Quote of the Week: “Gold is free from credit risk and cannot be devalued by any country’s economic policy.” - Adam Glapiński, Governor, National Bank of Poland

Markets have been setting all kinds of records lately, some good, some less so.

Major indexes have posted some of the biggest one-day point moves in history. In percentage terms, it’s not quite 2020-level chaos, but it’s close, comparable to the GFC or the early pandemic swings. Even US bond yields are on the move, notching one of their sharpest drops in recent memory.

But here’s a milestone you might’ve missed: Gold surged $100 in a single day on Wednesday, its first-ever triple-digit daily gain. It nearly did it again on Thursday, rising another $93. That’s a 3.3% move with gold now hovering near $3,000… and anything above 2.5% in a day is rare for the yellow metal.

We’ve talked gold before, but it’s time for an update. In this piece, we’ll revisit the catalysts driving demand, and take a fresh look at the supply side now that most producers are comfortably in the black.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets This Week?

Here’s a quick summary of what’s been going on:

📈 Long bond yields surge as investors seek non-USD safe havens ( Reuters )

- Debt is one of those things that doesn’t matter until it does matter!

- US treasuries sold off alongside US equities last week. 10-year yields rose as high as 4.51%, while 30-year yields briefly crossed the 5% level. As liquidity disappeared from the market, bid-offer spreads reached their widest in decades.

- Some analysts saw this as evidence of de-dollarization due to the combination of tariff turmoil and the US government debt problem.

- In this case, it seems there were some other dynamics at play. Some funds were raising cash to meet margin requirements for unrelated positions, while potential buyers were simply putting everything on hold. A key auction of 10-year bonds still had enough investor demand, and that calmed some nerves.

- Nevertheless, this episode was a reminder that one event can act as a catalyst for a much bigger risk, like the US’s $36 trillion debt pile. Everybody is happy to kick the can down the road until one day when there really are no more buyers. That’s when you’ll see the Fed jump in as a buyer of last resort, and guess how they’ll get the money to afford to buy those government bonds…

🛢️Oil price shock may be short-lived, Canada energy execs say ( Bloomberg )

- Oil prices plunged 22% in the first week of April 2025, triggered by Trump-era tariffs and OPEC+ unexpectedly ramping up production.

- Canadian energy execs are calling it a panic sell-off disconnected from physical fundamentals. One called it a “ crisis of confidence, not barrels .” They noted that demand is steady, inventories are normal, and pipelines are still full.

- For some producers though, the short-term pain is real. Any unhedged producers are facing tight margins. As a result, those producers are cutting non-essential capex while maintaining dividends by taking loans through reserve-based lending facilities… That’s not ideal in our eyes, but clearly they’re confident it’s a short-term issue.

- Canada’s sector is leaning into export diversification (like shipping to Asia instead) and ESG differentiation to weather the storm. Structural tailwinds like limited OPEC+ spare capacity and disciplined U.S. shale output support a potential price rebound by late 2025.

- This appears to be a confidence crisis, not a crude oil crisis. Analysts say there is still upside in resilient, hedged Canadian names with Asian export potential.

✈️ Delta yanks its full-year guidance thanks to “broad economic uncertainty around global trade” ( Sherwood )

- Delta yanked its full-year guidance after Q1 revenue missed even revised targets, citing global trade uncertainty as travel demand wobbles.

- Passenger revenue rose 3%, but main cabin sales slipped while premium seating kept climbing. Capacity growth is now expected to flatline in H2.

- Delta’s pivot from bullish to cautious in three months highlights how quickly trade policies can throttle demand. With bookings and load factors under pressure, airline stocks may remain grounded, especially those most exposed to international routes.

- Some investors are avoiding or hedging their airline exposure for now. Instead, they’re focusing on travel-adjacent plays like credit card partners (e.g., AmEx) that are still seeing high-margin revenue from loyalty programs.

📉 JPMorgan sees more pain ahead for junk and private lender bonds (Bloomberg)

- Trump’s tariff blitz has chilled Wall Street’s risk appetite: IPOs, M&A deals, leveraged loans, and bond issuances are all on pause.

- Credit spreads widened, raising fears of a recession and making refinancing tougher, especially for junk-rated and private credit borrowers.

- Banks are bracing for a rough Q1 earnings season, with big players like JPM and BofA expected to report lower profits. The tariff turmoil could delay capital markets recovery and spark a rise in loan defaults.

- Markets have entered wait-and-see mode. Until D.C. calms the noise, expect deal droughts and rocky roads for rate-sensitive sectors.

✋Sweden's Klarna pauses US IPO plans as tariffs roil markets, sources say ( Reuters )

- Klarna has hit pause on its $1B U.S. IPO plans as Trump’s tariffs slam market sentiment and reignite trade war fears.

- The decision derails a potential spark for the fragile IPO market, already suffering from poor debuts and investor skittishness.

- Klarna’s delay is part of a broader retreat from risk. Market instability is freezing IPO pipelines, especially for high-growth, unprofitable tech names. The likes of Plaid, Circle, eToro, and Chime, and others have also put their IPO plans on pause. Expect valuations to compress and private funding rounds to get tougher.

- Investors seem to be bracing for extended volatility, trimming exposure to highly volatile names and rotating into cash-flow-positive stocks until they believe some clarity returns.

🏦 Jack Dorsey’s Block pushes into banking as stock price tumbles ( Bloomberg )

- Cash App’s viral user growth is cooling, and Block Inc. is pivoting hard into banking to monetize its 57M active users.

- Direct deposits and lending products are now key battlegrounds in a crowded fintech arena that includes Chime, Robinhood, and Venmo.

- The path to profitability lies in turning peer-to-peer users into full-fledged banking customers, but trust, legacy habits, and recent compliance fines remain headwinds. Despite a 25% YoY jump in direct deposits, user skepticism still runs deep.

- The stock is down 32% YTD, showing that investor patience is wearing thin.

- Block’s upside hinges on successfully converting Cash App users into banking clients. Until direct deposit and lending adoption inflects meaningfully, the stock may stay under pressure. Watch for user monetization trends in upcoming earnings.

✨ Gold’s Glow-Up: Why It’s Outshining Everything Else

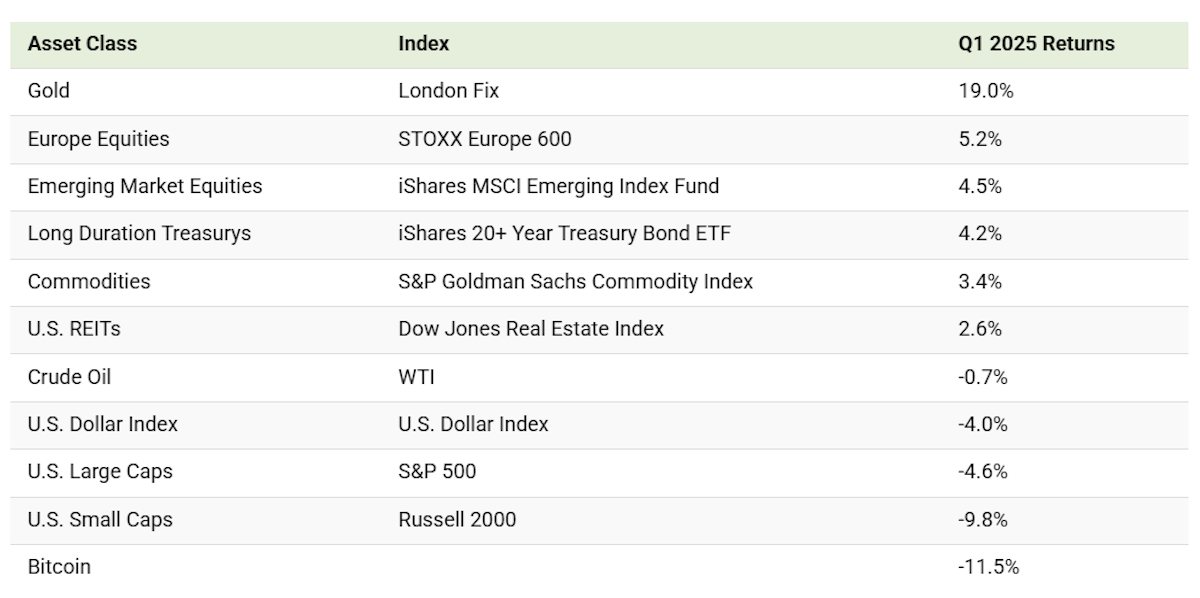

Gold was the clear winner in Q1, beating every major asset class and reminding investors why it exists: to shine when everything else stumbles.

📈 What’s Fueling The Rally?

This surge is more about demand than supply, though both sides matter.

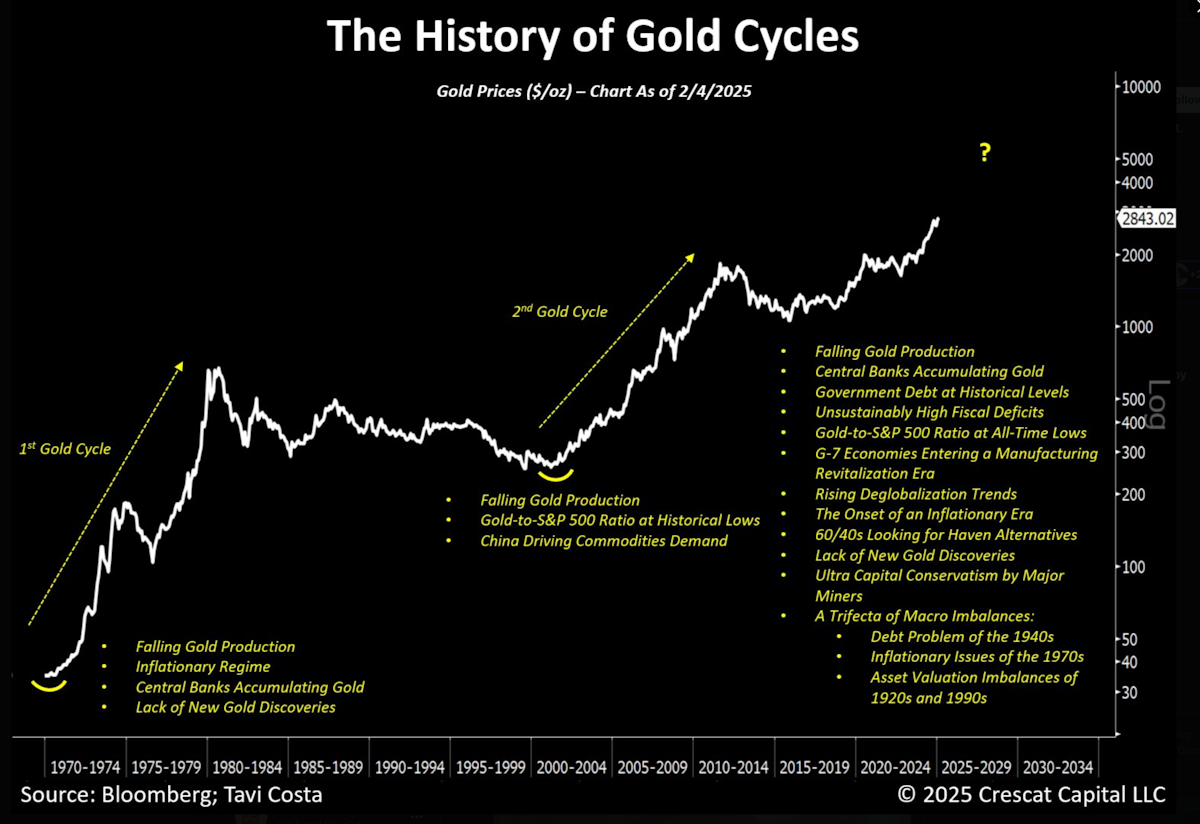

The chart below has been making the rounds, and it highlights just how many catalysts are stacking up for gold right now.

🔁 Geopolitical Tension Is The Constant

If it feels like we’re always talking about geopolitical risk, it’s because… we are. The usual suspects, Middle East conflict and US-China friction, haven’t gone anywhere.

But the context has shifted:

- 🌍 The world’s becoming more polarized, raising the stakes.

- 🛃 Tariffs are muddying capital flows, trade balances, and currencies.

- 🤝 Even US allies are feeling the heat, as trade tensions go global.

- 🪖 Wars in Ukraine and Gaza are showing no signs of winding down.

✨ The bottom line: when trust breaks down between nations, gold’s neutrality becomes a feature, not a bug . It’s a rare asset that doesn’t pick sides, and that’s exactly what investors want in times like these.

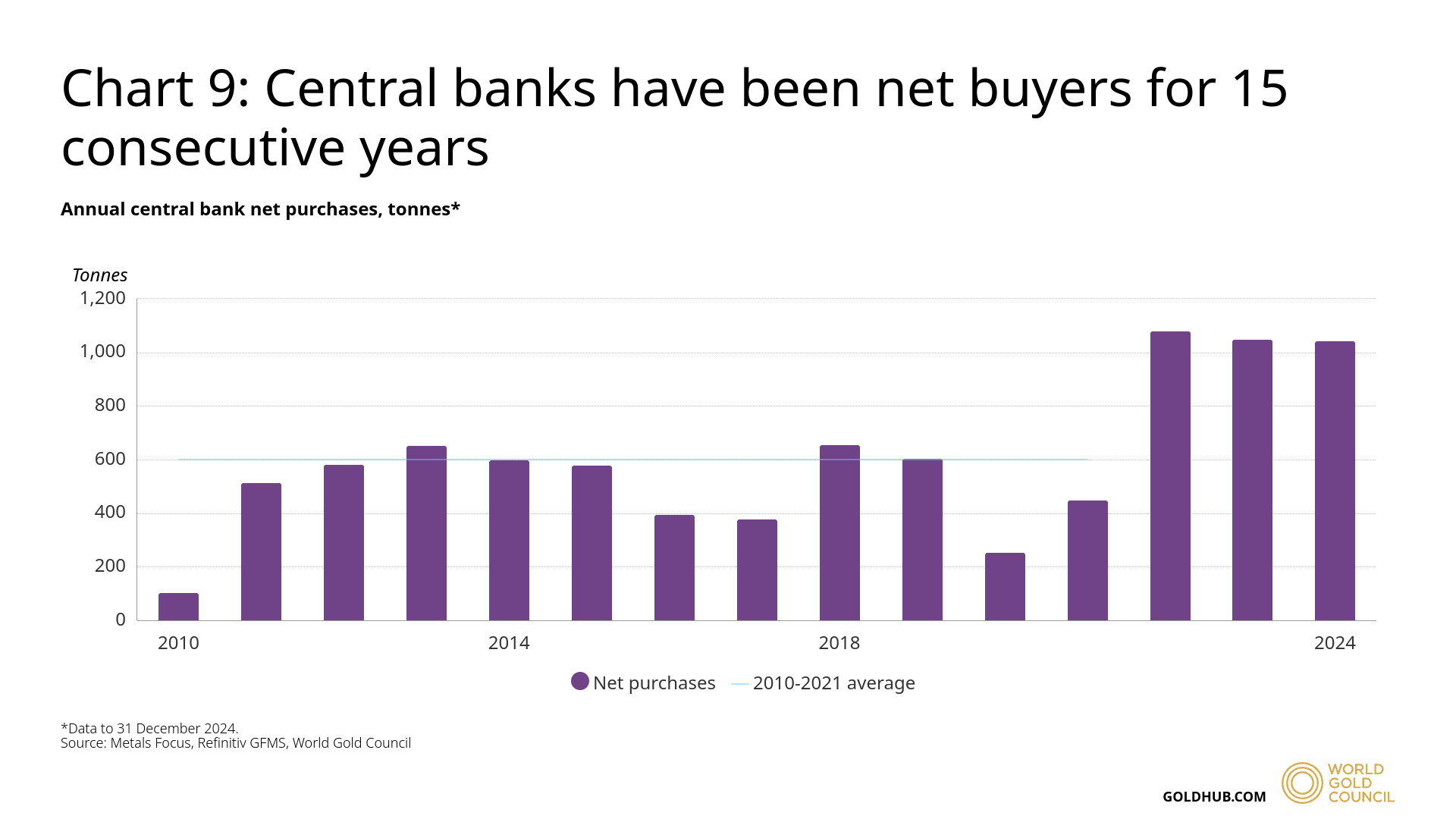

🏦 Why Central Banks Keep Buying Gold (and Ditching USD)

Central banks have been net buyers of gold since 2008 , and lately, that buying has gone into overdrive.

One big reason? 🔒 The weaponization of the US dollar .

When Russia invaded Ukraine, the US froze its USD reserves overnight, reminding the world that USD-denominated assets can be turned off with a keystroke.

That move spooked a lot of countries, and central banks started hedging:

- 💰 In 2024, central banks added over 1,040 tonnes to global gold reserves.

- 🏗️ That’s over a third of total annual gold supply (~3,000 tonnes).

- 🇵🇱 Poland led the charge with over 90 tonnes , followed by Turkey (75) and India (73).

- 🌍 Middle Eastern central banks are also stepping up.

✨ The logic is simple: diversify away from USD, and gold becomes the default safe haven.

📌 The takeaway? This isn’t a short-term trade, it’s a multi-decade trend. And it’s only likely to accelerate if the dollar is seen as “less neutral” going forward.

🔥 Gold Still Loves Inflation (and Debt)

Yes, inflation has cooled from its 2022 highs, but central banks haven’t declared victory yet. And with Donald Trump eyeing an inflation-prone fiscal agenda, investors are preparing for round two.

But zoom out a bit more, and there’s a structural issue: sovereign debt is sky-high, and inflation is one of the easiest tools to shrink it.

Here’s how it plays out:

- 📈 Inflate your way out of debt = higher gold demand.

- 💸 Stimulate the economy by printing = also inflationary. ⚖️ Stagflation (low growth + persistent inflation) = gold’s sweet spot.

Unless the world pulls off high growth with low inflation (a tough combo), gold is likely to keep its tailwind.

📌 The takeaway? Inflation has been the go-to gold thesis since the ‘70s, and that narrative is just as powerful today.

📊 Investor Demand for Gold Is Heating Up

Almost exactly two years ago, we flagged gold crossing the $2,000 mark and took a closer look at who was buying .

Fast forward to today, and that demand story is building again, but this time with more retail participation.

Here’s a quick refresher on how to read the chart:

- ⚫ Commercials (black line): These are producers and physical traders, they usually hedge and hold short positions .

- 🔵 Non-commercials (blue line): Think hedge funds and speculators. They typically go long and drive price momentum.

Two years ago (see the red line), hedge fund positions were moderately bullish. Today, speculative long positions are higher, but still well below the frothy levels we saw in 2022 and 2023.

🧠 Translation: Funds are leaning long, but the market isn’t overextended. No flashing red lights, yet.

But the even bigger surprise? Retail is jumping back in too.

🏦 In Q1 2025, $7.3 billion flowed into gold ETFs, the highest quarterly inflow since Q1 2020 (aka peak pandemic panic). That’s a clear signal of renewed interest in gold as a safety net.

📌 The takeaway? Institutional and retail demand is rising but not yet at extreme levels. While previous peaks in demand have sometimes led to corrections, the broader context matters.

✨ If macro catalysts (like inflation, geopolitics, and central bank buying) stick around, demand could stay strong for a while.

⚖️ The Supply Side: Can Production Keep Up With Demand?

Gold might be precious, but it’s still a commodity, and like all commodities, the price comes down to supply and demand .

We’ve heard a lot about growing demand drivers lately. But when it comes to commodities, higher demand can lead to overproduction , which eventually pressures prices. So, is gold at risk of that?

Here’s the current picture:

- 🪙 Global gold supply hit ~4,974 metric tons in 2024 , a 1% increase from 2023 and the previous record in 2018.

- 🏗️ With prices at record highs, miners are pushing hard to extract more from existing projects.

- ⚠️ But if prices dip, that urgency disappears, scaling up production is expensive.

The catch? Most current reserves are finite and expected to decline over the next few decades. That brings us to exploration .

- 🧪 New discoveries are mostly known deposits being re-evaluated using better tech.

- 💸 Exploration is expensive, and most budgets go toward feasibility studies.

- 🔭 If prices stay high, exploration budgets could shift toward finding truly new reserves.

📌 The takeaway? Gold supply might rise modestly in the short term, but the risk of oversupply is limited, especially if exploration remains cautious.

⛏️ What About the Gold Miners?

Despite gold gaining over 600% in the last two decades, miners haven’t kept up . Most struggled to convert rising prices into profits, until now.

🟡 VanEck Gold Miners ETF (GDX) is up 42% over the last year, just ahead of gold’s 40% rally, and pays a small 0.8% dividend . That’s a noticeable shift from the past.

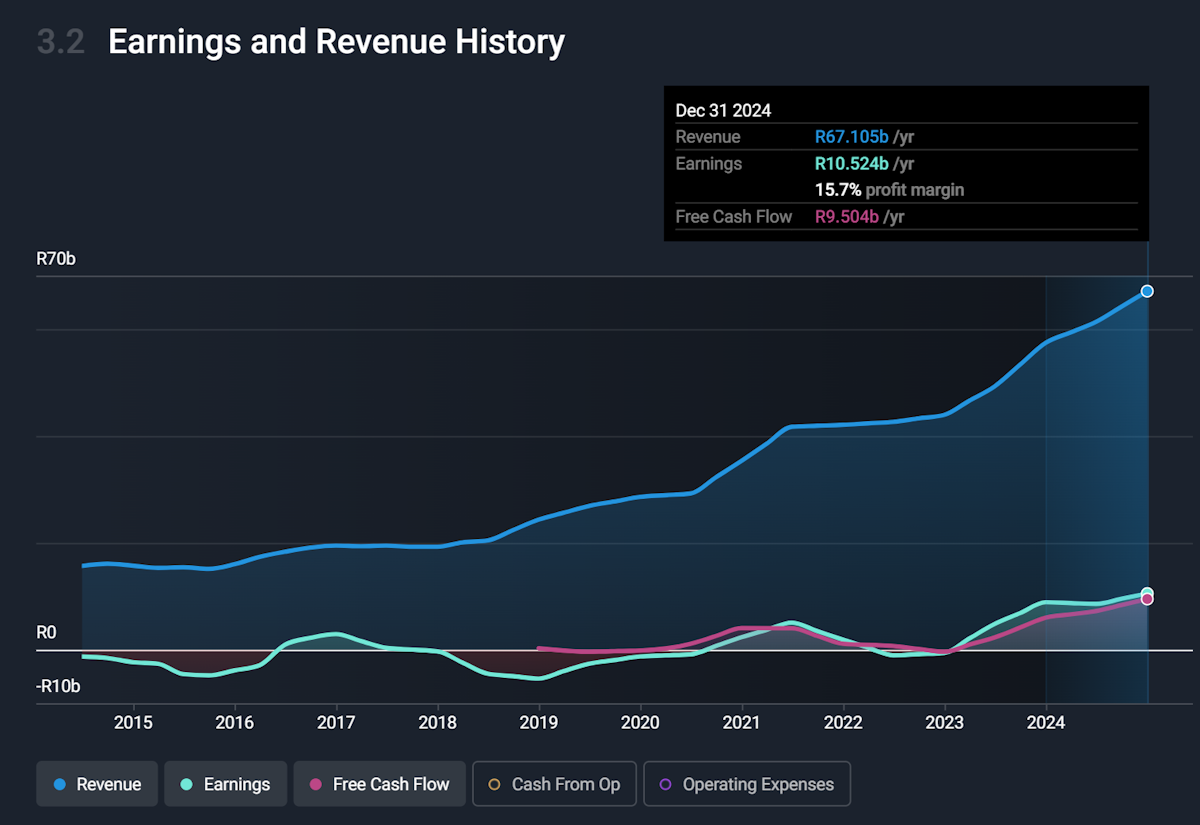

Companies like Harmony Gold are showing what happens when earnings start catching up to revenue.

- ✅ 2024 saw most major miners boost production

- ⚙️ They also lowered per-ounce costs as scale advantages kicked in

- 🚨 But cost control remains the wildcard, one of the biggest risks for investors in this space

📌 The takeaway? For now, the miners are finally starting to deliver. But margin management will be key if you’re betting on the producers, not just the metal.

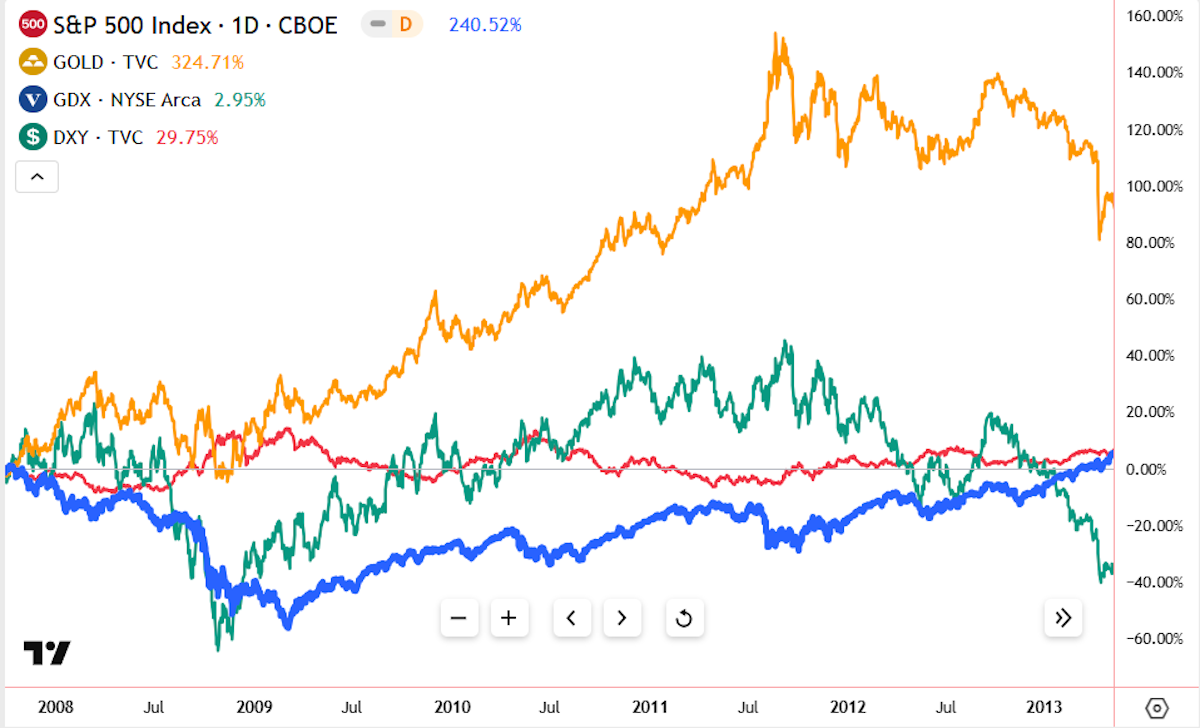

🐻 Gold Performance in a Bear Market

Gold took a hit after Trump’s global tariffs announcement on April 2nd, and that might’ve caught a few people off guard.

But it’s not unusual.

During times of financial stress , traders often sell gold to raise cash or cover losses elsewhere. Higher margin calls and tighter risk limits can force funds to trim positions, even in safe-haven assets.

📉 It’s part of what we saw in the 2008 Global Financial Crisis too.

Gold was volatile and fell with everything else in late 2008, but it bounced back faster than equities , and surged as the Fed turned on the money printer.

Gold outperformed the S&P 500 during the downturn , while gold miners were hit hard in the initial sell-off but recovered later.

📌 The takeaway? Gold isn’t immune to short-term shocks, but when the dust settles, it tends to shine. Especially when central banks start printing.

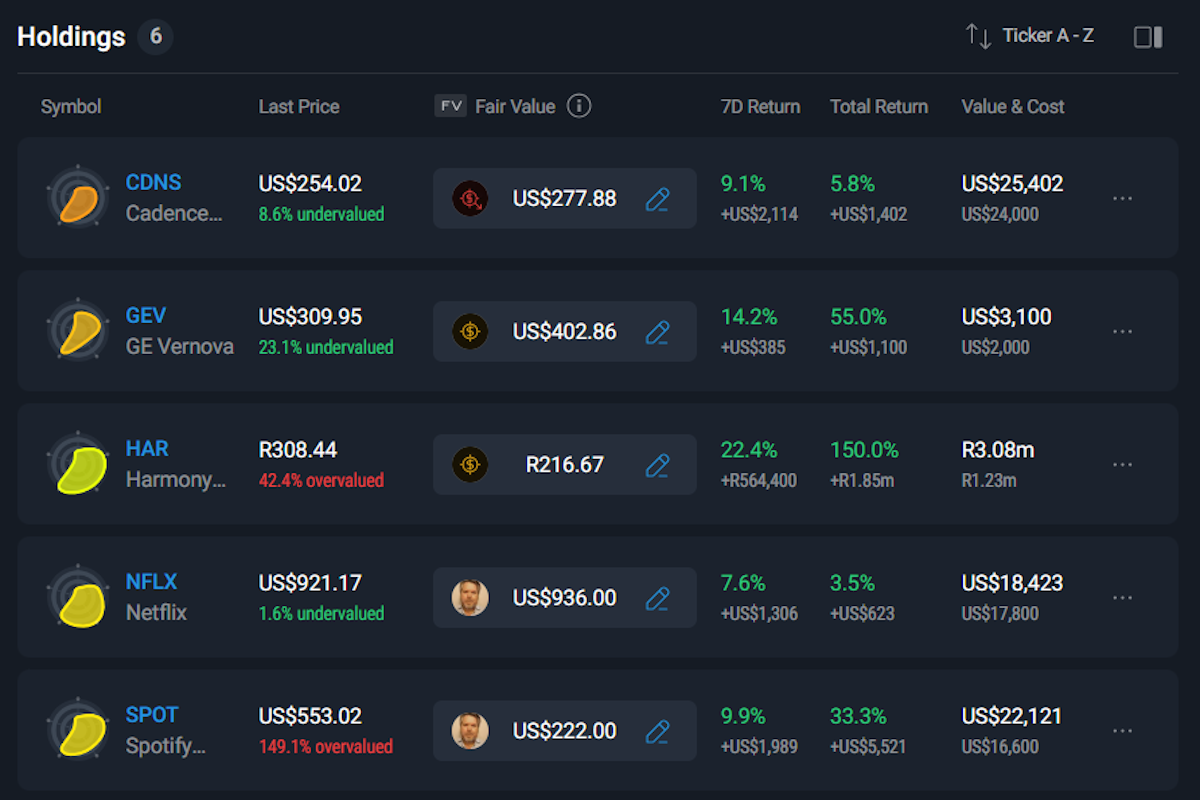

💡 The Insight: Price Is What You Pay, Value Is What You Get.

Watching your portfolio swing up and down in volatile markets? You’re not alone. And it’s easy to let short-term noise push you into long-term mistakes.

One way to stay grounded is to own assets like gold , which help reduce portfolio-level volatility. But there’s another strategy that’s just as powerful:

✨ Focus on value, not just price.

Share prices move daily, sometimes wildly. But intrinsic value? That shifts much more slowly. And if you keep your eyes on what something’s worth , rather than what it costs today, you’re far less likely to panic.

Our portfolio tool helps you track both price and your own fair value for each holding, based on your own thesis or someone else’s on the platform.

Here’s how it helps:

- 📌 Link fair value to a custom or community narrative

- 🔔 Get notified if the narrative, or fair value, changes

- 🧠 Reframe your mindset: It’s not just about the stock price; it’s about why you own it

✨ Instead of reacting to red numbers, you’ll be reminded of your investment rationale, and whether the stock is still worth holding.

Key Events During the Next Week

Tuesday

-

🇦🇺 RBA Meeting Minutes

- Why it matters 👉: Could reveal if Australia’s central bank is leaning closer to rate cuts. Watch for signals that impact housing and banks.

-

🇬🇧 UK Jobs Data

- 📊 Forecast: Unemployment steady at 4.4%

- Why it matters 👉: A resilient labor market could delay rate cuts, which is important for consumer-facing and domestic UK stocks.

-

🇨🇦 Canada Inflation (CPI)

- 📈 Forecast: 2.8%, up from 2.6%

- Why it matters 👉: Hotter inflation might force the Bank of Canada to hold off on rate cuts, which would affect everything from housing to bank margins.

Wednesday

-

🇨🇳 China Q1 GDP

- 📉 Forecast: 4.7%, down from 5.4%

- Why it matters 👉: Slower growth could trigger more stimulus, supporting global commodities and China-exposed firms.

-

🇬🇧 UK Inflation (CPI)

- 📈 Forecast: 3.2%, up from 2.8%

- Why it matters 👉: Higher inflation keeps the Bank of England on alert. Watch UK bonds and interest-rate sensitive sectors.

-

🇺🇸 US Retail Sales

- 🛍️ Forecast: +0.1%, vs. +0.2% in Feb

- Why it matters 👉: Consumer spending drives 70% of the US economy, weak sales could signal broader slowdown.

-

🇨🇦 Bank of Canada Rate Decision

- 💰 Expected to hold at 2.75%

- Why it matters 👉: No cut is expected, but investors will watch the ton. Any hint of future easing could move the CAD and financials.

Thursday

- 🇪🇺 European Central Bank Rate Decision

- 📉 Expected: 0.25% cut to 2.4%

- Why it matters 👉: A rate cut could boost European equities, weaken the euro, and signal more support ahead for EU economies.

Friday

- 🇯🇵 Japan Inflation

- 📈 Forecast: 4.3%, up from 3.7%

- Why it matters 👉: Rising inflation may pressure the BOJ to tighten policy after years of ultra-low rates. Watch the yen and Japanese bank stocks.

Also This Week: Tech Earnings Begin

🧾 It’s the start of Q1 earnings season, and the first big tech names are reporting. Expect volatility in individual stocks and sector ETFs.

Companies to watch:

- Bank of America

- Goldman Sachs

- Netflix

- Johnson & Johnson

- ASML Holding

- Infosys

- Kinder Morgan

- UnitedHealth

- Abbott Laboratories

- TSM

- Interactive Brokers

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.