Last Update07 May 25Fair value Decreased 3.12%

Key Takeaways

- Accelerated adoption of digital health, personalized treatments, and operational efficiencies is driving lasting revenue growth and improved profitability.

- Strategic partnerships, advanced technology integration, and expanding offerings increase cross-selling, retention, and global market potential.

- Increasing regulatory, consumer, and competitive pressures threaten margins, marketing efficiency, and revenue growth, especially given limited product differentiation and reliance on digital advertising.

Catalysts

About Hims & Hers Health- Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

- The expanding comfort and preference among consumers for digital and telehealth solutions continues to accelerate platform adoption, as evidenced by Hims & Hers surpassing 2.4 million subscribers and maintaining subscriber growth rates near 40 percent year-over-year. This positions the company to capture a rapidly growing share of healthcare spend shifting from in-person to online, directly driving long-term topline revenue growth.

- Hims & Hers’ rapidly expanding portfolio of highly personalized, subscription-based treatments—including recent moves into weight loss, hormone health, and upcoming longevity and preventative offerings—unlocks longer customer lifetimes and cross-selling potential, supporting higher average revenue per user and improved retention rates, both of which underpin sustained revenue expansion and margin improvement.

- The company's investments in data-driven, vertically integrated care (such as proprietary fulfillment, lab diagnostics, automation, and peptide manufacturing) are enabling both broader and deeper personalization at scale, while lowering unit costs. These operational efficiencies translate to expanding gross and EBITDA margins as the business scales, providing a platform for outsized earnings growth.

- High advocacy, organic acquisition, and growing brand recognition are enabling the company to reduce marketing spend as a percentage of revenue, as seen by an 8-point year-over-year efficiency gain. This structural improvement in customer acquisition costs should continue to provide operational leverage and support expanding net margins as the subscriber base matures.

- Strategic partnerships with global pharmaceutical leaders like Novo Nordisk, combined with advancements in wearable-integrated diagnostics and AI-powered care, pave the way for both new specialty launches and global expansion. These catalysts position Hims & Hers to tap into new markets, increase its addressable market, and deliver both outsized revenue growth and margin expansion in the years ahead.

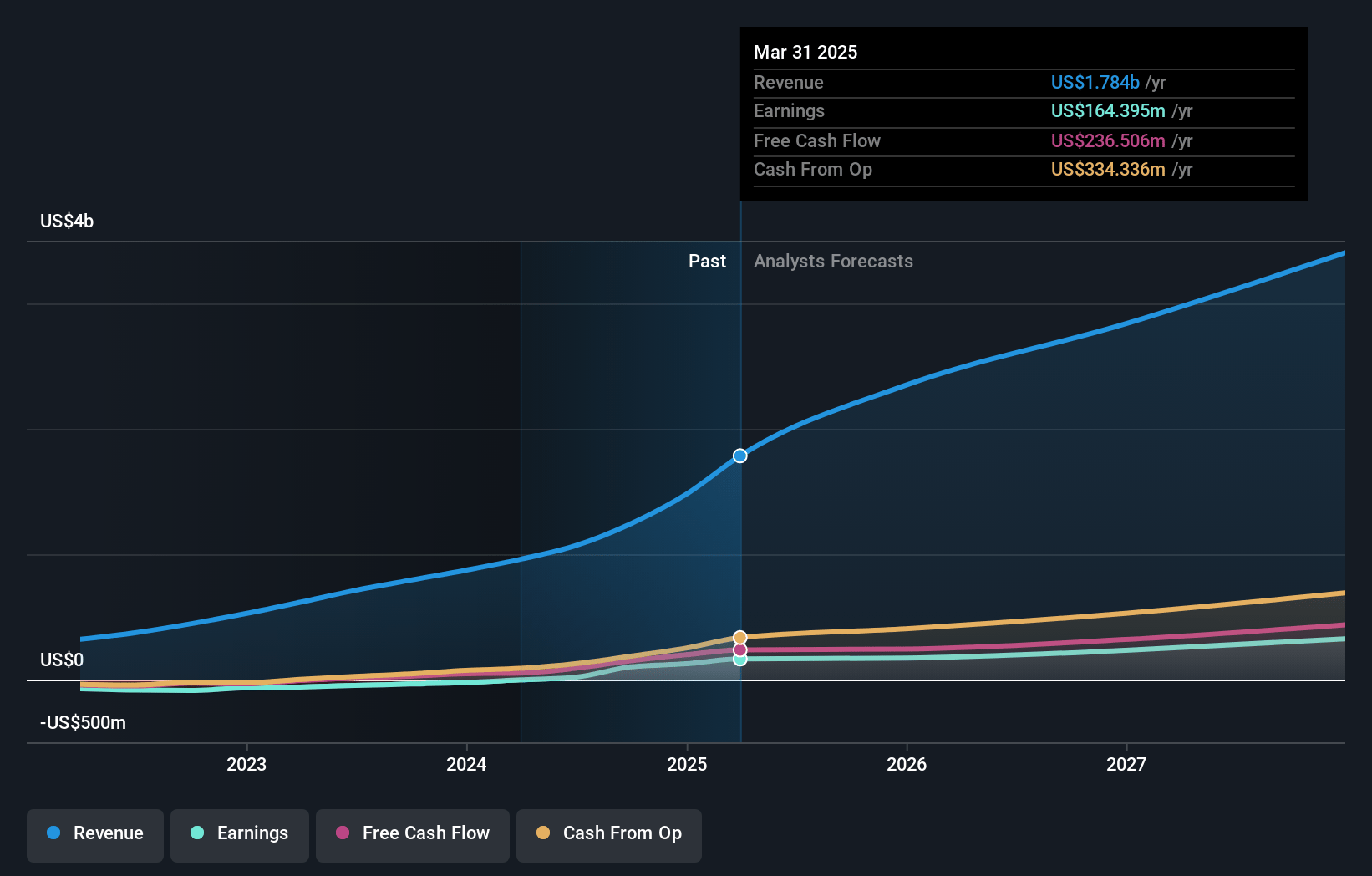

Hims & Hers Health Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hims & Hers Health compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hims & Hers Health's revenue will grow by 30.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.2% today to 12.7% in 3 years time.

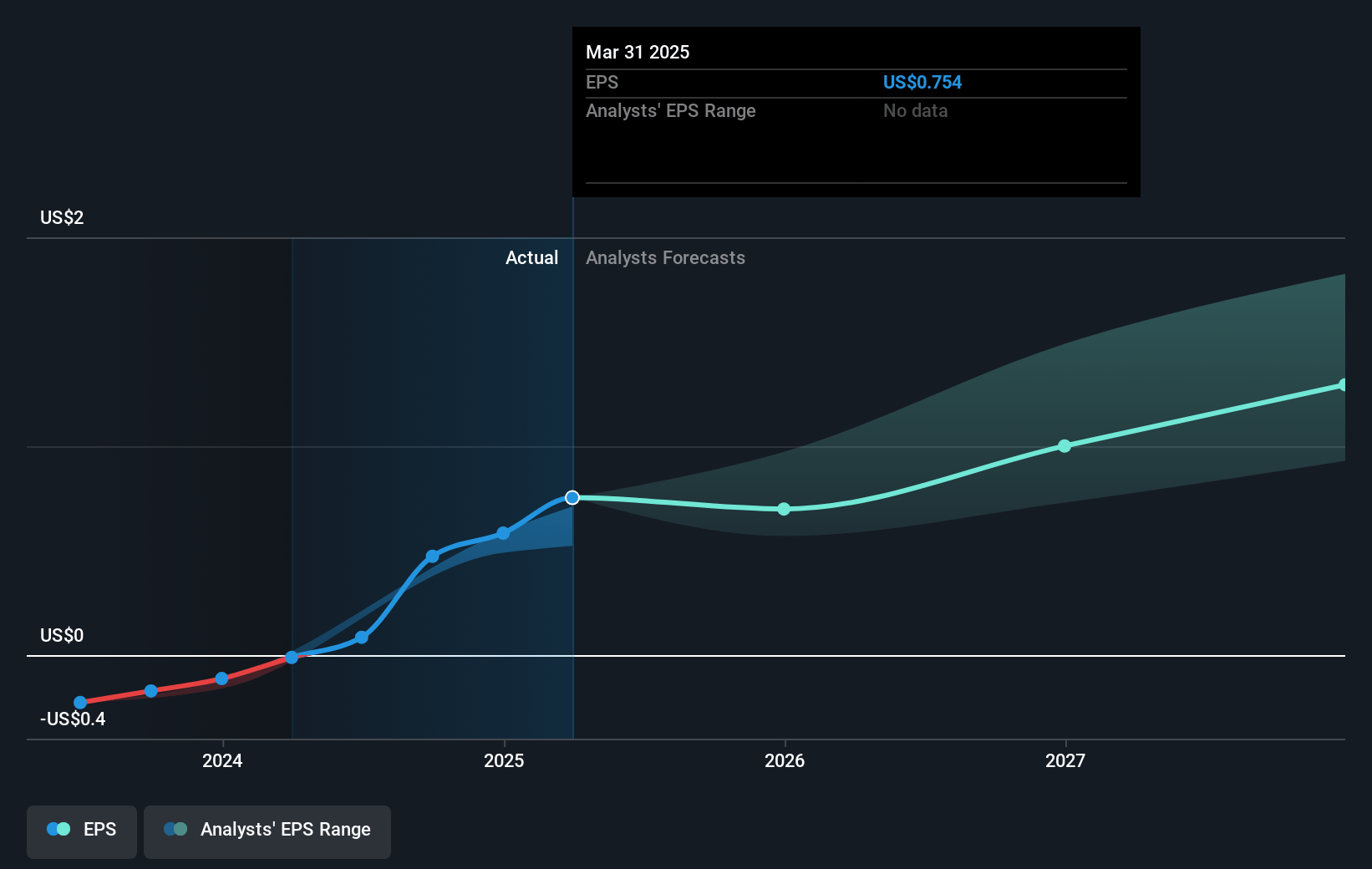

- The bullish analysts expect earnings to reach $499.9 million (and earnings per share of $2.08) by about May 2028, up from $164.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 46.7x on those 2028 earnings, down from 67.4x today. This future PE is greater than the current PE for the US Healthcare industry at 19.7x.

- Analysts expect the number of shares outstanding to grow by 4.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Hims & Hers Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising regulatory scrutiny around digital health privacy, data security, and the use of personalized medical data could drive significant increases in compliance and operational costs for Hims & Hers Health over the coming years, which may pressure operating margins and limit the scope of growth initiatives.

- Consumer skepticism and increased public scrutiny around direct-to-consumer wellness and digital health products—especially as public awareness of health misinformation, compounding practices, and side effect risks rises—may erode customer trust, reduce conversion rates, and pose risks to revenue growth and brand equity.

- Heightened competition from both established healthcare systems, large pharmacy chains, and technology giants entering digital health could squeeze Hims & Hers Health’s market share, potentially drive down pricing, and constrain long-term margin expansion.

- The company’s continued heavy reliance on digital advertising for customer acquisition, at a time when platform ad costs are rising and data privacy restrictions are tightening, could diminish marketing efficiency and require higher spend to sustain revenue growth, thus compressing EBITDA margins over time.

- Limited differentiation in core products like generic medications (e.g., for hair loss, ED, and weight loss), combined with the risk of regulatory clampdowns on online prescribing or compounded drugs, may lead to commoditization, pricing pressures, and a potential plateau in revenue and gross profit, especially if geographic or category expansion efforts do not deliver expected growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hims & Hers Health is $77.02, which represents two standard deviations above the consensus price target of $44.03. This valuation is based on what can be assumed as the expectations of Hims & Hers Health's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.9 billion, earnings will come to $499.9 million, and it would be trading on a PE ratio of 46.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $49.47, the bullish analyst price target of $77.02 is 35.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.