into the broader “electrification” of its economy.

📊 Sector Highlights

- In Europe, analysts are particularly bullish on financials, industrials , and utilities.

- For the UK, healthcare, technology , and select consumer staples are in focus.

- There’s more caution around UK consumer discretionary stocks, given the drag from higher interest rates.

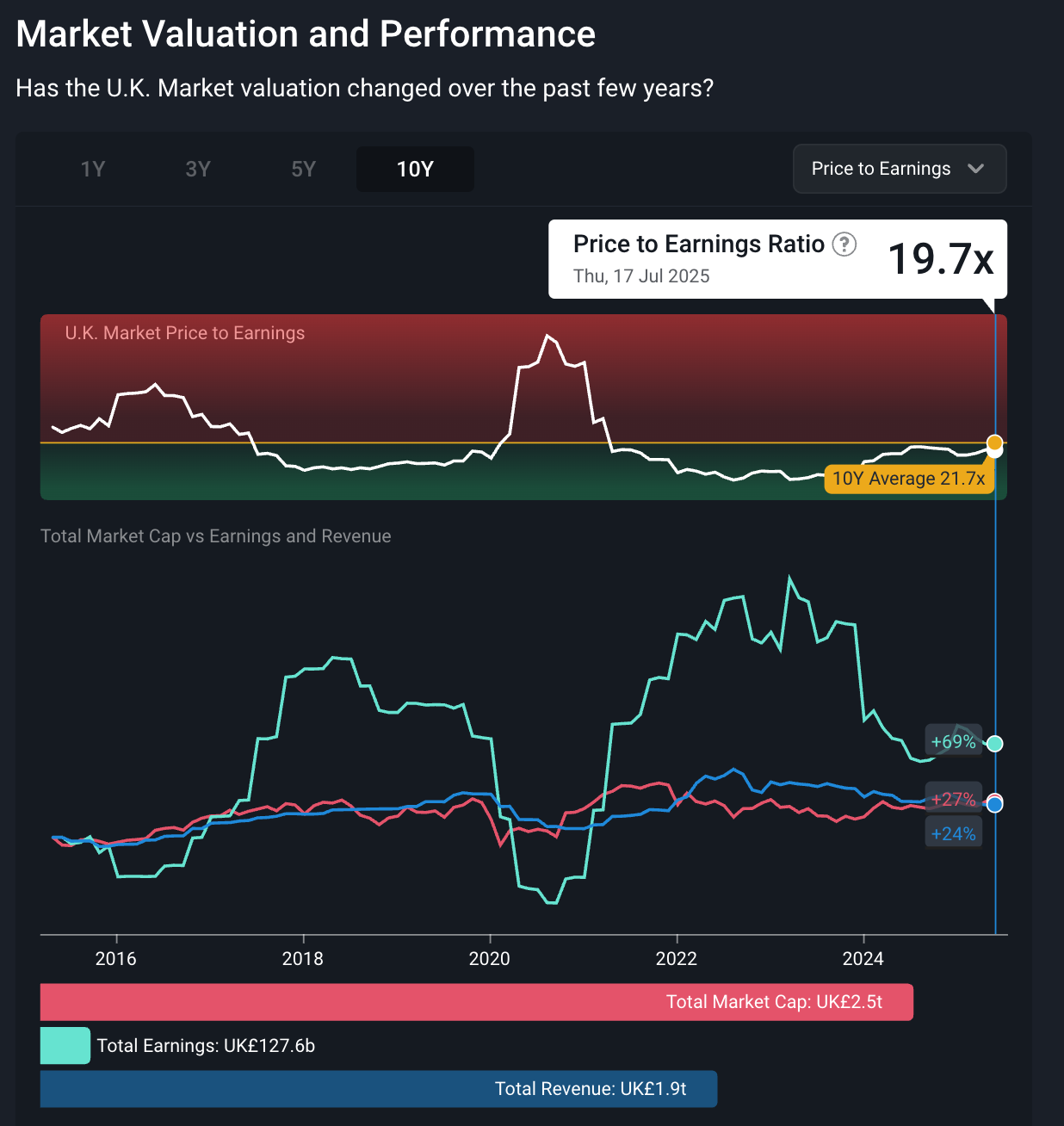

📈 The FTSE’s Unique Makeup

It’s worth remembering that the UK’s large-cap market comes with some quirks.

