Quote of the Week: “Learning is the only thing the mind never exhausts, never fears, and never regrets.” - Leonardo da Vinci

At Simply Wall St, we believe successful investors follow three principles:

- Think in decades, not months,

- Reach your own conclusions,

- Be a lifelong learner.

This is our last newsletter of the year and a good time to focus on the third of those principles - the investing lessons we can all take from 2024.

It’s been an eventful year and there have been lots of opportunities to learn. We’ve narrowed it down to 7, but we would love to know if you have others to add.

If you’re experiencing déjà vu, fret not, because we did the same thing back in 2023. If you missed last year's lessons, here are our 7 Investing Lessons From 2023.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

📈 Nasdaq Composite crossed 20,000 for the first time ( Forbes )

- What’s our take?

- Stock prices can move very quickly - or very slowly.

- The Nasdaq Composite took 17 years to get from 5,000 to 6,000, which is 1.08% per year. It’s taken just 4 years to double from 10K to 20K, or 19% a year.

- Of course, the move from 5K to 6K included a 75% decline after the dot com bubble burst, and a 53% drop during the GFC. It finally regained the 5,000 level in 2015.

- During the Nasdaq’s lost decade, other investments around the world did very well. Just remember, sectors, industries and companies have their moments in the limelight, but nothing lasts forever.

- What’s our take?

-

🏛️ Trump’s FTC Chair nomination points to a very different focus ( Quartz )

- What’s our take?

- A more relaxed FTC could be a key factor in 2025.

- Anti-trust regulation is a double-edged sword. On the one hand, monopolies and corporate action that reduces competition can stifle innovation, give consumers less choice, and lead to higher prices. On the other hand, without acquisitions, venture capital funds have less opportunity to exit investments and reinvest in other startups.

- Lina Khan, the outgoing chair of the Federal Trade Commission, has been controversial from day one, and received both support and criticism from across the political spectrum. She took a hard line on M&A and other ‘anti-competitive’ behavior, particularly when it involved ‘big tech’.

- Donald Trump has appointed Andrew Ferguson to take over. Ferguson also promised to crack down on big tech, but in his case it's because of their ‘vendetta against competition and free speech’.

- Outside big tech, he’s expected to take a more relaxed approach to mergers and to the regulation of AI and other emerging technologies.

- What’s our take?

-

🤝 Ad giant Omnicom takes aim at Big Tech, AI era with $13 billion Interpublic deal ( Reuters )

- What’s our take?

- Regulators aren’t the only ones taking on big tech, and industry consolidation is one way to adapt in a world where they’re eating your lunch.

- With increased self-serve and AI tools being offered by the likes of Google and Meta in their ad businesses, traditional ad agencies need to keep up. The goal of this merger is to combine the talent, resources, services, and capabilities of both firms to better serve their clients. Some customers include the likes of Apple, Disney, Volkswagen, Johnson and Johnson, and Levi Strauss.

- As mentioned, with the new FTC chair, the deal is less likely to face regulatory scrutiny, which if successful, would create the world’s largest ad agency. If finalized, the companies would merge by the end of 2025, and Omnicom and Interpublic shareholders will own the final entity at about a 60/40 split.

-

🇮🇳 India’s second-largest renewables company plans Nasdaq delisting ( FT )

- What’s our take?

- It’s a hard spot to be in when not only are you associated with bribery accusations, but you’re working in clean energy, have a load of debt and a Trump administration is on the way.

- ReNew is a part of a group of companies led by the group Adani Clean Energy, and it’s planning to delist from the Nasdaq and go private. This was spurred on by a 30% share price decline since it’s IPO in 2021.

- While the shares are now trading at $7.46, which is more than what was going to be offered, some analysts believe they’ll have to offer shareholders more than that. Other analysts mentioned that the biggest challenge is the US listing itself, and that it could possibly relist in India later on with a fresh capital raise.

- The volatility of revenue from its wind portfolio and its high debt level are a concern for some investors, but clearly not the consortium that would buy out existing shareholders.

-

⚠️ Business leaders warn Reeves about the impact of her Budget tax rises ( FT )

- What’s our take?

- UK businesses will likely have a lower appetite for spending when these increased taxes are passed.

- Planned employment reforms and tax raises have many business leaders concerned in an environment that is already economically challenging.

- The government proposed increased government spending and investment in its 2024 budget. The issue is it’s looking for businesses and individuals to help foot the bill with higher taxes, and additional government borrowing making up the difference. However, those business leaders warned there may be unintended consequences in the economy, such as lower recruitment and lower investment due to these higher taxes.

- So, it seems like companies will either cut costs to make up for the increased taxes, or you’ll see their net margins contract as a result.

-

💰 Micron scores $6.2B from Uncle Sam as the China chip war sparks US investment ( Sherwood )

- What’s our take?

- The tit-for-tat between the US and China will benefit some companies and hinder others.

- As the 2022 CHIPS Act continues, semiconductor companies like Micron, Intel, and TSMC continue to receive government funding to onshore chip manufacturing. The Commerce Department wants the funds to help increase the US’s advanced chip production from 2% to 10% by 2035.

- Both China and the US are trying to make their chip industries more self-sufficient, but the incoming US administration might take a different approach to the same goal, given they’ve criticized the cost of the CHIPS act.

7 Investing Lessons From 2024

Lesson 1: ❌ Expect To Be Wrong On Some Ideas

In January, we listed the themes Wall Street strategists saw playing out in 2024. There were some that strategists from various firms mostly agreed on, and some where they didn't agree.

Most were optimistic about high-quality technology companies, Japan, India, Mexico, and US healthcare stocks. So how did those calls work out?

- High-quality tech shot the lights out.

- India and Japan performed very well during the first half of the year, but lost some momentum in the second half.

- US healthcare is up about 2% YTD, but it’s been the worst performing sector by quite a margin.

- Mexico has been trending lower all year. The IPC index is down about 10%, and the MSCI Mexico index is down 24% YTD.

On balance, those forecasts were quite good. Three winners, one that underperformed but ended flat, and one proper loser.

Incidentally, there was less agreement about the direction of inflation, interest rates, and emerging markets. As it turned out, the inflation and rates outlook has been murky for most of the year. Emerging markets have also been complicated due to rates and China’s economy.

✨ Every investor, even those highly qualified ones employed by the likes of Goldman Sachs and JPMorgan, will have ideas that don’t work out. It’s just the nature of dealing with uncertain outcomes in a world of unlimited possibilities.

We can’t avoid the losers, but we can mitigate the impact on our portfolios by not putting all our eggs in one basket - i.e. diversifying and limiting exposure to each company, sector, or country.

We’ve added some great tools to the portfolio page to help you monitor your exposure to sectors, industries, and markets.

.png)

Lesson 2: 🔮 Models Work Until They Don’t

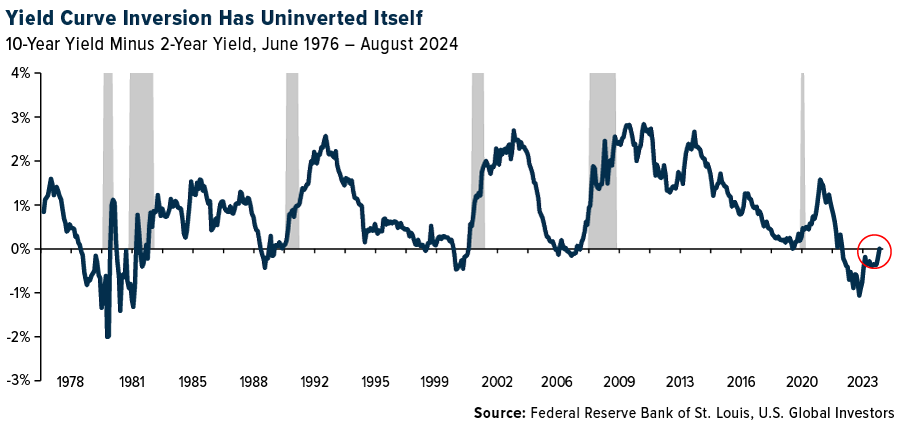

One of the reasons many investors expected a recession through 2023 and earlier in 2024, was the inverted yield curve.

