Last Update 03 Jul 25

Fair value Decreased 24%Hims: The Platform Powering Personalised Healthcare

Update: Still Compelling, but Caution Warranted After Novo Nordisk Fallout

Hims & Hers Health (HIMS) has been one of the most impressive growth stories in public markets, but recent developments have introduced material uncertainty in the medium term. While I remain confident in the long-term thesis, I’m becoming more cautious as regulatory tensions begin to affect execution.

Recent Performance: Hypergrowth Continues

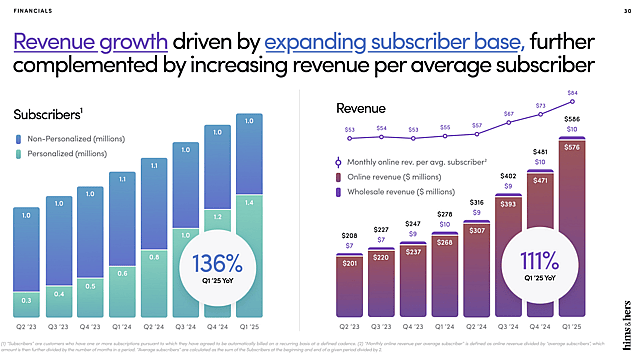

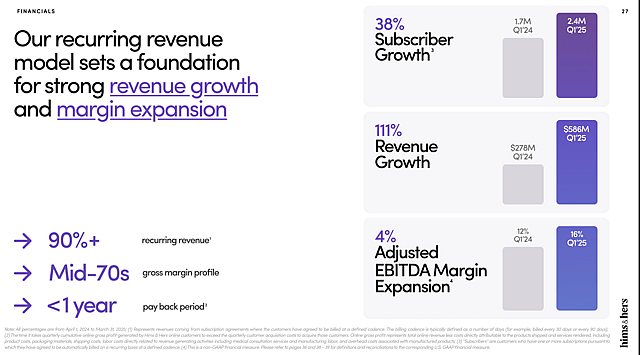

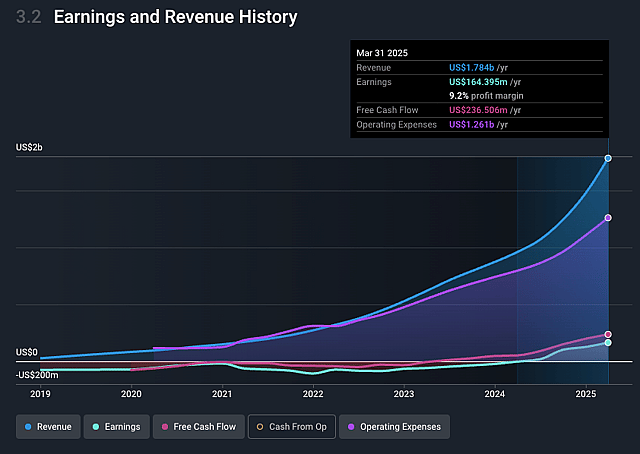

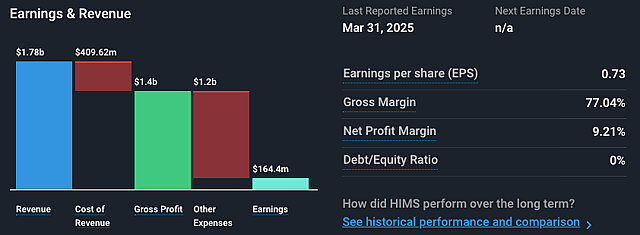

Q1 2025 revenue reached $586M, up 111% year over year. Net income quadrupled to $49.5M. Subscriber growth remained strong at 2.4 million, up 38% year over year, while ARPU climbed 53% to $84. The company generated $109M in operating cash flow and $50M in free cash flow. Adjusted EBITDA margin topped 15%, highlighting strong underlying profitability.

Even excluding the new GLP-1 segment, the core business grew approximately 43% in 2024, a sign of healthy demand across established categories.

Novo Nordisk Fallout: A Medium-Term Overhang

In April, Hims announced a partnership with Novo Nordisk to offer Wegovy through its platform. Just two months later, Novo abruptly cancelled the deal, citing concerns about Hims continuing to offer compounded semaglutide after the FDA ended the shortage designation. This led to a 35% single-day drop in the share price.

While Hims has since halted sales of compounded semaglutide and reaffirmed its full-year guidance, this episode underscores how quickly regulatory changes can impact operations. It also signals a potential shift toward tighter oversight of compounding practices and telehealth prescribing.

Long-Term Vision Intact, but Execution Risk Has Risen

Hims is still targeting $6.5B in revenue and $1.3B in adjusted EBITDA by 2030, implying a 22% CAGR. The long-term opportunity remains significant. However, the road ahead may be slower and more complex.

This is no longer just a story of fast growth. Hims must now prove it can scale while navigating a shifting regulatory landscape, maintain trust with partners, and avoid further compliance setbacks. The loss of the Wegovy partnership is not a thesis breaker, but it is a reality check.

Positioning

I continue to hold my position. My long-term conviction is intact, particularly given the strength of the core business and the company's ambition to become a vertically integrated healthcare platform. That said, I’m watching the regulatory narrative closely as it will likely shape the pace of growth in the quarters ahead.

Summary

- Platform Play, Not a Pill Company: Hims is building the infrastructure for personalised, direct-to-consumer healthcare across diagnostics, treatment, and prevention, similar to what Amazon did for retail and Spotify for music.

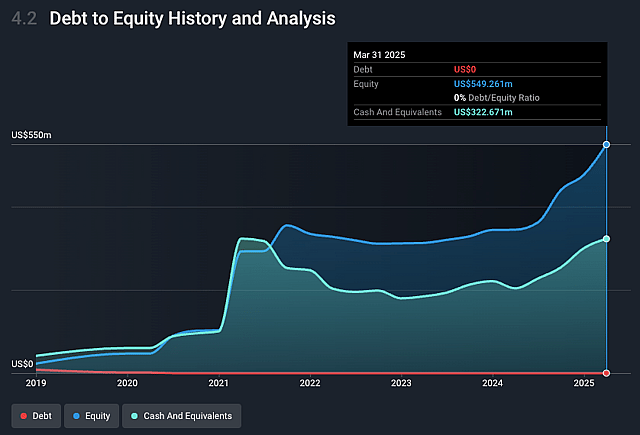

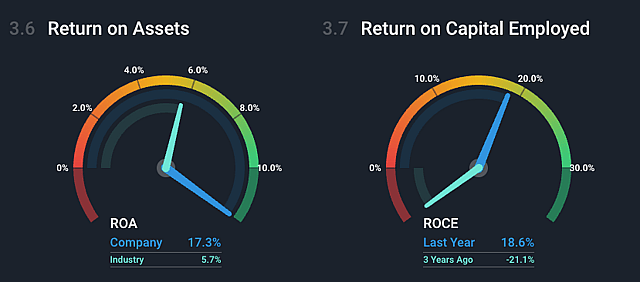

- Strong Fundamentals with Operating Leverage: The company is growing fast, generating free cash flow, and scaling efficiently, with rising margins, high retention, and zero debt.

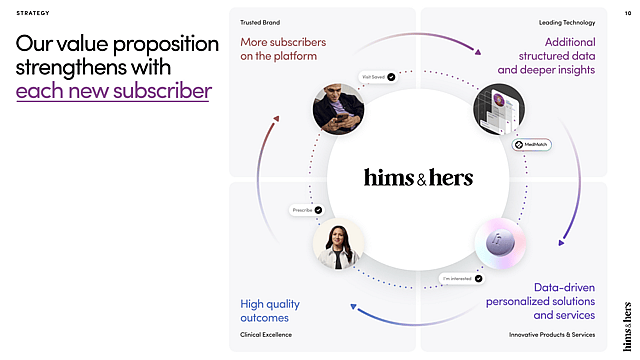

- Personalisation Drives Retention and Monetisation: With 60% of users on personalised plans, Hims is increasing user stickiness and average revenue per subscriber, reinforcing its moat.

- Regulatory and Legal Risks Are Real, but Strategic: Hims is pushing the boundaries of healthcare regulation, particularly with GLP-1s, but has diversified offerings and strong partnerships to weather industry pushback.

- Long-Term Asymmetric Opportunity: At <$50/share and a $10B market cap, Hims offers a rare venture-style return profile in public markets—with potential to become healthcare’s top-of-funnel platform.

---------------------------------------------------------------------------------------------------------------------------------------------

The Case for Hims

Hims & Hers Health isn’t a telehealth gimmick or a GLP-1 hype stock; it’s quietly becoming the top-of-funnel infrastructure layer for healthcare in the United States. It is executing a strategy similar to Amazon, Spotify, and Costco: deliver more value per dollar spent, reinvest scale advantages, and win via customer-centric efficiency. But unlike those companies, Hims operates in a $4T market that desperately needs reinvention.

This is a company not trying to compete with traditional healthcare, it’s rewriting the rules. Hims is vertically integrating diagnosis, fulfilment, treatment, and retention under one platform, avoiding insurance entirely, and personalising care at scale. The result? Faster growth, higher margins, and better patient outcomes.

Company Overview

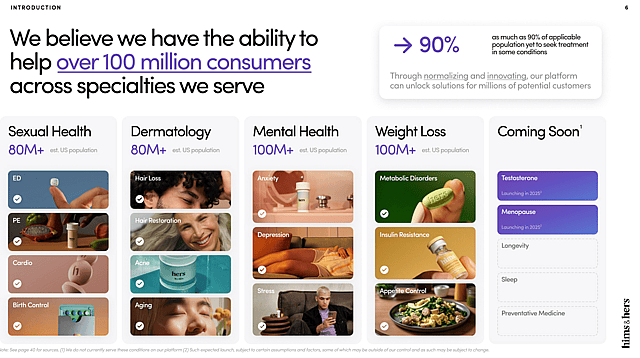

Founded in 2017, Hims offers subscription-based healthcare services across multiple verticals:

- Established: Sexual health, mental health, dermatology

- Scaling: Weight loss (GLP-1), hormone optimization, menopause

- Emerging: Longevity, cardiovascular, peptides, pain management

With 2.4M subscribers (up 38% YoY) and 60% now on personalised plans (up from 30% YoY), Hims is building a lock-in model. ARPU reached $84 in Q1 2025 (+53% YoY), driven by personalisation, daily-use products, and platform engagement.

The company recently acquired Tribe Health for lab testing and expanded its fulfillment footprint by 75%, positioning itself to deliver diagnostics + treatment + prevention in one stack.

Fundamentals & Past Performance

Hims is demonstrating rare execution: fast growth, rising profitability, and increasing efficiency all at once. The company is not only expanding its subscriber base but also deepening engagement through personalised care, which boosts retention and monetisation. Despite the complexity of launching new healthcare verticals, Hims is managing to grow without sacrificing margins or operational discipline. It’s already cash-flow positive, carries no debt, and has the financial strength to keep investing in infrastructure and innovation, without relying on outside capital. Simply put, Hims is proving it can scale sustainably.

Growth Catalysts

1. Deepening Personalisation

- More personalisation = more retention, better outcomes, higher ARPU.

- 60% of users are now in personalised plans, driving 10% better retention on average.

2. Weight Loss Partnerships

- GLP-1 strategy de-risked via branded Novo Nordisk partnership (Wegovy) and branded Eli Lilly products (Zepbound, Mounjaro).

- Management indicated this is a blueprint for future pharma integrations.

3. Diagnostics + Lab Testing

- Tribe Labs acquisition powers at-home biomarker tracking.

- Enables verticals like testosterone, menopause, cardiovascular health, and longevity.

- Vision: Annual diagnostics + personalisation = a preventative health utility.

4. Platform Expansion

- Peptide-based therapies are next, with a manufacturing facility already acquired.

- Peptides could enable new treatments for chronic and degenerative conditions—deflationary and transformative.

5. World-Class Leadership

- New COO Nader Kabbani (ex-Amazon) brings expertise from Amazon Pharmacy, Kindle, Prime, and global ops, ideal for scaling Hims to global healthcare infrastructure.

Risks: Legal, Regulatory, and Strategic Tensions

1. GLP-1 & 503A Loophole Scrutiny

- Critics argue personalising semaglutide at scale under 503A exemptions may violate pharma IP and FDA frameworks.

- If regulators intervene, parts of the vertical could be shut down, but core weight loss revenue is from oral and Liraglutide, which remain compliant.

- Strategic partnerships further mitigate long-term risk.

2. Big Pharma and Big Tech Competition

- Hims is a deflationary force in a historically protected industry.

- Big Pharma may seek to litigate or lobby against Hims to preserve high-margin drug distribution models.

- Amazon (via One Medical, PillPack, and Amazon Pharmacy) and Apple (with Apple Watch increasingly a health-monitoring device) both pose long-term threats if they expand more aggressively into consumer healthcare.

- However, Hims' first-mover advantage, vertically integrated infrastructure, and consumer trust give it a meaningful head start.

3. FDA Action on Advertising

- Super Bowl ads and bold claims like “⅔ the weight loss for ⅓ the price” may attract regulatory scrutiny.

- If proven misleading, fines or restrictions could follow. That said, the strong subscriber growth and retention suggest real efficacy behind the messaging.

4. Prescribing Practice Risk

- Critics argue that Hims’ onboarding and prescription processes may be too light-touch.

- If regulators tighten standards, or medical boards flag overprescribing, Hims may be forced to increase compliance overhead.

5. Execution Complexity

- Simultaneously managing new verticals (GLP-1s, hormones, peptides, diagnostics) poses coordination, clinical, and regulatory risks.

- Any operational slip could erode user trust or delay growth.

6. Short Interest & Sentiment Volatility

- With ~33% of float shorted, sentiment remains fragile.

- Insider selling and polarised public narratives (especially around legality or ethics) may weigh on investor confidence, despite consistent execution.

Valuation

Using a DCF model:

- Revenue CAGR: ~29% through 2030

- Net profit margins: Expanding toward 15%

- WACC: 8%, Terminal growth: 3%

We estimate a fair value of $114/share.

At around $35/share as of May 2025, Hims trades at less than half our estimated $114 fair value, despite rapid growth, expanding margins, zero debt, and growing penetration across high-value healthcare verticals. This is a rare chance to own a profitable, fast-scaling platform early in its evolution into a category-defining business.

How well do narratives help inform your perspective?

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NYSE:HIMS. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.