- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

3 Stocks Estimated To Be Up To 30.1% Below Intrinsic Value

Reviewed by Simply Wall St

Amid recent market volatility, the U.S. stock indices have experienced significant fluctuations, with a notable surge following President Trump's softened stance on China. As investors navigate these turbulent times, identifying stocks that are potentially undervalued can present opportunities for those looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $136.16 | $260.98 | 47.8% |

| NeuroPace (NPCE) | $10.48 | $20.14 | 48% |

| MoneyHero (MNY) | $1.27 | $2.54 | 49.9% |

| Midland States Bancorp (MSBI) | $16.02 | $30.68 | 47.8% |

| Glaukos (GKOS) | $83.09 | $162.17 | 48.8% |

| Equity Bancshares (EQBK) | $40.46 | $78.29 | 48.3% |

| e.l.f. Beauty (ELF) | $132.69 | $254.55 | 47.9% |

| Dime Community Bancshares (DCOM) | $29.27 | $57.31 | 48.9% |

| Corpay (CPAY) | $282.51 | $548.56 | 48.5% |

| AGNC Investment (AGNC) | $9.99 | $19.72 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

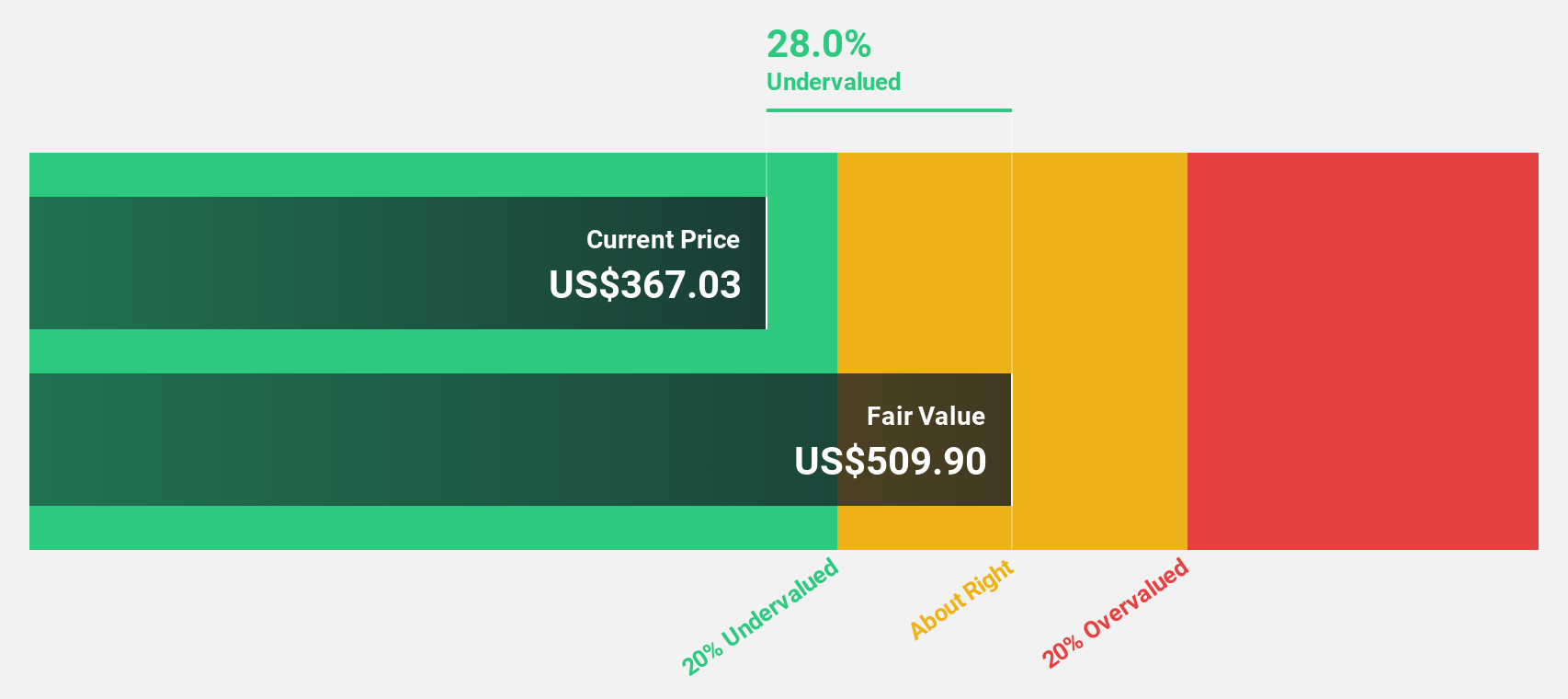

LPL Financial Holdings (LPLA)

Overview: LPL Financial Holdings Inc. offers a comprehensive platform of brokerage and investment advisory services to independent financial advisors and institutional financial advisors in the United States, with a market capitalization of approximately $25.22 billion.

Operations: The company's revenue is primarily derived from its brokerage segment, totaling $13.78 billion.

Estimated Discount To Fair Value: 28.1%

LPL Financial Holdings appears undervalued based on cash flows, trading over 20% below its estimated fair value of US$441.96. Recent onboarding of approximately US$12 billion in assets from First Horizon Bank enhances its growth prospects. Despite slower expected revenue growth at 14.5% annually, it's above the market average, and earnings are forecast to grow at 17.9% per year. The company reported robust Q2 earnings with net income rising to US$273.25 million from the previous year’s US$243.8 million.

- Our earnings growth report unveils the potential for significant increases in LPL Financial Holdings' future results.

- Navigate through the intricacies of LPL Financial Holdings with our comprehensive financial health report here.

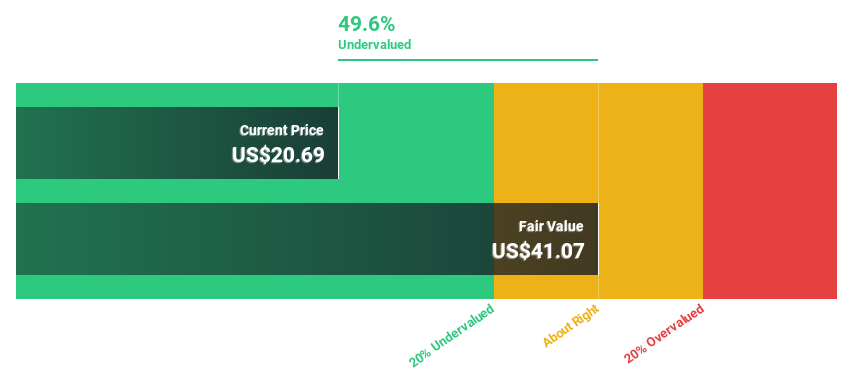

MINISO Group Holding (MNSO)

Overview: MINISO Group Holding Limited is an investment holding company that operates in the retail and wholesale sectors, offering design-led lifestyle and pop toy products across China, Asia, the Americas, Europe, Indonesia, and internationally; it has a market cap of approximately $6.49 billion.

Operations: The company generates revenue through its TOP TOY Brand, which amounts to CN¥1.33 billion.

Estimated Discount To Fair Value: 30.1%

MINISO Group Holding is trading at US$22.43, over 20% below its estimated fair value of US$32.1, suggesting it may be undervalued based on cash flows. Despite a recent decline in net income to CNY 489.69 million for Q2 2025, earnings are forecasted to grow significantly at 23.8% annually, outpacing the market average of 15.5%. The company has also expanded its European footprint with a flagship store in Amsterdam, enhancing its growth potential further.

- Our comprehensive growth report raises the possibility that MINISO Group Holding is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of MINISO Group Holding.

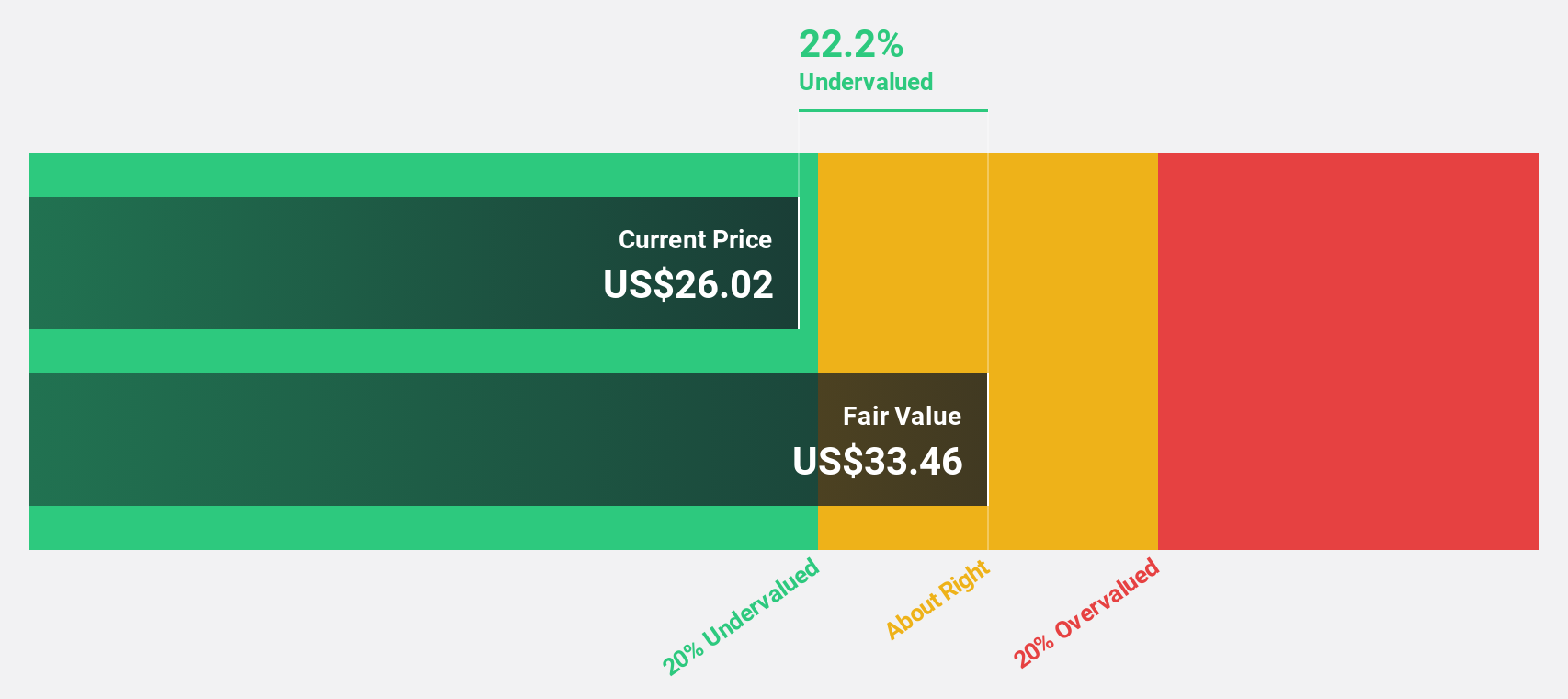

BBB Foods (TBBB)

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico and has a market cap of $2.88 billion.

Operations: The company's revenue is primarily generated from the sale, acquisition, and distribution of various products and consumer goods, amounting to MX$67.08 billion.

Estimated Discount To Fair Value: 20.7%

BBB Foods, trading at US$25.42, is 20.7% below its estimated fair value of US$32.05, highlighting potential undervaluation based on cash flows. Revenue growth is projected at 21.3% annually, surpassing the U.S. market average of 9.9%. Although currently unprofitable, it is expected to achieve profitability within three years with earnings growth forecasted at 60.14% per year, despite a low future return on equity projection of 15.8%.

- In light of our recent growth report, it seems possible that BBB Foods' financial performance will exceed current levels.

- Click here to discover the nuances of BBB Foods with our detailed financial health report.

Summing It All Up

- Discover the full array of 182 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion