- United States

- /

- Luxury

- /

- NYSE:ONON

Uncovering 3 US Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed performances following a post-election rally that has begun to lose momentum, investors are recalibrating their expectations amid fluctuating interest rates and inflation data. In such an environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $123.80 | $245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | $50.32 | $99.93 | 49.6% |

| Business First Bancshares (NasdaqGS:BFST) | $28.58 | $55.58 | 48.6% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.78 | $63.93 | 48.7% |

| XPEL (NasdaqCM:XPEL) | $45.62 | $91.03 | 49.9% |

| West Bancorporation (NasdaqGS:WTBA) | $23.98 | $46.86 | 48.8% |

| Pinterest (NYSE:PINS) | $29.98 | $59.53 | 49.6% |

| Privia Health Group (NasdaqGS:PRVA) | $21.84 | $43.16 | 49.4% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.36 | $30.28 | 49.3% |

| Carter Bankshares (NasdaqGS:CARE) | $19.56 | $38.28 | 48.9% |

Let's dive into some prime choices out of the screener.

Genius Sports (NYSE:GENI)

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries, with a market cap of approximately $1.98 billion.

Operations: Genius Sports Limited generates revenue through its technology-led offerings tailored for the sports, sports betting, and sports media sectors.

Estimated Discount To Fair Value: 27.7%

Genius Sports is currently trading at US$9.59, below its estimated fair value of US$13.26, suggesting it may be undervalued based on discounted cash flows. Recently, the company reported a net income of US$12.51 million for Q3 2024, reversing a prior year's loss. Revenue growth is forecasted at 15% annually, outpacing the broader U.S. market's growth rate and indicating potential for future profitability within three years despite low projected return on equity.

- Our comprehensive growth report raises the possibility that Genius Sports is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Genius Sports.

