RIO strategy

At a high level, RIO’s growth strategy is to diversify away from Iron ore into in-demand commodities. Specifically, copper, aluminum and lithium. RIO plans to launch the Simandou mine in 2025 to support the core business, which looks to become the largest high grade iron ore mine, with a ramp up to 120m tonnes.

BHP has more or less the same strategy with a focus on potash instead of aluminum and lithium.

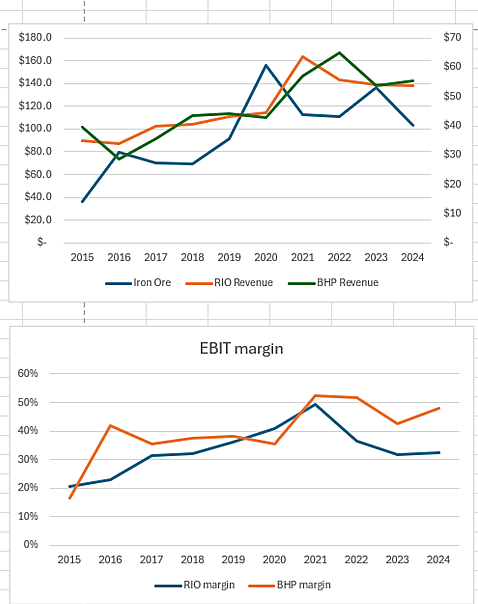

Iron ore outlook ($106.9 USD/T)

There is a bearish sentiment for future iron ore prices driven by both suppressed demand and increasing supply.

China’s demand for iron ore is expected to be weak in the near term due to a lagging property sector, increasing stockpiles and US tariffs. Supply is expected to increase from primarily Brazil and RIO’s Simandou mine.

Sentiments vary, but almost all expect prices to fall further in the next 2 years. Pessimistic views range from as low as $70 to $85, but the majority claim prices to fall to the low $90s.

RIO outlook

RIO is poised to weather a mature and depressed iron ore environment with the ramp up of the Simandou mine to increase volumes to offset lower prices of the core business. Signs of growth are starting to show in RIO’s copper and aluminum production, which has increased in its contribution to RIO group revenues by 7% in 2024. Its purchase of Arcadium Lithium and Oyu Tolgoi copper mine expansion improves RIO’s growth potential, albeit at the cost of lower margin commodities (see below).

My $110.51 estimate valuation comes from a 5% p.a. growth in revenues, offset with a 2.5% increase in margin (reflecting a higher mix of lower margin growth commodities). It's worth noting most analysts forecast a small revenue reduction for RIO, so maybe I've missed something here.

Watch-outs

Margin – Compared to BHP, RIO has consistently underperformed in terms of margin. In the past 10yrs, BHP’s EBIT margin has on average been 7 percentage points better than RIOs.

On a product level, BHP’s EBIT margin is more competitive than RIO with 60% and 47% for iron ore respectively and 35% and 20% for copper. RIO aluminum EBIT margin is currently 18%.

At any rate, RIO’s margin management will be a key lever of its future growth. Both to protect it from a depressed iron ore market, as well as set it up for success in emerging markets.

(source - see pages 219 and 268 of BHP and RIO’s respective annual reports)

Near-term tariff exposure – Between 2023 and 2024, 74% of RIO revenue has come from China and the US (with an increase in aluminum sale to the US in 2024). US tariffs would have a direct impact on RIO’s US revenues, as well as indirect impacts, further depressing demand on China revenues.

In the long term this can potentially be disregarded noise, as RIO has other potential buyers of aluminum. The US imports ~85% of its aluminum needs with 70% of that coming from Canada. RIO makes up half of these imports. If the US cannot fill the deficit themselves, the cost of tariffs could be passed onto end customers. There is also potential upside for RIO’s US based Kennecott copper operation.

How well do narratives help inform your perspective?

Disclaimer

The user Dusty has a position in ASX:RIO. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.