- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Discovering 3 Stocks That May Be Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

In recent days, the U.S. stock market has shown resilience with major indices like the Dow Jones and Nasdaq surging amid optimism over eased China tariffs and renewed investor confidence. As investors navigate these fluctuating conditions, identifying stocks that may be trading below their estimated fair value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MetroCity Bankshares (NasdaqGS:MCBS) | $28.55 | $56.26 | 49.3% |

| Truist Financial (NYSE:TFC) | $36.34 | $71.55 | 49.2% |

| DoorDash (NasdaqGS:DASH) | $176.61 | $352.46 | 49.9% |

| AGNC Investment (NasdaqGS:AGNC) | $8.45 | $16.73 | 49.5% |

| Flotek Industries (NYSE:FTK) | $6.67 | $13.11 | 49.1% |

| Verra Mobility (NasdaqCM:VRRM) | $21.89 | $43.36 | 49.5% |

| First Advantage (NasdaqGS:FA) | $13.63 | $27.00 | 49.5% |

| Sotera Health (NasdaqGS:SHC) | $10.64 | $20.91 | 49.1% |

| CNX Resources (NYSE:CNX) | $30.29 | $60.47 | 49.9% |

| Comstock Resources (NYSE:CRK) | $18.22 | $35.86 | 49.2% |

Underneath we present a selection of stocks filtered out by our screen.

Celsius Holdings (NasdaqCM:CELH)

Overview: Celsius Holdings, Inc. is engaged in the development, processing, manufacturing, marketing, selling, and distribution of functional energy drinks across various international markets with a market cap of approximately $8.49 billion.

Operations: The company generates revenue of $1.36 billion from its non-alcoholic beverages segment, focusing on functional energy drinks distributed globally.

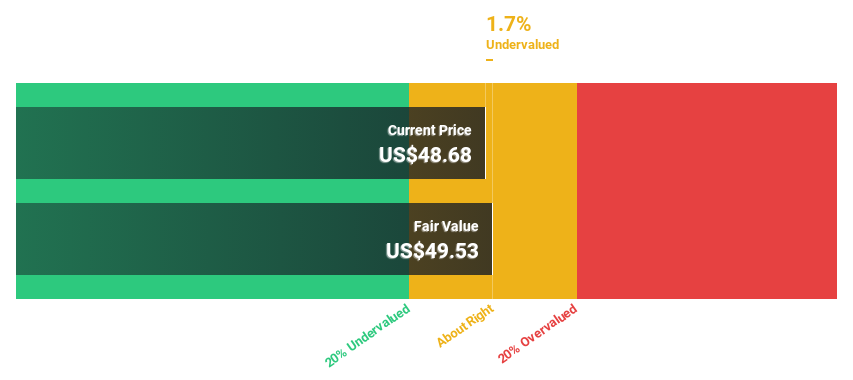

Estimated Discount To Fair Value: 32.3%

Celsius Holdings is trading at US$37.84, below its estimated fair value of US$55.91, indicating it may be undervalued based on cash flows. Despite a volatile share price and declining profit margins from 13.8% to 7.9%, the company anticipates strong annual earnings growth of 25.95%. Recent executive changes and product launches in the hydration segment aim to capitalize on significant market opportunities, potentially enhancing future cash flows and reinforcing its position in functional beverages.

- Our growth report here indicates Celsius Holdings may be poised for an improving outlook.

- Take a closer look at Celsius Holdings' balance sheet health here in our report.

Hesai Group (NasdaqGS:HSAI)

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and other international markets with a market cap of approximately $1.54 billion.

Operations: The company's revenue primarily stems from the development, manufacturing, and delivery of LiDAR products, amounting to CN¥2.08 billion.

