- United States

- /

- Banks

- /

- NYSE:CPF

3 Dividend Stocks To Consider With Yields Up To 3.8%

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq hit new highs, reflecting strong corporate earnings and positive economic data, investors are increasingly looking for stable income sources in a market characterized by volatility and record-breaking indices. In this environment, dividend stocks with attractive yields up to 3.8% offer potential stability and income, making them a compelling consideration for those seeking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.98% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.70% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.37% | ★★★★★★ |

| Ennis (EBF) | 5.54% | ★★★★★★ |

| Dillard's (DDS) | 5.22% | ★★★★★★ |

| Credicorp (BAP) | 4.64% | ★★★★★☆ |

| CompX International (CIX) | 4.90% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.17% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.84% | ★★★★★☆ |

| Carter's (CRI) | 9.77% | ★★★★★☆ |

Click here to see the full list of 140 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

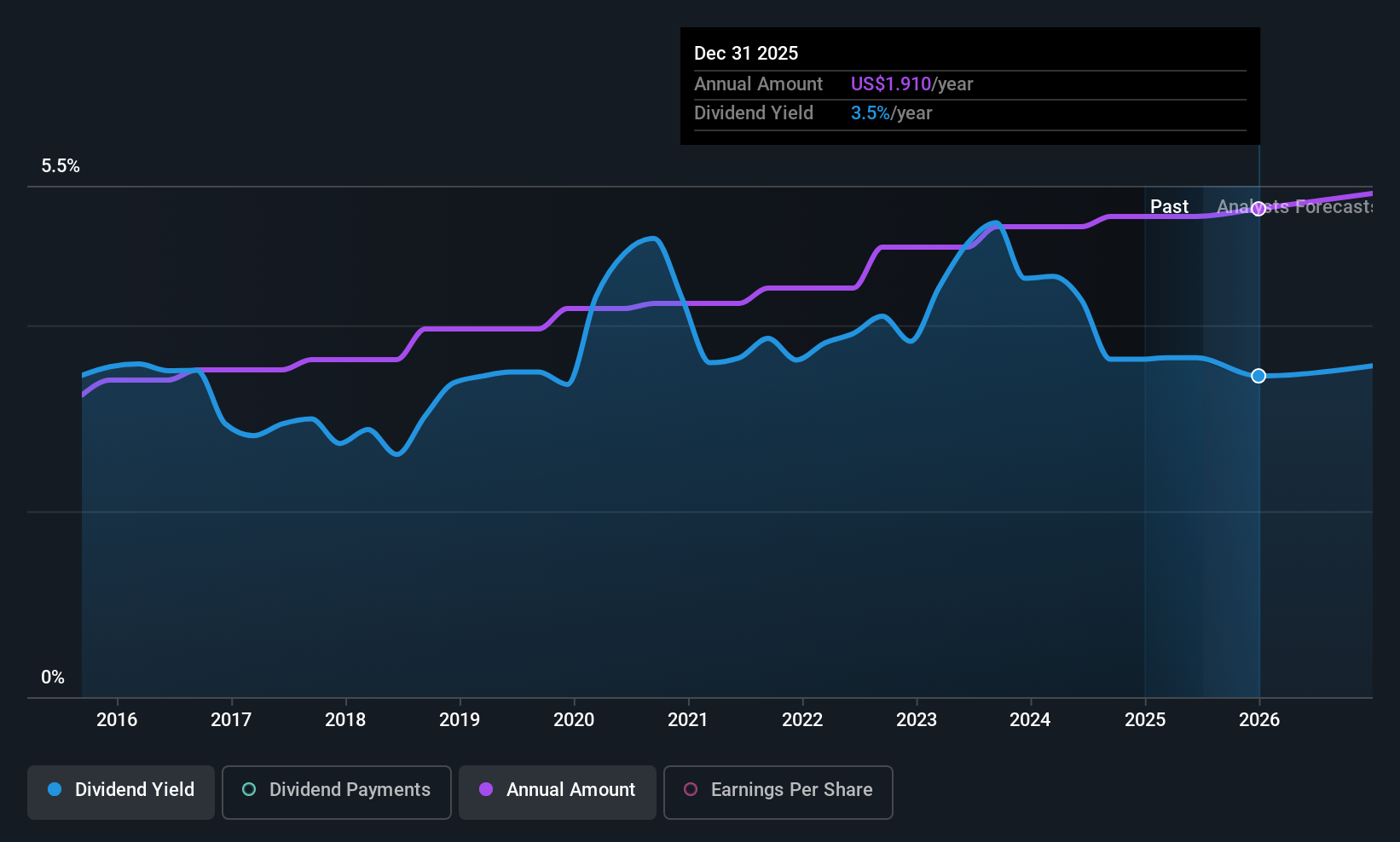

Community Trust Bancorp (CTBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Community Trust Bancorp, Inc. is the bank holding company for Community Trust Bank, Inc., with a market capitalization of approximately $1.03 billion.

Operations: Community Trust Bancorp, Inc. generates its revenue through its role as a bank holding company for Community Trust Bank, Inc.

Dividend Yield: 3.4%

Community Trust Bancorp offers a stable dividend profile with a recent increase to $0.53 per share, reflecting consistent growth over the past decade. Its dividends are well-covered by earnings, supported by a low payout ratio of 37%. Despite its reliable history, the current yield of 3.37% is below the top quartile in the U.S. market. Recent earnings reports show strong growth in net income and interest income, which may support continued dividend stability.

- Dive into the specifics of Community Trust Bancorp here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Community Trust Bancorp is priced lower than what may be justified by its financials.

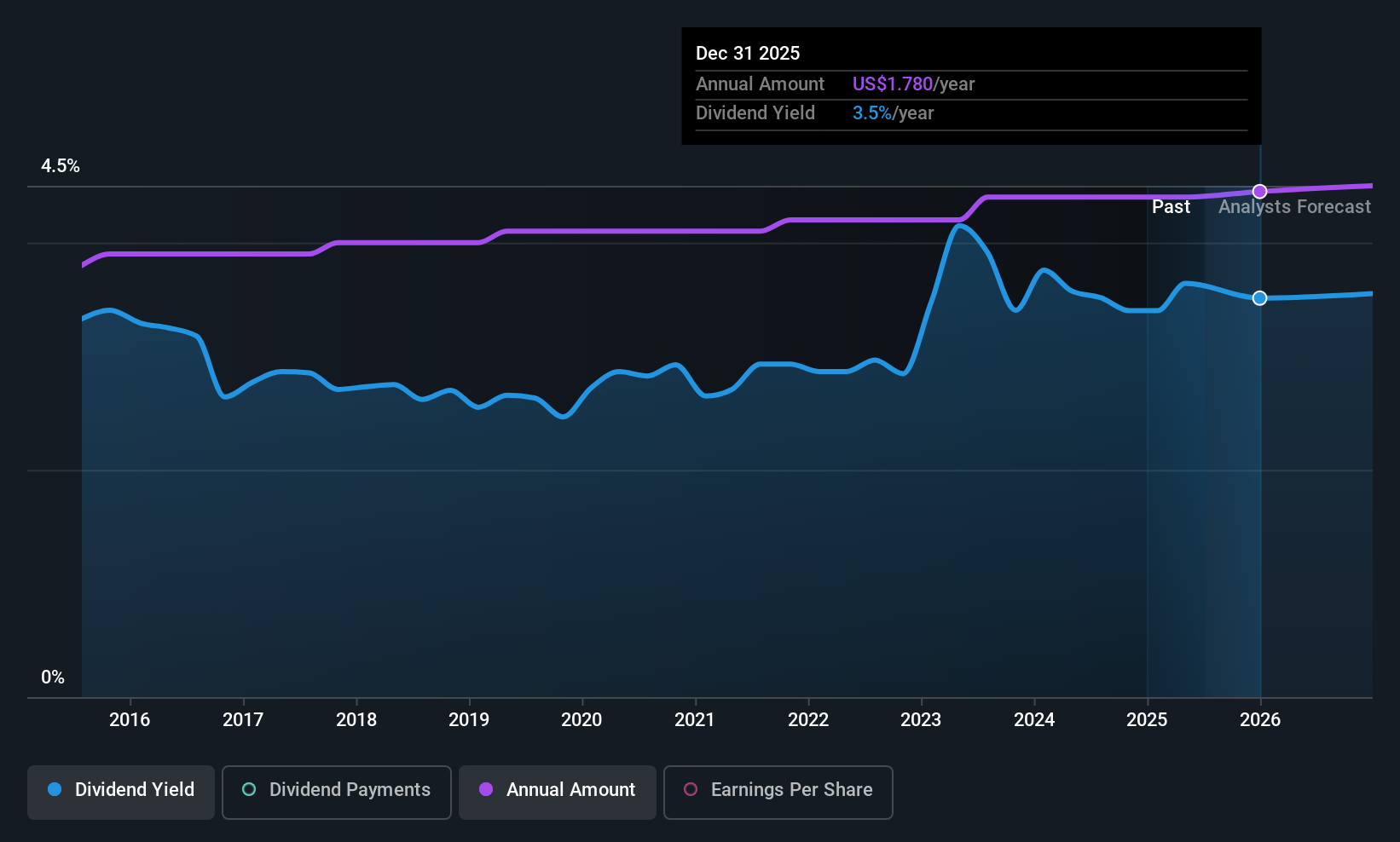

Westamerica Bancorporation (WABC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Westamerica Bancorporation is a bank holding company for Westamerica Bank, offering a range of banking products and services to individual and commercial clients in the United States, with a market capitalization of approximately $1.28 billion.

Operations: Westamerica Bancorporation generates its revenue primarily from its banking segment, which accounted for $274.79 million.

Dividend Yield: 3.8%

Westamerica Bancorporation's dividend stability is underscored by a decade of consistent payments and recent affirmation of a $0.46 per share quarterly dividend, payable August 15, 2025. Despite being 61.4% below estimated fair value and offering a reliable yield of 3.76%, it trails the top U.S. quartile for dividend payers at 4.51%. Recent earnings show declines in net interest income and net income compared to last year, though dividends remain well-covered with a payout ratio of 37.2%.

- Unlock comprehensive insights into our analysis of Westamerica Bancorporation stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Westamerica Bancorporation shares in the market.

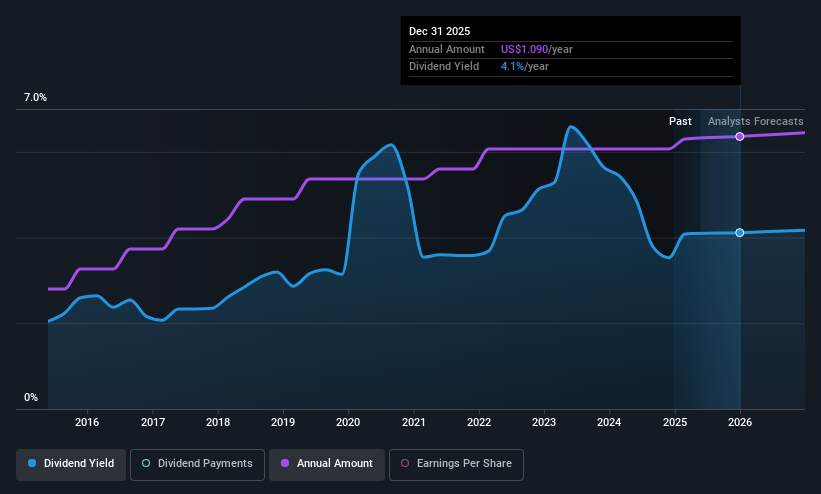

Central Pacific Financial (CPF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Pacific Financial Corp. is the bank holding company for Central Pacific Bank, offering a variety of commercial banking products and services to businesses, professionals, and individuals in the United States, with a market cap of $767.47 million.

Operations: Central Pacific Financial Corp. generates its revenue primarily through its banking segment, which accounted for $247.71 million.

Dividend Yield: 3.9%

Central Pacific Financial maintains a reliable dividend history, recently affirming a $0.27 quarterly payout. Although its 3.88% yield lags behind the top U.S. quartile, it remains well-covered with a 48.8% payout ratio and has shown stability over the past decade. Recent earnings growth supports sustainability, with net interest income rising to US$59.8 million in Q2 2025 from US$51.92 million last year, despite increased net charge-offs of US$4.7 million this quarter.

- Get an in-depth perspective on Central Pacific Financial's performance by reading our dividend report here.

- The analysis detailed in our Central Pacific Financial valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Take a closer look at our Top US Dividend Stocks list of 140 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPF

Central Pacific Financial

Operates as the bank holding company for Central Pacific Bank that provides a range of commercial banking products and services to businesses, professionals, and individuals in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)