The yield curve is said to be inverted when short-term rates (2 years) are higher than long-term rates (10 to 30 years).

This has been one of the most reliable leading indicators for a recession over the last 50 years.

In September, the US yield curve inverted after being inverted for a record 783 days. At this point, a recession isn’t impossible, but it certainly seems less likely than it has over the last two years.

Recessions typically occur within 18 months of the initial inversion, so it would turn out to be an extremely early warning anyway.

Historically, the bond market was regarded as the ‘smart money’, and the most accurate predictor of future inflation, growth, and rates.

Lyn Alden wrote a great post on the reasons it may be losing its edge earlier this year. She points out that bond markets have changed, and central banks are a bigger part of the market than they used to be.

In August, another recession indicator, the Sahm Rule, flashed a warning signal.

At the time, Claudia Sahm the inventor of the indicator was quick to point out that its “historical accuracy doesn't mean it will never be wrong”. She developed the indicator during the GFC and adopted it because it had been accurate up to that point.

It’s not just economic models that have had a bad year. Allan Lichtman’s

“13 keys to the White House” model failed to predict Donald Trump’s win in November. His model - which isn’t based on polling, but on 13 True/False questions - correctly predicted the winner in the previous nine elections. But it failed on the 10th try .

✨ The lesson here is that no indicator, model, or rule of thumb is foolproof. We can use them as a guide, but not as something that will never fail.

Lesson 3: ⚖️ A Goldilocks Economy Is Good For Equity Prices

Most of the world economy is now ‘mid-cycle’ and has been for most of the year. Mid-cycle typically implies that the economy is growing at a moderate rate, inflation is relatively stable, and interest rates are normalizing.

During the second quarter, a few analysts pointed out that we had the ingredients for a ‘Goldilocks economy’. That means growth is neither too hot nor too cold. This can be good for business confidence, as decision-makers are neither concerned about a recession, nor inflation.

✨ A Goldilocks economy can also be very good for markets. Expectations usually aren’t too high, which means things tend to turn out better than expected.

Worries about stocks being overvalued can actually prove to be bullish, too. That may seem counterintuitive, but when investors think the market is overvalued, they often stay on the sidelines, and then capitulate when prices are even higher.

The same applies to perceived risks. There are always risks to investing, but unless perceived risks turn into reality, stock prices keep rising.

This proved to be the case during the second half, even before the US election.

Lesson 4: ⛈️ Volatility Is Usually The Time To Take Action

Just a few weeks into the third quarter, global markets were hit by a perfect storm, causing volatility to spike. The primary catalysts were the return of recession fears and the BOJ raising rates, which caused the carry trade to unwind in a matter of days.

It turned out that those catalysts were temporary, and markets quickly recovered. That turned out to be one of the best buying opportunities of the year. The S&P 500 is up 18% since that correction, while the Nikkei 225 index is up 29% from the low.

Sometimes market volatility leads to more volatility - but more often than not it turns out to be a buying opportunity for patient long-term investors.

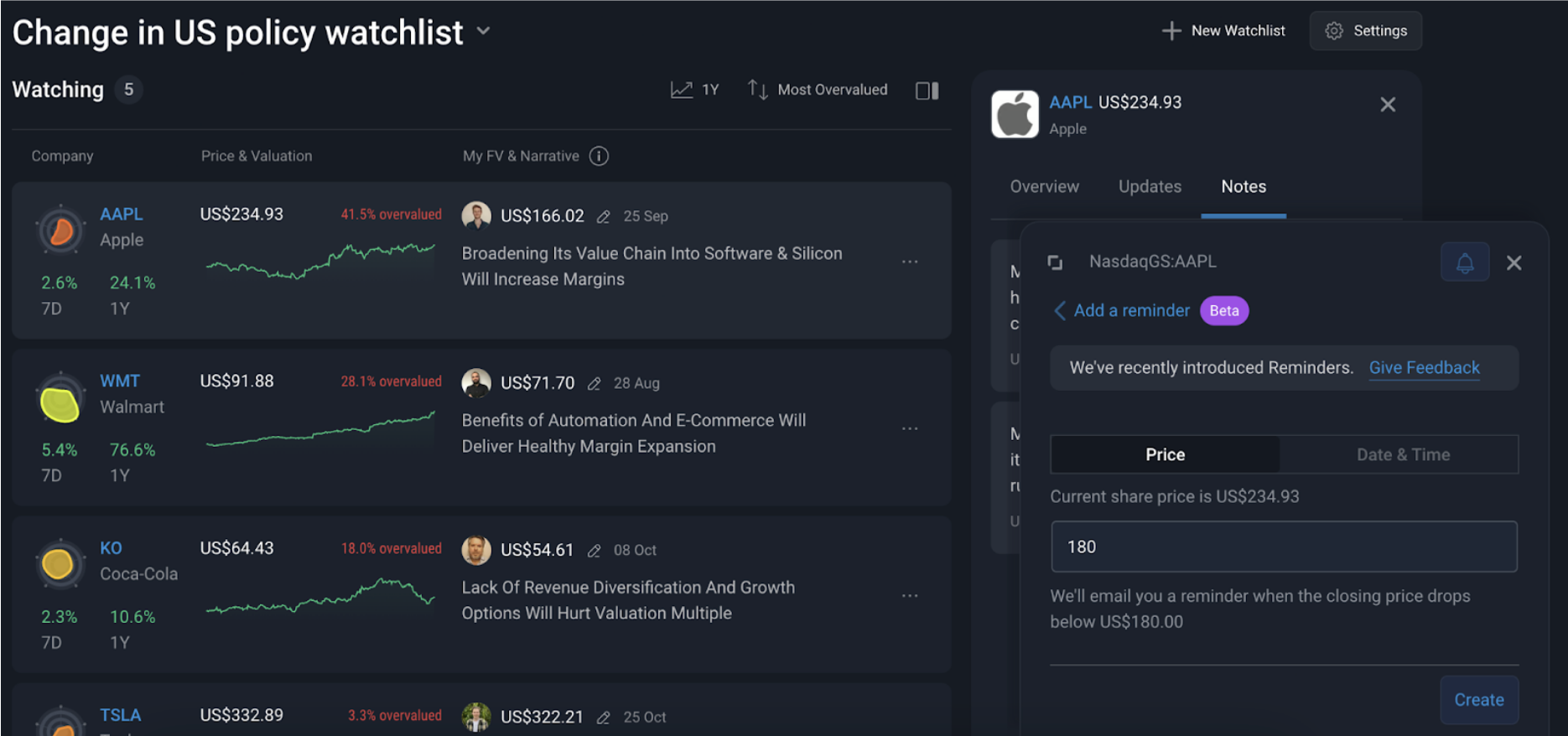

To take advantage of volatility, you need to know which stocks you’d like to own, AND the price you are prepared to pay for them. If you load those stocks into a watchlist, with a price alert, you will know what to do when everyone else is trying to figure out what to do.

Another theme coming into the year was geopolitical risk.

We covered the major geopolitical risks in March. They included the wars in Ukraine and Gaza, China’s economy, protectionism, and the threat of cyberattacks. Those risks are all still present as we head into 2025.

Geo-political events usually turn out to be buying opportunities too. Some, like Trump’s tariffs, turn out to be impactful for certain economies and companies. But for the most part, these events come and go without affecting markets.

Lesson 5: 🎢 The Semiconductor Industry Is Still Cyclical

The semiconductor industry has generally been considered to be cyclical, unlike other technology and growth industries.

New innovation drives demand which leads to higher prices, increased capacity and ultimately to too much inventory, too much capacity, and a collapse in prices.

✨ More recently, analysts have begun to think it’s getting less cyclical, as it becomes more complex and the number of end-use industries increases.

The charts below for Micron Technology (red) and AMD (blue) suggest it’s still as cyclical as ever. In the last few years, the focus has been on Nvidia, which has enjoyed ongoing demand for AI infrastructure. But most of the chip industry is exposed to other industries, where demand continues to be cyclical.

The reason we mention this is that the semiconductor industry is exposed to nearly every important secular trend, from AI to automation, clean energy, EVs, and healthcare.

If there’s one industry worth getting to know, it’s the semiconductor industry.

✨ Typically, quality companies in growth industries are always fully valued. The fact that chip makers are cyclical means you occasionally get the chance to invest at really attractive valuations.

If you missed it we did a five-part deep dive on the industry earlier this year.

Lesson 6: 🤔 A lot Of Investors Are Still Relying On Hype And Sentiment To Make Decisions

In 2021 the ‘meme stock‘ phenomenon emerged, and stocks with poor fundamentals traded up to ridiculous valuations. The stocks that started it all, GameStop and AMC, have since fallen by 98% and 96% respectively.

One would have thought it would have ended there. Nope, since 2021, we’ve seen a boom and bust in NFTs (now apparently all worthless) and SPACs -most down 95%, and those that are successful are well off their highs.

Last week we talked about institutional adoption of Bitcoin, some who view it as a speculative asset, and some who view it as a long-term store of value.

Somehow Dogecoin is now the 7th most valuable cryptocurrency, with a market value of $59 billion! We are still trying to work out the bull case for that one… and it is quite different from Bitcoin.

All speculative assets typically have two things in common. The first is that the valuation can’t be explained. The second is that the price typically collapses within a year.

If something is an investment, you should be able to explain the valuation and the catalysts that back the valuation up.

Speaking of which, we now have hundreds of excellent narratives from the community on the platform. You can check them out here.

Lesson 7: ⏰ Premiums Can Persist For A Long Time

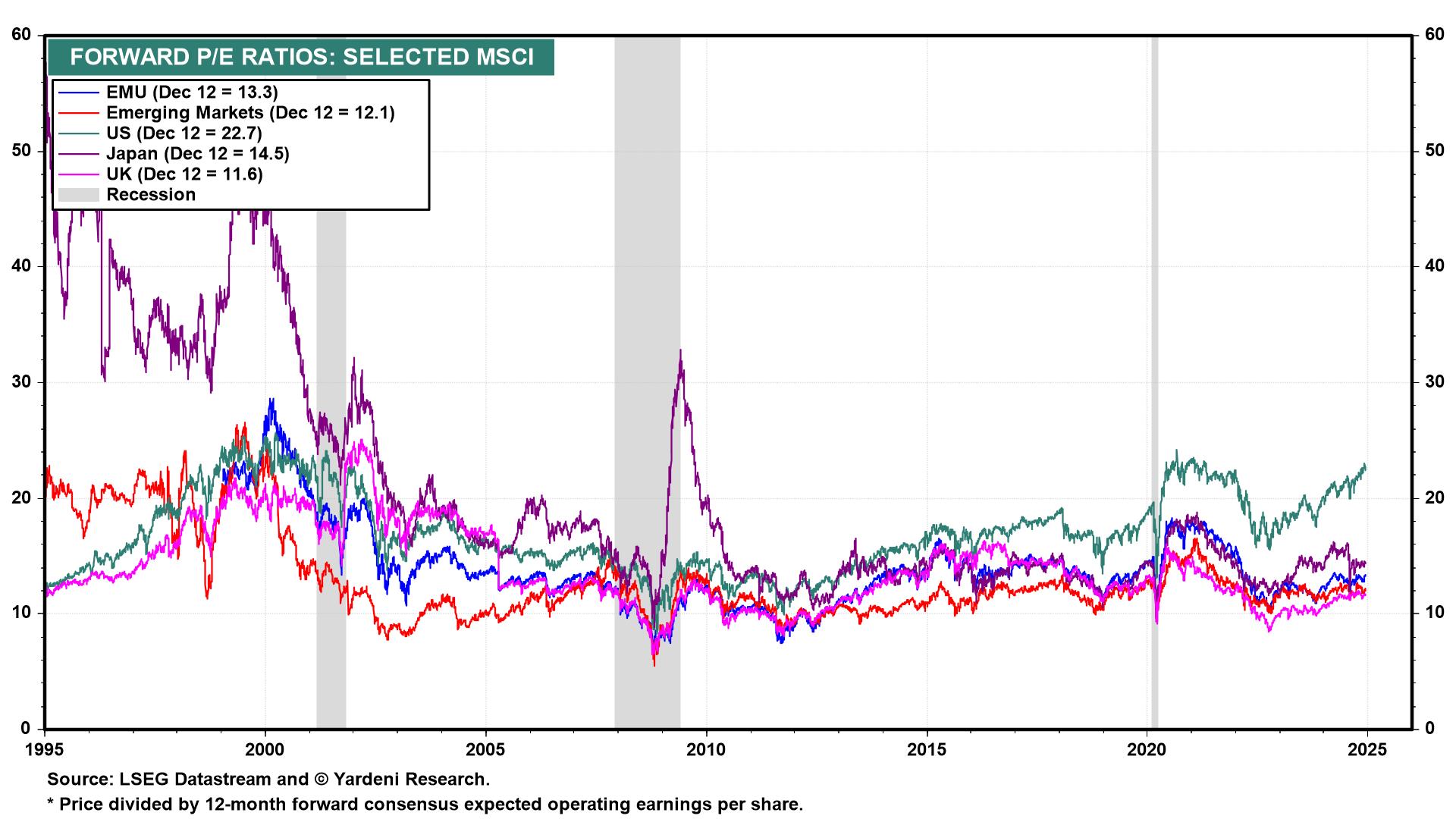

In September we made the case for the US market’s exceptionalism premium. With the right environment, a virtuous cycle begins and attracts capital, entrepreneurs, and skilled workers. Equities in markets like the US trade at a premium because investors would rather pay more to have their capital in an environment likely to generate more innovation and growth.

Unless something changes, the premium is likely to persist or grow. This chart shows how the US premium (in green) continues to expand compared to other markets.

The performance of the Magnificent 7 stocks in 2024 has illustrated the point. At the beginning of the year they traded at a premium to the rest of the US market, and to other markets. But they went on to justify the premium, and continued to outperform.

When you're working out what you think a company is worth, it’s worth accounting for the premium, and whether its’ likely to remain, expand or contract.

Key Events During The Next Week

It’s a busy week for economists with three interest rate decisions and lots of other data being released.

Tuesday

- 🇬🇧 UK unemployment is forecast to remain at 4.3%

- 🇨🇦 Canada’s headline inflation rate is expected to edge up to 2.2% from 2%. Core CPI is expected to remain steady at 0.4%.

- 🇺🇸 US retail sales will be published. The annual increase is forecast at 3.8%, up from 2.8%.

Wednesday

- 🇬🇧 UK inflation is forecast to remain at 2.3%, with core inflation rising from 3.3% to 3.4%.

- 🇪🇺 Eurozone inflation is forecast at 2.3%, up from 2%.

- 🇺🇸 The US Fed will announce its decision on the Fed Funds Rate, which is widely anticipated to be a 0.25% cut to 4.5%. The FOMC members will also be presenting their economic projections.

Thursday

- 🇬🇧 The Bank of England will also announce its interest rate decision but is expected to keep rates at 4.75%.

- 🇺🇸 US Initial Jobless Claims are anticipated to be slightly lower at 235K.

- 🇺🇸 US GDP Growth Rate for Q3 is anticipated to be 2.8%. This is the last of three estimates.

Friday

- 🇯🇵 Japan’s inflation rate is expected to rise from 2.3% to 2.5%.

- 🇬🇧 UK retail sales data will be released. Economists are expecting to see a 1.9% increase over 12 months, down from 2.4% in the 12 months to October.

- 🇺🇸 US personal income and spending data will be released along with the PCE price index, which is forecast to rise from 2.8% to 2.9%.

There are still a handful of larger companies due to report this week:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.