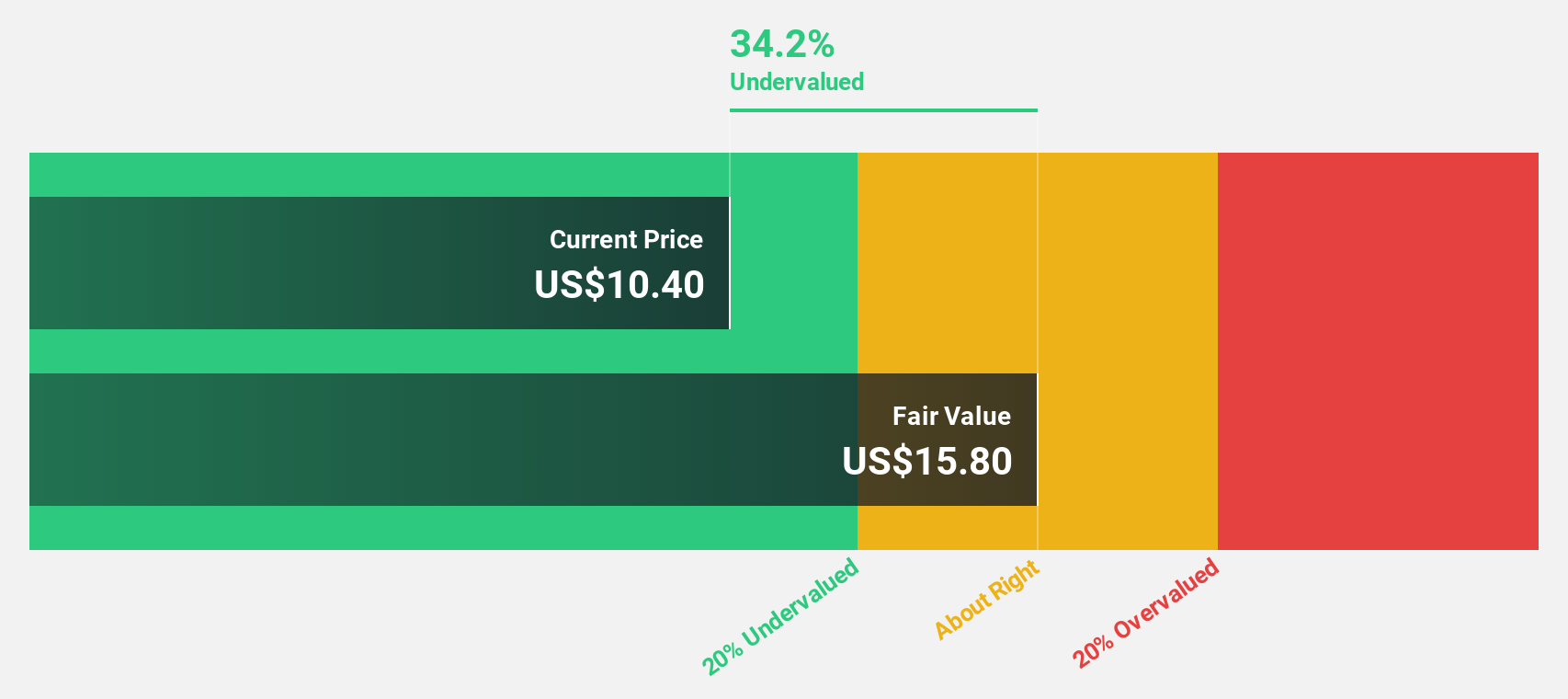

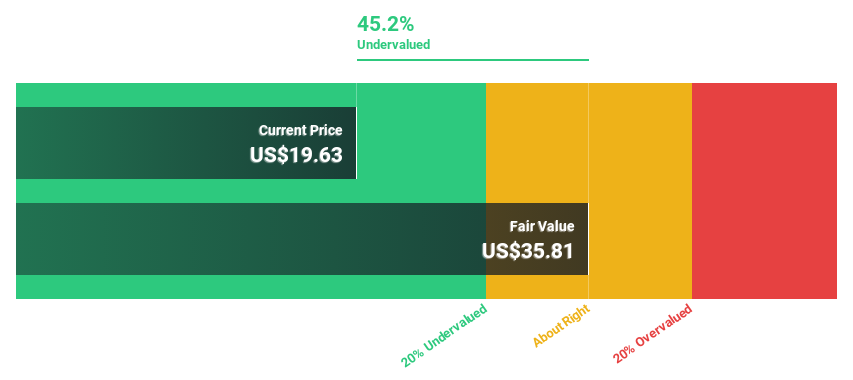

Annaly Capital Management (NYSE:NLY)

Overview: Annaly Capital Management, Inc. is a diversified capital manager specializing in mortgage finance with a market capitalization of approximately $10.92 billion.

Operations: The company's revenue primarily comes from mortgage-backed securities, totaling $369.37 million.

Estimated Discount To Fair Value: 42.2%

Annaly Capital Management trades at US$19.62, significantly below its estimated fair value of US$33.92, highlighting potential undervaluation based on cash flows. The company reported a Q3 2024 net income of US$66.45 million, a turnaround from last year's loss, with revenue growth expected to surpass the market at 82.6% annually over the next three years. However, dividend sustainability is questionable as payouts exceed earnings and free cash flow coverage remains weak amidst ongoing shareholder dilution and debt challenges.

- Our earnings growth report unveils the potential for significant increases in Annaly Capital Management's future results.

- Dive into the specifics of Annaly Capital Management here with our thorough financial health report.

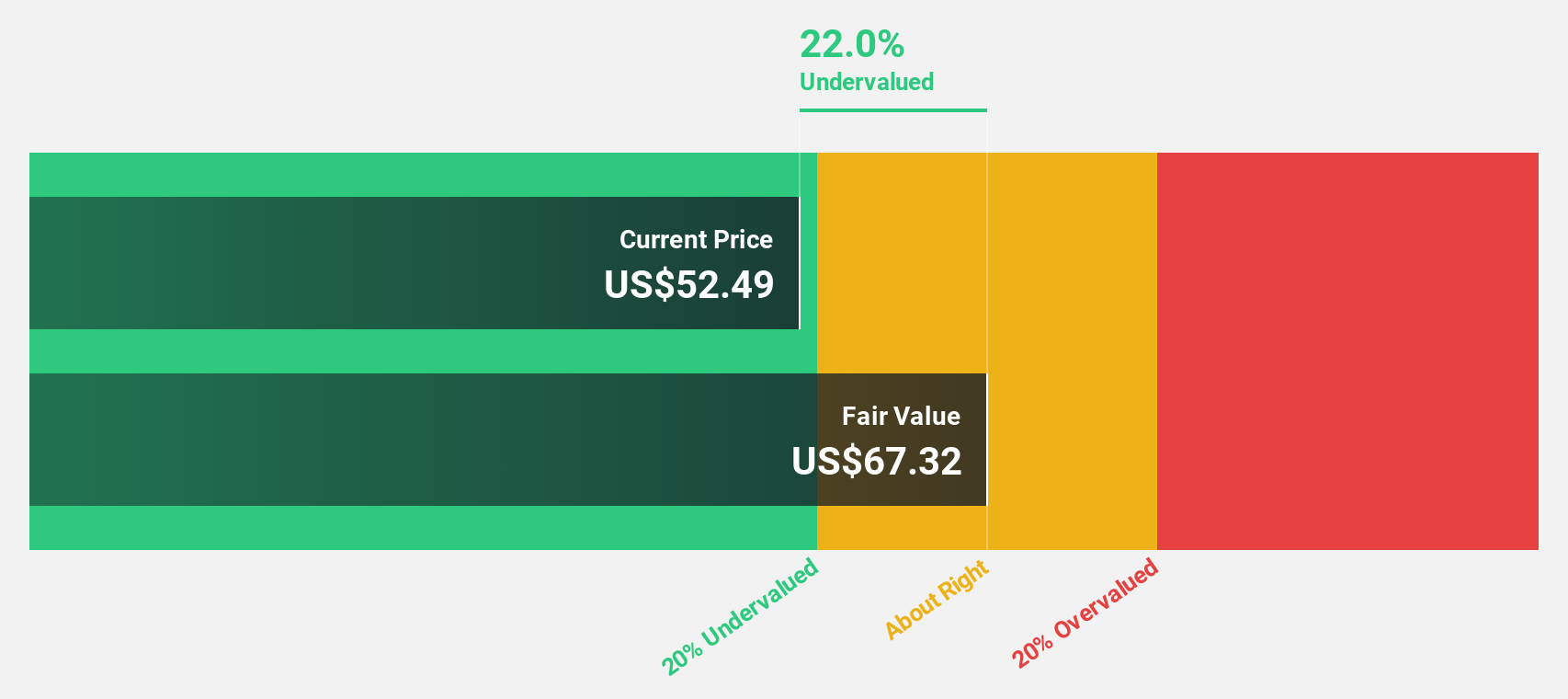

On Holding (NYSE:ONON)

Overview: On Holding AG is a company that develops and distributes sports products globally, with a market capitalization of approximately $16.84 billion.

Operations: The company's revenue segments include footwear at CHF 1.12 billion and apparel and accessories at CHF 0.11 billion.

Estimated Discount To Fair Value: 14.4%

On Holding AG, trading at $52.71, is undervalued compared to its estimated fair value of $61.59. The company reported a Q3 2024 net income drop to CHF 30.5 million from CHF 58.7 million last year, despite sales growth to CHF 635.8 million from CHF 480.5 million. Earnings are forecasted to grow significantly at 29.72% annually, outpacing the US market's growth rate and indicating potential for future cash flow-driven valuation improvements despite current earnings volatility.

- According our earnings growth report, there's an indication that On Holding might be ready to expand.

- Click here to discover the nuances of On Holding with our detailed financial health report.

Summing It All Up

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 197 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives