📈 Investing In Innovation to Beat Stagflation

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: “The best way to predict the future is to create it.” - Peter Drucker

The level of uncertainty has been off the charts lately. That’s why we’ve been talking about defensive strategies over the last few weeks.

Playing defense is one way to take on an uncertain future. But you can also take the bull by the horns and play offense. In fact, as we mentioned recently , there are good reasons to do both.

Productivity growth and outsized returns are usually the result of innovation and/or disruption. So innovative, growing companies are a logical approach to combating inflation and/or slowing economic growth.

This week’s newsletter is an introduction to the topic of innovation and a few pointers on investing in high-risk, high-reward companies.

Over the next few weeks, we’ll dive into a few industries within the space, including automation, AI-powered healthtech, as well as a check-in on the AI arms race.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened In Markets This Week?

Here’s a quick summary of what’s been going on:

-

📈📉 Stock market volatility shows no sign of calming as trade questions linger ( S&P Global )

- April has seen markets experience whiplash on Trump’s tariff tweets and trade flip-flops.

- No clear policy direction means traders are flying blind, and volatility isn’t going anywhere.

- Equity rallies are proving short-lived since a single social media post can erase gains within hours. Some investors are rotating into gold, bitcoin, and diversification plays, while trimming exposure to volatile small and mid-caps.

- With recession fears and trade chaos tugging at sentiment, the market is stuck in a holding pattern. Basically, it’s bullish if tariffs ease, but bearish if they deepen.

- Just focus on your long-term positioning. Stay diversified, lean into quality names, and avoid knee-jerk moves while trade policy noise plays out. Patience pays in a headline-driven market.

-

🛰️ Amazon launches first Kuiper internet satellites in a bid to take on Elon Musk’s Starlink ( CNBC )

- Amazon has launched its first 27 Kuiper satellites to challenge Starlink’s dominance in space-based internet. It has until mid-2026 to deploy at least 1,618 satellites, with over 80 launch contracts already booked.

- The $10 billion Kuiper project is a long-term bet by Amazon in infrastructure and global connectivity. While the service could eventually drive meaningful returns, it will likely weigh on cash flow and margins in the near term.

- Funding probably won’t be an issue, so stay focused on Amazon’s execution, capex guidance, commentary, and cash flow signals to get an idea of Project Kuiper’s progress.

-

💸 Record growth and diverse product offering drive Revolut to $1.4bn profit in 2024 ( Digital Banking )

- Revolut just posted a record $1.4 billion profit in 2024, driven by a 72% revenue jump and deeper customer engagement across its retail and business platforms.

- Wealth and subscription products were standout performers, with customer balances and transaction volumes surging.

- Revolut’s model is scaling well, with strong operating leverage pushing net margins to 26%. Momentum in business banking and new product adoption (crypto, savings, RevPoints) is driving continued growth. While it’s still private, this kind of profitability and scale strengthens its IPO case.

- Revolut is now converting its scale into real profit, something plenty of fintechs have struggled with. Keep an eye out for signs of IPO prep or signals on how incumbents respond.

-

🧑🏭 Metals get outsized exemptions from 'reciprocal' tariffs amid trade probes ( S&P Global )

- Nearly 30% of US metal and mineral imports escaped Trump’s new “reciprocal” tariffs, thanks to carve-outs for critical materials like lithium, cobalt, and uranium.

- The White House is slow-walking additional tariffs through national security probes, adding months of uncertainty to key industrial inputs.

- For now, sectors reliant on battery metals, EV components, and nuclear fuel catch a break. However, this relief may be temporary. National security probes on key minerals are ongoing and could still trigger tariffs later this year. Traders may front-run those tariffs by stockpiling metals like copper, which is already trading at a US premium. Expect volatile pricing as policy whiplash continues to drive investor sentiment.

- Expect volatile pricing as policy whiplash continues to drive investor sentiment.

-

🤖 Meta’s LlamaCon was all about undercutting OpenAI ( TechCrunch )

- Meta launched its Llama API and a consumer-facing AI chatbot app at its first LlamaCon, aiming to challenge OpenAI’s position.

- The new tools simplify access to Llama models in the cloud, cutting out third-party infrastructure for developers.

- By promoting its open Llama models, Meta is building a developer ecosystem aligned against closed AI platforms like OpenAI. The chatbot’s social feed positions Meta ahead of OpenAI’s rumored social features. This move also supports potential regulatory advantages under the EU AI Act’s open-source carve-out, which we commented on last week.

- Meta’s open AI push is a move to win developer loyalty and stunt OpenAI’s growth with its own market share expansion.

-

🇺🇸U.S. economy declined in Q1 ( CBS News )

- U.S. GDP shrank 0.3% in Q1 2025, missing expectations, as firms front-loaded imports ahead of Trump’s April tariffs.

- A surge in imports and a steep 5.1% drop in government spending were key drags, despite resilient private demand.

- While underlying demand remained solid, the inventory buildup sets up a Q2 hangover, and weak April jobs data adds to recession jitters. The tariff shock and government spending cuts may stall consumer momentum, and the Fed is likely to pause rate cuts as it watches how inflation and demand evolve. Some forecasts now see a mild rebound in Q2, but risks are clearly skewed to the downside.

- Defensive positioning, higher cash allocations, and exposure to domestic demand leaders may help investors ride out a bumpy 2025.

💥 Investing in Innovation and Disruption

The future’s always a bit murky, but right now, it’s practically fogged over.

That said, if there’s one thing history’s made clear, it’s this: human innovation doesn’t stop .

And when we innovate, we grow. Productivity surges, and entire industries transform.

Over the last 200 years, the biggest winners, by market cap and cultural impact, have been the disruptors. The ones who saw what was coming before everyone else did.

And right now, there are some solid reasons to take another look at today’s tech innovators.

We’re staring down economic threats like recessions, inflation, and that brutal combo: stagflation (low growth + high inflation).

But this environment is exactly where disruptive companies can shine.

Here’s why:

- 🔥 Earnings growth is still the best antidote to inflation.

- 📉 Inflation pushes businesses to find cost-cutting tech, which boosts demand.

- ⚙️ Several breakthrough technologies are finally hitting their stride, going from shiny ideas to real-world game changers.

- 💸 And share prices are still well below their January peaks.

📘 ARK Invest’s Big Ideas Presentation

Each year, ARK Invest publishes its Big Ideas report. This is a detailed look at the transformative technologies in which their funds are invested. The 2025 edition is 145 pages long and filled with charts, data, and forecasts.

ARK has a reputation for making very optimistic projections. While not everyone agrees with their outlook, the report still presents a compelling picture of how certain technologies could evolve in the near future.

Many people did not fully understand what the internet, smartphones, or cloud computing would eventually become. We like it because it encourages us to think more deeply about what comes next.

The 2025 edition highlights five major technology platforms and introduces eleven core ideas that are connected to one or more of these areas.

The 5 technologies include:

Artificial Intelligence (AI) 🧠

AI has been getting most of the attention lately, with good reason. AI provides the brains behind the other technologies.

Robotics 🤖

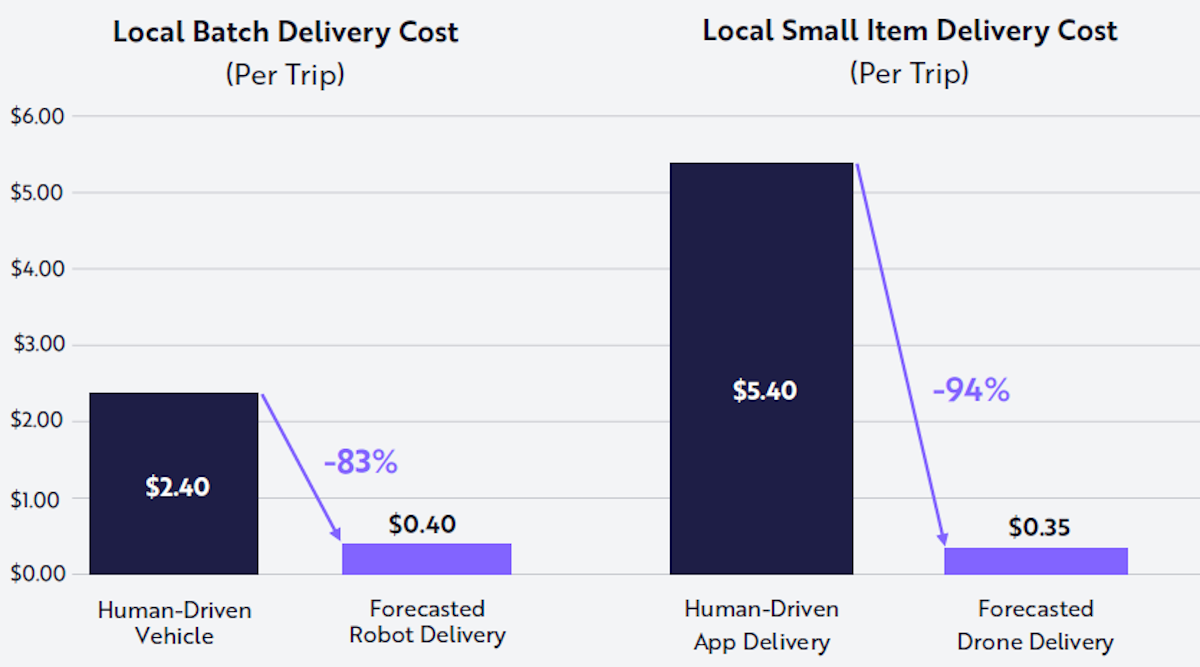

The robots are coming. Automation is rapidly becoming a reality, and is particularly relevant now as companies look to ‘reshore’ manufacturing. ARK highlights:

- 🦾 Humanoid robots

- 🚗 Robotaxis (which it now sees as a two-horse race)

- 📦 Autonomous delivery

- 🚀 Reusable rockets

Energy Storage 🔋

Cheaper, more efficient batteries are crucial to electrifying the economy and to the adoption of autonomous drones, vehicles, and robots.

Nuclear energy is also back on the agenda, with potential breakthroughs in SMRs (small modular reactors) and nuclear fusion on the horizon.

Multiomic Sequencing 🧬

Multomics refers to the analysis of multiple forms of biological data. This field and other AI-powered strategies are being used to speed up drug discovery, detect diseases earlier and develop new therapeutic strategies.

Public Blockchains 🔗

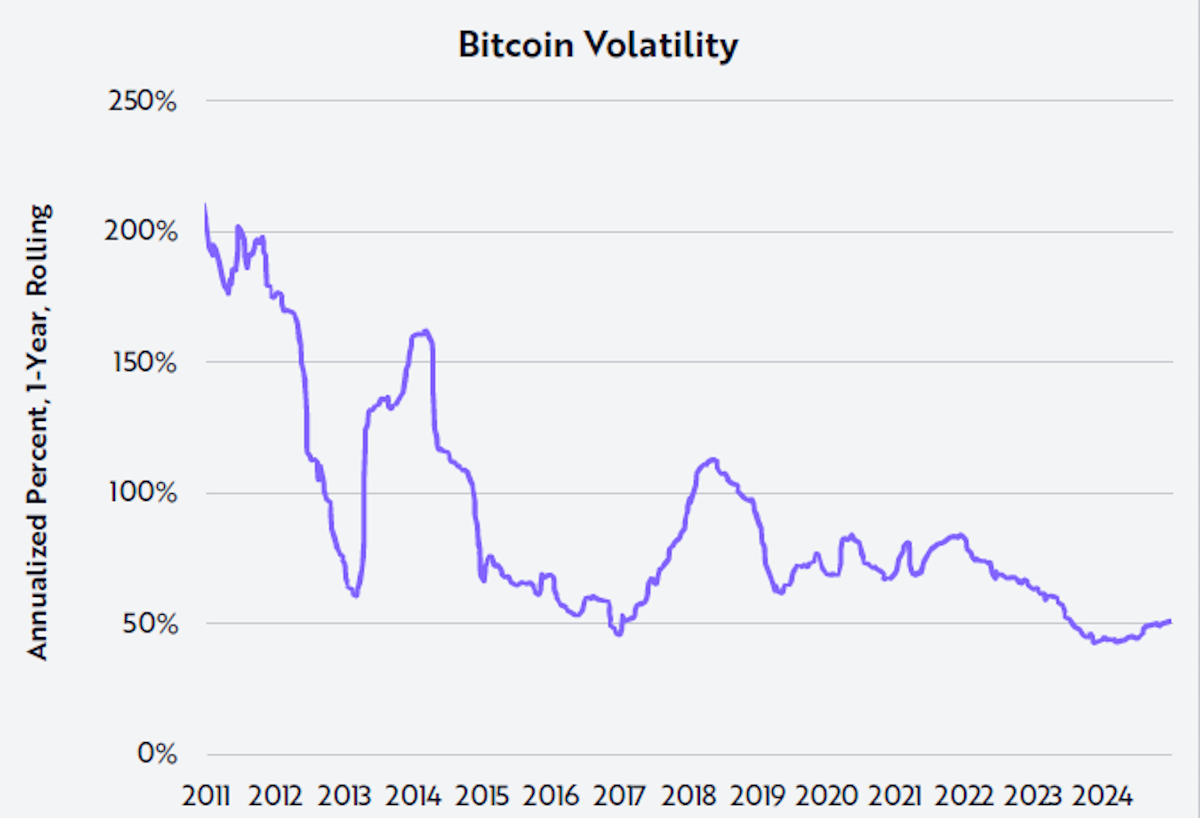

Bitcoin is up, and its volatility is down as corporate adoption increases. ARK sees potential for Bitcoin and for stablecoins, as well as smart contracts, as blockchains become faster and cheaper. Of course, the pro-crypto Trump Administration helps too.

Three important aspects of ARK’s thesis are:

- ❎Convergence between these technologies amplifies their impact and speeds up adoption.

- 🤖 AI acts as a catalyst , accelerating progress everywhere else. This tech convergence could dramatically boost productivity.

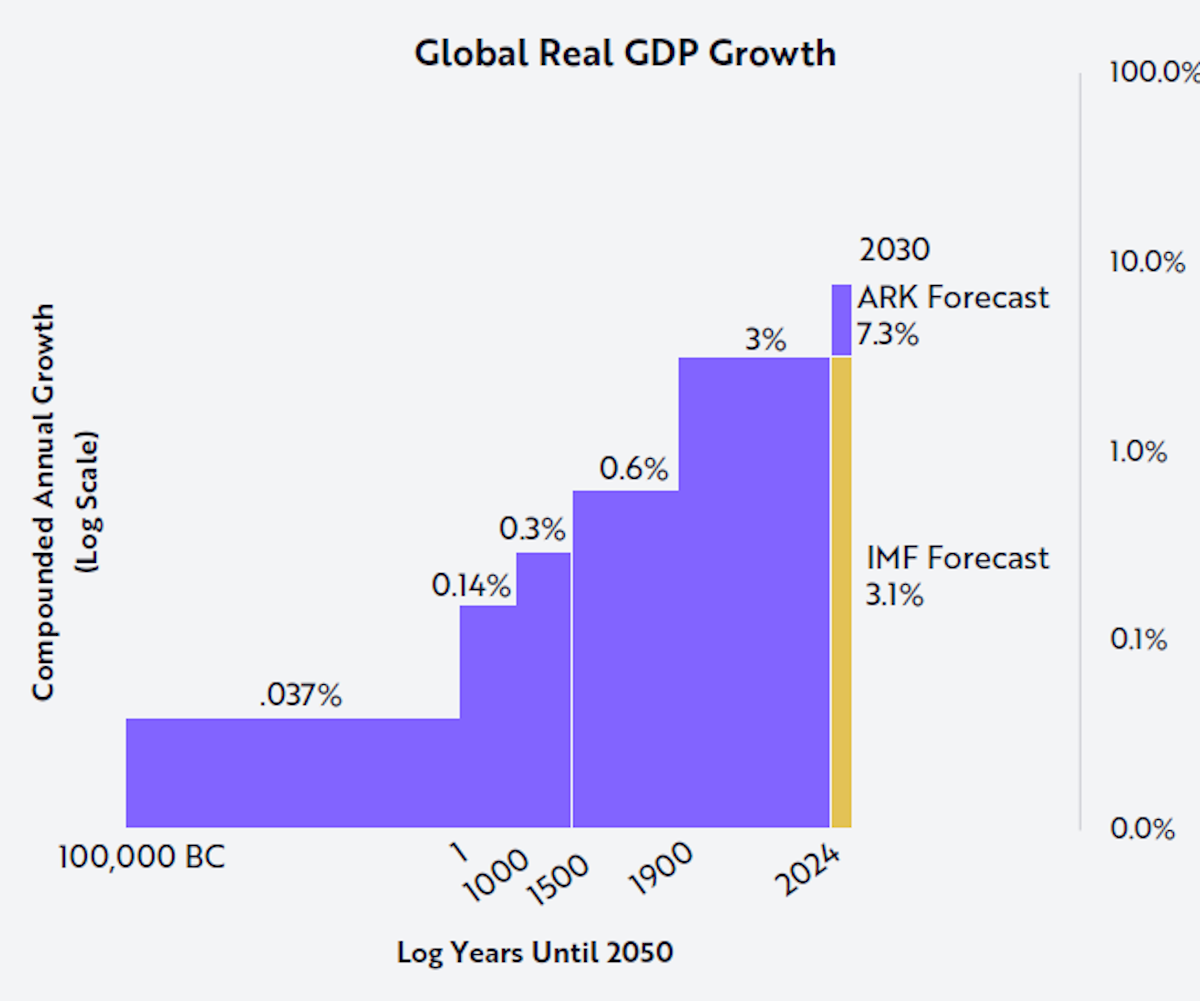

- 📈 Rapid acceleration of global GDP growth could result from productivity gains and cost declines. ARK forecasts global growth potentially hitting 7.3% annually by 2030 (vs. the IMF's 3.1% baseline).

🤯 ARK also believes disruptive innovation could command over 66% of global equity market cap by 2030, compounding at 38% annually.

Before you gasp, that may not actually be that far-fetched, considering that 8 of the 10 most valuable companies in the world are disruptors.

Last week, ARK’s CIO, Cathie Wood, published an update outlining her thoughts on current events.

✨TL;DR: She points out that we’ve already seen rolling recessions across quite a few sectors, and markets will soon benefit from productivity gains.

📈 The Power Law Of Innovation

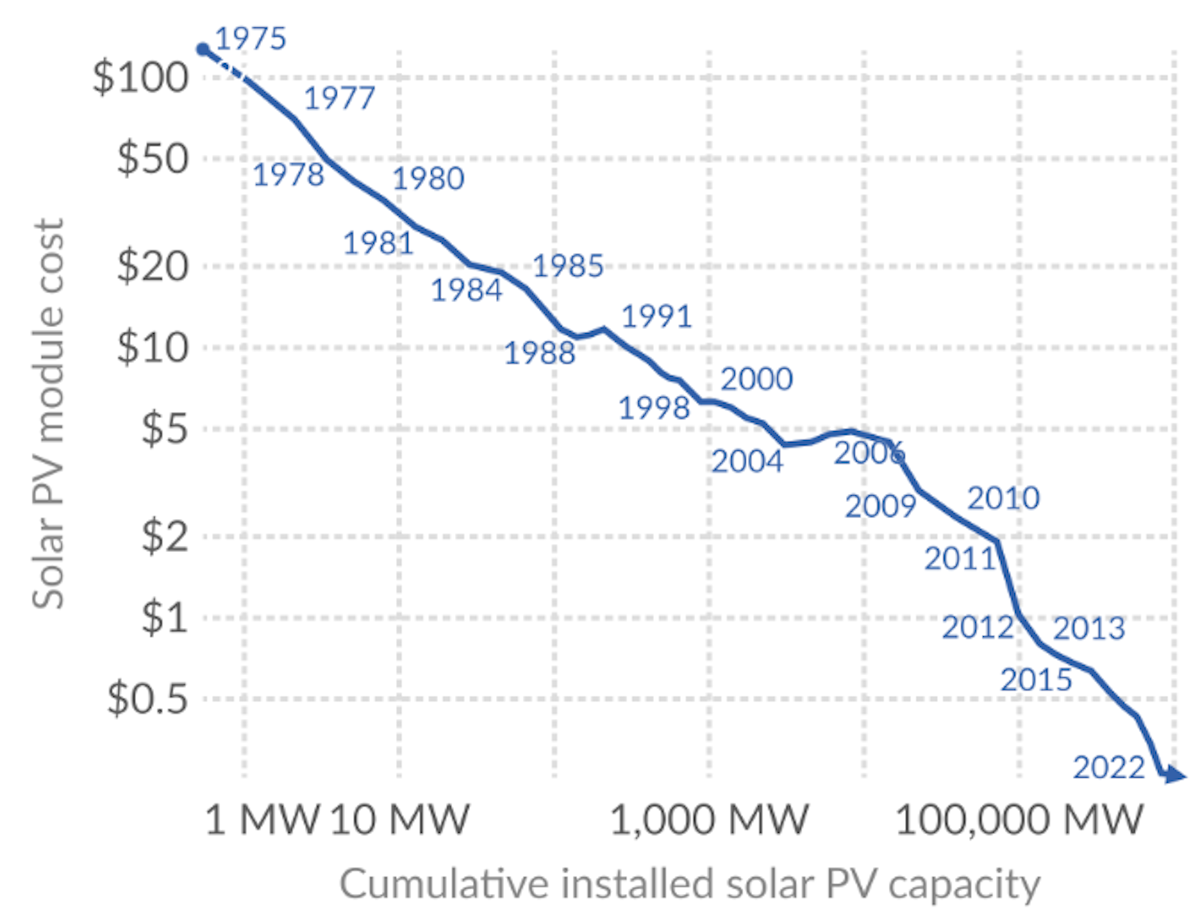

The analysts at ARK often mention Wright’s Law, which is a key aspect of innovative technologies and their economic potential.

