Quote of the Week: “The smart investor looks for opportunities to acquire value on the cheap, with one eye out for a dynamic change in the offing that might make that investment even more valuable.” - Jim Rogers

Last week, we took a look at the evolving outlook for oil and gas, both in the near term, and in the long term.

This week, we are taking a look at the medium-term outlook, which is probably the right time frame for investors to be considering.

We are taking a closer look at some of the key countries, and the dynamics affecting different types of companies in the sector.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🚗 Tesla braces for the delay to China license as trade tensions mount ( FT )

- This may be the leverage China has been looking for…

- Tesla is waiting for approval to extend testing of its autonomous driving technology in China. Elon Musk’s involvement in the Trump administration may well make the issue a bargaining chip when it comes to negotiations over trade.

- As the FT points out, another hurdle is data security. US platforms like Google and Facebook are banned in China, while the US is wary of Chinese companies like TikTok, Huawei and BYD.

- Adding to the pressure on Tesla’s prospects in China, BYD is now offering autonomous driving features for free with new vehicles.

- All in all, Tesla probably shouldn't count on China as its primary growth engine.

🤖 Meta is developing humanoid robots ( Forbes )

- Meta is launching a new division under Reality Labs to combine AI and robotics. It’s tapping into its AI model Llama to power these bots. It’s aiming to revolutionize healthcare with robots that can help with everything from nursing tasks to lifting heavy objects for the elderly.

- The tech is evolving fast, and Meta’s AI glasses and tactile sensors are paving the way for the robots to do everything from remote patient monitoring to helping with daily chores. But Meta’s not alone; Tesla, Nvidia, and startups like Figure AI are also in the race.

- This robot revolution could be a game-changer for healthcare and a large new revenue stream for Meta. Keep an eye on it as competition ramps up and this technology becomes an everyday tool in hospitals and homes.

📉 Nikola Stock Plunges on Chapter 11 Bankruptcy Filing ( Barrons )

- Nikola, the once-high-flying EV startup, has crashed and burned into bankruptcy, going from a $29 billion peak to a $100 million valuation. This follows a series of scandals, including fraud convictions against its founder, and years of poor stock performance.

- It joins the ranks of other SPAC-backed EV companies that flamed out quickly, raising questions about the long-term viability of such ventures.

- Nikola’s fall serves as a cautionary tale for investors: SPAC-backed EV companies may offer high rewards, but they come with steep risks, so proceed with caution in the sector.

💰 Trump suggests 25% tariffs on autos, pharma and semiconductors ( CNBC )

- President Trump is eyeing 25% tariffs on cars, drugs, and semiconductors, potentially starting April 2. This would expand his aggressive trade policy, adding more pressure on countries like Mexico, Japan, and Canada.

- The move could raise costs on everything from pharmaceuticals to tech, with U.S. patients possibly feeling the pinch on drug prices. Meanwhile, some companies are considering shifting manufacturing to the U.S. to avoid the tariffs.

- Watch out for potential price hikes in cars, drugs, and tech—these tariffs could shake up industries and have a ripple effect on global supply chains.

💵 China’s holdings of US Treasuries fall to lowest level since 2009 ( FT )

- Beijing is shifting its bonds into low-profile accounts and diversifying into gold.

- They’re playing the game of financial hide-and-seek while pulling back from U.S. debt.

- This move could affect global markets, as China’s decreased demand for treasuries adds pressure on the U.S. to finance its budget deficit. Meanwhile, the U.K., Belgium, and Luxembourg are stepping up to fill the void.

- As China diversifies away from Treasuries and buys more gold, investors should keep an eye on shifting global bond flows and their potential impact on U.S. debt markets. If the U.S. struggles to find buyers of new government-issued debt at certain yields, it then has to offer higher yields to entice investors, but that means a higher interest expense.

📈 UK inflation leaps to higher-than-expected 3% in January ( CNBC )

- The U.K.'s inflation rate jumped to 3% in January, surprising analysts who expected it to be lower. The rise was driven by higher airfares and a spike in food and private school fees, alongside an increase in core inflation.

- Despite the uptick, the Bank of England is still on track for more rate cuts, with inflation expected to dip below 2% by 2026. But higher global energy costs could keep inflation stubbornly above 3% for the rest of the year.

- With inflation creeping up and rate cuts on the horizon, stay alert for potential shifts in the U.K.'s economic trajectory—especially in services and energy prices.

🛢️🔥 Oil and Gas: The Medium-Term Outlook

The International Energy Agency’s Oil 2024 report is an analysis of the global oil and gas market to 2030. This is a good base case for the medium term, though the scenario could change during that period.

✨ The IEA is projecting a plateauing of global demand for oil and gas and a significant increase in supply between now and 2030.

On the demand side, there’s a big difference between the demand curve for different countries.

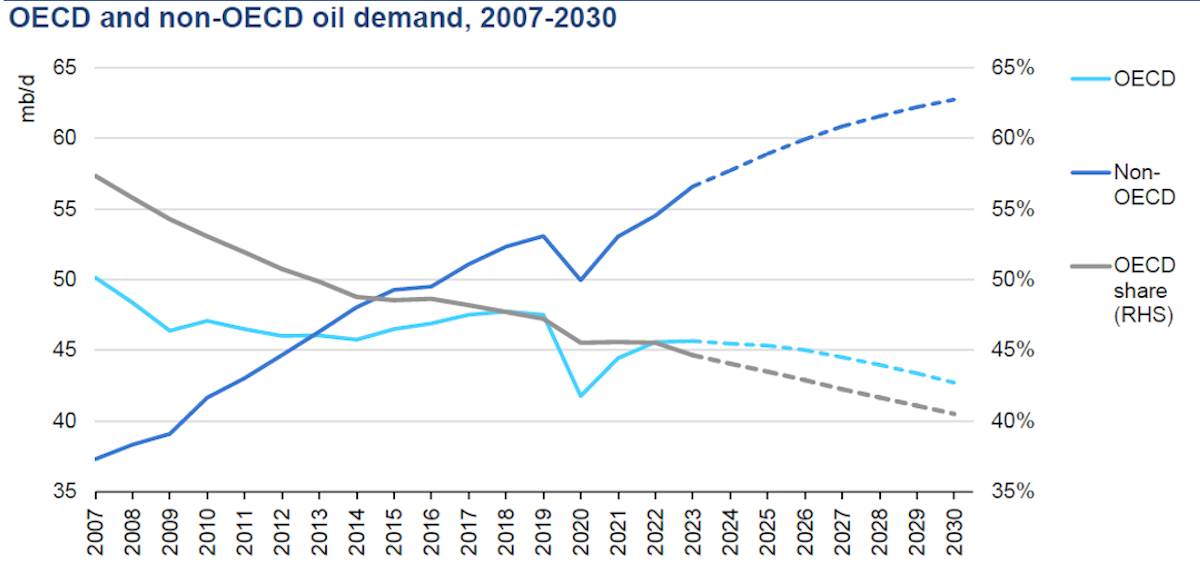

🆚 OECD vs non-OECD Countries

There’s a significant difference between the oil outlook for OECD (developed) and non-OECD (developing) economies.

✨ Most notably, demand is seen peaking in developed economies, while developing economies are still growing, and so too is demand for oil, gas, and other forms of energy.

Typically, energy consumption increases along with GDP. But in developed economies, the increased demand has been offset by more efficient energy consumption.

This trend actually began in the early 2000s due to the more efficient use of energy in vehicles and buildings. More recently, demand has been displaced by renewable energy and EVs.

What does this mean for the oil and gas industries in mature economies?

- 💰 Firstly, there is less justification for investing in new infrastructure, particularly refining capacity.

- ⛓️ Secondly, oil and gas companies are hyper-focused on managing assets and supply chains as efficiently as possible.

- An interesting by-product of this is that the global O&G data and analytics market is now estimated at $15 billion a year, and growing at 20% annually.

In rapidly growing economies, demand is growing faster than any efficiency gains. This means 3 things:

- 📈 Oil and gas companies can expect volumes to increase in the medium term.

- 📊 Infrastructure and refining capacity must be increased to meet demand.

- 🛢️ Most developing economies are net importers of oil.

- Those imports are both essential to growth and a key factor affecting currency strength and the cost of debt.

🇺🇸 Dynamics are Changing in the US Oil and Gas Industry

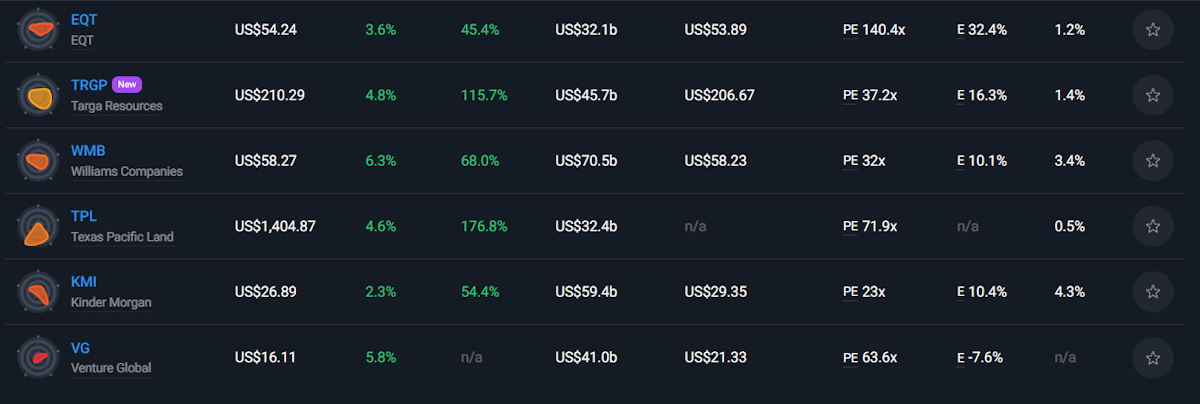

If you open up the Simply Wall St stock screener and rank US oil and gas companies by Total Score , you’ll see a few themes emerging.

The first is that the top-scoring companies are all oil services companies, independent oil and gas producers, and integrated oil and gas companies.

Then, at the bottom of the table are oil infrastructure companies, and those producing LNG (liquid natural gas).

This screener only includes companies with a market value above $10 billion. Below that, most companies in the sector also have weak fundamentals, which proves that scale is a contributing factor.

The fundamentals for different types of companies reflect the dynamics facing the US oil and gas industry:

- 🛢️ Upstream oil producers have the most exposure to the oil price. However, at $70- $80 a barrel, most existing assets are still quite profitable. Production costs for new wells have risen significantly, but cost increases have slowed recently. Donald Trump’s deregulation agenda could cause even lower production costs.

- 🛠️ Oil service companies benefit from increased activity in the sector rather than the oil price itself.

- 🚂 Storage, transportation, and refining have become more challenging. To generate returns, companies either need growing volumes, or they need to squeeze out more margin through efficiency or scale.

- ⛓️ Integrated oil and gas producers have been better positioned to improve efficiencies as they operate throughout the value chain. They are also slightly less exposed to the oil price and benefit from more diversification.

The outlook for US natural gas is suddenly less certain due to two recent developments:

- 🇺🇸 US LNG was set to replace Europe’s gas imports from Russia.

- However, if sanctions on Russia are lifted, piped natural gas from Russia would probably be more attractive for European importers. LNG is more expensive to process and transport, so it's hard to see Europe opting for that option if they could choose piped instead.

- 📈 The sudden increase in electricity demand for AI data centers is another demand driver for natural gas.

- That narrative has also become less certain with the launch of DeepSeek’s R1 model .

✨ Regardless of what happens with Russia and data center demand, US domestic demand for natural gas is expected to increase unless there are significant breakthroughs in battery storage or nuclear investment.

🇨🇦 Canada Will Remain a Key Supplier

Canada is amongst the world’s largest oil and gas producers and exporters. It’s also closely tied to the US oil industry.

While the US is now the world’s largest producer of oil, 40% of the crude that passes through its refineries is imported. This is due to its refineries being set up to process types of oil that were historically imported. And most of the oil that is imported comes from Canada.

Canada’s export volumes received a boost last year when the Trans Mountain Expansion pipeline came online. This pipeline triples Canada’s capacity to transport oil and refined products to the Pacific coast.

Canada is and will continue to be a key supplier to China and other parts of Asia.

🇪🇺 Europe and the 🇬🇧 UK - Energy Uncertainty and Diversity

Europe as a region is currently the largest importer of oil and gas - as its own reserves are being depleted. European nations have also been amongst the fastest to transition away from fossil fuels.

The continent probably has the most diversified energy mix, with substantial power generation coming from not just fossil fuels, solar and wind, but hydroelectric, geo-thermal, and nuclear too.

Nevertheless, Europe is still dependent on oil and natural gas, which means its energy security is a little uncertain - and it will remain a key market for exporters.

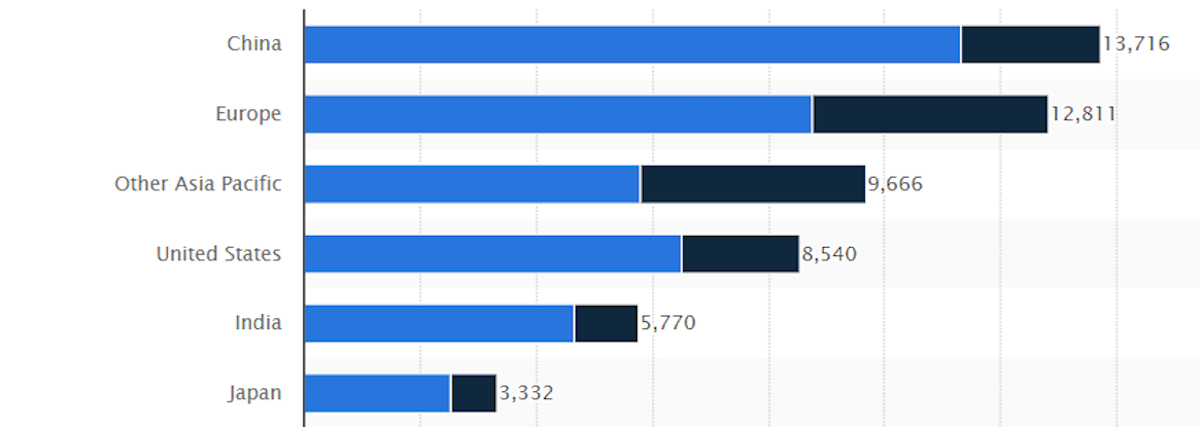

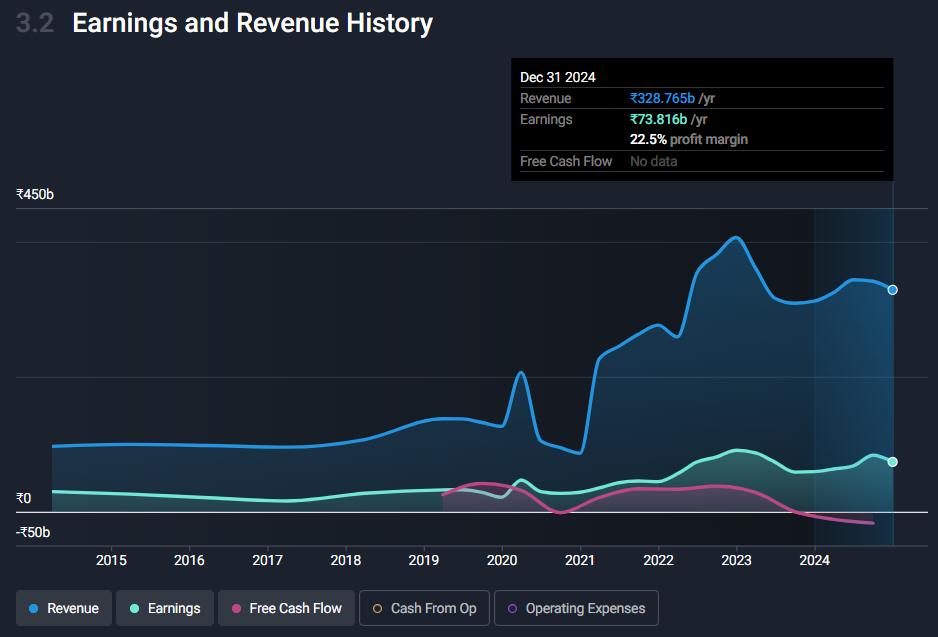

🇨🇳 China and 🇮🇳 India

For more than 20 years, China has driven much of the annual increase in global oil demand. India recently became the largest source of demand growth, but China and other Asian countries are still increasing consumption.

China’s total energy consumption is actually much higher than India’s, but China uses more renewable energy and biofuels, and EV adoption has been a lot faster. Both countries are also very reliant on coal.

✨ China, India, and many other Asian nations have some oil and gas reserves but rely on imports for most of their oil.

This means most of the oil and gas industry is focussed on refining and distribution, which offers exposure to volume growth - unlike developed nations with steady demand growth.

✨ One thing to be aware of in many developing economies - governments are often very involved in the industry.

They typically own large stakes in key companies (in Oil India’s case, 56%) and often regulate prices. There are pros and cons to this - but it does mean companies have financial backing when needed.

💡 The Insight: Oil Is Still A Cyclical Commodity

The oil price is prone to very big swings from time to time.

When the Covid pandemic started it fell to zero, and when Russia invaded Ukraine it shot up to $130.

Storing oil is expensive relative to its value, so large stockpiles don’t exist - which means imbalances in supply and demand lead to massive changes in price.

✨ These extremes don’t last long, but they can create incredible opportunities for investors with a long time horizon. What really matters to oil companies is long-term supply and demand dynamics.

The current outlook points to growing capacity, and sluggish demand growth. To an extent that’s already reflected in the price, but there’s probably room for downside (or upside) surprises based on news flow.

Ultimately though, when prices are too low to be economical for producers, production falls. Conversely, when prices are too high, demand falls.

That cycle will probably continue until major investments are made in nuclear, or major breakthroughs are made in battery storage or another alternative.

Key Events During The Next Week

The big event this week will no doubt be Nvidia’s Q4 earnings on Wednesday. Elsewhere, there are a few inflation and GDP data releases scheduled:

Monday

- 🇪🇺 Eurozone inflation rate is forecast to be 2.5% up from 2.4%.

Wednesday

- 🇦🇺 Australia’s consumer price inflation data will be released. Economists expect to see a 0.1% increase to 2.6%.

Thursday

- 🇺🇸 US durable good orders are forecast to be down 0.4% over the past year, after declining 2.2% in the year to December.

- 🇺🇸 The second estimate for US GDP growth for Q4 will be published. The consensus estimate is 2.3%, down from 3.1% in Q3.

Friday

- 🇨🇦 Canada’s Q4 GDP growth is expected to be 0.7%, down from 1% during Q3.

- 🇺🇸 US personal income and spending data will be published. Incomes are forecast to have risen 0.3% in January, while spending is expected to be down 0.3% after rising 0.7% in December.

Apart from Nvidia, there are a few prominent software companies and retailers scheduled to report:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.