The FTSE 100 has unusually heavy weightings in consumer staples (18%), energy (11%) , and materials (7.4%) , but just 1% in IT and 3% in communications.

This skew makes FTSE earnings far more cyclical than the US market. (If you compare the sector charts, the difference is clear.)

UK Market 10 Year PE, Earnings and Revenue Simply Wall St

❓ What Could Go Wrong?

The outlook might be positive, but most analysts aren’t expecting huge gains from here, at least not on top of the strong year-to-date rally.

And there are a few risks and potential speed bumps worth watching:

- 🚨 A full-blown trade war would be a major drag. Exporters would take a direct hit from 30% (or higher) tariffs, while importers could also feel the pain if reciprocal measures kick in.

- 💵 A weaker USD against the euro and pound would squeeze European and UK exporters’ margins. (Though importers would get a bit of relief from lower input costs.)

- ⚡️ An energy price shock could make it harder for central banks to keep easing policy, and might even force a rethink on rate cuts.

- 🏗️ Slower-than-expected infrastructure investment would likely see growth forecasts dialled down. With Europe’s notoriously complex regulatory frameworks, delays aren’t out of the question.

💡 The Insight: Index Tracking Might Not Cut It

In the US, sticking with an S&P 500 ETF has been a winning strategy.

The “Magnificent 7” dominate the index and keep powering higher, meaning their contribution to overall returns just keeps snowballing.

But European markets? They play by a very different set of rules.

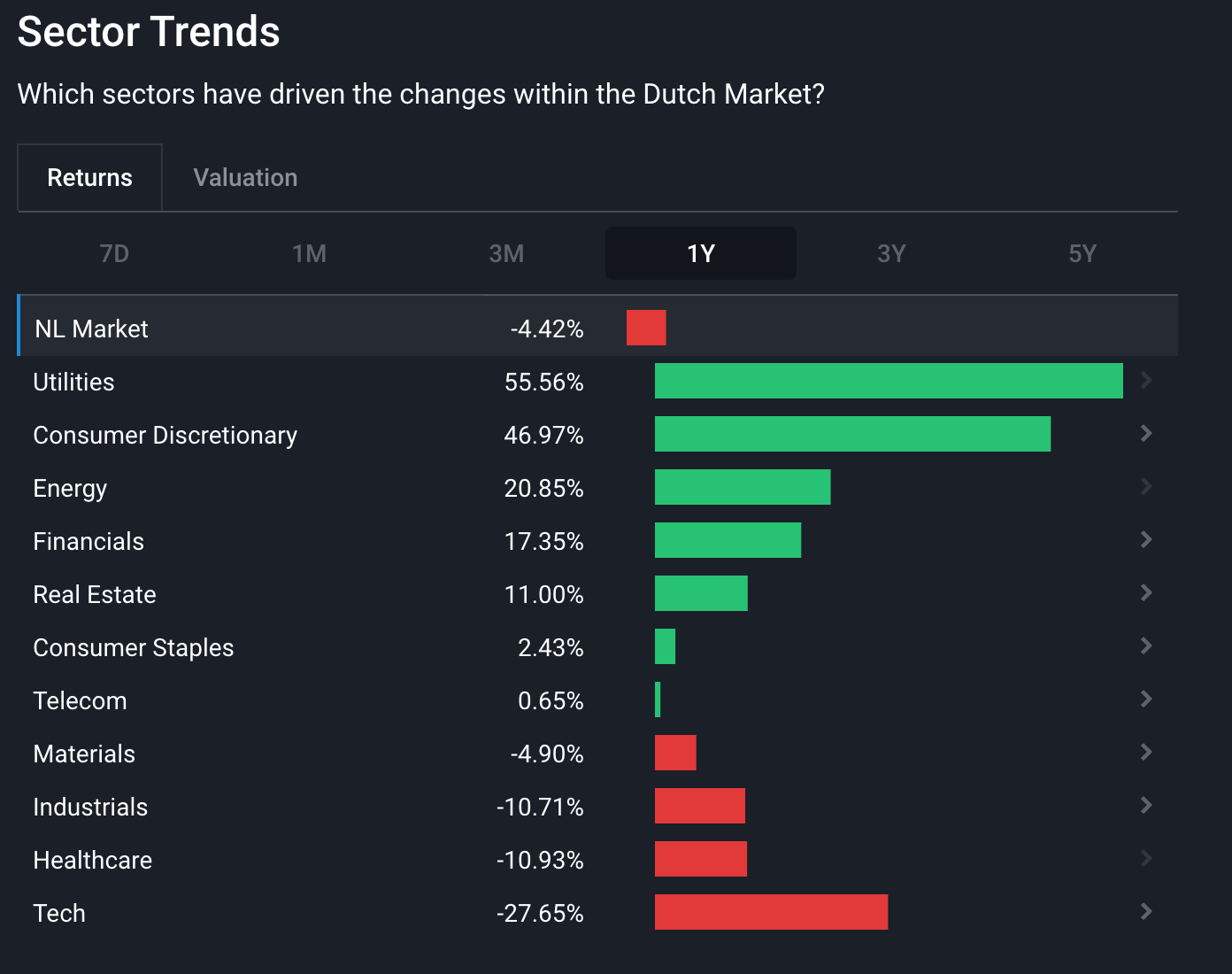

The UK’s charts, for example, show just how cyclical its large-cap indexes really are. Take the Netherlands: over the past 12 months, sector returns ranged from -27% to +55%. That’s a huge spread.

Netherlands Market 1-Year Returns by Sector Simply Wall St

Most European markets show a similar picture, but with entirely different sectors at the top and bottom of the table. In Germany, Industrials and Technology have been standouts, while Consumer sectors lagged behind.

For investors in Europe and the UK, this suggests a different approach: focus on individual companies rather than broad index tracking.

Here’s the key question to ask first: Is this company operating globally or locally?

- 🌍 For global players (usually the large caps), what matters most is whether they’re an industry leader and whether their sector has strong global fundamentals.

- The health of their home economy is not as important.

- 🏠 For locally focused companies, the domestic economy and industry dynamics will play a much bigger role in their prospects.

Key Events During the Next Week

Tuesday

🇦🇺 RBA Meeting Minutes

- ➡️ Why it matters: Minutes from these meetings provide insight into what policymakers are focused on.

🇺🇸 Fed Chair Powell Speech

- ➡️ Why it matters: Jerome Powell is under pressure from the Trump Administration, so this is likely to be closely watched by investors.

Wednesday

🇺🇸 Existing Home Sales

- 📈 Forecast: 4m (Previous: 4.03m)

- ➡️ Why it matters: Indicates housing market health and consumer confidence, with implications for construction and related industries.

Thursday

🇪🇺 ECB Interest Rate Decision

- 📈 Forecast: 2.15% (Previous: 2.15%)

- ➡️ Why it matters: No change is expected, but the statement may provide clues as to the ECB’s stance.

Friday

🇬🇧 UK Retail Sales MoM

- 📈 Forecast: 2% (Previous: -2.7%)

- ➡️ Why it matters: This will be of interest as some UK indicators were weak in April and May.

🇺🇸 US Durable Goods Orders

- 📈 Forecast: -9% (Previous: 16.4%)

- ➡️ Why it matters: A sharp swing from last month’s surge signals a potential slowdown in business investment and economic momentum.

Q2 Earnings season enters its second week with the first of the Big Tech names due to report.

Below are the largest companies reporting, but you can view “upcoming events” on the left-hand side of your Dashboard on Simply Wall St for stocks relevant to you.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.