- United States

- /

- Metals and Mining

- /

- NYSE:CDE

March 2025's Top Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge following a temporary reprieve from tariffs on automakers, investors are keenly observing the fluctuations in major indices like the Dow Jones Industrial Average and S&P 500, which have recently rebounded after consecutive days of losses. In light of these market dynamics, identifying stocks that may be trading below their fair value can present unique opportunities for investors looking to capitalize on potential growth amid shifting economic conditions and policy developments.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $17.62 | $34.83 | 49.4% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.23 | $21.94 | 48.8% |

| First National (NasdaqCM:FXNC) | $23.50 | $46.37 | 49.3% |

| Gilead Sciences (NasdaqGS:GILD) | $115.44 | $229.94 | 49.8% |

| Brunswick (NYSE:BC) | $57.91 | $114.32 | 49.3% |

| Full Truck Alliance (NYSE:YMM) | $13.26 | $26.21 | 49.4% |

| Live Oak Bancshares (NYSE:LOB) | $30.05 | $58.72 | 48.8% |

| JBT Marel (NYSE:JBTM) | $131.16 | $260.99 | 49.7% |

| Coeur Mining (NYSE:CDE) | $5.61 | $11.15 | 49.7% |

| Nutanix (NasdaqGS:NTNX) | $77.10 | $153.46 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

German American Bancorp (NasdaqGS:GABC)

Overview: German American Bancorp, Inc. is a financial holding company for German American Bank, offering retail and commercial banking services, with a market cap of $1.47 billion.

Operations: The company's revenue segments include Core Banking generating $196.36 million, Wealth Management Services contributing $14.57 million, and Insurance bringing in $4.38 million.

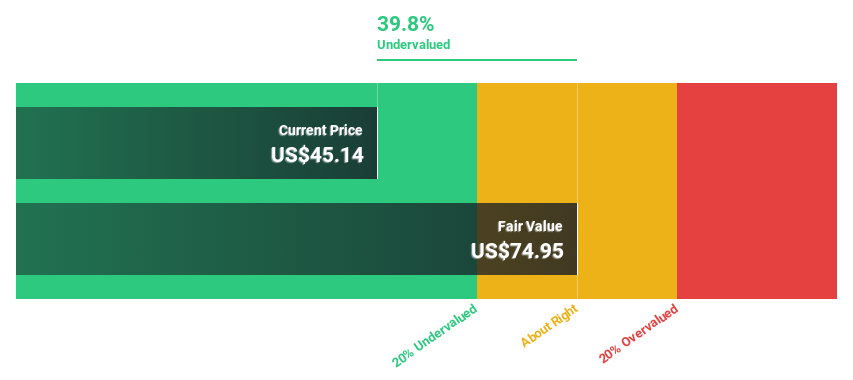

Estimated Discount To Fair Value: 48.4%

German American Bancorp is trading at US$38.9, significantly below its estimated fair value of US$75.38, suggesting it may be undervalued based on cash flows. The company forecasts earnings growth of 23.5% annually, outpacing the broader U.S. market's 13.9%. Despite a recent decline in net income to US$83.81 million for 2024, GABC increased its quarterly dividend by 7.4%, reflecting confidence in future cash flows and financial stability amidst executive board changes post-merger with Heartland Bank.

- According our earnings growth report, there's an indication that German American Bancorp might be ready to expand.

- Take a closer look at German American Bancorp's balance sheet health here in our report.

Coeur Mining (NYSE:CDE)

Overview: Coeur Mining, Inc. is a precious metals producer operating in the United States, Canada, and Mexico with a market cap of approximately $3.30 billion.

Operations: The company's revenue segments include Wharf at $234.01 million, Palmarejo at $379.06 million, Rochester at $215.81 million, and Kensington at $225.13 million.

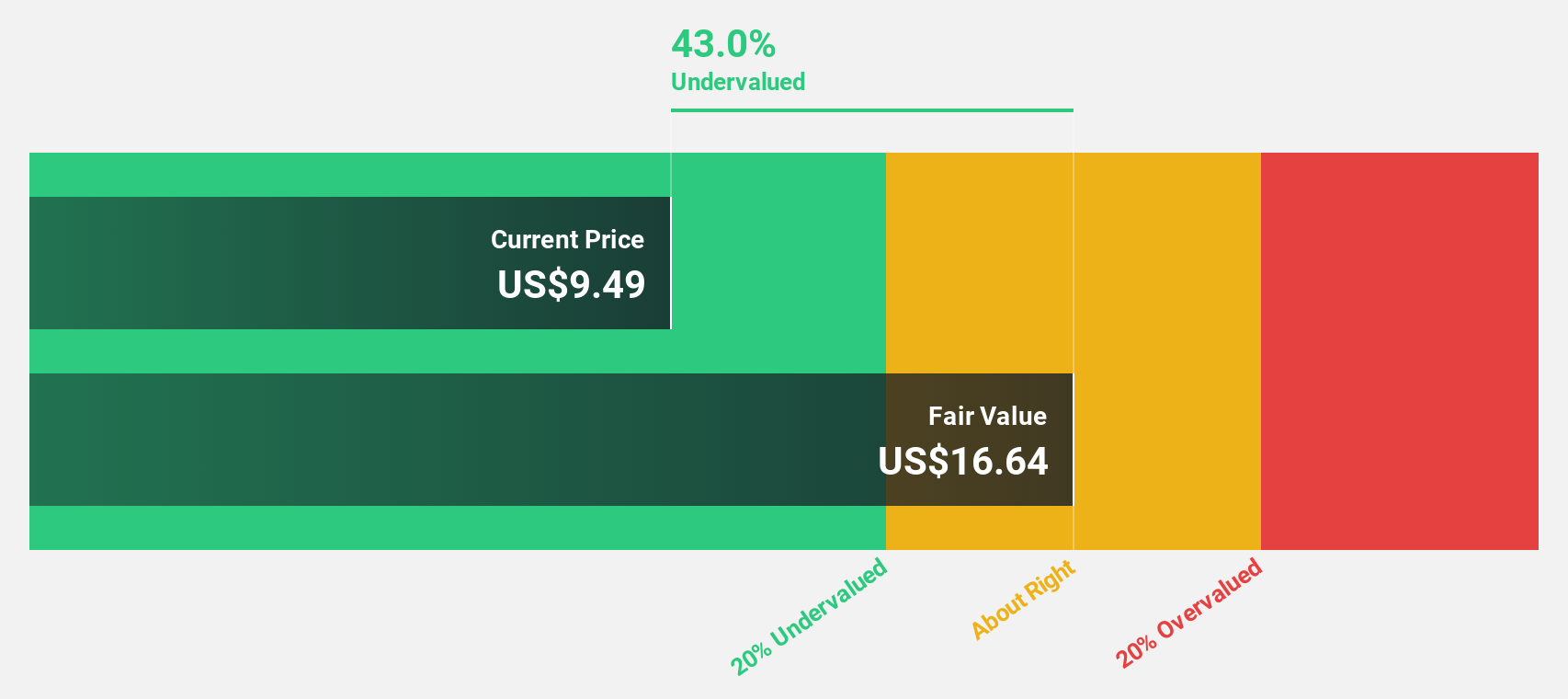

Estimated Discount To Fair Value: 49.7%

Coeur Mining is trading at US$5.61, well below its estimated fair value of US$11.15, highlighting potential undervaluation based on cash flows. The company reported a turnaround with net income of US$58.9 million for 2024 and expects earnings to grow significantly by 41% annually over the next three years. Despite past shareholder dilution, Coeur's strategic acquisitions and resource expansions position it for robust growth in both gold and silver production in 2025.

- Our comprehensive growth report raises the possibility that Coeur Mining is poised for substantial financial growth.

- Navigate through the intricacies of Coeur Mining with our comprehensive financial health report here.

Full Truck Alliance (NYSE:YMM)

Overview: Full Truck Alliance Co. Ltd. operates a digital freight platform in the People's Republic of China, connecting shippers with truckers for various shipment needs, and has a market cap of approximately $12.20 billion.

Operations: Revenue segments for Full Truck Alliance Co. Ltd. include the operation of a digital freight platform that links shippers with truckers to manage shipments across different distances, cargo weights, and types within China.

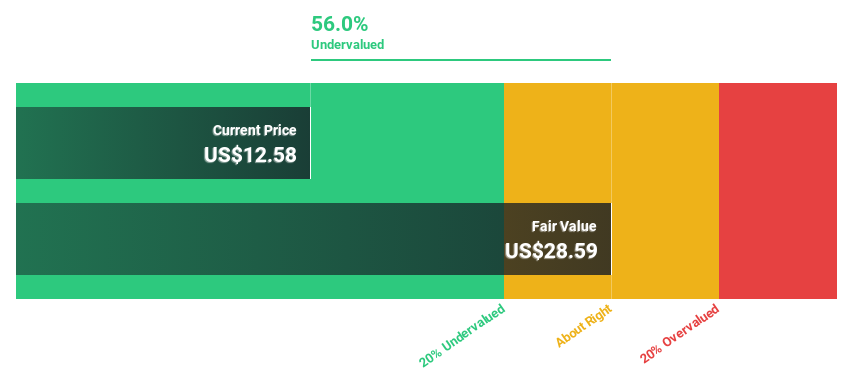

Estimated Discount To Fair Value: 49.4%

Full Truck Alliance trades at CNY 13.26, significantly below its estimated fair value of CNY 26.21, suggesting undervaluation based on cash flows. Despite a recent impairment charge of RMB 352.7 million, the company reported strong annual revenue and net income growth for 2024. Earnings are forecast to grow annually by over 25%, outpacing the US market average, while revenue is expected to increase between 15.9% and 18.1% in Q1 2025.

- Upon reviewing our latest growth report, Full Truck Alliance's projected financial performance appears quite optimistic.

- Dive into the specifics of Full Truck Alliance here with our thorough financial health report.

Where To Now?

- Explore the 199 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coeur Mining, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDE

Coeur Mining

Operates as a producer of precious metals in the United States, Canada, and Mexico.

High growth potential and fair value.