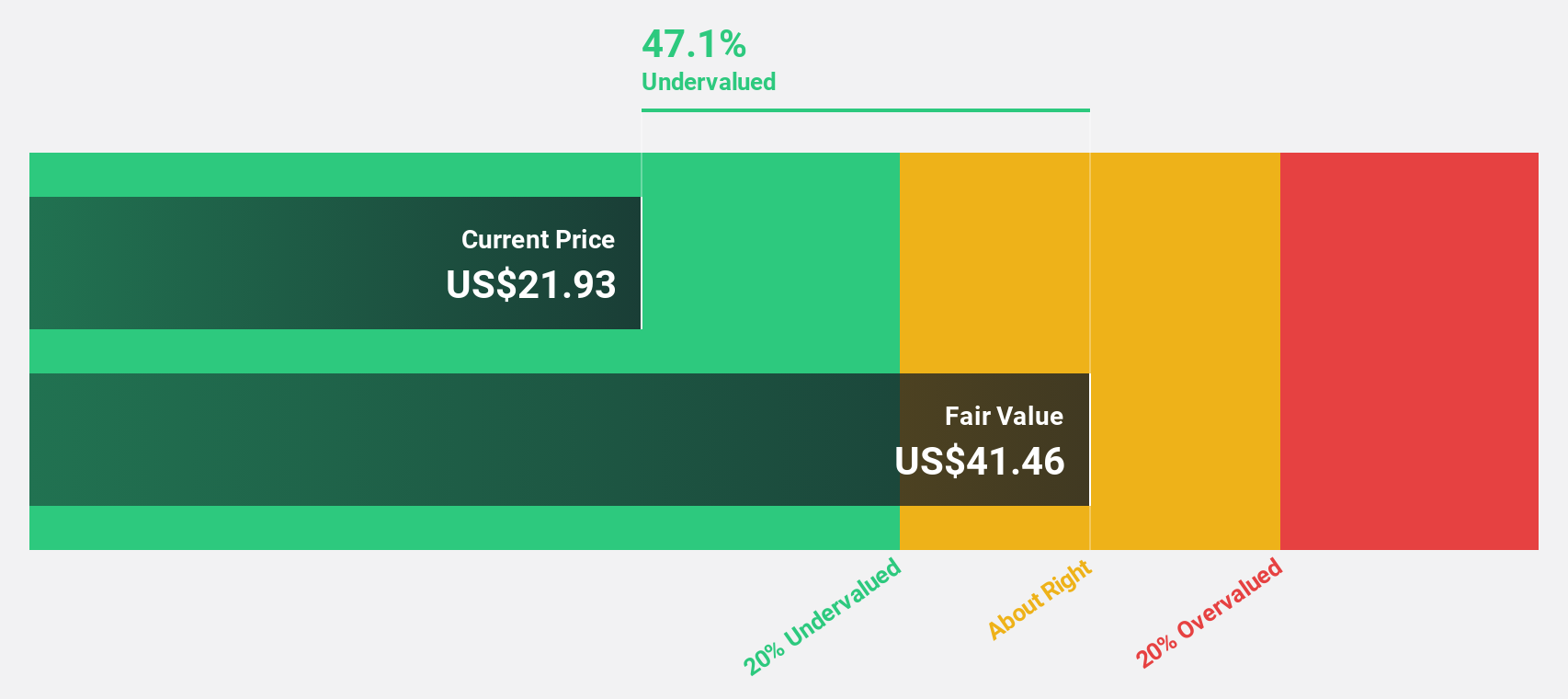

Estimated Discount To Fair Value: 33.2%

Hesai Group's stock, trading at US$13.09, is valued below its estimated fair value of US$19.58, suggesting potential undervaluation based on cash flows. Despite recent share price volatility, the company forecasts robust annual revenue growth of 24.8%, surpassing market averages and indicating strong future cash flow prospects. Recent lidar product launches and strategic partnerships with major OEMs like BYD and Chery enhance its competitive edge in autonomous driving technology, supporting anticipated profitability within three years.

- Our earnings growth report unveils the potential for significant increases in Hesai Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Hesai Group.

Upstart Holdings (NasdaqGS:UPST)

Overview: Upstart Holdings, Inc. operates a cloud-based AI lending platform in the United States and has a market capitalization of approximately $3.78 billion.

Operations: The company's revenue is primarily derived from its personal lending segment, which generated $625.31 million.

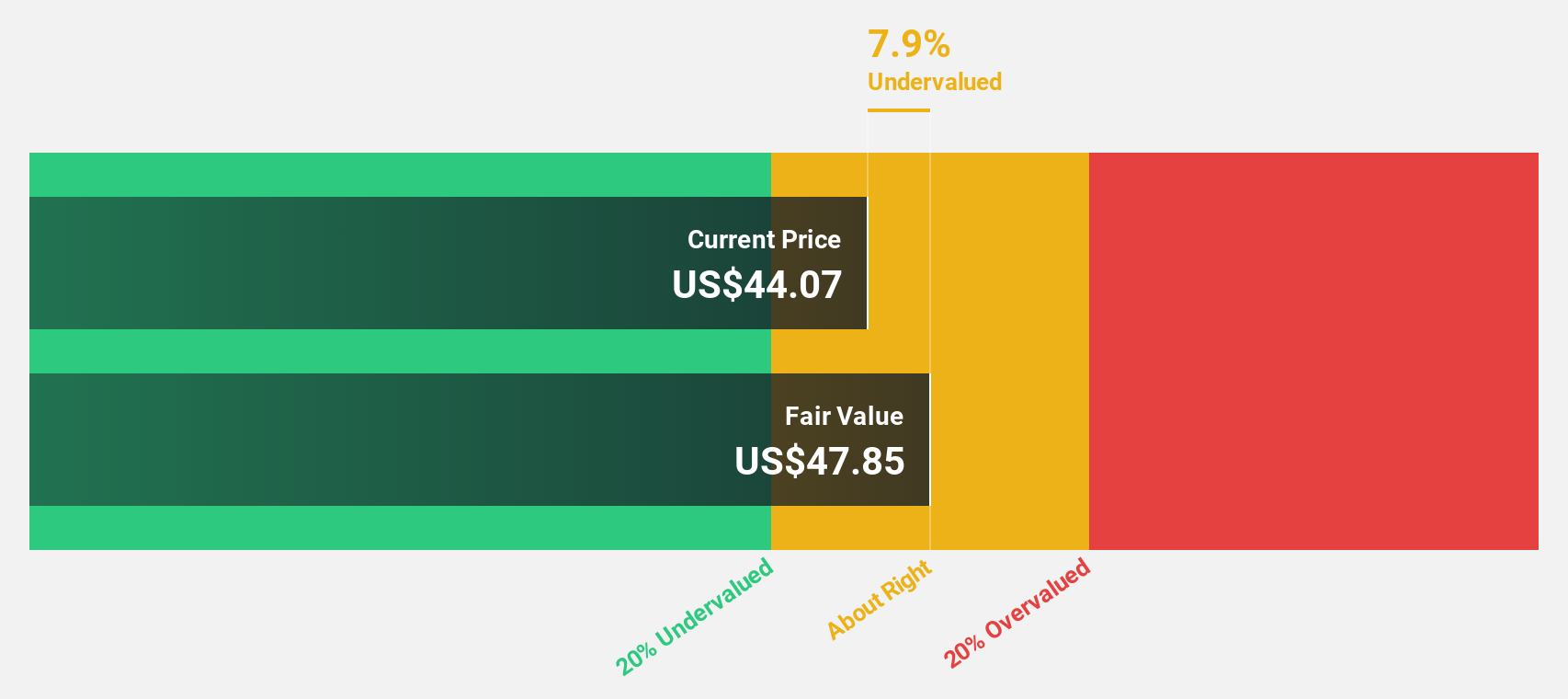

Estimated Discount To Fair Value: 14.7%

Upstart Holdings, trading at US$41.93, is undervalued compared to its estimated fair value of US$49.16, reflecting potential in cash flow-based valuation despite recent share price volatility. The company anticipates revenue growth of 21.8% annually, outpacing the market and supporting future cash flows with expected profitability within three years. Recent partnerships with credit unions like First Commonwealth expand its lending network, enhancing loan access and integration capabilities through Upstart's platform APIs.

- Our comprehensive growth report raises the possibility that Upstart Holdings is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Upstart Holdings' balance sheet health report.

Make It Happen

- Discover the full array of 176 Undervalued US Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Celsius Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives