Quote of the Week: “The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.” - Bill Gates

This week we are back to our series on innovation and disruption, after a brief detour to honour Warren Buffett’s career.

Specifically, we are looking at the field of automation and robotics. Automation comes in many forms: autonomous vehicles and drones, AI agents, automated assembly lines, and humanoid robots.

They all have two things in common.

Firstly, they are all powered by AI. And secondly, they have significant tailwinds behind them.

If you want to invest in the big trends shaping the future, this is one of the most important ones to explore.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

- 🏙️ Main Street isn’t very optimistic ( Axios )

- Small business optimism dropped for a fourth straight month in April, with investment plans at their lowest since the early COVID lockdowns.

- The NFIB survey shows Main Street is spooked by unstable economic conditions, especially the whiplash from shifting U.S. tariff policy.

- Lower capital spending from small firms (the economy’s job engine) hints at weaker near-term GDP growth and softer demand for B2B suppliers, industrials, and regional banks. Even with some sales gains, businesses aren't buying into a better future just yet.

- Some investors are reducing their exposure to small-cap cyclical stocks and considering defensive sectors. Main Street’s retreat could be an indicator of weakness ahead for growth-sensitive stocks.

- 🤝 What the U.S.-China Trade Agreement Means for Markets ( WSJ )

- Monday's rally may have been about more than just tariffs.

- For those of you who missed it: the U.S. and China agreed to a 90-day tariff rollback, and U.S. tariffs on Chinese goods drop from a punitive 145% to 30%, while China's retaliatory duties fall from 125% to 10%.

- But possibly more important is that Treasury Secretary Scott Bessent, seen as more pragmatic than Trump, now appears to be steering trade policy, and investors liked that.

- Markets are betting this 90-day truce could evolve into deeper structural talks aimed at long-term trade rebalancing with China.

- Lower near-term tariff risks reduce stagflation fears and restore dollar confidence, which is bullish for equities but bearish for gold. A more predictable policy hand (Bessent) would also likely boost investors' risk appetite, especially for global cyclicals and exporters.

- With Bessent at the helm, analysts are expecting less chaos and more coherence. That’s good news for equity bulls and anyone long the dollar.

- 📈 Coinbase joining S&P 500 days after bitcoin soared past $100,000 ( CNBC )

- Coinbase is set to join the S&P 500 on May 19, replacing Discover Financial as it gets acquired by Capital One.

- The news comes just days after bitcoin broke above $100,000 and Coinbase announced a $2.9B acquisition of crypto derivatives exchange Deribit.

- S&P 500 inclusion means passive inflows and institutional legitimacy, which is a short-term tailwind for COIN. But the stock’s volatility and lag behind BTC highlight ongoing investor caution, especially post-2021 highs.

- Expect near-term buying pressure from index funds, but don’t chase COIN blindly. Its fate is still tied tightly to crypto sentiment and price action.

- 🕵️♂️ UnitedHealth under criminal probe for possible Medicare fraud, report says ( Reuters )

- UnitedHealth is under criminal investigation by the DOJ for potential Medicare fraud, compounding investor jitters after its CEO’s abrupt exit and a suspended 2025 outlook.

- Shares have nosedived over 25% this week, hitting a four-year low as legal and operational uncertainties mount.

- This probe could have ripple effects across the Medicare Advantage sector, especially for peers like Humana and CVS . With regulatory risk rising and profit visibility dimming, health insurers may see their PE multiples compress.

- It might be time to reassess exposure to Medicare-heavy insurers. Reputational and legal risk could erode earnings and investor confidence for quarters to come.

- 🇺🇸 US agrees to sell Saudi Arabia $142bn arms package ( Reuters )

- The U.S. has agreed to a record $142 billion arms deal with Saudi Arabia, spanning air defense, naval systems, and advanced communications.

- Lockheed , RTX , Boeing, and Northrop Grumman are expected beneficiaries, though the F-35 jet, which Saudi Arabia is very keen on, is still off the table for now.

- This deal could supercharge revenue pipelines for defense contractors, especially those with existing Gulf exposure. Look for tailwinds in large-cap defense names, and potentially in supporting aerospace and component suppliers.

- Defense stocks just got yet another catalyst as geopolitical alliances tighten and global rearmament continues.

- ✈️ Boeing inks record-breaking deal for Qatar Airways to buy up to 210 planes ( CNBC )

- Boeing landed a $96 billion order from Qatar Airways for up to 210 widebody jets, its largest ever, plus 400+ engines from GE Aerospace to match.

- The mega deal arrives as Boeing tries to rebuild trust and profitability after years of manufacturing issues, losses, and labor unrest.

- Consider this deal a major tailwind for Boeing and GE Aerospace. Political influence helped secure the deal, and the move aligns with Trump’s goal of increasing U.S. exports and manufacturing jobs. Boeing’s backlog, revenue visibility, and South Carolina plant all just got a huge boost.

- Long-suffering Boeing investors may finally be cleared for takeoff. Shares were already up 47% from lows on April 7th, and this deal might put further upward pressure on the stock and offer stability amid a turbulent turnaround.

🤖 The Next Leg in the Automation and Robotics Trend

Humans have been automating repetitive tasks for centuries.

From inventing the printing press in 1440, the “spinning jenny” (textile manufacturing) in 1764, to steam engines in the 1700s, we have a knack for creating increasingly clever ways of doing more with less.

Nowadays, the tailwinds behind automation are stacking up faster than ever.

Several technologies are converging and turning 1970s science fiction into reality:

- 🧠 Artificial Intelligence (AI) and Machine Learning (ML): AI makes robots smarter, more adaptable, and capable of complex, non-repetitive tasks. ML allows machines to learn from data and improve.

- 🌐 Internet of Things (IoT): Increased connectivity lets robots and automated systems communicate seamlessly, enabling smarter factories and supply chains.

- 🔋 Battery Storage: Allows autonomous vehicles, drones, and robots to operate longer before a recharge.

- 👁️ Improved Sensors and Vision Systems: Advanced sensors like LiDAR and high-def cameras give robots a better understanding of their environment for safer, more sophisticated interactions.

- 📉 Falling Costs: Robots and components are getting cheaper, making automation accessible to more industries, including small and medium-sized businesses (SMEs).

While technology is making more possible on the supply side, demographic and geopolitical factors are fueling demand:

- 🧑⚕️ Labor Shortages & Demographics: Aging populations and shrinking workforces in developed countries create persistent labor gaps. Automation helps fill these and maintain productivity.

- ⚙️ Quest for Efficiency: Companies globally need to cut costs, boost quality, and improve efficiency. Robotics offers precision, speed, and endurance.

- 🏭 Reshoring & Supply Chain Resilience: The supply chain issues of 2021, and even recent tariff turmoil, highlighted supply chain vulnerabilities. If governments want to bring manufacturing “home” or businesses want to diversify their supply chains, automation is crucial.

- 🏠 Consumer Acceptance: Robotics is moving beyond factories and into the home, as consumers become more comfortable with technology.

✨ Over and above these points, automation reduces costs, which brings prices down and makes products affordable to a larger market. While low-paying jobs are lost, new, higher-paying jobs are created.

🧩 The 7 Segments In The Automation Industry

The automation and robotics world is vast, with both large competitive segments and highly specialized niche segments.

🏭 Industrial Automation

Assembly lines have included robotic machines for decades, so this is by far the largest, most mature segment.

Developing machines that help manufacturers increase productivity is big business. Companies like Honeywell and ABB Ltd (in Switzerland) have decade-long track records in this space.

💡 Some good news for investors: Both ABB and Honeywell are planning to spin off their robotics companies in the next year. So if you’re looking for pure-play robotics businesses, watch that space.

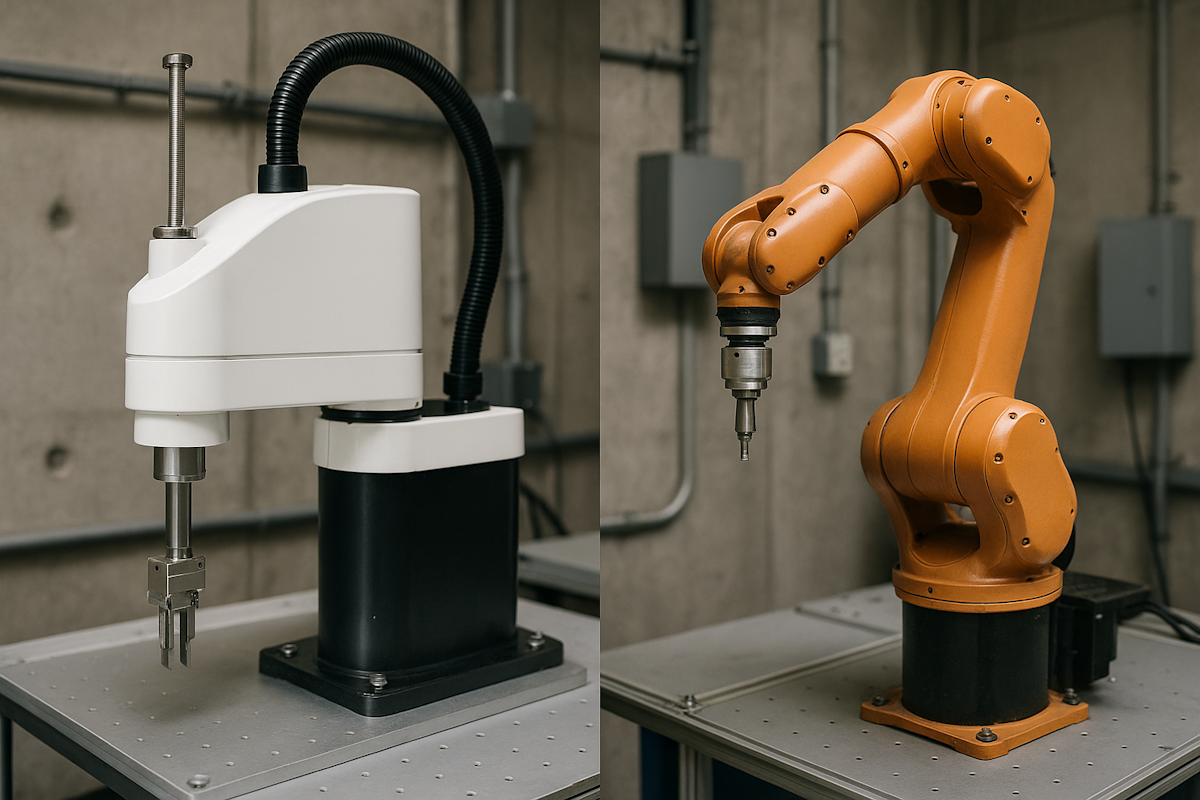

There are also lots of specialist applications, particularly in industries that require precision. Articulated arms (above right) have been used for some time to move and handle large parts.

SCARA robots (Selective Compliance Assembly Robot Arm) can pick, sort, and assemble with precision. As they become more capable, they can be used more extensively in the electronics industry.

For some industries, like semiconductors and pharmaceuticals, sterile environments are essential. SCARA robots reduce the number of people entering these environments, which reduces the chance of contamination.

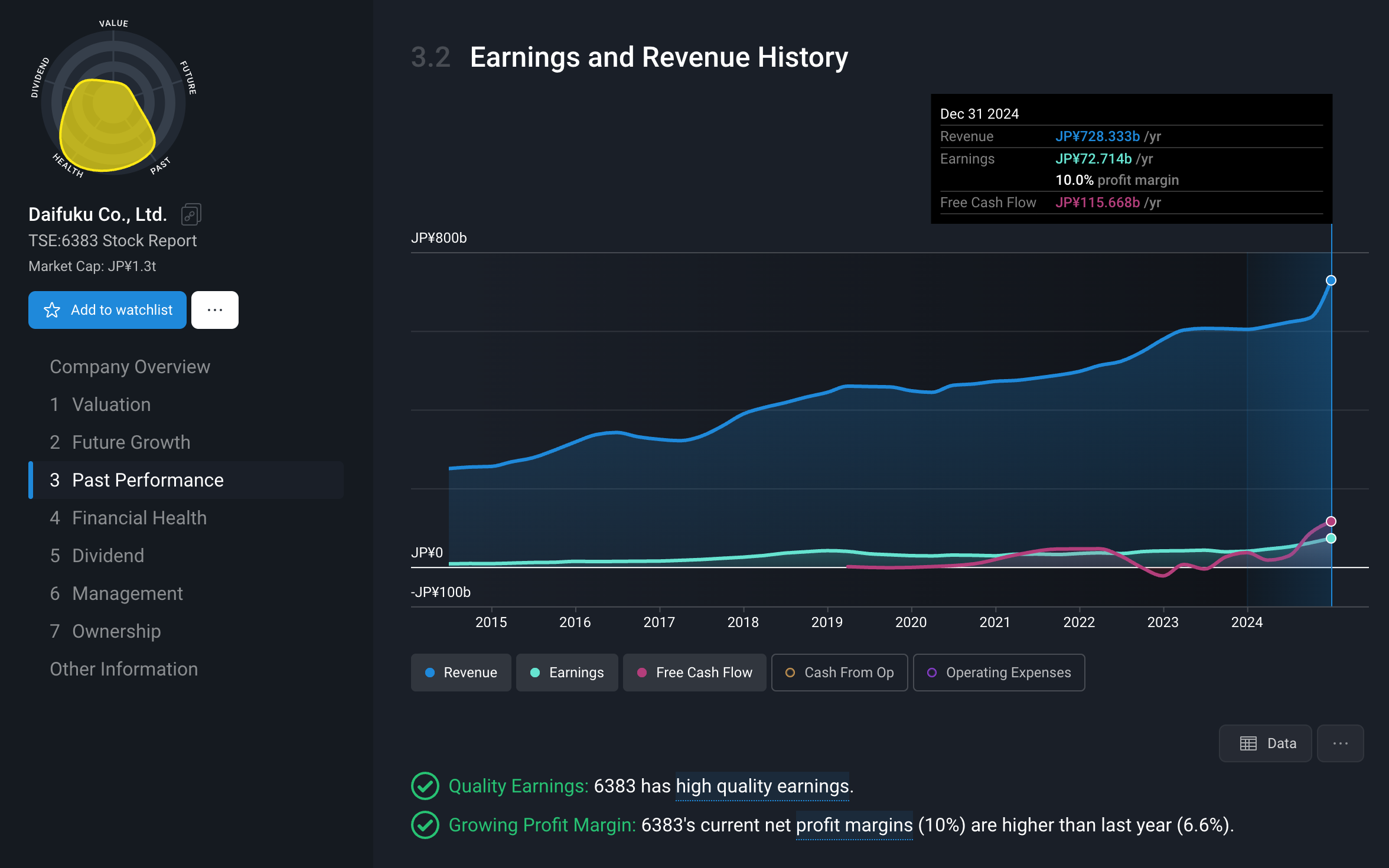

AMHSs (Automated Materials Handling Systems) are used to move products around a factory. Daifuku in Japan has built a lucrative niche supplying the materials handling systems used in semiconductor fabs.

🤖 Humanoid Robots

A growing list of companies are developing two-legged robots capable of mimicking humans, and performing non-repetitive tasks 24/7.

It’s probably inevitable that these will eventually be in widespread use. When that will be though, is the real question.

✨Much like quantum computing, humanoid robots exist, but they might not be truly useful for a while.

Tesla has dived into this space, joining a bunch of start-ups and Boston Dynamics , which has been at it for decades.

Several Chinese companies are also investing in humanoids, like XPeng, Xiaomi, Ubtech Robotics, and many large automation specialists

🧑💻 Process Automation

Process automation generally refers to the automation of business admin processes, so it’s more of a software thing than robotics.

It can also include inputs from sensors too, which is relevant in industries like security, logistics, and healthcare.

So, almost every software company is now involved in process automation in one way or another. One company that stands out is UIpath, which has been providing end-to-end automation for two decades, and could be the O.G. of “agentic AI”.

Salesforce already deals with processes and data for large companies, and is also leaning into AI.

🐕🦺 Service Robotics

Robots performing tasks for humans or equipment, outside industrial settings. These can be:

- Professional Service Robots: For corporations – logistics robots, medical robots, agricultural robots, inspection, commercial cleaning.

- Personal/Domestic Service Robots: For homes – cleaning, lawn mowing, entertainment, elder assistance.

- Collaborative Robots (Cobots): Designed to work safely alongside humans. This is a new and growing space that will become more important as capabilities increase.

Richtech Robotics is a small company, developing robots across a number of verticals, including hospitality, healthcare, and logistics. iRobot (even smaller) is developing products for consumers, including the Roomba robot vacuum.

Two areas where service robots are already seeing widespread adoption are logistics and healthcare:

-

🚚 Logistics Automation: Robots and systems for warehouses and supply chains – AGVs, AMRs, AS/RS, robotic sorters. E-commerce is a major driver. Examples include Symbotic and Serve Robotics.

-

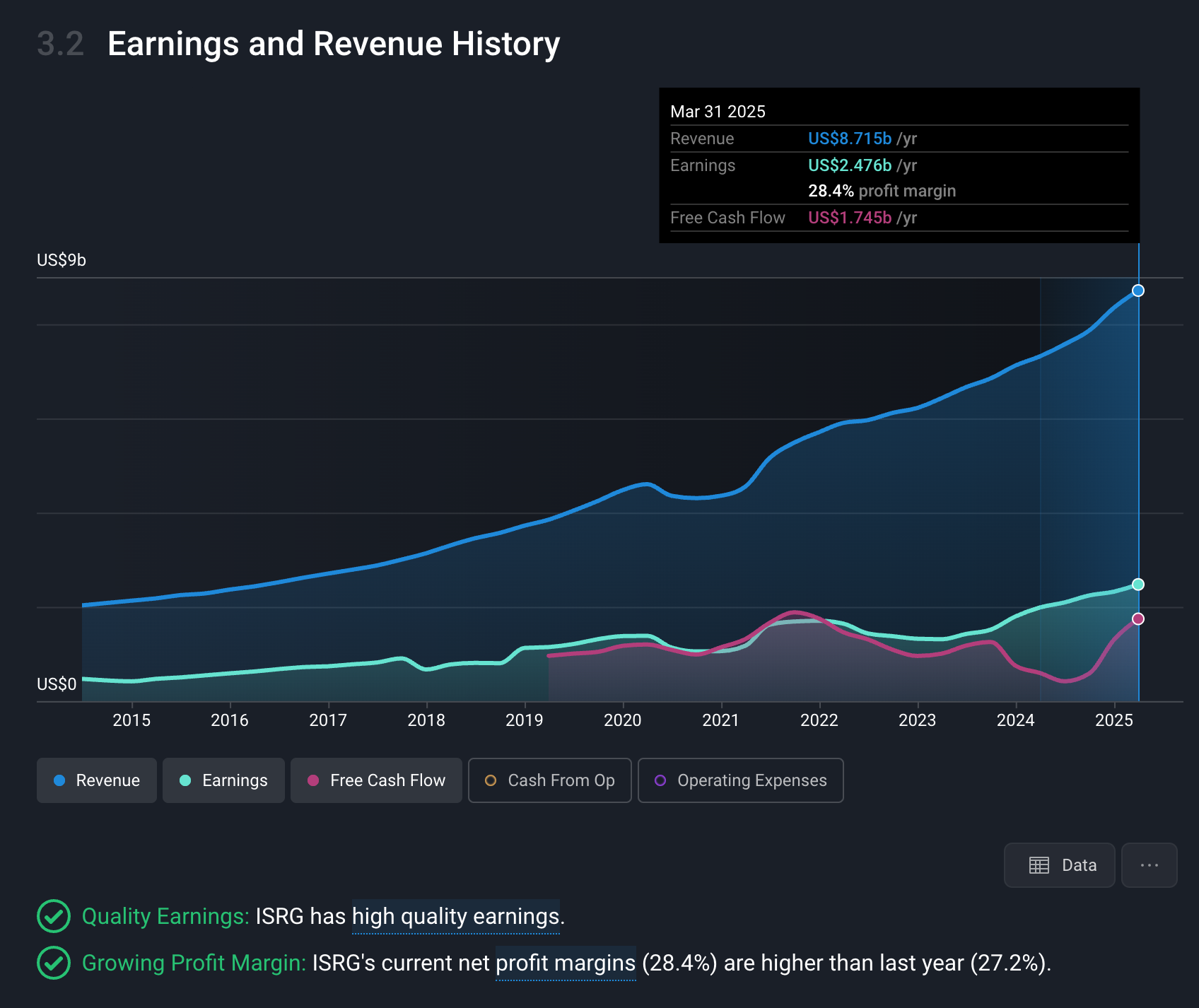

🏥 Surgical Robotics: Systems allowing surgeons greater precision, often for minimally invasive procedures. This is an industry with high R&D spend, strict regulations, and strong Intellectual Property advantages. Examples include: Intuitive Surgical, Medtronic, and Accuray.

Intuitive Surgical stands out in this space, with consistent revenue growth over the last 10 years.

🚕 Autonomous Vehicles & Robo-taxis

In the US, the robotaxi race is now dominated by two companies, Tesla and Alphabet’s Waymo . However, a few Chinese companies are also developing systems.

We covered robotaxis in more detail in September , and we’ll do another update later in the year.

🛩️ Drone Technology (UAVs)

Some parts of the automation industry (ie, robotaxis) are progressing slower than many anticipated.

On the flip side, drone technology has progressed faster than expected.

They’ve been a major feature of the war in Ukraine, but are also seeing widespread use for aerial photography, surveillance, agriculture, infrastructure inspection, and other industries.

The next frontier is delivery by autonomous drone. It’s not a secret that Amazon and a few other companies are testing and in some cases already deploying drone technology.

Other Applications

We haven’t covered every single application here. There are other industries where autonomous robots, vehicles, and drones have obvious uses.

Here are just a few:

- 🚀 Space Exploration (reusable rockets)

- 🏰 Defense

- 👮 Policing and security

- ☢️ Handling hazardous materials and explosives

- 🏚️ Disaster relief

🛠️ The Automation & Robotics Ecosystem

Much like the AI and semiconductor industry, there’s a much larger ecosystem supporting the development of automation and robotics technologies.

- Component Manufacturers (The "Picks & Shovels"):

- Sensors (vision, LiDAR, force/torque).

- Actuators & Motors.

- Controllers & Processors.

- End-effectors/Grippers.

- Semiconductor and electronic component companies are key here. Special mention should be made for Nvidia , as enabling robotics is a key objective for the company.

- 🧑💻 Software and AI Developers:

- Robot Operating Systems (ROS) & Control Software: Platforms for robot apps.

- Machine Learning & AI for Robotics: Algorithms for perception, navigation, decision-making. The "intelligence."

- Simulation & Digital Twin Technology: Virtual design, testing, and optimization.

- 🔀 System Integrators & Solutions Providers:

- Design and implement complete robotic solutions for end-users, combining robots, software, and components.

- 🛜 Enabling Technologies:

- IoT & Connectivity (e.g., 5G): Seamless communication.

- Cloud Robotics: Cloud computing for data, processing, shared learning.

- Cybersecurity for Robotics: Protecting connected, autonomous robots.

🌍 Geographical Focus: Where are the Robotics Hotspots?

The automation and robotics sector has notable geographical diversity, which makes a nice change given the dominance of US companies in most sectors.

- 🇺🇸 USA: Strong in AI, software, AVs (Waymo, Tesla), surgical robotics (Intuitive Surgical), and logistics automation.

- 🇯🇵 Japan: A traditional industrial robotics powerhouse (Fanuc, Yaskawa); pushing service robots for elder care.

- 🇩🇪 Germany: Known for "Industrie 4.0" and strong in industrial robotics (KUKA) for manufacturing.

- 🇨🇳 China: A rapidly growing force in robot production and adoption, backed by government support. Big in AI, drones (DJI).

- 🇰🇷 South Korea: High robot density in electronics manufacturing.

- 🇨🇭 Switzerland: Hub for precision engineering, cobots (ABB).

- 🇨🇦 Canada: Growing AI research, strengths in industrial automation components.

- 🇬🇧 UK: Strong academic research, emerging niche companies.

🔍 Finding Investment Opportunities In Automation

There are hundreds of listed companies involved in the robotics revolution in one way or another.

✨ As is often the case, checking the holdings of thematic ETFs is one way to find companies you may not have heard of.

Often, these types of ETFs take a very broad view when deciding which companies qualify for inclusion. The following ETFs actually do a good job of sticking to what the label says.

Better yet, they include companies from around the globe, so you aren’t limited by your home market. Here are a few:

- VanEck Robotics ETF (IBOT)

- Global X Robotics & Artificial Intelligence ETF (BOTZ)

- Global X Global Robotics & Automation Index ETF (ROBO)

- Pacer BlueStar Engineering the Future ETF (BULD)

You can check the largest 15 holdings in these ETFs at etfdb.com .

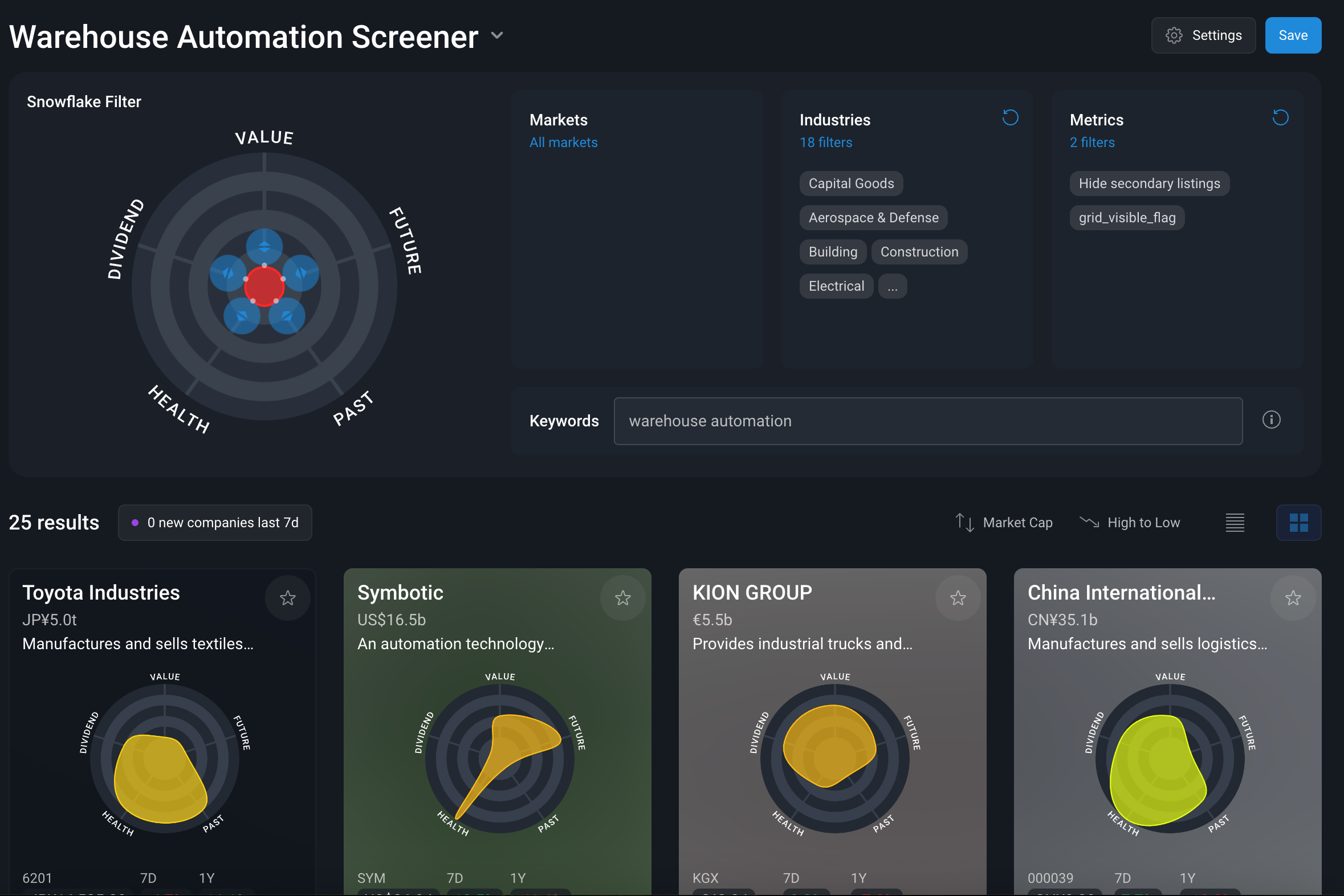

You can also use the Simply Wall St Stock Screener to find niche companies that may be overlooked.

Besides filtering by Country, Industry and Sector, and Financial Metrics you can also search using Keywords.

This is especially useful for a diverse theme like robotics. Since "robotics" isn't always a distinct industry classification, use keywords in the company description search.

- 🚚 Identifying "Logistics Automation" Players: Search "Industrials" or "Software" with keywords like "warehouse automation," "logistics robots," or "AGV."

- 🩺 Uncovering "Surgical Robotics" Companies: Use keywords "surgical robot" or "robotic surgery," as they might not all be in "Healthcare Equipment."

The screener below lists companies that include ‘warehouse automation’ in their profile.

💡 The Insight: There Are Many Ways to Diversify Your Bets Across the Automation & Robotics Ecosystem

There are already some exciting companies in the robotics space, and more are likely to emerge in the next decade.

Humanoid robots and flying cars are cool and all, but will they deliver for investors? If you think about the demand side of things, the industry does have a lot going for it.

There are a few things to keep in mind with these types of companies:

- 💰 Robotics is very capital-intensive. Not only do these machines need GPUs to power their ‘brains’, but moving parts need to be developed, built, and tested.

- 📅 Breakeven delays: There’s a good chance reaching breakeven will take longer and cost more than anticipated.

- 📊 Lower Margins: They aren’t software stocks with 80% gross margins either.

- 🤑 Raising more capital: Companies developing these technologies often need to raise new capital, and to do that, they’re likely to present the most rose-tinted outlook they can.

✨ All of this needs to be considered when assessing the companies that are prone to being over-hyped.

This doesn’t mean you should avoid the disruptors and innovators, but there are lots of ways to hedge your bets.

This industry stands to benefit from strong secular trends for a long time. As we mentioned last week, Warren Buffett generated great returns investing in companies that compounded slowly and steadily.

The robotics and automation industry includes innovators, companies with decades-long track records, and, of course, all the other companies in the value chain.

Keep a lookout for companies getting the Human Robot Synergy right.

✨ Machines are already beating humans at many tasks. But humans collaborating with robots will probably beat machines working on their own. The companies that excel at developing intuitive human-robot interfaces and collaborative systems could be long-term winners.

Key Events During the Next Week

Tuesday

- RBA Interest Rate Decision

- 📊 Forecast : 3.85%, down from 4.1%

- ➡️ Why it matters: Australia’s economy needs some relief on rates. Lenders are already cutting rates in anticipation of a 0.25% cut, while some economists are calling for a 0.5% cut.

- 🇨🇦 Canada Consumer Price Index (YoY)

- 📊 Forecast : 2.5%, Previous: 2.3%

- ➡️ Why it matters: Canada has effectively suspended most retaliatory tariffs on US imports, but economists still expect some inflationary pressure in the near term.

Wednesday

- 🇯🇵 Japan Balance of Trade

- 📊 Forecast : ¥ -200.0 billion, up from ¥ 544.1 billion

- ➡️ Why it matters: Japan’s trade balance was abnormally high in February and March, possibly due to front-running of tariffs. It’s believed to have swung to a deficit in April.

- 🇬🇧 United Kingdom Consumer Price Index (CPI) (YoY)

- 📊 Forecast : 3.3%, up from 2.6%

- ➡️ Why it matters: The expected increase in prices will be bad news for consumers and businesses hoping for more rate cuts.

- 🇺🇸 United States Existing Home Sales

- 📊 Forecast : 3.9 million, down from 4.02 million

- ➡️ Why it matters: Home sales data could provide insights about the effect ‘Trumpanomics’ is having on the housing market.

Thursday

- 🇪🇺 Eurozone HCOB Manufacturing PMI (Flash)

- 📊 Forecast : 49.2, up from 49

- ➡️ Why it matters: This isn’t a widely followed indicator, but it is regarded as a leading indicator for business sentiment. This is particularly relevant given the current economic uncertainty.

We’re now in the back half of Q1 earnings season, which means most of the notable companies reporting are retailers and software companies:

- Home Depot

- Intuit

- PDD Holdings

- TJX Companies

- Lowe's Companies

- Palo Alto Networks

- Analog Devices

- Medtronic

- Workday

- Autodesk

- Snowflake

- Target Corporation

- Baidu

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.