💡 Wright's Law states that for every cumulative doubling of units produced, costs fall by a constant percentage.

It’s similar to Moore's Law , but that one describes the relationship between cost and time .

Wright's Law links cost to volume, which reflects the economic potential of certain technologies.

The positive feedback loop is straightforward:

- 📈As demand and capacity increase, companies become more efficient, which brings costs down.

- 📉 As costs decline, demand increases: More consumers and businesses can afford to buy the product, and more applications emerge for the technology.

Since the industrial revolution, industries ranging from railways and electricity to air travel and mobile phones have all benefited from this virtuous cycle.

Another example is solar PV panels, illustrated below.

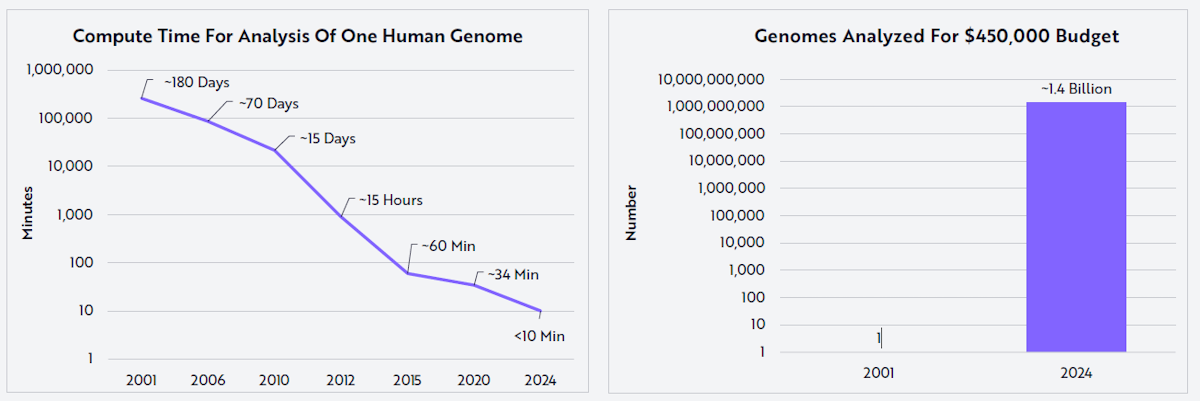

Wright’s Law is currently playing out across many industries:

- 🔋 Batteries: As more batteries are produced for EVs and energy storage, the cost per kilowatt-hour keeps falling.

- 🚀 Reusable Rockets: Each successful landing and reuse brings down the average cost of a space launch.

- 🧬 DNA Sequencing: The cost of sequencing a genome has plummeted as sequencing volume has exploded.

🧠🎢 Investing In Innovation

Technology growth stocks can be a wild ride.

ARK’s own flagship fund is still more than 65 % below its 2022 high. As is always the case, higher rewards require investors to take more risk.

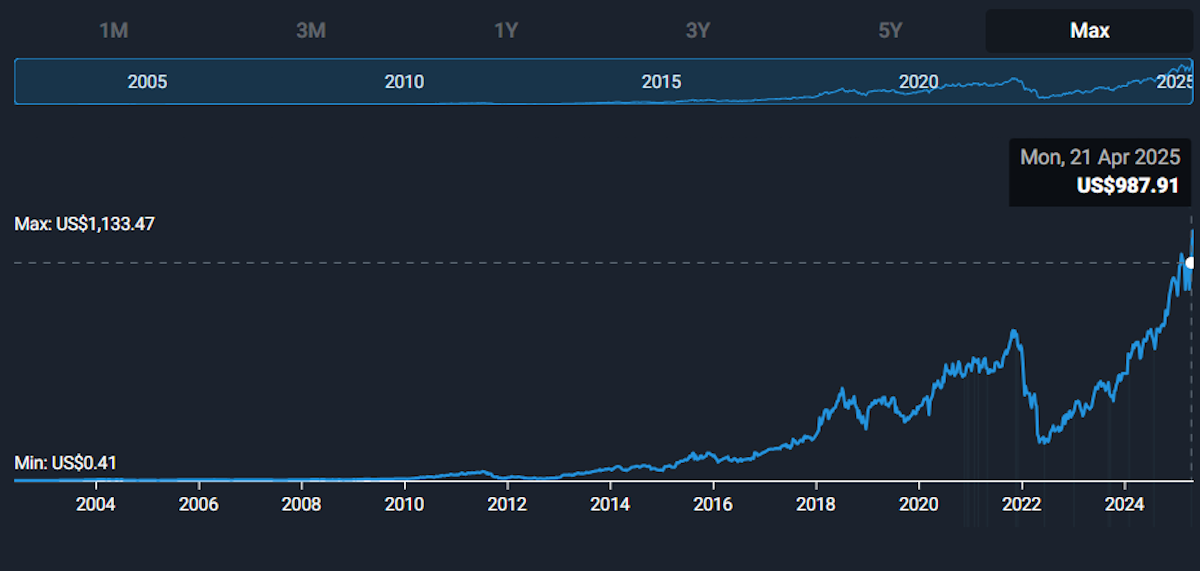

Netflix is a good example of the realistic path to big returns.

The share price has climbed from just over $1 to nearly $1000 (i.e. a thousand bagger ). But investors would have had to endure three separate 70%+ drawdowns along the way.

The challenge for investors is threefold:

- 🔥 The companies themselves are risky, and there’s every chance they won’t succeed.

- 🎢 Inevitable hype cycles mean volatility and steep price declines are part of the process.

- 🤔 Valuing companies that are pre-revenue, or pre-breakeven isn’t easy. It can even be difficult to estimate the size of the opportunity for profitable companies.

✨ When it comes to assessing emerging companies and newly profitable companies trading on very high price multiples, the qualitative analysis is often just as important as the quantitative analysis.

Here are a few ideas to help you navigate the space:

-

🌎 Try to estimate the potential market size as costs decline.

- Not only will more businesses and consumers be able to afford a cheaper product, but new uses will emerge.

- In Google’s early days, memory was too expensive for the company to be viable.

- Not only will more businesses and consumers be able to afford a cheaper product, but new uses will emerge.

-

🧠 Consider the company’s competitive advantage and intellectual property.

- How much would another company pay to acquire that company for IP alone?

-

💼 Determine if large investors will keep funding this company until it becomes profitable.

- This was the weak point for most of the EV start-ups that are no longer around.

-

📉Anticipate declines .

- If the hype level is off the charts AND the valuation doesn’t make sense to you, it probably makes sense to reduce risk. It doesn’t have to be a binary Hold or Sell decision.

-

🔀 Look for optionality.

- When a company starts gaining traction, the outlook can improve faster than the market anticipates. With scale, new opportunities arise.

- Amazon evolved from an online store into a leader in cloud computing AND digital advertising.

- When a company starts gaining traction, the outlook can improve faster than the market anticipates. With scale, new opportunities arise.

Yep, the big gains will probably come from smaller companies. But Big Tech companies like Amazon, Meta, etc. are innovating too. They also have the advantage of deep pockets AND benefit from overlap (i.e. convergence) between businesses.

💡 The Insight: Narrative Investing Is A Great way To Balance Qualitative And Quantitative Factors

By creating a narrative, you can arrive at a future valuation for a company.

This doesn’t have to rely on the more conventional metrics, particularly current revenue, costs or margins.

A company’s current financials may not be relevant when there’s a much bigger opportunity in the future. At the same time, you do need a framework to arrive at a future valuation.

🥇 Set milestones

You can set out milestones that the company will need to achieve to reach its potential. These could include technical milestones or the number of customers.

Along the way, you can update your narrative as new information becomes available.

💰 Adding to your position

With riskier and more volatile investments, it often makes sense to build a position over time. You can set out a plan to add to a position when milestones are achieved. This can be helpful when emotion starts to take over.

⏱️ Create your narrative - and then wait for your opportunity

You might love a company but hate the price. That’s how Buffett currently feels about a lot. And that’s all the more reason to create a narrative and figure out the price you would pay. Then, when volatility inevitably picks up and everyone else is selling, you can confidently put a buy order in at your price.

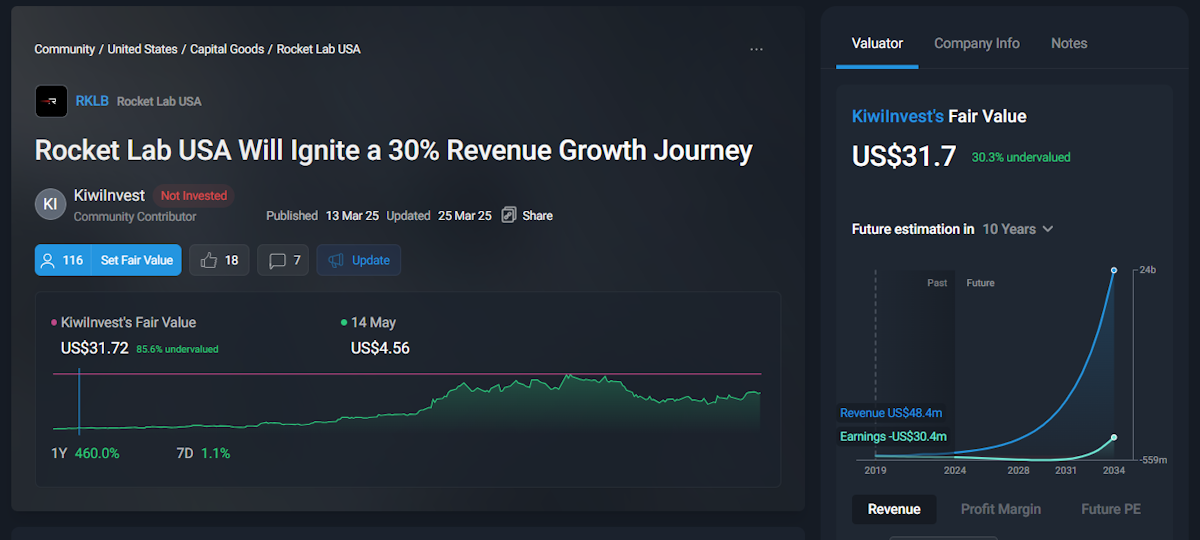

Speaking of innovative tech companies, check out this user’s narrative for Rocket Lab - a company that’s burning cash right now but might have a bright future:

Key Events During the Next Week

Tuesday

- 🇨🇦 Canada Balance of Trade

- 📉 Forecast: –$6.9B , down from –$1.5B

- ➡️ Why it matters: A widening trade deficit could signal weaker exports or rising import costs—both potential headwinds for Canadian GDP and the Canadian Dollar.

Thursday

- 🇺🇸 US Fed Funds Rate + Press Conference

- 📊 Forecast: No change at 4.5%

- ➡️ Why it matters: Even without a rate change, the Fed’s language could move markets. Investors will be watching for clues on the timing of future cuts or delays.

- 🇩🇪 Germany Balance of Trade

- 📈 Forecast: €20.8B , up from €17.7B

- ➡️ Why it matters: Stronger exports can boost European sentiment and earnings outlooks, especially in industrial and manufacturing sectors.

- 🇬🇧 Bank of England Rate Decision

- 📉 Expected cut from 4.5% to 4.25%

- ➡️ Why it matters: A cut would mark a dovish pivot—potentially positive for UK equities, but negative for the pound.

Friday

- 🇨🇳 China Export Growth (YoY)

- 📉 Forecast: –2.0%, down sharply from +12.4%

- ➡️ Why it matters: A dramatic reversal here could confirm weakening global demand—and may trigger more Chinese stimulus.

- 🇨🇳 China Trade Balance

- 📉 Forecast: $70B, down from $102B

- ➡️ Why it matters: A shrinking surplus could weigh on confidence in China’s recovery—and hurt sentiment across commodities and EMs.

- 🇨🇳 China Import Growth (YoY)

- 📉 Forecast: –5.0%, vs –4.3%

- ➡️ Why it matters: Ongoing import weakness suggests sluggish domestic demand—bad news for exporters and multinationals reliant on China.

- 🇨🇦 Canada Unemployment Rate

- 📈 Forecast: 6.8%, up from 6.7

- ➡️ Why it matters: A rising jobless rate could increase pressure on the Bank of Canada to cut rates sooner than expected.

The ball keeps rolling for earnings, with a ton of heavy hitters reporting their quarterly earnings this week. Some notable names include:

- Palantir

- Vertex Pharmaceuticals

- Ford

- AMD

- Ferrari

- Arista Networks

- Novo Nordisk

- Uber

- Disney

- Arm

- Shopify

- ConocoPhillips

- DoorDash

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.