Buffett Steps Down - The Lessons And Legacy Of The G.O.A.T.

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: “Life is like a snowball, all you need is wet snow and a really long hill.” - From “The Snowball – Warren Buffett and the Business of Life” by Alice Schroeder.

The time has come. The G.O.A.T. is retiring.

Warren Buffett’s decision to step down as CEO of Berkshire Hathaway marks the end of an era - 60 years to be precise.

So we are interrupting our new series on innovation and disruption to take a look at Buffett’s legacy and impact on investors, and the lessons we investors can learn from his success.

We are also briefly recapping the Berkshire AGM and having a look at the resume of incoming CEO Greg Abel, someone who has some very, very big shoes to fill.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

📊 Fiverr raises outlook despite AI challenges - and a few AI wins ( CTech )

- AI giveth and AI taketh away !

- Freelancer platform Fiverr reported Q1 revenue growth of 15%, and a slight improvement in its net margin. The company also raised the lower end of its guidance for full year revenue and Adjusted EBITDA. With many companies shying away from providing guidance, even a slightly improved outlook has to count as a win.

- Fiverr’s revenue growth came from new large-scale contracts in areas such as content writing, app development, video production, and digital marketing. This offset rising churn amongst buyers, as the number of active buyers on the platform fell 12% from a year earlier. The company said buyers were starting to use AI tools for certain services offered by freelancers on the platform, particularly translation and copywriting.

- On the positive side of the AI equation, in February Fiverr launched a suite of AI tools to help freelancers improve efficiency. So far 6,000 freelancers have used the tools and 200,000 buyers have interacted with AI agents.

- In a separate memo to employees, Fiverr’s CEO Micha Kaufman said “AI was coming for most jobs — including his” . His advice: Use AI to become an exceptional talent in your field.

❌ OpenAI abandons plan to become a for-profit company ( The Verge )

- OpenAI scrapped its capped-profit model and plan to become a for-profit entity, opting instead for a Public Benefit Corporation (PBC) structure (like Anthropic, xAI, and Patagonia), still controlled by its nonprofit.

- The move follows pressure from civic leaders and regulators, particularly the attorneys general of California and Delaware, who oversee nonprofit governance.

- While the new PBC model removes the 100x return cap and allows traditional equity, it preserves nonprofit oversight, introducing a unique blend of mission control and market ambition. This could make OpenAI more competitive in fundraising (because investors don’t have capped upside) but potentially less aggressive in pure-profit moves than traditional startups.

- OpenAI now wants to scale like a startup, raise like a unicorn, and still answer to humanity. Investors get uncapped upside, just with a moral chaperone.

🔎 Apple's plan to offer AI search options on Safari: A blow to Google dominance ( Reuters )

- Apple may soon open up Safari to AI-powered search engines like OpenAI and Perplexity, threatening Google’s $20B/year grip as the default.

- Safari searches just dropped for the first time, signaling users are already shifting toward AI tools.

- Alphabet's search ad cash cow is under siege, from regulators and now its biggest distribution partner. If Apple cuts exclusivity, it opens the door for rivals and potentially slices Google’s mobile ad revenue by double digits.

- Apple’s AI search shake-up could kneecap Google’s dominance. The fact that it lost $150B in market cap says investors are paying attention.

🤝 Trump announces his first trade deal with the UK. ( Yahoo Finance )

- Trump announced a limited trade deal with the UK, slashing U.S. tariffs on UK steel and cars, while the UK will open up to more U.S. ethanol, machinery, and agriculture.

- Tariffs stay in place broadly, and major sticking points (like UK beef standards and digital taxes) are still unresolved.

- The pact boosts select sectors (autos, ethanol, machinery), but falls short of meaningful structural trade shifts. Still, markets rallied on signs that Trump may be shifting from tariff escalation to deal-making. It was a mood shift with positive implications for global trade-sensitive stocks.

- It’s only a small step, and not even fully resolved. But for jittery markets, even a handshake counts.

⏸️ Fed holds rates steady as it notes rising uncertainty and stagflation risk ( CNBC )

- The Fed held rates at 4.25%-4.5%, citing rising uncertainty and dual risks: slowing growth and sticky inflation.

- With tariffs looming and GDP slipping, policymakers flagged stagflation concerns for the first time in years.

- A rate cut isn’t on the immediate horizon, but market bets on easing later this year remain. Expect heightened volatility in rate-sensitive sectors, especially housing, autos, and small-cap equities, until trade policy and inflation trends become clearer.

- If you’re looking for a way to handle a stagflationary environment, check out some of our recent insights on how best to navigate it.

🏰 Warren Buffett’s Legacy

The investment community already knew the "Oracle of Omaha" would be stepping down in the next few years. But still, last week, it was a significant moment.

His investment journey started 74 years ago, and he’s led Berkshire for 60 of them.

Buffett, alongside the late Charlie Munger, didn’t just build an unmatched investment track record. They influenced millions of investors, championed a common-sense approach to investing, and acted as a vital counterpoint to Wall Street's excesses.

Their timeless investing philosophy has inspired and shaped a lot of our platform!

Here are some of the big items from the AGM in Omaha last weekend.

📢 3 Key Takeaways from the 2025 Berkshire Hathaway AGM

This year's AGM in Omaha was one for the history books. Here’s the rundown:

📜 Greg Abel is Officially CEO: Succession Sealed

- No major surprise here: Greg Abel is the new CEO. This was telegraphed back in 2021 and strongly endorsed by Charlie Munger, too.

- Abel (62) is currently Vice Chair of Non-Insurance Operations and a seasoned operator within Berkshire.

- Buffett isn't disappearing. He remains Chairman of the Board. Expect him to offer guidance and mentorship, especially on big capital decisions and preserving Berkshire’s unique culture. In his own words: " I'll still be around, probably with my feet up, reading more annual reports than ever. But Greg's the boss. "

📊 Berkshire's Report Card: Solid, With Mixed Spots 📊

Operating Companies:

- 🚂 Strong performance from BNSF (railroad) and Berkshire Hathaway Energy (BHE).

- 🏢 GEICO : Showing underwriting improvements despite a tough insurance market.

- 🛍️ Manufacturing, Service & Retail : A mixed bag (pardon the pun), reflecting the broader economy.

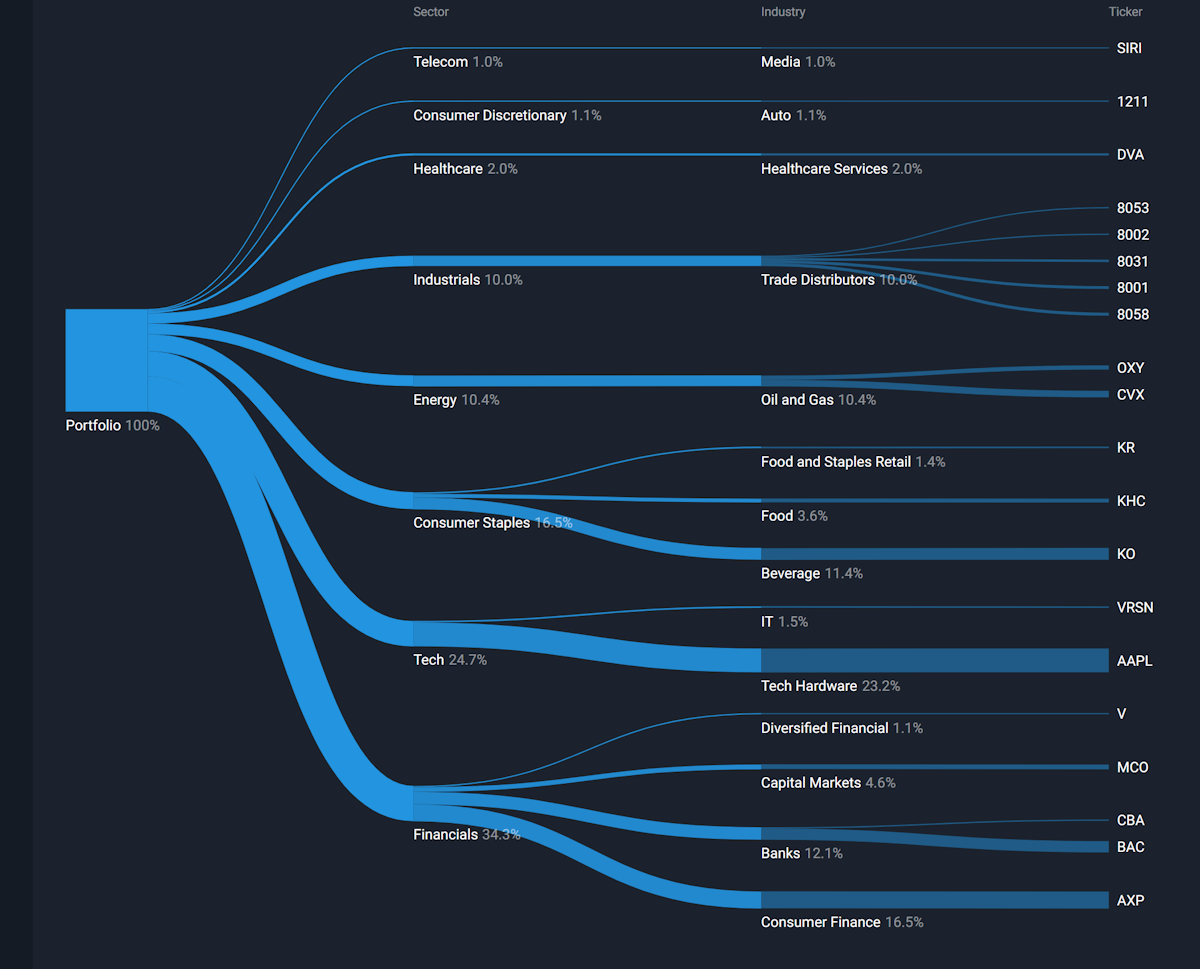

- 📈Investment Portfolio: Apple, American Express, Coca-Cola, and Bank of America remain core holdings.

The company’s listed investments are worth some $280 billion, and the cash pile has grown to a whopping $350 billion .

As for what they’ll do going forward, the approach remains largely the same:

- 🔎 The approach to public equities will remain opportunistic, with a focus on long-term value. They’re yet to see any good deals within their size range.

- 💸 Share buybacks will still be the go-to when Berkshire stock is below their estimated intrinsic value.

- 🔩 Bolt-on acquisitions and smaller deals for existing businesses remain a priority.

✨ Greg Abel acknowledged technology's growing importance across Berkshire's businesses. So don’t be surprised if we see more tech names among their holdings under his leadership.

🌍 Buffett shared his candid views on the economy.

- 📈 Inflation : Still a concern. "Inflation is a tapeworm," he warned, noting persistent cost pressures.

- 🌐 Tariffs & Geopolitics : He hopes for rational trade, but acknowledged ongoing global uncertainties. Berkshire's portfolio diversity helps with this.

- 🇺🇸 US Economy : Long-term, he’s optimistic, but he sees slower growth ahead. " The American tailwind is powerful, but even strong winds can face headwinds. "

👨✈️ The New Captain: Things to Know About Incoming CEO Greg Abel

With Buffett as Chairman, Greg Abel steps into the CEO shoes, and they are BIG shoes to fill.

Here’s the lowdown on the new leader:

⚡ From Energy to Empire: Abel's Berkshire Journey

Greg Abel is 62 and Canadian-born. He joined Berkshire in 1992 via MidAmerican Energy. He was appointed Vice Chair of Non-Insurance Operations for all of Berkshire in 2018 and joined the board.

He oversaw massive growth, turning BH Energy into a utility giant in electricity, gas, and renewables (US, UK, Canada). He led major investments in renewables, especially wind, making BHE an industry leader.

✨ Abel knows the company inside out and is regarded as a skilled manager and capital allocator.

His background isn’t in stock picking or insurance, but he’ll have help with those functions:

- Ajit Jain , Vice Chair of Insurance, remains head of Berkshire's massive insurance arm.

- Todd Combs & Ted Weschler continue managing large parts of the investment portfolio.

- 🔔 If you want to stay updated on leadership news within Berkshire, simply add BRK.B to your Simply Wall St Watchlist to get notified.

Abel isn’t expected to make changes to Berkshire’s strategy or culture anytime soon, and that’s probably exactly what shareholders want to hear.

So, given his past 30+ years working within Berkshire and his time spent under Buffett’s wing, it’s probably fair to say he’s well prepared for the job ahead of him.

With Buffett handing over the reins to Abel, we want to reflect on 4 key lessons we’ve learnt from Buffett over the years.

🧐 The Underappreciated Lessons From Buffett’s Career

Buffett is famed for value investing and folksy wisdom. But some easily overlooked aspects fueled Berkshire’s rise:

🎧 Cutting Out the Noise

Yes, this is a cliche, but it works.

Buffett has demonstrated it on several levels. He could have moved to New York or any other financial capital, but he remained in Omaha, Nebraska, to avoid the noise.

You barely ever hear Buffett talk about all the short-term quarterly data that Wall Street obsesses over.

- In 2011, he stated: “ We make projections in our head all the time. But we sure don’t want to listen to anybody else’s projections .”

- His focus is on reading annual reports ( decades of them) to truly understand a business.

🏰 Look for Enduring and Sustainable Competitive Advantages (Moats)

Buffett is known for buying high-quality stocks when they trade at prices that provide a margin of safety.

But his biggest wins haven't come from stock prices rising from discounted prices to “fair value.” The big winners have resulted from earnings compounding over decades.

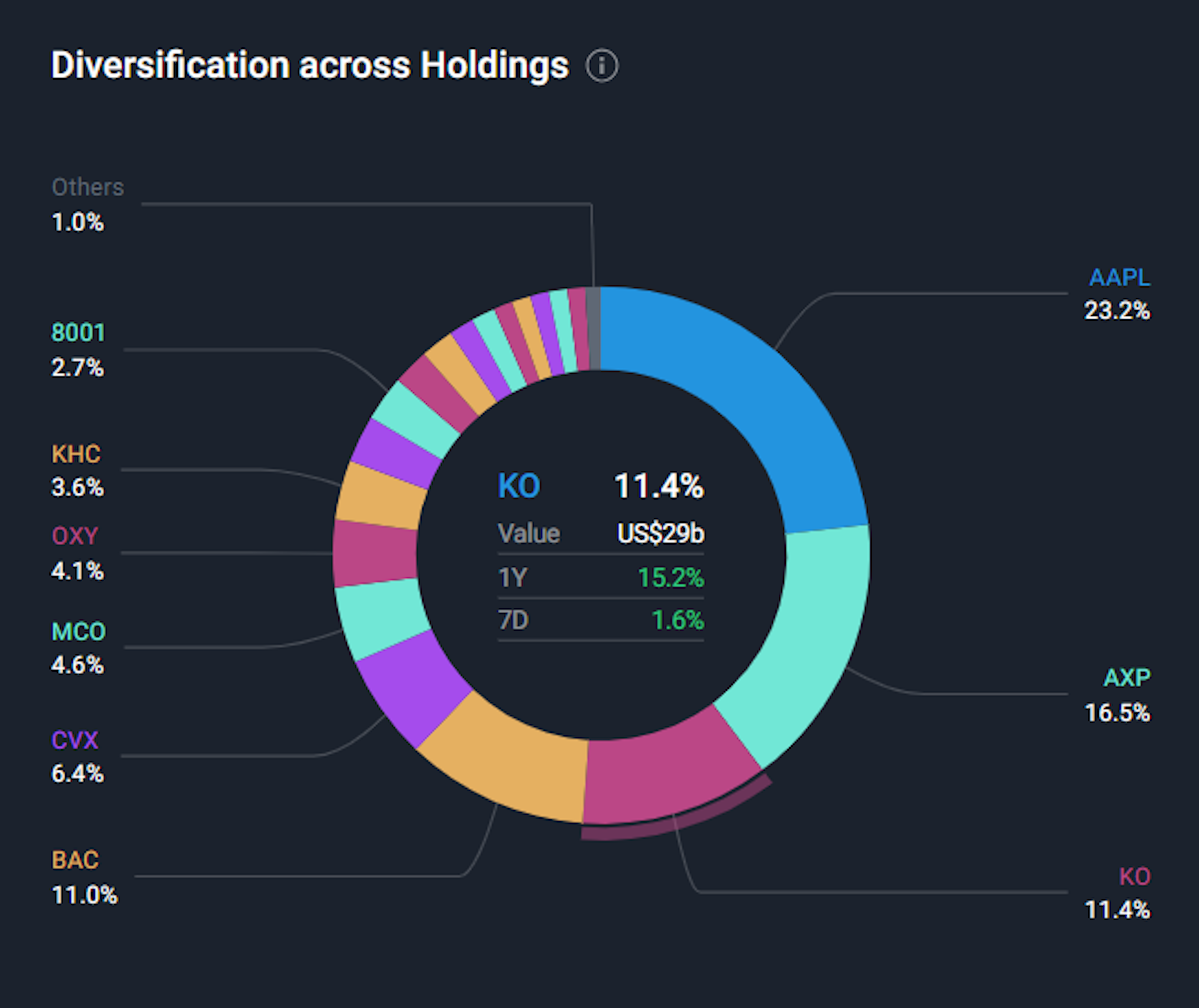

Coca-Cola is a great example. Between 1988 and 1994, Berkshire spent $1.3 billion buying 400 million shares. That stake is now worth about $29 billion. The share price has gained a fairly modest 10% a year since 1994.

But 10% compounded for 31 years has resulted in a 2,100% gain on the share price alone.

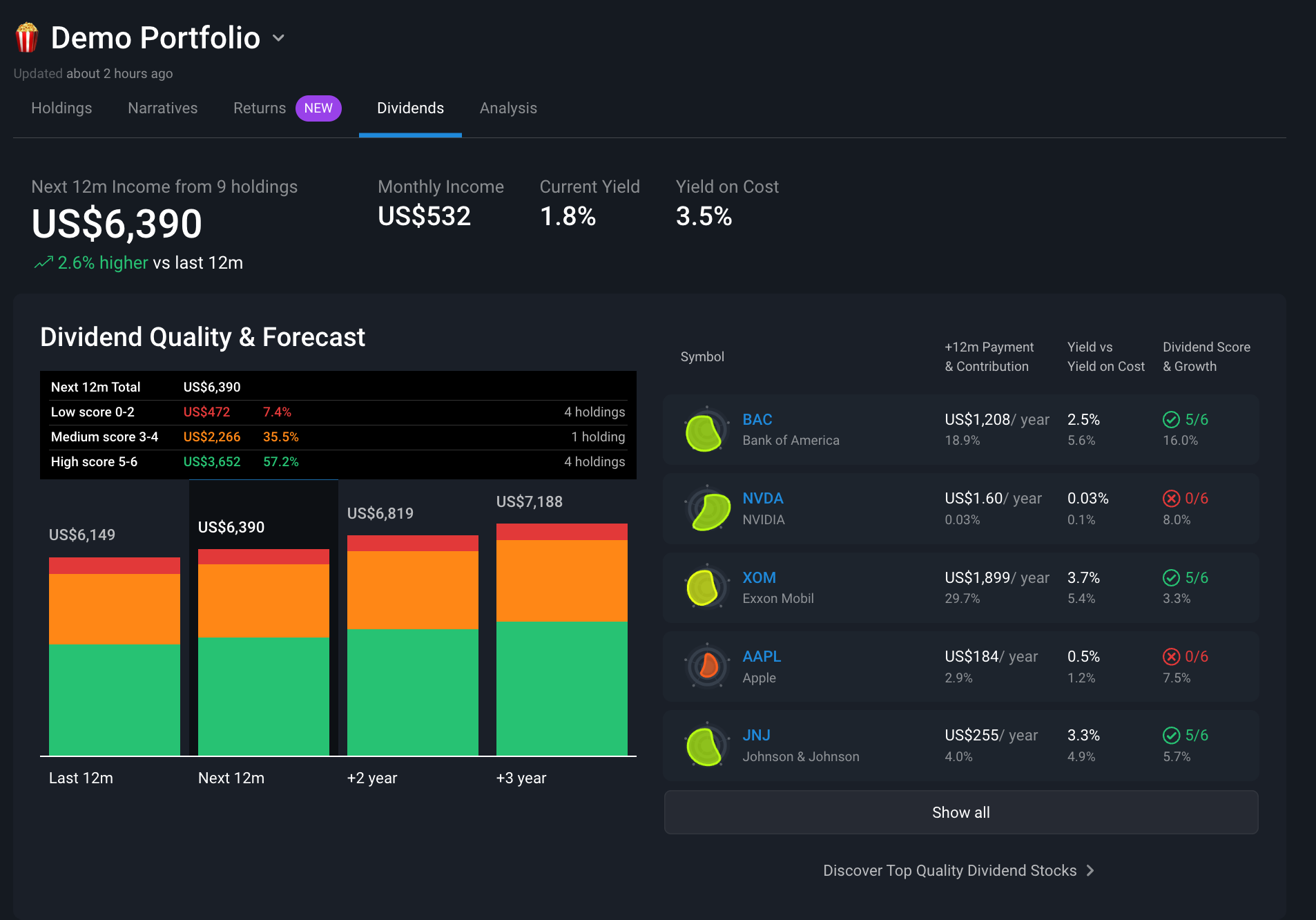

In 2024, Berkshire received dividends worth $776 million from its Coca-Cola stake. That’s a roughly 60% annual yield on cost (a valuable metric which we also display in our portfolio tool).

Since 1994, it’s received $12 billion in total dividends, or 9x its initial investment. That’s a prime example of the saying “ patience pays ”.

Coca-Cola wasn’t a shiny new company when Berkshire invested, nor was it growing at breakneck pace. In fact, it was 100 years old.

✨ The key was the sustainable competitive advantage (moat) and a long, long runway of growth ahead. Coca-Cola’s brand recognition and distribution network made life difficult for competitors.

He thought in decades, not months.

If a company has a sustainable moat, it only needs to grow modestly to compound earnings over time.

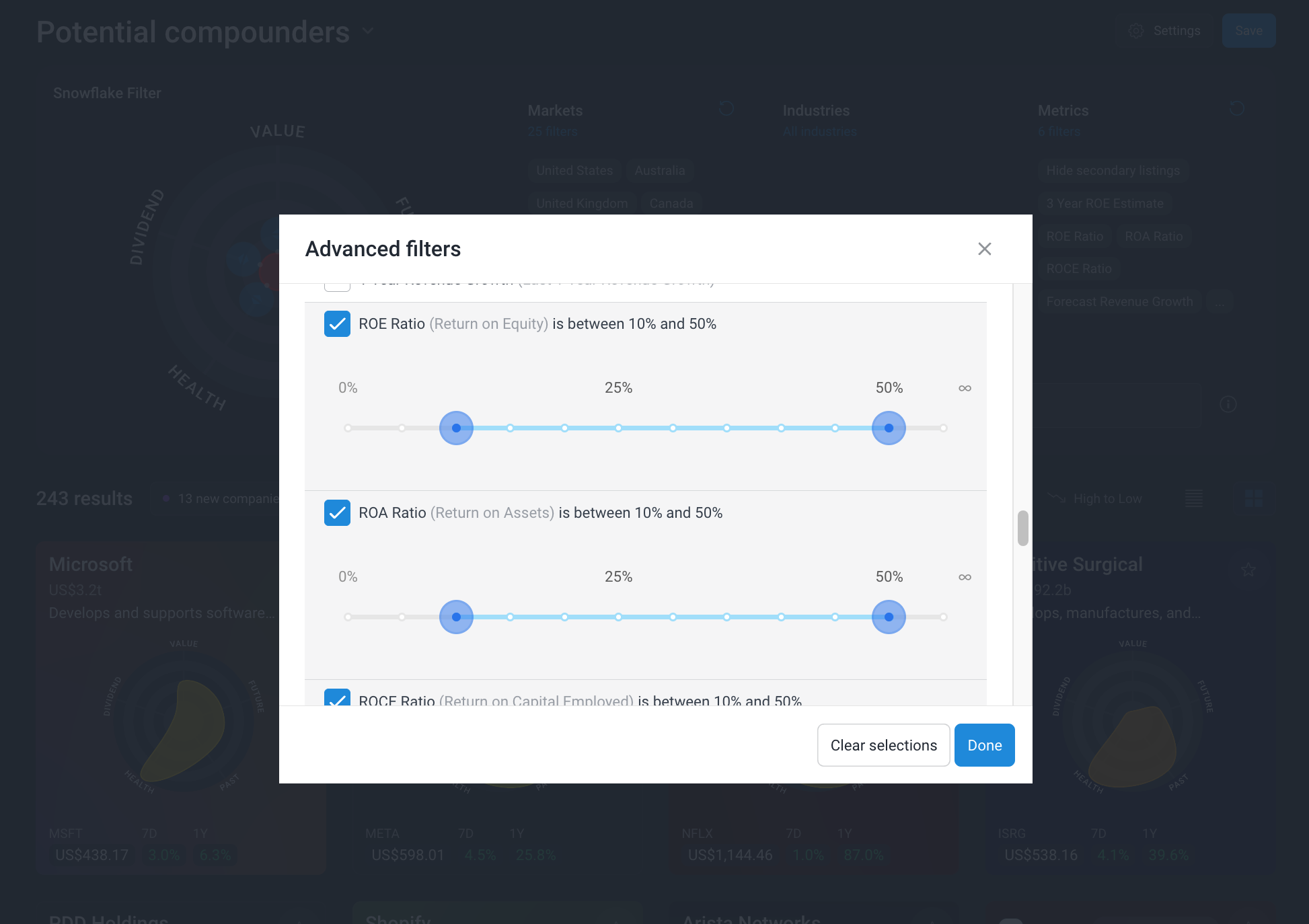

- You can use the Simply Wall St Company Screener to find firms with potential moats. Open the Potential compounders , screener below, and save it as your own. If you want to filter down even further, add more filters like strong net margins and manageable debt.

🎯 The Importance of Capital Allocation

While Buffett is generally regarded as an investor, he’s just as much a manager and business leader.

✨ By deploying capital effectively across diverse opportunities (insurance float, whole companies, stocks), he consistently maximized long-term value.

Poor capital allocation destroys value, and this is something investors need to be on the lookout for.

Capital allocation also goes hand in hand with the prudent use of debt. Conservative use of leverage puts a company in a stronger position during bear markets and economic turmoil than if it were highly leveraged.

📚 Be a Lifelong Learner and Know Your Limits

Buffett also champions two of Simply Wall St’s mantras about learning

- ⭕️ He sticks to his Circle of Competence , investing only in what he understands. He famously sidestepped the dot-com bubble, then later invested in Apple once he "got" its moat.

- 📚 "The more you learn, the more you earn." Buffett knows the value of Continuous Learning and compounding knowledge. Despite his success and wealth, he has continued to spend most of his time reading trade journals, annual reports, and anything else that helps him improve his understanding of businesses and the economy.

Finally, we shouldn’t overlook Buffett’s impact on the broader investment industry:

- 👨⚖️ Corporate Governance : He has championed shareholder interests and rational executive compensation, albeit with varying degrees of adoption.

- 👨🏫 Millions of Investors : He taught common sense and patience to everyday investors, often counteracting Wall Street hype.

- 🏞️ The Omaha Way : By staying grounded and far from the madding crowd of financial centers, he allowed for clearer, long-term thinking.

- 🤝 Trust as a Currency : His integrity and transparency built a unique, decentralized business empire, and that brings it’s own value.

💡 The Insight: Individual Investors Can Apply The Buffett Playbook with a Few Tweaks

The principles that built one of the world's most successful investment records can be directly applied to how you choose your own stocks and manage your portfolio.

The core ideas – value, quality, long-term thinking – are as potent as ever.

- 💰

Define Your Own Fair Value for Any Stock :

- Understanding what a business is truly worth is crucial.

- For any company you're considering, use your research and understanding of Buffett's valuation principles (like looking for a margin of safety) to establish what you believe is its fair value .

- This acts as an anchor, helping you make rational buy, hold, or sell decisions based on value, not just price swings (a core Buffett discipline).

- Simply Wall St’s Community Narratives are a great place to start if you’re wanting to understand how to value a company, or to see how fellow investors perceive value.

- 🔍

Discover Your Own "Buffett-Like" Opportunities :

- Look for strong and consistent Return on Equity (ROE)

- Low debt-to-equity ratios

- A history of positive free cash flow

- Reasonable P/E or P/B ratios relative to their industry and historical averages.

- ⚖️ Analyze Stocks Through a Buffett Filter :

- Is the company in your " circle of competence "?

- Does it have an identifiable and durable competitive advantage?

- Is it run by management teams you trust?

- Is it financially sound with manageable levels of debt?

💡Pro Tip : Consider looking for smaller, perhaps overlooked, owner-operated businesses in less glamorous industries. Small companies won’t move the needle for Berkshire, but for individual investors like us, they can be big winners.

If you're using the Simply Wall St screener, you can start with moderate scores for value, health, and past ( and ignore the future score),

Then refine further by filtering on profitability metrics like net margin and ROE:

It’s important to remember that Buffett’s principles don’t necessarily need to apply to every single stock you own.

For highly innovative companies pioneering new technologies, identifying a competitive advantage that will endure for decades can be challenging.

In such cases, it might make sense to adopt a shorter time horizon and reassess your investment more frequently as the company's story and the industry landscape evolve.

Speaking of innovation, we’re getting back to our series on innovation and disruption next week!

Key Events During the Next Week

Here’s some data releases to keep an eye on next week:

Tuesday

🇬🇧 UK Unemployment Rate

- 📊 Forecast: 4.4% - flat from previous week

- ➡️ Why it matters: If unemployment is higher than expected, it could force the BoE to loosen interest rates, weakening the pound.

🇺🇸 US Monthly Inflation Rate

- 📊 Forecast : A 0.3% increase, up from -0.1% last month.

- ➡️ Why it matters: Hotter inflation means the Fed keeps rates steady, cold inflation means rate cuts are back on the table. This includes food and energy, “Core” doesn’t.

Wednesday

🇺🇸 US Monthly Retail Sales

- 📊 Forecast : -0.8% down from 1.4%

- ➡️ Why it matters: Weak sales mean consumers are pulling back, raising red flags for growth.

Thursday

🇦🇺 Australia Home Loans QoQ

- 📊 Forecast : -1.2% down from 4.2%

- ➡️ Why it matters: Falling loan volumes point to a cooling property market and weaker household confidence.

Friday

🇯🇵 Japan Quarterly GDP Growth Rate

- 📊 Forecast: 0.1% down from 0.6%

- Why it matters: A slowdown adds pressure on the BoJ to keep policy ultra-loose.

Earnings season continues, with companies in all sectors due to report:

- Petróleo Brasileiro

- Sony

- Sea Ltd

- JD.com

- Vodafone Plc

- Cisco

- CoreWeave

- Walmart

- Alibaba

- Deere and Co

- Applied Materials

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.