- United States

- /

- Software

- /

- NYSE:ESTC

3 Growth Companies With Insider Ownership Up To 16%

Reviewed by Simply Wall St

As February 2025 comes to a close, the U.S. stock market has experienced a turbulent month with major indexes like the Nasdaq Composite and S&P 500 posting losses despite a late-month rally fueled by easing inflation data. Amidst this backdrop of economic uncertainty and geopolitical tensions, investors are increasingly looking for growth companies where high insider ownership may indicate strong confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.1% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Kingstone Companies (NasdaqCM:KINS) | 17.7% | 24.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Astera Labs (NasdaqGS:ALAB) | 16.1% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Let's review some notable picks from our screened stocks.

Elastic (NYSE:ESTC)

Simply Wall St Growth Rating: ★★★★☆☆

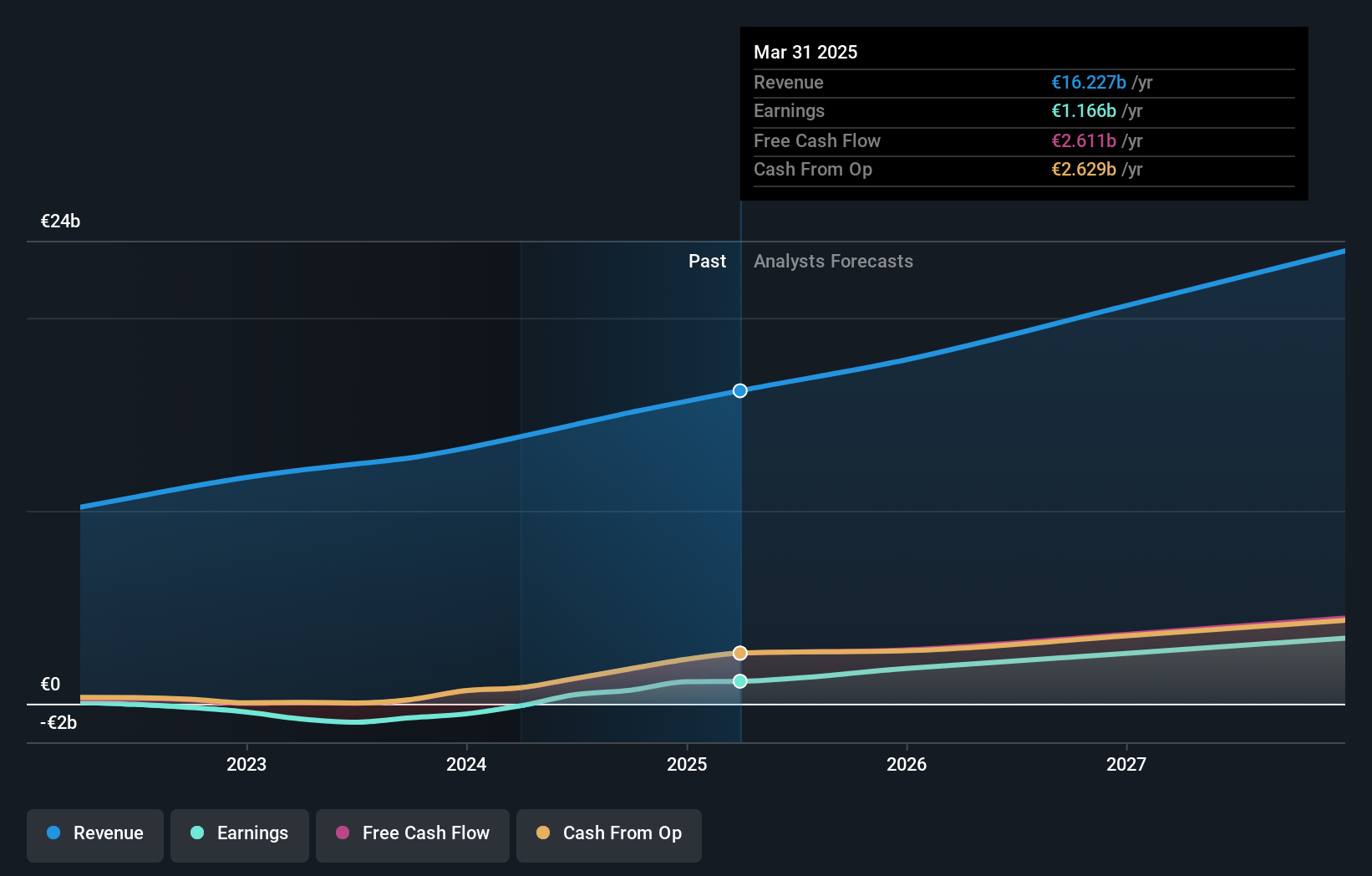

Overview: Elastic N.V. is a search AI company that provides hosted and managed solutions for hybrid, public, private, and multi-cloud environments globally, with a market cap of approximately $12.15 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $1.43 billion.

Insider Ownership: 12.7%

Elastic has demonstrated significant growth potential, with revenue projected to grow faster than the US market. Recent guidance indicates expected revenue of up to US$1.476 billion for fiscal 2025, marking a 16% increase year-over-year. Despite recent insider selling and legal challenges related to sales operation changes, Elastic continues to innovate with product enhancements like the Elasticsearch Open Inference API and logsdb index mode, which could bolster its competitive edge in data management solutions.

- Take a closer look at Elastic's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Elastic is priced lower than what may be justified by its financials.

Ryan Specialty Holdings (NYSE:RYAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. provides specialty products and solutions for insurance brokers, agents, and carriers across multiple regions including the United States, Canada, Europe, India, and Singapore with a market cap of approximately $8.80 billion.

Operations: The company generates revenue primarily from its Insurance Brokers segment, which accounts for $2.46 billion.

Insider Ownership: 15.8%

Ryan Specialty Holdings shows strong growth potential with earnings forecasted to grow significantly at 62.2% annually, outpacing the US market. Despite recent insider selling, the company remains focused on strategic M&A to drive value and expand capabilities. Recent financial results reveal a revenue increase to US$2.52 billion for 2024, though net income dipped in Q4 compared to last year. The company also increased its quarterly dividend by 9.1%, reflecting confidence in future cash flow generation.

- Get an in-depth perspective on Ryan Specialty Holdings' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Ryan Specialty Holdings shares in the market.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $124.46 billion.

Operations: The company generates revenue through two main segments: Premium, contributing €13.82 billion, and Ad-Supported, adding €1.85 billion.

Insider Ownership: 16.2%

Spotify Technology's recent strategic alliance with Warner Music Group enhances its growth trajectory, focusing on innovative collaborations and expanded content offerings. The company reported a significant turnaround in 2024, with net income reaching €1.14 billion from a prior loss. Earnings are expected to grow substantially at 23.6% annually, outpacing the US market average. Despite no recent insider buying or selling activity, Spotify remains undervalued by 11.2% relative to its estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of Spotify Technology.

- In light of our recent valuation report, it seems possible that Spotify Technology is trading beyond its estimated value.

Where To Now?

- Navigate through the entire inventory of 202 Fast Growing US Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, delivers hosted and managed solutions designed to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives